Global Lysine Market

Market Size in USD Billion

CAGR :

%

USD

8.41 Billion

USD

13.97 Billion

2024

2032

USD

8.41 Billion

USD

13.97 Billion

2024

2032

| 2025 –2032 | |

| USD 8.41 Billion | |

| USD 13.97 Billion | |

|

|

|

|

Lysine Market Size

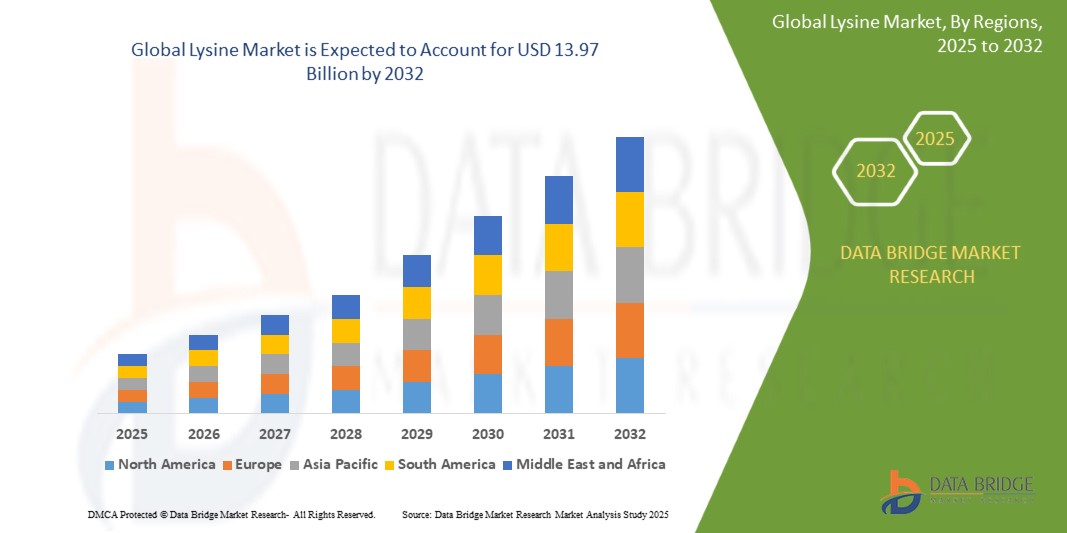

- The global lysine market was valued at USD 8.41 billion in 2024 and is expected to reach USD 13.97 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.55%, primarily driven by expansion of the pharmaceutical industry

- This growth is driven by factors such as nutraceutical growth, drug formulations and biopharma manufacturing

Lysine Market Analysis

- Lysine refers to an essential amino acid widely used in animal feed, pharmaceuticals, and dietary supplements. It plays a vital role in protein synthesis, calcium absorption, and tissue repair. Industrially produced via microbial fermentation, lysine is primarily added to livestock feed to promote growth and improve meat quality, but it also finds use in human nutrition and pharmaceutical formulations

- The market is experiencing steady growth due to rising meat consumption, increasing demand for animal nutrition, and expanding pharmaceutical applications. As urbanization and income levels rise, particularly in Asia-Pacific and Latin America, the need for high-quality protein sources such as pork and poultry is increasing, which in turn boosts the demand for lysine-enriched feed. Its use in supplements and antiviral treatments is also contributing to market growth.

- The lysine market is evolving with a focus on improved production technologies, sustainability, and expanding health-related applications. Manufacturers are adopting advanced fermentation processes to enhance efficiency and reduce costs. There is also growing interest in plant-based and bio-based lysine sources, in line with the broader trend toward environmentally friendly and precision-based animal nutrition

- For instance, companies such as Ajinomoto and CJ CheilJedang are scaling up bio-fermentation facilities and developing specialized lysine formulations tailored to different livestock requirements and regional market needs

- The lysine market is expected to maintain upward momentum, supported by continued demand across the animal feed, pharmaceutical, and functional food sectors. Technological advancements, increasing awareness of animal health, and the global shift toward high-protein diets will likely sustain market growth in the coming years

