Global Medical Laser Systems Market

Market Size in USD Billion

CAGR :

%

USD

4.83 Billion

USD

7.28 Billion

2024

2032

USD

4.83 Billion

USD

7.28 Billion

2024

2032

| 2025 –2032 | |

| USD 4.83 Billion | |

| USD 7.28 Billion | |

|

|

|

|

Medical Laser Systems Market Size

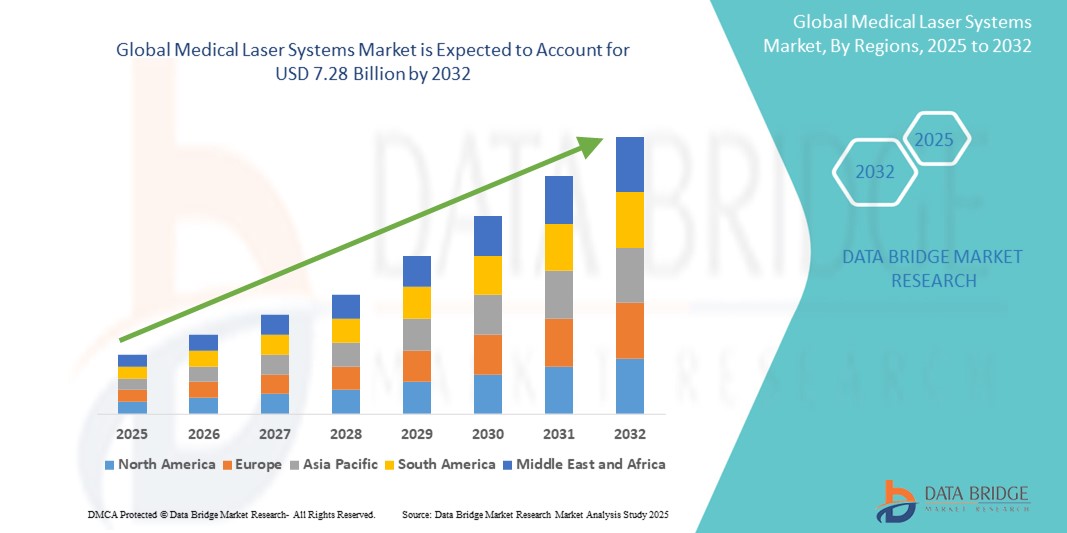

- The global medical laser systems market was valued at USD 4.83 billion in 2024 and is expected to reach USD 7.28 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.25%, primarily driven by the rising demand for minimally invasive procedures and technological advancements in laser-based treatments

- This growth is driven by factors such as the increasing prevalence of chronic diseases, growing adoption of aesthetic laser procedures, and expanding applications of medical lasers across ophthalmology, dermatology, and oncology

Medical Laser Systems Market Analysis

- Medical laser systems are vital tools in modern healthcare, offering precise, minimally invasive treatment options across various specialties, including dermatology, ophthalmology, urology, and oncology. They are widely used in procedures such as laser eye surgery, tattoo and scar removal, and tumor ablation

- The market growth is significantly driven by the increasing demand for cosmetic and aesthetic procedures, rising prevalence of chronic diseases, and the growing preference for outpatient laser surgeries due to shorter recovery times

- North America dominates the global medical laser systems market, supported by its advanced healthcare infrastructure and high adoption rates of cutting-edge laser technologies

- For instance, the U.S. leads in laser-based dermatological and ophthalmic procedures, with significant investments in laser innovations and outpatient surgery centers

- Globally, medical laser systems are considered a core component of modern surgical and diagnostic toolkits, ranking among the top choices for clinicians seeking precision, reduced patient trauma, and enhanced treatment outcomes

Report Scope and Medical Laser Systems Market Segmentation

|

Attributes |

Medical Laser Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Laser Systems Market Trends

“Rising Demand for Aesthetic and Non-Invasive Laser Procedures”

- One prominent trend in the global medical laser systems market is the rising demand for aesthetic and non-invasive laser procedures

- These procedures, including laser hair removal, skin resurfacing, tattoo removal, and body contouring, are increasingly favored for their minimal downtime, safety, and quick results

