Global Bio Plastics Market

Market Size in USD Billion

CAGR :

%

USD

23.25 Billion

USD

67.35 Billion

2024

2032

USD

23.25 Billion

USD

67.35 Billion

2024

2032

| 2025 –2032 | |

| USD 23.25 Billion | |

| USD 67.35 Billion | |

|

|

|

|

Bio-Plastics Market Analysis

The bio-plastics market is rapidly growing as industries shift toward sustainable and eco-friendly alternatives to conventional plastics. With increasing environmental concerns, the demand for bio-based plastics made from renewable resources such as plant starch, vegetable oils, and algae is rising. This market is expected to witness significant growth, driven by rising awareness of plastic pollution and stricter government regulations on single-use plastics. Innovations in bio-plastics production, including advancements in biopolymer development, are further propelling market expansion. For instance, the development of Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), and Bio-based PET is improving the properties and applications of bio-plastics in industries such as packaging, automotive, textiles, and consumer goods. In addition, advancements in recycling technologies for bio-plastics are addressing challenges related to waste management. With increased focus on sustainability and the continuous evolution of technology, the bio-plastics market is set for a promising future, contributing to global efforts in reducing plastic waste and enhancing environmental responsibility.

Bio-Plastics Market Size

The global bio-plastics market size was valued at USD 23.25 billion in 2024 and is projected to reach USD 67.35 billion by 2032, with a CAGR of 14.22% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Bio-Plastics Market Trends

“Rising Demand for Sustainable Materials”

The bio-plastics market is witnessing significant growth, driven by the rising demand for sustainable materials to replace conventional plastics. One notable trend is the increasing adoption of bio-based packaging solutions, particularly in the food and beverage industry. Companies are prioritizing eco-friendly alternatives such as Polylactic Acid (PLA) and Polyhydroxyalkanoates (PHA) to meet the growing consumer demand for environmentally responsible packaging. For instance, Coca-Cola has committed to using 50% recycled content in its PET bottles and exploring bio-based packaging options. This trend aligns with stringent regulations and consumer preferences for sustainability, prompting brands to adopt bio-plastics that reduce carbon footprints and improve biodegradability. In addition, advancements in biopolymer technology are enhancing the properties of bio-plastics, making them more durable and versatile. As a result, the bio-plastics market is expanding, particularly in packaging, textiles, and automotive sectors, as more companies embrace eco-friendly alternatives to traditional plastic materials.

Report Scope and Bio-Plastics Market Segmentation

|

Attributes |

Bio-Plastics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Danimer Scientific (U.S.), Novamont S.p.A (Italy), TotalEnergies (France), Plantic (Australia), Braskem (Brazil), Corbion NV (Netherlands), SABIC (Saudi Arabia), Rodenburg Biopolymers (Netherlands), BASF (Germany), NatureWorks LLC (U.S.), HARBEC (U.S.), Merck KGaA (Germany), The BiomeTech Protocol (U.S.), Cardia Bioplastics (Australia), DuPont (U.S.), ADM (U.S.), Mitsubishi Chemical Group Corporation (Japan), Arkema (France), Green Dot Bioplastics, Inc. (U.S.), and TORAY INDUSTRIES, INC. (Japan) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bio-Plastics Market Definition

Bio-plastics are a type of plastic that is derived from renewable, bio-based resources such as plants, algae, or microorganisms, as opposed to conventional plastics made from fossil fuels such as petroleum. Bio-plastics can be biodegradable or non-biodegradable, and they are designed to offer more sustainable alternatives to traditional plastics, reducing environmental impact.

Bio-Plastics Market Dynamics

Drivers

- Increasing Shift towards Eco-Friendly Plastic Products

The increasing shift towards eco-friendly plastic products is a major driver in the bio-plastics market, as consumers and industries alike prioritize sustainability. With growing awareness of the environmental impact of conventional plastics, companies are turning to bio-based alternatives made from renewable resources such as corn, sugarcane, and algae. For instance, companies such as Coca-Cola and Unilever are investing in biodegradable packaging solutions, such as bio-based PET and PLA, to reduce their carbon footprint and meet consumer demand for greener products. This shift is further supported by consumer preferences for sustainable packaging in sectors such as food and beverage, where eco-consciousness is rising. As governments implement stricter regulations on plastic waste and single-use plastics, businesses are increasingly turning to bio-plastics to comply with these laws while also aligning with global sustainability goals. This growing emphasis on eco-friendly plastics is significantly driving the adoption and expansion of the bio-plastics market.

