Global Low Emission Vehicles Market

Market Size in USD Billion

CAGR :

%

USD

208.52 Billion

USD

688.33 Billion

2024

2032

USD

208.52 Billion

USD

688.33 Billion

2024

2032

| 2025 –2032 | |

| USD 208.52 Billion | |

| USD 688.33 Billion | |

|

|

|

|

Low Emission Vehicles Market Size

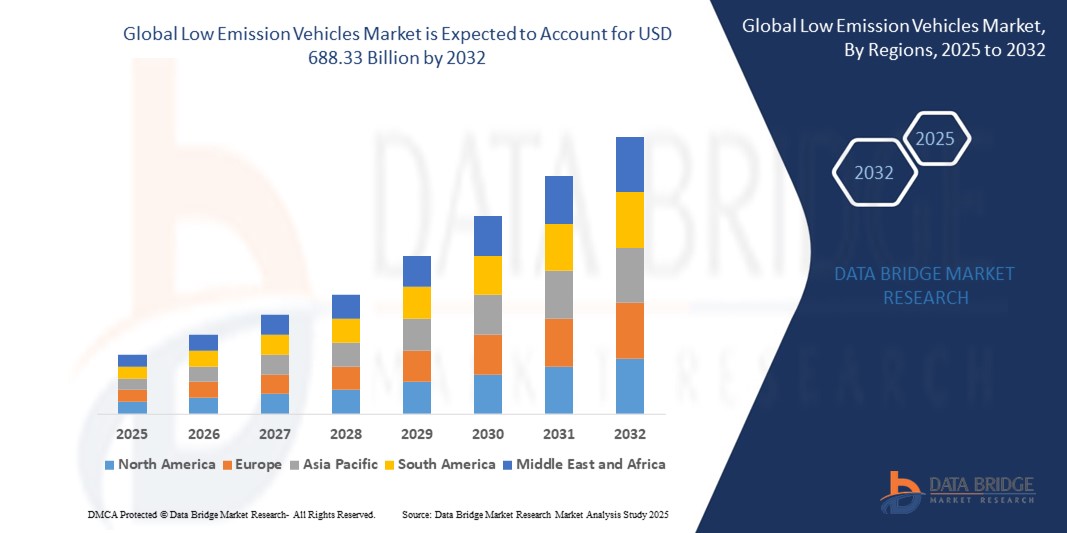

- The global low emission vehicles market size was valued at USD 208.52 billion in 2024 and is expected to reach USD 688.33 billion by 2032, at a CAGR of 16.10% during the forecast period

- The market growth is largely fueled by increasing environmental concerns and the urgent need to reduce carbon footprints, coupled with rising fuel costs and stringent government regulations promoting cleaner transportation

- Advancements in battery technology, expanding charging infrastructure, and increasing consumer preference for sustainable mobility solutions are further propelling the demand for low emission vehicles across various segments

Low Emission Vehicles Market Analysis

- The low emission vehicles market is experiencing robust growth driven by a global shift towards sustainable transportation and a strong emphasis on reducing greenhouse gas emissions

- Growing demand from both private consumers and commercial fleets is encouraging manufacturers to innovate with high-performance, efficient, and technologically advanced low emission vehicle solutions, including Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs)

- North America dominates the low emission vehicles market with the largest revenue share of 39% in 2024, driven by favorable government policies, significant investments in charging infrastructure, and a mature automotive industry

- Europe is expected to be the fastest-growing region in the low emission vehicles market during the forecast period, primarily due to stringent emission regulations, substantial government incentives, and a strong focus on electric mobility initiatives

- The lithium-ion battery segment holds the largest market revenue share of 72.6% in 2024, driven by its high energy density, longer lifespan, and widespread adoption in battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). Advancements in lithium-ion technology, such as faster charging and improved safety, further fuel this segment’s growth

Report Scope and Low Emission Vehicles Market Segmentation

|

Attributes |

Low Emission Vehicles Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Low Emission Vehicles Market Trends

“Accelerating Shift Towards Battery Electric Vehicles (BEVs)”

- The market for low emission vehicles is witnessing a significant trend of increasing adoption of battery electric vehicles (BEVs) due to their zero tailpipe emissions and continuous improvements in battery range and charging speeds

- Consumers are increasingly opting for BEVs as concerns over air quality and climate change intensify, coupled with the availability of a wider range of attractive models across different price points

- Governments worldwide are bolstering this trend through substantial subsidies, tax incentives, and investments in public charging infrastructure, making BEVs more accessible and appealing.

