Global Liposome Drug Delivery Market

Market Size in USD Billion

CAGR :

%

USD

5.31 Billion

USD

10.20 Billion

2024

2032

USD

5.31 Billion

USD

10.20 Billion

2024

2032

| 2025 –2032 | |

| USD 5.31 Billion | |

| USD 10.20 Billion | |

|

|

|

|

Liposome Drug Delivery Market Size

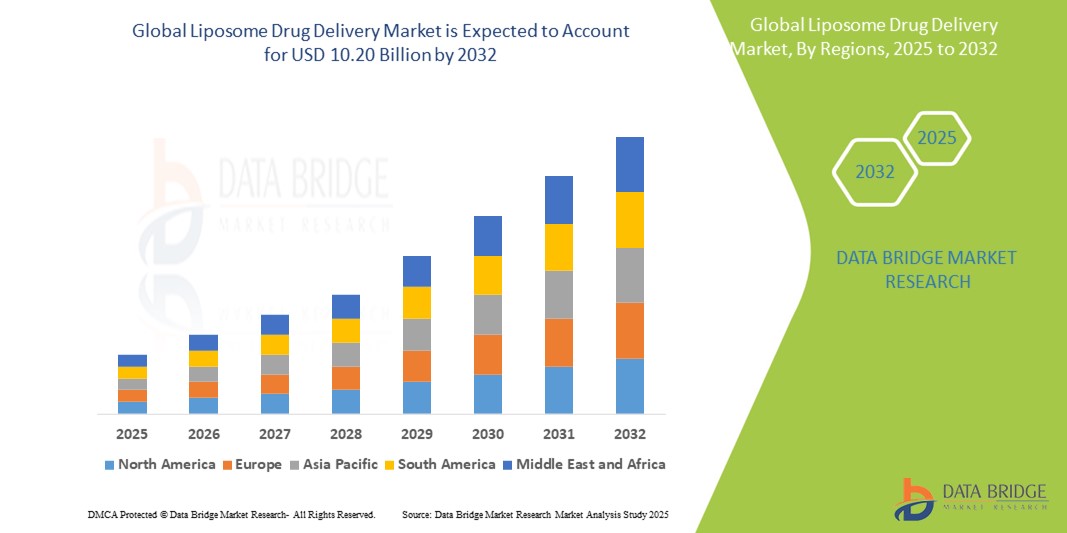

- The global Liposome Drug Delivery market was valued at USD 5.31 billion in 2024 and is expected to reach USD 10.20 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.50 %, primarily driven by the rising demand for targeted drug delivery systems and increasing prevalence of chronic diseases

- This growth is driven by factors such as the increasing adoption of liposomal formulations in cancer therapy, advancements in nanotechnology, and growing investments in pharmaceutical research and development

Liposome Drug Delivery Market Analysis

- Liposome drug delivery systems are innovative carriers that encapsulate drugs within lipid bilayers, enhancing drug stability, bioavailability, and targeted delivery while minimizing toxicity. They are widely used in oncology, infectious diseases, and vaccine delivery

- The demand for liposome-based drug delivery is significantly driven by the rising prevalence of chronic conditions such as cancer and infectious diseases, alongside growing interest in personalized medicine. The ability of liposomes to deliver drugs directly to disease sites enhances treatment efficacy and patient outcomes

- North America stands out as one of the dominant regions for the liposome drug delivery market, driven by strong pharmaceutical Research and Development, regulatory support, and the presence of major market players investing in novel drug formulations

- For instance, the U.S. FDA has approved several liposomal formulations in recent years, reflecting growing confidence in their therapeutic benefits. Leading biotech and pharmaceutical firms in North America continue to invest in liposome-based innovations to address unmet medical needs

- Globally, liposome drug delivery systems are ranked among the most effective nanocarrier technologies in modern drug delivery platforms, offering a critical advantage in precision therapy and controlled drug release

Report Scope and Liposome Drug Delivery Market Segmentation

|

Attributes |

Liposome Drug Delivery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Liposome Drug Delivery Market Trends

“Rising Integration of Liposomal Nanotechnology in Personalized Medicine”

- One prominent trend in the global liposome drug delivery market is the rising integration of liposomal nanotechnology into personalized medicine and targeted therapies

- Liposomes enable the precise delivery of therapeutic agents to specific tissues or cells, reducing off-target effects and enhancing treatment efficacy—an essential component of personalized treatment strategies

