Global Life Sciences Commercialization Vendor Platform Market

Market Size in USD Billion

CAGR :

%

USD

14.76 Billion

USD

26.33 Billion

2024

2032

USD

14.76 Billion

USD

26.33 Billion

2024

2032

| 2025 –2032 | |

| USD 14.76 Billion | |

| USD 26.33 Billion | |

|

|

|

|

Life Sciences Commercialization Vendor Platform Market Size

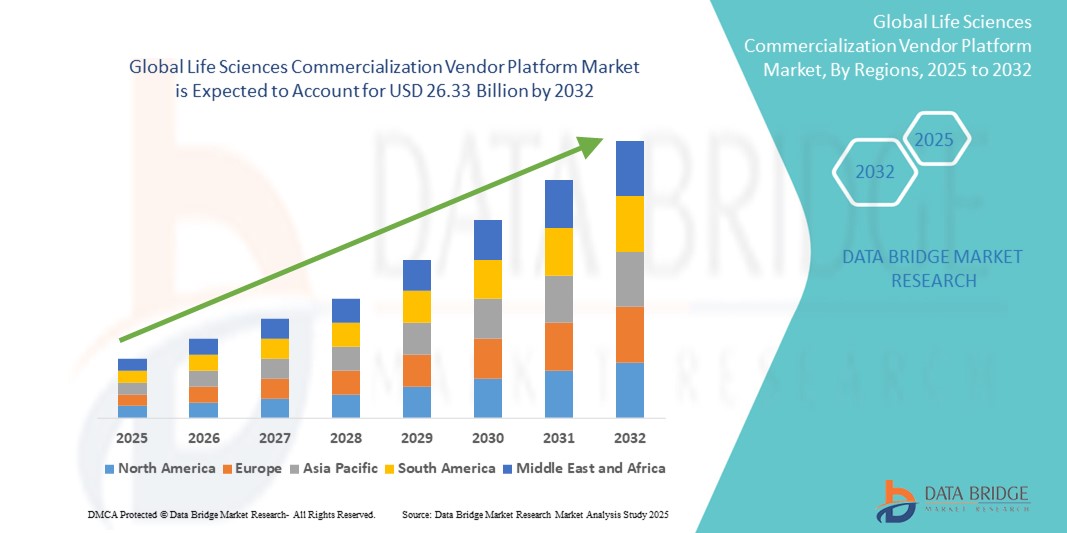

- The global life sciences commercialization vendor platform market size was valued at USD 14.76 billion in 2024 and is expected to reach USD 26.33 billion by 2032, at a CAGR of 7.50% during the forecast period

- The market growth is largely fueled by the increasing complexity of commercial operations in the life sciences sector, requiring data-driven, integrated platforms to manage sales, marketing, regulatory compliance, and market access efficiently

- Furthermore, rising demand for real-time analytics, personalized customer engagement, and omnichannel strategies is driving the adoption of comprehensive commercialization vendor platforms. These converging factors are empowering life sciences companies to streamline operations and accelerate go-to-market strategies, thereby significantly boosting the industry's growth

Life Sciences Commercialization Vendor Platform Market Analysis

- Life sciences commercialization vendor platforms, offering digital tools for managing sales operations, market access, regulatory support, and launch planning, are becoming crucial to pharmaceutical, biotech, and medtech companies seeking to navigate increasingly complex commercialization pathways

- The rising adoption of these platforms is primarily fueled by the demand for real-time healthcare analytics, data-driven decision-making, and integrated engagement across stakeholders including providers, payers, and patients

- North America dominated the life sciences commercialization vendor platform market with the largest revenue share of 42.2% in 2024, driven by the presence of major pharmaceutical companies, early digital transformation initiatives, and strong investments in AI-powered commercialization tools, particularly in the U.S. where digital product launches and omnichannel strategies are rapidly maturing

