Global Led Headlight Market

Market Size in USD Billion

CAGR :

%

USD

6.79 Billion

USD

10.35 Billion

2024

2032

USD

6.79 Billion

USD

10.35 Billion

2024

2032

| 2025 –2032 | |

| USD 6.79 Billion | |

| USD 10.35 Billion | |

|

|

|

|

What is the Global LED Headlight Market Size and Growth Rate?

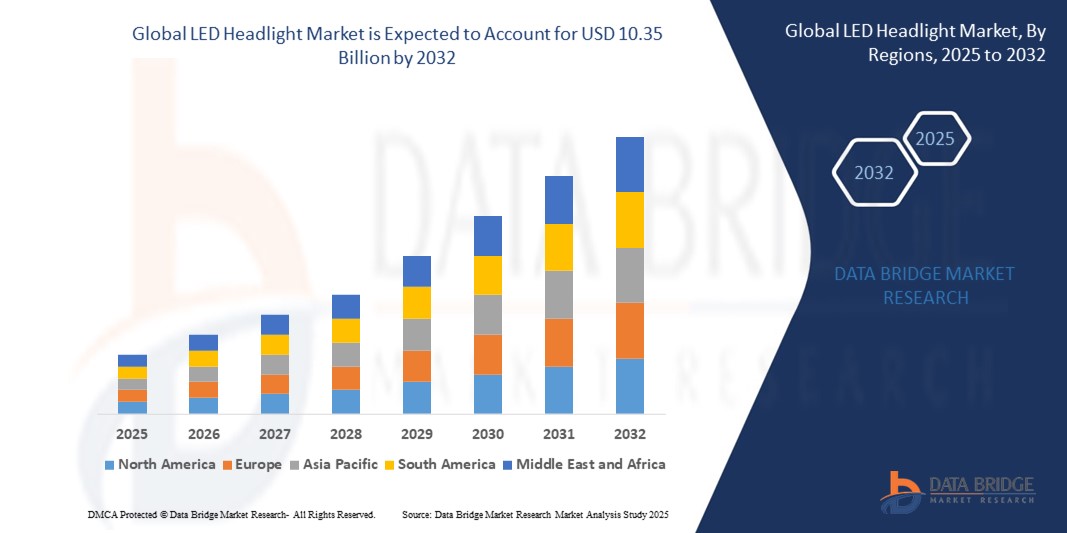

- The global LED headlight market size was valued at USD 6.79 billion in 2024 and is expected to reach USD 10.35 billion by 2032, at a CAGR of 5.40% during the forecast period

- Various factors such as growing emphasis on energy efficiency, enhanced brightness, and advanced features. Automotive manufacturers and aftermarket suppliers were increasingly adopting LED technology for headlights, as it offered longer lifespan, lower power consumption, and improved visibility

- Moreover, the market was witnessing a shift towards adaptive lighting systems, where LEDs could be dynamically adjusted to provide optimal illumination based on driving conditions. Integration of smart technologies, such as connectivity and automation, was also gaining traction, allowing for innovative functionalities such as adaptive beam patterns and customizable lighting options

What are the Major Takeaways of LED Headlight Market?

- LED headlights are known for their energy efficiency compared to traditional halogen or HID lights. They consume less power while providing brighter illumination. As energy-efficient solutions are becoming more critical in the automotive industry, the demand for LED headlights is increasing. In addition, the long lifespan of LEDs contributes to cost savings for vehicle owners, as they require less frequent replacements. These factors are driving the adoption of LED headlight in the global market

- North America dominated the LED headlight market with the largest revenue share of 37.9% in 2024, driven by high adoption of advanced automotive technologies, stringent safety regulations, and rising preference for energy-efficient lighting systems

- Asia-Pacific is projected to grow at the fastest CAGR of 13.7% from 2025 to 2032, fueled by rapid urbanization, increasing vehicle sales, and technological innovation in countries such as China, Japan, and India

- The Type I segment dominated the LED headlight market with the largest market revenue share of 38.9% in 2024, attributed to its high beam performance, long-range visibility, and wide adoption in passenger vehicles

Report Scope and LED Headlight Market Segmentation

|

Attributes |

LED Headlight Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the LED Headlight Market?

Adaptive Lighting and Integration with Advanced Driver Assistance Systems (ADAS)

- A major trend in the LED headlight market is the integration of adaptive lighting systems with ADAS technologies, enabling real-time adjustments based on driving conditions, vehicle speed, and traffic patterns

- For instance, HELLA GmbH & Co. KGaA has developed Matrix LED headlamps that automatically adjust light distribution to avoid glare for oncoming vehicles while maximizing road visibility

- Sensor-based adaptive headlights are increasingly used in high-end and mid-range vehicles, supporting functions such as automatic high-beam, bending lights, and weather-based beam pattern adjustments

- These innovations are enhancing night-time driving safety and driver comfort, aligning with growing consumer expectations and regulatory standards for intelligent lighting

- Automakers are partnering with suppliers such as Valeo and KOITO to develop integrated systems that combine LED headlights, cameras, and radar, forming a critical part of modern ADAS ecosystems

- This trend is accelerating the shift toward smart, connected lighting systems in the automotive sector, reinforcing LED technology’s value beyond illumination

What are the Key Drivers of LED Headlight Market?

