Global Marine Shackle Market

Market Size in USD Billion

CAGR :

%

USD

3.53 Billion

USD

4.66 Billion

2025

2033

USD

3.53 Billion

USD

4.66 Billion

2025

2033

| 2026 –2033 | |

| USD 3.53 Billion | |

| USD 4.66 Billion | |

|

|

|

|

What is the Global Marine Shackle Market Size and Growth Rate?

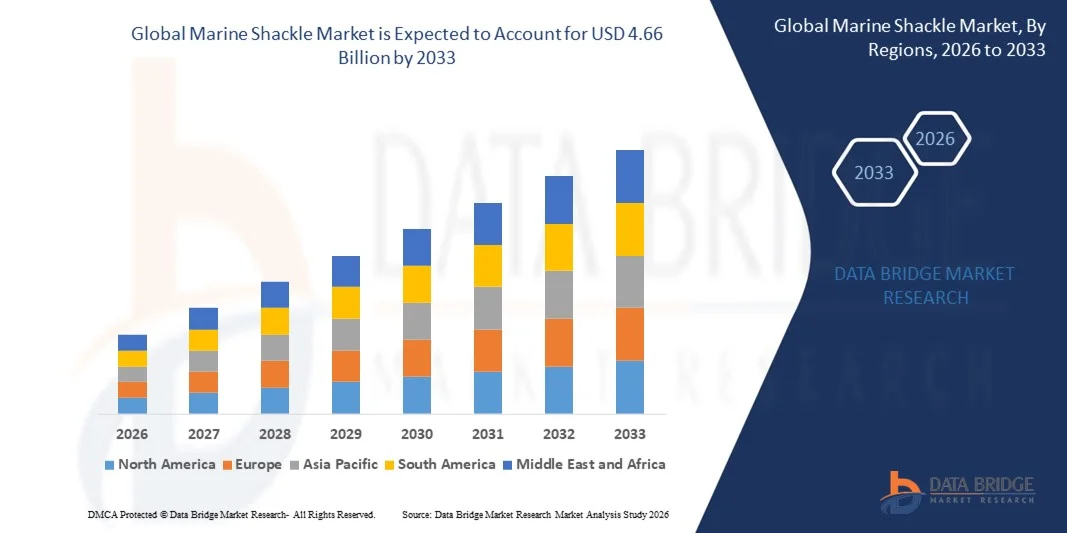

- The global marine shackle market size was valued at USD 3.53 billion in 2025 and is expected to reach USD 4.66 billion by 2033, at a CAGR of 3.50% during the forecast period

- Increasing seaborne trade which raises the growth of the economy, growing number of tourism activities such as marine and coastal tourism, rising growth of the boating and cruise shipping industry across the globe, availability of heavy duty shackles which is used to suit different weight conditions along with rising number of applications in securing multiple ropes and chains from different angles are some of the major as well as important factors which will likely to accelerate the growth of the marine shackle market

What are the Major Takeaways of Marine Shackle Market?

- increasing levels of disposable income of the people along with rising engagement in marine recreational activities in developing economies and stable economic growth across the globe which will further contribute by generating immense opportunities that will led to the growth of the marine shackle market in the above mentioned projected timeframe

- Increasing adoption of stringent government regulations along with safety concerns related to the attachment of shackles on jet boats marine shackle in the above mentioned projected timeframe. Enforcement of environment related regulations for cruising which will become the biggest and foremost challenge for the growth of the market

- Asia-Pacific dominated the marine shackle market with the largest revenue share of 39.1% in 2025, driven by rapid expansion in shipbuilding, offshore operations, and marine trade activities in countries such as China, Japan, South Korea, and India

- North America is projected to witness the fastest growth rate of 9.8% during 2026–2033, fueled by expanding offshore exploration, naval operations, and the adoption of advanced marine safety equipment

- The Bow Shackle segment dominated the market with the largest revenue share of 37.4% in 2025, owing to its widespread use in lifting, towing, and anchoring operations across marine, offshore, and industrial sectors

Report Scope and Marine Shackle Market Segmentation

|

Attributes |

Marine Shackle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Marine Shackle Market?