- Increasing Use of Bio-Plastics in Packaging

The increasing use of bio-plastics in packaging is a key driver in the growth of the bio-plastics market, as industries seek sustainable alternatives to traditional petroleum-based plastics. With mounting concerns over plastic waste and environmental impact, bio-plastics offer an eco-friendly solution, particularly in packaging applications. For instance, companies such as Nestlé and PepsiCo are shifting to biodegradable packaging materials such as PLA and PHA to reduce their reliance on conventional plastics and align with global sustainability initiatives. The demand for bio-based packaging is particularly strong in the food and beverage sector, where consumers are increasingly favoring products with minimal environmental impact. In addition, regulatory pressures, such as bans on single-use plastics in many countries, are encouraging businesses to adopt bio-plastics as a compliant and responsible alternative. As a result, the growing emphasis on sustainable packaging is fueling the widespread adoption of bio-plastics, further driving the market’s expansion.

Opportunities

- Increasing Investments in Research and Development (R&D)

Increasing investments in research and development (R&D) are creating significant opportunities in the bio-plastics market, as companies strive to enhance the performance and scalability of bio-based materials. R&D efforts are focused on improving the properties of bio-plastics, such as strength, durability, and biodegradability, making them more competitive with traditional plastics. For instance, NatureWorks LLC has invested heavily in developing its Ingeo product line, which is made from renewable resources such as corn, offering an eco-friendly alternative for packaging and other applications. Similarly, companies such as BASF and TotalEnergies are investing in biopolymer innovations to expand the range of bio-plastics and meet the growing demand across industries such as automotive, packaging, and textiles. These R&D advancements contribute to making bio-plastics more cost-effective and open up new markets by enhancing the material’s versatility. As a result, the increasing focus on R&D presents a major market opportunity, driving both innovation and adoption of bio-plastics across various sectors.

- Increasing Advancements in Technology

Advancements in technology are a key market opportunity for the bio-plastics industry, as innovations in bio-plastic production processes and recycling technologies improve the performance, scalability, and cost-effectiveness of bio-based materials. For instance, the development of advanced biopolymers such as PHA (Polyhydroxyalkanoates) and PLA (Polylactic Acid) has enabled the production of bio-plastics that offer enhanced durability, strength, and biodegradability, making them more suitable for a wide range of applications. Companies such as TotalEnergies Corbion have made significant strides in developing bio-based BOPLA (Bio-based Oriented Polypropylene) films for packaging, which are sustainable and cost-competitive. In addition, advancements in bio-plastic recycling technologies are making it possible to reuse bio-plastics more efficiently, reducing waste and lowering production costs. These technological breakthroughs are helping to overcome previous barriers, such as high costs and limited applications, creating new opportunities for industries such as packaging, automotive, and textiles to adopt bio-plastics on a larger scale.

Restraints/Challenges

- Regulatory and Certification Issues

Regulatory and certification issues present a significant challenge for the bio-plastics market, as the lack of standardized regulations and clear certifications creates confusion for both consumers and producers. Without a unified set of guidelines, the market is fragmented, and different regions or countries may have varying requirements for what qualifies as "bio-based" or "biodegradable." For instance, a product certified as biodegradable in one country might not meet the same standards elsewhere, leading to inconsistencies in how bio-plastics are marketed and understood. This regulatory ambiguity can undermine consumer trust and slow adoption. In addition, certifications such as the OK compost label or Biodegradable Products Institute standards are not universally recognized, and the criteria for such certifications may vary widely. As a result, consumers may be misled into thinking they are making environmentally responsible choices when they are not. The absence of universally accepted standards also makes it difficult for manufacturers to navigate the compliance landscape, creating barriers to market entry and expansion. For the bio-plastics market to achieve sustainable growth and widespread adoption, a unified regulatory framework and clear, consistent certification processes are essential.

