Global Medical Grade Cyanoacrylate Adhesive Formulations Market

Market Size in USD Million

CAGR :

%

USD

280.00 Million

USD

759.78 Million

2024

2032

USD

280.00 Million

USD

759.78 Million

2024

2032

| 2025 –2032 | |

| USD 280.00 Million | |

| USD 759.78 Million | |

|

|

|

|

Medical-Grade Cyanoacrylate Adhesive Formulations Market Size

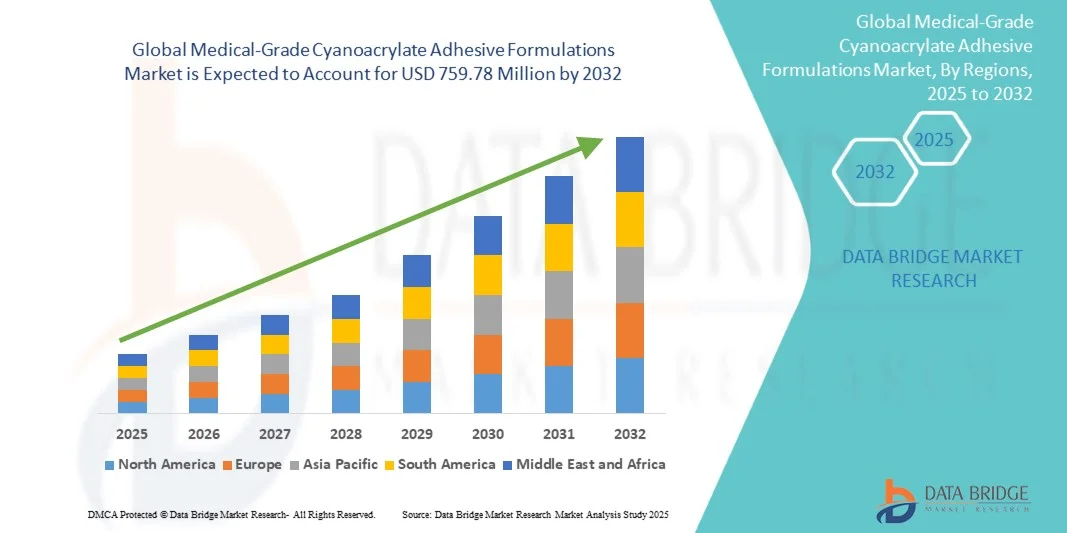

- The global medical-grade cyanoacrylate adhesive formulations market size was valued at USD 280 million in 2024 and is expected to reach USD 759.78 million by 2032, at a CAGR of 13.29% during the forecast period

- The market growth is largely fueled by the increasing demand for minimally invasive surgical procedures and advanced wound closure techniques, driving the adoption of medical-grade cyanoacrylate adhesive formulations

- Furthermore, rising use of these adhesives in hospitals, clinics, and ambulatory surgical centers for faster healing, reduced infection risk, and improved cosmetic outcomes is accelerating the uptake of medical-grade cyanoacrylate adhesive formulations solutions, thereby significantly boosting the industry’s growth

Medical-Grade Cyanoacrylate Adhesive Formulations Market Analysis

- Medical-Grade Cyanoacrylate Adhesive Formulations, known for their rapid bonding and high strength, are increasingly utilized in surgical procedures, wound closure, and medical device assembly due to their biocompatibility, precision, and ease of application

- The rising demand for these adhesives is primarily driven by advancements in minimally invasive surgeries, increasing use of medical devices, and a growing focus on faster and infection-free wound closure solutions

- North America dominated the medical-grade cyanoacrylate adhesive formulations market with the largest revenue share of 44.3% in 2024, attributed to the presence of major adhesive manufacturers, advanced healthcare infrastructure, and high adoption of innovative surgical techniques. The U.S. in particular witnessed substantial growth due to increased use in outpatient surgeries, dental applications, and medical device manufacturing, supported by strong R&D activities and regulatory approvals for new formulations

