Global Maltitol In Chocolate Market

Market Size in USD Billion

CAGR :

%

USD

178.26 Billion

USD

288.44 Billion

2024

2032

USD

178.26 Billion

USD

288.44 Billion

2024

2032

| 2025 –2032 | |

| USD 178.26 Billion | |

| USD 288.44 Billion | |

|

|

|

|

Maltitol in Chocolate Market Size

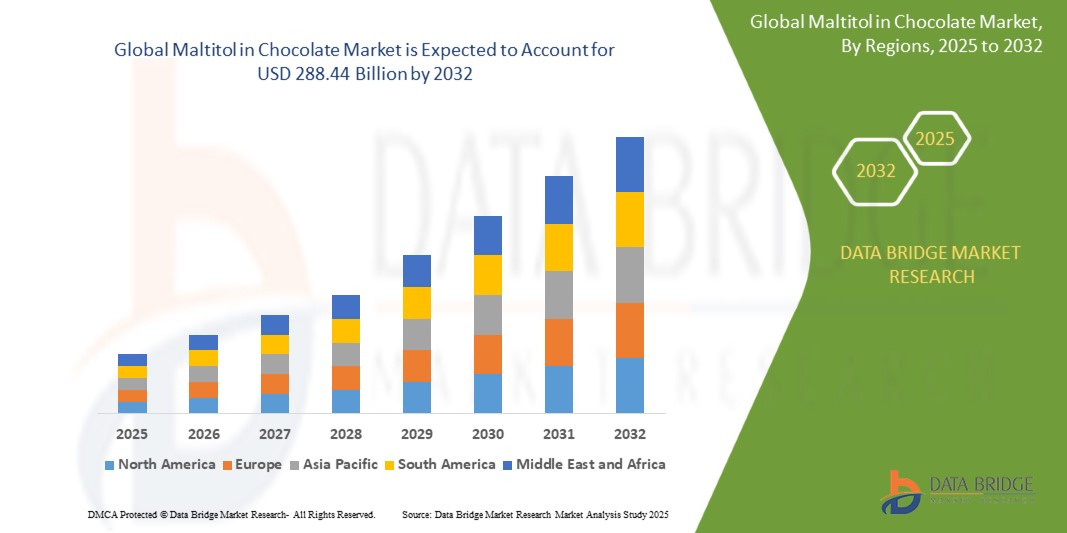

- The global maltitol in chocolate market size was valued at USD 178.26 billion in 2024 and is expected to reach USD 288.44 billion by 2032, at a CAGR of 6.20% during the forecast period

- The market growth is largely fuelled by the rising demand for low-calorie and sugar-free confectionery products, increasing health consciousness among consumers, and the growing prevalence of lifestyle-related diseases such as diabetes and obesity

- In addition, the expanding use of maltitol by chocolate manufacturers to maintain sweetness and texture while reducing caloric content is further supporting market expansion

Maltitol in Chocolate Market Analysis

- Consumers are increasingly shifting toward healthier alternatives, and maltitol offers a sugar-like taste with fewer calories, making it a preferred sugar substitute in chocolates

- The growing diabetic population and rising awareness of low-glycemic sweeteners are driving the demand for maltitol-based chocolate formulations

- Europe dominated the maltitol in chocolate market with the largest revenue share of 37.45% in 2024, driven by increasing demand for sugar-free and low-calorie chocolate products, along with a growing diabetic population across the region

- Asia-Pacific region is expected to witness the highest growth rate in the global maltitol in chocolate market, driven by expanding consumer base, growing preference for Western-style confectionery with health benefits, and the increasing adoption of low-glycemic sweeteners in countries such as India, China, and Japan

- The crystal powder segment dominated the market with the largest revenue share of 57.3% in 2024, driven by its ease of handling, longer shelf life, and compatibility with traditional chocolate manufacturing processes. Crystal maltitol allows for consistent sweetness and texture while maintaining the desired mouthfeel in solid chocolate applications. Its ability to mimic the properties of sucrose while offering fewer calories makes it a preferred choice among large-scale confectionery producers

