Global Lymphedema Drugs Market

Market Size in USD Million

CAGR :

%

USD

108.80 Million

USD

224.54 Million

2025

2033

USD

108.80 Million

USD

224.54 Million

2025

2033

| 2026 –2033 | |

| USD 108.80 Million | |

| USD 224.54 Million | |

|

|

|

|

Lymphedema Drugs Market Size

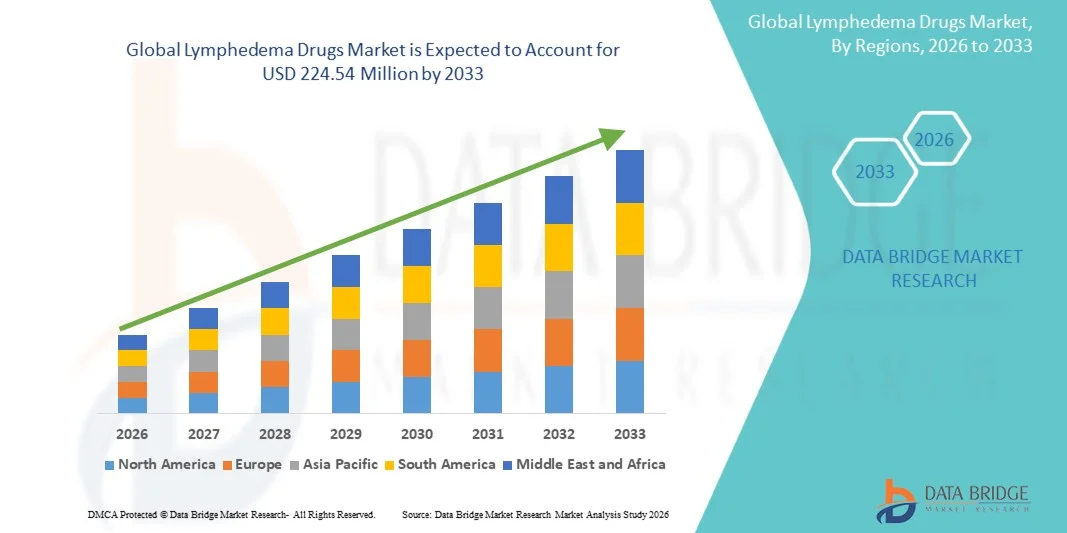

- The global lymphedema drugs market size was valued at USD 108.80 million in 2025 and is expected to reach USD 224.54 mllion by 2033, at a CAGR of 9.48% during the forecast period

- The market growth is largely fueled by the rising prevalence of cancer-related lymphedema, increasing awareness of early intervention, and ongoing advancements in pharmacological therapies aimed at reducing inflammation, fibrosis, and lymphatic dysfunction

- Furthermore, growing patient demand for effective, non-invasive, and integrated treatment options along with supportive reimbursement frameworks and expanding clinical research continues to strengthen the adoption of lymphedema drug therapies, thereby significantly accelerating the industry’s growth

Lymphedema Drugs Market Analysis

- Lymphedema drugs, spanning drug classes such as benzopyrones, venoactive agents, NSAIDs, diuretics, antifibrotic agents, lymphangiogenic agents, immunomodulators, gene & cell therapies, and nutraceuticals, are becoming increasingly vital in improving lymphatic function and reducing chronic swelling across both primary and secondary lymphedema patients

- The growing demand for lymphedema drugs is primarily driven by rising cases of cancer-related lymphedema, increased clinical focus on early-stage management, and expanding adoption of pharmacologic approaches that complement traditional therapies and improve long-term symptom control

- North America dominated the lymphedema drugs market with the largest revenue share of 38.9% in 2025, supported by high diagnosis rates, strong oncology treatment infrastructure, and increased use of prescription pharmacotherapies across hospitals, specialty clinics, ambulatory centers, and home-healthcare settings

- Asia-Pacific is expected to be the fastest-growing region in the lymphedema drugs market during the forecast period due to rising cancer incidence, improving healthcare access, and rapid expansion of hospital and specialty clinic networks

- NSAIDs dominated the lymphedema drugs market with a market share of 41.8% in 2025, driven by their widespread use in reducing inflammation and pain, easy oral and topical administration, and strong physician preference as a first-line pharmacologic option across all major end-user settings