Report Scope and Lysine Market Segmentation

|

Attributes |

Lysine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Lysine Market Trends

“Increasing Adoption of Precision Nutrition in Animal Feed”

- One prominent trend in the global lysine market is the increasing adoption of precision nutrition in animal feed

- This trend is driven by the growing need for efficient livestock production, rising feed costs, and the demand for sustainable farming practices. Precision nutrition focuses on providing animals with diets specifically formulated to meet their exact nutritional needs, improving feed conversion and reducing waste

- For instance, feed producers are increasingly formulating lysine-enriched diets tailored to species, age, and growth stage, helping optimize animal performance while minimizing nitrogen emissions and environmental impact

- The rising emphasis on animal health, resource efficiency, and environmentally conscious farming is expected to accelerate the integration of precision nutrition across poultry, swine, and aquaculture sectors

- As the animal feed industry becomes more technology-driven, manufacturers are investing in data-driven solutions, advanced amino acid profiling, and species-specific feed formulations. The adoption of precision nutrition, supported by innovations in lysine production and application, will continue to shape feed strategies and expand lysine’s role in modern livestock farming

Lysine Market Dynamics

Driver

“Growing Focus on the Animal Health”

- The growing focus on animal health is a key driver of growth in the lysine market. As livestock producers and feed manufacturers place increasing importance on maintaining animal well-being and preventing disease, lysine has become essential in supporting optimal growth, immunity, and overall productivity

- This shift is particularly evident in regions with advanced livestock industries, where producers aim to reduce antibiotic use and enhance nutrient efficiency through balanced, amino acid-rich diets. Lysine plays a critical role in muscle development, immune response, and recovery, making it a vital component of modern feed strategies.

- With increasing consumer demand for high-quality, ethically raised animal products, the adoption of lysine in feed formulations has accelerated. Livestock producers are seeking nutritional solutions that promote healthier animals, better weight gain, and improved feed conversion ratios.

- Attributes such as bioavailability, species-specific formulations, and lysine’s contribution to gut health and disease resistance are transforming how feed is developed and administered. This growing emphasis on animal health is not only improving production outcomes but also supporting broader goals around food safety and sustainability.

- Companies are responding by offering advanced lysine solutions tailored to swine, poultry, and aquaculture, often integrated into comprehensive animal health programs

For instance,

- Evonik Industries has introduced enhanced amino acid blends, including lysine, to promote gut health in poultry and reduce the need for antibiotic growth promoters

- ADM Animal Nutrition integrates lysine into its AMPT mineral program to promote muscle health and reduce illness in beef cattle, aligning with health-first management systems

- As global awareness of responsible animal farming and food safety rises, lysine’s role as a health-promoting additive is expanding. The market is poised for continued growth as producers seek solutions that enhance productivity while supporting animal welfare, regulatory compliance, and consumer trust

Opportunity

“Rising Meat Consumption in Developing Economies”

- Rising meat consumption in developing economies presents a significant opportunity for growth in the lysine market. As dietary habits shift due to urbanization and higher income levels, the demand for protein-rich foods such as poultry and pork is increasing across emerging markets.

- Livestock producers in regions including Asia Pacific, Latin America, and Africa are expanding their operations to meet growing consumer demand, which is driving the need for efficient and cost-effective feed solutions. Lysine, as a key amino acid, plays an essential role in promoting muscle growth and improving feed efficiency, making it a valuable addition to modern animal nutrition programs.

- The ability of lysine to enhance animal growth rates, support lean meat development, and reduce the use of excess crude protein makes it an attractive solution for producers looking to maximize output while managing costs and resources

For instance,

- In China, the pork industry is increasingly incorporating lysine into swine feed to improve meat yield and quality as consumer expectations evolve

- In Nigeria and Vietnam, expanding poultry and aquaculture industries are turning to lysine to meet the nutritional demands of growing populations

- As meat demand continues to climb in these developing economies, investments in livestock production, feed technology, and nutritional strategies will further strengthen lysine's role in sustainable and scalable animal agriculture. This ongoing shift presents a long-term growth opportunity for lysine manufacturers focused on emerging markets

Restraint/Challenge

“Increasing Number of Restrictions and Regulatory Bans”

- Increasing restrictions and regulatory bans present a significant challenge for the lysine market. As governments and international bodies tighten controls on animal feed additives and emissions from livestock production, lysine manufacturers are facing greater scrutiny and compliance requirements.

