Global Medical Device Warehouse And Logistics Market

Market Size in USD Billion

CAGR :

%

USD

43.03 Billion

USD

62.13 Billion

2024

2032

USD

43.03 Billion

USD

62.13 Billion

2024

2032

| 2025 –2032 | |

| USD 43.03 Billion | |

| USD 62.13 Billion | |

|

|

|

|

Medical Device Warehouse and Logistics Market Size

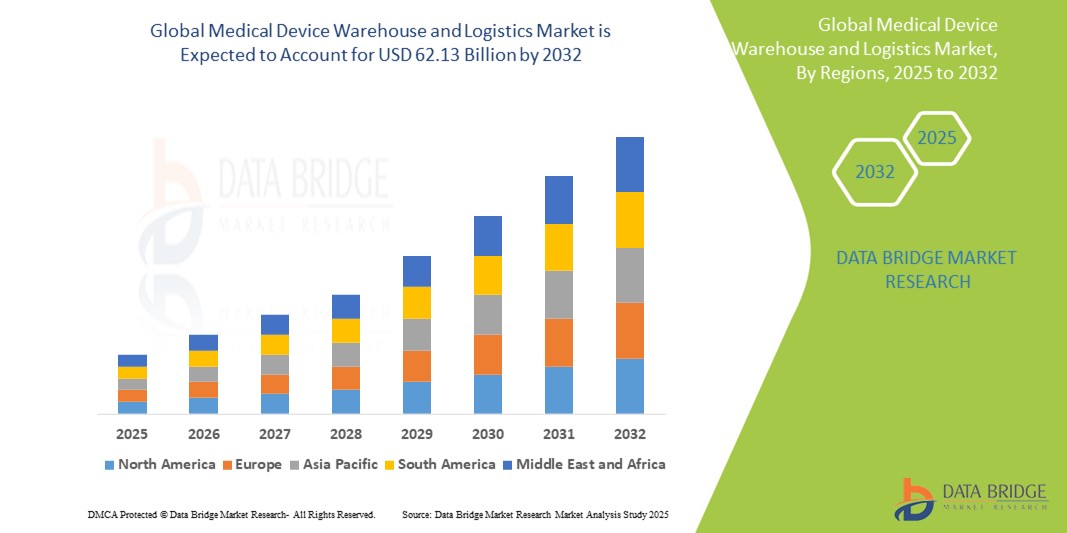

- The global medical device warehouse and logistics market was valued at USD 43.03 billion in 2024 and is expected to reach USD 62.13 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.70%, primarily driven by rising demand for medical devices

- This growth is driven by factors such as aging population, growing chronic diseases, and home healthcare expansion

Medical Device Warehouse and Logistics Market Analysis

- The medical device warehouse and logistics market involves the efficient storage, handling, and transportation of temperature-sensitive and high-value medical devices using advanced logistics and tracking technologies

- Market growth is driven by the rising demand for medical devices, growing home healthcare needs, increased chronic disease prevalence, and the need for timely, secure deliveries

- The market is evolving with innovations in cold chain logistics, real-time inventory tracking, automated warehousing, and AI-powered supply chain optimization

- For instance, companies such as DHL and UPS Healthcare are enhancing their medical logistics capabilities by investing in temperature-controlled storage, IoT-enabled tracking systems, and specialized medical device distribution networks

- The medical device warehouse and logistics market is projected to grow substantially, fueled by expanding healthcare infrastructure, digital supply chain transformation, and regulatory compliance for device safety and traceability

Report Scope and Medical Device Warehouse and Logistics Market Segmentation

|

Attributes |

Medical Device Warehouse and Logistics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Medical Device Warehouse and Logistics Market Trends

“Rising Technological Advancements in Medical Technology”

- One prominent trend in the global medical device warehouse and logistics market is the rising technological advancements in medical technology

- This trend is driven by the increasing need to handle complex, high-value, and sensitive devices that require precise storage conditions, real-time monitoring, and streamlined distribution

- For instance, companies such as FedEx and Cardinal Health are adopting IoT-enabled tracking, automated cold chain solutions, and AI-driven logistics systems to ensure the safe and efficient delivery of advanced medical devices

- The shift toward miniaturized, connected, and personalized medical devices is pushing logistics providers to adopt more agile, tech-enabled operations

