Global Lumber Pallet Market

Market Size in USD Billion

CAGR :

%

USD

8.44 Billion

USD

13.86 Billion

2021

2029

USD

8.44 Billion

USD

13.86 Billion

2021

2029

| 2022 –2029 | |

| USD 8.44 Billion | |

| USD 13.86 Billion | |

|

|

|

|

Lumber Pallet Market Analysis and Size

Lumber pallets are easily available and unlike heavy cartons, the workers can use forklifts, pallet jacks, conveyors, or other handling equipment to easily move and place the pallets in the position. By using pallets, different goods and packs can be combined, which saves a lot of space and hassle to track multiple boxes or pallets. As wooden pallets can be reused, they provide a lower cost per trip and lesser environmental impacts than pallets, which can be used only once and are subjected to the cost of reverse logistics.

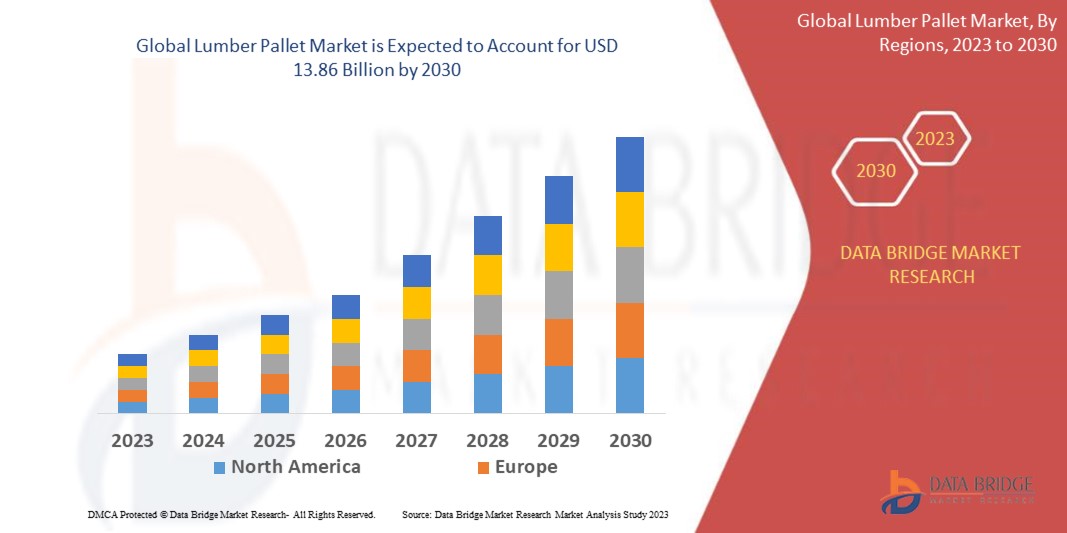

Data Bridge Market Research analyses that the global lumber pallet market which was USD 8.44 billion in 2022, is expected to reach USD 13.86 billion by 2030, and is expected to undergo a CAGR of 6.1% during the forecast period of 2023 to 2030. “Food and beverages” dominates the end-user segment of the global lumber pallet market due to the need for safe and sanitary transportation and storage of their products. The dominance of these segments could be attributed to the essential nature of their products and stringent quality requirements. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Lumber Pallet Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Kilo Tons, Pricing in USD |

|

Segments Covered |

Product Type (Stringer Lumber Pallets, Block Lumber Pallets, Double Face Pallets, Double Wing Pallets, and Others), Wood Type (Softwood, and Hardwood), Size (800 x 1200 mm, 1000 x 1200 mm, 800 x 600 mm, 914 x 914 mm, 1118 x 1118 mm, 1200 x 1000 mm, and Others), Distribution Channel (Offline, and Online), End-User (Food and Beverages, Pharmaceuticals, Chemicals, Retail, Automotive, and Others) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, U.A.E., Saudi Arabia, Egypt, South Africa, Israel, and the rest of Middle East and Africa |

|

Market Players Covered |

CHEP (A subsidiary of Brambles) (Australia), Greif (U.S.), UFP Industries, Inc. (U.S.), PALLETBIZ (Germany), PGS Group (France), UAB Vigidas Pack (Lithuania), LOSCAM (Australia), JGD Pallets (U.K.), Palcon LLC (U.S.), Falkenhahn AG (Germany), Conquest Joinery (U.K.), SandS Box and Pallet Manufacturers (U.S.), Imperial Timber (U.K.), HG Timber Ltd. (U.K.), Johannesburg Timber and Box (South Africa), Premier Pallets, Inc. (U.S.), Rowlinsons Packaging Ltd. (U.K.), and Christies Industries (U.K.) |

|

Market Opportunities |

|

Market Definition

A lumber pallet is a flat, portable, and rigid platform that is made of wood. It is primarily used to carry heavy loads of goods and materials. Lumber pallets are also used to pile up, store, assemble, and transport goods. These pallets improve operational efficiency in warehouses by allowing easy movement of stocked goods. As the goods placed on these pallets are much heavier, they could be combined with the use of machinery or tools, such as forklifts and pallet jacks, to make the transport smoother and easier.

Global Lumber Pallet Market Dynamics

Drivers

- Growing Sustainable Practices

One major driver of the global lumber pallet market is the increasing adoption of sustainable and eco-friendly pallet solutions. As environmental concerns rise, businesses are seeking pallets made from renewable sources and with longer lifespans. This shift is driven by both consumer demand for greener products and regulatory pressures, creating opportunities for pallet manufacturers to produce and market sustainable pallets.

