Global Licensed Sports Merchandise Market

Market Size in USD Billion

CAGR :

%

USD

37.03 Billion

USD

55.42 Billion

2024

2032

USD

37.03 Billion

USD

55.42 Billion

2024

2032

| 2025 –2032 | |

| USD 37.03 Billion | |

| USD 55.42 Billion | |

|

|

|

|

Licensed Sports Merchandise Market Size

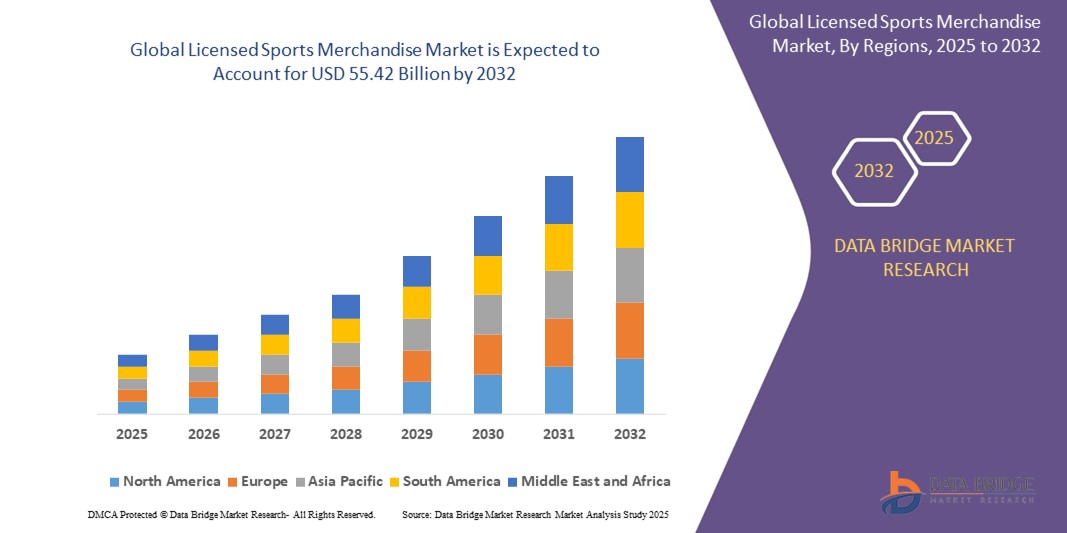

- The global licensed sports merchandise market size was valued at USD 37.03 billion in 2024 and is expected to reach USD 55.42 billion by 2032, at a CAGR of 5.17% during the forecast period

- Market growth is primarily driven by intensifying global sports fandom, increasing disposable incomes, and the proliferation of sports leagues and tournaments that boost fan engagement across both developed and emerging economies

- Rise in e-commerce platforms, exclusive collaborations between sports teams and fashion brands, and a growing trend of athlete-driven merchandise collections are significantly accelerating the market’s expansion

Licensed Sports Merchandise Market Analysis

- Licensed sports merchandise encompasses a wide range of products including apparel, footwear, accessories, toys, games, and collectibles, officially branded by sports organizations, teams, and athletes. These products have become powerful brand extensions that deepen fan loyalty and generate significant revenue for leagues and franchises

- The increasing popularity of global sporting events such as the FIFA World Cup, Olympics, Super Bowl, and IPL, coupled with year-round demand for merchandise from iconic teams and players, is fueling sustained product sales

- Moreover, digital transformation in retail through online stores, mobile apps, and augmented reality experiences is reshaping how fans interact with and purchase licensed merchandise—making the buying experience more personalized and accessible globally

- North America dominates the Licensed Sports Merchandise market with the largest revenue share of 52.36% in 2024, driven by strong sports culture, high consumer spending, and robust licensing frameworks across major leagues such as the NFL, NBA, MLB, and NHL

- Asia-Pacific market is projected to grow at the fastest CAGR of 24.25% from 2025 to 2032, driven by expanding fan bases for European football, basketball, and U.S.-based franchises in countries such as China, Japan, and India

- The Apparel segment dominated the market with the largest revenue share of 37.8% in 2024, driven by the widespread popularity of team jerseys, t-shirts, and hoodies among sports fans

Report Scope and Licensed Sports Merchandise Market Segmentation

|

Attributes |

Licensed Sports Merchandise Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Licensed Sports Merchandise Market Trends

