Global Low Calorie Noodles Market

Market Size in USD Billion

CAGR :

%

USD

4.70 Billion

USD

9.04 Billion

2024

2032

USD

4.70 Billion

USD

9.04 Billion

2024

2032

| 2025 –2032 | |

| USD 4.70 Billion | |

| USD 9.04 Billion | |

|

|

|

|

Low-calorie Noodles Market Size

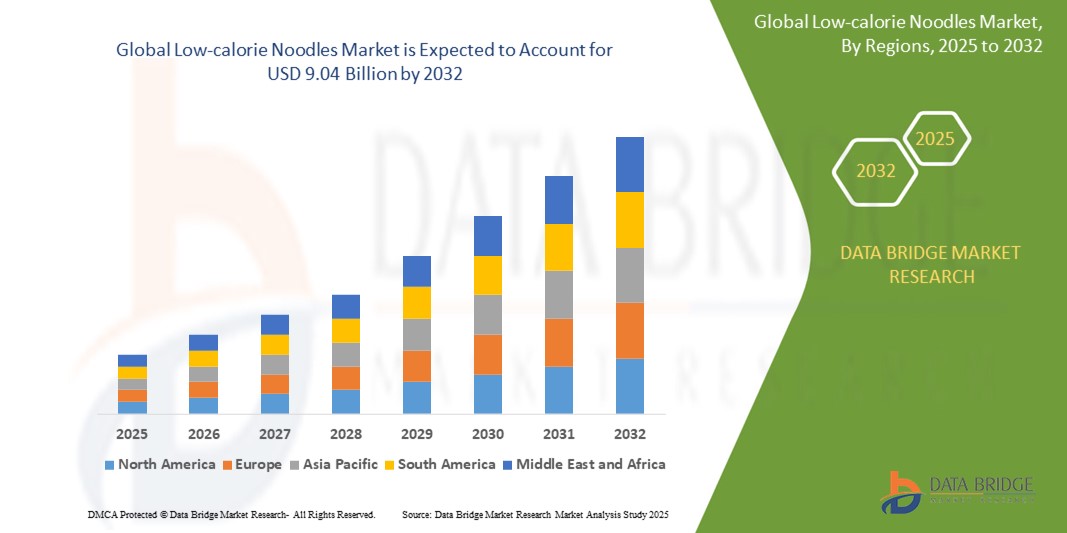

- The global low-calorie noodles market size was valued at USD 4.7 billion in 2024 and is expected to reach USD 9.04 billion by 2032, at a CAGR of 8.5% during the forecast period

- This growth is driven by factors such as the rising global demand for healthier food options, increasing awareness of calorie-controlled diets, and the growing popularity of plant-based and functional foods. Product innovations—such as konjac-based noodles and high-protein low-carb variants—are also playing a significant role in market expansion

Low-calorie Noodles Market Analysis

- Low-calorie noodles are a healthier alternative to traditional noodles, formulated with ingredients such as konjac, shirataki, whole grains, and legumes, offering reduced caloric intake without compromising taste or texture. These noodles are increasingly consumed by individuals seeking weight management and healthier lifestyles

- The demand for low-calorie noodles is significantly driven by the growing prevalence of obesity, diabetes, and other lifestyle-related diseases, along with the rising popularity of low-carb and keto diets globally

- North America is expected to dominate the low-calorie noodles market, accounting for 35% of the total market share in 2024. This dominance is driven by high health awareness, a well-established functional food sector, and the presence of key market players launching innovative products in the region

- Asia-Pacific is expected to be the fastest-growing region in the low-calorie noodles market, with a CAGR of 8.4% during the forecast period. The region's market share is projected to reach 30% by 2032, driven by increasing urbanization, rising middle-class income, and growing consumer preference for low-calorie traditional foods in countries like Japan, China, and South Korea

- The Made from Konjac Yam segment is expected to dominate the market, holding a significant market share of 48% in 2024. This growth is due to its extremely low-calorie content, high fiber profile, and expanding use in vegan, diabetic-friendly, and gluten-free diets. Major brands are increasingly incorporating konjac flour into ready-to-eat and instant noodle products

Report Scope and Low-calorie Noodles Market Segmentation

|

Attributes |

Low-calorie Noodles Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Low-calorie Noodles Market Trends

“Product Innovation and Clean Label Trends Driving Functional Food Adoption”

- One prominent trend in the low-calorie noodles market is the increasing adoption of clean label and functional ingredients, including plant-based proteins, soluble fibers, and low-GI (glycemic index) components to enhance both health benefits and consumer appeal.