Increasing Adoption of High-Strength and Corrosion-Resistant Shackles in Marine and Offshore Applications

- The Marine Shackle market is experiencing a significant shift toward the use of high-strength alloys and corrosion-resistant materials, driven by increasing offshore exploration, naval operations, and maritime transport activities. Manufacturers are innovating with stainless steel, galvanized steel, and synthetic-coated shackles to enhance durability and reduce maintenance costs

- For instance, Gunnebo Industries AB and Crosby Group have introduced advanced marine shackles with improved load-bearing capacity and corrosion protection, catering to offshore, shipping, and lifting applications

- The demand for lightweight yet high-tensile shackles is growing across offshore oil & gas and renewable energy sectors, where operational efficiency and safety are key

- Advancements in digital inspection technologies and smart shackles integrated with sensors for real-time load monitoring are transforming equipment safety and asset management in marine operations

- Sustainability initiatives promoting eco-friendly coatings, recyclable materials, and long-service-life components are gaining momentum across global markets

- As industries focus on safety, sustainability, and innovation, the adoption of advanced marine shackles for heavy-duty, offshore, and naval applications is expected to remain a defining trend shaping market evolution

What are the Key Drivers of Marine Shackle Market?

- Growing maritime trade volumes, expansion of offshore oil & gas projects, and increasing demand from the shipping and defense sectors are key drivers boosting marine shackle adoption globally

- For instance, in 2025, James Fisher and Sons plc expanded its marine equipment portfolio, introducing heavy-load shackles for deep-sea lifting and subsea anchoring applications

- Rising emphasis on safety compliance and load certification standards in marine operations is driving the need for precision-engineered and tested shackles

- Technological advancements such as forged manufacturing, non-destructive testing (NDT), and smart load monitoring are enhancing product performance and reliability

- The rapid growth of offshore wind energy installations and coastal infrastructure development in Europe and Asia-Pacific further stimulates market demand

- As marine logistics, defense procurement, and renewable energy operations expand, the Marine Shackle market is set to experience sustained growth supported by innovation and regulatory compliance

Which Factor is Challenging the Growth of the Marine Shackle Market?

- Fluctuations in raw material prices, especially for stainless steel and galvanized iron, along with high production and testing costs, remain major challenges for manufacturers

- For instance, during 2024–2025, supply chain disruptions and tariff fluctuations in the steel and alloy markets affected pricing stability and delayed global shipments of marine shackles

- Intense competition among global and regional players has led to pricing pressures and increased focus on cost optimization without compromising safety standards

- Stringent certification requirements from organizations such as DNV GL and ABS add complexity to the production and approval process

- Corrosion and fatigue issues in harsh marine environments continue to pose design and maintenance challenges for manufacturers

- To counter these obstacles, companies are emphasizing material innovation, quality control, and sustainable manufacturing practices to ensure product longevity, compliance, and customer trust

How is the Marine Shackle Market Segmented?

The market is segmented on the basis of type, vessel, material, and sales channel.

- By Type

On the basis of type, the marine shackle market is segmented into Bow Shackle, D-Shackle, Headboard Shackle, Pin Shackle, Snap Shackle, Threaded Shackle, and Twist Shackle. The Bow Shackle segment dominated the market with the largest revenue share of 37.4% in 2025, owing to its widespread use in lifting, towing, and anchoring operations across marine, offshore, and industrial sectors. Its wide bow design allows multi-dimensional load distribution, ensuring enhanced strength, flexibility, and durability.

The Snap Shackle segment is expected to register the fastest CAGR from 2026 to 2033, supported by growing demand in sailing, recreational boating, and naval applications due to its quick-release mechanism and corrosion-resistant build. Rising emphasis on efficiency, safety, and ease of operation in modern vessels continues to drive the adoption of high-quality snap shackles globally.

- By Vessel

On the basis of vessel, the marine shackle market is segmented into Personal Watercraft and Sailboats, Passenger Vessels, Fishing Vessels, Naval and Coast Guard Vessels, Service Vessels, and Cargo Vessels. The Cargo Vessels segment dominated the market with a revenue share of 41.2% in 2025, attributed to the high demand for heavy-duty shackles used in cargo securing, towing, and load-lifting operations. Increasing global seaborne trade and expansion of containerized transport networks are further driving segment growth.

