Global Marine And Protective Coatings Resins Market

Market Size in USD Billion

CAGR :

%

USD

5.37 Billion

USD

8.84 Billion

2024

2032

USD

5.37 Billion

USD

8.84 Billion

2024

2032

| 2025 –2032 | |

| USD 5.37 Billion | |

| USD 8.84 Billion | |

|

|

|

|

Marine and Protective Coatings Resins Market Size

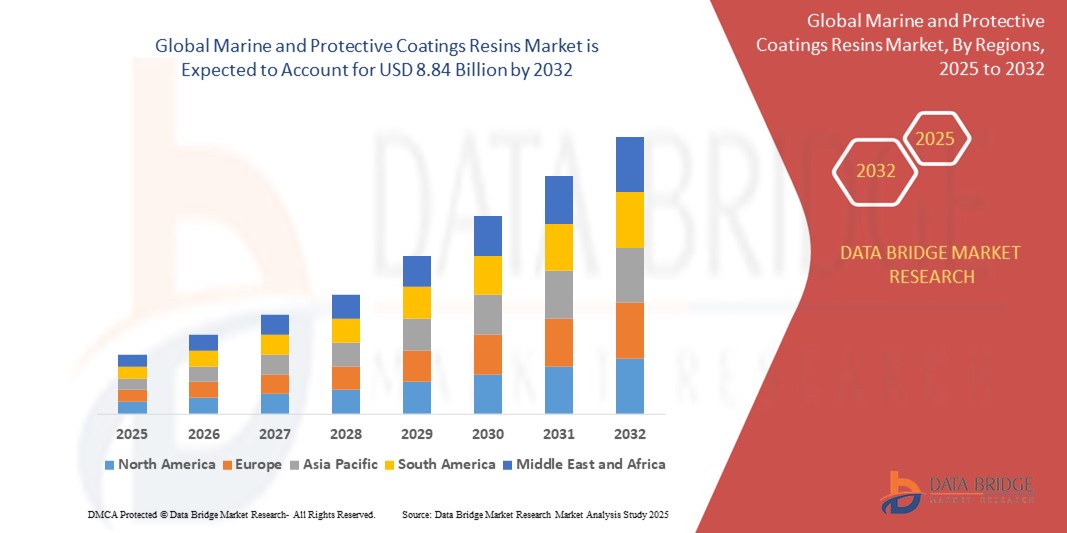

- The global marine and protective coatings resins market size was valued at USD 5.37 billion in 2024 and is expected to reach USD 8.84 billion by 2032, at a CAGR of 6.45% during the forecast period

- The market growth is primarily driven by increasing demand for durable and high-performance coatings in marine and industrial applications, spurred by advancements in resin technology and growing infrastructure development

- Rising environmental regulations and the shift toward eco-friendly, low-VOC (volatile organic compound) coatings are further accelerating the adoption of advanced resin solutions, boosting industry growth

Marine and Protective Coatings Resins Market Analysis

- Marine and protective coatings resins are critical components in formulating coatings that provide corrosion resistance, durability, and aesthetic appeal for surfaces exposed to harsh environmental conditions, such as marine vessels, offshore platforms, and industrial infrastructure

- The growing demand for these coatings is fueled by rising global trade, expansion of the shipping industry, and increasing investments in oil and gas exploration, alongside the need for sustainable and high-performance coating solutions

- North America dominated the marine and protective coatings resins market with the largest revenue share of 38.5% in 2024, driven by a robust marine industry, advanced manufacturing capabilities, and significant investments in infrastructure and oil & gas sectors. The U.S. leads the region due to innovations in eco-friendly coatings and a strong presence of key industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid industrialization, urbanization, and increasing maritime activities in countries such as China, Japan, and South Korea

- The epoxy segment is expected to hold the largest market revenue share of 35.6% in 2024, primarily driven by its superior adhesion, chemical resistance, and durability, making it ideal for harsh marine and industrial environments

Report Scope and Marine and Protective Coatings Resins Market Segmentation

|

Attributes |

Marine and Protective Coatings Resins Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Marine and Protective Coatings Resins Market Trends

“Increasing Adoption of Eco-Friendly and High-Performance Resins”

- The global marine and protective coatings resins market is experiencing a notable trend toward the adoption of eco-friendly and high-performance resin formulations

- Advanced resin technologies, such as water-based and low-VOC (volatile organic compound) epoxy and polyurethane coatings, are gaining traction due to stricter environmental regulations and sustainability demands

- These resins offer enhanced durability, corrosion resistance, and UV protection, making them ideal for harsh marine and industrial environments

- For instance, companies are developing bio-based resins and smart coatings with self-healing properties to extend the lifespan of coated surfaces and reduce maintenance costs

- This trend is increasing the appeal of marine and protective coatings for applications in marine vessels, offshore platforms, and industrial infrastructure