- Asia-Pacific is expected to be the fastest growing region in the life sciences commercialization vendor platform market during the forecast period due to expanding pharmaceutical markets, increased clinical trial activity, and growing demand for cloud-based solutions among emerging economies

- The healthcare analytics segment dominated the life sciences commercialization vendor platform market with a share of 26.8% in 2024, driven by the critical need for actionable insights in decision-making, sales forecasting, and patient targeting across commercialization workflows

Report Scope and Life Sciences Commercialization Vendor Platform Market Segmentation

|

Attributes |

Life Sciences Commercialization Vendor Platform Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Life Sciences Commercialization Vendor Platform Market Trends

“AI-Powered Insights and Real-Time Commercial Intelligence”

- A significant and accelerating trend in the global life sciences commercialization vendor platform market is the integration of artificial intelligence (AI) and machine learning (ML) into commercial analytics, enabling companies to derive real-time insights, predict market behavior, and optimize stakeholder engagement strategies

- For instance, Veeva Systems has expanded its platform capabilities with AI-driven solutions that deliver actionable insights across sales, marketing, and medical affairs. Similarly, companies such as Aktana utilize AI to enhance decision support in omnichannel engagement by personalizing outreach based on behavior and preferences of healthcare professionals (HCPs)

- AI-powered platforms can analyze vast datasets from multiple sources EMRs, CRM, claims, and social platforms to provide intelligent recommendations on next-best-actions for field reps, improve segmentation accuracy, and predict patient access trends. These capabilities significantly enhance the precision and agility of commercialization strategies

- Real-time commercial intelligence helps life sciences firms respond faster to changing market conditions, such as pricing pressures or competitive launches, by providing dynamic forecasting and scenario planning capabilities. This integration enables better resource allocation and prioritization of high-impact market opportunities

- The convergence of AI with cloud-based commercialization platforms allows seamless updates, remote accessibility, and automation of routine compliance processes, thereby improving operational efficiency across global teams. Providers such as IQVIA and Indegene are increasingly investing in integrated AI solutions that support global launch planning, market access, and patient-centric engagement

- As the complexity of global product launches grows, the demand for intelligent, adaptive, and data-rich commercialization tools continues to rise. This trend is reshaping life sciences firms’ expectations, pushing platform vendors to deliver more predictive, scalable, and integrated digital ecosystems

Life Sciences Commercialization Vendor Platform Market Dynamics

Driver

“Rising Demand for Data-Driven Commercial Strategies in a Complex Regulatory Landscape”

- The growing complexity of global life sciences commercialization characterized by varied regulatory requirements, pricing pressures, and diverse payer environments is driving demand for integrated vendor platforms that offer data-driven decision support

- For instance, in February 2024, IQVIA announced new capabilities in its Orchestrated Customer Engagement (OCE) platform, combining real-time market data, compliance workflows, and AI-powered engagement planning. Such advancements are increasingly essential for pharmaceutical firms navigating fragmented markets and optimizing launch readiness

- As life sciences companies aim to reduce time-to-market, improve HCP engagement, and comply with stringent data transparency rules, comprehensive commercialization platforms enable centralized control, performance monitoring, and automated reporting

- These platforms also support cross-functional collaboration between field reps, market access teams, and regulatory affairs professionals, ensuring consistent messaging, efficient resource use, and improved outcomes across product lifecycles

- The transition to omnichannel marketing, the need for customized stakeholder engagement, and the push for global launch excellence are further fueling adoption of these solutions across both established firms and emerging biotech players

Restraint/Challenge

“High Integration Costs and Data Privacy Compliance Complexity”

- Despite their strategic value, life sciences commercialization vendor platforms face adoption challenges stemming from high implementation and integration costs especially for small and mid-sized enterprises with limited IT budgets

- Platform deployment often requires integration with existing enterprise systems demanding both financial resources and organizational alignment, which can slow adoption

- Moreover, the increasing global emphasis on data privacy presents additional challenges, as life sciences firms must ensure that platforms comply with multiple regional frameworks simultaneously