The Naval and Coast Guard Vessels segment is projected to record the fastest CAGR from 2026 to 2033, fueled by defense modernization programs, enhanced maritime safety standards, and rising investments in advanced shackles with superior load-bearing capacity and anti-corrosion properties for naval operations.

- By Material

On the basis of material, the marine shackle market is segmented into Stainless Steel Shackle, Galvanized Shackle, Carbon Steel Shackle, and Alloy Steel Shackle. The Stainless Steel Shackle segment dominated the market with the largest share of 44.8% in 2025, driven by its superior corrosion resistance, tensile strength, and long service life in harsh marine environments. It is widely used in both commercial and recreational marine applications, making it a preferred choice across shipbuilding and offshore industries.

The Alloy Steel Shackle segment is anticipated to grow at the fastest CAGR during 2026–2033, owing to increasing adoption in heavy-duty industrial, oil & gas, and naval applications where high load capacity and fatigue resistance are critical. Technological advances in alloy composition and coating treatments are enhancing shackle performance in extreme conditions.

- By Sales Channel

On the basis of sales channel, the marine shackle market is segmented into Original Equipment Manufacturers (OEMs) and Aftermarket. The Aftermarket segment dominated the market with a revenue share of 56.5% in 2025, driven by the continuous need for replacement parts, maintenance, and upgrades in marine vessels. The growing global fleet size, along with the periodic inspection and certification requirements of marine hardware, further supports segment growth.

The OEM segment is expected to exhibit the fastest CAGR from 2026 to 2033, propelled by rising shipbuilding activities, customized shackle integration during vessel construction, and long-term supply contracts with defense and commercial shipyards. Manufacturers are focusing on durable, pre-certified components to meet global maritime safety and performance standards.

Which Region Holds the Largest Share of the Marine Shackle Market?

- Asia-Pacific dominated the marine shackle market with the largest revenue share of 39.1% in 2025, driven by rapid expansion in shipbuilding, offshore operations, and marine trade activities in countries such as China, Japan, South Korea, and India. The region’s growing commercial fleet size, increasing infrastructure investments in ports, and strong presence of marine hardware manufacturers are major contributors to this dominance

- Both local and international players are focusing on product innovation, cost efficiency, and supply chain integration to meet the growing demand for corrosion-resistant and high-strength shackles

- Furthermore, government initiatives promoting maritime safety, naval modernization, and industrial expansion are bolstering Asia-Pacific’s leading position in the global Marine Shackle market

China Marine Shackle Market Insight

China is the largest contributor to the Asia-Pacific marine shackle market, supported by its robust shipbuilding industry, export-oriented manufacturing, and growing offshore energy activities. The country’s emphasis on developing high-tensile, stainless, and galvanized shackles for cargo handling, naval, and industrial uses is strengthening its market position. Leading domestic players are investing in automation, quality certifications, and precision forging technologies to enhance production efficiency. Continuous R&D efforts and growing export partnerships are reinforcing China’s dominance across the regional and global supply chains.

India Marine Shackle Market Insight

India is witnessing significant growth in the Marine Shackle market due to increasing shipbuilding projects, coastal trade, and naval modernization programs. The government’s “Make in India” and Maritime India Vision 2030 initiatives are promoting local manufacturing and technological upgrades in marine hardware. Expansion of shipyards, investment in renewable offshore energy, and demand for cost-effective shackles in fishing and passenger vessels are fueling market development. Domestic manufacturers are also focusing on sustainability and standard compliance to boost exports and enhance competitiveness in the Asia-Pacific region.

North America Marine Shackle Market Insight

North America is projected to witness the fastest growth rate of 9.8% during 2026–2033, fueled by expanding offshore exploration, naval operations, and the adoption of advanced marine safety equipment. The region’s strong ship repair and maintenance network, coupled with the rising demand for high-strength alloy and stainless steel shackles, is driving the market. Ongoing investments in marine automation, defense projects, and green port infrastructure are accelerating adoption. Manufacturers are increasingly focusing on product durability and corrosion resistance to meet U.S. Coast Guard and international maritime standards.

