Global Medical Device Sterilization Market

Market Size in USD Billion

CAGR :

%

USD

12.59 Billion

USD

22.76 Billion

2024

2032

USD

12.59 Billion

USD

22.76 Billion

2024

2032

| 2025 –2032 | |

| USD 12.59 Billion | |

| USD 22.76 Billion | |

|

|

|

|

Medical Device Sterilization Market Size

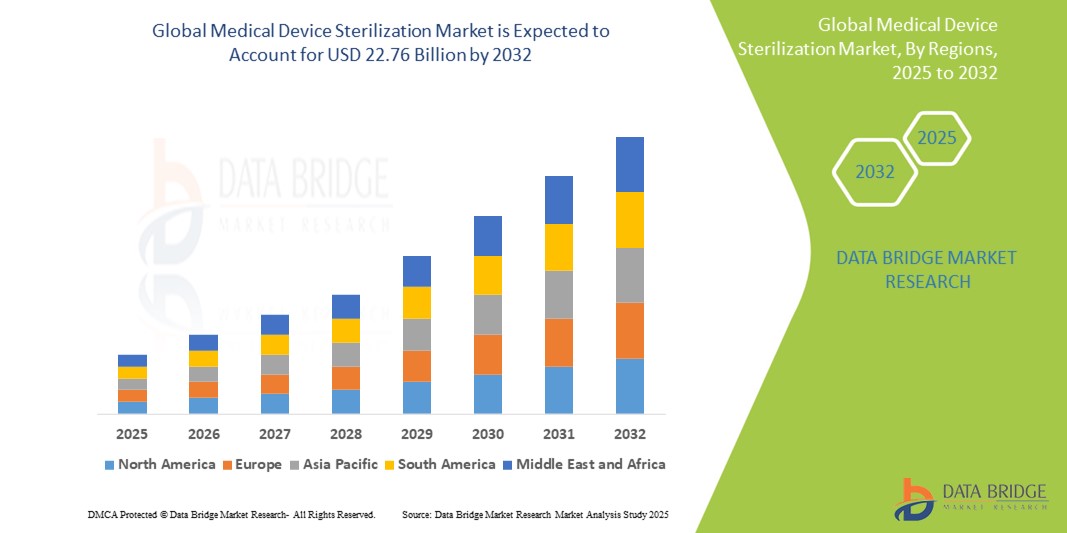

- The global medical device sterilization market was valued at USD 12.59 billion in 2024 and is expected to reach USD 22.76 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.68%, primarily driven by the rising prevalence of hospital-acquired infections and the increasing demand for sterile medical equipment

- This growth is driven by factors such as the expanding healthcare infrastructure, rising surgical procedures, and strict regulatory standards for infection control and patient safety

Medical Device Sterilization Market Analysis

- Medical device sterilization is a critical process ensuring that medical instruments are free from viable microorganisms, thereby preventing infections and ensuring patient safety. It is essential across hospitals, surgical centers, and diagnostic labs for sterilizing instruments such as surgical tools, catheters, and implants

- The demand for sterilization solutions is significantly driven by the increasing volume of surgical procedures, rising incidence of hospital-acquired infections, and stringent regulatory standards on healthcare safety. The adoption of single-use medical devices and reusable instruments further fuels the need for effective sterilization methods

- North America stands out as one of the dominant regions for the medical device sterilization market, attributed to its advanced healthcare systems, strong regulatory enforcement, and widespread awareness about infection control practices

- For instance, the U.S. has seen growing investments in sterilization infrastructure across hospitals and outpatient surgical centers, with major players continuously innovating low-temperature and hydrogen peroxide-based sterilization technologies

- Globally, medical device sterilization is regarded as one of the foundational components of infection control strategies, ranking alongside personal protective equipment and disinfection systems, playing a vital role in maintaining sterile healthcare environments

Report Scope and Medical Device Sterilization Market Segmentation

|

Attributes |

Medical Device Sterilization Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Device Sterilization Market Trends

“Rising Adoption of Low-Temperature and Advanced Sterilization Technologies”

- One prominent trend in the global medical device sterilization market is the increasing adoption of low-temperature and advanced sterilization technologies

