Global Luxury Gin Market

Market Size in USD Billion

CAGR :

%

USD

6.38 Billion

USD

10.65 Billion

2024

2032

USD

6.38 Billion

USD

10.65 Billion

2024

2032

| 2025 –2032 | |

| USD 6.38 Billion | |

| USD 10.65 Billion | |

|

|

|

|

What is the Global Luxury Gin Market Size and Growth Rate?

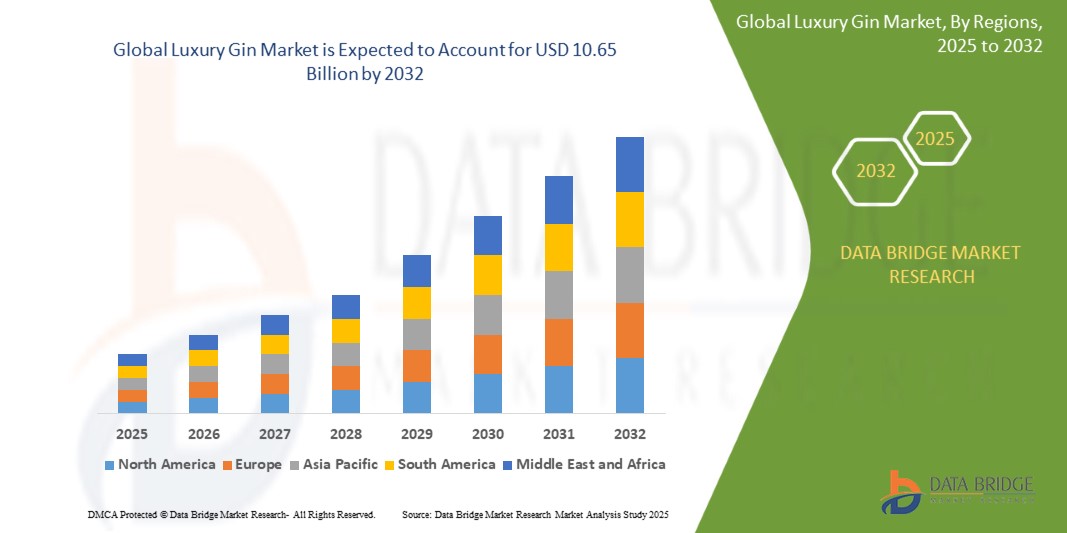

- The global luxury gin market size was valued at USD 6.38 billion in 2024 and is expected to reach USD 10.65 billion by 2032, at a CAGR of 6.60% during the forecast period

- The trend toward premiumization was a significant driver, with consumers increasingly willing to pay for high-quality and unique gin offerings. Premium and craft gins, often associated with superior ingredients and craftsmanship, were gaining popularity

- Consumers were showing a preference for craft and artisanal spirits, including gin. The unique and handcrafted nature of small-batch gins appealed to those seeking distinctive flavor profiles, and a connection to the production process can drive market growth and maintain their dominance throughout the forecast period

What are the Major Takeaways of Luxury Gin Market?

- Consumers today are more discerning and sophisticated in their tastes. There is a growing desire for unique and premium experiences, and this extends to the beverages they choose, such as luxury gins. As individuals become more knowledgeable about different types of spirits, they are willing to explore and invest in higher-quality products

- Premium and luxury gins are often associated with superior quality, craftsmanship, and exclusivity. The use of rare botanicals, intricate distillation methods, and limited production contribute to the perceived value of these spirits

- Consumers are willing to pay a premium for products that offer a unique and exclusive drinking experience. Consuming luxury gins can be seen as a status symbol and a reflection of one's lifestyle choices. This new formed interest is a major growth driver

- North America dominated the luxury gin market with the largest revenue share of 42.3% in 2024, driven by a strong preference for premium spirits, growing cocktail culture, and the rising trend of artisanal and craft beverages

- Asia-Pacific luxury gin market is set to grow at the fastest CAGR of 10.25% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing adoption of premium spirits

- The London Dry Gin segment dominated the luxury gin market with the largest revenue share of 46.8% in 2024, driven by its global popularity, consistent flavor profile, and widespread use in cocktails such as gin and tonic or martinis

Report Scope and Luxury Gin Market Segmentation

|

Attributes |

Luxury Gin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Luxury Gin Market?

Premiumization and Experiential Drinking Shaping Luxury Gin Innovation

- A significant and accelerating trend in the global luxury gin market is the rising demand for premium botanicals, artisanal production methods, and immersive brand experiences, driven by consumers seeking exclusivity and authenticity

- For instance, Diageo’s Tanqueray No. Ten has focused on small-batch distillation with fresh citrus fruits, while Pernod Ricard’s Monkey 47 highlights its 47 botanicals sourced from Germany’s Black Forest, emphasizing provenance and craftsmanship

- Brands are also embracing experiential marketing, including distillery tours, virtual tastings, and personalized bottle engravings to build emotional connections with consumers

- Sustainability is gaining traction, with brands such as Bacardi introducing eco-friendly packaging and carbon-neutral production processes to appeal to environmentally conscious buyers

- This trend reflects a shift toward luxury spirits as lifestyle products, where quality, storytelling, and sustainability enhance perceived value. Consequently, the luxury gin segment is evolving beyond traditional consumption into an experiential and aspirational category

What are the Key Drivers of Luxury Gin Market?

