Global Medical Cannabis Extraction Market

Market Size in USD Billion

CAGR :

%

USD

5.14 Billion

USD

17.11 Billion

2025

2033

USD

5.14 Billion

USD

17.11 Billion

2025

2033

| 2026 –2033 | |

| USD 5.14 Billion | |

| USD 17.11 Billion | |

|

|

|

|

Medical Cannabis Extraction Market Size

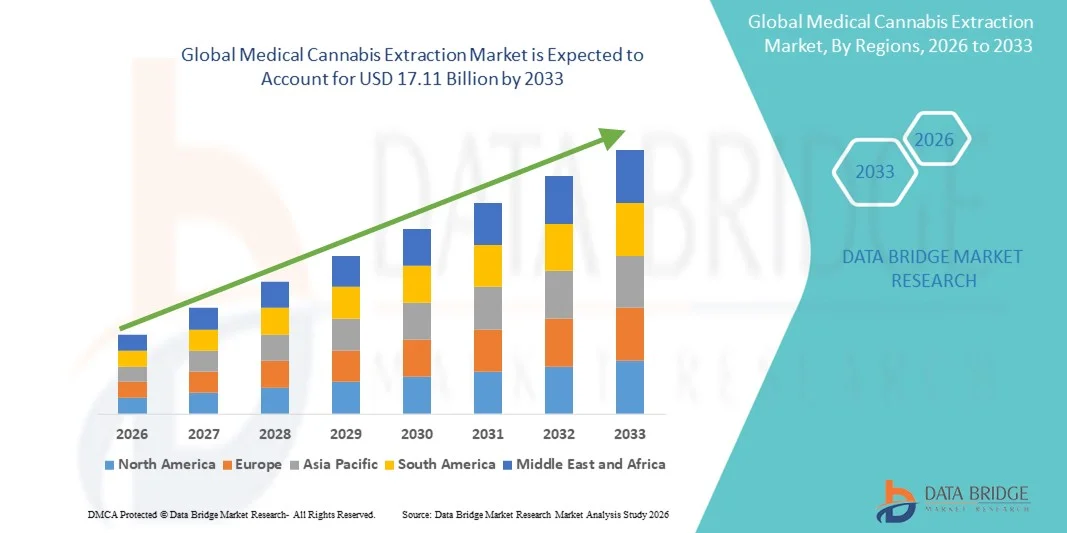

- The global medical cannabis extraction market size was valued at USD 5.14 billion in 2025 and is expected to reach USD 17.11 billion by 2033, at a CAGR of 16.20% during the forecast period

- The market growth is primarily driven by the rapid expansion of the medical cannabis industry, increasing legalization for medical use across key regions, and rising demand for high-purity cannabis extracts used in pharmaceuticals, nutraceuticals, and therapeutic formulations. Continuous advancements in extraction technologies such as supercritical CO₂ and ethanol extraction are further improving efficiency, yield, and product quality

- In addition, growing preference for standardized, safe, and dosage-controlled medical cannabis products, along with increased investment by pharmaceutical and biotechnology companies, is positioning medical cannabis extraction as a critical process within the value chain. These combined factors are accelerating the adoption of advanced extraction solutions and significantly supporting overall market growth

Medical Cannabis Extraction Market Analysis

- Medical cannabis extraction, which involves isolating cannabinoids and other active compounds from cannabis plants, is becoming a vital process in the pharmaceutical and therapeutic sectors due to its role in producing high-purity, standardized, and dosage-controlled products for pain management, neurological disorders, oncology, and other medical applications

- The escalating demand for medical cannabis extraction solutions is primarily fueled by the growing legalization of medical cannabis, increasing acceptance of cannabinoid-based therapies among healthcare professionals, and rising investments in pharmaceutical-grade manufacturing. Technological advancements in extraction methods such as supercritical CO₂, ethanol, and hydrocarbon extraction are further enhancing yield, purity, and efficiency