- Data analytics and AI are being integrated into coating development processes to optimize formulations, predict performance, and tailor solutions for specific environmental conditions

Marine and Protective Coatings Resins Market Dynamics

Driver

“Growing Demand for Durable and Sustainable Coatings in Marine and Industrial Applications”

- Rising demand for durable, high-performance coatings in marine, oil & gas, and industrial sectors is a key driver for the marine and protective coatings resins market

- These coatings protect critical infrastructure, such as ships, pipelines, and offshore rigs, from corrosion, abrasion, and extreme weather conditions, extending asset lifespans

- Stringent environmental regulations, particularly in North America and Europe, are pushing the adoption of sustainable, low-VOC, and bio-based resin coatings

- The expansion of global shipping and offshore renewable energy projects, such as wind farms, is increasing the need for advanced marine coatings to withstand harsh oceanic environments

- Advancements in resin technologies, such as nanotechnology and hybrid coatings, are enabling manufacturers to offer customized solutions that meet specific end-user requirements

Restraint/Challenge

“High Development Costs and Regulatory Compliance Challenges”

- The high cost of developing and producing advanced resin formulations, such as eco-friendly and high-performance coatings, can be a significant barrier, particularly for small and medium-sized enterprises in emerging markets

- Formulating and testing new coatings to meet stringent performance and environmental standards requires substantial R&D investment and specialized expertise

- In addition, compliance with diverse and evolving environmental regulations across regions, such as REACH in Europe and EPA standards in the U.S., poses challenges for manufacturers

- Concerns over the safe disposal and environmental impact of coating residues and byproducts further complicate market operation

- These factors can limit market growth, especially in cost-sensitive regions or industries with limited budgets for adopting advanced coating solutions

Marine and Protective Coatings Resins market Scope

The market is segmented on the basis of resin type and end-user.

- By Resin Type

On the basis of resin type, the global marine and protective coatings resins market is segmented into epoxy, polyurethane, acrylic, alkyd, polyester, and others. The epoxy segment is expected to hold the largest market revenue share of 35.6% in 2024, primarily driven by its superior adhesion, chemical resistance, and durability, making it ideal for harsh marine and industrial environments. Its versatility allows for a wide range of applications, from anti-corrosion coatings to floor coatings.

The Polyurethane segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its excellent abrasion resistance, flexibility, and UV stability. These properties make it highly desirable for protective coatings exposed to weathering and high wear, such as on ship decks and industrial machinery.

- By End-User

On the basis of end-user, the global marine and protective coatings resins market is segmented into industrial, oil & gas, marine, automotive, construction, mining, and others. The Marine segment is expected to hold the largest market revenue share in 2024, driven by the constant need for protection against corrosion, fouling, and harsh weather conditions for ships, offshore structures, and other marine vessels. Regulatory demands for environmentally friendly coatings also contribute to market growth.

The Oil & Gas segment is anticipated to experience robust growth from 2025 to 2032. This growth is fueled by the critical need for high-performance protective coatings to safeguard infrastructure such as pipelines, rigs, and storage tanks from extreme corrosive environments, high temperatures, and chemical exposure, ensuring operational longevity and safety.

Marine and Protective Coatings Resins Market Regional Analysis

- North America dominated the marine and protective coatings resins market with the largest revenue share of 38.5% in 2024, driven by a robust marine industry, advanced manufacturing capabilities, and significant investments in infrastructure and oil & gas sectors

- Consumers prioritize resins for enhancing equipment longevity, protecting against harsh environmental conditions, and improving safety in marine and industrial applications

- Growth is supported by advancements in resin technologies, such as low-VOC and water-based formulations, alongside rising adoption in both OEM and aftermarket segments

U.S. Marine and Protective Coatings Resins Market Insight

The U.S. marine and protective coatings resins market captured the largest revenue share of 63.6% in 2024 within North America, fueled by strong demand from the marine, oil & gas, and industrial sectors. Increasing awareness of corrosion protection and environmental compliance drives market expansion. The trend toward sustainable coatings, including bio-based epoxy and polyurethane resins, complements both OEM and aftermarket applications, creating a diverse product ecosystem.

Europe Marine and Protective Coatings Resins Market Insight

The Europe marine and protective coatings resins market is expected to witness significant growth, supported by stringent regulatory emphasis on environmental sustainability and safety. Consumers seek resins that offer corrosion resistance, thermal stability, and compliance with low-VOC regulations. Growth is prominent in marine and construction applications, with countries such as Germany and the U.K. showing strong uptake due to expanding shipbuilding and infrastructure projects.