- As the medical technology landscape evolves, the demand for smarter, adaptive logistics systems will continue to grow, making technology integration a key trend shaping the future of this market

Medical Device Warehouse and Logistics Market Dynamics

Driver

“Increasing Spending on Healthcare Infrastructure”

- The rise in spending on healthcare infrastructure is a key driver of growth in the medical device warehouse and logistics market

- As healthcare systems expand globally, there is an increasing demand for efficient logistics solutions to manage and distribute medical devices effectively

- This shift is particularly noticeable in emerging economies where new hospitals, clinics, and medical centers are being established, driving the need for specialized storage and transportation systems for medical devices

- With growing expectations for timely deliveries, regulatory compliance, and temperature-sensitive logistics, healthcare providers are adopting advanced warehouse and logistics solutions to ensure safe and efficient distribution

- The integration of automation, real-time monitoring, and cold chain logistics is transforming the storage and transportation processes within the medical device supply chain

For instance,

- XPO Logistics is expanding its healthcare-specific services, investing in advanced warehouse management systems and temperature-sensitive logistics to meet regulatory standards and improve delivery efficiency

- FedEx has launched dedicated healthcare logistics solutions, offering custom storage and transportation options tailored to the unique needs of medical device suppliers and healthcare providers

- As investment in healthcare infrastructure continues to rise, it is expected to remain a key driver, fueling the growth of the medical device warehouse and logistics market.

Opportunity

“Adoption of Advanced Technologies in Logistics Management”

- The integration of advanced technologies presents a significant opportunity in the medical device warehouse and logistics market. Technologies such as IoT, AI, automation, and blockchain can enhance the efficiency, security, and transparency of logistics operations, especially for high-value and temperature-sensitive medical devices

- These technologies enable real-time tracking, predictive maintenance, and intelligent route optimization, improving the management of medical devices throughout the supply chain and ensuring timely and safe delivery

- AI and machine learning also enable predictive analytics to optimize inventory management, forecast demand, and reduce waste, while blockchain ensures tamper-proof tracking and greater traceability for compliance with regulatory standards

For instance,

- Companies such as IBM and Maersk are incorporating blockchain technology into their logistics systems to improve the traceability and security of medical device shipments, ensuring compliance with healthcare regulations and enhancing supply chain transparency

- Siemens and Honeywell are utilizing IoT solutions and automation in healthcare logistics, enabling real-time monitoring and improved management of temperature-sensitive medical devices

- As these advanced technologies continue to evolve, their adoption in the medical device warehouse and logistics market is expected to accelerate, offering enhanced security, efficiency, and operational transparency, driving significant market growth

Restraint/Challenge

“Complex Regulatory Requirements for Logistics Providers”

- Complex regulatory requirements present a significant challenge in the medical device warehouse and logistics market. Logistics providers must navigate a range of stringent regulations concerning the storage, handling, and transportation of medical devices, which can vary by region and device type

- Challenges such as ever-changing regulations, compliance with safety standards, and the need for specialized documentation and reporting can slow down the logistics process, increasing operational costs and complicating supply chain management

- This issue is particularly critical in markets with strict regulatory frameworks, such as the EU and the U.S., where non-compliance can result in fines, product recalls, or reputational damage

For instance,

- World Courier faces the challenge of meeting strict regulatory standards for handling temperature-sensitive medical devices, requiring constant updates to their compliance protocols and documentation systems

- Without clear processes, continuous monitoring of regulatory changes, and effective compliance management systems, logistics providers in the medical device market may face delays, penalties, and operational inefficiencies, hindering the growth potential of the market

Medical Device Warehouse and Logistics Market Scope

The market is segmented on the basis of offerings, temperature, mode of transportation, application, end use, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Offerings |

|

|

By Temperature |

|

|

By Mode of Transportation |

|

|

By Application

|

|

|

By End Use |

|

|

By Distribution Channel |

|

Medical Device Warehouse and Logistics Market Regional Analysis

“North America is the Dominant Region in the Medical Device Warehouse and Logistics Market”

- North America dominates the medical device warehouse and logistics market, driven by the growing demand for medical devices from hospitals and clinics, as well as the increased use of diagnostic devices

- U.S. holds a significant share due to its well-established healthcare infrastructure, advanced medical technology, and high levels of investment in healthcare services