- High Cost of Producing Bio-Plastics

The higher cost of producing bio-plastics compared to traditional plastics is a major challenge that hinders their widespread adoption in the market. Bio-plastics are often made from plant-based materials such as corn, sugarcane, or algae, which are typically more expensive than petroleum-based feedstocks. For instance, polylactic acid (PLA), a common bio-plastic derived from corn starch or sugarcane, can cost significantly more to produce than conventional plastics such as polyethylene or polypropylene. This price difference arises from the higher cost of raw materials and from the more complex production processes involved, which may require advanced technologies and specialized machinery. In addition, bio-plastics often have lower production efficiency and economies of scale, as their manufacturing infrastructure is not yet as developed or widespread as that for petroleum-based plastics. As a result, manufacturers face higher production costs, which are passed on to consumers, making bio-plastics less competitive in price-sensitive markets. This cost challenge limits the adoption of bio-plastics in various industries, from packaging to automotive, where cost efficiency is a major consideration, and undermines the drive for more sustainable alternatives. Until technological advancements and economies of scale can bring down production costs, the higher price of bio-plastics remains a significant barrier to their broader market acceptance.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Bio-Plastics Market Scope

The market is segmented on the basis of product type and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Biodegradable

- Polylactic Acid (PLA)

- Starch Blends

- Polybutylene Adipate Terephthalate (PBAT)

- Polybutylene Succinate (PBS)

- Others

- Non-Biodegradable

- Polyethylene

- Polyethylene Terephthalate (PET)

- Polyamide

- Polytrimethylene Terephthalate (PTT)

- Others

End User

- Rigid Packaging

- Flexible Packaging

- Textile

- Agriculture and Horticulture

- Consumer Goods

- Automotive

- Electronics

- Building and Construction

- Others

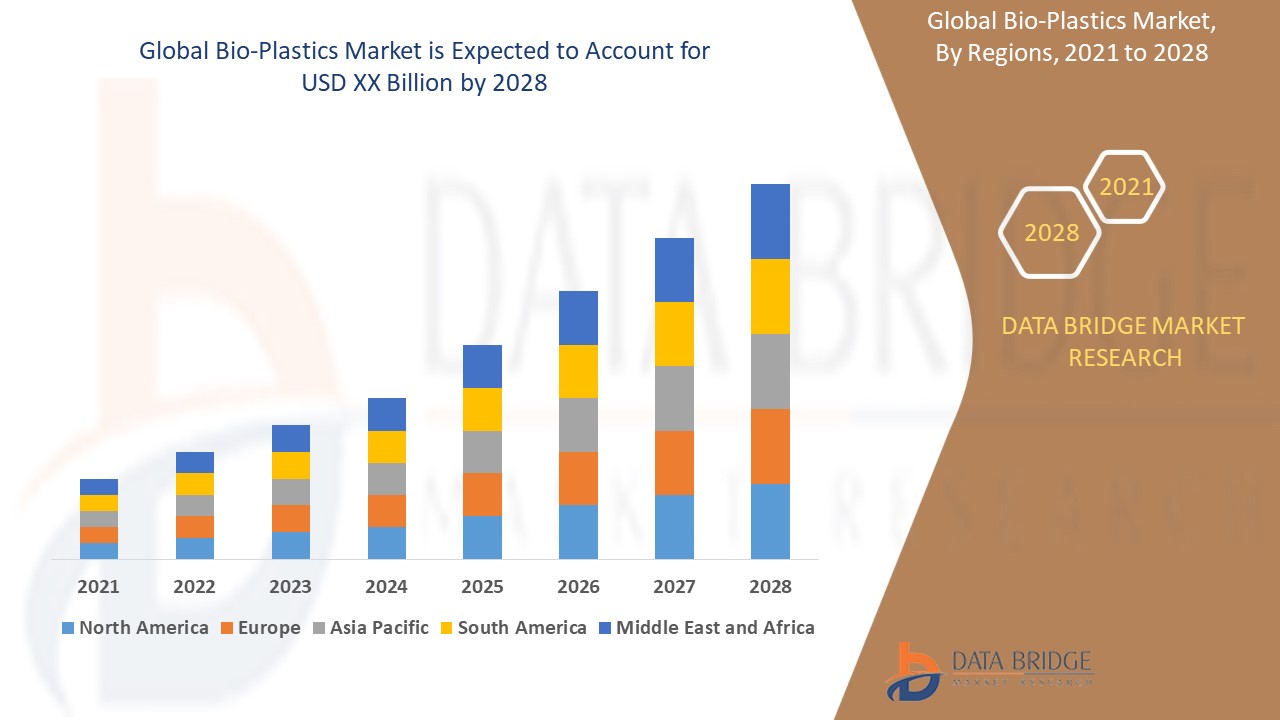

Bio-Plastics Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product type, and end user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Europe dominates the bio-plastics market due to a combination of stringent government regulations on single-use plastics, growing environmental awareness, and significant investments in research and development. The region’s strict laws and policies, such as the European Union's ban on certain single-use plastics, have pushed industries to adopt sustainable alternatives such as bio-plastics. In addition, public and private organizations are increasingly funding research to develop innovative, eco-friendly materials. As a result, Europe remains at the forefront of the bio-plastics market, with a strong focus on reducing plastic waste and advancing sustainable packaging solutions.