Report Scope and Lymphedema Drugs Market Segmentation

|

Attributes |

Lymphedema Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Lymphedema Drugs Market Trends

“Shift Toward Targeted and Regenerative Lymphatic Therapies”

- A significant and accelerating trend in the global lymphedema drugs market is the advancement of targeted pharmacological therapies and regenerative biologics aimed at improving lymphatic function, reducing inflammation, and addressing underlying tissue fibrosis more effectively than traditional symptomatic treatments

- For instance, investigational lymphangiogenic agents and VEGF-C–based therapeutics are gaining momentum for their potential to stimulate lymphatic vessel growth and offer disease-modifying benefits beyond conventional symptom management

- AI-enabled diagnostic platforms and digital health tools are increasingly being integrated into lymphedema management, enabling early detection of fluid changes, personalized drug-response tracking, and more intelligent treatment optimization for both primary and secondary lymphedema

- For instance, emerging wearable sensors paired with AI algorithms can detect subtle lymphatic dysfunction patterns and guide clinicians in adjusting drug regimens for improved therapeutic outcomes and reduced complications

- The integration of pharmacological therapies with broader multidisciplinary care pathways including physical therapy, compression therapy, and remote monitoring systems is creating more coordinated and holistic treatment strategies for patients

- This trend toward smarter, more targeted, and biologically advanced drug solutions is fundamentally reshaping expectations for lymphedema care, prompting pharmaceutical innovators to invest in next-generation therapies such as gene modulation and immune-focused agents aimed at long-term disease control

Lymphedema Drugs Market Dynamics

Driver

“Rising Prevalence of Cancer-Related Lymphedema and Growing Therapeutic Adoption”

- The increasing burden of cancer-related lymphedema, particularly among breast, gynecological, and melanoma cancer survivors, is a major driver accelerating the demand for pharmacological interventions that support long-term symptom reduction and inflammation management

- For instance, new oncology-care guidelines across major health systems emphasize early intervention with drug-based therapies to control swelling, improve mobility, and reduce infection risks, strengthening the adoption of lymphedema medications across hospital and specialty clinic settings

- As awareness of lymphedema's chronic nature grows, patients and clinicians are showing heightened interest in drug therapies that offer predictable dosing, ease of administration, and measurable clinical benefits

- Furthermore, the expansion of home-based care models and growing availability of oral and topical therapeutic options make pharmacologic treatment more accessible across diverse patient populations

- The trend toward integrated care pathways and digital monitoring tools further supports increased adoption of drug-based lymphedema management in both primary and secondary healthcare environments

- The rapid expansion of cancer survivorship programs and rehabilitation centers is boosting demand for lymphedema medications, as more patients receive structured post-treatment care that includes pharmacological support

- For instance, integrated oncology lymphedema clinics in major health networks are increasingly prescribing NSAIDs, venoactive agents, and antifibrotic drugs as routine components of comprehensive lymphedema management

Restraint/Challenge

“Limited Drug Options and Regulatory Barriers to Novel Therapy Development”

- The scarcity of FDA-approved or highly specialized pharmacological treatments for lymphedema poses a major challenge, as many current options focus on symptom relief rather than addressing the underlying lymphatic dysfunction

- For instance, the reliance on repurposed drugs such as NSAIDs and diuretics highlights the market’s unmet need for targeted therapies with proven lymphangiogenic or antifibrotic efficacy

- Regulatory approval processes for novel lymphatic therapies remain complex, requiring extensive clinical evidence due to the chronic and heterogeneous nature of lymphedema across patient groups

- In addition, the high cost of developing advanced biologics, gene therapies, and regenerative medicines can delay commercialization and limit accessibility for patients in lower-income regions

- Low commercial incentives for developing rare-disease therapies continue to slow innovation in lymphedema-specific drug pipelines, limiting the range of targeted solutions available to clinicians

- For instance, many pharmaceutical companies prioritize broader inflammatory or vascular indications, causing delays in funding and prioritization for dedicated lymphedema drug research and clinical trials

- Overcoming these challenges through clearer regulatory pathways, increased investment in lymphatic disease research, and broader clinical trial participation will be essential for unlocking long-term growth in the lymphedema drugs market

Lymphedema Drugs Market Scope

The market is segmented on the basis of drug class, route of administration, indication, and end user.