U.S. Marine Shackle Market Insight

The U.S. leads the North American Marine Shackle market, driven by expanding naval modernization programs, offshore oil and gas operations, and commercial shipping activities. Domestic manufacturers are emphasizing sustainability, lightweight alloys, and precision forging technologies to produce shackles with improved load-bearing capacity and longevity. Major industry players such as Columbus McKinnon Corporation, Mazzella Companies, and Gunnebo Industries AB are investing in R&D and strategic partnerships to strengthen their supply chains and meet evolving market needs.

Canada Marine Shackle Market Insight

Canada contributes steadily to the North American Marine Shackle market, supported by its strong shipbuilding sector, port modernization initiatives, and offshore energy development. Increasing demand for galvanized and stainless-steel shackles in fishing, transport, and naval applications is driving growth. The government’s focus on enhancing marine safety standards and sustainability is encouraging local manufacturers to adopt advanced production and recycling techniques. Continuous investments in marine infrastructure and logistics are enhancing Canada’s position within the regional market.

Europe Marine Shackle Market Insight

Europe continues to hold a significant share of the global Marine Shackle market, driven by demand from shipping, fishing, and offshore oil industries. Countries such as Germany, the U.K., France, and Norway are major contributors, focusing on premium-quality shackles for marine, industrial, and defense applications. Strict environmental regulations and emphasis on eco-friendly materials and traceable supply chains are promoting sustainable growth across the region.

Germany Marine Shackle Market Insight

Germany leads Europe’s Marine Shackle market, supported by advanced engineering capabilities, export-oriented manufacturing, and high standards for marine safety. The country’s shipbuilding and offshore equipment sectors rely on precision-forged shackles for heavy-duty operations. Continuous innovations in high-tensile alloys and automated production are reinforcing Germany’s leadership in premium marine hardware manufacturing across Europe.

U.K. Marine Shackle Market Insight

The U.K. market is expanding steadily, driven by renewable offshore energy projects, naval modernization, and maritime logistics. Companies are focusing on sustainable sourcing, product innovation, and corrosion-resistant coatings to cater to demanding marine environments. The rising adoption of lightweight and high-durability shackles for commercial and defense vessels continues to strengthen the U.K.’s share in the European Marine Shackle market.

Which are the Top Companies in Marine Shackle Market?

The Marine Shackle industry is primarily led by well-established companies, including:

- Canadian Metal Pacific Ltd. (Canada)

- LE BÉON MANUFACTURING (France)

- Kesteloo Stainless Steel Fittings (New Zealand)

- Mazzella Companies [USA] (U.S.)

- Gunnebo Industries AB (Sweden)

- Indian Steel Company (India)

- Columbus McKinnon Corporation (U.S.)

- KRYFS (Greece)

- James Fisher and Sons plc (U.K.)

- Sotra Anchor & Chain AS (Norway)

- Wichard (France)

- Sealinkers (Singapore)

- TACKLETECH ENTERPRISES (U.S.)

- Liftvelindustries (Netherlands)

- Nidhi Maritime Consultancy (India)

- China Deyuan Marine Fitting Co., Ltd. (China)

- Katradis Marine Ropes Ind. S.A. (Greece)

- Qingdao Sail Rigging Co., Ltd. (China)

- Cargo Lift USA, LLC (U.S.)

- Monroe (U.S.)

What are the Recent Developments in Global Marine Shackle Market?

- In January 2022, Suncor Stainless Inc. launched a new range of Forged Shackles made from 316 stainless steel, offering enhanced durability and superior corrosion resistance, making them suitable for the harshest marine environments, and these forged shackles provide higher strength and longer service life, ensuring better wear performance for industrial and maritime applications

- In September 2021, Møllerodden, a new member of GCE Ocean Technology, acquired Inovatum Lifting AS’s patented technology to simplify operations and make them more environmentally friendly, and the company is also developing a hydraulically releasable shackle for safer handling without the use of oil, enhancing operational safety and sustainability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.