Global Lingerie Market

Market Size in USD Billion

CAGR :

%

USD

37.48 Billion

USD

69.38 Billion

2024

2032

USD

37.48 Billion

USD

69.38 Billion

2024

2032

| 2025 –2032 | |

| USD 37.48 Billion | |

| USD 69.38 Billion | |

|

|

|

|

Lingerie Market Size

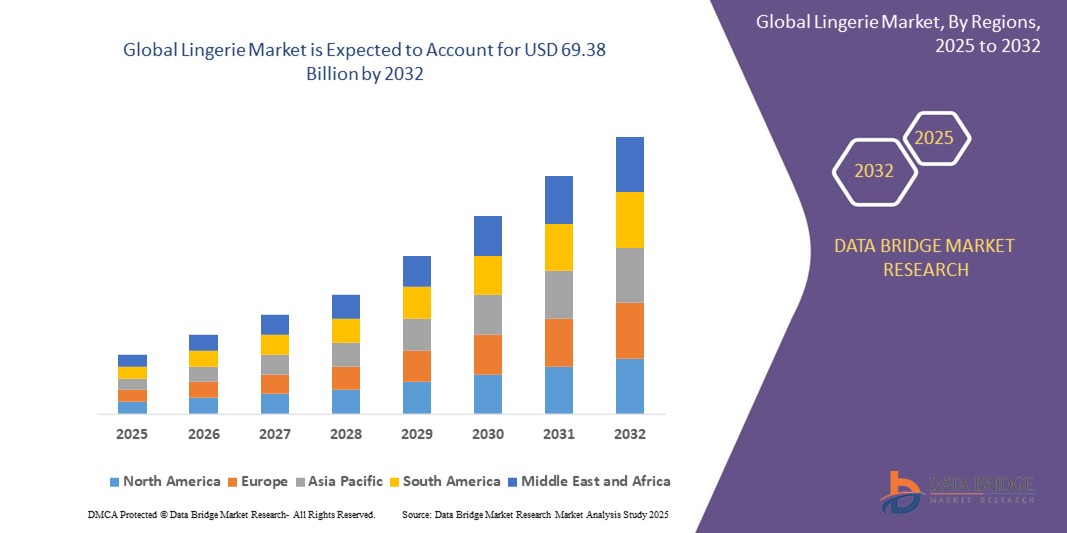

- The global Lingerie market was valued at USD 37.48 billion in 2024 and is expected to reach USD 69.38 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.00%, primarily driven by the increasing consumer demand for comfortable, stylish, and inclusive lingerie products

- This growth is driven by factors such as the rising awareness of body positivity, increasing disposable incomes, the growing popularity of online shopping, and innovations in fabric and design

Lingerie Market Analysis

- The global lingerie market is experiencing significant growth, driven by evolving consumer preferences and increased demand for diverse and inclusive product ranges. The market has been shifting from traditional styles to more fashion-forward and comfortable options. This change is also influenced by the growing importance of self-expression through fashion choices

- Technological innovations are transforming the lingerie industry, particularly in the development of fabrics and design. Manufacturers are increasingly focusing on creating more comfortable, breathable, and durable materials to meet consumer expectations for both style and comfort. This has resulted in higher-quality products that appeal to a broader range of consumers

- The rise of e-commerce has become a crucial factor in the growth of the lingerie market. Online shopping platforms provide a convenient way for consumers to access a wide variety of lingerie brands and styles, often at competitive prices

- For instance, large retail platforms such as Amazon and specialized lingerie sites have expanded their reach, making it easier for customers to purchase products from the comfort of their home

- Consumer behavior is also influenced by the growing trend of body positivity, with more brands offering products that cater to a wide range of body types. This inclusivity has led to greater representation in lingerie advertisements and product offerings, expanding the market to include people of all sizes

- The increasing focus on sustainability is another key factor in the market's development. Many brands are adopting eco-friendly practices, such as using sustainable fabrics and reducing waste in production processes. Consumers are becoming more aware of the environmental impact of their purchases, which has prompted lingerie brands to incorporate sustainability into their business models

Report Scope and Lingerie Market Segmentation

|

Attributes |

Lingerie Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Lingerie Market Trends

Rise of Sustainable and Eco-Friendly Lingerie

- Consumers are becoming more conscious of the environmental impact of their purchases and are seeking lingerie made from organic, recycled, or eco-friendly materials

- Brands are responding to this trend by introducing lingerie lines made from sustainable fabrics such as organic cotton, bamboo, hemp, and recycled polyester, which have a lower environmental footprint compared to traditional fabrics