- For instance, liposomal formulations such as liposomal doxorubicin have demonstrated improved outcomes in cancer therapy by concentrating the drug at tumor sites while minimizing systemic toxicity, aligning with the goals of precision medicine

- Recent advancements also include stimuli-responsive liposomes that release their payload in response to specific triggers such as pH or temperature, further enhancing therapeutic control

- This trend is transforming drug development and delivery approaches, fostering innovation, improving patient-specific treatment outcomes, and fueling the demand for advanced liposomal technologies in the pharmaceutical market

Liposome Drug Delivery Market Dynamics

Driver

“Increasing Demand for Targeted and Controlled Drug Delivery”

- The growing need for targeted and controlled drug delivery is a significant driver of the global liposome drug delivery market. Liposomal formulations enable drugs to be delivered directly to disease sites, enhancing efficacy while minimizing side effects

- With the rising burden of chronic diseases such as cancer, cardiovascular disorders, and infectious diseases, healthcare providers are increasingly turning to advanced drug delivery systems that ensure better therapeutic outcomes and patient compliance

- The Liposomes offer advantages such as sustained release, biocompatibility, and the ability to encapsulate both hydrophilic and hydrophobic drugs, making them ideal for complex therapies

- Further advancements in liposomal engineering, such as PEGylation and ligand-targeting, are enabling more precise delivery to affected tissues, reducing toxicity, and improving drug absorption

- As the demand for safer, more effective treatment options grows, liposomal drug delivery systems are becoming essential tools in the pharmaceutical industry’s effort to improve patient care and reduce treatment-related complications

For instance,

- In March 2023, the FDA approved a liposomal formulation of irinotecan for the treatment of pancreatic cancer, highlighting the growing reliance on liposomal technology for hard-to-treat diseases

- In According to a 2022 report by the World Health Organization (WHO), cancer cases are expected to rise by 47% globally by 2040, further emphasizing the urgent need for effective, targeted drug delivery platforms such as liposomes

- As pharmaceutical companies prioritize precision medicine and the treatment of complex diseases, the demand for liposome drug delivery systems continues to rise, establishing them as a key component in the future of therapeutics

Opportunity

“Harnessing Artificial Intelligence to Optimize Liposomal Drug Development and Delivery”

- The integration of artificial intelligence (AI) in pharmaceutical research presents a transformative opportunity for the global liposome drug delivery market, enabling the design, optimization, and personalization of liposomal formulations with greater precision and efficiency

- AI algorithms can model and predict drug-liposome interactions, optimize lipid compositions, and simulate release profiles to accelerate formulation development and reduce time-to-market

- In addition, AI can assist in patient stratification and treatment planning by analyzing vast datasets to predict how individuals will respond to specific liposomal therapies, thereby enhancing treatment efficacy and minimizing adverse effects

For instance,

- In February 2024, according to a study published in Nature Machine Intelligence, AI-driven predictive modeling significantly improved the design of stable liposomal formulations for anticancer drugs by identifying optimal lipid combinations and encapsulation parameters

- In August 2023, researchers at MIT developed a deep learning model that accurately predicted the pharmacokinetic behavior of liposomal drugs in vivo, enabling more tailored and effective dosage regimens based on patient-specific factors

- The use of AI in liposome drug delivery is expected to streamline drug development pipelines, reduce clinical trial failures, and ultimately deliver safer, more effective therapies to market faster. This technological advancement opens new avenues for personalized nanomedicine, offering substantial growth potential for pharmaceutical companies investing in liposomal platforms

Restraint/Challenge

“High Development and Production Costs Limiting Accessibility”

- The high development and production costs associated with liposome drug delivery systems present a significant challenge to market penetration, particularly in low- and middle-income regions

- These Liposomal formulations require specialized manufacturing processes, stringent quality controls, and costly raw materials such as phospholipids and cholesterol, all of which contribute to elevated production expenses

- These financial barriers can limit the commercial viability of liposomal drugs, especially for small to mid-sized pharmaceutical companies or in regions with constrained healthcare budgets

For instance,

- In October 2024, a report by the International Journal of Pharmaceutics highlighted that liposomal drug production costs can be up to five times higher than conventional formulations due to the need for sterile conditions, complex encapsulation processes, and stability testing