- The lysine segment, closely linked to the animal feed industry, is affected by evolving policies related to environmental protection, food safety, and antimicrobial resistance. Regulations targeting nitrogen emissions, synthetic feed ingredients, and factory farming practices are forcing producers to adapt manufacturing methods and reformulate products to meet new standards.

- These changing policies vary widely by region and can lead to increased production costs, delays in approvals, and uncertainty in market access. Inconsistent regulatory frameworks also create barriers for international trade, limiting the ability of lysine producers to expand into new markets or maintain stable exports

For instance,

- In the European Union, stricter environmental regulations are prompting feed producers to reduce protein levels in animal diets, which affects lysine usage and necessitates precise reformulation strategies

- As regulatory environments continue to evolve globally, the lysine market remains challenged by compliance complexity, unpredictable policy shifts, and higher operational demands. These constraints may slow market expansion and require significant investment in research, reformulation, and regional adaptation strategies by producers

Lysine Market Scope

The market is segmented on the basis of live stock and application.

|

Segmentation |

Sub-Segmentation |

|

By Live Stock |

|

|

By Application |

|

Lysine Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Lysine Market”

- Asia-Pacific dominates the lysine market, driven by its extensive livestock population, high meat consumption rates, and the widespread adoption of amino acid-based feed formulations across major economies

- China holds a significant share due to its large-scale pork and poultry industries and domestic production of feed-grade lysine. The country’s push toward modernizing livestock farming and improving feed efficiency has fueled consistent demand for lysine in commercial feed applications

- In addition, Southeast Asian nations such as Vietnam, Indonesia, and Thailand are rapidly increasing investments in livestock infrastructure and feed technology, creating favorable conditions for lysine market growth.

- With increasing focus on food security, expansion of aquaculture and poultry sectors, and the presence of several key lysine manufacturers in the region, Asia-Pacific is expected to maintain its leading position in the global lysine market throughout the forecast period 2025 to 2032

“North America is Projected to Register the Highest Growth Rate”

- The North America region is expected to witness the highest growth rate in the lysine market, driven by rising demand for high-quality animal protein, advanced feed formulations, and increasing awareness of precision livestock nutrition

- The U.S. holds a significant share due to its large-scale meat production, established feed industry, and adoption of sustainable and science-based feeding practices. Livestock producers are increasingly incorporating lysine to improve feed efficiency, reduce crude protein content, and comply with regulatory guidelines related to emissions and animal health

- Canada is also contributing to regional growth through investments in agricultural innovation, expansion of the swine and poultry industries, and rising focus on environmentally responsible farming. Feed manufacturers in both countries are leveraging lysine as a cost-effective solution to meet productivity and performance goals

- With growing emphasis on animal welfare, regulatory compliance, and high consumer demand for responsibly sourced meat, North America is poised to become the fastest-growing region in the global lysine market over the forecast period

Lysine Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cargill, Incorporated (U.S.)

- Dow (U.S.)

- BASF (Germany)

- dsm-firmenich (Switzerland)

- DuPont (U.S.)

- Evonik Industries AG (Germany)

- Novus International, Inc. (U.S.)

- Alltech (U.S.)

- Associated British Foods plc (U.K.)

- Charoen Pokphand Foods Public Company Limited (Thailand)

- Nutreco (Netherlands)

- ForFarmers Group (EN) (Netherlands)

- De Heus Animal Nutrition (Netherlands)

- SunOpta (Canada)

- Scratch & Peck (U.S.)