U.K. Marine and Protective Coatings Resins Market Insight

The U.K. market for marine and protective coatings resins is projected to experience rapid growth, driven by demand for high-performance coatings in marine and industrial settings. Increased focus on environmental regulations and the need for durable, anti-corrosive coatings encourage adoption. Evolving safety standards and consumer preference for eco-friendly formulations, such as water-based acrylic and epoxy resins, balance performance with compliance.

Germany Marine and Protective Coatings Resins Market Insight

Germany is expected to witness significant growth in the marine and protective coatings resins market, attributed to its advanced industrial and automotive manufacturing sectors and high consumer focus on durability and sustainability. German consumers prefer technologically advanced resins, such as polyurethane and epoxy, that enhance corrosion resistance and contribute to energy efficiency. Integration of these resins in premium marine and industrial applications supports sustained market growth.

Asia-Pacific Marine and Protective Coatings Resins Market Insight

The Asia-Pacific region is projected to experience the fastest growth rate, driven by expanding marine and industrial sectors in countries such as China, India, and Japan. Rising awareness of corrosion protection, UV resistance, and environmental sustainability boosts demand for advanced resins. Government initiatives promoting eco-friendly coatings and infrastructure development further encourage the adoption of epoxy, polyurethane, and acrylic resins.

Japan Marine and Protective Coatings Resins Market Insight

Japan’s marine and protective coatings resins market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced resins that enhance durability and safety in marine and industrial applications. The presence of major shipbuilding and automotive manufacturers accelerates market penetration of epoxy and polyurethane resins. Rising interest in aftermarket applications and sustainable coatings also contributes to growth.

China Marine and Protective Coatings Resins Market Insight

China holds the largest share of the Asia-Pacific marine and protective coatings resins market, propelled by rapid industrialization, expanding maritime activities, and increasing demand for corrosion-resistant solutions. The country’s growing industrial base and focus on sustainable coatings support the adoption of advanced resins such as acrylic and bio-based epoxy. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Marine and Protective Coatings Resins Market Share

The marine and protective coatings resins industry is primarily led by well-established companies, including:

- Diamond Vogel (U.S.)

- Jotun (Norway)

- RPM International, Inc. (U.S.)

- DSM (Netherlands)

- Solvay (Belgium)

- Sono-Tek Corporation (U.S.)

- Hempel A/S (Denmark)

- Wacker Chemie AG (Germany)

- Akzonobel N.V. (Netherlands)

- The Sherwin-Williams (U.S.)

- PPG Industries, Inc. (U.S.)

- Valspar (U.S.)

- Sika AG (Switzerland)

- Ashland (U.S.)

- Clariant International Ltd. (Switzerland)

What are the Recent Developments in Global Marine and Protective Coatings Resins Market?

- In April 2025, Awlgrip, a premium yacht coatings brand under AkzoNobel, is set to launch its low VOC two-in-one Gloss Finish Primer, designed to streamline superyacht coating applications. This innovative primer combines a yacht primer and a show coat, reducing application steps while maintaining high-performance durability. Its high-gloss surface allows applicators to identify and correct imperfections before the final topcoat, minimizing rework and material waste. The formulation also cuts VOC emissions by up to 50% per square meter, supporting eco-friendly coating solutions

- In May 2024, IGL Coatings unveiled the second wave of its Marine Solutions series, expanding its range of sustainable, eco-friendly detailing products for the marine sector. This launch builds on the success of the July 2023 debut, introducing eight new products designed to enhance marine maintenance and protection. The lineup includes protective coatings for wood, glass, fabrics, and leather, along with water spot removers, deodorizers, glass cleaners, and biodegradable boat shampoo. IGL Coatings continues to lead in green technology, offering high-performance solutions for boating enthusiasts

- In November 2023, Induron Protective Coatings introduced Novasafe, a furfuryl-modified, thick-film, ceramic-filled novolac epoxy designed to withstand extreme conditions in treatment plants. This innovative coating provides superior corrosion and erosion resistance, ensuring long-lasting protection for concrete and carbon steel surfaces. Novasafe’s advanced formulation allows for efficient application, reducing the need for multiple coats while maintaining high durability. Engineered for wastewater environments, it resists strong acids, alkalis, and hydrogen sulfide exposure. Induron’s expertise in ceramic epoxy technology ensures optimal performance

- In March 2023, PPG launched SIGMAGLIDE 2390, a biocide-free marine coating designed to reduce power consumption and carbon emissions while maintaining high-performance efficiency. Utilizing PPG HYDRORESET™ technology, this coating creates a super-smooth, friction-free surface, preventing marine organism adhesion and minimizing drag. Ships coated with SIGMAGLIDE 2390 can achieve up to 20% power savings, less than 1% speed loss, and up to 35% CO₂ reduction compared to traditional antifouling coatings. The formulation supports electrostatic application, ensuring high transfer efficiency and extended durability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Marine And Protective Coatings Resins Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Marine And Protective Coatings Resins Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Marine And Protective Coatings Resins Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.