- Growing E-Commerce Boom

The rapid growth of e-commerce is driving demand for pallets in the logistics and supply chain sectors. As more consumers shop online, the need for efficient warehousing and transportation of goods has surged. Pallets are essential for handling and shipping products, making them a crucial component in the e-commerce driven supply chain. This trend is likely to continue fuelling the demand for pallets globally.

- Rising Global Trade Expansion

The expansion of global trade and international supply chains is another driver of the lumber pallet market. Pallets play a vital role in facilitating the movement of goods across borders. As international trade continues to grow, there is an increased need for standardized and durable pallets to ensure the smooth flow of products, presenting an opportunity for pallet manufacturers to tap into this expanding market.

Opportunity

- Growing Technological Advancements

The incorporation of advanced technologies, such as IoT-based tracking and monitoring systems, offers an opportunity for pallet manufacturers to add value to their products. These technologies can help improve pallet management, tracking, and inventory control, making the supply chain more efficient and reducing costs for businesses. Manufacturers that embrace these innovations can gain a competitive edge in the market.

Restraints/Challenges

- Fluctuating Raw Material Costs

The lumber pallet industry is highly sensitive to fluctuations in the cost of wood and other raw materials. Variations in timber prices can impact production costs, making it challenging for manufacturers to maintain consistent pricing and profitability. Managing these cost fluctuations is a significant restraint in the industry.

- Rising Stringent Regulations

Pallet manufacturers must adhere to strict regulations, especially related to international trade and phytosanitary standards. Meeting these regulations can be costly and time-consuming, acting as a restraint for smaller manufacturers and potentially limiting market entry for new players.

- Competition from Alternative Materials

One of the challenges facing the lumber pallet market is competition from alternative materials, such as plastic and metal pallets. These materials offer different benefits, including durability and hygiene advantages. Pallet manufacturers must continuously innovate to demonstrate the advantages of wood pallets and maintain their market share.

- Rising Supply Chain Disruptions

Disruptions in the supply chain, whether due to natural disasters, transportation issues, or pandemics (as seen with COVID-19), can have a significant impact on the availability and cost of pallet materials and transportation logistics. Adapting to and mitigating these disruptions is an ongoing challenge for the global lumber pallet market.

This global lumber pallet market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global lumber pallet market contact Data Bridge Market Research for an Analyst Brief, our team will help you make an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- In September 2022, ArbaBlox, an engineered wood products company, invested $51.34 million in a state-of-the-art pallet blocks manufacturing plant in Winona, Mississippi. This initiative, their first of its kind, aims to produce composite wood pallet blocks using sawmill residuals from a nearby facility, with plans for future expansions. The Mississippi Development Authority and local authorities are supporting the project, which will create 41 jobs and supply composite wood pallets to the food service industry and more. ArbaBlox's CEO, Ed Milburn, expressed gratitude for the community's support and emphasized their commitment to the local area

Global Lumber Pallet Market Scope

The global lumber pallet market is segmented on the basis of product type, wood type, size, distribution channel and end-user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Stringer Lumber Pallets

- Block Lumber Pallets

- Double Face Pallets

- Double Wing Pallets

- Others

Wood Type

- Softwood

- Hardwood

Size

- 800 x 1200 mm

- 1000 x 1200 mm

- 800 x 600 mm

- 914 x 914 mm

- 1118 x 1118 mm

- 1200 x 1000 mm

- Others

Distribution Channel

- Offline

- Online

End-User

- Food and Beverages

- Pharmaceuticals

- Chemicals

- Retail

- Automotive

- Others

Global Lumber Pallet Market Regional Analysis/Insights

The global lumber pallet market is analyzed and market size insights and trends are provided by product type, wood type, size, distribution channel and end-user as referenced above.

The countries covered in the global lumber pallet market report are U.S., Canada, and Mexico in North America, Brazil, Argentina, and the rest of South America in South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, and the rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, and the rest of Asia-Pacific in Asia-Pacific, and U.A.E., Saudi Arabia, Egypt, South Africa, Israel, and the rest of the Middle East and Africa in Middle East and Africa

Europe dominates the global lumber pallet market due to the rise in the production and consumption of lumber pallet in the region.

Asia-Pacific is expected to witness the fastest growth in the global lumber pallet market during the forecast period of 2023 to 2030, due to increasing demand of lumber pallets in the food and beverage industry in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Lumber Pallet Market Share Analysis

The global lumber pallet market competitive landscape provides details by competitors. details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus related to the global lumber pallet market.

Some of the major players operating in the global lumber pallet market are:

- CHEP (A subsidiary of Brambles) (Australia)

- Greif (U.S.)

- UFP Industries, Inc. (U.S.)

- PALLETBIZ (Germany)

- PGS Group (France)

- UAB Vigidas Pack (Lithuania)

- LOSCAM (Australia)

- JGD Pallets (U.K.)

- Palcon LLC (U.S.)

- Falkenhahn AG (Germany)

- Conquest Joinery (U.K.)

- SandS Box and Pallet Manufacturers (U.S.)

- Imperial Timber (U.K.)

- HG Timber Ltd. (U.K.)

- Johannesburg Timber and Box (South Africa)

- Premier Pallets, Inc. (U.S.)

- Rowlinsons Packaging Ltd. (U.K.)

- Christies Industries (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Lumber Pallet Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Lumber Pallet Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Lumber Pallet Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.