- For instance, many European countries and China have set ambitious targets for phasing out internal combustion engine (ICE) vehicles, directly fueling the demand for BEVs

- Automakers are heavily investing in dedicated EV platforms and expanding their electric vehicle portfolios, often offering factory BEV upgrades to enhance vehicle performance and sustainability

- Dealerships are actively promoting BEVs, often bundling charging solutions and maintenance packages to attract buyers. For instances, Tesla's growing supercharger network and direct-to-consumer sales model continue to drive BEV adoption globally

Low Emission Vehicles Market Dynamics

Driver

“Increasing Environmental Regulations and Government Incentives”

- Growing global awareness of climate change and air pollution is driving governments to implement increasingly stringent emission standards and policies aimed at reducing carbon footprints from the transportation sector

- These regulations, such as Euro 7 in Europe, CAFE standards in the U.S., and China VI, compel automakers to invest heavily in low-emission technologies, including electric and hybrid powertrains

- Concurrently, governments are offering a wide array of incentives, including tax credits, subsidies, purchase rebates, and preferential parking or charging access, to encourage consumer adoption of low emission vehicles

- For Instances, the Indian government's FAME scheme offers direct subsidies for electric vehicle purchases, and many state governments provide additional benefits such as reduced road tax. Such incentives significantly reduce the upfront cost barrier, making LEVs more accessible and attractive to a broader consumer base

- The push for decarbonization and the establishment of "green zones" in urban areas further amplify the demand for cleaner vehicles, positioning LEVs as essential for future urban mobility

Restraint/Challenge

“High Upfront Costs and Limited Charging Infrastructure”

- Despite government incentives, the initial purchase price of low emission vehicles, particularly battery electric vehicles (BEVs) and fuel cell electric vehicles (FCEVs), remains higher than that of comparable internal combustion engine (ICE) vehicles

- Furthermore, the availability and accessibility of adequate charging and refueling infrastructure pose a substantial challenge to widespread adoption

- While home charging is convenient for some, a robust public charging network with reliable and fast chargers is crucial for overcoming and enabling long-distance travel

- The uneven distribution of charging stations, coupled with varied charging standards and payment systems across regions, complicates the user experience. For instance, in many developing economies, the charging infrastructure is still nascent, hindering mass adoption

- The high cost of deploying extensive charging networks and the strain it can place on existing electrical grids also present significant investment and logistical hurdles

Low Emission Vehicles Market Scope

The market is segmented on the basis of Battery type, degree of hybridization, Vehicle type, and application.

- By Battery Type

On the basis of battery type, the low emission vehicles market is segmented into nickel metal hydride, metal hydride batteries, lithium-ion batteries, nickel-cadmium batteries, and lead acid batteries. The lithium-ion battery segment holds the largest market revenue share of 72.6% in 2024, driven by its high energy density, longer lifespan, and widespread adoption in battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). Advancements in lithium-ion technology, such as faster charging and improved safety, further fuel this segment’s growth.

The nickel-metal hydride battery segment is expected to witness steady growth from 2025 to 2032, particularly in hybrid electric vehicles (HEVs) and mild hybrid electric vehicles (MHEVs), due to its cost-effectiveness and reliability in hybrid applications, especially in price-sensitive markets.

- By Degree of Hybridization

On the basis of degree of hybridization, the low emission vehicles market is segmented into full hybrid electric vehicles (FHEVs), mild hybrid electric vehicles (MHEVs), pure electric vehicles (EVs or BEVs), and plug-in hybrid electric vehicles (PHEVs). The BEV segment dominates the market with a revenue share of 65.5% in 2024, supported by declining battery costs, advancements in charging infrastructure, and increasing consumer preference for zero-emission vehicles. Regulatory incentives and environmental awareness further drive this segment’s growth.