- Asia-Pacific is expected to be the fastest-growing region in the medical-grade cyanoacrylate adhesive formulations market during the forecast period, driven by rising healthcare expenditures, rapid urbanization, expanding hospital infrastructure, and increasing awareness among healthcare professionals about advanced adhesive technologies

- The Butyl Cyanoacrylate segment dominated the medical-grade cyanoacrylate adhesive formulations market with the largest market revenue share of 39.4% in 2024, owing to its strong tissue bonding capabilities, rapid polymerization, and widespread use in wound closure and minor surgical procedures

Report Scope and Medical-Grade Cyanoacrylate Adhesive Formulations Market Segmentation

|

Attributes |

Medical-Grade Cyanoacrylate Adhesive Formulations Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical-Grade Cyanoacrylate Adhesive Formulations Market Trends

“Rising Adoption in Healthcare and Surgical Applications”

- A significant and accelerating trend in the global medical-grade cyanoacrylate adhesive formulations market is the increasing adoption of these adhesives in various healthcare and surgical applications, including wound closure, tissue repair, and minimally invasive procedures

- Medical-grade cyanoacrylate adhesives are gaining preference due to their rapid polymerization, high bond strength, biocompatibility, and reduced need for sutures or staples, making procedures faster and less invasive

- For instance: In March 2022, B. Braun Medical launched an advanced tissue adhesive formulation designed for both internal and external wound closure, highlighting the trend of enhanced biocompatible adhesives in clinical practice

- The development of advanced formulations with enhanced antimicrobial properties and improved flexibility is driving their use across diverse medical applications

- This trend toward adopting high-performance cyanoacrylate adhesives is reshaping expectations for wound management and surgical closure procedures globally

- Growing awareness of minimally invasive techniques and hospital initiatives for faster patient recovery are further propelling market growth

Medical-Grade Cyanoacrylate Adhesive Formulations Market Dynamics

Driver

“Growing Demand in Surgical, Dental, and Tissue Engineering Applications”

- The increasing prevalence of surgical procedures, rising geriatric population, and demand for faster wound healing are key drivers for the medical-grade cyanoacrylate adhesive formulations market

- For instance: In April 2024, Histoacryl by B. Braun expanded its product line with a low-viscosity adhesive for ophthalmic surgeries, reflecting the market’s focus on patient safety and procedural efficiency

- These adhesives offer advantages such as reduced scarring, infection control, and decreased procedural time, providing significant benefits over traditional closure methods

- Furthermore, expanding use in dental applications, ophthalmology, and tissue engineering is boosting adoption across healthcare facilities

- The convenience of ready-to-use formulations and improved shelf life, combined with strong clinical acceptance, continues to support the adoption of medical-grade cyanoacrylate adhesives in hospitals, specialty clinics, and research facilities

- Increasing collaboration between adhesive manufacturers and medical institutions to develop customized solutions for specific clinical applications is also fueling market growth

Restraint/Challenge

“Concerns Regarding Cytotoxicity and Regulatory Compliance”

- Potential cytotoxicity, allergic reactions, and sensitivity in certain patients pose significant challenges for widespread adoption of medical-grade cyanoacrylate adhesives

- For Instance: In September 2023, the U.S. FDA issued safety recommendations for certain tissue adhesives, warning about improper use and cytotoxicity risks, demonstrating regulatory challenges in the market

- Strict regulatory requirements and the need for extensive clinical validation can delay product approvals, particularly in highly regulated markets such as North America and Europe

- High costs of advanced formulations compared to conventional closure methods can also act as a barrier, particularly in price-sensitive regions or smaller clinics

- Addressing these challenges through rigorous safety testing, transparent regulatory approvals, and development of cost-effective, low-toxicity adhesives is crucial for sustained market expansion

- Overcoming these limitations will enable broader clinical adoption and reinforce confidence in medical-grade cyanoacrylate adhesive solutions

Medical-Grade Cyanoacrylate Adhesive Formulations Market Scope

The market is segmented on the basis of type, application, and end-user.