“Rising Fan Engagement through Digital and Customizable Merchandise”

- A significant trend reshaping the global licensed sports merchandise market is the increasing demand for customized and digitally interactive merchandise, which allows fans to engage more deeply with their favorite teams, players, and events. Digital innovations are enabling sports brands to deliver immersive fan experiences and personalized products

- For instance, major sports leagues such as the NBA and NFL have launched platforms where fans can design and purchase custom jerseys with their name and number. Similarly, clubs such as Manchester United offer AR-enabled merchandise where scanning an item unlocks exclusive content such as player interviews or highlight reels

- Technologies such as augmented reality (AR), NFC chips, and mobile integration are being embedded in apparel and accessories to enhance interactivity. Consumers can access real-time game stats, team updates, or exclusive media through wearable merchandise

- The surge in e-sports and digital fan engagement platforms is also fueling this trend, as younger consumers seek connected merchandise that bridges physical and virtual worlds

- This push toward personalization and digital experience is helping brands strengthen emotional connections with fans, drive higher value sales, and reduce reliance on traditional retail formats

- As a result, companies such as Fanatics, Adidas, and Nike are investing in on-demand production and augmented merchandise experiences, paving the way for scalable, fan-centric merchandising models

Licensed Sports Merchandise Market Dynamics

Driver

“Expanding Global Sports Culture and Celebrity Influence”

- The increasing global popularity of sports leagues, events, and athletes is a major driver boosting the Licensed Sports Merchandise market. Globalization of sports through streaming platforms, social media, and international tournaments is turning local teams into global brands

- For instance, the 2024 UEFA Euro Cup merchandise sales crossed record levels due to expanded global broadcasting rights and fan activation campaigns. Similarly, athlete collaborations such as Lionel Messi’s Inter Miami merchandise surge highlight the power of star influence on consumer buying behavior

- The rise of sports influencers and athlete-led fashion lines is significantly shaping merchandise preferences, especially among Gen Z and millennial consumers. Social media platforms such as Instagram and TikTok serve as key merchandising channels, driving direct-to-consumer (DTC) sales

- Furthermore, mega sporting events such as the Olympics, FIFA World Cup, and Super Bowl continue to boost seasonal demand for themed merchandise across apparel, souvenirs, and accessories

- Sports teams and franchises are increasingly leveraging celebrity brand ambassadors and strategic fashion partnerships to drive hype and increase merchandise value. For instance, Nike’s collaboration with NBA stars has expanded its merchandising footprint globally

- This trend is creating consistent demand across all end-user segments and driving the growth of both offline and online distribution channels

Restraint/Challenge

“Licensing Complexity and Counterfeit Risks”

- A key challenge faced by the licensed sports merchandise market is the complexity of intellectual property (IP) licensing and the widespread threat of counterfeit goods, which can dilute brand value and affect revenues

- The fragmented and region-specific licensing regulations often make it difficult for brands to manage cross-border operations efficiently. Smaller brands and retailers may struggle with the cost and legal barriers to obtain official licenses for teams or leagues

- Counterfeit merchandise is a major concern in both physical markets and online platforms. For instance, the U.S. Customs and Border Protection seized over USD 25 million worth of fake sports merchandise ahead of the 2024 Super Bowl. Such incidents cause revenue losses and damage brand trust and consumer safety

- To counter these risks, companies are investing in blockchain-based authentication, QR codes, and smart labels to enable product verification and traceability. Brands such as Puma and Adidas are using embedded NFC tags to prove authenticity and track product lifecycle

- However, enforcing IP rights and educating consumers about fake products remain persistent hurdles. In addition, licensing royalties and contractual restrictions can increase production costs and limit design flexibility for manufacturers

- Overcoming these challenges will require stronger collaboration between brands, licensing bodies, and governments, along with robust anti-counterfeit technologies and legal enforcement

Licensed Sports Merchandise Market Scope

The market is segmented on the basis of product, distribution channel, application, and end user.

• By Product

On the basis of product, the licensed sports merchandise market is segmented into Apparel, Footwear, Accessories and Toys, Video Games, Gifts and Novelties, Souvenirs, and Others. The Apparel segment dominated the market with the largest revenue share of 37.8% in 2024, driven by the widespread popularity of team jerseys, t-shirts, and hoodies among sports fans. Apparel remains a primary medium for fans to showcase team loyalty, especially during sporting events, tournaments, and fan meetups. The demand is further fueled by frequent merchandise collaborations between sports teams and fashion brands, offering exclusive limited-edition collections.