- The rising production of electric and hybrid vehicles is a primary driver, as EV makers prioritize energy-efficient lighting systems to reduce power consumption and extend battery life

- For instance, in April 2024, Hyundai Mobis unveiled a lightweight LED module that reduces energy use by 20% and is designed for next-gen electric vehicles

- Stringent global regulations mandating brighter and more energy-efficient headlights are pushing automakers to adopt LED over traditional halogen or HID systems. The European Union and U.S. DOT have set standards that favor LED-based adaptive lighting for improved road safety

- The growing consumer preference for premium aesthetics and safety is driving demand for sleek LED headlamp designs with features such as DRLs (daytime running lights), sequential indicators, and customizable lighting signatures

- Advancements in thermal management, lens materials, and electronics miniaturization are expanding LED adoption across all vehicle segments from economy to luxury

- In addition, aftermarket demand is rising due to the availability of LED retrofit kits, offering improved visibility and style for older vehicles

Which Factor is challenging the Growth of the LED Headlight Market?

- A key challenge is the high initial cost of LED headlight systems compared to halogen alternatives, especially in price-sensitive markets such as Southeast Asia, Africa, and Latin America

- For instance, Fiem Industries Limited noted that LED adoption in India’s two-wheeler segment is slower due to cost constraints, despite growing consumer awareness

- Thermal management complexity is another barrier, as LED systems require effective heat dissipation to maintain performance and lifespan, increasing design and engineering costs

- Furthermore, repair and replacement costs for LED systems are higher, as components are often integrated and sealed, requiring complete unit replacements instead of bulb swaps

- OEMs also face challenges in standardization and regulatory compliance, as different regions have varying standards for headlight brightness, color temperature, and adaptive functions

- Lastly, the growing demand for OLED and laser lighting technologies presents a competitive threat, particularly in the premium vehicle segment, where automakers seek differentiation through advanced lighting innovations

- To overcome these challenges, manufacturers must focus on cost optimization, modular design, and collaboration with OEMs to deliver scalable and compliant LED solutions

How is the LED Headlight Market Segmented?

The market is segmented on the basis of type, application, and sales channel.

- By Type

On the basis of type, the LED headlight market is segmented into Type I, Type II, Type III, and Type IV. The Type I segment dominated the LED headlight market with the largest market revenue share of 38.9% in 2024, attributed to its high beam performance, long-range visibility, and wide adoption in passenger vehicles. Type I headlights are known for their optimal balance between brightness and energy efficiency, making them ideal for standard automotive applications.

The Type IV segment is projected to register the fastest CAGR from 2025 to 2032, driven by increasing deployment in premium vehicles and heavy-duty industrial applications. Type IV LED headlights offer adaptive lighting capabilities and enhanced durability, which are vital for off-road and high-performance use cases.

- By Application

On the basis of application, the LED headlight market is segmented into Automotive, Surgical Lighting, and Industrial Lighting. The Automotive segment held the largest market revenue share of 56.2% in 2024, fueled by growing vehicle production, rising consumer demand for energy-efficient lighting, and government regulations mandating LED technology in headlights. Advanced features such as automatic beam adjustment, glare reduction, and intelligent lighting systems further boost this segment.

The Surgical Lighting segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the increasing adoption of high-lumen, low-heat LED lights in operating rooms. Enhanced illumination precision, minimal shadowing, and reduced energy consumption make LED headlights highly desirable for medical applications.

- By Sales Channel

On the basis of sales channel, the LED headlight market is segmented into Direct and Indirect channels. The Indirect channel segment dominated the market with the highest revenue share of 61.4% in 2024, driven by widespread distribution through auto parts retailers, online platforms, and OEM suppliers. This route offers greater market penetration and enhances customer accessibility across regions.

The Direct channel is projected to experience the fastest growth from 2025 to 2032, as manufacturers focus on strengthening direct relationships with automotive OEMs and large industrial clients. Direct sales facilitate better customization, product development collaboration, and improved control over pricing and brand communication.

Which Region Holds the Largest Share of the LED Headlight Market?

- North America dominated the LED headlight market with the largest revenue share of 37.9% in 2024, driven by high adoption of advanced automotive technologies, stringent safety regulations, and rising preference for energy-efficient lighting systems

- The region is home to several luxury and electric vehicle manufacturers integrating high-performance LED lighting for improved visibility and vehicle aesthetic

- Government mandates around automotive lighting standards, combined with increasing consumer demand for connected and autonomous vehicles, are further fueling market growth

U.S. LED Headlight Market Insight

The U.S. LED headlight market held the largest share in North America in 2024, powered by the country’s strong automotive production base, consumer preference for feature-rich vehicles, and widespread EV adoption. Manufacturers are incorporating matrix LED and adaptive lighting technologies for enhanced road safety and styling. In addition, government incentives for EVs and energy-efficient components are boosting LED adoption across vehicle segments.