- For instance, fractional CO₂ lasers and diode lasers are widely used in dermatology clinics for skin rejuvenation and hair removal, attracting a broad demographic seeking cosmetic enhancements without surgery

- The social media influence and growing focus on personal appearance are encouraging younger populations to opt for laser-based aesthetic treatments

- This trend is transforming the medical laser landscape, prompting manufacturers to innovate portable, user-friendly, and cost-effective laser systems, thereby expanding their reach across dermatology clinics, medspas, and outpatient centers worldwide

Medical Laser Systems Market Dynamics

Driver

“Increasing Demand for Minimally Invasive Procedures”

- The growing preference for minimally invasive procedures is significantly driving the demand for medical laser systems across multiple medical specialties, including dermatology, ophthalmology, and urology

- Patients increasingly seek treatments that offer reduced recovery times, less pain, and minimal scarring, making laser-based treatments a preferred option over traditional surgery

- Laser eye surgeries such as LASIK for vision correction and laser treatments for kidney stones and prostate conditions are in high demand due to their precision and shorter recovery periods compared to conventional surgery

- The medical lasers provide highly accurate and controlled procedures, enabling surgeons to perform complex surgeries with improved outcomes and lower risk of complications

- As the global healthcare landscape shifts toward more patient-centric, non-invasive treatment options, the adoption of medical laser systems continues to rise

For instance,

- In February 2023, a study published in The Lancet highlighted the growing demand for LASIK and other laser vision correction surgeries, with an annual growth rate of 5-7% in North America. This highlights the increasing patient preference for laser-based eye surgeries

- In January 2022, the World Health Organization (WHO) reported an increase in the use of laser-based treatments for benign prostatic hyperplasia (BPH), reflecting the broader trend of non-invasive treatments in urology

- As a result the increasing demand for minimally invasive and precise procedures is a key driver for the growth of the global medical laser systems market

Opportunity

“Advancing Treatments with Artificial Intelligence Integration”

- The integration of Artificial Intelligence (AI) into medical laser systems offers significant opportunities for enhancing treatment precision, improving patient outcomes, and automating routine tasks

- AI can optimize laser treatments by analyzing real-time patient data, offering personalized treatment plans, and predicting the most effective laser settings for individual patients

- In addition, AI algorithms can also assist in monitoring patient responses during laser treatments, adjusting parameters dynamically to ensure optimal results and minimize potential complication

- AI-powered systems can analyze large datasets, enabling more accurate diagnoses and early detection of medical conditions, such as skin cancer, retinal diseases, or tumors, through laser-based imaging techniques

For instance,

- In March 2024, a study published in Medical Imaging highlighted the use of AI to improve the accuracy of laser-based diagnostic tools, such as in the detection of skin lesions using laser scanners. AI algorithms could identify potential malignancies with greater precision than traditional methods

- In December 2023, a clinical trial published in The Journal of Laser Therapy demonstrated how AI-powered laser systems in ophthalmology were able to optimize laser settings during retinal treatments, enhancing the effectiveness of therapies for diabetic retinopathy and macular degeneration

- The integration of AI in medical laser systems holds the potential to revolutionize treatment approaches, leading to more effective and personalized care while optimizing operational efficiency

Restraint/Challenge

“High Equipment Costs Hindering Market Penetration”

- The high cost of medical laser systems remains a significant barrier for widespread adoption, especially in developing regions and smaller healthcare facilities.

- These advanced laser systems, which are critical for precise treatments in fields such as dermatology, ophthalmology, and oncology, can cost hundreds of thousands of dollars, making them unaffordable for many clinics and hospitals, particularly those with limited budgets

- The financial burden of acquiring and maintaining medical laser systems, along with the need for specialized training, restricts the ability of healthcare facilities to invest in these technologies, leading to reliance on outdated equipment

- Smaller and rural healthcare providers, in particular, may struggle to justify the investment, even as the demand for laser treatments continues to rise

For instance,

- In January 2025, an article published by Medical Equipment News highlighted that the high costs of laser systems for dermatological and aesthetic procedures often limit access to these treatments, especially in lower-income regions. This pricing issue has been identified as a key barrier to the global growth of the medical laser systems market

- In October 2023, a study by the National Institute for Health Research reported that healthcare facilities in emerging economies face significant challenges in acquiring advanced medical laser systems, affecting their ability to provide cutting-edge treatments and resulting in disparities in healthcare quality