The PHEV segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its flexibility in combining electric and combustion engine capabilities, making it ideal for consumers in regions with limited charging infrastructure while still reducing emissions.

- By Vehicle Type

On the basis of vehicle type, the low emission vehicles market is segmented into pure electric, hybrid electric, and others. The pure electric segment holds the largest market revenue share of 60.8% in 2024, owing to the global push for zero-emission transportation, supportive government policies, and the increasing availability of affordable electric vehicle models. Pure electric vehicles benefit from both OEM production and growing consumer demand for sustainable mobility.

The hybrid electric segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its appeal to consumers seeking fuel efficiency and reduced emissions without relying solely on charging infrastructure, particularly in commercial fleets and emerging markets.

- By Application

On the basis of application, the low emission vehicles market is segmented into personal and commercial. The personal segment dominates the market with a revenue share of 71% in 2024, fueled by growing consumer awareness of environmental concerns, government incentives, and the appeal of advanced features such as regenerative braking and smart connectivity in electric and hybrid vehicles.

The commercial segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of low emission vehicles in logistics, delivery services, and public transportation to reduce operational costs and comply with urban emission regulations.

Low Emission Vehicles Market Regional Analysis

- North America dominates the low emission vehicles market with the largest revenue share of 39% in 2024, driven by favorable government policies, significant investments in charging infrastructure, and a mature automotive industry

- The region benefits from the presence of major electric vehicle manufacturers and a strong emphasis on reducing greenhouse gas emissions

- Growth is further supported by the expansion of public charging networks and the adoption of low emission zones in major cities, encouraging both individual consumers and commercial fleets to transition to cleaner vehicles

U.S. Low Emission Vehicles Market Insight

The U.S. dominates the North America low emission vehicles market with the highest revenue share in 2023, fueled by robust government incentives, increasing consumer awareness of environmental benefits, and significant investments in charging infrastructure. The trend towards sustainable transportation and the growing availability of diverse electric and hybrid models further boost market expansion. Automakers' aggressive rollout of new EV models and the expansion of domestic manufacturing capabilities contribute to a dynamic market ecosystem.

Europe Low Emission Vehicles Market Insight

The Europe low emission vehicles market is expected to witness the fastest growth rate, supported by stringent emission regulations and ambitious decarbonization targets set by the European Union. Consumers are increasingly seeking cleaner vehicles to comply with urban low-emission zones and benefit from various subsidies and tax breaks. The growth is prominent across both private and commercial vehicle segments, with countries such as Germany, France, and Norway showing significant uptake due to strong policy support and expanding charging networks.

U.K. Low Emission Vehicles Market Insight

The U.K. market for low emission vehicles is expected to witness significant growth, driven by the government's commitment to phasing out petrol and diesel car sales and substantial investments in charging infrastructure. Increased consumer interest in electric vehicles, fueled by environmental concerns and financial incentives, encourages adoption. Evolving regulations, such as the introduction of clean air zones, also influence consumer and fleet operator choices, balancing vehicle affordability with environmental compliance.

Germany Low Emission Vehicles Market Insight

Germany is expected to witness substantial growth in low emission vehicles, attributed to its advanced automotive manufacturing sector and strong governmental support for electric mobility. German consumers prioritize technologically advanced and high-performance electric and hybrid vehicles that contribute to lower emissions and reduced running costs. The integration of these vehicles in premium segments and the expansion of public and private charging solutions support sustained market growth.

Asia-Pacific Low Emission Vehicles Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapidly expanding automotive markets, rising disposable incomes, and increasing environmental awareness in countries such as China, India, and Japan. Government initiatives promoting cleaner transportation, significant investments in charging infrastructure, and the presence of major domestic and international EV manufacturers are boosting demand for low emission vehicles across the region.