- Manufacturers are focusing on formulating noodles with fewer additives and preservatives, using natural ingredients to align with rising consumer demand for transparent and healthy food labels

- For instance, In February 2024, Better Than Foods Ltd. expanded its “Organic Konjac Noodles” range in the U.K. and Europe with new flavors and enhanced texture using non-GMO, gluten-free ingredients, catering to health-conscious consumers following keto, vegan, and diabetic-friendly diets

- These innovations are transforming consumer perception of instant and ready-to-eat noodles, repositioning them from indulgent snacks to functional, diet-aligned meals, and thereby expanding the market base beyond traditional buyers

Low-calorie Noodles Market Dynamics

Driver

“Rising Demand Due to Increasing Lifestyle-Related Health Issues”

- The rising prevalence of lifestyle-related health conditions such as obesity, type 2 diabetes, and cardiovascular diseases is significantly contributing to the increased demand for low-calorie noodles

- As global dietary habits shift, consumers are increasingly seeking healthier meal alternatives that are lower in calories and carbohydrates yet still satisfying and easy to prepare

- As more individuals adopt weight management programs or follow diet plans such as keto, low-carb, or diabetic-friendly diets, the demand for low-calorie noodles continues to rise, positioning them as a staple in the functional and health-focused food market

For instance,

- In March 2024, The Skinny Food Co. in the UK expanded its low-calorie noodle offerings to meet growing demand from consumers with diabetes and those engaged in fitness and weight-loss programs. The company's zero-fat konjac noodles quickly became one of its top-selling items due to their suitability for calorie-restricted diets

- As a result of increasing health consciousness and the prevalence of diet-related conditions, the low-calorie noodles market is experiencing strong growth as consumers seek convenient, healthy substitutes to traditional carbohydrate-heavy meals

Opportunity

“Product Innovation with Functional and Personalized Low-Calorie Noodles”

- The growing interest in personalized nutrition and functional foods presents a major opportunity for low-calorie noodle manufacturers to develop products that go beyond basic calorie reduction—focusing instead on targeted health benefits such as gut health, blood sugar control, and heart health.

- Innovations using ingredients such as konjac (glucomannan), chickpea flour, lentils, oat fiber, and fortified proteins allow brands to cater to diverse dietary needs including gluten-free, keto, high-protein, and diabetic-friendly diets.

- In addition, brands can leverage consumer demand for customized health solutions, offering noodles tailored for specific health goals like weight management, muscle gain, or digestive health

For instance,

- In January 2025, Unilever’s Kissan brand in India launched a new range of low-calorie noodles enriched with prebiotic fibers and protein targeting health-conscious millennials and diabetic consumers. The launch was accompanied by a personalized diet app integration, allowing users to track macros and receive meal suggestions based on individual health goals

- This growing trend toward functional and purpose-driven foods enables manufacturers to position low-calorie noodles not just as diet options but as smart, health-enhancing meals, opening up new consumer segments and retail opportunities

Restraint/Challenge

“Higher Production Costs and Limited Consumer Awareness in Emerging Markets”

- The higher production costs associated with formulating low-calorie noodles—especially those made with specialty ingredients like konjac, lentil flour, or fortified protein blends—pose a significant challenge to market penetration, particularly in price-sensitive and developing economies.

- These products often require advanced processing technologies and specialized supply chains, which elevate end-product pricing and may limit their accessibility to mainstream consumers.

- Furthermore, limited consumer awareness regarding the health benefits of low-calorie noodles in certain regions hampers demand, as traditional noodles remain preferred for taste, cost, and cultural familiarity

For instance,

- In October 2024, according to a press release by Juroat, a niche health food brand in Southeast Asia, the company cited high ingredient import costs and minimal market education as major barriers to scaling its low-calorie konjac noodle range in Vietnam and Indonesia. The brand emphasized the need for consumer education campaigns to build trust and awareness around low-calorie and functional noodle alternatives

- Consequently, the combination of high production costs and lack of consumer education restricts the adoption of low-calorie noodles in emerging markets, slowing the overall pace of global market growth

Low-calorie Noodles Market Scope

The market is segmented on the basis product type, ingredients, packaging type, distribution channel, and consumer type.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Ingredients |

|

|

By Packaging Type |

|

|

By Distribution Channel |

|

|

By Consumer Type |

|

In 2025, the made from konjac yam is projected to dominate the market with a largest share in ingredients segment

The "Made from Konjac Yam" segment is projected to dominate the global low-calorie noodles market in 2025, driven by the increasing preference for konjac-based noodles. These noodles are renowned for their low-calorie, high-fiber content and suitability for various diet plans, including keto, gluten-free, and diabetic-friendly diets. They are gaining popularity as an ideal solution for individuals seeking low-calorie, high-fiber meals that aid in weight management and digestive health.Asia Pacific is expected to hold the largest market share of approximately 45% in 2025, driven by the long-standing cultural use of konjac in countries like Japan, China, and South Korea. Meanwhile, North America is projected to grow at the highest rate, with a share of around 25% by 2025, fueled by rising health consciousness and increasing demand for low-carb, gluten-free foods.

The ready-to-eat packs is expected to account for the largest share during the forecast period in technology segment

The "Ready-to-Eat Packs" segment is expected to experience significant growth in 2025 due to rising demand for convenient, quick meals in the low-calorie noodles market. Consumers increasingly prefer easy-to-prepare options that fit their fast-paced lifestyles, and ready-to-eat packs offer a healthy and convenient solution without sacrificing taste or nutrition. North America is projected to dominate this segment with an estimated 40% market share in 2025, driven by the demand for convenience foods in the United States. Additionally, Europe is expected to capture around 30% of the market, with strong growth fueled by on-the-go meal preferences in countries like the UK and Germany.