- The growing global demand for premium spirits, fueled by rising disposable incomes and evolving consumer preferences, is a significant driver of luxury gin sales

- For instance, in 2024, Davide Campari-Milano N.V. expanded its premium gin portfolio by acquiring new artisanal brands to strengthen its foothold in Europe and Asia, demonstrating the sector's lucrative growth potential

- The “cocktail culture” boom in urban markets and the increasing popularity of gin-based drinks in high-end bars and restaurants are propelling market expansion

- Health-conscious consumers are drawn to gin’s botanical ingredients, perceived as a lighter and more sophisticated alternative to other spirits

- Digital channels, including e-commerce platforms and social media campaigns, are further amplifying brand reach, enabling direct-to-consumer premiumization and personalized marketing, which supports rapid adoption across global markets

Which Factor is challenging the Growth of the Luxury Gin Market?

- The high price point of artisanal and small-batch luxury gin poses a barrier in price-sensitive markets, limiting accessibility for a broader consumer base

- Regulatory hurdles surrounding alcohol taxation, distribution laws, and labeling requirements also challenge market penetration, especially in emerging economies

- For instance, stringent alcohol regulations in regions such as the Middle East restrict promotional activities, hampering brand visibility and consumer awareness

- Intense competition among premium spirit categories, particularly from luxury whiskey and tequila, diverts consumer spending and adds pressure on gin brands to differentiate through innovation

- To overcome these challenges, brands must focus on affordably priced premium offerings, transparent sustainability practices, and targeted marketing strategies to expand their global footprint while maintaining exclusivity

How is the Luxury Gin Market Segmented?

The market is segmented on the basis of type, price point, and distribution channel.

• By Type

On the basis of type, the luxury gin market is segmented into London Dry Gin, Old Tom Gin, Plymouth Gin, and Others. The London Dry Gin segment dominated the luxury gin market with the largest revenue share of 46.8% in 2024, driven by its global popularity, consistent flavor profile, and widespread use in cocktails such as gin and tonic or martinis. Consumers often favor London Dry Gin for its classic taste, premium positioning, and versatility in mixology, making it a staple across both on-trade and off-trade channels.

The Old Tom Gin segment is anticipated to witness the fastest growth rate of 20.9% from 2025 to 2032, fueled by the rising interest in craft spirits and the revival of vintage cocktail recipes. Its slightly sweeter profile appeals to modern consumers seeking unique flavor experiences and artisanal offerings, particularly in premium bars and restaurants.

• By Price Point

On the basis of price point, the luxury gin market is segmented into Standard, Premium, and Luxury. The Premium segment held the largest revenue share of 51.2% in 2024, supported by increasing consumer willingness to pay more for superior quality, authentic botanicals, and artisanal production techniques. Premium brands are widely adopted across urban markets and are driving growth through innovative flavors and eco-conscious packaging.

The Luxury segment is expected to register the fastest CAGR from 2025 to 2032, propelled by high-net-worth consumers, limited edition releases, and experiential marketing strategies such as personalized distillery tours and bespoke bottle designs.

• By Distribution Channel

On the basis of distribution channel, the luxury gin market is segmented into On-trade and Off-trade. The On-trade segment accounted for the largest revenue share of 58.6% in 2024, driven by the expansion of premium bars, luxury hotels, and fine-dining restaurants that showcase high-end gin-based cocktails and signature serves. The segment benefits from brand visibility through mixologists and curated tasting experiences.

The Off-trade segment is projected to witness the fastest growth during the forecast period, supported by e-commerce platforms, premium liquor stores, and duty-free retail, which offer convenience and access to exclusive releases for at-home consumption.

Which Region Holds the Largest Share of the Luxury Gin Market?

- North America dominated the luxury gin market with the largest revenue share of 42.3% in 2024, driven by a strong preference for premium spirits, growing cocktail culture, and the rising trend of artisanal and craft beverages

- Consumers in this region are increasingly drawn to botanical-rich profiles and innovative blends, with luxury gins gaining traction in both on-trade and off-trade channels

- The region's growth is further supported by high disposable incomes, a vibrant nightlife culture, and premium positioning by global brands through exclusive launches and experiential marketing. This has established luxury gin as a leading choice among affluent consumers and mixology enthusiasts across urban markets

U.S. Luxury Gin Market Insight

The U.S. luxury gin market captured the largest revenue share in 2024 within North America, fueled by the surge in craft distilleries, premium gin cocktails, and innovative flavor infusions. Increasing demand for locally produced, small-batch luxury gins is shaping consumer preferences, while celebrity endorsements and luxury bar experiences are further driving growth. The rising popularity of ready-to-drink premium cocktails and e-commerce liquor platforms also contributes to the rapid expansion of the Luxury Gin segment in the U.S.