- By Drug Class

On the basis of drug class, the global lymphedema drugs market is segmented into benzopyrones, venoactive agents, NSAIDs, diuretics, antifibrotic agents, lymphangiogenic agents, immunomodulators, gene & cell therapies, nutraceuticals, and others. The NSAIDs segment dominated the market in 2025 with the largest revenue share of 41.8% due to its widespread clinical acceptance in reducing inflammation and pain associated with both primary and secondary lymphedema. NSAIDs remain the first-line pharmacological option because they offer rapid symptomatic relief and are widely available across hospital, specialty clinic, and home-care settings. Their diverse oral and topical formulations allow physicians to tailor dosing to patient severity, improving compliance and accessibility. Strong prescription volume in oncology-associated lymphedema, coupled with their low cost, keeps NSAIDs ahead of emerging drug classes. In addition, the segment benefits from extensive clinical evidence supporting its role in early symptom management. These factors collectively ensure NSAIDs remain the most commonly utilized drug class in lymphedema care.

The lymphangiogenic agents segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising R&D investments in therapies aimed at regenerating or repairing lymphatic vessels. These agents represent a major scientific advancement, as they target the underlying cause of lymphedema rather than providing only symptomatic relief. Increasing clinical trials evaluating VEGF-C–based molecules and other lymphatic growth factors are accelerating interest in this category. For instance, regenerative biologics are gaining traction among cancer survivors seeking long-term therapeutic solutions. Their potential to improve fluid drainage and reduce fibrotic tissue is generating strong momentum among researchers and clinicians. As a result, lymphangiogenic agents are set to emerge as a transformative therapy class in the coming decade.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral, topical, parenteral, and local injection. The oral segment held the largest market revenue share in 2025, attributed to the convenience, high patient adherence, and widespread availability of oral formulations such as NSAIDs, venoactive agents, and antifibrotic drugs. Oral medications are preferred in long-term management due to their ease of dosing and suitability for home-based treatment, reducing the need for frequent clinical visits. Physicians across oncology and rehabilitation centers increasingly prescribe oral drugs as part of standard lymphedema care pathways. The ability to deliver systemic therapeutic effects also enhances the segment’s dominance. In addition, strong generic penetration improves affordability and adoption in both developed and emerging markets. Overall, the oral route remains the primary mode of drug administration for lymphedema worldwide.

The topical route is expected to witness the fastest CAGR from 2026 to 2033, driven by growing adoption of creams, gels, and transdermal formulations that directly target swelling, inflammation, and skin complications. Topical drugs are emerging as preferred choices for mild-to-moderate lymphedema patients seeking non-systemic treatment options with fewer side effects. Their ability to be easily applied at home makes them especially valuable in chronic disease management. For instance, new topical anti-inflammatory and antifibrotic formulations are being developed to improve lymphatic flow in affected limbs. Increasing consumer preference for minimally invasive therapies also supports the segment’s rapid growth. As awareness increases, topical medications are expected to gain substantial traction across both primary and secondary lymphedema populations.

- By Indication

On the basis of indication, the market is segmented into primary lymphedema, secondary lymphedema (cancer-related), secondary lymphedema (non-cancer), and lymphedema complications. The cancer-related secondary lymphedema segment dominated the market in 2025, driven by the high prevalence of breast cancer, gynecologic cancers, melanoma, and lymphatic surgeries that disrupt normal lymph flow. With millions of cancer survivors worldwide, the demand for long-term pharmacological management continues to rise rapidly. Hospitals and oncology centers increasingly integrate lymphedema drugs into survivorship care plans to reduce swelling, prevent fibrosis, and minimize infection risk. For instance, cancer therapy advancements have improved survival rates, indirectly increasing the number of patients prone to lymphedema. Robust diagnostic awareness and early detection programs further strengthen this segment’s dominance. Consequently, cancer-related secondary lymphedema remains the most clinically significant and commercially influential category.

The non-cancer secondary lymphedema segment is expected to observe the fastest growth rate during 2026–2033, driven by rising cases linked to infections, obesity, trauma, venous disorders, and surgeries unrelated to oncology. Increasing global obesity rates and aging populations contribute significantly to lymphatic impairment, boosting the need for drug-based interventions. For instance, chronic venous insufficiency–related swelling is becoming a common trigger for lymphedema, especially in geriatric patients. Growing clinical attention to non-oncologic causes is expanding treatment demand in primary care and rehabilitation settings. Improved diagnostic tools are also helping identify non-cancer lymphedema earlier than before. As awareness grows, this segment is projected to accelerate faster than cancer-related cases.