- Failure to meet these compliance requirements can result in significant financial penalties and damage to brand reputation, making compliance automation and data governance critical but resource-intensive priorities

- Companies such as Veeva, Salesforce Health Cloud, and Oracle are responding by offering modular, compliance-ready platforms, but the need for continual updates and secure data handling still presents barriers particularly for firms operating in multiple geographies

- Overcoming these hurdles will require improved standardization, vendor collaboration, and investment in secure, interoperable, and cost-effective platform solutions tailored to the scale and complexity of different life sciences organizations

Life Sciences Commercialization Vendor Platform Market Scope

The market is segmented on the basis of type of vendor platform, purchase mode, deployment mode, size of organization, application, and end user.

- By Type of Vendor Platform

On the basis of type, the life sciences commercialization vendor platform market is segmented into patient engagement, population health management, field performance, marketing and sales operation, data management, healthcare analytics, and others. The healthcare analytics segment dominated the market with the largest market revenue share of 26.8% in 2024, driven by the need for real-time insights, predictive modeling, and data-driven decision-making across sales, marketing, and market access teams. Pharmaceutical and biotech companies are increasingly leveraging analytics to refine segmentation, improve field force efficiency, and optimize product launches.

The marketing and sales operation segment is anticipated to witness the fastest growth rate of 21.2% from 2025 to 2032, fueled by the demand for omnichannel engagement tools, CRM integration, and personalized outreach to healthcare professionals. The rapid shift toward digital-first commercialization strategies is significantly boosting demand for advanced marketing and sales support tools.

- By Purchase Mode

On the basis of purchase mode, the life sciences commercialization vendor platform market is segmented into group purchase and individual purchase. The group purchase segment dominated the market with a revenue share of 61.5% in 2024, as large enterprises and consortiums prefer enterprise-wide platform deals for standardization, cost savings, and centralized implementation.

The individual purchase segment is expected to grow steadily during forecast period, as small and mid-sized firms adopt modular or region-specific platform solutions for targeted commercialization needs.

- By Deployment Mode

On the basis of deployment mode, the life sciences commercialization vendor platform market is segmented into on-premises, cloud-based, and web-based platforms. The cloud-based segment held the largest market revenue share of 47.8% in 2024, driven by its scalability, flexibility, and ease of remote access. Cloud platforms support real-time updates, global collaboration, and lower upfront IT infrastructure costs, making them increasingly favored by both large and mid-sized life sciences organizations.

The web-based segment is projected to witness the fastest growth during the forecast period, due to ease of access via browsers, cost-efficiency, and increasing use in SME deployments with limited IT capacity.

- By Size of Organization

On the basis of organization size, the life sciences commercialization vendor platform market is segmented into large enterprises and small and medium-sized enterprises (SMEs). The large enterprises segment dominated the market with a revenue share of 68.2% in 2024, attributed to their complex commercialization processes, broader geographic operations, and higher IT budgets to invest in enterprise-grade solutions.

However, SMEs are projected to gain momentum during forecast period, due to growing access to affordable SaaS platforms and the rising presence of mid-sized biotech and specialty pharma companies looking to commercialize niche products.

- By Application

On the basis of application, the life sciences commercialization vendor platform market is segmented into product launch and marketing, market access and pricing, clinical development, regulatory affairs, supply chain and logistics, and others. The product launch and marketing segment dominated the market with a share of 30.7% in 2024, due to the critical need for coordinated, timely, and effective product introductions in competitive therapeutic markets. Platforms that support digital launch readiness and omnichannel HCP engagement are especially in demand.

The market access and pricing segment is projected to grow at a rapid pace during forecast period, driven by increased regulatory scrutiny and the need to navigate complex payer environments globally.

- By End User

On the basis of end user, the life sciences commercialization vendor platform market is segmented into providers and payers. The providers segment captured the largest market share of 57.4% in 2024, as they are key stakeholders in the product lifecycle, involved in adoption, education, and real-world evidence collection. Provider-focused commercialization platforms enable more precise targeting and engagement.