North America is anticipated to experience highest growth from 2025 to 2032, driven by increasing demand from the packaging industry in emerging markets such as Canada, the U.S., and Mexico. The growing awareness of environmental issues and the need for sustainable packaging solutions are key factors fueling this demand. As businesses and consumers alike shift toward eco-friendly alternatives, the region's packaging sector is embracing more sustainable materials, such as bio-based plastics. In addition, government initiatives and regulations aimed at reducing plastic waste further contribute to the rising demand for bio-plastics in North America.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Bio-Plastics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Bio-Plastics Market Leaders Operating in the Market Are:

- Danimer Scientific (U.S.)

- Novamont S.p.A (Italy)

- TotalEnergies (France)

- Plantic (Australia)

- Braskem (Brazil)

- Corbion NV (Netherlands)

- SABIC (Saudi Arabia)

- Rodenburg Biopolymers (Netherlands)

- BASF (Germany)

- NatureWorks LLC (U.S.)

- HARBEC (U.S.)

- Merck KGaA (Germany)

- The BiomeTech Protocol (U.S.)

- Cardia Bioplastics (Australia)

- DuPont (U.S.)

- ADM (U.S.)

- Mitsubishi Chemical Group Corporation (Japan)

- Arkema (France)

- Green Dot Bioplastics, Inc. (U.S.)

- TORAY INDUSTRIES, INC. (Japan)

Latest Developments in Bio-Plastics Market

- In June 2024, Floreon, a bioplastics company, secured USD 328.3 million in funding to scale up its bioplastics technology. In addition, this investment will enable the company to expand its production capabilities and strengthen its position in the sustainable materials market. In particular, the funding aims to accelerate the development and commercialization of Floreon's innovative bioplastic solutions, meeting the rising demand for eco-friendly alternatives to traditional plastics

- In February 2024, Balrampur Chini Mills Limited (BCML), a major sugar company in India, announced a forward integration project valued at USD 238.5 million to establish the country's first industrial bioplastic plant. In essence, the plant will produce Polylactic Acid (PLA), a sustainable alternative to conventional plastics, with a production capacity of 75,000 tons per year, targeting a global market

- In May 2023, TotalEnergies Corbion partnered with Changsu Industrial to promote the adoption of sustainable biobased BOPLA films. In particular, this collaboration is expected to boost TotalEnergies Corbion's revenue from biobased products and strengthen its market position in the growing sustainable materials sector

- In April 2023, Solvay entered into a strategic collaboration with Ginkgo Bioworks to expand its research and innovation efforts in the U.S. In addition, the collaboration aims to develop new sustainable biopolymers, solidifying Solvay's presence in the North American market

- In April 2023, NatureWorks LLC introduced its new biopolymer-based product, Ingeo 6500D, designed to offer enhanced strength and softness in biobased nonwovens, particularly for hygiene applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL BIO-PLASTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL BIO-PLASTICS MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.10 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL BIO-PLASTICS MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6. PRICE TREND ANALYSIS

