Global Spirits Market

Market Size in USD Billion

CAGR :

%

USD

82.01 Billion

USD

226.82 Billion

2024

2032

USD

82.01 Billion

USD

226.82 Billion

2024

2032

| 2025 –2032 | |

| USD 82.01 Billion | |

| USD 226.82 Billion | |

|

|

|

|

Spirits Market Size

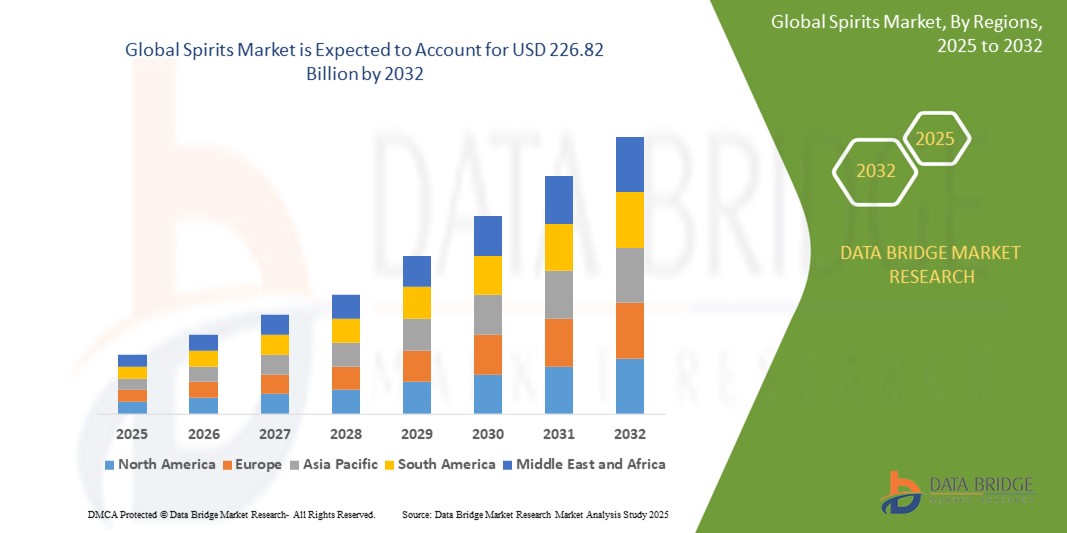

- The global spirits market was valued at USD 82.01 billion in 2024 and is expected to reach USD 226.82 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 13.56%, primarily driven by the rising global demand for premium and craft spirits, increasing disposable income, and evolving consumer preferences

- This growth is supported by factors such as the expansion of e-commerce alcohol delivery services, premiumization trends in developed economies, and increased consumption among millennials and Gen Z consumers in emerging markets

Spirits Market Analysis

- Spirits are alcoholic beverages distilled from grains, fruits, or vegetables, and include categories such as whiskey, vodka, rum, gin, tequila, and brandy. These beverages are widely consumed across cultures and occasions, often associated with social events, celebrations, and lifestyle trends

- The demand for spirits is significantly driven by changing consumer preferences toward premium and craft products, increasing urbanization, and rising disposable income, especially in emerging economies. Premiumization is a key factor, as consumers seek high-quality, authentic, and artisanal beverages

- The Asia-Pacific region stands out as one of the dominant regions for spirits consumption, fueled by its large population base, rising middle class, and growing inclination toward Western-style social drinking and nightlife

- For instance, In India and China, premium spirits have witnessed substantial growth due to increasing young adult populations and expanding middle-income groups. Local brands are also innovating with flavors and packaging to cater to diverse consumer tastes

- Globally, whiskey and vodka rank among the most consumed spirit types, with significant contributions from the U.S., U.K., Russia, and Japan. Innovations in flavor infusions, sustainability in packaging, and celebrity-endorsed product lines continue to shape the evolution of the global spirits market

Report Scope and Spirits Market Segmentation

|

Attributes |

Spirits Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Spirits Market Trends