Latest Developments in Global Lysine Market

- In April 2025, Eurolysine announced the launch of a feasibility study to explore expanding its production capacity. This strategic move is expected to positively impact the lysine market by reinforcing the EU’s self-sufficiency in essential amino acids for animal nutrition and supporting the region’s shift toward sustainable, locally sourced feed ingredients

- In May 2023, Evonik introduced an updated version of its Biolys product for animal feeds, featuring a higher concentration of L-lysine. As the lysine source with the lowest carbon footprint currently available in the feed additives market, the new Biolys strengthens Evonik’s position in the sustainability-driven segment of the lysine industry. This launch is expected to enhance the product's appeal among environmentally conscious producers, support the growing demand for efficient and eco-friendly feed solutions, and contribute to Evonik’s competitive edge in both mature and emerging markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL LYSINE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 ARRIVING AT THE GLOBAL LYSINE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.4.1. MARKET VENDORS

2.2.4.2. PROSPECT LEADERS

2.2.4.3. MARKET DISRUPTORS

2.2.4.4. NICHE PLAYERS

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL LYSINE MARKET : RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 PORTER FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTE PRODUCTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.5 TECHNOLOGY INNOVATIONS

5.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.7 FACTOR INFLUENCING PURCHASING DECISION OF END USERS

6 REGULATORY FRAMEWORK AND GUIDELINES

7 POST COVID-19 IMPACT ANALYSIS

8 GLOBAL LYSINE MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 L-LYSINE

8.3 D-LYSINE

9 GLOBAL LYSINE MARKET, BY SOURCE

9.1 OVERVIEW

9.2 MICROBE-BASED

9.2.1 MICROBE-BASED, BY TYPE

9.2.1.1. BACTERIA

9.2.1.2. YEAST

9.2.1.3. OTHERS (IF ANY)

9.3 PLANT-BASED

9.3.1 PLANT-BASED, BY TYPE

9.3.1.1. BEET SUGAR

9.3.1.2. CANE SUGAR

9.3.1.3. STRACH SUGAR

9.4 OTHERS (IF ANY)

10 GLOBAL LYSINE MARKET, BY FORM

10.1 OVERVIEW

10.2 LIQUID

10.3 DRY

10.3.1 DRY, BY TYPE

10.3.1.1. POWDER

10.3.1.2. GRANUALE

10.3.1.3. CRYSTAL

10.3.1.4. CRYSTALLINE POWDER

11 GLOBAL LYSINE MARKET, BY GRADE

11.1 OVERVIEW

11.2 FEED GRADE

11.3 PHARMACEUTICAL GRADE

11.4 OTHERS

12 GLOBAL LYSINE MARKET, BY COLOR

12.1 OVERVIEW

12.2 WHITE

12.3 BROWN