• By Type

On the basis of type, the medical-grade cyanoacrylate adhesive formulations market is segmented into Butyl Cyanoacrylate, Octyl Cyanoacrylate, and Others. The Butyl Cyanoacrylate segment dominated the largest market revenue share of 39.4% in 2024, owing to its strong tissue bonding capabilities, rapid polymerization, and widespread use in wound closure and minor surgical procedures. Its compatibility with various biological tissues, proven safety profile, and cost-effectiveness make it a preferred choice among surgeons and healthcare facilities. The segment also benefits from extensive clinical experience, regulatory approvals, and established manufacturing processes, which reinforce its leadership position globally. In addition, its versatility across different medical applications, including dental procedures, vascular access closure, and suture replacement, further drives its adoption in hospitals and clinics.

The Octyl Cyanoacrylate segment is expected to witness the fastest CAGR of 10.6% from 2025 to 2032, driven by increasing demand for longer-lasting, flexible adhesives in delicate surgeries and aesthetic procedures. Its superior elasticity, lower tissue irritation, and enhanced cosmetic outcomes are fueling its adoption in pediatric care, outpatient surgeries, and minimally invasive procedures. Growing awareness among surgeons about advanced wound closure solutions, coupled with rising surgical volumes and investments in healthcare infrastructure, supports rapid growth. Market players are also introducing innovative octyl formulations with improved bonding strength, ease of application, and packaging designs, which further accelerates uptake.

• By Application

On the basis of application, the medical-grade cyanoacrylate adhesive formulations market is segmented into Wound Closure, Surgical Procedures, Drug Delivery, and Others. The Wound Closure segment held the largest market revenue share of 41.7% in 2024, driven by the increasing need for rapid, infection-free closure techniques in emergency care, surgical settings, and outpatient treatments. The segment benefits from growing incidences of injuries, chronic wounds, and surgical interventions worldwide. Hospitals and clinics prefer cyanoacrylate adhesives over traditional sutures for their ease of use, reduced procedure time, minimal scarring, and lower risk of infection. Rising awareness among healthcare professionals and patients regarding advanced wound management solutions further supports its dominance.

The Surgical Procedures segment is anticipated to witness the fastest CAGR of 11.2% from 2025 to 2032, propelled by the rising adoption of minimally invasive and aesthetic surgeries. Cyanoacrylate adhesives provide precise, blood-free, and fast bonding, making them ideal for ophthalmic, plastic, and laparoscopic surgeries. Increasing investment in advanced surgical technologies, surgeon training programs, and awareness campaigns about sutureless techniques contribute to the rapid growth of this segment. In addition, the segment benefits from expanding ambulatory surgical centers and outpatient procedures across developed and emerging markets.

• By End-User

On the basis of end-user, the medical-grade cyanoacrylate adhesive formulations market is segmented into Hospitals, Clinics, Ambulatory Surgical Centers, and Others. The Hospitals segment dominated the largest market revenue share of 45.2% in 2024, attributed to high patient inflow, complex surgical procedures, and procurement of large volumes of adhesive formulations for diverse medical applications. Hospitals leverage these adhesives for wound closure, surgical interventions, and device assembly, supported by regulatory compliance, standardized protocols, and skilled staff. Efficient supply chains and consistent product availability further strengthen hospital dominance.

The Ambulatory Surgical Centers segment is expected to witness the fastest CAGR of 10.9% from 2025 to 2032, driven by the increasing shift toward outpatient surgeries, minimally invasive procedures, and cost-effective care delivery. The segment benefits from shorter procedure times, reduced hospital stays, and convenience for patients, encouraging the adoption of cyanoacrylate adhesives. Expansion of ambulatory centers in urban and semi-urban regions, along with rising awareness of advanced wound closure techniques, further fuels rapid growth in this segment. In addition, growing investments in modern surgical infrastructure and the integration of advanced adhesive technologies for enhanced safety and precision are contributing to its expansion.