“Premiumization and Craft Spirits Revolution”

- One prominent trend in the global spirits market is the growing shift toward premiumization and craft spirits. Consumers are increasingly seeking unique, high-quality, and artisanal spirits that offer distinctive flavor profiles and authentic production methods

- This trend is fueled by the rising popularity of experiential drinking, cocktail culture, and an increasing number of millennials and Gen Z consumers who are willing to spend more on premium brands and limited-edition releases

- For instance, brands like Diageo, Pernod Ricard, and Beam Suntory have expanded their craft and small-batch product lines, introducing flavored whiskies, botanical gins, and aged rums to cater to evolving consumer tastes

- The emergence of craft distilleries in regions like North America and Europe is also contributing to this trend, offering localized, small-batch alternatives to mass-produced spirits

- In addition, storytelling, sustainable practices, and heritage branding are playing a significant role in influencing consumer preferences, making premium and craft spirits a cornerstone of future market growth

Spirits Market Dynamics

Driver

“Growing Demand Fueled by Premiumization and Evolving Consumer Preferences”

- The increasing consumer shift toward premium and craft spirits is a major driver propelling the growth of the global spirits market. As global incomes rise, especially in developing economies, consumers are showing a greater willingness to pay more for high-quality, branded, and artisanal products

- Product differentiation through flavor innovations, limited editions, and sustainable production practices is helping brands capture new segments and expand customer loyalty

- The growing popularity of cocktail culture has further accelerated the demand for a variety of base spirits like gin, rum, and whiskey, especially in bars, restaurants, and home mixology setups

- The expansion of e-commerce alcohol platforms and digital marketing strategies has also made premium spirits more accessible to a broader audience

For instance,

- In anuary 2024, Diageo launched a limited-edition release of its Johnnie Walker Blue Label Elusive Umami, crafted in collaboration with Japanese chef Kei Kobayashi, highlighting the growing emphasis on premium experiences and cross-cultural craftsmanship

- In September 2023, Pernod Ricard introduced a new super-premium gin brand called The Chuan, targeting Asian markets with a blend of traditional botanicals and modern distillation, showcasing how companies are tapping into regional preferences to drive premium growth

- In addition, e-commerce platforms like Drizly and ReserveBar are increasingly being used to market and distribute premium spirits directly to consumers, providing accessibility and convenience

Opportunity

“Leveraging Sustainability and Eco-Friendly Practices in Spirits Production”

- As environmental concerns continue to grow, the global spirits market is presented with an opportunity to embrace sustainability and eco-friendly production practices, catering to the increasing demand for environmentally responsible products

- Consumers are showing a greater preference for spirits produced using sustainable ingredients, renewable energy, and eco-conscious packaging, creating a niche for brands that prioritize environmental impact

- Leading brands in the spirits industry are already capitalizing on this trend by introducing environmentally friendly initiatives, reducing carbon footprints, and exploring innovative production methods

For instance,

- In 2023, Diageo announced its commitment to achieving net-zero carbon emissions by 2030 and introduced its new line of Johnnie Walker bottles made from 100% recycled plastic, emphasizing its dedication to sustainable production

- In October 2023, Pernod Ricard launched its Green Bottle initiative for Absolut Vodka, a sustainable packaging initiative made from 100% recycled glass, reflecting its commitment to reducing waste and enhancing sustainability

- In November 2023, Whistlepig Whiskey introduced a new organic rye whiskey, highlighting their sustainable farming practices and use of carbon-neutral distillation techniques

- In addition, the rise in plant-based and low-alcohol spirits offers a growth opportunity, driven by health-conscious consumers looking for more responsible drinking options

- The shift toward eco-friendly packaging and carbon offset programs could help spirits brands attract and retain a more environmentally conscious consumer base while positioning themselves as leaders in sustainability

Restraint/Challenge

“Regulatory Challenges and Compliance Issues in Global Markets”