The Video Games segment is anticipated to witness the fastest CAGR from 2025 to 2032, supported by the increasing integration of licensed sports content in gaming franchises and the rising popularity of e-sports. These games often feature official team branding, player likenesses, and authentic gear, enhancing user experience and attracting a younger demographic.

• By Distribution Channel

On the basis of distribution channel, the licensed sports merchandise market is segmented into Offline Retail Stores and Online Retail Stores. The Offline Retail Stores segment held the largest market revenue share of 64.5% in 2024, attributed to the immersive in-store shopping experience and the availability of exclusive team merchandise in stadium shops and branded outlets. Physical stores enable customers to verify quality and fit, and often benefit from high foot traffic during live events and seasonal sports tournaments.

The Online Retail Stores segment is expected to witness the fastest growth rate during 2025 to 2032, driven by the rising penetration of e-commerce platforms, global fan base accessibility, and the convenience of doorstep delivery. Online platforms also offer a wider variety of products, frequent discounts, and official team stores that cater to international audiences.

• By Application

On the basis of application, the licensed sports merchandise market is segmented into Individual and Commercial. The Individual segment dominated the market with a revenue share of 69.3% in 2024, supported by the strong emotional connection fans have with their favorite teams and athletes. Individual consumers frequently purchase merchandise for personal use, gifting, and collecting, especially around championship seasons or when a popular player joins a team.

The Commercial segment is projected to grow at the fastest CAGR from 2025 to 2032, fueled by increasing merchandising partnerships, sponsorship deals, and the demand for sports-themed decor and accessories in commercial settings such as sports bars, gyms, and theme-based retail outlets.

• By End User

On the basis of end user, the licensed sports merchandise market is segmented into Men, Women, and Kids. The Men segment held the dominant market share of 51.6% in 2024, largely due to the traditionally higher consumption of sports merchandise by male fans, especially for teams and events such as the NFL, NBA, and major European football leagues. Men’s sportswear, gaming accessories, and collectibles see strong and consistent demand throughout the year.

The Women segment is expected to record the fastest CAGR from 2025 to 2032, driven by increased female viewership of major sports events and expanding product lines tailored specifically for women. Teams and brands are investing more in women-centric designs and marketing strategies to tap into this growing demographic.

Licensed Sports Merchandise Market Regional Analysis

- North America dominates the licensed sports merchandise market with the largest revenue share of 52.36% in 2024, driven by strong sports culture, high consumer spending, and robust licensing frameworks across major leagues such as the NFL, NBA, MLB, and NHL

- The region's dominance is reinforced by the widespread popularity of licensed team apparel, collectibles, and exclusive fan experiences promoted by both online and retail channels

- In addition, collaborations between athletes and global brands further boost market traction, especially across youth and millennial demographics

U.S. Licensed Sports Merchandise Market Insight

The U.S. held the largest revenue share in 2024 within North America, supported by the country's deep-rooted sports fandom and the commercialization of college and professional sports. The rise of e-commerce platforms such as Fanatics and Amazon, along with exclusive merchandise tie-ups during events such as Super Bowl and NBA Finals, is accelerating product demand. Seasonal sales spikes and partnerships with universities and local teams continue to make the U.S. a focal point for market expansion.

Europe Licensed Sports Merchandise Market Insight

The Europe market is expected to expand at a notable CAGR during the forecast period, driven by the popularity of football (soccer) clubs such as FC Barcelona, Real Madrid, and Manchester United. Club loyalty across countries and active fan communities fuel steady merchandise demand, particularly for jerseys, scarves, and accessories. The integration of licensed products in both physical stores and official club e-shops drives visibility and accessibility.

U.K. Licensed Sports Merchandise Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR, supported by the Premier League's international appeal and long-standing merchandising culture. Limited-edition drops, retro kit releases, and athlete endorsements significantly contribute to market activity. The rise of mobile shopping and augmented reality (AR) experiences through official club apps is enhancing fan engagement and sales.