Medical-Grade Cyanoacrylate Adhesive Formulations Market Regional Analysis

- North America dominated the medical-grade cyanoacrylate adhesive formulations market with the largest revenue share of 44.3% in 2024, attributed to the presence of major adhesive manufacturers, advanced healthcare infrastructure, and high adoption of innovative surgical techniques

- The region continues to benefit from strong clinical demand for wound closure products and the ongoing shift toward minimally invasive procedure

- Moreover, collaborations between research institutions and adhesive manufacturers have accelerated innovation in tissue engineering and surgical care. For instance, in February 2024, Ethicon (Johnson & Johnson) introduced an enhanced tissue adhesive solution for surgical wound management, strengthening its presence in the North American market

U.S. Medical-Grade Cyanoacrylate Adhesive Formulations Market Insight

The U.S. medical-grade cyanoacrylate adhesive formulations market captured the largest revenue share in 2024 within North America, fueled by increased utilization in outpatient surgeries, dental applications, and medical device assembly. The nation’s advanced healthcare infrastructure and robust regulatory support for new product approvals significantly contribute to market expansion. In addition, continuous R&D investments by leading players such as 3M, B. Braun, and Advanced Medical Solutions have led to the development of bio-compatible formulations suitable for internal tissue bonding and wound management. In October 2023, the U.S. FDA approved a novel cyanoacrylate-based adhesive developed for ophthalmic use, marking a key milestone for the country’s growing medical adhesive industry.

Europe Medical-Grade Cyanoacrylate Adhesive Formulations Market Insight

The Europe medical-grade cyanoacrylate adhesive formulations market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing focus on advanced wound care management, stringent product quality standards, and regulatory emphasis on patient safety. European healthcare systems are witnessing greater integration of tissue adhesive products into routine surgical procedures as alternatives to sutures and staples. Furthermore, initiatives promoting reduced hospital stays and faster recovery are accelerating product adoption. In June 2023, B. Braun Medical GmbH expanded its adhesive production capacity in Germany to meet growing European demand, underscoring the region’s leadership in high-quality medical-grade adhesives.

U.K. Medical-Grade Cyanoacrylate Adhesive Formulations Market Insight

The U.K. medical-grade cyanoacrylate adhesive formulations market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the adoption of advanced wound management solutions and growing surgical volumes in both public and private healthcare sectors. The U.K. National Health Service (NHS) has been increasingly emphasizing the use of non-invasive wound closure systems to improve surgical efficiency and patient comfort. In April 2024, a major hospital group in London implemented cyanoacrylate-based adhesives in emergency care procedures to reduce infection risk and recovery time, reflecting the growing institutional acceptance of these products.

Germany Medical-Grade Cyanoacrylate Adhesive Formulations Market Insight

The Germany medical-grade cyanoacrylate adhesive formulations market is expected to expand at a considerable CAGR during the forecast period, fueled by strong clinical adoption and a focus on sustainability in medical material development. Germany’s healthcare ecosystem supports innovation through collaborations between academic institutions and manufacturers focusing on bioabsorbable adhesive formulations. In March 2023, a German research consortium initiated a project to develop eco-friendly medical-grade cyanoacrylate adhesives with reduced cytotoxicity and improved biodegradability, aligning with the nation’s commitment to sustainable healthcare technology.

Asia-Pacific Medical-Grade Cyanoacrylate Adhesive Formulations Market Insight

The Asia-Pacific medical-grade cyanoacrylate adhesive formulations market is poised to grow at the fastest CAGR of 9.6% during the forecast period of 2025 to 2032, driven by rising healthcare expenditures, rapid urbanization, expanding hospital infrastructure, and growing awareness about advanced wound closure systems. The increasing volume of surgical and dental procedures in countries such as China, India, and Japan is fostering high product demand. In addition, local production initiatives and government healthcare modernization programs are improving access to advanced adhesives. For example, in August 2023, Toagosei Co., Ltd. (Japan) introduced a next-generation cyanoacrylate formulation designed for ophthalmic surgeries, demonstrating APAC’s growing innovation capacity.