- North America dominated the medical cannabis extraction market with the largest revenue share of 45.9% in 2025, supported by established regulatory frameworks, high R&D investment, and a strong presence of licensed producers and extraction technology providers. The U.S. witnessed significant growth in medical cannabis extraction, particularly in pharmaceutical and clinical applications, driven by innovations in high-efficiency extraction technologies

- Asia-Pacific is expected to be the fastest-growing region in the medical cannabis extraction market during the forecast period due to increasing regulatory approvals, rising awareness of medical cannabis benefits, and growing investments in extraction infrastructure and clinical research across emerging markets

- Carbon Dioxide Cannabis Extraction segment dominated the market with a share of 48.2% in 2025, driven by its high purity, safety, scalability, and preference among pharmaceutical-grade cannabis manufacturers

Report Scope and Medical Cannabis Extraction Market Segmentation

|

Attributes |

Medical Cannabis Extraction Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Medical Cannabis Extraction Market Trends

Advancements in Automated and High-Purity Extraction Technologies

- A significant and accelerating trend in the global medical cannabis extraction market is the adoption of automated and high-precision extraction technologies such as supercritical CO₂, ethanol, and hydrocarbon extraction, enabling consistent and pharmaceutical-grade cannabinoid products

- For instance, Apeks Supercritical’s automated CO₂ extraction systems allow manufacturers to produce high-purity THC and CBD isolates with minimal manual intervention, improving efficiency and reproducibility

- Integration of real-time monitoring, process control, and solvent recovery systems in extraction units is enhancing operational efficiency, reducing waste, and maintaining consistent product quality across batches

- The trend towards automation and advanced extraction processes is driving standardization in medical cannabis products, aligning with stringent regulatory requirements for dosage control and therapeutic applications

- This trend is reshaping manufacturer expectations for operational scalability, process optimization, and extract quality, leading companies such as Precision Extraction Solutions to innovate with modular, AI-enabled extraction units

- The adoption of high-purity, automated extraction systems is rapidly increasing across licensed producers and pharmaceutical companies as they seek to meet regulatory standards and the growing global demand for standardized cannabinoid formulations

- Continuous research into solvent-free and low-temperature extraction techniques is creating opportunities for cleaner, more stable extracts, appealing to pharmaceutical and wellness applications

- Growing partnerships between technology providers and licensed cannabis producers are accelerating innovation, enabling faster commercialization of advanced extraction solutions

Medical Cannabis Extraction Market Dynamics

Driver

Rising Demand Due to Legalization and Pharmaceutical Applications

- The expanding legalization of medical cannabis and rising acceptance of cannabinoid-based therapies are significant drivers for the increasing adoption of advanced extraction solutions

- For instance, in March 2025, GW Pharmaceuticals expanded its GMP-compliant extraction facilities in the U.S. to meet growing demand for cannabinoid-based therapeutics

- Growing investment in pharmaceutical-grade medical cannabis production is enabling manufacturers to supply high-quality extracts for pain management, neurological disorders, and oncology applications

- The increasing patient base and physician recommendations for cannabinoid therapies are stimulating demand for standardized, high-purity extracts

- Advanced extraction technologies allow manufacturers to produce targeted formulations, enhancing efficacy and safety profiles, thus further supporting market growth

- Expansion of medical cannabis programs across Europe, North America, and select Asia-Pacific countries is boosting adoption of extraction technologies to meet regulatory and therapeutic requirements

- The rising prevalence of chronic diseases and patient preference for plant-based therapies is increasing reliance on precise cannabinoid formulations, creating additional market growth opportunities

- Strategic collaborations between pharmaceutical companies and extraction technology providers are accelerating R&D and scaling of medical cannabis extracts for global markets

Restraint/Challenge

Regulatory Compliance and High Operational Costs

- Stringent regulatory requirements for medical cannabis extraction, including GMP compliance and quality testing, pose a significant challenge to new market entrants and small-scale producers

- For instance, reports from the FDA and Health Canada highlight strict guidelines on solvent use, potency limits, and contamination testing, which can increase operational complexity

- High initial investment in automated extraction equipment and facility setup can limit adoption, particularly among small and medium-sized licensed producers

