Global Livestock Flooring Market

Market Size in USD Billion

CAGR :

%

USD

6.27 Billion

USD

9.55 Billion

2024

2032

USD

6.27 Billion

USD

9.55 Billion

2024

2032

| 2025 –2032 | |

| USD 6.27 Billion | |

| USD 9.55 Billion | |

|

|

|

|

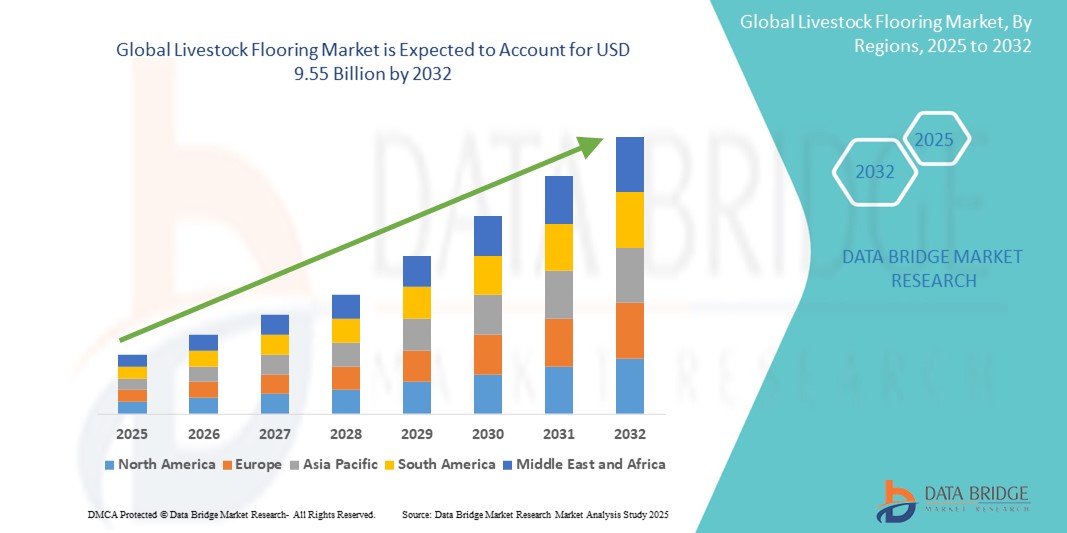

What is the Global Livestock Flooring Market Size and Growth Rate?

- The global Livestock Flooring market size was valued at USD 6.27 billion in 2024 and is expected to reach USD 9.55 billion by 2032, at a CAGR of 5.40% during the forecast period

- Market expansion is largely driven by the increasing emphasis on animal welfare, hygiene, and productivity across commercial and small-scale livestock farms globally

- In addition, rising awareness about the benefits of durable, easy-to-clean, and ergonomic flooring systems especially in intensive farming has significantly propelled demand across both developed and emerging agricultural economies

What are the Major Takeaways of Livestock Flooring Market?

- Livestock Flooring systems, designed to support livestock comfort, mobility, and waste management, are becoming critical components in modern farm infrastructure to enhance animal health and farm efficiency

- The demand for advanced flooring is rising due to growing livestock populations, increasing automated farm practices, and the need for cost-effective solutions that reduce labor and maintenance requirements

- The market is witnessing a notable shift toward rubber, plastic, and hybrid materials offering greater slip resistance, insulation, and longevity, further transforming livestock housing standards worldwide

- Asia-Pacific dominated the livestock flooring market with the largest revenue share of 42.6% in 2024, driven by the expansion of the livestock industry, increasing demand for animal welfare, and infrastructure development across emerging economies such as China, India, and Southeast Asia

- North America is expected to grow at the fastest CAGR of 21.8% during the forecast period of 2025 to 2032, driven by the adoption of modern farming practices, automation, and a rising emphasis on biosecurity and animal welfares

- The Concrete segment dominated the market with the largest revenue share of 38.5% in 2024, owing to its widespread use in commercial farming due to its durability, affordability, and load-bearing capacity

Report Scope and Livestock Flooring Market Segmentation

|

Attributes |

Livestock Flooring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Livestock Flooring Market?