- Consequently, these financial barriers limit access to advanced laser technologies, creating challenges for market penetration and hindering the growth of the global medical laser systems market

Medical Laser Systems Market Scope

The market is segmented on the basis of product and application.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

Medical Laser Systems Market Regional Analysis

“North America is the Dominant Region in the Medical Laser Systems Market”

- North America leads the global medical laser systems market, fueled by a robust healthcare infrastructure, high demand for minimally invasive procedures, and the widespread adoption of advanced laser technologies

- U.S. represents the largest market share due to the rising prevalence of chronic conditions such as skin disorders, eye diseases, and cancer, which require laser-based interventions

- The well-structured reimbursement systems, a high concentration of top-tier medical laser manufacturers, and continuous innovation in aesthetic and therapeutic laser applications bolster regional growth

- In addition, the popularity of cosmetic procedures and outpatient laser treatments, supported by a growing number of specialized clinics and trained professionals, significantly drives the market forward

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to exhibit the highest growth in the medical laser systems market, driven by a surge in medical tourism, increasing disposable incomes, and expanding access to advanced healthcare services

- Countries such as China, India, and South Korea are key contributors, with a rapidly growing demand for cosmetic laser treatments, laser-assisted surgeries, and diagnostic applications

- India and China, in particular, are seeing increased adoption of laser systems in both public and private healthcare sectors, supported by government initiatives to modernize hospitals and expand surgical capabilities

- South Korea, known for its strong cosmetic industry and innovation in dermatological treatments, continues to drive the demand for aesthetic laser systems, contributing to regional growth

- The presence of local manufacturers and growing collaborations with global laser technology companies further accelerate the market’s expansion in the Asia-Pacific region.

Medical Laser Systems Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Boston Scientific Corporation (U.S.)

- AngioDynamics (U.S.)

- Candela Corporation (U.S.)

- Koninklijke Philips N.V., (Netherlands)

- Stryker (U.S.)

- IRIDEX Corporation (U.S.)

- Lumenis Be Ltd. (Israel)

- Artivion, Inc (U.S.)

- Bausch + Lomb (U.S.)

- BIOLASE, Inc. (U.S.)

- Alcon (Switzerland)

- American Medical Systems (U.S.)

- www.photomedex.com (U.S.)

- Novadaq Technologies, Inc. (Canada)

- Fujikura Ltd. (Japan)

- LASOS Lasertechnik GmbH (Germany)

- Modu-Laser (U.S.)

- El.En. S.p.A. (Italy)

- LUMIBIRD (France)

- Fotona (Slovenia)

- Cynosure, LLC (U.S.)

- Alma Lasers (Israel)

- Carl Zeiss AG (Germany)

- Jenoptik AG (Germany)

Latest Developments in Global Medical Laser Systems Market

- In February 2025, Lumenis introduced NuEra Tight, a non-invasive radiofrequency (RF) platform featuring FocalRF technology. This system offers customizable treatments for fat reduction, skin tightening, cellulite, and wrinkle reduction by utilizing multiple RF frequencies to control energy penetration depth.The device includes NuAPIC (Automatic Personalized Intelligent Control) for maintaining therapeutic temperatures and NuLogic for advanced protocol customization.

- In February 2024, Cutera announced the international limited commercial release of AviClear, the first FDA-cleared energy-based device for the treatment of mild to severe acne. AviClear uses a 1726 nm wavelength to selectively target and suppress sebaceous glands, reducing acne without the need for prescription medications

- In November 2024, Alma Lasers expanded its Harmony XL PRO platform, a multi-application aesthetic system that offers over 65 clinical indications, including treatments for vascular and pigmented lesions, acne, and skin rejuvenation. The platform includes modules such as ClearLift and Dye-VL, providing practitioners with versatile tools for various skin conditions

- In May 2023 – BIOLASE received FDA clearance for its Waterlase iPlus all-tissue laser system for use in orthopedic and podiatric surgeries.This marks the first non-dental clearance for the Waterlase iPlus, expanding its applications beyond dentistry