- In July 2023, the WHO emphasized the affordability challenge in deploying advanced drug delivery systems such as liposomes in low-income countries, calling for global efforts to enhance cost-efficiency and accessibility

- Consequently, the high cost of development and production restricts broader adoption and may delay patient access to innovative therapies, particularly in underserved markets. This restraint could hinder the market’s growth potential unless addressed through cost-effective manufacturing innovations and public-private partnerships

Liposome Drug Delivery Market Scope

The market is segmented on the basis of product, indication, technology, end user and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Indication |

|

|

By Technology |

|

|

By End User |

|

|

By Distribution Channel

|

|

Liposome Drug Delivery Market Regional Analysis

“North America is the Dominant Region in the Liposome Drug Delivery Market”

- North America dominates the global liposome drug delivery market, driven by robust pharmaceutical Research and development, high adoption of advanced drug delivery technologies, and a well-established regulatory framework

- U.S. holds a substantial market share due to the increasing prevalence of chronic diseases such as cancer and cardiovascular disorders, and the growing demand for targeted and personalized therapies

- The presence of major pharmaceutical and biotechnology companies actively investing in liposomal formulations, coupled with strong government support for innovative therapeutics, further accelerates market growth

- In addition, favorable reimbursement policies, increasing clinical trials involving liposomal drugs, and a high level of healthcare expenditure contribute to the region's leadership in the market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to record the highest growth rate in the liposome drug delivery market, fueled by rising healthcare investments, increasing disease burden, and improving access to advanced treatment options

- Countries such as China, India, and South Korea are emerging as key growth hubs due to growing populations, increasing cancer incidence, and expanding pharmaceutical manufacturing capabilities

- Japan remains a prominent market in the region, driven by its innovation in nanomedicine, advanced healthcare infrastructure, and strong presence of research institutions focusing on drug delivery systems

- China and India are witnessing significant government and private sector investments in healthcare Research and Development, with growing interest in biosimilars and liposomal generics. The increasing focus on affordable yet effective treatment options is further boosting demand for liposome-based therapeutics across the region

Liposome Drug Delivery Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Gilead Sciences, Inc. (U.S.)

- Pacira Pharmaceuticals, Inc. (U.S.)

- Luye Pharma Group (Hong Kong)

- Johnson & Johnson Services, Inc. (U.S.)

- Ipsen Pharma (France)

- Imunon (U.S.)

- Novartis AG (Switzerland)

- Takeda Pharmaceutical Company Limited (Japan)

- Astellas Pharma Inc. (Japan)

- Sun Pharmaceutical Industries Ltd. (India)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Pfizer Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Acuitas (Canada)

- LIPOSOMA B.V. (Netherlands)

- TAIWAN LIPOSOME CO., LTD. (China)

- Endo, Inc. (U.S.)

- Jazz Pharmaceuticals, Inc. (Ireland)

- Arcturus Therapeutics, Inc. (U.S.)

Latest Developments in Global Liposome Drug Delivery Market

- In August 2024, Lupin Ltd. launched Doxorubicin Hydrochloride Liposome Injection in 20 mg/10 mL and 50 mg/25 mL formulations, expanding its oncology portfolio and providing a critical cancer treatment option with improved patient compliance through liposomal delivery

- In February 2024, The U.S. Food and Drug Administration (FDA) approved irinotecan liposome (Onivyde) in combination with oxaliplatin, fluorouracil, and leucovorin for the first-line treatment of metastatic pancreatic adenocarcinoma, marking a significant advancement in liposomal drug applications for cancer therapy

- In May 2023, Gencor and Pharmacy Biotech launched PlexoZome technology, an advanced targeted delivery liposomal system for liquid formulations, offering customizable and stable liposomal ingredients to enhance drug delivery efficiency

- In June 2022, Endo International's subsidiary, Endo Ventures Limited, entered into an agreement with Taiwan Liposome Company to commercialize TLC599, an investigational injectable compound in phase 3 development for osteoarthritis knee pain, highlighting the expanding scope of liposomal formulations in pain management

In January 2022, Pfizer and Acuitas Therapeutics established a Development and Option agreement, granting Pfizer a non-exclusive option to license Acuitas' lipid nanoparticle (LNP) technology for potential use in up to 10 targets, reflecting the growing interest in lipid-based delivery systems for vaccines and therapeutics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.