“Sustainability and Animal Welfare Driving Material Innovation”

- A significant trend in the global livestock flooring market is the increasing shift toward eco-friendly, durable materials that enhance animal welfare and operational sustainability. Livestock producers are prioritizing flooring solutions that reduce environmental impact, improve animal comfort, and align with evolving regulatory and consumer expectations

- For instance, leading manufacturers such as Animat Inc. and GEA Group are developing recycled rubber matting and plastic slat systems designed to improve hygiene and reduce injuries in livestock. These materials also contribute to waste reduction and lower carbon footprints on farms

- Innovations in bio-based plastics, hybrid composites, and modular slat designs are supporting the need for long-lasting, easy-to-clean, and thermally efficient flooring that adapts to varied livestock needs. This is particularly crucial for swine and poultry farming, where sanitary conditions directly impact productivity

- As sustainability becomes central to agricultural practices, flooring systems that align with green certifications, reduce antibiotic usage, and promote animal comfort are gaining market traction

- Companies such as Rolflex Flooring are incorporating antimicrobial materials and ergonomic textures to improve traction and cleanliness, catering to both animal welfare and labor efficiency

- This trend is expected to reshape product development, pushing the market towards more sustainable, high-performance materials that support long-term operational efficiency and regulatory compliance in livestock farming

What are the Key Drivers of the Livestock Flooring Market?

- The increasing global demand for meat, dairy, and poultry products is driving investment in modern livestock infrastructure, with flooring playing a critical role in supporting animal health, hygiene, and productivity

- For instance, in March 2024, Big Dutchman launched a new plastic flooring system optimized for piglet rearing, emphasizing durability and sanitation. Such product innovations are fueling adoption across commercial farms

- Government regulations and welfare standards such as EU livestock housing mandates are also encouraging farmers to upgrade from traditional concrete floors to specialized materials such as rubber or steel-reinforced polymer slats

- In addition, the rise of commercial-scale animal husbandry, particularly in Asia-Pacific and Latin America, is boosting the demand for high-efficiency, load-bearing flooring that facilitates waste management and disease prevention

- The increasing focus on biosecurity, foot health, and floor drainage systems further propels the demand for modular and species-specific flooring options in cattle, swine, poultry, and equine facilities

- Together, these drivers are pushing livestock producers to adopt flooring that balances animal well-being, farm economics, and environmental sustainability

Which Factor is challenging the Growth of the Livestock Flooring Market?

- One of the key challenges facing the livestock flooring market is the high upfront cost and installation complexity associated with modern flooring systems. Many small-scale or traditional farmers are hesitant to invest in specialized materials due to limited budgets and lack of awareness

- For instance, steel or hybrid slat systems, while durable, require significant capital and structural adjustments, deterring adoption among cost-sensitive users in developing regions

- Moreover, improper selection or poor maintenance of flooring can lead to hoof disorders, slips, or hygiene issues, especially when transitioning from older systems without adequate training or support

- Another growing concern is the environmental disposal of non-biodegradable flooring materials, particularly certain plastics, which are raising regulatory scrutiny and sustainability concerns

- Addressing these challenges involves offering affordable, easy-to-install flooring options, increasing technical support, and advancing recyclable or bio-based materials

- Market leaders are responding with modular products, leasing models, and government-funded initiatives to make advanced livestock flooring more accessible, but widespread adoption will depend on continued cost optimization and education on long-term benefits

How is the Livestock Flooring Market Segmented?

The market is segmented on the basis of material type, product type, livestock, and farm type.