- The complex permitting processes and ongoing compliance audits add administrative and financial burdens for companies expanding into new regions

- While extraction efficiency and product standardization are improving, the premium cost of high-precision automated systems may restrict widespread implementation, especially in emerging markets

- Overcoming these challenges requires investment in regulatory expertise, efficient process design, and scalable extraction technologies to ensure compliance and cost-effectiveness across operations

- Inconsistent regulations across countries and regions create challenges for multinational companies aiming to standardize extraction processes and distribution

- Technical skill gaps in operating advanced extraction equipment and maintaining GMP compliance may slow market growth for smaller or less experienced producers

Medical Cannabis Extraction Market Scope

The market is segmented on the basis of species, product, extract type, technique, derivatives, route of administration, and application.

- By Species

On the basis of species, the market is segmented into cannabis indica, cannabis sativa, and hybrid. The Hybrid segment dominated the market with the largest revenue share in 2025, driven by its balanced cannabinoid profile and adaptability for medical formulations. Hybrid strains are preferred for producing standardized extracts that combine the therapeutic benefits of both Indica and Sativa varieties. Their cultivation flexibility and consistent potency make them ideal for large-scale extraction operations. Patient demand for multi-symptom relief formulations further supports hybrid dominance. In addition, hybrid strains benefit from ongoing R&D in high-yield medicinal varieties. Cross-regional cultivation feasibility and regulatory acceptance also strengthen market leadership.

Cannabis Sativa is expected to witness the fastest growth during forecast period due to its high CBD content, widely used for pain management, anti-inflammatory, and anxiety therapies. Sativa strains are favored for full-spectrum oils and tinctures in pharmaceutical and wellness applications. Increasing clinical studies highlight Sativa’s efficacy, driving adoption. Cultivation expansion in North America and Europe supports growth. Healthcare providers increasingly recommend Sativa-based extracts for targeted therapies. Investments in production facilities and clinical research further fuel its growth.

- By Product

On the basis of product, the market is segmented into oils and tinctures. The Oils segment dominated the market in 2025 due to versatility, ease of dosing, and long shelf life. Oils are extensively used in oral solutions, capsules, and topical formulations, making them highly suitable for pharmaceutical use. Standardized oil extracts comply easily with regulatory requirements, enhancing adoption. Patient preference for consistent dosing further supports market leadership. Oils also allow combination of multiple cannabinoids, increasing therapeutic value. Manufacturers favor oils for clinical trials and large-scale production. Market dominance is also aided by global awareness and accessibility of oil-based formulations.

Tinctures are anticipated to witness the fastest growth during forecast period due to their convenient sublingual administration and rapid absorption. Tinctures are gaining popularity among patients for at-home therapies. Their portability and precise dosing support outpatient care. Rising consumer interest in natural therapies drives adoption. Pharmaceutical companies are innovating with flavored and concentrated tincture formulations. Regulatory approvals for medical tinctures further enhance growth. R&D in efficient tincture production methods supports faster market penetration.

- By Extract Type

On the basis of extract type, the market is segmented into full spectrum and isolates. The Full Spectrum segment dominated in 2025 due to synergistic effects of multiple cannabinoids, terpenes, and flavonoids. Full-spectrum extracts are widely used in pharmaceutical and nutraceutical applications. Patients prefer multi-cannabinoid therapies for broader efficacy. Manufacturers benefit from brand differentiation and regulatory compliance. Continuous R&D improves yield, potency, and extract quality. Patient demand for holistic therapies supports sustained growth. Full-spectrum extracts also enhance the adoption of premium formulations in the market.

Isolates are expected to witness the fastest growth during forecast period due to rising demand for pure CBD and THC products in regulated doses. Isolates allow pharmaceutical manufacturers to produce targeted, standardized formulations. They are widely adopted in clinical trials and R&D applications. Growth is driven by regulations favoring precise dosing. Technological advances improve extraction efficiency and purity. Consumer preference for high-purity products boosts adoption. Regulatory approvals for isolate-based products ensure market expansion.