Report Scope and Maltitol in Chocolate Market Segmentation

|

Attributes |

Maltitol in Chocolate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Maltitol in Chocolate Market Trends

“Increasing Preference For Clean Label And Natural Sweeteners”

- Consumers are increasingly opting for chocolate products with transparent ingredient labels, prioritizing natural over artificial sweeteners

- Maltitol, being derived from starch, is gaining popularity as a clean label alternative that allows for sugar-free claims without sacrificing taste

- Brands are positioning maltitol-based chocolates as keto-friendly, diabetic-safe, and non-GMO, aligning with modern consumer expectations

- The premium chocolate segment is seeing notable growth in maltitol usage, especially among wellness-focused and specialty brands

- For instance, U.S.-based brand Lily’s is expanding its sugar-free chocolate offerings using maltitol to appeal to health-conscious and clean-label-seeking consumers

Maltitol in Chocolate Market Dynamics

Driver

“Rising Health Awareness And Demand For Low-Glycemic Chocolate Products”

- Increasing prevalence of diabetes, obesity, and lifestyle disorders is fueling demand for reduced-sugar chocolates using alternatives such as maltitol

- Maltitol’s low glycemic index and minimal impact on blood glucose make it ideal for diabetic-friendly and weight management products

- Consumers are seeking indulgent treats that provide sweetness without the negative effects of refined sugar, boosting maltitol adoption

- Manufacturers are leveraging maltitol to create formulations that are both functional and appealing, meeting health standards and taste expectations

- For instance, In Japan, confectionery companies are launching maltitol-based chocolates targeted at aging consumers concerned with blood sugar control and heart health

Restraint/Challenge

“Digestive Discomfort Associated With Excessive Consumption Of Sugar Alcohols”

- Overconsumption of maltitol can lead to gastrointestinal discomfort, including bloating and laxative effects, especially in sensitive individuals

- Consumer awareness of these side effects may deter some from purchasing products with higher maltitol content

- Regulatory labeling requirements highlighting potential digestive issues can negatively impact product appeal and trust

- Balancing sweetness and tolerance levels without compromising on taste or cost remains a challenge for manufacturers

- For instance, In the European Union, chocolate products containing more than 10% maltitol must carry a warning label about possible laxative effects, which can discourage health-focused buyers despite product benefits

Maltitol in Chocolate Market Scope

The market is segmented on the basis of form, chocolate category, and application.

• By Form

On the basis of form, the maltitol in chocolate market is segmented into crystal powder and syrups. The crystal powder segment dominated the market with the largest revenue share of 57.3% in 2024, driven by its ease of handling, longer shelf life, and compatibility with traditional chocolate manufacturing processes. Crystal maltitol allows for consistent sweetness and texture while maintaining the desired mouthfeel in solid chocolate applications. Its ability to mimic the properties of sucrose while offering fewer calories makes it a preferred choice among large-scale confectionery producers.

The syrups segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its growing use in soft-centered chocolates, fillings, and inclusions. Syrup-based maltitol offers excellent solubility and moisture retention, which helps maintain smooth consistency in layered and coated chocolate products. The rising demand for functional and filled chocolate variants is contributing to the increased adoption of syrup form.

• By Chocolate Category

On the basis of chocolate category, the market is segmented into white chocolate, milk chocolate, and dark chocolate. The milk chocolate segment held the largest market revenue share in 2024, supported by its widespread consumer preference and balanced flavor profile. Maltitol is frequently used in milk chocolates to retain sweetness and creaminess while significantly reducing sugar content. Its thermal stability and ability to replicate sugar's physical properties make it well-suited for mass-market applications.

The dark chocolate segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising consumer interest in high-cocoa, low-sugar options. As dark chocolate continues to be positioned as a healthier indulgence, manufacturers are reformulating products with maltitol to meet demand for reduced-glycemic and diabetic-friendly alternatives without compromising flavor intensity.