- These methods, including hydrogen peroxide gas plasma, vaporized hydrogen peroxide (VHP), and peracetic acid-based systems, are gaining traction due to their compatibility with heat-sensitive and complex medical instruments

- For instance, low-temperature sterilization enables the effective sterilization of delicate instruments such as endoscopes, robotic surgical tools, and plastic-based devices that cannot withstand traditional high-temperature methods such as autoclaving

- Automation and smart monitoring systems are being integrated into sterilization units, allowing for real-time data tracking, enhanced safety, and regulatory compliance

- This trend is transforming infection control practices in healthcare facilities, supporting improved operational efficiency, better equipment longevity, and increased safety for both patients and healthcare providers

Medical Device Sterilization Market Dynamics

Driver

“Rising Concern Over Hospital-Acquired Infections (HAIs)”

- The increasing concern over hospital-acquired infections (HAIs) is a major driver fueling the demand for medical device sterilization across healthcare facilities globally

- As HAIs pose a serious threat to patient safety, leading to prolonged hospital stays, additional medical costs, and higher morbidity and mortality rates

- As surgical volumes rise and more reusable medical devices are introduced, there is a growing need for effective sterilization processes that can eliminate all forms of microbial life, including bacteria, viruses, and spores.

- The Healthcare regulatory bodies, such as the CDC, FDA, and WHO, have implemented stringent sterilization standards and guidelines to ensure infection control, prompting hospitals and clinics to invest in advanced sterilization technologies

- The growing focus on patient safety and infection prevention, especially in high-risk environments such as operating rooms and ICUs, continues to accelerate the adoption of both traditional and modern sterilization methods

For instance,

- In March 2023, the CDC reported that approximately 1 in 31 hospital patients in the U.S. contracts at least one healthcare-associated infection each day, emphasizing the need for rigorous sterilization protocols

- In 2022, the World Health Organization (WHO) highlighted that 15% of hospitalized patients in low- and middle-income countries experience at least one HAI, driving global initiatives to improve sterilization and hygiene standards

- As awareness of the risks and costs associated with HAIs increases, the demand for reliable, efficient, and safe medical device sterilization methods continues to grow, making it a key driver for the global market

Opportunity

“Technological Advancements and Automation in Sterilization Processes”

- The integration of advanced technologies and automation in sterilization processes presents a significant opportunity to enhance efficiency, accuracy, and compliance in medical device sterilization

- Smart sterilization systems equipped with IoT sensors, AI-driven cycle tracking, and cloud-based monitoring can ensure consistent sterilization quality, reduce human error, and provide real-time operational insights for healthcare providers

- These innovations enable predictive maintenance, automatic cycle validation, and traceability, which are crucial for regulatory audits and improving infection control protocols

For instance,

- In September 2024, a report published by MedTech Dive highlighted the growing use of AI and machine learning in sterilization units to monitor sterilization parameters and automatically adjust settings for optimal outcomes. This not only improves patient safety but also enhances workflow efficiency in hospitals

- In December 2023, according to an article by HealthTech Magazine, several hospitals adopted RFID-enabled sterilization trays and AI-integrated sterilizers to track instruments throughout the sterilization cycle, significantly reducing instances of improper sterilization and associated infection risks

- The shift toward automated and intelligent sterilization solutions is revolutionizing infection prevention strategies, allowing healthcare institutions to scale operations, ensure compliance, and deliver safer care with reduced manual intervention

Restraint/Challenge

“High Capital Investment and Maintenance Costs”

- The high cost associated with purchasing, installing, and maintaining advanced sterilization equipment presents a major challenge for the medical device sterilization market, particularly in cost-sensitive and developing healthcare settings

- Modern sterilization systems, especially low-temperature and automated units, can require significant capital investment, often ranging from tens to hundreds of thousands of dollars, depending on capacity and technology

- These financial constraints limit access for small hospitals, clinics, and outpatient facilities, forcing them to rely on basic sterilization methods or third-party services, which can compromise efficiency and infection control

For instance,

- In October 2023, according to a report by Healthcare Purchasing News, many rural and smaller healthcare centers in Latin America and Southeast Asia cited budget limitations as a key barrier to upgrading to advanced sterilization systems, affecting their ability to meet global sterilization standards