- By Technique

On the basis of technique, the market is segmented into medicinal cannabis alcohol extraction, carbon dioxide cannabis extraction, hydrocarbon extraction, and solvent-free extractions. Carbon Dioxide Cannabis Extraction dominated in 2025 with a market share of 48.2% due to safety, efficiency, and high-purity yield. CO₂ extraction is preferred by pharmaceutical manufacturers for GMP-compliant production. Its scalability allows large-scale operations to meet rising demand. Minimal residual solvents enhance product safety. Continuous innovations improve throughput and efficiency. Consumer preference for clean extracts strengthens adoption. Regulatory acceptance of CO₂ extraction for medical use further solidifies dominance.

Solvent-Free Extractions are expected to witness the fastest growth during forecast period due to demand for chemical-free, clean extracts. This technique is gaining traction in pharmaceutical, nutraceutical, and wellness applications. Solvent-free methods reduce health and environmental risks. Mechanical and cryogenic extraction technologies improve yield and potency. Regulatory support for non-solvent products drives adoption. Consumer preference for natural, pure extracts accelerates growth. Innovations in scalable solvent-free equipment support rapid market expansion.

- By Derivatives

On the basis of derivatives, the market is segmented into CBD, THC, and others. CBD dominated in 2025 due to broad therapeutic applications, including pain, inflammation, and neurological disorders. CBD extracts are versatile for oils, capsules, and topicals. Non-psychoactive properties and regulatory approvals enhance adoption. Standardized manufacturing ensures consistent product quality. Clinical research confirming efficacy drives patient and physician confidence. Pharmaceutical preference for CBD supports market leadership. Global awareness of CBD-based therapies further strengthens dominance.

THC is expected to witness the fastest growth during forecast period due to increasing medical applications in pain management, chemotherapy side-effect relief, and neurological disorders. THC extracts are adopted in controlled, standardized formulations. Regulatory relaxation in multiple regions supports market expansion. Ongoing R&D for novel THC-based therapeutics drives innovation. Patient demand for psychoactive cannabinoid therapies contributes to adoption. Pharmaceutical collaborations accelerate THC product commercialization. Awareness campaigns and clinical validation support faster segment growth.

- By Route of Administration

On the basis of route, the market is segmented into oral solutions and capsules, smoking, vaporizers, topicals, and others. Oral Solutions and Capsules dominated in 2025 due to precise dosing, compliance with regulations, and suitability for chronic therapies. Pharmaceutical manufacturers favor oral administration for standardized delivery. Ease of patient adherence boosts market adoption. Hospitals and clinics prefer oral formulations for consistency. Manufacturing scalability supports dominance. Physician recommendations further drive adoption. Market growth is also supported by global availability and awareness of oral products.

Vaporizers are expected to witness the fastest growth during forecast period due to rapid onset, controlled dosing, and increasing outpatient use. Vaporizers are preferred for targeted therapies and patient convenience. Regulatory approval for medical vaporized cannabis supports growth. Awareness about safer alternatives to smoking enhances adoption. Technological improvements in design increase usability and efficiency. Clinical trials increasingly employ vaporized administration. Emerging markets adoption accelerates segment growth.

- By Application

On the basis of application, the market is segmented into pharmaceutical industry, research and development centers, and others. The Pharmaceutical Industry dominated in 2025 due to large-scale demand for standardized extracts for clinical and therapeutic use. Pharmaceutical adoption ensures adherence to quality, safety, and regulatory standards. Strong partnerships with extraction technology providers support market dominance. Rising global patient base drives pharmaceutical consumption. Standardized production and distribution systems favor industry adoption. Continuous innovation in formulations ensures sustained growth. Regulatory support further enhances pharmaceutical segment leadership.

Research and Development Centers are expected to witness the fastest growth during forecast period due to increasing clinical studies, novel therapeutic development, and funding for medical cannabis research. R&D centers drive innovation in extraction techniques and product formulations. Collaboration with pharmaceutical companies accelerates commercialization. Regulatory agencies often partner with research institutions for safety assessments. Emerging countries are investing heavily in cannabinoid research. Continuous product innovation ensures market expansion. Academic and private sector collaborations further boost growth.