- In May 2023, BIOLASE introduced the Waterlase Express, a compact and user-friendly all-tissue dental laser system designed to make laser dentistry more accessible. The system is approximately one-quarter the size, one-third the weight, and nearly half the U.S. retail price of the company's previous models.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MEDICAL LASER SYSTEMS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL MEDICAL LASER SYSTEMS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL MEDICAL LASER SYSTEMS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

5.3 IN-DEPTH ANALYSIS OF OPERATIONAL TECNIQUES, BY COUNTRY

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 COST ANALYSIS BREAKDOWN

8 TECHNONLOGY ROADMAP

9 INNOVATION TRACKER AND STRATEGIC ANALYSIS

9.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

9.1.1 JOINT VENTURES

9.1.2 MERGERS AND ACQUISITIONS

9.1.3 LICENSING AND PARTNERSHIP

9.1.4 TECHNOLOGY COLLABORATIONS

9.1.5 STRATEGIC DIVESTMENTS

9.2 NUMBER OF PRODUCTS IN DEVELOPMENT

9.3 STAGE OF DEVELOPMENT

9.4 TIMELINES AND MILESTONES

9.5 INNOVATION STRATEGIES AND METHODOLOGIES

9.6 RISK ASSESSMENT AND MITIGATION

9.7 FUTURE OUTLOOK

10 REGULATORY COMPLIANCE

10.1 REGULATORY AUTHORITIES

10.2 REGULATORY CLASSIFICATIONS

10.2.1 CLASS I

10.2.2 CLASS II

10.2.3 CLASS III

10.3 REGULATORY SUBMISSIONS

10.4 INTERNATIONAL HARMONIZATION

10.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

10.6 REGULATORY CHALLENGES AND STRATEGIES

11 REIMBURSEMENT FRAMEWORK

12 VALUE CHAIN ANALYSIS

13 HEALTHCARE ECONOMY

13.1 HEALTHCARE EXPENDITURE

13.2 CAPITAL EXPENDITURE

13.3 CAPEX TRENDS

13.4 CAPEX ALLOCATION

13.5 FUNDING SOURCES

13.6 INDUSTRY BENCHMARKS

13.7 GDP RATION IN OVERALL GDP

13.8 HEALTHCARE SYSTEM STRUCTURE

13.9 GOVERNMENT POLICIES

13.1 ECONOMIC DEVELOPMENT

14 GLOBAL MEDICAL LASER SYSTEMS MARKET, BY TYPE

14.1 OVERVIEW

14.2 THERAPEUTIC LASERS SYSTEMS

14.3 DIAGNOSTIC LASER SYSTEMS

14.4 COSMETIC/AESTHETIC LASERS SYSTEMS

15 GLOBAL MEDICAL LASER SYSTEMS MARKET, BY PRODUCTS

(NOTE: MARKET VALUE, VOLUME AND ASP ANALYSIS WOULD BE PROVIDED FOR ALL SEGMENTS AND SUB-SEGMENTS OF PRODUCT)