Germany Licensed Sports Merchandise Market Insight

The Germany market is expected to grow at a considerable CAGR, led by Bundesliga clubs and national team merchandise. Eco-conscious consumer behavior is encouraging brands to launch sustainable and recycled materials in their merchandise lines. Regional tournaments, training kits, and partnerships with retailers such as Adidas and Puma support localized merchandising success.

Asia-Pacific Licensed Sports Merchandise Market Insight

The Asia-Pacific market is projected to grow at the fastest CAGR of 24.25% from 2025 to 2032, driven by expanding fan bases for European football, basketball, and U.S.-based franchises in countries such as China, Japan, and India. The region’s rising middle-class population, increased spending on entertainment, and surge in online fan engagement are key market boosters. Licensing deals for regional tournaments such as IPL (India) and CBA (China) are strengthening localized product development.

Japan Licensed Sports Merchandise Market Insight

The Japan market is gaining momentum, influenced by the country’s love for baseball, soccer, and wrestling. Licensed memorabilia, action figures, and apparel tied to both domestic leagues and international franchises are popular among collectors. The blend of anime and sports collaborations is also emerging as a niche merchandise segment.

China Licensed Sports Merchandise Market Insight

The China market held the largest revenue share in Asia-Pacific in 2024, driven by large-scale fan engagement with basketball (NBA), football, and e-sports. Local leagues and athlete endorsements, coupled with state-backed support for sports development, are enhancing market scope. With the rise of digital commerce and regional manufacturing strength, licensed product affordability and accessibility are growing significantly.

Licensed Sports Merchandise Market Share

The Licensed Sports Merchandise industry is primarily led by well-established companies, including:

- EVERLAST WORLDWIDE INC. (U.S.)

- G-III Apparel Group, Ltd. (U.S.)

- Fanatics Inc. (U.S.)

- adidas (Germany)

- Under Armour, Inc. (U.S.)

- NIKE, Inc. (U.S.)

- New Era Cap (U.S.)

- PRADA (Italy)

- PUMA SE (Germany)

- Columbia Sportswear Company (U.S.)

- DICK'S Sporting Goods (U.S.)

- HANESBRANDS INC. (U.S.)

- Li Ning Sports Goods Co., Ltd. (China)

- SportsDirect (U.K.)

- Rawlings Sporting Goods (U.S.)

- Revgear (U.S.)

Latest Developments in Global Licensed Sports Merchandise Market

- In September 2023, Adidas introduced the X Crazyfast Messi 'Las Estrellas' boots, shortly followed by the launch of his 'Infinito' boots. These special edition boots were designed to commemorate Lionel Messi’s 2022 World Cup victory with Argentina. This launch added a significant milestone to Messi’s signature collection and reinforced Adidas’s connection with football legends

- In June 2023, Adidas unveiled a brand-new Team India cricket jersey across all formats—Tests, T20Is, and ODIs specifically launched for Indian cricket team captain Rohit Sharma. This move strengthened Adidas’s visibility in the cricket merchandising space and deepened its influence in the Indian sportswear market

- In May 2023, PUMA entered into a partnership with Formula 1 to become the official licensing partner and exclusive trackside retailer for F1 fanwear, including branded apparel, footwear, and accessories for all ten teams starting in 2024. This collaboration marked a strategic expansion of PUMA’s footprint in global motorsport merchandise

- In November 2022, the Saudi Arabian Football Federation (SAFF) signed an agreement with Adidas to become the exclusive kit supplier for its national football teams, replacing Nike, effective from 2023 through 2026. This deal solidified Adidas’s presence in Middle Eastern football and expanded its global portfolio of national team sponsorships

- In March 2022, Puma renewed its collaboration with the W Series, a premier motor racing championship for female drivers, to provide flame-retardant racewear tailored for women. This partnership highlighted Puma’s commitment to inclusivity and innovation in motorsport gear

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL LICENSED SPORTS MERCHANDISE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL LICENSED SPORTS MERCHANDISE MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL LICENSED SPORTS MERCHANDISE MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CONSUMER BUYING BEHAVIOUR