- By End User

On the basis of end user, the market is segmented into hospitals, specialty clinics, ambulatory centers, home healthcare, pharmacies, and online pharmacies. The hospital segment dominated the market in 2025, supported by the high volume of cancer surgery patients, immediate post-operative management, and access to multidisciplinary care teams specializing in lymphatic disorders. Hospitals serve as primary centers for diagnosis, prescription, and initial treatment planning for both primary and secondary lymphedema. For instance, comprehensive cancer centers routinely manage lymphedema through pharmacological therapies combined with physical therapy and compression treatment. Hospitals also benefit from well-established reimbursement structures, ensuring consistent drug utilization. Their access to advanced drug formulations and clinical expertise reinforces their position as the leading end-user category. As such, hospitals remain the central hub for structured and supervised lymphedema pharmacotherapy.

The home healthcare segment is projected to be the fastest-growing from 2026 to 2033, driven by the increasing shift toward home-based chronic disease management and the rising need for convenient long-term lymphedema therapy. Patients prefer home care for its comfort, reduced costs, and independence, especially when using oral or topical medications that do not require clinical supervision. For instance, telehealth programs and remote monitoring tools are enabling clinicians to adjust drug regimens without in-person visits. Growing elderly populations and the rise of self-administration practices further support the segment’s expansion. With better awareness and digital support systems, home healthcare is becoming a major growth engine for lymphedema drug consumption.

Lymphedema Drugs Market Regional Analysis

- North America dominated the lymphedema drugs market with the largest revenue share of 38.9% in 2025, supported by high diagnosis rates, strong oncology treatment infrastructure, and increased use of prescription pharmacotherapies across hospitals, specialty clinics, ambulatory centers, and home-healthcare settings

- The region benefits from the widespread availability of FDA-approved anti-inflammatory, antifibrotic, and regenerative therapies, alongside active clinical trials led by major pharmaceutical companies

- Patients and clinicians in North America increasingly favor pharmacological interventions that complement compression therapy, enhancing long-term symptom control and reducing complications

U.S. Lymphedema Drugs Market Insight

The U.S. lymphedema drugs market captured the largest revenue share in 2025 within North America, fueled by the high incidence of cancer-related lymphedema and strong access to advanced diagnostic and therapeutic options. Clinicians and patients are increasingly prioritizing pharmacological management that complements physical therapies, aiming to reduce inflammation, fibrosis, and symptom progression. The growing preference for early medical intervention, combined with active clinical trial participation and strong reimbursement coverage, further propels the adoption of lymphedema drug therapies. Moreover, increasing investment in biologics, antifibrotic agents, and lymphangiogenic research is significantly contributing to the market's expansion.

Europe Lymphedema Drugs Market Insight

The Europe lymphedema drugs market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by structured national cancer care programs and rising awareness of chronic lymphatic disorders. The region’s aging population, coupled with the increasing number of breast and gynecological cancer survivors, is fostering the demand for effective pharmacological solutions. European patients are also drawn to evidence-based therapies that reduce swelling and prevent complications. The region is experiencing strong uptake across hospitals, specialty clinics, and home-care settings, with lymphedema drugs being increasingly integrated into standardized treatment pathways.

U.K. Lymphedema Drugs Market Insight

The U.K. lymphedema drugs market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding national lymphedema services, improved referral pathways, and a strong emphasis on early intervention. In addition, rising awareness among cancer survivors about chronic lymphatic dysfunction is encouraging the adoption of pharmacological therapies. The U.K.’s supportive healthcare policies, along with its broad access to specialist clinics and community care programs, are expected to continue stimulating market growth.

Germany Lymphedema Drugs Market Insight

The Germany lymphedema drugs market is expected to expand at a considerable CAGR during the forecast period, fueled by high healthcare spending, access to advanced treatment technologies, and strong demand for evidence-backed therapeutic options. Germany’s emphasis on clinical research and innovation promotes the adoption of biologics, antifibrotic agents, and lymphangiogenic therapies in both hospital and outpatient settings. The integration of lymphedema management within comprehensive oncology care pathways is also becoming increasingly prevalent, aligning with the country's focus on long-term patient outcomes and quality of life.