Canada LED Headlight Market Insight

Canada's LED headlight market is expanding steadily, backed by its rising electric vehicle penetration and stringent vehicle lighting standards. Canadian automakers are focusing on daytime running lights (DRLs) and intelligent headlight systems for both environmental benefits and driver safety. Provincial rebates and support for green automotive technologies are also encouraging LED adoption in the aftermarket segment.

Mexico LED Headlight Market Insight

Mexico is emerging as a critical manufacturing hub in the North American LED headlight ecosystem, benefiting from low production costs and a growing cluster of OEM assembly plants. LED headlights are gaining traction in locally manufactured passenger and commercial vehicles, as global automakers demand higher energy efficiency and compliance with evolving global lighting norms.

Which Region is the Fastest Growing in the LED Headlight Market?

Asia-Pacific is projected to grow at the fastest CAGR of 13.7% from 2025 to 2032, fueled by rapid urbanization, increasing vehicle sales, and technological innovation in countries such as China, Japan, and India. A booming automotive aftermarket, coupled with strong domestic manufacturing capabilities, is driving demand for affordable and advanced LED headlight systems. Government mandates around energy efficiency and road safety are accelerating the transition from halogen to LED across vehicle types, especially two-wheelers and compact cars.

China LED Headlight Market Insight

China remains the largest LED headlight market in Asia-Pacific, driven by its vast vehicle production volume and regulatory push toward energy-efficient automotive components. The government's aggressive New Energy Vehicle (NEV) policies and the rise of domestic EV brands have significantly increased the use of smart LED lighting and adaptive front-lighting systems in mass-market vehicles.

Japan LED Headlight Market Insight

Japan’s LED headlight market is mature and technologically advanced, marked by significant penetration of adaptive driving beam (ADB) and laser-assisted LED systems. Domestic automakers are emphasizing driver-assist lighting systems to enhance night-time visibility and pedestrian safety. Sustainability and innovation remain central to Japan’s automotive lighting R&D initiatives.

India LED Headlight Market Insight

India’s LED headlight market is poised for high growth, driven by vehicle electrification, road safety awareness, and government-led initiatives such as the FAME scheme and BS-VI compliance. The two-wheeler segment, in particular, is shifting rapidly to LED technology due to cost efficiency, longer lifespan, and enhanced brightness in compact form factors. Growing investments in local LED component manufacturing also support market expansion.

Which are the Top Companies in LED Headlight Market?

The LED headlight industry is primarily led by well-established companies, including:

- Valeo (France)

- Marelli Holdings Co., Ltd. (Italy)

- HELLA GmbH & Co. KGaA (Germany)

- ZKW (Austria)

- OSRAM GmbH (Germany)

- KOITO MANUFACTURING CO., LTD. (Japan)

- STANLEY ELECTRIC CO., LTD. (Japan)

- HYUNDAI MOBIS (South Korea)

- Uno Minda (India)

- Fiem Industries Limited (India)

- Truck-Lite Co., LLC (U.S.)

What are the Recent Developments in Global LED Headlight Market?

- In January 2024, Kenwood launched its advanced range of LED headlights for cars and SUVs in India, offering variants in 4300 Kelvin and 6000 Kelvin, compatible with H1, H4 / H19, H7, H8, H27, 9005, and 9006 configurations. These products are distributed across India through Nippon Audiotronix India Pvt. Ltd., the official distributor. This launch strengthens Kenwood’s presence in India’s automotive lighting segment by offering diversified LED options

- In April 2024, Dominant Opto was announced as the second supplier for interior automotive lighting that leverages connected technology from ams OSRAM, marking a key expansion in its collaboration network. This strategic move boosts Dominant Opto’s role in the global intelligent automotive lighting ecosystem

- In April 2024, ams OSRAM partnered with DOMINANT Opto Technologies, a leading Malaysian LED manufacturer, to integrate Open System Protocol (OSP) into DOMINANT’s intelligent RGB LEDs tailored for ambient automotive lighting applications. This collaboration paves the way for smarter and more adaptable in-vehicle lighting experiences

- In June 2023, Motherson, in collaboration with Marelli, inaugurated the Motherson Automotive Lighting Tool Room—India’s first dedicated tool room exclusively focused on automotive lighting solutions. This milestone enhances local manufacturing capabilities and supports the "Make in India" initiative in the automotive sector

- In April 2023, Continental AG launched its specialized NightViu automotive lighting series, introducing 16 new products designed specifically for construction, mining, and off-road vehicles. This product line reinforces Continental’s commitment to safety and innovation in heavy-duty vehicle lighting solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.