12.4 YELLOW

12.5 COLORLESS

13 GLOBAL LYSINE MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 FOOD AND BEVERAGES

13.2.1 FOOD AND BEVERAGES, BY TYPE

13.2.1.1. BAKERY

13.2.1.1.1. BAKERY, BY TYPE

13.2.1.1.1.1 BREAD & ROLLS

13.2.1.1.1.2 CAKES, PASTRIES & TRUFFLE

13.2.1.1.1.3 BISCUIT

13.2.1.1.1.4 TART & PIES

13.2.1.1.1.5 BROWNIES

13.2.1.1.1.6 COOKIES & CRACKERS

13.2.1.1.1.7 TORTILLA

13.2.1.1.1.8 OTHERS

13.2.1.2. DAIRY PRODUCTS

13.2.1.2.1. DAIRY PRODUCTS, BY TYPE

13.2.1.2.1.1 YOGURT

13.2.1.2.1.2 ICE CREAM

13.2.1.2.1.3 CHEESE

13.2.1.2.1.4 OTHERS

13.2.1.3. PROCESSED FOOD

13.2.1.3.1. PROCESSED FOOD, BY TYPE

13.2.1.3.1.1 READY MEALS

13.2.1.3.1.2 SAUCES, DRESSINGS AND CONDIMENTS

13.2.1.3.1.3 SOUPS

13.2.1.3.1.4 JAMS, PRESERVES & MARMALADES

13.2.1.3.1.5 OTHERS

13.2.1.4. MEAT PRODUCTS

13.2.1.4.1. MEAT PRODUCTS, BY TYPE

13.2.1.4.1.1 PORK PRODUCTS

13.2.1.4.1.2 POULTRY PRODUCTS

13.2.1.4.1.3 BEEF PRODUCTS

13.2.1.4.1.4 SWINE PRODUCTS

13.2.1.4.1.5 OTHERS

13.2.1.5. CONFECTIONERY

13.2.1.5.1. CONFECTIONERY, BY TYPE

13.2.1.5.1.1 HARD-BOILED SWEETS

13.2.1.5.1.2 MINTS

13.2.1.5.1.3 GUMS & JELLIES

13.2.1.5.1.4 CHOCOLATE

13.2.1.5.1.5 CHOCOLATE SYRUPS

13.2.1.5.1.6 CARAMELS & TOFFEES

13.2.1.5.1.7 OTHERS

13.2.1.6. FROZEN DESSERTS

13.2.1.6.1. FROZEN DESSERTS, BY TYPE

13.2.1.6.1.1 GELATO

13.2.1.6.1.2 CUSTARD

13.2.1.6.1.3 SORBET

13.2.1.6.1.4 OTHERS

13.2.1.7. FUCNTIONAL FOOD

13.2.1.8. MEAT ALTERNATIVES

13.2.1.9. SEAFOOD PRODUCTS

13.2.1.10. CONVENIENCE FOOD

13.2.1.10.1. CONVENIENCE FOOD, BY TYPE

13.2.1.10.1.1 INSTANT NOODLES

13.2.1.10.1.2 PIZZA & PASTA

13.2.1.10.1.3 SANCKS& EXTRUDED SNACKS

13.2.1.10.1.4 OTHERS

13.2.1.11. BEVERAGES

13.2.1.11.1. BEVERAGES, BY TYPE

13.2.1.11.1.1 SMOOTHIES

13.2.1.11.1.2 SPORTS DRINKS

13.2.1.11.1.3 PLANT-BASED DRINKS

13.2.1.11.1.4 FORTIFIED BEVERAGES

13.2.1.11.1.5 OTHERS

13.2.1.11.2. FOOD AND BEVERAGES, BY LYSINE PRODUCT TYPE

13.2.1.11.2.1 L-LYSINE

13.2.1.11.2.2 D-LYSINE

13.3 DIETERY AND NUTRIONAL SUPPLEMENTS

13.3.1 DIETERY AND NUTRITIONAL SUPPLEMMENTS, BY TYPE

13.3.1.1. IMMUNITY SUPPLEMENTS

13.3.1.2. BONE AND JOINT HEALTH SUPPLEMENTS

13.3.1.3. OVERALL WELLBEING SUPPLEMENTS

13.3.1.4. BRAIN HEALTH SUPPLLEMNTS

13.3.1.5. SKIN HEALTH SUPPLEMENTS

13.3.1.6. OTEHRS

13.3.2 DIETERY AND NUTRITIONAL SUPPLEMMENTS, BY LYSINE PRODUCT TYPE

13.3.2.1. L-LYSINE

13.3.2.2. D-LYSINE

13.4 COSMETICS AND PERSONAL CARE

13.4.1 COSMETICS

13.4.2 COSMETICS, BY TYPE

13.4.2.1. FACE CREAM

13.4.2.2. FACE SERUM