7. GLOBAL BIO-PLASTICS PRODUCTION CAPABILITIES & NETWORK MAP

8. VALUE CHAIN ANALYSIS

9. SUPPLY CHAIN ANALYSIS

9.1 OVERVIEW

9.2 LOGISTIC COST SCENARIO

9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

10. CLIMATE CHANGE SCENARIO

10.1 ENVIRONMENTAL CONCERNS

10.2 INDUSTRY RESPONSE

10.3 GOVERNMENT’S ROLE

10.4 ANALYST RECOMMENDATIONS

11. PRODUCTION CAPACITY OUTLOOK

12. GLOBAL BIO-PLASTICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) (TONS)

12.1 OVERVIEW

12.2 BIODEGRADABLE BIO-PLASTICS

12.2.1 POLYLACTIC ACID (PLA)

12.2.1.1. HIGH-HEAT PLA

12.2.1.2. STANDARD PLA

12.2.1.3. AMORPHOUS PLA

12.2.1.4. BLENDED PLA

12.2.1.5. OTHERS

12.2.2 POLYHYDROXYALKANOATES (PHA)

12.2.2.1. POLY(3-HYDROXYBUTYRATE) (PHB)

12.2.2.2. POLY(3-HYDROXYBUTYRATE-CO-3-HYDROXYVALERATE) (PHBV)

12.2.2.3. POLY(3-HYDROXYBUTYRATE-CO-3-HYDROXYHEXANOATE) (PHBH)

12.2.2.4. POLY(3-HYDROXYBUTYRATE-CO-4-HYDROXYBUTYRATE) (P4HB)

12.2.3 STARCH BLENDS

12.2.3.1. THERMOPLASTIC STARCH (TPS)

12.2.3.2. STARCH-PLA BLENDS

12.2.3.3. STARCH-PBAT BLENDS

12.2.4 POLYBUTYLENE SUCCINATE (PBS)

12.2.4.1. PURE PBS

12.2.4.2. PBS BLENDS

12.2.5 POLYBUTYLENE ADIPATE TEREPHTHALATE (PBAT)

12.2.5.1. STANDARD PBAT

12.2.5.2. ENHANCED PBAT

12.2.6 CELLULOSE-BASED PLASTICS

12.2.6.1. CELLULOSE ACETATE

12.2.6.2. REGENERATED CELLULOSE

12.2.6.3. MICROBIAL CELLULOSE

12.2.7 OTHERS

12.3 NON-BIODEGRADABLE BIO-PLASTICS

12.3.1 BIO-POLYETHYLENE (BIO-PE)

12.3.1.1. HIGH-DENSITY POLYETHYLENE (BIO-HDPE)

12.3.1.2. LOW-DENSITY POLYETHYLENE (BIO-LDPE)

12.3.1.3. LINEAR LOW-DENSITY POLYETHYLENE (BIO-LLDPE)

12.3.2 BIO-POLYPROPYLENE (BIO-PP)

12.3.2.1. STANDARD BIO-PP

12.3.2.2. IMPACT-RESISTANT BIO-PP

12.3.3 BIO-POLYETHYLENE TEREPHTHALATE (BIO-PET)

12.3.3.1. 30% BIO-PET (PARTIALLY BIO-BASED)

12.3.3.2. 100% BIO-PET (FULLY BIO-BASED)