- The global spirits market faces significant challenges related to stringent regulations and compliance requirements in various countries. These regulations, which govern everything from alcohol production, labeling, and advertising to distribution and consumption, can create barriers to entry for both new and existing players

- Taxation policies, import/export restrictions, and local alcohol laws can create complexities for companies looking to expand their reach, particularly in emerging markets where regulatory environments are often inconsistent or subject to change

- The high regulatory compliance costs associated with manufacturing, distribution, and marketing of alcoholic beverages can limit profitability for small and medium-sized enterprises (SMEs), which may struggle to navigate the complex global landscape

For instance,

- In January 2024, Beam Suntory faced regulatory hurdles when entering the Chinese market due to strict alcohol import taxes and local regulations surrounding alcohol advertising, impacting its expansion plans

- Similarly, in the European Union, the EU Alcohol Labelling Regulation (effective from 2024) mandates specific information on the nutritional content and ingredients of alcoholic beverages. This change requires companies to adjust packaging and labeling processes, resulting in additional operational costs

- Restrictive marketing policies also pose challenges, especially in countries with regulations limiting alcohol advertising on television, digital platforms, and public spaces. These restrictions can hinder brand visibility and reduce the effectiveness of marketing campaigns

- In addition, the rise of health-conscious consumers and stricter regulations surrounding the promotion of alcohol consumption, such as minimum drinking age laws and restrictions on alcohol sales during certain hours, can dampen market growth, particularly in regions with high levels of regulatory control

Spirits Market Scope

The market is segmented on the basis of type, distribution channel and alcohol by volume.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Distribution Channel |

|

|

By Alcohol by Volume |

|

Spirits Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Global Spirits Market”

- Asia-Pacific holds a dominant share in the global spirits market, driven by rising disposable incomes, urbanization, and an increasing preference for premium and international spirits across emerging economies

- China and India are key players in the region, contributing significantly to market growth due to high consumer demand for whiskey, brandy, and other local and imported spirits, fueled by changing lifestyles and social drinking trends

- The growing influence of Western culture, expansion of the middle-class population, and increased popularity of nightlife and social gatherings further propel demand for spirits in the region

- Well-established distribution networks, including supermarkets, specialty liquor stores, and e-commerce platforms, along with a surge in product innovation and premiumization strategies by global brands, continue to strengthen Asia-Pacific’s position in the global market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the global spirits market, driven by increasing disposable incomes, changing consumer preferences, and growing demand for premium alcoholic beverages

- Countries such as China, India, and Japan are emerging as key markets due to their large populations, growing middle class, and increasing cultural acceptance of alcohol consumption

- China, with its expanding young adult consumer base, is increasingly adopting premium spirits such as whiskey, vodka, and rum, as consumers shift toward higher-quality and internationally recognized brands

- India is seeing a similar trend, with rising demand for whiskey and rum, particularly in urban areas where modern drinking habits are gaining popularity. Indian whiskey is also gaining recognition on the international stage, contributing to both local and export market growth

- Japan, known for its rich history in whiskey production, continues to lead in the production of premium and craft whiskey, with global exports surging, particularly in North America and Europe

- As disposable incomes rise and e-commerce platforms expand, Asia-Pacific is set to become a major hub for both domestic consumption and international sales, further accelerating the region’s market growth

Spirits Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Davide Campari-Milano N.V. (Netherlands)

- Diageo (U.K.)

- Halewood Sales (U.K.)

- ASAHI GROUP HOLDINGS, LTD. (Japan)

- Accolade Wines (Australia)

- Bacardi Limited (Bermuda)

- Mike's Hard Lemonade Co. (U.S.)

- CASTEL FRÈRES (France)

- SUNTORY HOLDINGS LIMITED (Japan)

- Anheuser-Busch Companies LLC (Belgium)

- Brown-Forman (U.S.)

- United Brands Company (U.S.)

- Pernod Ricard S.A. (France)

- Miller Brewing Co. (U.S.)