5.2 FACTORS AFFECTING BUYING DECISION

5.3 PRODUCT ADOPTION SCENARIO

5.4 PORTER’S FIVE FORCES

5.5 REGULATION COVERAGE

5.6 RAW MATERIAL SOURCING ANALYSIS

5.7 IMPORT EXPORT SCENARIO

6 PRODUCTION CAPACITY OUTLOOK

7 PRICING ANALYSIS

8 BRAND OUTLOOK

8.1 BRAND COMPARATIVE ANALYSIS

8.2 PRODUCT VS BRAND OVERVIEW

9 IMPACT OF ECONOMIC SLOWDOWN

9.1 IMPACT ON PRICES

9.2 IMPACT ON SUPPLY CHAIN

9.3 IMPACT ON SHIPMENT

9.4 IMPACT ON DEMAND

9.5 IMPACT ON STRATEGIC DECISIONS

10 SUPPLY CHAIN ANALYSIS

10.1 OVERVIEW

10.2 LOGISTIC COST SCENARIO

10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

11 GLOBAL LICENSED SPORTS MERCHANDISE MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) (MILLION UNITS)

11.1 OVERVIEW

11.2 APPAREL

11.2.1 JERSEYS

11.2.1.1. REPLICA JERSEYS

11.2.1.2. AUTHENTIC JERSEYS

11.2.1.3. LIMITED EDITION JERSEYS

11.2.1.4. TRAINING JERSEYS

11.2.1.5. RETRO/THROWBACK JERSEYS

11.2.1.6. ESPORTS JERSEYS

11.2.1.7. OTHERS

11.2.2 T-SHIRTS & POLOS

11.2.2.1. GRAPHIC TEAM TEES

11.2.2.2. PLAYER-INSPIRED TEES

11.2.2.3. TRAINING T-SHIRTS

11.2.2.4. PERFORMANCE POLOS

11.2.2.5. OTHERS

11.2.3 HOODIES & SWEATSHIRTS

11.2.3.1. PULLOVER HOODIES

11.2.3.2. ZIP-UP HOODIES

11.2.3.3. CREWNECK SWEATSHIRTS

11.2.3.4. THERMAL/FLEECE-LINED HOODIES

11.2.3.5. OTHERS

11.2.4 JACKETS

11.2.5 CAPS, HATS & BEANIES

11.2.5.1. SNAPBACK CAPS

11.2.5.2. FITTED CAPS

11.2.5.3. TRUCKER HATS

11.2.5.4. BUCKET HATS

11.2.5.5. WINTER BEANIES

11.2.5.6. VISORS

11.2.5.7. OTHERS

11.2.6 PANTS & SHORTS

11.2.7 SOCKS

11.2.8 OTHERS

11.3 FOOTWEAR

11.3.1 SNEAKERS

11.3.1.1. SIGNATURE PLAYER SNEAKERS

11.3.1.2. LIMITED-EDITION TEAM SNEAKERS

11.3.1.3. LIFESTYLE SNEAKERS

11.3.1.4. PERFORMANCE SNEAKERS

11.3.1.5. RETRO SNEAKERS

11.3.1.6. ESPORTS SNEAKERS

11.3.1.7. SKATEBOARDING-INSPIRED SNEAKERS

11.3.1.8. OTHERS

11.3.2 CLEATS

11.3.2.1. FOOTBALL (SOCCER) CLEATS

11.3.2.2. AMERICAN FOOTBALL CLEATS

11.3.2.3. BASEBALL CLEATS

11.3.2.4. CRICKET SHOES

11.3.2.5. RUGBY CLEATS

11.3.2.6. LACROSSE CLEATS

11.3.2.7. OTHERS

11.3.3 SANDALS & FLIP-FLOPS

11.3.3.1. FOAM SLIDES

11.3.3.2. GEL-CUSHIONED SANDALS

11.3.3.3. RETRO-THEMED FLIP-FLOPS

11.3.3.4. OTHERS

11.3.4 CUSTOM-THEMED SHOES

11.3.5 OTHERS

11.4 ACCESSORIES