13.4.2.3. LIP STICKS & LIP CARE PRODUCTS

13.4.2.4. OTHERS

13.4.3 PERSONAL CARE

13.4.4 PERSONAL CARE, BY TYPE

13.4.5 SKIN CARE

13.4.6 HAIR CARE

13.4.7 COSMETICS AND PERSONAL CARE, BY LYSINE PRODUCT TYPE

13.4.7.1. L-LYSINE

13.4.7.2. D-LYSINE

13.5 PHARMACEUTICAL

13.5.1 PHARMACEUTICAL, BY LYSINE PRODUCT TYPE

13.5.1.1. L-LYSINE

13.5.1.2. D-LYSINE

13.6 ANIMAL FEED

13.6.1 ANIMAL FEED, BY TYPE

13.6.1.1. POULTRY

13.6.1.2. SWINE

13.6.1.3. RUMINANT

13.6.1.4. EQUINE

13.6.1.5. AQUACULTURE

13.6.1.6. PET

13.6.1.7. OTHERS

13.6.1.8. ANIMAL FEED, BY LYSINE PRODUCT TYPE

13.6.1.8.1. L-LYSINE

13.6.1.8.2. D-LYSINE

13.7 OTHER (IF ANY)

14 GLOBAL LYSINE MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 DIRECT

14.3 INDIRECT

15 GLOBAL LYSINE MARKET , BY GEOGRAPHY

15.1 GLOBAL LYSINE MARKET , (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.2 NORTH AMERICA

15.2.1 U.S.

15.2.2 CANADA

15.2.3 MEXICO

15.3 EUROPE

15.3.1 GERMANY

15.3.2 U.K.

15.3.3 ITALY

15.3.4 FRANCE

15.3.5 SPAIN

15.3.6 SWITZERLAND

15.3.7 NETHERLANDS

15.3.8 BELGIUM

15.3.9 RUSSIA

15.3.10 DENMARK

15.3.11 SWEDEN

15.3.12 POLAND

15.3.13 TURKEY

15.3.14 REST OF EUROPE

15.4 ASIA-PACIFIC

15.4.1 JAPAN

15.4.2 CHINA

15.4.3 SOUTH KOREA

15.4.4 INDIA

15.4.5 AUSTRALIA

15.4.6 SINGAPORE

15.4.7 THAILAND

15.4.8 INDONESIA

15.4.9 MALAYSIA

15.4.10 PHILIPPINES

15.4.11 NEW ZEALAND

15.4.12 VIETNAM

15.4.13 REST OF ASIA-PACIFIC

15.5 SOUTH AMERICA

15.5.1 BRAZIL

15.5.2 ARGENTINA

15.5.3 REST OF SOUTH AMERICA

15.6 MIDDLE EAST AND AFRICA

15.6.1 SOUTH AFRICA

15.6.2 UAE

15.6.3 SAUDI ARABIA

15.6.4 OMAN

15.6.5 QATAR

15.6.6 KUWAIT

15.6.7 REST OF MIDDLE EAST AND AFRICA

16 GLOBAL LYSINE MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT & APPROVALS

16.7 EXPANSIONS & PARTNERSHIP

16.8 REGULATORY CHANGES

17 GLOBAL LYSINE MARKET , SWOT AND DBMR ANALYSIS

18 GLOBAL LYSINE MARKET , INGREDIENTS COMPANY PROFILE

18.1 ARCHER DANIEL MIDLAND (ADM)

18.1.1 COMPANY OVERVIEW

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 GEOGRAPHIC PRESENCE

18.1.5 RECENT DEVELOPMENTS

18.2 EVONIK INDUSTRIES

18.2.1 COMPANY OVERVIEW

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 GEOGRAPHIC PRESENCE

18.2.5 RECENT DEVELOPMENTS

18.3 SHANDONG SHAOUGUANG JUNENG GOLDEN CORN CO.

18.3.1 COMPANY OVERVIEW

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 GEOGRAPHIC PRESENCE

18.3.5 RECENT DEVELOPMENTS

18.4 C J CHEILJEDANG CORP

18.4.1 COMPANY OVERVIEW

18.4.2 PRODUCT PORTFOLIO

18.4.3 GEOGRAPHIC PRESENCE