Latest Developments in Global Spirits Market

- In April 2025, the U.S. introduced a 25% tariff on beer imports and expanded aluminum duties, causing ripples across the spirits industry. Brands such as Corona and Heineken are among those affected, facing higher production costs and supply chain disruptions. These tariffs are expected to lead to increased consumer prices and potential job losses, impacting economies on both sides of the Atlantic

- On April 10, 2025, Federvini, the Italian wine and spirits trade group, welcomed U.S. President Donald Trump's decision to pause most tariffs on Italian alcoholic beverages, describing it as "a step in the right direction." However, the group expressed concern over the remaining 10% tariff and the ongoing uncertainty in trade policies

- On April 10, 2025, Nicolas Ozanam, head of the French wine and spirits lobby group FEVS, commented on U.S. President Donald Trump's decision to pause most tariffs, calling it "half good news." The pause reduces custom duties on French wine and spirits exported to the U.S. from 20% to 10%, aligning them with other international suppliers. While this provides short-term relief and allows for increased shipments during a 90-day window, logistical constraints are expected as companies rush to restock

- In 2024, Radico Khaitan, a prominent Indian spirits company, introduced a premium whiskey line targeting international markets. This move reflects the evolving preferences and increasing sophistication of Indian consumers. The launch highlights the company's ambition to establish itself as a global player in the premium spirits segment while catering to the growing demand for high-quality products. Radico Khaitan's strategy aligns with the broader trend of Indian brands gaining recognition on the world stage

- In March 2023, Pernod Ricard announced plans to acquire a majority stake in Skrewball, a fast-growing flavored whiskey brand celebrated for its super-premium quality. Skrewball, renowned as the first peanut butter-flavored whiskey, offers a distinctive and smooth nutty taste. This acquisition reflects Pernod Ricard's commitment to consumer-centricity and premiumization, further enriching its diverse portfolio of iconic wine and spirits brands

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SPIRITS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL SPIRITS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL SPIRITS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMERS

5.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.4 INDUTRY TRENDS AND FUTURE PERSPECTIVES

