Global Meat Poultry And Seafood Processing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

12.61 Billion

USD

20.94 Billion

2024

2032

USD

12.61 Billion

USD

20.94 Billion

2024

2032

| 2025 –2032 | |

| USD 12.61 Billion | |

| USD 20.94 Billion | |

|

|

|

|

What is the Global Meat, Poultry and Seafood Processing Equipment Market Size and Growth Rate?

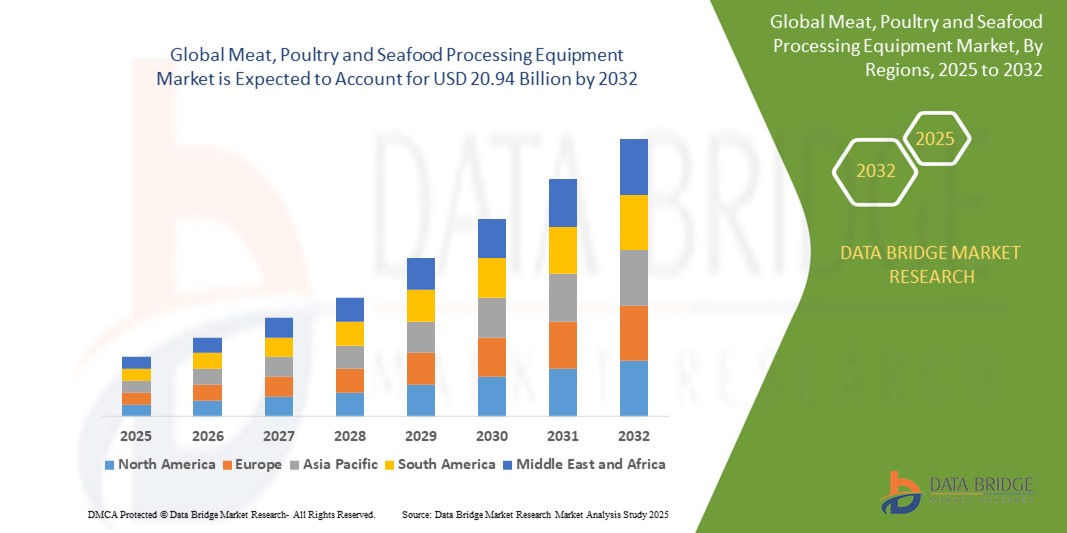

- The global meat, poultry and seafood processing equipment market size was valued at USD 12.61 billion in 2024 and is expected to reach USD 20.94 billion by 2032, at a CAGR of 5.80% during the forecast period

- The global meat, poultry, and seafood processing equipment market is majorly used in enhancing efficiency and productivity in food processing facilities. These advanced equipment and machinery play a crucial role in automating various stages of meat, poultry, and seafood processing, including cutting, grinding, packaging, and quality control

- This results in increased output, reduced labor costs, and improved hygiene standards, ultimately contributing to the modernization and optimization of the food processing industry

What are the Major Takeaways of Meat, Poultry and Seafood Processing Equipment Market?

- As lifestyles become busier, there is an increasing demand for convenient and ready-to-consume meat items. This trend propels the need for advanced processing equipment to efficiently handle larger production volumes, ensuring the timely and cost-effective production of processed meat products to meet the evolving consumer preferences

- The market benefits from catering to this shift in dietary choices by providing the necessary tools for streamlined and scalable processing in the meat, poultry, and seafood industry

- North America dominated the meat, poultry and seafood processing equipment market with the largest revenue share of 31.3% in 2024, driven by the region’s advanced meat processing infrastructure, increasing consumption of processed meat products, and the presence of leading equipment manufacturers

- Asia-Pacific meat, poultry and seafood processing equipment market is projected to grow at the fastest CAGR of 7.8% during 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and dietary shifts toward processed and convenience meat and seafood products

- The Killing/Slaughtering Equipment segment dominated the meat, poultry and seafood processing equipment market with the largest revenue share of 26.4% in 2024, driven by the essential role this equipment plays in ensuring efficiency, hygiene, and compliance in meat processing operations

Report Scope and Meat, Poultry and Seafood Processing Equipment Market Segmentation

|

Attributes |

Meat, Poultry and Seafood Processing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Meat, Poultry and Seafood Processing Equipment Market?