- With the rise in healthcare spending and ongoing demand for timely delivery of medical devices, companies in North America continue to innovate, integrating advanced technologies such as IoT, AI, and robotics into their logistics operations to enhance efficiency, track devices in real time, and improve patient outcomes

- As North America maintains its leadership in medical innovation and regulatory standards, the region is expected to remain the dominant player in the medical device warehouse and logistics market through the forecast period of 2025 to 2032

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth rate in the medical device warehouse and logistics market, driven by rapid technological advancements, industrialization, and increasing adoption of modern logistics solutions across the healthcare sector

- Countries such as China, India, Japan, and South Korea are leading the regional growth, with significant government investments in healthcare infrastructure and a strong push towards digital transformation in medical logistics

- The rising demand for healthcare services, coupled with the rapid expansion of hospitals, clinics, and diagnostic centers, is fueling the need for advanced warehouse and logistics solutions to handle the growing volume of medical devices in emerging markets such as Vietnam, Indonesia, and Thailand

- With its dynamic healthcare market, ongoing technological advancements, and increasing investments in smart logistics and automation, Asia-Pacific is poised to be the fastest-growing region in the medical device warehouse and logistics market through 2032

Medical Device Warehouse and Logistics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- FedEx (U.S.)

- United Parcel Service of America, Inc.(U.S.)

- AWL India Private Limited (India)

- C.H. Robinson Worldwide, Inc. (U.S.)

- Kuehne+Nagel (Switzerland)

- Crown LSP Group (U.S.)

- DSV (Denmark)

- FM Logistic (France)

- Hellmann Worldwide Logistics SE & Co. KG (Germany)

- Imperial (South Africa)

- Movianto (Netherlands)

- Murphy Logistics (U.S.)

- OIA Global (U.S.)

- Omni Logistics, LLC (U.S.)

- Rhenus Logistics SE & Co. KG (Germany)

- SEKO Logistics (U.S.)

- TIBA (Spain)

- Toll Holdings Limited (Australia)

- WA Solutions (U.S.)

- XPO, Inc. (U.S.)

Latest Developments in Global Medical Device Warehouse and Logistics Market

- In September 2024, Kuehne+Nagel, a leading logistics provider, has opened a new temperature-controlled fulfillment center for Medtronic in Milton, Ontario, just 50 km from Toronto. Spanning 25,000 sqm, the facility will distribute medical devices to hospitals and houses Medtronic's service, repair, and preventative maintenance centers for its equipment

- In September 2024, FedEx launched the fdx platform, a data-driven commerce solution now available to U.S. businesses. The platform leverages FedEx's network to enhance customer experiences by improving demand growth, conversion rates, and fulfillment optimization. Notable features include predictive delivery estimates, sustainability insights, branded order tracking, and simplified return processes. Raj Subramaniam, FedEx CEO, highlighted the platform's role in smarter supply chains during the Dreamforce 2024 event

- In March 2024, UPS Healthcare introduced UPS Supply Chain Symphony R, a cloud-based platform designed to integrate and manage healthcare supply chain data from various operational systems. This tool provides healthcare customers with full visibility of their logistics, empowering them to make informed decisions, improve planning, and accurately forecast. By enhancing control, efficiency, and transparency, this platform supports the critical need for streamlined supply chains in healthcare. Kate Gutmann emphasized its transformative potential in optimizing global operations and patient care

- In November 2023, DHL Express officially opened its expanded Central Asia Hub in Hong Kong, investing EUR 562 million to enhance its capabilities amid growing global trade. The hub, crucial for connecting Asia with the world, increased its peak shipment handling capacity by nearly 70% and can now manage six times the volume since its inception in 2004. This expansion underscores DHL's commitment to supporting customers’ growth and solidifying Hong Kong's status as a key international aviation hub

- In December 2022, DHL Supply Chain announced a USD 10.93 million investment to expand its warehousing capabilities in Northern Taiwan, particularly focusing on the semiconductor and life sciences and healthcare sectors. The newly opened Taoyuan Distribution Center-Jian Guo adds 10,000 square meters to DHL's total warehousing space in Taoyuan, increasing it to 37,000 square meters. This facility enhances connectivity for efficient logistics operations and supports the company's goal of reaching 200,000 square meters of total footprint in Taiwan by 2027

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.