Europe Luxury Gin Market Insight

The Europe luxury gin market is projected to grow at a steady CAGR during the forecast period, driven by the region’s rich heritage of gin craftsmanship and rising experimentation with regional botanicals. Consumers are seeking authentic, artisanal experiences, with countries such as Spain, Italy, and Germany witnessing a surge in premium gin bars and tasting events. Luxury gins are increasingly incorporated into fine dining and mixology trends, reinforcing their premium image across both traditional and emerging markets.

U.K. Luxury Gin Market Insight

The U.K. luxury gin market continues to be a cornerstone of global gin innovation, supported by a longstanding gin culture and premiumization trends. Growth is driven by limited-edition releases, botanical diversity, and heritage branding, appealing to both domestic consumers and export markets. The U.K.’s robust distribution network, coupled with experiential marketing through distillery tours and gin festivals, further strengthens its position as a leader in the luxury segment.

Germany Luxury Gin Market Insight

The Germany luxury gin market is expanding steadily, fueled by rising consumer interest in premium alcoholic beverages and a growing preference for sustainably produced and eco-conscious spirits. Craft distilleries are focusing on organic botanicals and innovative production techniques, aligning with Germany’s emphasis on quality and environmental responsibility. Premium gin consumption is also supported by specialty liquor stores and upscale hospitality venues, making Germany a key European hub for luxury spirits.

Which Region is the Fastest Growing in the Luxury Gin Market?

Asia-Pacific luxury gin market is set to grow at the fastest CAGR of 10.25% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing adoption of premium spirits. Emerging markets such as China, Japan, and India are witnessing a shift towards luxury lifestyle trends, with gin gaining popularity among younger consumers seeking sophisticated and versatile beverages. The expansion of craft distilleries and premium imports, coupled with social media-driven cocktail culture, is accelerating luxury gin adoption across the region.

Japan Luxury Gin Market Insight

The Japan luxury gin market is gaining momentum, supported by the country’s affinity for precision craftsmanship and premium beverages. Japanese distillers are experimenting with local botanicals such as yuzu and sakura, creating unique flavor profiles that appeal to both domestic and global consumers. The popularity of high-end bars, luxury hotels, and curated tasting experiences is further boosting the market, positioning Japan as a trendsetter in premium gin innovation.

China Luxury Gin Market Insight

The China luxury gin market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapidly expanding middle-class consumers, premium alcohol demand, and the rise of cocktail culture in urban centers. Luxury gin brands are increasingly targeting China through exclusive launches, e-commerce channels, and partnerships with upscale bars and restaurants. The growing trend of gifting premium spirits and government support for high-quality alcohol production are further propelling market growth.

Which are the Top Companies in Luxury Gin Market?

The luxury gin industry is primarily led by well-established companies, including:

- Diageo plc (U.K.)

- Rémy Cointreau (France)

- Pernod Ricard S.A. (France)

- South Western Distillery (U.K.)

- William Grant & Sons Limited (U.K.)

- Bacardi Limited (Bermuda)

- Forest Spirits’ Gin (Sweden)

- San Miguel Corporation (Philippines)

- Davide Campari-Milano N.V. (Italy)

What are the Recent Developments in Global Luxury Gin Market?

- In January 2025, Miami Breeze Car Care Inc. acquired 100% ownership of Gin City Group, Inc., marking its entry into the gin market. Through this acquisition, the company gains access to Gin City's diverse portfolio, including Gin City Original London Dry Gin, Gin City Zero (alcohol-free variant), and Gin City Gin-Tonic (ready-to-drink products), with expansion plans targeting Miami, Ibiza, Dubai, and London. This strategic move strengthens Miami Breeze's global presence in the premium gin segment

- In January 2025, Allied Blenders and Distillers Limited introduced two innovative variants under its premium Zoya Gin lineup: Watermelon Gin and Espresso Coffee Gin. Watermelon Gin captures the refreshing essence of a sunny day, while Espresso Coffee Gin delivers a bold, aromatic experience reminiscent of a classic espresso. These additions aim to enhance Zoya Gin’s premium appeal and diversify consumer choices in the luxury gin market

- In June 2024, Radico Khaitan launched the ‘Gold Edition’ of Jaisalmer Indian Craft Gin, positioned as a benchmark for India’s premium spirits category. Infused with saffron, the world’s most expensive spice, this edition offers a luxurious and exotic flavor profile. The launch underscores Radico Khaitan’s commitment to elevating Indian craft gin on a global platform

- In January 2024, Associated Alcohols and Breweries Limited (AABL), the flagship company of the Associated Kedia Group, unveiled its premium handcrafted gin, ‘Nicobar.’ Featuring a unique infusion of elderflower, hibiscus, and grains of paradise, Nicobar presents a distinctive and refined taste. This launch reinforces AABL’s vision to cater to the evolving demand for artisanal and high-quality gins

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Luxury Gin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Luxury Gin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Luxury Gin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.