- In June 2024, an article published by the Association for the Advancement of Medical Instrumentation (AAMI) emphasized that beyond initial purchase costs, the expenses related to system calibration, validation, and routine maintenance create ongoing financial pressure for healthcare providers

- Consequently, the high upfront and operational costs of modern sterilization solutions can slow market penetration, widen the gap in infection control capabilities across regions, and challenge the widespread adoption of best-in-class sterilization practices

Medical Device Sterilization Market Scope

The market is segmented on the basis of product, technology, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Technology |

|

|

By End User |

|

|

By Distribution Channel

|

|

Medical Device Sterilization Market Regional Analysis

“North America is the Dominant Region in the Medical Device Sterilization Market”

- North America dominates the medical device sterilization market, supported by its advanced healthcare infrastructure, strict regulatory frameworks, and widespread adoption of innovative sterilization technologies

- U.S. accounts for a major share due to the high volume of surgical procedures, increased focus on infection prevention, and presence of well-established players offering a wide range of sterilization solutions

- The supportive reimbursement systems and strong emphasis on healthcare quality and patient safety further drive the demand for high-end sterilization technologies in the region

- In addition, the region benefits from continuous Research and Development investments and the early adoption of emerging technologies such as hydrogen peroxide plasma, low-temperature sterilization, and automated tracking systems, enhancing operational efficiency and compliance

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to register the highest growth rate in the medical device sterilization market, driven by increasing healthcare investments, rising surgical volumes, and growing awareness of hospital-acquired infection prevention

- Countries such as China, India, and South Korea are witnessing significant growth due to their expanding healthcare infrastructure, growing middle-class populations, and increasing demand for high-quality medical services

- India and China, in particular, are experiencing rising demand for sterilization solutions in both public and private healthcare settings, as efforts to standardize infection control protocols gain momentum

- The influx of international medical device manufacturers, coupled with local government initiatives promoting better healthcare hygiene and safety standards, is further accelerating market growth across the region.

Medical Device Sterilization Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- STERIS (Ireland)

- Getinge (Sweden)

- 3M (U.S.)

- Sotera Health Company (U.S.)

- Fortive (U.S.)

- Cardinal Health (U.S.)

- Metall Zug AG (Switzerland)

- Stryker (U.S.)

- Merck KGaA (Germany)

- MMM Group (Germany)

- ANTONIO MATACHANA, S. A. (Spain)

- Tuttnauer (The Netherlands)

- Andersen Sterilizers (U.S.)

- Steelco S.p.A. (Italy)

- Noxilizer, Inc. (U.S.)

- DE LAMA S.P.A. (Italy)

- Cosmed Group (U.S.)

- C.B.M. S.r.l. Medical Equipment (Italy)

- E-BEAM Services, Inc. (U.S.)

- Shinva Medical Instrument Co., Ltd. (China)

Latest Developments in Global Medical Device Sterilization Market

- In November 2024, Cosmed Group Inc., a sterilization company, filed for Chapter 11 bankruptcy protection in Houston, Texas, following lawsuits alleging injuries, including cancer, caused by inhalation of ethylene oxide, a carcinogenic gas used in sterilization. The company faced at least 300 lawsuits, including two class actions, jeopardizing its continued operation

- In August 2024, Mudanjiang Plasma Physics Application Technology Co., Ltd. achieved CE certification for its hydrogen peroxide agent used in low-temperature plasma sterilizers. This certification marks a significant advancement in sterilization technology, offering an effective and environmentally friendly alternative to traditional method

- In April 2024, Ecolab announced the sale of its global surgical solutions unit to Medline for USD 950 million, aiming to enhance its focus on core healthcare services

- In March 2024, the U.S. Environmental Protection Agency (EPA) implemented new rules to reduce emissions of ethylene oxide (EtO) by 90%, addressing its carcinogenic risks associated with medical device sterilization

- In 2024, Sterile State LLC unveiled a breakthrough sterilization method utilizing nitric oxide, offering an environmentally friendly alternative to traditional EtO sterilization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of Global medical device sterilization market

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- MULTIVARIATE MODELLING

- PRODUCT LIFELINE CURVE

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- market END USER coverage grid

- vendor share analysis

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- Global Medical Device Sterilization Market: regulations

- REGULATIONS IN THE U.S.:

- REGULATIONS IN EUROPE

- REGULATIONS IN CHINA

- REGULATIONS IN INDIA

- Relevant Acts for the Framework:

- Market Overview

- drivers

- escalation in number of Surgeries

- INCREASE IN prevalence of CHRONIC DISEASES

- INCREASE IN NUMBER OF PRODUCT APPROVALS AND LAUNCHES

- RisE IN geriatric population

- Restraints

- High cost associated with sterilization products

- product recall

- Disadvantages associated with sterilization technologies

- OPPORTUNITIES

- RisE IN healthcare expenditure

- high prevalence Hospital-acquired infections (HAI’s)

- Strategic Initiatives by Key market players

- IncreasE IN usage of sterilizers in emerging market

- CHALLENGEs

- stringent Regulatory frameworks for product approval

- lack of accessibility of medical devices and sterilizers

- IMPACT OF COVID-19 ON THE GLOBAL MEDICAL DEVICE STERILIZATION MARKET

- IMPACT ON PRICE

- IMPACT ON SUPPLY

- IMPACT ON DEMAND

- STRATEGIC DECISIONS BY MANUFACTURERS

- CONCLUSION

- Global medical device sterilization market, By product

- overview

- Instruments

- thermal sterilizers

- HIGH TEMPERATURE STERILIZERS

- LOW TEMPERATURE STERILIZERS

- ionizing radiation sterilizers

- filtration sterilizers

- chemical & gas sterilization

- Reagents

- sterilization indicators

- CHEMICAL INDICATORS

- BIOLOGICAL INDICATORS

- POUCHES

- DETERGENTS

- LUBRICANTS

- ACCESSORIES

- Services

- STEAM STERILIZATION SERVICES

- GAMMA STERILIZATION SERVICES

- ETHYLENE OXIDE STERILIZATION SERVICES

- OTHERS

- Global medical device sterilization market, By TECHNOLOGY

- overview

- thermal sterilization

- AUTOCLAVE

- DISTILLATION

- PASTEURIZATION

- RETORTING

- OTHERS

- ionizing radiation sterilization

- E-BEAM RADIATION STERILIZATION

- GAMMA RADIATION STERILIZATION

- OTHERS

- FILTRATION STERILIZATION

- chemical & Gas sterilization

- ETHYLENE OXIDE STERILIZATION

- FORMALDEHYDE RADIATION STERILIZATION

- HYDROGEN PEROXIDE GAS PLASMA

- PERACETIC ACID STERILIZATION

- CHLORINE DIOXIDE STERILIZATION

- OTHERS

- Global medical device sterilization market, By END USER

- overview

- hospitals

- clinics

- laboratories

- medical device manufacturers

- academic and research institutes

- pharmaceutical companies

- Global medical device sterilization market, By distribution channel

- overview

- direct sales

- retail sales

- third party distributors

- GLOBAL Medical Device Sterilization MARKET, by REGION

- overview

- north america

- U.S.

- Canada

- MEXICO

- Europe

- Germany

- France

- U.K.

- Belgium

- Italy

- Spain

- Russia

- Turkey

- Netherlands

- Switzerland

- Rest of Europe

- Asia-Pacific

- China

- India

- JAPAN

- South Korea

- Australia

- Singapore

- Thailand

- Malaysia

- Indonesia

- Philippines

- Rest of Asia-Pacific

- Middle East and Africa

- South Africa

- Saudi Arabia

- U.A.E.

- Egypt

- Israel

- Rest of Middle East and Africa

- South America

- Brazil

- Argentina

- Rest of South America

- Global medical device sterilization market: COMPANY landscape

- company share analysis: Global

- company share analysis: North America

- company share analysis: Europe

- company share analysis: Asia-Pacific

- swot analysis

- Company profile

- Steris

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- 3m

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Merck kgaa

- COMPANY SNAPSHOT

- ReVENUE analysis

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Getinge AB

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Cardinal Health

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- ASP

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Belimed ag

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- BIObase Biodusty (Shandong), Co., Ltd.