12.3.4 BIO-POLYAMIDES (BIO-PA)

12.3.4.1. PA 6

12.3.4.2. PA 11

12.3.4.3. PA 12

12.3.4.4. PA 4.10

12.3.4.5. PA 6.10

12.3.5 BIO-POLYURETHANE (BIO-PUR)

12.3.5.1. RIGID BIO-PUR FOAM

12.3.5.2. FLEXIBLE BIO-PUR FOAM

12.3.6 BIO-POLYTRIMETHYLENE TEREPHTHALATE (BIO-PTT)

12.3.6.1. TEXTILE GRADE

12.3.6.2. INDUSTRIAL APPLICATIONS

12.3.7 BIO-ACRYLICS & OTHERS

12.3.7.1. BIO-POLYSTYRENE

12.3.7.2. BIO-EPOXY RESINS

12.3.8 OTHERS

13. GLOBAL BIO-PLASTICS MARKET, BY RAW MATERIAL SOURCE, 2018-2032 (USD MILLION)

13.1 OVERVIEW

13.2 PLANT-BASED

13.2.1 CORN

13.2.2 SUGARCANE

13.2.3 CASSAVA

13.2.4 POTATOES

13.2.5 WHEAT

13.2.6 RICE

13.2.7 OTHERS

13.3 CELLULOSE & LIGNIN-BASED

13.3.1 WOOD PULP

13.3.2 HEMP

13.3.3 BAMBOO

13.3.4 ALGAE

13.3.5 OTHERS

13.4 OIL & FAT-BASED

13.4.1 SOYBEAN OIL

13.4.2 PALM OIL

13.4.3 CASTOR OIL

13.4.4 OTHERS

13.5 MICROBIAL & WASTE-BASED

13.5.1 AGRICULTURAL WASTE

13.5.2 FOOD WASTE

13.5.3 ALGAE BIOMASS

13.5.4 OTHERS

13.6 OTHERS

14. GLOBAL BIO-PLASTICS MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

14.1 OVERVIEW

14.2 FERMENTATION-BASED PRODUCTION

14.2.1 MICROBIAL FERMENTATION

14.2.2 ENZYME-BASED PROCESSING

14.3 POLYMERIZATION TECHNIQUES

14.3.1 CONDENSATION POLYMERIZATION

14.3.2 RADICAL POLYMERIZATION

14.4 THERMOPLASTIC PROCESSING

14.4.1 INJECTION MOLDING

14.4.2 EXTRUSION

14.4.3 BLOW MOLDING

14.4.4 THERMOFORMING

14.5 3D PRINTING & ADDITIVE MANUFACTURING

14.5.1 FUSED DEPOSITION MODELING (FDM)

14.5.2 STEREOLITHOGRAPHY (SLA)

14.6 OTHERS

15. GLOBAL BIO-PLASTICS MARKET, BY DEGRADIBILITY, 2018-2032 (USD MILLION)

15.1 OVERVIEW

15.2 COMPOSTABLE

15.2.1 INDUSTRIAL COMPOSTABLE

15.2.2 HOME COMPOSTABLE

15.3 MARINE BIODEGRADABLE

15.4 SOIL BIODEGRADABLE

15.5 NON-BIODEGRADABLE

16. GLOBAL BIO-PLASTICS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

16.1 OVERVIEW

16.2 PACKAGING

16.2.1 RIGID PACKAGING

16.2.1.1. BOTTLES & CONTAINERS

16.2.1.1.1. WATER & BEVERAGE BOTTLES

16.2.1.1.2. DAIRY PRODUCT BOTTLES

16.2.1.1.3. PERSONAL CARE BOTTLES

16.2.1.1.4. PHARMACEUTICAL & NUTRACEUTICAL BOTTLES

16.2.1.1.5. HOUSEHOLD CHEMICAL CONTAINERS

16.2.1.2. CAPS & CLOSURES

16.2.1.2.1. BEVERAGE & JUICE CAPS

16.2.1.2.2. COSMETIC PRODUCT LIDS

16.2.1.3. FOOD TRAYS & CONTAINERS

16.2.1.3.1. MICROWAVE-SAFE PLA CONTAINERS

16.2.1.3.2. TAKEAWAY & DELIVERY FOOD PACKAGING

16.2.1.3.3. READY-TO-EAT MEAL PACKAGING

16.2.1.4. CUPS & BOWLS

16.2.1.4.1. COFFEE CUPS

16.2.1.4.2. ICE CREAM CUPS

16.2.1.5. AEROSOL CANS & RIGID TUBES

16.2.1.5.1. DEODORANT & SPRAY BOTTLES

16.2.1.5.2. TOOTHPASTE & CREAM TUBES

16.2.1.6. OTHERS

16.2.2 FLEXIBLE PACKAGING

16.2.2.1. PLASTIC FILMS & WRAPS

16.2.2.1.1. FOOD WRAPS (BIODEGRADABLE CLING FILMS)

16.2.2.1.2. STRETCH & SHRINK WRAPS

16.2.2.1.3. PROTECTIVE PACKAGING FILMS

16.2.2.2. POUCHES & SACHETS

16.2.2.2.1. STAND-UP POUCHES

16.2.2.2.2. SINGLE-USE SACHETS

16.2.2.2.3. SEALED BAGS FOR SNACKS & FROZEN FOODS

16.2.2.3. COMPOSTABLE SHOPPING BAGS

16.2.2.3.1. GROCERY BAGS

16.2.2.3.2. RETAIL SHOPPING BAGS

16.2.2.3.3. GARBAGE BAGS

16.2.2.4. FOOD SERVICE PACKAGING

16.2.2.5. TAKEOUT BAGS

16.2.2.6. DISPOSABLE CUTLERY

16.2.2.7. PAPER-COATED BIO-PLASTIC LININGS

16.2.3 OTHERS

16.3 CONSUMER GOODS

16.3.1 HOUSEHOLD PRODUCTS

16.3.1.1. STORAGE CONTAINERS & BINS