5.5 SHOPPING BEHAVIOUR AND DYNAMICS

5.5.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.5.2 RESEARCH

5.5.3 IMPULSIVE

5.5.4 ADVERTISEMENT

5.6 PRIVATE LABEL VS BRAND ANALYSIS

5.7 CONSUMER LEVEL TRENDS

5.8 NEW PRODUCT LAUNCHES

6 BRAND OUTLOOK GRID

6.1 BRAND COMAPARATIVE ANALYSIS

6.2 PRODUCT VS BRAND ANALYSIS

7 PRODUCTION CAPACITY OUTLOOK

8 REGULATORY FRAMEWORK AND GUIDELINES

9 GLOBAL SPIRITS MARKET, BY TYPE, (2022-2031) (USD MILLION) (MILLION LITRES)

9.1 OVERVIEW

9.2 WHISKEY

9.2.1 WHISKEY, BY TYPE

9.2.1.1. RYE WHISKEY

9.2.1.2. RYE MALT WHISKEY

9.2.1.3. MALT WHISKEY

9.2.1.4. BOURBON WHISKEY

9.2.1.5. IRISH WHISKEY

9.2.1.6. WHEAT WHISKEY

9.2.1.7. CORN WHISEY

9.2.1.8. OTHERS

9.3 RUM

9.3.1 RUM, BY TYPE

9.3.1.1. WHITE RUM

9.3.1.2. DARK RUM

9.4 VODKA

9.5 TEQUILA

9.5.1 TEQUILA, BY TYPE

9.5.1.1. TEQUILA BLANCO

9.5.1.2. TEQUILA JOVEN

9.5.1.3. TEQUILA REPOSADO

9.5.1.4. OTHERS

9.6 GIN

9.7 LIQUEUR

9.8 OTHERS

10 GLOBAL SPIRITS MARKET, BY SOURCE, (2022-2031) (USD MILLION)

10.1 OVERVIEW

10.2 GRAPES

10.3 MOLASSES

10.4 SUGAR

10.5 GRAIN

10.5.1 CORN

10.5.2 RYE

10.5.3 BARLEY

10.5.4 WHEAT

10.5.5 OTHERS

10.6 POTATO

10.7 OTHERS

11 GLOBAL SPIRITS MARKET, BY FLAVOR, (2022-2031) (USD MILLION)

11.1 OVERVIEW

11.2 PLAIN

11.3 HONEY

11.4 MAPLE

11.5 CARAMEL

11.6 CHOCOLATE

11.7 VANILLA

11.8 FRUIT

11.9 SPICES

11.9.1 CINNAMON

11.9.2 GINGER

11.9.3 PEPPER

11.9.4 CLOVE

11.9.5 NUTMEG

11.9.6 OTHERS

11.1 NUTS

11.10.1 ALMOND

11.10.2 WALNUT

11.10.3 HHAZELNUT

11.10.4 MACADAMIA NUTS

11.10.5 OTHERS

12 GLOBAL SPIRITS MARKET, BY AGEING, (2022-2031) (USD MILLION)

12.1 OVERVIEW

12.2 AGED

12.3 UNAGED

13 GLOBAL SPIRITS MARKET, BY AGING BARREL TYPE, (2022-2031) (USD MILLION)

13.1 OVERVIEW

13.2 OAK

13.3 MAPLE

13.4 CEDAR

13.5 HICKORY

13.6 OTHERS

14 GLOBAL SPIRITS MARKET, BY DISTILLATION TYPE , (2022-2031) (USD MILLION)

14.1 OVERVIEW

14.2 DISTILLED

14.2.1 SINGLE

14.2.2 DOUBLE

14.2.3 TRIPLE

14.2.4 OTHERS

14.3 UNDISTILLED

15 GLOBAL SPIRITS MARKET, BY DISTRIBUTION CHANNEL, (2022-2031) (USD MILLION)

15.1 OVERVIEW

15.2 ONLINE

15.2.1 COMPANY WEBSITES

15.2.2 THIRD PARTY WEBSITES/E-COMMERCE

15.3 OFFLINE

15.3.1 OFF-TRADE

15.3.1.1. SUPERMARKETS AND HYPERMARKETS

15.3.1.2. CONVENIENCE STORES

15.3.1.3. AIRPORT DUTY-FREE SHOPS

15.3.1.4. SPECIALTY WINE AND LIQUOR STORES

15.3.1.5. OTHERS

15.3.2 ON-TRADE

15.3.2.1. RESTAURANTS AND BARS

15.3.2.2. CAFES AND BISTROS

15.3.2.3. VENDING MACHINES

15.3.2.4. OTHERS

16 GLOBAL SPIRITS MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT & APPROVALS

16.7 EXPANSIONS & PARTNERSHIP

16.8 REGULATORY CHANGES

17 GLOBAL SPIRITS MARKET, BY GEOGRAPHY, (2022-2031) (USD MILLION) (MILLION LITRES)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