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- dentsply sirona

- COMPANY SNAPSHot

- REVENUE ANALYSIS

- product Portfolio

- RECENT DEVELOPMENT

- matachana group

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- MELAG Medizintechnik GmbH & Co. KG

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTs

- Midmark Corporation

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- MMM Group

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTs

- Sartorius AG

- COMPANY SNAPSHOT

- ReVENUE analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTs

- SciCan, Inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Steelco s.p.a.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTs

- Sterigenics U.S., LLC (a subsidiary of Sotera Health Company)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTs

- SYSTEC GMBH

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- tuttnauer

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- W&H Dentalwerk Bürmoos GmbH

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTs

- questionnaire

- related reports

List of Table

TABLE 1 NUMBER OF PEOPLE WITH DIABETES (MILLION) AMONG AGES 20–79 YEARS

TABLE 2 AVERAGE COST RANGE OF SURGERIES IN INDIA (USD)

TABLE 3 Global medical device sterilization market, By product, 2019-2028 (USD million)

TABLE 4 Global INSTRUMENTS IN Medical Device Sterilization Market, By Region, 2019-2028 (USD Million)

TABLE 5 Global INSTRUMENTS IN Medical Device Sterilization Market, By PRODUCT, 2019-2028 (USD Million)

TABLE 6 Global Thermal Sterilizers in Medical Device Sterilization Market, By Product, 2019-2028 (USD Million)

TABLE 7 Global Reagents in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 8 global Reagents in Medical Device Sterilization Market, By Product, 2019-2028 (USD Million)

TABLE 9 global Sterilization Indicators in Medical Device Sterilization Market, By Product, 2019-2028 (USD Million)

TABLE 10 Global Services in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 11 global Services in Medical Device Sterilization Market, By Product, 2019-2028 (USD Million)

TABLE 12 global Medical Device Sterilization Market, By Technology, 2019-2028 (USD Million)

TABLE 13 Global Thermal Sterilization in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 14 global Thermal Sterilization in Medical Device Sterilization Market, By Technology, 2019-2028 (USD Million)

TABLE 15 Global ionizing radiation Sterilization in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 16 global Ionizing Radiation Sterilization in Medical Device Sterilization Market, By Technology, 2019-2028 (USD Million)

TABLE 17 Global Filtration Sterilization in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 18 Global Chemical & Gas Sterilization in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 19 global Chemical & Gas Sterilization in Medical Device Sterilization Market, By Technology, 2019-2028 (USD Million)

TABLE 20 global Medical Device Sterilization Market, By End User, 2019-2028 (USD Million)

TABLE 21 Global Hospitals in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 22 Global Clinics in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 23 Global Laboratories in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 24 Global Medical Device Manufactures in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 25 Global Academic and Research Institutes in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 26 Global Pharmaceutical Companies in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 27 global Medical Device Sterilization Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 28 Global Direct sales in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 29 Global Retail Sales in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 30 Global Third Party Distributions in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 31 GLOBAL medical device sterilization market, BY REGION, 2019-2028 (USD MILLION)

TABLE 32 North America MEDICAL DEVICE Sterilization Market, By country, 2019-2028 (USD Million)

TABLE 33 North America medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 34 North America Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 35 North America Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 36 North America Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 37 North America Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 38 North America Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 39 North America medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 40 North America Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 41 North America Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 42 North America Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 43 North America medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 44 North America medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 45 U.S. medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 46 U.S. Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 47 U.S. Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 48 U.S. Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 49 U.S. Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 50 U.S. Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 51 U.S. medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 52 U.S. Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 53 U.S. Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 54 U.S. Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 55 U.S. medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 56 U.S. medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 57 Canada medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 58 Canada Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 59 Canada Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 60 Canada Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 61 Canada Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 62 Canada Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 63 Canada medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 64 Canada Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 65 Canada Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 66 Canada Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 67 Canada medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 68 Canada medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 69 MEXICO medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 70 MEXICO Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 71 MEXICO Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 72 MEXICO Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 73 MEXICO Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 74 MEXICO Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 75 MEXICO medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 76 MEXICO Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 77 MEXICO Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 78 MEXICO Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 79 MEXICO medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 80 MEXICO medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 81 EUROPE MEDICAL DEVICE Sterilization Market, By country, 2019-2028 (USD Million)