• By Material Type

On the basis of material type, the livestock flooring market is segmented into Concrete, Rubber, Plastic, and Steel & Hybrid. The Concrete segment dominated the market with the largest revenue share of 38.5% in 2024, owing to its widespread use in commercial farming due to its durability, affordability, and load-bearing capacity. Concrete flooring is highly preferred for cattle and swine housing, where strong, long-lasting flooring is essential for supporting heavy livestock and machinery.

The Rubber segment is anticipated to witness the fastest growth rate of 21.2% from 2025 to 2032, driven by rising demand for animal comfort, joint health, and non-slip surfaces. Rubber floors reduce injuries and enhance productivity in dairy and equine farms, supporting broader animal welfare trends.

• By Product Type

On the basis of product type, the livestock flooring market is segmented into Slat Floors, Interlocking Floors, Grating, and Panel Series. The Slat Floors segment led the market in 2024 with the largest revenue share of 41.7%, driven by its efficient waste drainage, easy cleaning, and high load capacity. Slatted floors are widely adopted in swine and cattle farming for improving hygiene and reducing labor.

The Interlocking Floors segment is projected to register the fastest CAGR from 2025 to 2032, due to their ease of installation, modular customization, and reusability. These systems are ideal for temporary setups, small farms, and retrofitting applications, especially in poultry operations.

• By Livestock

On the basis of livestock, the market is segmented into Cattle Flooring, Poultry Flooring, Swine Flooring, Equine Flooring, and Other Livestock. The Cattle Flooring segment dominated the market in 2024 with a revenue share of 36.9%, owing to the global expansion of dairy and beef production facilities that require durable, non-slip, and hygienic surfaces to support large animals.

The Swine Flooring segment is expected to witness the highest growth rate between 2025 and 2032, driven by increasing emphasis on piglet comfort, thermal insulation, and manure management efficiency. Plastic and slatted floors in this segment help improve farrowing and reduce piglet mortality.

• By Farm Type

On the basis of farm type, the livestock flooring market is segmented into Commercial Farms, Small Farms, and Other Farm Types. The Commercial Farms segment held the largest revenue share of 48.4% in 2024, due to the scale of operations, standardized infrastructure, and higher investment capacity in efficient flooring systems across industrial livestock farms.

The Small Farms segment is projected to exhibit the fastest CAGR from 2025 to 2032, as small and mid-size farmers increasingly adopt modular and affordable flooring systems to enhance productivity and meet evolving biosecurity and animal welfare standards.

Which Region Holds the Largest Share of the Livestock Flooring Market?

- Asia-Pacific dominated the livestock flooring market with the largest revenue share of 42.6% in 2024, driven by the expansion of the livestock industry, increasing demand for animal welfare, and infrastructure development across emerging economies such as China, India, and Southeast Asia

- The region’s agricultural reforms and supportive government policies toward sustainable animal husbandry have led to greater adoption of durable and hygienic livestock flooring solutions

- Growing investments in commercial dairy, swine, and poultry farms, along with heightened awareness of flooring’s impact on livestock health and productivity, are propelling demand across large-scale and integrated farm operations

China Livestock Flooring Market Insight

The China livestock flooring market captured the largest revenue share of 47% in 2024 within Asia-Pacific, driven by the country’s rapid transition from traditional to industrial farming. Increasing consumption of meat and dairy, coupled with government incentives to modernize livestock infrastructure, is boosting demand for concrete, plastic, and hybrid flooring systems. Domestic manufacturers are also expanding their offerings with cost-effective, durable, and easy-to-clean products tailored for local farm conditions.

India Livestock Flooring Market Insight

The India livestock flooring market is expected to witness a significant CAGR during the forecast period, supported by the country’s rapidly growing dairy and poultry sectors. Initiatives such as the National Livestock Mission and increased farmer education about animal welfare and hygiene are promoting the use of modern flooring systems. Small farms are increasingly adopting rubber and plastic flooring due to their affordability and ease of installation.