15.1 OVERVIEW

15.2 SOLID STATE (CRYSTAL) LASERS

15.2.1 BY TYPE

15.2.1.1. DIODE LASER

15.2.1.2. H OLMIUM

15.2.1.3. ND: YAG LASERS

15.2.1.4. GAAIAS LASER

15.2.1.5. ER:YAG LASER

15.2.1.6. HO:YAG LASER

15.2.1.7. THULIUM LASER

15.2.1.8. INGAASP LASER

15.2.1.9. OTHERS

15.2.2 BY WAVE LENGTH

15.2.2.1. 420 NM

15.2.2.2. 810 NM

15.2.2.3. 1200 NM

15.2.2.4. OTHERS

15.2.3 BY POWER

15.2.3.1. 60 W

15.2.3.2. 80W

15.2.3.3. OTHERS

15.2.4 OTHERS

15.3 GAS LASERS

15.3.1 BY TYPE

15.3.1.1. CO2 LASER

15.3.1.2. ARGON LASER

15.3.1.3. KRYPTON LASERS

15.3.1.4. HELIUM-NEON LASERS

15.3.1.5. EXCIMER LASERS

15.3.1.6. OTHERS

15.3.2 BY WAVELENGTH

15.3.2.1. 980 NM

15.3.2.2. 10600 NM

15.3.2.3. OTHERS

15.3.3 BY POWER

15.3.3.1. 10 W

15.3.3.2. 50 W

15.3.3.3. 70 W

15.3.3.4. OTHERS

15.3.4 OTHERS

15.4 FIBER LASER

15.4.1 BY TYPE

15.4.1.1. HO:YAG FIBER LASERS

15.4.1.2. THULIUM FIBER LASER

15.4.1.3. DIODE FIBRE LASER

15.4.1.4. HOLMIUM FIBER LASER

15.4.1.5. OTHERS

15.4.2 BY WAVELENGTH

15.4.2.1. 780 NM

15.4.2.2. 1080 NM

15.4.2.3. OTHERS

15.4.3 BY POWER

15.4.3.1. 30 W

15.4.3.2. 35 W

15.4.3.3. 140 W

15.4.3.4. OTHERS

15.4.4 OTHERS

15.5 DYE LASERS

15.6 OTHERS

16 GLOBAL MEDICAL LASER SYSTEMS MARKET, BY MODALITY

16.1 OVERVIEW

16.2 FIXED

16.2.1 TABLETOP

16.2.2 FLOOR STANDING

16.3 PORTABLE

16.3.1 TROLLY MOUNTED

16.3.2 HANDHELD

17 GLOBAL MEDICAL LASER SYSTEMS MARKET, BY PULSE DURATION

17.1 OVERVIEW

17.2 CONTINUOUS

17.3 NON-CONTINUES

17.3.1 MILLISECOND

17.3.2 MICROSECOND

17.3.3 NANOSECOND

17.3.4 OTHERS

18 GLOBAL MEDICAL LASER SYSTEMS MARKET, BY PRICE RANGE

18.1 OVERVIEW

18.2 STANDARD LASER SYSTEMS

18.3 PREMIUM LASER SYSTEMS

19 GLOBAL MEDICAL LASER SYSTEMS MARKET, BY LASER CLASS

19.1 OVERVIEW

19.2 CLASS 1

19.3 CLASS 2

19.4 CLASS 3

19.5 CLASS 4

19.6 OTHERS

20 GLOBAL MEDICAL LASER SYSTEMS MARKET, BY APPLICATION

20.1 OVERVIEW

20.2 DERMATOLOGY

20.2.1 SKIN RJUVENATION

20.2.2 EVEN OUT SKIN COLORING (PIGMENTATION)

20.2.3 TIGHTEN SKIN AND TO REMOVE LESIONS

20.2.4 OTHERS

20.3 OPHTHALMOLOGY

20.3.1 REFRACTIVE ERROR CORRECTION

20.3.2 CATARACT REMOVAL

20.3.3 GLAUCOMA TREATMENT

20.3.4 DIABETIC RETINOPATHY TREATMENT

20.3.5 OTHERS

20.4 GYNECOLOGY

20.4.1 TREATMENT OF CERVICAL EROSIONS

20.4.2 CERVICAL INTRAEPITHELIAL NEOPLASIA (CIN)

20.4.3 OTHERS

20.5 UROLOGY

20.5.1 PROSTATE PROCEDURES

20.5.2 LITHOTRIPSY

20.5.3 UROTHELIAL TUMOURS

20.5.4 LOWER URINARY TRACT STRICTURES INCISION

20.5.5 OTHERS

20.6 DENTISTRY

20.6.1 TOOTH DECAY

20.6.2 GUM DISEASE