11.4.1 BAGS & BACKPACKS

11.4.1.1. GYM BAGS

11.4.1.2. TOTES

11.4.1.3. LAPTOP BAGS

11.4.1.4. TRAVEL DUFFLE BAGS

11.4.1.5. OTHERS

11.4.2 BELTS, WALLETS & KEYCHAINS

11.4.3 WATCHES & JEWELRY

11.4.3.1. BRACELETS

11.4.3.2. NECKLACES

11.4.3.3. RINGS

11.4.3.4. OTHERS

11.4.4 HEADBANDS, WRISTBANDS & SWEATBANDS

11.4.5 SUNGLASSES & EYEWEAR

11.4.5.1. SPORT-SPECIFIC SUNGLASSES

11.4.5.2. STREETWEAR-INSPIRED SPORTS EYEWEAR

11.4.6 OTHERS

11.5 PROTECTIVE GEAR & SPORTS EQUIPMENT

11.5.1 HELMETS & PADS

11.5.1.1. NFL-STYLE REPLICA HELMETS

11.5.1.2. BASEBALL BATTING HELMETS

11.5.1.3. CRICKET HELMETS

11.5.1.4. HOCKEY GOALIE HELMETS

11.5.1.5. OTHERS

11.5.2 GLOVES

11.5.2.1. FOOTBALL RECEIVER GLOVES

11.5.2.2. GOALKEEPER GLOVES

11.5.2.3. BASEBALL BATTING GLOVES

11.5.2.4. MMA & BOXING GLOVES

11.5.2.5. OTHERS

11.5.3 SHIN GUARDS, ELBOW & KNEE PADS

11.5.4 RACKETS

11.5.4.1. TENNIS RACKET

11.5.4.2. BASMINTON RACKET

11.5.4.3. SQUASH RACKET

11.5.4.4. TABLE TENNIS PADDLES

11.5.4.5. OTHERS

11.5.5 STICKS

11.5.5.1. ICE HOCKEY STICKS

11.5.5.2. FIELD HOCKEY STICKS

11.5.5.3. LACROSSE STICKS

11.5.5.4. POLO MALLETS

11.5.5.5. OTHERS

11.5.6 BATS

11.5.6.1. BASEBALL BATS

11.5.6.2. CRICKET BATS

11.5.6.3. SOFTBALL BATS

11.5.6.4. OTHERS

11.5.7 GOALPOSTS, HOOPS, & NETS

11.5.8 TRAINING EQUIPMENT

11.5.8.1. AGILITY LADDERS

11.5.8.2. RESISTANCE BANDS

11.5.8.3. OTHES

11.6 TOYS, GAMES & COLLECTIBLES

11.6.1 TOYS & GAMES

11.6.1.1. ACTION FIGURES

11.6.1.2. TRADING CARDS

11.6.1.3. BOARD GAMES & PUZZLES

11.6.1.4. OTHERS

11.6.2 VIDEO GAMES & SOFTWARE

11.6.2.1. CONSOLE VIDEO GAMES

11.6.2.2. PC VIDEO GAMES

11.6.2.3. MOBILE SPORTS GAMES

11.6.2.4. VIRTUAL REALITY (VR) & AUGMENTED REALITY (AR) SPORTS GAMES

11.6.2.5. OTHERS

11.6.3 COLLECTIBLES & MEMORABILIA

11.6.3.1. AUTOGRAPHED MERCHANDISE

11.6.3.1.1. JERSEYS

11.6.3.1.2. BALLS

11.6.3.1.3. POSTERS

11.6.3.1.4. OTHERS

11.6.3.2. LIMITED EDITION MERCHANDISE

11.6.3.3. REPLICA TROPHIES & MEDALS

11.6.3.4. HISTORIC SPORTS ARTIFACTS

11.6.3.5. OTHERS

11.7 HOME, OFFICE & LIFESTYLE GOODS

11.7.1 HOME DECOR & OFFICE MERCHANDISE

11.7.1.1. POSTERS & WALL ART

11.7.1.2. FURNITURE & BEDDING

11.7.1.3. CLOCKS, LAMPS & LIGHTING

11.7.1.4. OTHERS

11.7.2 DRINKWARE & KITCHENWARE