16.3.1.2. GARBAGE BAGS & COMPOSTABLE TRASH LINERS

16.3.1.3. KITCHENWARE

16.3.1.3.1. CUPS

16.3.1.3.2. PLATES

16.3.1.3.3. SPOONS

16.3.1.3.4. FORKS

16.3.1.3.5. SPATULAS

16.3.1.3.6. OTHERS

16.3.2 ELECTRONICS & GADGETS

16.3.2.1. SMARTPHONE & LAPTOP CASINGS

16.3.2.2. REMOTE CONTROL CASINGS

16.3.2.3. GAMING CONSOLE ACCESSORIES

16.3.3 TOYS & BABY PRODUCTS

16.3.3.1. BIODEGRADABLE BABY BOTTLES

16.3.3.2. NON-TOXIC BIO-PLASTIC TOYS

16.3.3.3. OTHERS

16.3.4 FASHION & ACCESSORIES

16.3.4.1. EYEWEAR FRAMES

16.3.4.2. WATCH STRAPS

16.3.4.3. HANDBAGS & FOOTWEAR COMPONENTS

16.3.4.4. OTHERS

16.3.5 OTHERS

16.4 TEXTILES & FIBERS

16.4.1.1. APPAREL & SPORTSWEAR

16.4.1.1.1. BIO-BASED POLYESTER FIBERS

16.4.1.1.2. SUSTAINABLE ATHLETIC WEAR

16.4.1.1.3. ECO-FRIENDLY OUTDOOR JACKETS

16.4.1.1.4. OTHERS

16.4.2 HOME FURNISHINGS & UPHOLSTERY

16.4.2.1. BIODEGRADABLE CARPETS & RUGS

16.4.2.2. CUSHION COVERS & PILLOW STUFFING

16.4.2.3. CURTAIN FABRICS

16.4.2.4. OTHERS

16.4.3 INDUSTRIAL & TECHNICAL FIBERS

16.4.3.1. HIGH-STRENGTH BIO-POLYAMIDE FOR WORKWEAR

16.4.3.2. BIO-PLASTIC FIBER MESH FOR AGRICULTURE

16.4.3.3. OTHERS

16.5 AUTOMOTIVE & TRANSPORTATION

16.5.1 INTERIOR COMPONENTS

16.5.1.1. DASHBOARD PANELS

16.5.1.2. DOOR HANDLES & TRIMS

16.5.1.3. AIR VENT COVERS

16.5.1.4. OTHERS

16.5.2 SEATING & UPHOLSTERY

16.5.2.1. SEAT CUSHION FOAMS

16.5.2.2. HEADLINER MATERIALS

16.5.2.3. OTHERS

16.5.3 EXTERIOR APPLICATIONS

16.5.3.1. LIGHTWEIGHT BIO-BASED BUMPERS

16.5.3.2. BIO-COMPOSITE CAR BODY PANELS

16.5.4 UNDER-THE-HOOD COMPONENTS

16.5.5 OTHERS

16.6 AGRICULTURE & HORTICULTURE

16.6.1 BIODEGRADABLE MULCH FILMS

16.6.2 PLANT POTS & SEEDLING TRAYS

16.6.3 BIO-BASED IRRIGATION TUBING

16.6.4 SLOW-RELEASE BIO-PLASTIC FERTILIZER COATINGS

16.7 MEDICAL & HEALTHCARE

16.7.1 DISPOSABLE MEDICAL DEVICES

16.7.1.1. SURGICAL GLOVES & MASKS

16.7.1.2. BIODEGRADABLE BANDAGES & DRESSINGS

16.7.1.3. MEDICAL TUBING

16.7.1.4. OTHRS

16.7.2 DRUG DELIVERY SYSTEMS

16.7.2.1. BIODEGRADABLE CAPSULES & PILLS

16.7.2.2. IMPLANTABLE DRUG CARRIERS

16.7.2.3. OTHERS

16.7.3 SURGICAL EQUIPMENT & PACKAGING

16.7.3.1. STERILE TRAYS & SYRINGE PACKAGING

16.7.3.2. MEDICAL INSTRUMENT CASINGS

16.7.3.3. OTHERS

16.8 CONSTRUCTION & INFRASTRUCTURE

16.8.1 PIPES & CONDUITS (BIO-PVC ALTERNATIVES)

16.8.2 BIO-BASED INSULATION FOAMS

16.8.3 COMPOSITE PANELS & WALL CLADDINGS

16.8.4 PAINTS & COATINGS

16.8.5 OTHERS

16.9 3D PRINTING & ADDITIVE MANUFACTURING

16.9.1 BIODEGRADABLE FILAMENTS (PLA, PHA, BIO-ABS)

16.9.2 CUSTOM PROTOTYPING WITH SUSTAINABLE BIO-POLYMERS

16.9.3 OTHERS

16.10 OTHERS

17. GLOBAL BIO-PLASTICS MARKET, BY GEOGRAPHY, 2018-2032 (USD MILLION) (TONS)

17.1 GLOBAL BIO-PLASTICS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

17.2 NORTH AMERICA

17.2.1 U.S.

17.2.2 CANADA

17.2.3 MEXICO

17.3 EUROPE

17.3.1 GERMANY

17.3.2 U.K.

17.3.3 ITALY

17.3.4 FRANCE

17.3.5 SPAIN

17.3.6 RUSSIA

17.3.7 SWITZERLAND

17.3.8 TURKEY

17.3.9 BELGIUM

17.3.10 POLAND

17.3.11 DENMARK

17.3.12 NORWAY

17.3.13 SWEDEN

17.3.14 NETHERLANDS

17.3.15 REST OF EUROPE

17.4 ASIA-PACIFIC

17.4.1 JAPAN

17.4.2 CHINA

17.4.3 SOUTH KOREA

17.4.4 INDIA

17.4.5 SINGAPORE

17.4.6 THAILAND

17.4.7 INDONESIA

17.4.8 MALAYSIA

17.4.9 PHILIPPINES