TABLE 82 Europe medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 83 Europe Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 84 Europe Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 85 Europe Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 86 Europe Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 87 Europe Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 88 Europe medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 89 Europe Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 90 Europe Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 91 Europe Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 92 Europe medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 93 Europe medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 94 Germany medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 95 Germany Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 96 Germany Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 97 Germany Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 98 Germany Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 99 Germany Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 100 Germany medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 101 Germany Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 102 Germany Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 103 Germany Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 104 Germany medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 105 Germany medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 106 France medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 107 France Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 108 France Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 109 France Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 110 France Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 111 France Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 112 France medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 113 France Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 114 France Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 115 France Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 116 France medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 117 France medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 118 U.K. medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 119 U.K. Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 120 U.K. Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 121 U.K. Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 122 U.K. Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 123 U.K. Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 124 U.K. medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 125 U.K. Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 126 U.K. Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 127 U.K. Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 128 U.K. medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 129 U.K. medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 130 Belgium medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 131 Belgium Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 132 Belgium Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 133 Belgium Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 134 Belgium Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 135 Belgium Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 136 Belgium medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 137 Belgium Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 138 Belgium Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 139 Belgium Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 140 Belgium medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 141 Belgium medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 142 Italy medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 143 Italy Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 144 Italy Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 145 Italy Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 146 Italy Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 147 Italy Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 148 Italy medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 149 Italy Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 150 Italy Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 151 Italy Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 152 Italy medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 153 Italy medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 154 Spain medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 155 Spain Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 156 Spain Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 157 Spain Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 158 Spain Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 159 Spain Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 160 Spain medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 161 Spain Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 162 Spain Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 163 Spain Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 164 Spain medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 165 Spain medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 166 Russia medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 167 Russia Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 168 Russia Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 169 Russia Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 170 Russia Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 171 Russia Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 172 Russia medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 173 Russia Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 174 Russia Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 175 Russia Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 176 Russia medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 177 Russia medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 178 Turkey medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 179 Turkey Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 180 Turkey Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 181 Turkey Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 182 Turkey Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 183 Turkey Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 184 Turkey medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 185 Turkey Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 186 Turkey Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 187 Turkey Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 188 Turkey medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 189 Turkey medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 190 Netherlands medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 191 Netherland Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 192 Netherlands Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 193 Netherlands Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 194 Netherlands Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 195 Netherlands Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 196 Netherlands medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 197 Netherlands Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 198 Netherlands Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 199 Netherlands Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 200 Netherlands medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 201 Netherlands medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 202 Switzerland medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 203 Switzerland Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 204 Switzerland Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 205 Switzerland Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 206 Switzerland Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 207 Switzerland Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 208 Switzerland medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 209 Switzerland Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 210 Switzerland Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 211 Switzerland Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 212 Switzerland medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 213 Switzerland medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 214 Rest of Europe medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 215 Asia-Pacific MEDICAL DEVICE Sterilization Market, By country 2019-2028 (USD Million)

TABLE 216 Asia-Pacific medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 217 Asia-Pacific Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 218 Asia-Pacific Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 219 Asia-Pacific Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 220 Asia-Pacific Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 221 Asia-Pacific Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 222 Asia-Pacific medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 223 Asia-Pacific Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 224 Asia-Pacific Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 225 Asia-Pacific Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 226 Asia-Pacific medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 227 Asia-Pacific medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 228 China medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 229 China Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 230 China Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 231 China Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 232 China Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 233 China Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 234 China medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 235 China Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 236 China Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 237 China Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 238 China medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 239 China medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 240 India medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 241 India Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 242 India Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 243 India Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 244 India Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 245 India Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 246 India medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 247 India Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 248 India Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 249 India Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 250 India medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 251 India medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 252 JAPAN medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 253 JAPAN Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 254 JAPAN Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 255 JAPAN Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 256 JAPAN Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 257 JAPAN Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 258 JAPAN medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 259 JAPAN Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 260 JAPAN Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 261 JAPAN Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 262 JAPAN medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 263 JAPAN medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 264 South Korea medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 265 South Korea Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 266 South Korea Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 267 South Korea Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 268 South Korea Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 269 South Korea Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 270 South Korea medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 271 South Korea Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 272 South Korea Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 273 South Korea Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 274 South Korea medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 275 South Korea medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 276 Australia medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 277 Australia Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 278 Australia Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 279 Australia Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 280 Australia Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 281 Australia Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 282 Australia medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 283 Australia Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 284 Australia Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 285 Australia Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 286 Australia medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 287 Australia medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 288 Singapore medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 289 Singapore Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 290 Singapore Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 291 Singapore Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 292 Singapore Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 293 Singapore Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 294 Singapore medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 295 Singapore Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 296 Singapore Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 297 Singapore Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 298 Singapore medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 299 Singapore medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 300 Thailand medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 301 Thailand Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 302 Thailand Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 303 Thailand Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 304 Thailand Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 305 Thailand Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 306 Thailand medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 307 Thailand Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 308 Thailand Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 309 Thailand Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 310 Thailand medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 311 Thailand medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 312 Malaysia medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 313 Malaysia Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 314 Malaysia Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 315 Malaysia Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 316 Malaysia Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 317 Malaysia Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 318 Malaysia medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 319 Malaysia Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 320 Malaysia Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 321 Malaysia Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 322 Malaysia medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 323 Malaysia medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 324 Indonesia medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 325 Indonesia Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 326 Indonesia Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 327 Indonesia Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 328 Indonesia Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 329 Indonesia Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 330 Indonesia medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 331 Indonesia Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 332 Indonesia Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 333 Indonesia Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 334 Indonesia medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 335 Indonesia medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 336 Philippines medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 337 Philippines Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 338 Philippines Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 339 Philippines Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 340 Philippines Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 341 Philippines Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 342 Philippines medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 343 Philippines Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 344 Philippines Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 345 Philippines Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 346 Philippines medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 347 Philippines medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 348 Rest of Asia-Pacific medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 349 MIDDLE EAST AND AFRICA MEDICAL DEVICE Sterilization Market, By country, 2019-2028 (USD Million)