- For Instance, brands such as Patagonia and Organic Basics have launched eco-friendly lingerie collections that emphasize sustainability and ethical production practices, attracting environmentally conscious consumers

- Additionally, the use of eco-friendly dyes and packaging, along with sustainable manufacturing processes, is gaining traction as companies look to reduce their carbon footprint and promote sustainability across their entire value chain

- This trend is not limited to niche brands; large corporations such as H&M and Victoria’s Secret are also incorporating sustainability into their offerings, with Victoria’s Secret recently launching a sustainable lingerie line called "VS&Co" that uses sustainable fabrics and eco-friendly production methods

- As sustainability becomes a central focus for modern consumers, the lingerie market is increasingly moving towards more transparent and eco-conscious business practices, with more brands expected to follow suit in the coming years

Lingerie Market Dynamics

Driver

Increasing Demand for Comfortable and Stylish Lingerie

- The growing consumer preference for comfortable yet stylish lingerie is one of the key drivers in the global lingerie market

- Consumers today are prioritizing comfort, with an increased demand for lingerie that offers both support and aesthetic appeal, especially after the rise of athleisure and loungewear trends in the fashion industry

- The shift towards comfort is particularly evident in the popularity of wireless bras, bralettes, and seamless underwear, which provide all-day comfort without sacrificing style

- The demand for inclusive sizing has also risen, with more brands offering products that cater to diverse body shapes and sizes, ensuring that customers of all demographics feel represented

- For instance, companies such as ThirdLove in the U.S. have gained significant traction by offering bras in a variety of sizes and using soft, breathable fabrics that cater to comfort without compromising on design

- As the trend for self-care and body positivity continues to grow, consumers are more inclined to choose lingerie that aligns with their personal comfort while also being stylish and fashionable

- This shift in consumer preferences is anticipated to continue driving growth in the lingerie market, as more brands innovate to meet these evolving demands for both style and comfort

Opportunity

Expansion in Emerging Markets

- Emerging markets, particularly in Asia-Pacific and Latin America, present significant growth opportunities for the global lingerie market

- The rising middle class in countries such as China, India, and Brazil, coupled with increasing disposable incomes, is driving a growing demand for premium and stylish lingerie

- E-commerce platforms have played a pivotal role in opening up new markets, allowing consumers in these regions to access a wide variety of lingerie brands that were once unavailable locally

- For instance, Alibaba's Tmall and Amazon have seen significant growth in lingerie sales in China and India, as more consumers turn to online shopping for convenience and variety

- Moreover, changing social norms in these regions, such as the rising acceptance of body positivity and women's empowerment, are further boosting demand for lingerie that reflects these values

- Brands expanding into these regions, such as Victoria's Secret and H&M, are tapping into an under-served market, offering products that cater to local preferences and expanding their footprint in fast-growing economies

- This expansion into emerging markets is expected to be a key driver for future growth in the global lingerie market, as companies look to capture a larger share of the growing middle-class consumer base

Restraint/Challenge

Rising Raw Material Costs and Supply Chain Disruptions

- One of the major challenges facing the global lingerie market is the increasing cost of raw materials and supply chain disruptions

- The rising prices of materials such as cotton, silk, and lace, combined with the increased cost of labor and shipping, have significantly impacted production costs for lingerie manufacturers

- These factors have led to higher retail prices for lingerie products, which could affect consumer purchasing decisions, especially in price-sensitive markets

- The COVID-19 pandemic has also exacerbated these issues, causing widespread disruptions to supply chains and manufacturing processes, leading to delays and shortages in the availability of key materials

- For Instance, companies such as Hanesbrands have reported challenges related to supply chain constraints and increased costs of raw materials, which have affected their profit margins and overall market performance

- Furthermore, the reliance on overseas production, particularly in countries such as China and Bangladesh, creates vulnerabilities in the supply chain, with political instability, tariffs, and environmental issues potentially further affecting availability and costs

- Addressing these challenges will require companies to find ways to optimize their supply chains, manage costs more effectively, and adapt to changing economic conditions while maintaining product quality and affordability

Lingerie Market Scope

The market is segmented on the basis of product, material, price, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Material |

|

|

By Price |

|

|

By Distribution Channel |

|

Lingerie Market Regional Analysis

North America is the Dominant Region in the Lingerie Market

- North America is currently the dominant region in the global lingerie market

- The region has a large consumer base driven by an increasing demand for luxury and premium lingerie products

- The U.S. stands out with a high number of leading lingerie brands, including Victoria’s Secret, contributing to the region's market share