Medical Cannabis Extraction Market Regional Analysis

- North America dominated the medical cannabis extraction market with the largest revenue share of 45.9% in 2025, supported by established regulatory frameworks, high R&D investment, and a strong presence of licensed producers and extraction technology providers

- Patients and healthcare providers in the region increasingly prefer standardized, high-purity cannabis extracts for therapeutic applications, including pain management, neurological disorders, and oncology treatments

- The presence of major licensed producers, strong R&D capabilities, and continuous investment in advanced extraction technologies such as supercritical CO₂ and ethanol extraction further support market leadership

U.S. Medical Cannabis Extraction Market Insight

The U.S. medical cannabis extraction market captured the largest revenue share of 82% in 2025 within North America, fueled by widespread legalization of medical cannabis and the growing adoption of standardized, high-purity extracts. Patients and healthcare providers increasingly rely on pharmaceutical-grade cannabinoid products for pain management, neurological disorders, and oncology treatments. The preference for GMP-compliant extracts, combined with strong R&D initiatives and the presence of leading licensed producers, further propels the market. Moreover, integration of advanced extraction technologies, such as supercritical CO₂ and ethanol extraction, is significantly enhancing product quality and production efficiency. Growing awareness among physicians and patients about cannabinoid-based therapies is driving consistent demand. Continuous investment in clinical research and innovation in extraction techniques supports market expansion.

Europe Medical Cannabis Extraction Market Insight

The Europe medical cannabis extraction market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing legalization of medical cannabis and strict regulatory standards for extract quality. Rising adoption of pharmaceutical-grade cannabinoids in chronic disease management and growing R&D investments are fostering market growth. European consumers and healthcare providers are showing preference for standardized, high-purity extracts. The region is witnessing significant expansion across pharmaceutical, clinical, and research applications, with medical cannabis extraction facilities being integrated into both new setups and existing operations. Strategic collaborations between technology providers and licensed producers further stimulate market development. Regulatory alignment and increasing patient awareness are key factors supporting growth.

U.K. Medical Cannabis Extraction Market Insight

The U.K. medical cannabis extraction market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increased demand for cannabinoid-based therapies and the rising trend of medical cannabis research. Patient demand for precise, standardized formulations for pain, neurological, and mental health applications is encouraging manufacturers to adopt advanced extraction techniques. In addition, growing awareness of medical cannabis benefits among healthcare professionals and the expansion of licensed production facilities are expected to stimulate market growth. The U.K.’s regulatory framework supports GMP-compliant extraction and clinical research, ensuring consistent product quality. Collaborative R&D initiatives with pharmaceutical companies are also promoting innovation. Increasing healthcare expenditure and accessibility of standardized extracts further contribute to market expansion.

Germany Medical Cannabis Extraction Market Insight

The Germany medical cannabis extraction market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of therapeutic cannabis, well-developed healthcare infrastructure, and stringent quality standards. Pharmaceutical-grade extraction is gaining traction in both clinical and research applications. German manufacturers are increasingly integrating advanced extraction techniques such as supercritical CO₂ and ethanol systems to meet regulatory compliance and ensure high-purity products. Demand for standardized cannabinoid formulations in pain, oncology, and neurological therapies is increasing. The emphasis on sustainability and technological innovation promotes adoption of eco-friendly and efficient extraction methods. Regulatory clarity and growing R&D investments further support market growth.

Asia-Pacific Medical Cannabis Extraction Market Insight

The Asia-Pacific medical cannabis extraction market is poised to grow at the fastest CAGR of 25% during the forecast period, driven by increasing legalization in countries such as Thailand, South Korea, and Australia, alongside rising awareness of medical cannabis benefits. Rapid urbanization, growing healthcare infrastructure, and increasing government support for clinical research are boosting adoption. The region’s pharmaceutical and research institutions are investing in modern extraction technologies to produce high-quality, standardized extracts. Moreover, the emergence of Asia-Pacific as a hub for cannabis production and extraction is improving affordability and accessibility. Rising patient awareness and physician acceptance of cannabinoid therapies are accelerating demand. Collaborative R&D initiatives and technological advancements are further supporting market growth.