“Automation and Smart Processing Transforming Operational Efficiency”

- A significant and evolving trend in the global meat, poultry and seafood processing equipment market is the increasing integration of automation, robotics, and smart processing technologies to enhance efficiency, safety, and product quality across food processing operations

- AI and machine learning capabilities in processing equipment enable predictive maintenance, real-time quality monitoring, and process optimization, ensuring minimal downtime and consistent product standards. Companies such as Marel and JBT Corporation are at the forefront of developing intelligent processing lines equipped with automated controls and data-driven insights

- The integration of digital platforms and remote monitoring tools is enhancing operational visibility, allowing processors to track performance, improve traceability, and ensure compliance with stringent food safety regulations

- In addition, smart processing solutions support waste reduction, energy efficiency, and better resource utilization, aligning with sustainability goals across the meat, poultry, and seafood industries

- As global demand for protein-rich foods grows, the trend towards more automated, hygienic, and technologically advanced processing systems is reshaping industry standards, driving investments in next-generation equipment worldwide

What are the Key Drivers of Meat, Poultry and Seafood Processing Equipment Market?

- Rising global consumption of meat, poultry, and seafood products, fueled by population growth, urbanization, and changing dietary preferences, is a primary factor driving demand for advanced processing equipment

- For instance, in March 2024, Marel announced the expansion of its automated poultry processing solutions in Asia, aiming to meet the region's growing protein consumption and improve processing efficiency. Such initiatives are boosting the market outlook

- Stringent food safety regulations and the need for consistent product quality are pushing food processors to adopt modern equipment with hygienic designs, automated cleaning systems, and real-time quality control features

- Labor shortages, particularly in developed markets, are accelerating the shift towards automation, with companies investing in robotics and AI-powered machinery to reduce operational costs and enhance productivity

- Furthermore, the growing emphasis on sustainability and resource optimization is prompting manufacturers to upgrade to energy-efficient, low-waste processing solutions, contributing to overall market growth across regions

Which Factor is challenging the Growth of the Meat, Poultry and Seafood Processing Equipment Market?

- High capital investment requirements for advanced processing machinery remain a key challenge, particularly for small and medium-sized enterprises (SMEs) in emerging markets. The upfront cost of installing automated lines and smart processing systems can limit adoption

- For instance, fluctuations in raw material and equipment costs, coupled with tight profit margins in the food processing industry, make it difficult for some processors to upgrade aging infrastructure

- In addition, the complexity of integrating new technologies into existing facilities, along with workforce training requirements, can hinder smooth adoption, particularly in markets with limited technical expertise

- Regulatory complexities across different regions, particularly concerning hygiene standards, import restrictions, and environmental compliance, also pose operational hurdles for manufacturers and equipment suppliers

- Overcoming these challenges will require collaborative efforts from equipment manufacturers to offer modular, scalable, and cost-effective processing solutions, as well as increased government support for technology upgrades to enhance food safety and processing efficiency worldwide

How is the Meat, Poultry and Seafood Processing Equipment Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Equipment Type

On the basis of equipment type, the meat, poultry and seafood processing equipment market is segmented into Portioning Equipment, Frying Equipment, Filtering Equipment, Coating Equipment, Cooking Equipment, Smoking Equipment, Killing/Slaughtering Equipment, Refrigeration Equipment, High Pressure Processing, Massaging Equipment, and Others. The Killing/Slaughtering Equipment segment dominated the meat, poultry and seafood processing equipment market with the largest revenue share of 26.4% in 2024, driven by the essential role this equipment plays in ensuring efficiency, hygiene, and compliance in meat processing operations. The demand for automated slaughtering systems is growing due to labor shortages, strict animal welfare regulations, and the need to maintain processing consistency at high volumes.

The High Pressure Processing segment is expected to witness the fastest growth rate of 23.1% from 2025 to 2032, fueled by the increasing demand for pathogen-free, extended shelf-life meat, poultry, and seafood products without compromising nutritional quality. This non-thermal technology is gaining traction in both premium and export-oriented markets due to its ability to enhance food safety while preserving freshness.

- By Process

On the basis of process, the meat, poultry and seafood processing equipment market is segmented into Size Reduction, Size Enlargement, Homogenization, Mixing, and Others. The Size Reduction segment accounted for the largest market revenue share of 33.8% in 2024, attributed to its critical role in preparing meat cuts, seafood portions, and processed products. Equipment such as grinders, slicers, and mincers are widely used across meat and seafood processing plants to meet diverse product specifications, contributing to this segment's dominance.

The Homogenization segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by the increasing demand for uniform texture and quality in processed meat, poultry, and seafood products. Homogenization ensures consistency in emulsified products, sausages, and ready-to-eat meals, which are gaining popularity among consumers.