The payers segment is expected to grow steadily during forecast period, as market access and value-based pricing models gain prominence, requiring tools that facilitate negotiation, outcomes tracking, and payer engagement

Life Sciences Commercialization Vendor Platform Market Regional Analysis

- North America dominated the life sciences commercialization vendor platform market with the largest revenue share of 42.2% in 2024, driven by the presence of major pharmaceutical companies, early digital transformation initiatives, and strong investment

- Life sciences companies in the region increasingly rely on integrated platforms to streamline product launches, improve HCP engagement, and ensure compliance with evolving regulatory standards

- This leadership position is further supported by robust healthcare IT infrastructure, the presence of key market players, and a strategic focus on personalized, data-driven commercialization, establishing North America as the hub for innovation in life sciences commercial solutions across both enterprise and emerging biotech sectors

U.S. Life Sciences Commercialization Vendor Platform Market Insight

The U.S. life sciences commercialization vendor platform market captured the largest revenue share of 78% in 2024 within North America, driven by the country's dominant pharmaceutical and biotech sector and strong adoption of AI-powered commercialization tools. Companies are increasingly leveraging integrated platforms to streamline product launches, manage regulatory compliance, and optimize HCP engagement. The shift toward digital-first strategies, personalized outreach, and real-time analytics continues to strengthen demand. Furthermore, the U.S. healthcare system’s complexity reinforces the need for scalable, compliant, and interoperable commercialization solutions.

Europe Life Sciences Commercialization Vendor Platform Market Insight

The Europe life sciences commercialization vendor platform market is projected to grow at a substantial CAGR throughout the forecast period, driven by stringent data protection regulations (e.g., GDPR), increasing cross-border commercialization efforts, and rising demand for coordinated product launch platforms. European pharmaceutical firms are adopting vendor platforms to enhance transparency, manage value-based pricing, and streamline multi-country regulatory submissions. Growth is particularly notable in Western Europe, where digital maturity and demand for AI-driven tools support broader adoption across large and mid-sized enterprises.

U.K. Life Sciences Commercialization Vendor Platform Market Insight

The U.K. life sciences commercialization vendor platform market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by government support for the pharmaceutical sector, the expansion of clinical trials, and increased investment in digital transformation. Companies are seeking commercialization platforms that support accelerated launch readiness and align with the U.K.’s focus on real-world evidence and outcome-based access models. The country’s emphasis on market access innovation and digital health infrastructure is further propelling platform adoption.

Germany Life Sciences Commercialization Vendor Platform Market Insight

The Germany life sciences commercialization vendor platform market is expected to expand at a considerable CAGR, driven by the country’s status as a leading pharmaceutical hub in Europe and its focus on data security and compliance. German companies prioritize integrated, privacy-focused solutions that ensure regulatory alignment while delivering robust analytics and commercial planning capabilities. The demand for scalable platforms that support decentralized teams and multichannel stakeholder engagement is growing, especially in the context of complex regulatory frameworks and increasing launch activity.

Asia-Pacific Life Sciences Commercialization Vendor Platform Market Insight

The Asia-Pacific life sciences commercialization vendor platform market is poised to grow at the fastest CAGR of 22.8% from 2025 to 2032, driven by a booming pharmaceutical industry, increased R&D investments, and accelerating digital transformation across countries such as China, India, and Japan. Governments are promoting innovation and data infrastructure, making the region attractive for platform providers. Local and global firms are investing in solutions that enable cross-market commercialization, compliance automation, and scalable operations across emerging and mature APAC economies.

Japan Life Sciences Commercialization Vendor Platform Market Insight

The Japan life sciences commercialization vendor platform market is gaining traction due to the country's advanced healthcare system, high regulatory standards, and focus on innovation. Japanese pharmaceutical companies are increasingly adopting digital platforms to support personalized HCP engagement, multichannel sales strategies, and AI-driven commercial analytics. As smart health ecosystems evolve, demand for integrated, compliant commercialization tools is growing, particularly among large biopharma firms and multinational corporations operating in Japan.