- Factors such as a high disposable income, fashion-forward trends, and an expanding e-commerce industry further strengthen the market in this region

- Additionally, growing awareness about body positivity and inclusivity has fueled demand for a wide range of lingerie products catering to diverse body types

- Major retailers in North America are also focusing on offering high-quality products with innovative designs and fabrics, which enhances the region's market position

Asia-Pacific is Projected to Register the Highest Growth Rate

- The Asia-Pacific region is expected to be the fastest-growing market for lingerie

- Countries such as China, India, and Japan are driving this growth due to an expanding middle class and rising disposable incomes

- The region’s growing urbanization, along with changing consumer preferences towards fashion and comfort, contributes to the market's rapid expansion

- The increasing acceptance of e-commerce platforms in countries such as China and India allows consumers easy access to a wide range of lingerie products, propelling market growth

- Additionally, the focus on offering diverse and inclusive lingerie products, including sizes and designs tailored to local preferences, is helping to drive market penetration

- International brands are increasingly expanding their presence in the APAC region, further fueling the market’s growth trajectory

Lingerie Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Victoria's Secret (U.S.)

- Marks and Spencer Reliance India Private Limited (India)

- MAS (Sri Lanka)

- Jockey (U.S.)

- Fashion Nova LLC (U.S.)

- LVMH Moët Hennessy - Louis Vuitton (France)

- HANESBRANDS INC (U.S.)

- Fruit of the Loom Inc (U.S.)

- Triumph International Ltd (Switzerland)

- WACOAL HOLDINGS CORP (Japan)

- UNIQLO CO. LTD (Japan)

- Aimer online store (China)

- Hop Lun (Hong Kong) Limited (Hong Kong)

- Leno International Company Ltd (Hong Kong)

- AEO Management Co (U.S.)

- Lise Charmel (France)

- Maisonleja (U.S.)

Latest Developments in Global Lingerie Market

- In August 2024, Bali (HanesBrands), America’s leading national bra brand, introduced Bali Breathe, its airiest and most breathable collection yet. The new line combines nearly a century of design expertise with a modern approach to comfort and style. Features light-air bras, underwear, and shapewear, Bali Breathe redefines luxurious innerwear with innovative breathable fabrics for all-day comfort

- In July 2023, Swiss innerwear brand Sloggi, part of Triumph International, launched ‘Move Comfortably through Our World,’ a campaign aimed at redefining the innerwear category. Targeting Gen Z, the brand emphasizes comfort and innovation while expanding its product line across global markets, including India. With a focus on modern design and functionality, Sloggi aims to set new standards in everyday innerwear

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL LINGERIE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL LINGERIE MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL LINGERIE MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CONSUMER BUYING PREFERENCES

5.2 FACTORS INFLUENCING BUYING DECISION

5.3 PRODUCT ADOPTION SCENARIO

5.4 PORTER’S FIVE FORCES

5.5 VENDOR SELECTION CRITERIA

5.6 REGULATION COVERAGE

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 IMPACT OF COVID-19 PANDEMIC ON GLOBAL LINGERIE MARKET

7.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTUERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 PRICE IMPACT