Japan Medical Cannabis Extraction Market Insight

The Japan medical cannabis extraction market is gaining momentum due to increasing focus on clinical research, high demand for regulated medical therapies, and advancements in extraction technology. Japanese healthcare institutions are adopting standardized extracts for neurological, oncology, and chronic disease treatments. The integration of precision extraction methods ensures high-purity, pharmaceutical-grade formulations. Moreover, regulatory approvals and growing clinical studies are driving the adoption of medical cannabis extracts. Rising awareness among healthcare professionals and patients contributes to consistent market growth. Japan’s emphasis on safety, quality, and technological innovation further supports the expansion of extraction operations.

India Medical Cannabis Extraction Market Insight

The India medical cannabis extraction market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s growing healthcare infrastructure, increasing patient awareness, and emerging legalization for research and therapeutic use. India is witnessing rising adoption of standardized cannabis extracts for clinical and pharmaceutical applications. The government’s support for clinical trials and research in cannabinoid therapies, coupled with increasing investments in modern extraction facilities, is driving market growth. In addition, affordable extraction technologies and a growing base of domestic licensed producers enhance accessibility. Rising demand for cannabinoid-based therapeutics in urban and semi-urban healthcare centers supports market expansion. Collaborations between research institutions and pharmaceutical companies further accelerate innovation and adoption.

Medical Cannabis Extraction Market Share

The Medical Cannabis Extraction industry is primarily led by well-established companies, including:

- Apeks Supercritical (U.S.)

- Precision Extraction Solutions (U.S.)

- Delta Separations (U.S.)

- Eden Labs LLC (U.S.)

- extraktLAB (U.S.)

- Capna Systems (U.S.)

- Green Mill Supercritical (U.S.)

- Cedarstone Industry (U.S.)

- Lab Society (U.S.)

- MRX Xtractors (U.S.)

- Root Sciences LLC (U.S.)

- Vitalis Extraction Technology (Canada)

- Pope Scientific Inc. (U.S.)

- Thar Process Inc. (U.S.)

- SFE Process (France)

- GEA Group AG (Germany)

- Buchi Labortechnik AG (Switzerland)

- VTA Verfahrenstechnische Anlagen GmbH & Co. KG (Germany)

- Isolate Extraction Systems Inc. (U.S.)

- Across International (U.S.)

What are the Recent Developments in Global Medical Cannabis Extraction Market?

- In October 2025, OneStep launched its next‑generation cannabis extraction system based on electromagnetic TFE closed‑loop technology, designed to deliver true‑to‑plant oil with dramatically higher yields and reduced costs, representing a major innovation in extraction efficiency and productivity

- In August 2025, Illuminated Extractors Ltd. unveiled breakthrough hydrocarbon extraction technology with the issuance of U.S. Patent US12135149 for its advanced heating and refrigeration system, aimed at significantly improving extraction performance, efficiency, and safety in industrial cannabis processing

- In January 2025, Prodigy Processing Solutions and ProXtracts announced the launch of New York’s first hydrocarbon extraction laboratory, enabling GMP‑compliant extraction of cannabis oil, distillate, and concentrates in the Bronx and marking a regulatory milestone for extraction operations in a major U.S. market

- In March 2024, Agrify Corporation signed a multi‑million‑dollar turnkey hydrocarbon extraction and lab equipment deal with Justice Cannabis Co., expanding cannabis extraction capabilities and supporting the operator’s growth into the New Jersey market with integrated extraction technologies

- In January 2022, Flora Growth Corp. completed construction of its 10,500 ft² cannabis extraction facility in Bucaramanga, Colombia, and successfully extracted its first batch of crude oil while initiating the process for EU‑GMP certification, positioning the company to serve international medical cannabis markets with high‑quality cannabinoid derivatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.