India Life Sciences Commercialization Vendor Platform Market Insight

The India life sciences commercialization vendor platform market accounted for the largest market revenue share in Asia Pacific in 2024, driven by a rapidly growing pharmaceutical sector, expanding clinical trials, and strong domestic demand for commercial technology solutions. India’s rising number of mid-sized biotech firms and contract research organizations (CROs) are adopting cost-effective, cloud-based platforms to support product launches, regulatory processes, and real-world data integration. Government initiatives promoting digital health, alongside an expanding talent pool, continue to attract investment in commercialization technology.

Life Sciences Commercialization Vendor Platform Market Share

The life sciences commercialization vendor platform industry is primarily led by well-established companies, including:

- Veeva Systems Inc. (U.S.)

- IQVIA Inc. (U.S.)

- Indegene Limited (India)

- Oracle Corporation (U.S.)

- Salesforce, Inc. (U.S.)

- Cognizant Technology Solutions Corporation (U.S.)

- Infosys Limited (India)

- Accenture plc (Ireland)

- Deloitte Touche Tohmatsu Limited (U.K.)

- ZS Associates, Inc. (U.S.)

- Optymyze, Inc. (U.S.)

- Axtria, Inc. (U.S.)

- PharmaForceIQ (U.S.)

- Model N, Inc. (U.S.)

- Syndigo LLC (U.S.)

- Benchling, Inc. (U.S.)

- NNIT A/S (Denmark)

- Beghou Consulting, Inc. (U.S.)

- HighPoint Solutions, LLC (U.S.)

- Saama Technologies, Inc. (U.S.)

What are the Recent Developments in Global Life Sciences Commercialization Vendor Platform Market?

- In April 2023, Veeva Systems Inc., a leading provider of cloud-based software for the global life sciences industry, launched Veeva Compass, an advanced analytics platform delivering real-world insights for more precise commercial decision-making. By integrating claims, prescription, and demographic data into a unified system, Veeva Compass empowers life sciences companies to enhance territory planning, identify growth opportunities, and improve salesforce effectiveness. This launch reinforces Veeva’s leadership in supporting data-driven commercialization strategies

- In March 2023, IQVIA announced the expansion of its Orchestrated Customer Engagement (OCE) platform with new AI-powered features for next-best-action suggestions, personalized HCP engagement, and multichannel optimization. This upgrade aims to enhance field performance and marketing operations by combining real-time analytics with advanced automation, enabling commercial teams to respond more dynamically to market shifts and customer behavior. The development reflects IQVIA’s ongoing commitment to digital innovation in life sciences

- In February 2023, Indegene, a global commercialization partner for biopharma companies, launched its Enterprise Commercialization Suite, a modular, AI-enabled platform designed to streamline product launches and manage omnichannel campaigns across global markets. The platform supports various commercialization functions, including regulatory readiness, field force coordination, and stakeholder engagement. This launch marks Indegene’s strategic move to strengthen its platform offerings for large and mid-sized pharma clients

- In February 2023, Salesforce expanded its Health Cloud for Life Sciences, introducing enhanced features to support regulatory compliance, patient engagement, and sales automation. The updates include advanced AI-driven insights, field team coordination tools, and compliance-focused workflows. This initiative aims to bridge clinical, commercial, and patient-facing operations, helping life sciences firms create unified, data-driven commercialization journeys

- In January 2023, Optymyze, a provider of no-code enterprise automation solutions, announced the deployment of its Sales Performance Management (SPM) platform for a global pharmaceutical company to optimize field sales effectiveness and incentive compensation. The platform enables agile commercial execution through real-time performance tracking, automated data management, and AI-based insights. This development highlights the growing importance of automation and data intelligence in supporting global commercialization efforts

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.