18.4.4 RECENT DEVELOPMENTS

18.5 CHANGCHUN DACHENG

18.5.1 COMPANY OVERVIEW

18.5.2 PRODUCT PORTFOLIO

18.5.3 GEOGRAPHIC PRESENCE

18.5.4 RECENT DEVELOPMENTS

18.6 EPPEN

18.6.1 COMPANY OVERVIEW

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 GEOGRAPHIC PRESENCE

18.6.5 RECENT DEVELOPMENTS

18.7 MEIHUA GROUP

18.7.1 COMPANY OVERVIEW

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 GEOGRAPHIC PRESENCE

18.7.5 RECENT DEVELOPMENTS

18.8 COFCO BIOCHEMICAL

18.8.1 COMPANY OVERVIEW

18.8.2 PRODUCT PORTFOLIO

18.8.3 GEOGRAPHIC PRESENCE

18.8.4 RECENT DEVELOPMENTS

18.9 GLOBAL BIO-CHEM TECH

18.9.1 COMPANY OVERVIEW

18.9.2 PRODUCT PORTFOLIO

18.9.3 GEOGRAPHIC PRESENCE

18.9.4 RECENT DEVELOPMENTS

18.1 KYOWA HAKKO BIO CO., LTD.

18.10.1 COMPANY OVERVIEW

18.10.2 PRODUCT PORTFOLIO

18.10.3 GEOGRAPHIC PRESENCE

18.10.4 RECENT DEVELOPMENTS

18.11 SHANDONG SHOUGUANG JUNENG GOLDEN CORN CO.,LTD

18.11.1 COMPANY OVERVIEW

18.11.2 PRODUCT PORTFOLIO

18.11.3 GEOGRAPHIC PRESENCE

18.11.4 RECENT DEVELOPMENTS

18.12 BANGYE INC.

18.12.1 COMPANY OVERVIEW

18.12.2 PRODUCT PORTFOLIO

18.12.3 GEOGRAPHIC PRESENCE

18.12.4 RECENT DEVELOPMENTS

18.13 AJINOMOTO LTD.

18.13.1 COMPANY OVERVIEW

18.13.2 PRODUCT PORTFOLIO

18.13.3 GEOGRAPHIC PRESENCE

18.13.4 RECENT DEVELOPMENTS

18.14 CHANGCHUN DACHENG GROUP

18.14.1 COMPANY OVERVIEW

18.14.2 PRODUCT PORTFOLIO

18.14.3 GEOGRAPHIC PRESENCE

18.14.4 RECENT DEVELOPMENTS

18.15 NAUGRA EXPORT

18.15.1 COMPANY OVERVIEW

18.15.2 PRODUCT PORTFOLIO

18.15.3 GEOGRAPHIC PRESENCE

18.15.4 RECENT DEVELOPMENTS

18.16 FOODCHEM

18.16.1 COMPANY OVERVIEW

18.16.2 PRODUCT PORTFOLIO

18.16.3 GEOGRAPHIC PRESENCE

18.16.4 RECENT DEVELOPMENTS

18.17 FENGCHEN GROUP CO.,LTD

18.17.1 COMPANY OVERVIEW

18.17.2 PRODUCT PORTFOLIO

18.17.3 GEOGRAPHIC PRESENCE

18.17.4 RECENT DEVELOPMENTS

18.18 NANJING JIAYI SUNWAY CHEMICAL CO., LTD

18.18.1 COMPANY OVERVIEW

18.18.2 PRODUCT PORTFOLIO

18.18.3 GEOGRAPHIC PRESENCE

18.18.4 RECENT DEVELOPMENTS

18.19 MERCK KGAA

18.19.1 COMPANY OVERVIEW

18.19.2 PRODUCT PORTFOLIO

18.19.3 GEOGRAPHIC PRESENCE

18.19.4 RECENT DEVELOPMENTS

18.2 HEBEI BOYU BIOTECHNOLOGY CO.,LTD

18.20.1 COMPANY OVERVIEW

18.20.2 PRODUCT PORTFOLIO

18.20.3 GEOGRAPHIC PRESENCE

18.20.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19 CONCLUSION

20 QUESTIONNAIRE

21 RELATED REPORTS

Global Lysine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Lysine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Lysine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.