TABLE 350 Middle East and Africa medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 351 Middle East and Africa Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 352 Middle East and Africa Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 353 Middle East and Africa Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 354 Middle East and Africa Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 355 Middle East and Africa Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 356 Middle East and Africa medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 357 Middle East and Africa Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 358 Middle East and Africa Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 359 Middle East and Africa Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 360 Middle East and Africa medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 361 Middle East and Africa medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 362 South Africa medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 363 South Africa Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 364 South Africa Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 365 South Africa Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 366 South Africa Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 367 South Africa Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 368 South Africa medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 369 South Africa Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 370 South Africa Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 371 South Africa Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 372 South Africa medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 373 South Africa medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 374 Saudi Arabia medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 375 Saudi Arabia Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 376 Saudi Arabia Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 377 Saudi Arabia Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 378 Saudi Arabia Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 379 Saudi Arabia Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 380 Saudi Arabia medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 381 Saudi Arabia Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 382 Saudi Arabia Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 383 Saudi Arabia Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 384 Saudi Arabia medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 385 Saudi Arabia medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 386 U.A.E. medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 387 U.A.E. Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 388 U.A.E. Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 389 U.A.E. Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 390 U.A.E. Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 391 U.A.E. Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 392 U.A.E. medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 393 U.A.E. Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 394 U.A.E. Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 395 U.A.E. Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 396 U.A.E. medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 397 U.A.E. medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 398 Egypt medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 399 Egypt Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 400 Egypt Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 401 Egypt Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 402 Egypt Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 403 Egypt Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 404 Egypt medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 405 Egypt Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 406 Egypt Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 407 Egypt Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 408 Egypt medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 409 Egypt medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 410 Israel medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 411 Israel Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 412 Israel Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 413 Israel Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 414 Israel Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 415 Israel Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 416 Israel medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 417 Israel Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 418 Israel Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 419 Israel Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 420 Israel medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 421 Israel medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 422 Rest of Middle East and Africa medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 423 SOUTH AMERICA MEDICAL DEVICE Sterilization Market, By country, 2019-2028 (USD Million)

TABLE 424 South America medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 425 South America Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 426 South America Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 427 South America Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 428 South America Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 429 South America Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 430 South America medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 431 South America Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 432 South America Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 433 South America Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 434 South America medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 435 South America medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 436 Brazil medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 437 Brazil Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 438 Brazil Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 439 Brazil Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 440 Brazil Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 441 Brazil Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 442 Brazil medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 443 Brazil Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 444 Brazil Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 445 Brazil Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 446 Brazil medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 447 Brazil medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 448 Argentina medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 449 Argentina Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 450 Argentina Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 451 Argentina Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 452 Argentina Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 453 Argentina Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 454 Argentina medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 455 Argentina Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 456 Argentina Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 457 Argentina Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 458 Argentina medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 459 Argentina medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 460 Rest of South America medical device sterilization market, By Product, 2019-2028 (USD Million)