Japan Medical-Grade Cyanoacrylate Adhesive Formulations Market Insight

The Japan medical-grade cyanoacrylate adhesive formulations market is gaining momentum due to its technologically advanced healthcare system, rising surgical volumes, and preference for quick, effective wound healing solutions. The nation’s focus on precision medicine and minimally invasive surgery supports the demand for medical-grade adhesives in complex procedures. In May 2024, a collaboration between Terumo Corporation and a Tokyo-based university hospital led to the clinical evaluation of an improved cyanoacrylate adhesive for vascular surgery, signaling continued innovation within the Japanese market.

China Medical-Grade Cyanoacrylate Adhesive Formulations Market Insight

The China medical-grade cyanoacrylate adhesive formulations market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding healthcare infrastructure, growing patient population, and rising preference for cost-effective, advanced surgical adhesives. China’s strong domestic manufacturing base and increasing focus on medical device exports are further accelerating adoption. In December 2023, Beijing Compont Medical Devices Co., Ltd. launched a new medical-grade cyanoacrylate adhesive for tissue repair applications, supporting the country’s leadership position in the regional market.

Medical-Grade Cyanoacrylate Adhesive Formulations Market Share

The Medical-Grade Cyanoacrylate Adhesive Formulations industry is primarily led by well-established companies, including:

- Johnson & Johnson and is affiliates (U.S.)

- B. Braun SE (Germany)

- 3M (U.S.)

- Adhezion Biomedical LLC (U.S.)

- Hollister Incorporated (U.S.)

- Cryolife, Inc. (U.S.)

- Cardinal Health, Inc. (U.S.)

- BVI (U.K.)

- Leukos Biotech, S. L. (U.S.)

- Smith + Nephew (U.K.)

- Alliqua (U.S.)

- HemoSonics, LLC. (U.S.)

- AxioMed LLC. (U.S.)

- H.B. Fuller Medical Adhesive Technologies, LLC (U.S.)

- Dexterity Medical & Transport Services Pte. Ltd (Singapore)

Latest Developments in Medical-Grade Cyanoacrylate Adhesive Formulations Market

- In May 2021, the U.S. Food and Drug Administration (FDA) published a comprehensive technical review of cyanoacrylate materials used in medical devices, focusing on their performance, toxicity profile, and regulatory aspects. The review included detailed clinical evidence on n-butyl and 2-octyl cyanoacrylates, outlining testing requirements for wound closure, embolization, and surgical applications. This development provided manufacturers with clearer regulatory guidance, improving the safety and consistency of medical-grade cyanoacrylate adhesive formulations in clinical use

- In August 2023, a multicenter clinical study published in the Journal of Clinical Medicine demonstrated the safe use of N-butyl cyanoacrylate (Glubran 2) as an anastomotic sealant in minimally invasive colorectal surgeries. The study analyzed 103 patient cases and reported no adhesive-related inflammatory complications and only a single anastomotic leak (0.9%), establishing strong safety credentials for internal surgical applications. The findings encouraged broader research into cyanoacrylate-based sealants in gastrointestinal and laparoscopic procedures

- In January 2024, StatPearls updated its clinical guidance for 2-octyl cyanoacrylate, commonly marketed under the Dermabond family. The update incorporated new insights on advanced high-viscosity formulations, mesh-integrated closure systems, and management of hypersensitivity reactions. It also provided refreshed recommendations for appropriate surgical applications, ensuring improved patient safety and clinician adherence to best practices in wound closure

- In April 2024, an increase in post-market surveillance reports in the FDA’s MAUDE database highlighted rare cases of allergic contact dermatitis and blistering following the use of Dermabond Prineo and similar mesh-based cyanoacrylate closure systems. These cases raised awareness among clinicians regarding potential skin reactions, prompting hospitals and manufacturers to reinforce patient screening and product labeling to mitigate risks

- In August 2024, Resivant Medical announced FDA 510(k) clearance for its CUTIVA Topical Skin Adhesive and CUTIVA PLUS Skin Closure System, featuring a high-viscosity 2-octyl cyanoacrylate formulation with integrated mesh technology. The launch positioned the company as a new competitor in the advanced wound closure market, offering improved application precision, faster curing times, and enhanced biocompatibility for surgical incisions and traumatic wounds. This clearance reinforced innovation trends within the medical-grade cyanoacrylate adhesive formulations market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.