• By Application

On the basis of application, the maltitol in chocolate market is segmented into bakery, retail chocolates, and chocolate inclusions. The retail chocolates segment dominated the market in 2024, accounting for the highest revenue share, owing to the increasing popularity of sugar-free and low-calorie chocolate bars and snacks. Consumers are seeking healthier indulgences, and brands are using maltitol to develop chocolates that maintain taste and texture while catering to dietary needs.

The chocolate inclusions segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand in cereal bars, dairy products, and baked goods. Manufacturers are incorporating maltitol-based chocolate chips and pieces into various functional foods to enhance flavor while reducing sugar content. This trend is especially prominent in protein-rich and low-carb product formulations aimed at fitness-conscious and diabetic consumers.

Maltitol in Chocolate Market Regional Analysis

- Europe dominated the maltitol in chocolate market with the largest revenue share of 37.45% in 2024, driven by increasing demand for sugar-free and low-calorie chocolate products, along with a growing diabetic population across the region

- Consumers in Europe are showing heightened awareness of clean label ingredients and actively seeking healthier chocolate alternatives that do not compromise taste

- This trend is further supported by stringent regulatory standards on sugar content, a rising number of health-conscious consumers, and strong innovation in functional confectionery, making maltitol-based chocolate products highly favored across retail and specialty segments

Germany Maltitol in Chocolate Market Insight

The Germany maltitol in chocolate market captured the largest revenue share of 31% in 2024 within Europe, driven by the growing popularity of reduced-sugar confectionery products among health-aware consumers. The presence of leading chocolate manufacturers, coupled with the country’s push for sugar reduction in food formulations, supports the increasing adoption of maltitol. Moreover, the rise in vegan and diabetic-friendly chocolate lines incorporating maltitol has further accelerated its use across mainstream and niche segments.

U.K. Maltitol in Chocolate Market Insight

The U.K. maltitol in chocolate market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing health consciousness and rising demand for sugar-reduced confectionery. Consumers in the U.K. are actively seeking chocolates that align with low-calorie, diabetic-friendly, and clean-label preferences. The government’s ongoing initiatives to reduce sugar consumption, such as the Sugar Reduction Programme, have encouraged manufacturers to reformulate products using alternatives such as maltitol. The growing popularity of functional snacks and premium wellness-oriented chocolate brands further supports the market’s expansion across retail and specialty stores.

North America Maltitol in Chocolate Market Insight

The North America maltitol in chocolate market is expected to witness the fastest growth rate from 2025 to 2032, supported by rising consumer preference for sugar-free and keto-friendly chocolate products. Manufacturers in the U.S. and Canada are increasingly reformulating their product lines using sugar alcohols such as maltitol to align with evolving dietary trends. The expanding demand for functional snacks and better-for-you treats across retail channels continues to strengthen the market outlook across the region.

U.S. Maltitol in Chocolate Market Insight

The U.S. maltitol in chocolate market accounted for the largest revenue share in North America in 2024, fueled by growing health consciousness, the rise of diabetic-friendly product offerings, and expanding interest in low-carb and keto diets. Food and confectionery brands are increasingly introducing chocolate products made with maltitol to appeal to calorie-conscious consumers seeking indulgence without added sugars. Moreover, the presence of leading clean-label chocolate manufacturers further propels market growth in the country.

Asia-Pacific Maltitol in Chocolate Market Insight

The Asia-Pacific maltitol in chocolate market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and growing demand for low-sugar food products in countries such as China, Japan, and India. As awareness of diabetes and obesity spreads across the region, consumers are showing strong interest in reduced-glycemic and sugar-replacement products. In addition, the rising influence of Western diets and the development of premium chocolate segments are contributing to increased adoption of maltitol-based formulations.

Japan Maltitol in Chocolate Market Insight

The Japan maltitol in chocolate market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s focus on health-oriented innovation, aging population, and growing interest in functional foods. Maltitol is increasingly being used in diabetic-friendly chocolate products, especially those targeting senior consumers who seek healthier indulgences with low glycemic impact. The integration of maltitol into mainstream and specialty chocolate offerings reflects Japan’s broader commitment to reduced-sugar, wellness-focused snacking.