Japan Low Emission Vehicles Market Insight

Japan's low emission vehicles market is expected to witness significant growth due to a strong consumer preference for fuel-efficient and environmentally friendly vehicles, coupled with the presence of leading hybrid and fuel cell vehicle manufacturers. The country's continuous advancements in battery technology and hydrogen infrastructure accelerate market penetration. Rising interest in sustainable mobility solutions and governmental support for green technologies also contribute to growth.

China Low Emission Vehicles Market Insight

China holds the largest share of the Asia-Pacific low emission vehicles market, propelled by aggressive government policies, massive investments in charging infrastructure, and rapid urbanization. The country's vast consumer base, strong domestic manufacturing capabilities, and a focus on new energy vehicles (NEVs) have made it the global leader in EV production and sales. Competitive pricing and a wide array of models further enhance market accessibility and drive sustained growth.

Low Emission Vehicles Market Share

The low emission vehicles industry is primarily led by well-established companies, including:

- Tesla (U.S.)

- Toyota Kirloskar Motor (India)

- Ford Motor Company (U.S.)

- Mitsubishi Motors Corporation (Japan)

- Hyundai Motor Company (South Korea)

- Daimler AG (Germany)

- Honda Motor Co., Ltd. (Japan)

- BMW AG (Germany)

- BYD Company Ltd. (China)

- Renault (France)

- AUDI AG (Germany)

- AB Volvo (Sweden)

- Geely Auto (China)

- JAGUAR LAND ROVER LIMITED (U.K.)

- Polestar (Sweden)

Latest Developments in Global Low Emission Vehicles Market

- In February 2025, Toyota Motor Corporation unveiled its next-generation bZ4X electric SUV, featuring enhanced battery efficiency and an extended range exceeding 500 km. This advanced Battery Electric Vehicle (BEV) integrates cutting-edge lithium-ion battery technology and improved regenerative braking, optimizing energy efficiency and reducing charging times. Targeting the rising demand for sustainable and high-performance EVs, particularly in Europe and Asia-Pacific, the bZ4X aligns with stringent environmental regulations. By expanding its BEV lineup, Toyota reinforces its competitive stance in the global low-emission vehicle market, appealing to eco-conscious consumers and fleet operators

- In January 2025, BYD Company Ltd. launched the Han EV Pro model in the Asia-Pacific region, equipped with an advanced blade battery for enhanced safety and a driving range of up to 600 km. This electric vehicle supports fast-charging, reaching 80% capacity in under 30 minutes, and integrates vehicle-to-grid (V2G) technology for efficient energy management. Targeting growing demand in China and India, where urbanization and government incentives accelerate EV adoption, the Han EV Pro strengthens BYD’s leadership in the low-emission vehicle market

- In December 2024, General Motors acquired a minority stake in VoltCycle, a U.S.-based battery recycling startup, to enhance its electric vehicle battery supply chain. This strategic investment strengthens GM’s ability to recycle and repurpose lithium-ion batteries, reducing reliance on raw materials and lowering production costs. The acquisition supports GM’s Ultium battery platform, aiding the rollout of models such as the Chevrolet Equinox EV. By integrating sustainable practices, GM aims to expand its presence in the North American low-emission vehicle market while aligning with circular economy principles

- In September 2024, Hyundai Motor Company secured a controlling stake in SolidEnergy Systems, a South Korean solid-state battery startup, to advance next-generation battery technology for its electric vehicle lineup. This acquisition supports Hyundai’s integration of solid-state batteries into models such as the Ioniq 7, set for release in 2026, delivering higher energy density, improved safety, and extended lifespan compared to conventional lithium-ion batteries. The move reinforces Hyundai’s leadership in the Asia-Pacific low-emission vehicle market, leveraging the region’s rapid adoption of advanced EV technologies

- In August 2024, Rivian Automotive, Inc. introduced the R2 compact electric SUV in the U.S., focusing on affordability with a starting price of under $40,000 and a range of approximately 450 km. This model integrates sustainable materials, including recycled plastics in its interior, and features bidirectional charging for home energy backup. Designed for cost-conscious consumers and urban drivers, the R2 strengthens Rivian’s presence in the North American low-emission vehicle market. By expanding its portfolio with accessible EV models, Rivian aims to secure a larger share of the competitive U.S. market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.