20.6.3 BIOPSY OR LESION REMOVAL

20.6.4 OTHERS

20.7 CARDIOLOGY

20.7.1 LASER ANGIOPLASTY

20.7.2 LASER VASCULAR ANASTOMOSIS

20.7.3 TRANSMYOCARDIAL LASER REVASCULARIZATION FOR END-STAGE ISCHEMIC HEART DISEASES

20.7.4 OTHERS

20.8 OTHERS

21 GLOBAL MEDICAL LASER SYSTEMS MARKET, BY END USER

21.1 OVERVIEW

21.2 HOSPITALS

21.2.1 BY TYPE

21.2.1.1. PUBLIC

21.2.1.2. PRIVATE

21.2.2 BY LEVEL

21.2.2.1. TIER 1

21.2.2.2. TIER 2

21.2.2.3. TIER 3

21.3 SPECIALTY CLINICS

21.3.1 PUBLIC

21.3.2 PRIVATE

21.4 ACADEMIC AND RESEARCH INSTITUTE

21.4.1 PUBLIC

21.4.2 PRIVATE

21.5 MEDICAL SPAS

21.6 TRAUMA CENTRES

21.7 DERMATOLOGY CENTRES

21.8 AMBULATORY SURICAL CENTERS

21.9 OTHERS

22 GLOBAL MEDICAL LASER SYSTEMS MARKET, BY DISTRIBUTION CHANNEL

22.1 OVERVIEW

22.2 DIRECT TENDER

22.3 RETAIL SALES

22.3.1 ONLINE

22.3.1.1. COMPANY WEBSITE

22.3.1.2. E-COMMERCE PLATEFORM

22.3.1.3. OTHERS

22.3.2 OFFLINE

22.3.2.1. MEDICAL DEVICE SELLER

22.3.2.2. THIRD PARTY DISTRIBUTOR

22.3.2.3. OTHERS

22.4 OTHERS

23 GLOBAL MEDICAL LASER SYSTEMS MARKET, COMPANY LANDSCAPE

23.1 COMPANY SHARE ANALYSIS: GLOBAL

23.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

23.3 COMPANY SHARE ANALYSIS: EUROPE

23.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

23.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

23.6 MERGERS & ACQUISITIONS

23.7 NEW PRODUCT DEVELOPMENT & APPROVALS

23.8 EXPANSIONS

23.9 REGULATORY CHANGES

23.1 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

24 GLOBAL MEDICAL LASER SYSTEMS MARKET, BY GEOGRAPHY

24.1 GLOBAL MEDICAL LASER SYSTEMS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

24.1.1 NORTH AMERICA

24.1.1.1. U.S.

24.1.1.2. CANADA

24.1.1.3. MEXICO

24.1.2 EUROPE

24.1.2.1. GERMANY

24.1.2.2. FRANCE

24.1.2.3. U.K.

24.1.2.4. ITALY

24.1.2.5. SPAIN

24.1.2.6. RUSSIA

24.1.2.7. TURKEY

24.1.2.8. NETHERLANDS

24.1.2.9. SWITZERLAND

24.1.2.10. REST OF EUROPE

24.1.3 ASIA-PACIFIC

24.1.3.1. JAPAN

24.1.3.2. CHINA

24.1.3.3. SOUTH KOREA

24.1.3.4. INDIA

24.1.3.5. AUSTRALIA

24.1.3.6. SINGAPORE

24.1.3.7. THAILAND

24.1.3.8. MALAYSIA

24.1.3.9. INDONESIA

24.1.3.10. PHILIPPINES

24.1.3.11. REST OF ASIA-PACIFIC

24.1.4 SOUTH AMERICA

24.1.4.1. BRAZIL

24.1.4.2. ARGENTINA

24.1.4.3. REST OF SOUTH AMERICA

24.1.5 MIDDLE EAST AND AFRICA

24.1.5.1. SOUTH AFRICA

24.1.5.2. SAUDI ARABIA

24.1.5.3. UAE

24.1.5.4. EGYPT

24.1.5.5. ISRAEL

24.1.5.6. REST OF MIDDLE EAST AND AFRICA

24.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