Low-calorie Noodles Market Regional Analysis

“North America Holds the Largest Share in the Low-Calorie Noodles Market”

- North America is expected to dominate the low-calorie noodles market, accounting for 35% of the total market share in 2024. This dominance is driven by high health awareness, a well-established functional food sector, and the presence of key market players launching innovative products in the region

- The U.S. holds a significant share of the market due to a rising focus on fitness, weight management, and healthier eating habits. The demand for low-carb, gluten-free, and low-calorie foods, especially in the context of busy lifestyles, further supports market growth

- The availability of retail and online distribution channels, along with growing awareness of dietary restrictions (e.g., vegan, keto), strengthens the market position in North America

- In addition, rising health concerns such as obesity and diabetes, along with an expanding population of fitness enthusiasts, drive the demand for low-calorie noodles in the region. The increasing availability of ready-to-eat, healthy meal options in supermarkets and e-commerce platforms further fuels market growth

“Asia-Pacific is Projected to Register the Highest CAGR in the Low-Calorie Noodles Market”

- Asia-Pacific is expected to be the fastest-growing region in the low-calorie noodles market, with a CAGR of 8.4% during the forecast period. The region's market share is projected to reach 30% by 2032, driven by increasing urbanization, rising middle-class income, and growing consumer preference for low-calorie traditional foods in countries like Japan, China, and South Korea

- Countries such as China, India, and Japan are emerging as key markets due to the growing middle-class population, increasing adoption of Western food trends, and a heightened focus on health and wellness. These countries are witnessing a shift toward low-calorie, nutrient-dense foods as consumers become more conscious of their dietary choices

- Japan, with its long-standing culinary use of healthy ingredients like konjac, remains a crucial market for low-calorie noodles. The country is known for its preference for healthy, low-calorie diets, and the popularity of konjac-based noodles continues to rise

- China and India, with their large and diverse populations, are seeing a surge in demand for healthier food options due to rising awareness of diet-related diseases, such as obesity and diabetes. Increasing disposable incomes and the growing availability of low-calorie noodle products in both urban and rural markets are contributing to the region's growth. The expansion of online retail platforms and supermarkets further fuels market expansion in these countries

Low-calorie Noodles Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Miracle Noodle (U.S.)

- It’s Skinny (U.S.)

- LIVIVA Foods (Canada)

- Sea Tangle Noodle Company (U.S.)

- Palmini (U.S.)

- Explore Cuisine (U.S.)

- ThinSlim Foods (U.S.)

- Great Low Carb Bread Company (U.S.)

- Kaizen Food Company (U.S.)

- ZENB (U.S.)

- Chickapea (Canada)

- Lion Keto (U.S.)

- Trader Joe’s (U.S.)

- Nasoya (U.S.)

- Skinny Pasta (Israel)

Latest Developments in Global Low-calorie Noodles Market

- In March 2025, It's Skinny unveiled its ready-to-eat pasta meals at the Natural Products Expo West, showcasing a modern twist on traditional pasta. Made with konjac flour, these meals provide a low-calorie, low-carb, gluten-free, vegan, and keto-friendly option for health-conscious consumers. This innovative launch addresses the increasing demand for convenient and nutritious meal solutions. By combining dietary inclusivity with ease of preparation, It's Skinny aims to redefine comfort food for the modern eater

- In June 2024, Miracle Noodle unveiled its innovative egg white noodles, catering to the growing demand for protein-enriched diets. Each serving offers 10 grams of premium protein, making them an excellent choice for health-conscious consumers. These noodles are low in carbohydrates and align with various dietary preferences, including keto and paleo. Initially launched at Sprouts Farmers Market, they are set to expand availability on platforms like Amazon and Thrive Market. This addition reflects Miracle Noodle's commitment to providing nutritious and convenient food options

- In December 2024, Winn Foods introduced Winn Hakka Noodles Curly Chow in India, revolutionizing the instant noodle market with a healthier and more flavorful option. These noodles are made using an innovative air-drying process that retains their natural texture and taste while significantly cutting down on fat content. Free from oil, MSG, trans fats, preservatives, artificial colors, and flavors, they cater to health-conscious consumers seeking quality and convenience. This launch underscores Winn Foods' commitment to offering premium, wholesome meal solutions

- In March 2025, Korea embraced the zero-sugar trend with the launch of sugar-free instant noodles. Paldo Bibimmyeon, a leading brand in the bibimmyeon market, introduced a zero-sugar variant to meet the growing demand for healthier, low-calorie options. This innovative product uses allulose as a natural sugar substitute, offering a sweet taste similar to traditional sugar while reducing calories and carbohydrates. The noodles maintain their signature sweet and spicy flavor, appealing to health-conscious consumers. This launch highlights Paldo's commitment to adapting to evolving dietary preferences

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Low Calorie Noodles Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Low Calorie Noodles Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Low Calorie Noodles Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.