- By Mode of Operation

On the basis of mode of operation, the meat, poultry and seafood processing equipment market is segmented into Automatic, Semi-Automatic, and Manual. The Automatic segment dominated the market with the largest revenue share of 49.5% in 2024, owing to the growing preference for fully automated processing lines that offer improved efficiency, lower labor dependency, and enhanced product consistency. Automation is particularly favored in large-scale operations to meet high output demands and stringent hygiene standards.

The Semi-Automatic segment is projected to register the fastest growth during the forecast period, especially among small to mid-sized processors seeking a balance between operational efficiency and affordability. Semi-automatic systems are popular for their flexibility, ease of integration, and cost-effective production capabilities.

- By Application

On the basis of application, the meat, poultry and seafood processing equipment market is segmented into Fresh Processed, Raw Cooked, Precooked, Raw Fermented, Dried Meat, Cured, Frozen, and Others. The Frozen segment held the largest market revenue share of 30.9% in 2024, driven by rising global demand for frozen meat, poultry, and seafood products due to their extended shelf life, convenience, and suitability for international trade. Increasing urbanization and busy lifestyles are further fueling frozen food consumption.

The Raw Cooked segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the growing popularity of ready-to-cook and partially processed meat products among consumers seeking convenience without compromising on quality and freshness.

- By Function

On the basis of function, the meat, poultry and seafood processing equipment market is segmented into Cutting, Blending, Tenderizing, Filling, Marinating, Slicing, Grinding, Smoking, Killing and De-Feathering, Deboning and Skinning, Evisceration, Gutting, Filleting, and Others. The Cutting segment dominated the market with the largest revenue share of 28.7% in 2024, attributed to its fundamental role across all meat, poultry, and seafood processing operations. Cutting equipment ensures product uniformity, optimizes yields, and facilitates further processing stages, making it indispensable.

The Deboning and Skinning segment is projected to grow at the fastest rate from 2025 to 2032, driven by increasing demand for boneless meat, poultry, and seafood products. Technological advancements in automated deboning systems are enhancing efficiency, reducing waste, and improving product quality, particularly in export-oriented markets.

- By Processed Products Type

On the basis of processed product type, the meat, poultry and seafood processing equipment market is segmented into Meat, Poultry, and Seafood. The Meat segment accounted for the largest revenue share of 44.6% in 2024, driven by the high consumption of red meat products globally, especially in developed markets. The demand for processed meat, such as sausages, burgers, and deli meats, continues to drive investment in advanced processing equipment for this segment.

The Seafood segment is anticipated to witness the fastest CAGR from 2025 to 2032, supported by growing consumer awareness of the health benefits of seafood, rising demand for convenience seafood products, and the increasing adoption of specialized processing technologies to ensure freshness and safety.

Which Region Holds the Largest Share of the Meat, Poultry and Seafood Processing Equipment Market?

- North America dominated the meat, poultry and seafood processing equipment market with the largest revenue share of 31.3% in 2024, driven by the region’s advanced meat processing infrastructure, increasing consumption of processed meat products, and the presence of leading equipment manufacturers

- U.S. and Canada continue to experience rising demand for automation, efficiency, and food safety within meat, poultry, and seafood processing plants, fueling investments in advanced equipment solutions

- Growing consumer demand for convenience foods, stringent food safety regulations, and the modernization of processing facilities are collectively contributing to North America's market leadership

U.S. Meat, Poultry and Seafood Processing Equipment Market Insight

U.S. meat, poultry and seafood processing equipment market captured the largest revenue share within North America in 2024, supported by the country's highly developed meat and poultry industries, technological advancements, and regulatory emphasis on food hygiene and safety. The U.S. is witnessing increased adoption of automated and energy-efficient processing equipment to meet growing demand for ready-to-eat meals, portion-controlled products, and processed seafood. Moreover, investments in sustainability, waste reduction, and workforce efficiency are driving the replacement of aging equipment with modern, high-performance solutions.

Europe Meat, Poultry and Seafood Processing Equipment Market Insight

The Europe meat, poultry and seafood processing equipment market is expected to grow steadily throughout the forecast period, driven by consumer demand for high-quality, processed meat products and compliance with strict food safety regulations such as HACCP. The region is seeing an increased focus on energy-efficient, automated equipment to meet sustainability targets and enhance production efficiency. In addition, evolving dietary preferences and demand for value-added products, including plant-based meat alternatives, are influencing equipment innovation across Europe.

U.K. Meat, Poultry and Seafood Processing Equipment Market Insight

The U.K. meat, poultry and seafood processing equipment market is anticipated to grow at a notable CAGR during the forecast period, fueled by increasing investments in food processing automation and innovation. The market benefits from heightened awareness of food traceability, animal welfare, and hygiene standards, leading to the adoption of advanced processing equipment. Moreover, the rising consumption of convenience food products and processed seafood is further driving market growth in the country.