25 GLOBAL MEDICAL LASER SYSTEMS MARKET, SWOT AND DBMR ANALYSIS

26 GLOBAL MEDICAL LASER SYSTEMS MARKET, COMPANY PROFILE

26.1 LUMENIS BE LTD.

26.1.1 COMPANY OVERVIEW

26.1.2 REVENUE ANALYSIS

26.1.3 GEOGRAPHIC PRESENCE

26.1.4 PRODUCT PORTFOLIO

26.1.5 RECENT DEVELOPMENTS

26.2 IRIDEX CORPORATION

26.2.1 COMPANY OVERVIEW

26.2.2 REVENUE ANALYSIS

26.2.3 GEOGRAPHIC PRESENCE

26.2.4 PRODUCT PORTFOLIO

26.2.5 RECENT DEVELOPMENTS

26.3 CARL ZEISS MEDITEC AG

26.3.1 COMPANY OVERVIEW

26.3.2 REVENUE ANALYSIS

26.3.3 GEOGRAPHIC PRESENCE

26.3.4 PRODUCT PORTFOLIO

26.3.5 RECENT DEVELOPMENTS

26.4 QUANTEL MEDICAL ELLEX

26.4.1 COMPANY OVERVIEW

26.4.2 REVENUE ANALYSIS

26.4.3 GEOGRAPHIC PRESENCE

26.4.4 PRODUCT PORTFOLIO

26.4.5 RECENT DEVELOPMENTS

26.5 TOPCON HEALTHCARE

26.5.1 COMPANY OVERVIEW

26.5.2 REVENUE ANALYSIS

26.5.3 GEOGRAPHIC PRESENCE

26.5.4 PRODUCT PORTFOLIO

26.5.5 RECENT DEVELOPMENTS

26.6 OD-OS

26.6.1 COMPANY OVERVIEW

26.6.2 REVENUE ANALYSIS

26.6.3 GEOGRAPHIC PRESENCE

26.6.4 PRODUCT PORTFOLIO

26.6.5 RECENT DEVELOPMENTS

26.7 NIDEK CO., LTD.

26.7.1 COMPANY OVERVIEW

26.7.2 REVENUE ANALYSIS

26.7.3 GEOGRAPHIC PRESENCE

26.7.4 PRODUCT PORTFOLIO

26.7.5 RECENT DEVELOPMENTS

26.8 MEDA CO., LTD.

26.8.1 COMPANY OVERVIEW

26.8.2 REVENUE ANALYSIS

26.8.3 GEOGRAPHIC PRESENCE

26.8.4 PRODUCT PORTFOLIO

26.8.5 RECENT DEVELOPMENTS

26.9 ALCON

26.9.1 COMPANY OVERVIEW

26.9.2 REVENUE ANALYSIS

26.9.3 GEOGRAPHIC PRESENCE

26.9.4 PRODUCT PORTFOLIO

26.9.5 RECENT DEVELOPMENTS

26.1 A.R.C. LASER GMBH

26.10.1 COMPANY OVERVIEW

26.10.2 REVENUE ANALYSIS

26.10.3 GEOGRAPHIC PRESENCE

26.10.4 PRODUCT PORTFOLIO

26.10.5 RECENT DEVELOPMENTS

26.11 HEIDELBERG ENGINEERING INC.

26.11.1 COMPANY OVERVIEW

26.11.2 REVENUE ANALYSIS

26.11.3 GEOGRAPHIC PRESENCE

26.11.4 PRODUCT PORTFOLIO

26.11.5 RECENT DEVELOPMENTS

26.12 LIGHTMED

26.12.1 COMPANY OVERVIEW

26.12.2 REVENUE ANALYSIS

26.12.3 GEOGRAPHIC PRESENCE

26.12.4 PRODUCT PORTFOLIO

26.12.5 RECENT DEVELOPMENTS

26.13 LUMIBIRD MEDICAL

26.13.1 COMPANY OVERVIEW

26.13.2 REVENUE ANALYSIS

26.13.3 GEOGRAPHIC PRESENCE

26.13.4 PRODUCT PORTFOLIO

26.13.5 RECENT DEVELOPMENTS

26.14 NORLASE

26.14.1 COMPANY OVERVIEW

26.14.2 REVENUE ANALYSIS

26.14.3 GEOGRAPHIC PRESENCE

26.14.4 PRODUCT PORTFOLIO

26.14.5 RECENT DEVELOPMENTS

26.15 AEON MEDITEC

26.15.1 COMPANY OVERVIEW

26.15.2 REVENUE ANALYSIS

26.15.3 GEOGRAPHIC PRESENCE

26.15.4 PRODUCT PORTFOLIO

26.15.5 RECENT DEVELOPMENTS

26.16 SIMOVISION BV (A HILCO VISION COMPANY)

26.16.1 COMPANY OVERVIEW

26.16.2 REVENUE ANALYSIS