17.2 EUROPE

17.2.1 GERMANY

17.2.2 U.K.

17.2.3 ITALY

17.2.4 FRANCE

17.2.5 SPAIN

17.2.6 SWITZERLAND

17.2.7 NETHERLANDS

17.2.8 BELGIUM

17.2.9 RUSSIA

17.2.10 TURKEY

17.2.11 REST OF EUROPE

17.3 ASIA-PACIFIC

17.3.1 JAPAN

17.3.2 CHINA

17.3.3 SOUTH KOREA

17.3.4 INDIA

17.3.5 AUSTRALIA

17.3.6 SINGAPORE

17.3.7 THAILAND

17.3.8 INDONESIA

17.3.9 MALAYSIA

17.3.10 PHILIPPINES

17.3.11 REST OF ASIA-PACIFIC

17.4 SOUTH AMERICA

17.4.1 BRAZIL

17.4.2 ARGENTINA

17.4.3 REST OF SOUTH AMERICA

17.5 MIDDLE EAST AND AFRICA

17.5.1 SOUTH AFRICA

17.5.2 U.A.E.

17.5.3 SAUDI ARABIA

17.5.4 KUWAIT

17.5.5 REST OF MIDDLE EAST AND AFRICA

18 GLOBAL SPIRITS MARKET, SWOT & DBMR ANALYSIS

19 GLOBAL SPIRITS MARKET, COMPANY PROFILES

19.1 BACARDI LIMITED

19.1.1 COMPANY OVERVIEW

19.1.2 REVENUE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT UPDATES

19.2 CONSTELLATION BRANDS, INC.

19.2.1 COMPANY OVERVIEW

19.2.2 REVENUE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT UPDATES

19.3 NOVABEV GROUP

19.3.1 COMPANY OVERVIEW

19.3.2 REVENUE ANALYSIS

19.3.3 GEOGRAPHICAL PRESENCE

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT UPDATES

19.4 PROXIMO SPIRITS

19.4.1 COMPANY OVERVIEW

19.4.2 REVENUE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT UPDATES

19.5 DIAGEO

19.5.1 COMPANY OVERVIEW

19.5.2 REVENUE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT UPDATES

19.6 BELVEDERE VODKA

19.6.1 COMPANY OVERVIEW

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT UPDATES

19.7 PINNACLE VODKA

19.7.1 COMPANY OVERVIEW

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT UPDATES

19.8 CRYSTAL HEAD

19.8.1 COMPANY OVERVIEW

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT UPDATES

19.9 CHIVAS BROTHERS LIMITED & CHIVAS BROTHERS INTERNATIONAL LIMITED

19.9.1 COMPANY OVERVIEW

19.9.2 REVENUE ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT UPDATES

19.1 WILLIAM GRANT & SONS

19.10.1 COMPANY OVERVIEW

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT UPDATES

19.11 EDRINGTON

19.11.1 COMPANY OVERVIEW

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT UPDATES

19.12 SUNTORY GLOBAL SPIRITS, INC.

19.12.1 COMPANY OVERVIEW

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT UPDATES

19.13 WHYTE & MACKAY

19.13.1 COMPANY OVERVIEW

19.13.2 REVENUE ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT UPDATES

19.14 INTERNATIONAL BEVERAGE HOLDINGS LTD.

19.14.1 COMPANY OVERVIEW

19.14.2 REVENUE ANALYSIS

19.14.3 PRODUCT PORTFOLIO

19.14.4 RECENT UPDATES

19.15 LOCH LOMOND GROUP

19.15.1 COMPANY OVERVIEW

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT UPDATES

19.16 DAVIDE CAMPARI-MILANO N.V.

19.16.1 COMPANY OVERVIEW

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT UPDATES

19.17 IAN MACLEOD DISTILLERS LIMITED

19.17.1 COMPANY OVERVIEW

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT UPDATES

19.18 JAMES EADIE LTD

19.18.1 COMPANY OVERVIEW

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT UPDATES

19.19 BROWN-FORMAN

19.19.1 COMPANY OVERVIEW

19.19.2 REVENUE ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT UPDATES

19.2 JOHN DISTILLERIES

19.20.1 COMPANY OVERVIEW

19.20.2 REVENUE ANALYSIS

19.20.3 PRODUCT PORTFOLIO

19.20.4 RECENT UPDATES

19.21 PERNOD RICARD

19.21.1 COMPANY OVERVIEW

19.21.2 REVENUE ANALYSIS

19.21.3 PRODUCT PORTFOLIO

19.21.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

20 RELATED REPORTS

21 CONCLUSION

22 QUESTIONNAIRE

23 ABOUT DATA BRIDGE MARKET RESEARCH

Global Spirits Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Spirits Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Spirits Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.