17.4.10 AUSTRALIA

17.4.11 NEW ZEALAND

17.4.12 REST OF ASIA-PACIFIC

17.5 SOUTH AMERICA

17.5.1 BRAZIL

17.5.2 ARGENTINA

17.5.3 REST OF SOUTH AMERICA

17.6 MIDDLE EAST AND AFRICA

17.6.1 SOUTH AFRICA

17.6.2 EGYPT

17.6.3 SAUDI ARABIA

17.6.4 UNITED ARAB EMIRATES

17.6.5 ISRAEL

17.6.6 REST OF MIDDLE EAST AND AFRICA

18. GLOBAL BIO-PLASTICS MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.5 MERGERS AND ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

18.7 EXPANSIONS

18.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

19. GLOBAL BIO-PLASTICS MARKET - SWOT ANALYSIS

20. GLOBAL BIO-PLASTICS MARKET - COMPANY PROFILES

20.1 DANIMER SCIENTIFIC

20.1.1 COMPANY SNAPSHOT

20.1.2 PRODUCT PORTFOLIO

20.1.3 REVENUE ANALYSIS

20.1.4 RECENT UPDATES

20.2 NOVAMONT S.P.A.

20.2.1 COMPANY SNAPSHOT

20.2.2 PRODUCT PORTFOLIO

20.2.3 REVENUE ANALYSIS

20.2.4 RECENT UPDATES

20.3 TOTALENERGIES

20.3.1 COMPANY SNAPSHOT

20.3.2 PRODUCT PORTFOLIO

20.3.3 REVENUE ANALYSIS

20.3.4 RECENT UPDATES

20.4 BRASKEM

20.4.1 COMPANY SNAPSHOT

20.4.2 PRODUCT PORTFOLIO

20.4.3 REVENUE ANALYSIS

20.4.4 RECENT UPDATES

20.5 CORBION

20.5.1 COMPANY SNAPSHOT

20.5.2 PRODUCT PORTFOLIO

20.5.3 REVENUE ANALYSIS

20.5.4 RECENT UPDATES

20.6 SABIC

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 REVENUE ANALYSIS

20.6.4 RECENT UPDATES

20.7 RODENBURG BIOPOLYMERS

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 REVENUE ANALYSIS

20.7.4 RECENT UPDATES

20.8 BASF

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 REVENUE ANALYSIS

20.8.4 RECENT UPDATES

20.9 CARDIA BIOPLASTICS

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 REVENUE ANALYSIS

20.9.4 RECENT UPDATES

20.10 MITSUBISHI CHEMICAL GROUP CORPORATION

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 REVENUE ANALYSIS

20.10.4 RECENT UPDATES

20.11 ARKEMA

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 REVENUE ANALYSIS

20.11.4 RECENT UPDATES

20.12 GREEN DOT BIOPLASTICS, INC.

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 REVENUE ANALYSIS

20.12.4 RECENT UPDATES

20.13 TORAY INDUSTRIES, INC.

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 REVENUE ANALYSIS

20.13.4 RECENT UPDATES

20.14 KURARAY

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 REVENUE ANALYSIS

20.14.4 RECENT UPDATES

20.15 ECOLASTIC PRODUCTS PVT. LTD.

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 REVENUE ANALYSIS

20.15.4 RECENT UPDATES

20.16 FKUR

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 REVENUE ANALYSIS

20.16.4 RECENT UPDATES

20.17 EASTMAN CHEMICAL COMPANY

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 REVENUE ANALYSIS

20.17.4 RECENT UPDATES

20.18 BIOME BIOPLASTICS.

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 REVENUE ANALYSIS

20.18.4 RECENT UPDATES

20.19 SOLVAY

20.19.1 COMPANY SNAPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 REVENUE ANALYSIS

20.19.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21. RELATED REPORTS

22. QUESTIONNAIRE

23. CONCLUSION

24. ABOUT DATA BRIDGE MARKET RESEARCH

Global Bio Plastics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bio Plastics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bio Plastics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.