Asia-Pacific Lymphedema Drugs Market Insight

The Asia-Pacific lymphedema drugs market is poised to grow at the fastest CAGR during the forecast period, driven by rising cancer incidence, increasing healthcare access, and growing awareness of chronic lymphatic conditions across China, Japan, and India. The region’s expanding investments in oncology and rehabilitation services are driving the adoption of drug-based lymphedema management. Furthermore, as APAC strengthens its pharmaceutical manufacturing capabilities, the affordability and accessibility of lymphedema therapies are expanding to a wider patient base.

Japan Lymphedema Drugs Market Insight

The Japan lymphedema drugs market is gaining momentum due to the country’s advanced healthcare system, aging population, and emphasis on early cancer detection. The Japanese market places a significant focus on long-term postoperative outcomes, and the adoption of lymphedema drugs is driven by growing demand for therapies that reduce fibrosis and improve lymphatic function. The integration of pharmacological options with established compression and rehabilitation protocols is fueling growth. Moreover, Japan's leadership in regenerative medicine is such asly to spur demand for innovative, targeted lymphedema therapies.

India Lymphedema Drugs Market Insight

The India lymphedema drugs market accounted for one of the largest shares in the Asia-Pacific region in 2025, attributed to rising cancer cases, increased healthcare spending, and expanding awareness of lymphedema as a treatable condition. India stands as one of the fastest-growing markets for rehabilitation and chronic disease therapies, and lymphedema drugs are becoming increasingly relevant across hospitals, specialty clinics, and home-care settings. The push toward early cancer management, combined with domestic production of affordable pharmacological options, is a key factor propelling the market in India.

Lymphedema Drugs Market Share

The Lymphedema Drugs industry is primarily led by well-established companies, including:

- PureTech Health (U.S.)

- HERANTIS PHARMA Plc (Finland)

- Laurantis Pharma Oy (Finland)

- Ropirio Therapeutics (U.S.)

- Tactile Medical (U.S.)

- BioCompression Systems (U.S.)

- SIGVARIS GROUP (Switzerland)

- medi GmbH & Co. KG (Germany)

- Paul Hartmann AG (Germany)

- 3M (U.S.)

- L&R Group (Germany)

- Mego Afek AC Ltd. (Israel)

- Koya Medical (U.S.)

- ImpediMed Limited (Australia)

- Sofusa (U.S.)

- AnGes Inc. (Japan)

- BIAcare Medical LLC (U.S.)

- Compression Dynamics LLC (U.S.)

- Riancorp Pty Ltd (Australia)

What are the Recent Developments in Global Lymphedema Drugs Market?

- In March 2025, a multicenter study reported that adenoviral VEGF-C (Lymfactin®) combined with vascularized lymph node transfer (VLNT) improved clinical outcomes in patients with secondary lymphedema. The study showed meaningful improvements in limb swelling, lymphatic regeneration, and patient quality of life, providing strong real-world support for combining biological therapy with microsurgical techniques

- In December 2024, the TheraLymph program in Europe reported major progress toward launching a Phase I/II clinical trial for an innovative VEGF-C gene therapy designed to regenerate lymphatic vessels in cancer-related lymphedema. This investigational approach uses next-generation, non-integrative lentiviral vectors to deliver therapeutic VEGF-C directly to affected tissues, aiming to restore lymphatic drainage rather than simply manage symptoms

- In September 2024, Ropirio Therapeutics secured an exclusive license from Harvard and Boston University for novel molecules that specifically activate the lymphatic system. These small-molecule “lymphatic system activators” are designed to open junctions between lymphatic endothelial cells and restore drainage, even under inflammatory conditions potentially offering a first-in-class oral therapy for lymphedema

- In January 2024, researchers published preclinical data on APLN-VEGF-C mRNA delivery showing robust lymphatic regeneration in secondary lymphedema models. They demonstrated that apelin (APLN) drives VEGF-C processing and lymphatic endothelial cell proliferation, boosting lymphatic drainage and pumping function in animal models, which could pave the way for a novel mRNA-based therapy for lymphedema

- In November 2021, PureTech Health announced the publication of its Phase 1 clinical results for LYT-100 (deupirfenidone), an anti-fibrotic small molecule being evaluated for lymphedema. The study demonstrated a favorable safety, tolerability, and pharmacokinetic profile, supporting its potential for treating chronic fibrotic conditions, including breast-cancer–related lymphedema

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.