Germany Meat, Poultry and Seafood Processing Equipment Market Insight

The Germany meat, poultry and seafood processing equipment market is expected to grow at a moderate pace, supported by the country’s strong food processing sector, focus on technological advancement, and demand for sustainable, high-efficiency equipment. Germany’s reputation for engineering excellence extends to processing equipment, with manufacturers and processors emphasizing automation, energy savings, and hygiene compliance. Rising consumer demand for premium meat and seafood products is also contributing to market expansion.

Which Region is the Fastest Growing Region in the Meat, Poultry and Seafood Processing Equipment Market?

Asia-Pacific meat, poultry and seafood processing equipment market is projected to grow at the fastest CAGR of 7.8% during 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and dietary shifts toward processed and convenience meat and seafood products. Countries such as China, India, and Southeast Asian nations are witnessing significant expansion in food processing infrastructure, supported by growing domestic consumption and exports. Government initiatives to boost food safety, automation, and processing efficiency are further propelling market growth across the region.

Japan Meat, Poultry and Seafood Processing Equipment Market Insight

The Japan meat, poultry and seafood processing equipment market is gaining momentum, driven by the country’s focus on food safety, quality, and automation within its processing sector. Japan's aging workforce and high consumer expectations for premium, ready-to-eat meat and seafood products are prompting investments in advanced, labor-saving processing technologies. Moreover, the country's strong seafood consumption culture supports steady demand for specialized seafood processing equipment.

Which are the Top Companies in Meat, Poultry and Seafood Processing Equipment Market?

The meat, poultry and seafood processing equipment industry is primarily led by well-established companies, including:

- Equipamientos Cárnicos, S.L. (Spain)

- Biro Manufacturing (U.S.)

- BRAHER INTERNACIONAL, S.A. (Spain)

- RZPO - Food Processing Equipment Manufacturer (Russia)

- Riopel Industries Inc. (Canada)

- Minerva Omega Group s.r.l. (Italy)

- RISCO S.p.A (Italy)

- Millard Manufacturing Corporation (U.S.)

- Apache Stainless Equipment (U.S.)

- Gee Gee Foods & Packaging Co. Pvt. Ltd. (India)

- PSS SVIDNÍK, a.s. (Slovakia)

- Ross Industries, Inc. (U.S.)

- Metal-Bud. (Poland)

- BAADER (Germany)

- CTB, INC. (U.S.)

- JBT (U.S.)

- Marel (Iceland)

- Key Technology (U.S.)

- Illinois Tool Works Inc. (U.S.)

- The Middleby Corporation (U.S.)

- Bettcher Industries, Inc. (U.S.)

What are the Recent Developments in Global Meat, Poultry and Seafood Processing Equipment Market?

- In July 2024, Fortifi Food Processing Solutions acquired LIMA S.A.S., a France-based company specializing in the design and manufacture of meat processing equipment, strengthening Fortifi's capabilities in protein processing and expanding its portfolio alongside established brands such as Bettcher Industries and Frontmatec. This acquisition reinforces Fortifi's global presence and positions the company to better meet rising demand in the meat processing sector

- In January 2023, JPG Resources, a food and beverage innovation and commercialization firm, completed the acquisition of the research and development team of RodeoCPG, a New York-based strategic sales agency focused on retail consumer brands. This move enhances JPG’s innovation capabilities and expands its expertise in supporting the commercialization of food products in competitive markets

- In May 2022, Bettcher Industries, Inc. announced the acquisition of Frontmatec, a global leader in automated protein processing solutions, aiming to enhance Bettcher's technological expertise and broaden its product portfolio. This strategic move strengthens Bettcher’s position in the protein processing market and supports future growth

- In April 2021, Duravant LLC completed the acquisition of Foodmate, a recognized leader in poultry processing equipment, known for its industry-leading automated secondary processing systems. This acquisition enhances Duravant’s ability to meet evolving demands within the poultry processing sector and supports its global expansion strategy

- In September 2020, Key Technology formed a strategic collaboration with Heat and Control Pty Ltd, leveraging Heat and Control's extensive network across Australia, New Zealand, and India to expand Key Technology's market presence in the meat, poultry, and seafood processing equipment sector. This collaboration capitalizes on growing regional demand for advanced processing solutions and strengthens both companies’ market positions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Meat Poultry And Seafood Processing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Meat Poultry And Seafood Processing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Meat Poultry And Seafood Processing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.