26.16.3 GEOGRAPHIC PRESENCE

26.16.4 PRODUCT PORTFOLIO

26.16.5 RECENT DEVELOPMENTS

26.17 COHERENT CORP.

26.17.1 COMPANY OVERVIEW

26.17.2 REVENUE ANALYSIS

26.17.3 GEOGRAPHIC PRESENCE

26.17.4 PRODUCT PORTFOLIO

26.17.5 RECENT DEVELOPMENTS

26.18 MODULIGHT CORPORATION

26.18.1 COMPANY OVERVIEW

26.18.2 REVENUE ANALYSIS

26.18.3 GEOGRAPHIC PRESENCE

26.18.4 PRODUCT PORTFOLIO

26.18.5 RECENT DEVELOPMENTS

26.19 BAUSCH + LOMB

26.19.1 COMPANY OVERVIEW

26.19.2 REVENUE ANALYSIS

26.19.3 GEOGRAPHIC PRESENCE

26.19.4 PRODUCT PORTFOLIO

26.19.5 RECENT DEVELOPMENTS

26.2 JOHNSON & JOHNSON SERVICES, INC.

26.20.1 COMPANY OVERVIEW

26.20.2 REVENUE ANALYSIS

26.20.3 GEOGRAPHIC PRESENCE

26.20.4 PRODUCT PORTFOLIO

26.20.5 RECENT DEVELOPMENTS

26.21 HAAG-STREIT

26.21.1 COMPANY OVERVIEW

26.21.2 REVENUE ANALYSIS

26.21.3 GEOGRAPHIC PRESENCE

26.21.4 PRODUCT PORTFOLIO

26.21.5 RECENT DEVELOPMENTS

26.22 ZIEMER OPHTHALMIC SYSTEMS

26.22.1 COMPANY OVERVIEW

26.22.2 REVENUE ANALYSIS

26.22.3 GEOGRAPHIC PRESENCE

26.22.4 PRODUCT PORTFOLIO

26.22.5 RECENT DEVELOPMENTS

26.23 KONINKLIJKE PHILIPS N.V.

26.23.1 COMPANY OVERVIEW

26.23.2 REVENUE ANALYSIS

26.23.3 GEOGRAPHIC PRESENCE

26.23.4 PRODUCT PORTFOLIO

26.23.5 RECENT DEVELOPMENTS

26.24 BOSTON SCIENTIFIC CORPORATION OR ITS AFFILIATES

26.24.1 COMPANY OVERVIEW

26.24.2 REVENUE ANALYSIS

26.24.3 GEOGRAPHIC PRESENCE

26.24.4 PRODUCT PORTFOLIO

26.24.5 RECENT DEVELOPMENTS

26.25 ANGIODYNAMICS

26.25.1 COMPANY OVERVIEW

26.25.2 REVENUE ANALYSIS

26.25.3 GEOGRAPHIC PRESENCE

26.25.4 PRODUCT PORTFOLIO

26.25.5 RECENT DEVELOPMENTS

26.26 CRYOLIFE

26.26.1 COMPANY OVERVIEW

26.26.2 REVENUE ANALYSIS

26.26.3 GEOGRAPHIC PRESENCE

26.26.4 PRODUCT PORTFOLIO

26.26.5 RECENT DEVELOPMENTS

26.27 LASOS LASERTECHNIK GMBH

26.27.1 COMPANY OVERVIEW

26.27.2 REVENUE ANALYSIS

26.27.3 GEOGRAPHIC PRESENCE

26.27.4 PRODUCT PORTFOLIO

26.27.5 RECENT DEVELOPMENTS

26.28 FUJIKURA LTD.

26.28.1 COMPANY OVERVIEW

26.28.2 REVENUE ANALYSIS

26.28.3 GEOGRAPHIC PRESENCE

26.28.4 PRODUCT PORTFOLIO

26.28.5 RECENT DEVELOPMENTS

26.29 STRYKER

26.29.1 COMPANY OVERVIEW

26.29.2 REVENUE ANALYSIS

26.29.3 GEOGRAPHIC PRESENCE

26.29.4 PRODUCT PORTFOLIO

26.29.5 RECENT DEVELOPMENTS

26.3 PHOTOMEDEX

26.30.1 COMPANY OVERVIEW

26.30.2 REVENUE ANALYSIS

26.30.3 GEOGRAPHIC PRESENCE

26.30.4 PRODUCT PORTFOLIO

26.30.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

27 RELATED REPORTS

28 CONCLUSION

29 QUESTIONNAIRE

30 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.