11.7.2.1. MUGS

11.7.2.2. TUMBLERS

11.7.2.3. WATER BOTTLES

11.7.2.4. PLATES & BOWLS

11.7.2.5. UTENSILS

11.7.2.6. OTHERS

11.7.3 STATIONERY & OFFICE SUPPLIES

11.7.3.1. NOTEBOOKS

11.7.3.2. PENS

11.7.3.3. PLANNERS

11.7.3.4. LAPTOP SKINS

11.7.3.5. MOUSE PADS

11.7.3.6. OTHERS

11.8 OTHERS

12 GLOBAL LICENSED SPORTS MERCHANDISE MARKET, BY SPORT TYPE, 2018-2032 (USD MILLION)

12.1 OVERVIEW

12.2 TEAM SPORTS

12.2.1 FOOTBALL (SOCCER)

12.2.2 AMERICAN FOOTBALL

12.2.3 BASEBALL

12.2.4 BASKETBALL

12.2.5 ICE HOCKEY

12.2.6 CRICKET

12.2.7 RUGBY

12.2.8 OTHERS

12.3 INDIVIDUAL SPORTS

12.3.1 TENNIS

12.3.2 GOLF

12.3.3 BOXING & MIXED MARTIAL ARTS (MMA)

12.3.4 MOTORSPORTS

12.3.5 WRESTLING

12.3.6 OTHERS

12.4 MULTI-SPORT & SPECIAL EVENTS

12.4.1 OLYMPICS

12.4.2 PARALYMPICS & SPECIAL OLYMPICS

12.4.3 ESPORTS & VIRTUAL SPORTS

12.4.4 OTHERS

13 GLOBAL LICENSED SPORTS MERCHANDISE MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

13.1 OVERVIEW

13.2 MASS MARKET

13.3 PREMIUM & LUXURY

13.4 COLLECTOR’S ITEMS & EXCLUSIVE RELEASES

14 GLOBAL LICENSED SPORTS MERCHANDISE MARKET, BY LICENSING TYPE, 2018-2032 (USD MILLION)

14.1 OVERVIEW

14.2 OFFICIAL TEAM & LEAGUE LICENSED MERCHANDISE

14.3 PLAYER-ENDORSED MERCHANDISE

14.4 BRAND COLLABORATIONS & LIMITED-EDITION DROPS

14.5 OTHERS

15 GLOBAL LICENSED SPORTS MERCHANDISE MARKET, BY DEMOGRAPHY, 2018-2032 (USD MILLION)

15.1 OVERVIEW

15.2 KIDS & YOUTH

15.3 MILLENNIALS & GEN Z (18-35 YEARS)

15.4 ADULTS (35+ YEARS)

16 GLOBAL LICENSED SPORTS MERCHANDISE MARKET, BY END-USER, 2018-2032 (USD MILLION)

16.1 OVERVIEW

16.2 MEN

16.3 WOMEN

16.4 KIDS

17 GLOBAL LICENSED SPORTS MERCHANDISE MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

17.1 OVERVIEW

17.2 OFFLINE STORES

17.2.1 SPORTS SPECIALTY STORES

17.2.2 BRAND-OWNED STORES

17.2.3 DEPARTMENT STORES

17.2.4 SUPERMARKETS & HYPERMARKETS

17.2.5 AIRPORT & TRAVEL RETAIL

17.2.6 OTHERS

17.3 ONLINE STORES

17.3.1 OFFICIAL TEAM & LEAGUE WEBSITES

17.3.2 E-COMMERCE MARKETPLACES

17.3.3 RETAIL BRAND WEBSITES

18 GLOBAL LICENSED SPORTS MERCHANDISE MARKET, BY GEOGRAPHY, 2018-2032 (USD MILLION) (MILLION UNITS)

Global licensed sports merchandise market, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