China Maltitol in Chocolate Market Insight

The China maltitol in chocolate market held the largest revenue share in Asia-Pacific in 2024, driven by the country’s growing middle-class population, expanding interest in wellness products, and demand for sugar-free confectionery. The rise in urban retail chains and e-commerce platforms promoting low-sugar chocolate products has increased accessibility and consumer reach. In addition, local chocolate manufacturers are leveraging maltitol as a key ingredient in new product development aimed at health-conscious younger consumers and diabetic-friendly segments.

Maltitol in Chocolate Market Share

The Maltitol in Chocolate industry is primarily led by well-established companies, including:

- Zhejiang Huakang Pharmaceutical Co. Ltd. (China)

- Roquette Frères (France)

- Ingredion (U.S.)

- Mitsubishi Corporation Life Sciences Limited (Japan)

- ADM (U.S.)

- Brenntag (Germany)

- Merck KGaA (Germany)

- Shandong Futaste Co. (China)

- Cargill, Incorporated (U.S.)

- B Food Science Co., Ltd. (China)

- Hangzhou Verychem Science And Technology Co. Ltd. (China)

- Haihang Industry (China)

- Sosa (Spain)

- Foodchem International Corporation (China)

- PT. Ecogreen Oleochemicals (Indonesia)

- Mitushi Biopharma (India)

- MUBY CHEMICALS (India)

- Hylen Co., Ltd. (South Korea)

- Nutra Food Ingredients (U.S.)

Latest Developments in Global Maltitol in Chocolate Market

- In July 2023, Tate & Lyle PLC announced the expansion of its sweetener portfolio, aiming to address consumers’ solubility challenges in food and beverage products. This strategic move seeks to enhance product functionality, ensuring improved taste and texture for manufacturers. By developing innovative solutions, Tate & Lyle aims to meet evolving consumer preferences, ultimately fostering greater satisfaction and loyalty within a competitive market landscape

- In 2023, Ingredion Incorporated revealed plans to invest USD 150 million in expanding its maltitol production facility located in Germany. This significant investment is aimed at enhancing production capabilities to meet increasing demand for maltitol, a popular sugar substitute. By bolstering its manufacturing operations, Ingredion strives to support the growing global trend toward healthier and lower-calorie food and beverage options, thereby positioning itself as a leader in the market

- In January 2023, Cargill reported a robust sales growth of 8% year-over-year, fueled by heightened demand for its food and beverage ingredients. To capitalize on this momentum, the company announced plans to invest USD 100 million in its innovation center in India. This investment aims to develop customized solutions tailored for the local market, enabling Cargill to strengthen its competitive edge and cater effectively to regional consumer needs

- In February 2023, DuPont experienced a 5% increase in sales within its food and beverage sector compared to the prior year. The company’s strategic expansion into emerging markets contributed to a monthly revenue average of USD 1.25 billion in 2023. This growth reflects DuPont’s commitment to investing in new technologies and forming strategic partnerships, allowing it to capture new opportunities and respond to shifting consumer demands on a global scale

- In August 2022, Luker Chocolate, a privately owned Colombian chocolate manufacturer, introduced a new variety of couvertures featuring erythritol and stevia in response to growing customer demand. This innovative product line also includes a maltitol-sweetened variant and allulose for specialized markets. By diversifying its offerings, Luker Chocolate aims to cater to health-conscious consumers seeking delicious alternatives, further solidifying its presence in the competitive chocolate industry

- In 2022, MCLS ASIA CO., LTD. launched Lesys, a crystalline maltitol product designed as a natural sugar substitute. Made from non-GM tapioca, a renewable resource, Lesys boasts a versatile total sugar taste while being lower in calories compared to traditional sugar. This innovative product caters to health-conscious consumers and manufacturers seeking alternatives that do not compromise on taste, positioning MCLS ASIA as a significant player in the natural sweetener market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Maltitol In Chocolate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Maltitol In Chocolate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Maltitol In Chocolate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.