7.5 IMPACT ON DEMAND

7.6 IMPACT ON SUPPLY CHAIN

7.7 CONCLUSION

8 GLOBAL LINGERIE MARKET, BY PRODUCT, (MILLION UNITS) (USD MILLION)

8.1 OVERVIEW

8.2 PRICE, BY PRODUCT, 2020-2029, (USD/UNIT)

8.3 BRAS

8.3.1 BY SEGMENT

8.3.1.1. PADDED

8.3.1.2. NON-PADDED

8.3.2 BY MATERIAL

8.3.2.1. COTTON

8.3.2.2. MICROFIBER

8.3.2.3. OTHERS

8.4 KNICKERS & PANTIES

8.5 SHAPEWEAR

8.5.1 BY SEGMENT

8.5.1.1. BODY BRIEFS

8.5.1.2. SEAMLESS

8.5.1.3. CONTROL CAMISOLES

8.5.1.4. LONG LEGS

8.5.1.5. CORSETS

8.5.1.6. BODY SHAPERS

8.5.1.7. OTHERS

8.6 LOUNGEWEAR

8.6.1 BY MATERIAL

8.6.1.1. COTTON

8.6.1.2. WOOL

8.6.1.3. SILK

8.6.1.4. OTHERS

8.7 OTHERS

9 GLOBAL LINGERIE MARKET, BY PRICE, (USD MILLION)

9.1 OVERVIEW

9.2 ECONOMY

9.3 PREMIUM

10 GLOBAL LINGERIE MARKET, BY DISTRIBUTION CHANNEL, (USD MILLION)

10.1 OVERVIEW

10.2 STORE-BASED

10.2.1 MALLS

10.2.2 SPECIALTY STORES

10.2.3 OTHERS

10.3 NON-STORE BASED

11 GLOBAL LINGERIE MARKET, BY AGE-GROUP, (USD MILLION)

11.1 OVERVIEW

11.2 LESS THAN 18.0 YEARS

11.2.1 BY PRODUCT

11.2.1.1. BRAS

11.2.1.2. KNICKERS & PANTIES

11.2.1.3. SHAPEWEAR

11.2.1.4. LOUNGEWEAR

11.2.1.5. OTHERS

11.3 18.1-30.0 YEARS

11.3.1 BY PRODUCT

11.3.1.1. BRAS

11.3.1.2. KNICKERS & PANTIES

11.3.1.3. SHAPEWEAR

11.3.1.4. LOUNGEWEAR

11.3.1.5. OTHERS

11.4 30.1-45.0 YEARS

11.4.1 BY PRODUCT

11.4.1.1. BRAS

11.4.1.2. KNICKERS & PANTIES

11.4.1.3. SHAPEWEAR

11.4.1.4. LOUNGEWEAR

11.4.1.5. OTHERS

11.5 45.1 YEARS+

11.5.1 BY PRODUCT

11.5.1.1. BRAS

11.5.1.2. KNICKERS & PANTIES

11.5.1.3. SHAPEWEAR

11.5.1.4. LOUNGEWEAR

11.5.1.5. OTHERS

12 GLOBAL LINGERIE MARKET, BY GEOGRAPHY, (USD MILLION)

12.1 GLOBAL LINGERIE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.2 NORTH AMERICA

12.2.1 U.S.

12.2.2 CANADA

12.2.3 MEXICO

12.3 EUROPE

12.3.1 GERMANY

12.3.2 U.K.

12.3.3 ITALY

12.3.4 FRANCE

12.3.5 SPAIN

12.3.6 RUSSIA

12.3.7 SWITZERLAND

12.3.8 TURKEY

12.3.9 BELGIUM

12.3.10 NETHERLANDS

12.3.11 LUXEMBURG

12.3.12 REST OF EUROPE

12.4 ASIA-PACIFIC

12.4.1 JAPAN

12.4.2 CHINA

12.4.3 SOUTH KOREA

12.4.4 INDIA

12.4.5 SINGAPORE

12.4.6 THAILAND

12.4.7 INDONESIA

12.4.8 MALAYSIA

12.4.9 PHILIPPINES

12.4.10 AUSTRALIA & NEW ZEALAND

12.4.11 REST OF ASIA-PACIFIC

12.4.12 SOUTH AMERICA

12.4.13 BRAZIL

12.4.14 ARGENTINA

12.4.15 REST OF SOUTH AMERICA

12.5 MIDDLE EAST AND AFRICA

12.5.1 SOUTH AFRICA

12.5.2 EGYPT

12.5.3 SAUDI ARABIA

12.5.4 UNITED ARAB EMIRATES

12.5.5 ISRAEL

12.5.6 REST OF MIDDLE EAST AND AFRICA

13 GLOBAL LINGERIE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS AND ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

15 GLOBAL LINGERIE MARKET - COMPANY PROFILES

15.1 HANESBRANDS INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 VICTORIA'S SECRET

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATES

15.3 JOCKEY INTERNATIONAL INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 TRIUMPH INTERNATIONAL

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATES

15.5 ZIVAME

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATES

15.6 MAS HOLDINGS

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 PHILLIPS-VAN HEUSEN CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 WACOAL GROUP

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 AGENT PROVOCATEUR

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 LA PERLA

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

15.11 FLEUR DU MAL

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATES

15.12 GIANNI VERSACE S.R.L.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT UPDATES

15.13 SAVAGE X FENTY

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT UPDATES

15.14 THE NATORI COMPANY

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 L BRANDS INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT UPDATES

15.16 H & M

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT UPDATES

15.17 AUTHENTIC BRANDS GROUP LLC

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT UPDATES

15.18 URBAN OUTFITTERS, INC.

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT UPDATES

15.19 SKIMS

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT UPDATES

15.2 WOLF LINGERIE

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 RELATED REPORTS

17 QUESTIONNAIRE

18 CONCLUSION

19 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.