Australia Livestock Flooring Market Insight

The Australia livestock flooring market is gaining traction, particularly in beef and dairy farming regions. High standards for animal health, safety, and export compliance are encouraging investment in advanced, comfortable flooring solutions. Rubber and steel-hybrid floorings are seeing increased use in large-scale operations, with a focus on minimizing injury and enhancing productivity.

Which Region is the Fastest Growing in the Livestock Flooring Market?

North America is expected to grow at the fastest CAGR of 21.8% during the forecast period of 2025 to 2032, driven by the adoption of modern farming practices, automation, and a rising emphasis on biosecurity and animal welfare. Large-scale dairy and swine farms across the U.S. and Canada are replacing outdated flooring with advanced systems designed for efficient waste management and animal comfort. The presence of key manufacturers, supportive subsidies, and increasing demand for traceable, high-quality animal products are fostering market growth across commercial livestock operations.

U.S. Livestock Flooring Market Insight

The U.S. livestock flooring market held the largest share of 80% in 2024 within North America, driven by rapid industrialization of livestock farming and the adoption of advanced technologies to ensure herd health and facility sanitation. Innovations in flooring design for climate control, reduced hoof diseases, and productivity gains are shaping product preferences in large dairy, swine, and poultry operations.

Canada Livestock Flooring Market Insight

The Canada livestock flooring market is expanding steadily, supported by government initiatives promoting animal well-being and sustainable agriculture. The rising demand for modular and environment-friendly flooring solutions in small and mid-sized farms is contributing to market momentum, especially in cattle and equine farming.

Which are the Top Companies in Livestock Flooring Market?

The livestock flooring industry is primarily led by well-established companies, including:

- Tetra Laval Group (Switzerland)

- Anders Concrete (Belgium)

- Animat Inc. (Canada)

- Legend Rubber Inc. (Canada)

- Wolfenden Concrete Limited (U.K.)

- Nooyen Group (Netherlands)

- Kapoor Mats and Steel (India)

- Agri & Industrial Rubber Ltd. (Ireland)

- Agri-Plastics (Canada)

- Vikas Rubbers (India)

- Gummiwerk KRAIBURG Elastik GmbH & Co. KG (Germany)

- J&D Manufacturing (U.S.)

- Agriprom (Netherlands)

- MIK INTERNATIONAL GmbH & Co. KG (Germany)

- Bioret Group (France)

What are the Recent Developments in Global Livestock Flooring Market?

- In October 2024, Gummiwerk KRAIBURG Elastik GmbH & Co. KG introduced the KEW Plus LongLine TarsaCare continuous roll system, offering jointless mats that deliver enhanced hock protection, improved comfort, and superior bedding retention. This launch responds directly to rising animal welfare standards and the evolving needs of modern dairy farms. The innovation is expected to further solidify the company’s leadership position in the livestock flooring market

- In September 2023, Anders Concrete established a strategic partnership with AvT Montage and van Osch to advance concrete pen flooring solutions for pig houses across the Netherlands. This collaboration integrates diverse expertise to drive innovation, improve project efficiency, and deliver farm-specific flooring systems. The alliance significantly strengthens Anders Concrete's presence and competitive advantage in the European livestock flooring segment

- In August 2022, Gummiwerk KRAIBURG Elastik GmbH & Co. KG (Germany) launched the KEW Plus JarsaCare, a 3-layer mattress system designed to optimize animal joint health and comfort. The product emphasizes sustainable livestock welfare in response to industry demands for eco-conscious and high-comfort solutions. This strategic move enhances the company's brand credibility and visibility in the comfort-centric livestock flooring space

- In March 2022, EASYFIX implemented its Dream Cubicles and Jupiter Cow Mattresses at Funks Midway Dairy in Minnesota. The deployment of these flexible and impact-absorbing flooring solutions significantly reduced cow injuries and stress levels. This customer-centric installation reinforces EASYFIX’s reputation for delivering premium livestock comfort systems in the North American market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.