List of Figure

FIGURE 1 Global medical device sterilization market: segmentation

FIGURE 2 Global medical device sterilization market: data triangulation

FIGURE 3 Global medical device sterilization market: DROC ANALYSIS

FIGURE 4 Global medical device sterilization market : global vs REGIONAL MARKET ANALYSIS

FIGURE 5 Global medical device sterilization market : COMPANY RESEARCH ANALYSIS

FIGURE 6 Global medical device sterilization market: INTERVIEW DEMOGRAPHICS

FIGURE 7 Global medical device sterilization market: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL medical device sterilization MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 Global medical device sterilization market: vendor share analysis

FIGURE 10 Global medical device sterilization market: SEGMENTATION

FIGURE 11 ESCALATION IN NUMBER OF SURGERIES is expected to drive THE Global medical device sterilization market IN THE FORECAST PERIOD of 2021 to 2028

FIGURE 12 instruments segment is expected to account for the largest share of the Global medical device sterilization market in 2021 & 2028

FIGURE 13 nORTH AMERICA is expected to DOMINATE the gLOBAL medical device sterilization market and ASIA-PACIFIC is EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 asia-pacific is the fastest growing market for medical device sterilization manufacturers in the forecast period of 2021 to 2028

FIGURE 15 DRivers, Restraints OPPORTUNITIES, AND CHALLENGEs OF the Global medical device sterilization market

FIGURE 16 AGING POPULATION In the world (in million)

FIGURE 17 Global medical device sterilization market: By product, 2020

FIGURE 18 Global medical device sterilization market: By product, 2019-2028 (USD million)

FIGURE 19 Global medical device sterilization market: By product, CAGR (2021-2028)

FIGURE 20 Global medical device sterilization market: By product, LIFELINE CURVE

FIGURE 21 Global medical device sterilization market: By technology, 2020

FIGURE 22 Global medical device sterilization market: By technology, 2019-2028 (USD million)

FIGURE 23 Global medical device sterilization market: By technology, CAGR (2021-2028)

FIGURE 24 Global medical device sterilization market: By technology, LIFELINE CURVE

FIGURE 25 Global medical device sterilization market: BY END USER, 2020

FIGURE 26 Global medical device sterilization market: BY END USER, 2019-2028 (USD million)

FIGURE 27 Global medical device sterilization market: BY END USER, CAGR (2021-2028)

FIGURE 28 Global medical device sterilization market: BY END USER, LIFELINE CURVE

FIGURE 29 Global medical device sterilization market: BY DISTRIBUTION CHANNEL, 2020

FIGURE 30 Global medical device sterilization market: BY DISTRIBUTION CHANNEL, 2019-2028 (USD million)

FIGURE 31 Global medical device sterilization market: BY DISTRIBUTION CHANNEL, CAGR (2021-2028)

FIGURE 32 Global medical device sterilization market: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 33 GLOBAL medical device sterilization market: SNAPSHOT (2020)

FIGURE 34 GLOBAL medical device sterilization market: BY region (2020)

FIGURE 35 GLOBAL medical device sterilization market: BY region (2021 & 2028)

FIGURE 36 GLOBAL medical device sterilization market: BY region (2020 & 2028)

FIGURE 37 GLOBAL medical device sterilization market: BY PRODUCT (2021-2028)

FIGURE 38 North America medical device sterilization market: SNAPSHOT (2020)

FIGURE 39 North America medical device sterilization market: BY COUNTRY (2020)

FIGURE 40 North America medical device sterilization market: BY COUNTRY (2021 & 2028)

FIGURE 41 North America medical device sterilization market: BY COUNTRY (2020 & 2028)

FIGURE 42 North America medical device sterilization market: BY PRODUCT (2021-2028)

FIGURE 43 Europe medical device sterilization market: SNAPSHOT (2020)

FIGURE 44 Europe medical device sterilization market: BY COUNTRY (2020)

FIGURE 45 Europe medical device sterilization market: BY COUNTRY (2021 & 2028)

FIGURE 46 Europe medical device sterilization market: BY COUNTRY (2020 & 2028)

FIGURE 47 Europe medical device sterilization market: BY PRODUCT (2021-2028)

FIGURE 48 Asia-Pacific medical device sterilization market: SNAPSHOT (2020)

FIGURE 49 Asia-Pacific medical device sterilization market: BY COUNTRY (2020)