18.2 EUROPE

18.2.1 GERMANY

18.2.2 U.K.

18.2.3 ITALY

18.2.4 FRANCE

18.2.5 SPAIN

18.2.6 RUSSIA

18.2.7 SWITZERLAND

18.2.8 TURKEY

18.2.9 BELGIUM

18.2.10 POLAND

18.2.11 DENMARK

18.2.12 NORWAY

18.2.13 SWEDEN

18.2.14 NETHERLANDS

18.2.15 REST OF EUROPE

18.3 ASIA-PACIFIC

18.3.1 JAPAN

18.3.2 CHINA

18.3.3 SOUTH KOREA

18.3.4 INDIA

18.3.5 SINGAPORE

18.3.6 THAILAND

18.3.7 INDONESIA

18.3.8 MALAYSIA

18.3.9 PHILIPPINES

18.3.10 AUSTRALIA

18.3.11 NEW ZEALAND

18.3.12 REST OF ASIA-PACIFIC

18.4 SOUTH AMERICA

18.4.1 BRAZIL

18.4.2 ARGENTINA

18.4.3 REST OF SOUTH AMERICA

18.5 MIDDLE EAST AND AFRICA

18.5.1 SOUTH AFRICA

18.5.2 EGYPT

18.5.3 SAUDI ARABIA

18.5.4 UNITED ARAB EMIRATES

18.5.5 ISRAEL

18.5.6 REST OF MIDDLE EAST AND AFRICA

19 GLOBAL LICENSED SPORTS MERCHANDISE MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

19.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

19.3 COMPANY SHARE ANALYSIS: EUROPE

19.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

19.5 MERGERS AND ACQUISITIONS

19.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

19.7 EXPANSIONS

19.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

20 GLOBAL LICENSED SPORTS MERCHANDISE MARKET - SWOT ANALYSIS

21 GLOBAL LICENSED SPORTS MERCHANDISE MARKET - COMPANY PROFILES

21.1 EVERLAST WORLDWIDE INC.

21.1.1 COMPANY SNAPSHOT

21.1.2 PRODUCT PORTFOLIO

21.1.3 REVENUE ANALYSIS

21.1.4 RECENT UPDATES

21.2 G-III APPAREL GROUP, LTD.

21.2.1 COMPANY SNAPSHOT

21.2.2 PRODUCT PORTFOLIO

21.2.3 REVENUE ANALYSIS

21.2.4 RECENT UPDATES

21.3 FANATICS INC.

21.3.1 COMPANY SNAPSHOT

21.3.2 PRODUCT PORTFOLIO

21.3.3 REVENUE ANALYSIS

21.3.4 RECENT UPDATES

21.4 ADIDAS

21.4.1 COMPANY SNAPSHOT

21.4.2 PRODUCT PORTFOLIO

21.4.3 REVENUE ANALYSIS

21.4.4 RECENT UPDATES

21.5 UNDER ARMOUR, INC.

21.5.1 COMPANY SNAPSHOT

21.5.2 PRODUCT PORTFOLIO

21.5.3 REVENUE ANALYSIS

21.5.4 RECENT UPDATES

21.6 NEW ERA CAP

21.6.1 COMPANY SNAPSHOT

21.6.2 PRODUCT PORTFOLIO

21.6.3 REVENUE ANALYSIS

21.6.4 RECENT UPDATES

21.7 PUMA SE

21.7.1 COMPANY SNAPSHOT

21.7.2 PRODUCT PORTFOLIO

21.7.3 REVENUE ANALYSIS

21.7.4 RECENT UPDATES

21.8 COLUMBIA SPORTSWEAR INDIA

21.8.1 COMPANY SNAPSHOT

21.8.2 PRODUCT PORTFOLIO

21.8.3 REVENUE ANALYSIS

21.8.4 RECENT UPDATES

21.9 DICK'S SPORTING GOODS

21.9.1 COMPANY SNAPSHOT

21.9.2 PRODUCT PORTFOLIO

21.9.3 REVENUE ANALYSIS

21.9.4 RECENT UPDATES

21.1 HANESBRANDS INC.

21.10.1 COMPANY SNAPSHOT

21.10.2 PRODUCT PORTFOLIO

21.10.3 REVENUE ANALYSIS

21.10.4 RECENT UPDATES

21.11 SUNLIGHT SPORTS STUDIO LLP

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.11.3 REVENUE ANALYSIS

21.11.4 RECENT UPDATES

21.12 RAWLINGS SPORTING GOODS.

21.12.1 COMPANY SNAPSHOT

21.12.2 PRODUCT PORTFOLIO

21.12.3 REVENUE ANALYSIS

21.12.4 RECENT UPDATES

21.13 LI NING (CHINA) SPORTS GOODS CO. LTD

21.13.1 COMPANY SNAPSHOT

21.13.2 PRODUCT PORTFOLIO

21.13.3 REVENUE ANALYSIS

21.13.4 RECENT UPDATES

21.14 ASICS CORPORATION

21.14.1 COMPANY SNAPSHOT

21.14.2 PRODUCT PORTFOLIO

21.14.3 REVENUE ANALYSIS

21.14.4 RECENT UPDATES

21.15 ICONIX BRAND GROUP

21.15.1 COMPANY SNAPSHOT

21.15.2 PRODUCT PORTFOLIO

21.15.3 REVENUE ANALYSIS

21.15.4 RECENT UPDATES

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

22 RELATED REPORTS

23 QUESTIONNAIRE

24 CONCLUSION

25 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.