Global Medical Polyoxymethylene Market

Market Size in USD Million

CAGR :

%

USD

131.26 Million

USD

222.18 Million

2024

2032

USD

131.26 Million

USD

222.18 Million

2024

2032

| 2025 –2032 | |

| USD 131.26 Million | |

| USD 222.18 Million | |

|

|

|

|

Medical Polyoxymethylene Market Size

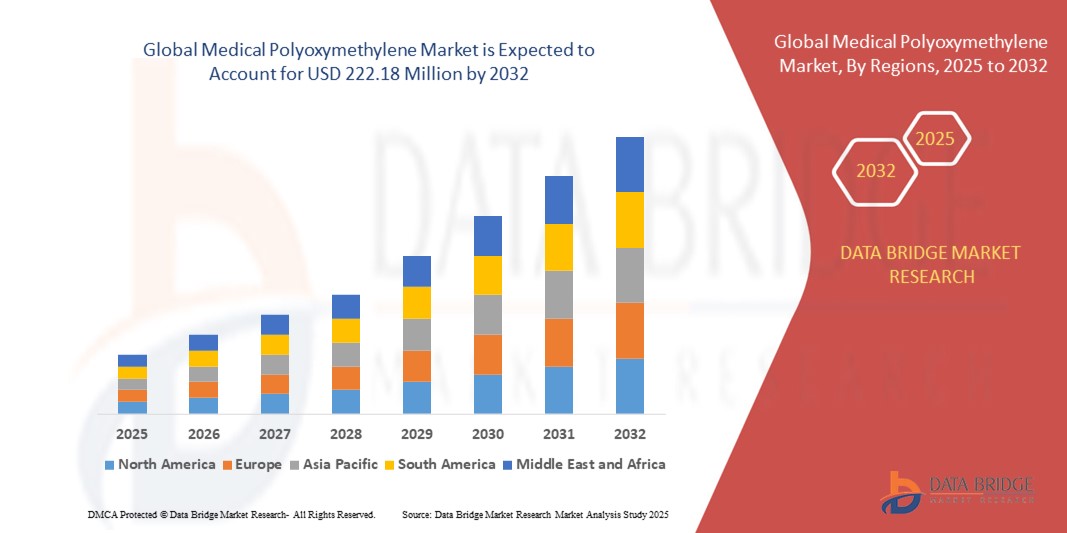

- The global medical polyoxymethylene market size was valued at USD 131.26 Million in 2024 and is projected to reach USD 222.18 million by 2032, with a CAGR of 6.80% during the forecast period.

- Market growth is being driven by the rising demand for high-performance engineering plastics in the medical industry, particularly in applications requiring precision, chemical resistance, and sterilizability such as drug delivery devices, diagnostic equipment, and surgical instruments

- In addition, increasing healthcare expenditure, advancements in medical device manufacturing, and the growing trend toward miniaturization and automation in medical technology are fueling the adoption of medical-grade polyoxymethylene. These factors are significantly contributing to the market's steady expansion

Medical Polyoxymethylene Market Analysis

- Medical polyoxymethylene (POM), a high-performance engineering thermoplastic known for its excellent mechanical properties, chemical resistance, and biocompatibility, is widely used in medical devices, surgical instruments, and healthcare equipment, offering durability and precision in critical applications

- The rising demand for medical polyoxymethylene is primarily driven by the growth of the medical device industry, increasing adoption of minimally invasive surgeries, and the need for reliable, lightweight, and sterilizable materials in healthcare applications

- North America held the largest revenue share of 38.5% in the global medical polyoxymethylene market in 2024, driven by a well-established healthcare infrastructure, high healthcare spending, and a strong presence of major medical device manufacturers

- The Asia-Pacific medical polyoxymethylene market is anticipated to grow at the fastest CAGR of 8.3% from 2024 to 2031, driven by rapid healthcare expansion, rising medical device production, and growing investments in medical infrastructure in countries such as China, India, and Japan

- The homopolymer segment dominated the market with the largest revenue share of 52.4% in 2024, attributed to its superior mechanical strength, stiffness, and dimensional stability, which are critical for high-precision medical components

Report Scope and Market Segmentation

|

Attributes |

Medical Polyoxymethylene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Polyoxymethylene Market Trends

Increased Focus on Preventive Healthcare

- The rising global emphasis on preventive healthcare is emerging as a significant driver in the medical polyoxymethylene (POM) market. As healthcare systems worldwide transition from treatment-centric models to proactive, preventive approaches, the demand for advanced medical devices that support early diagnosis, monitoring, and ongoing patient care is steadily increasing. This shift is creating new opportunities for high-performance materials such as polyoxymethylene, which are critical in manufacturing reliable, long-lasting, and biocompatible medical components

- Polyoxymethylene’s unique combination of properties including excellent dimensional stability, strength, chemical resistance, and low friction makes it an ideal material for devices that require consistent performance over extended periods

- In preventive healthcare, this includes applications in diagnostic instruments, home-use medical equipment, wearable health monitors, and smart drug delivery systems. These tools are designed to support regular health assessments, enable early intervention, and empower patients to actively manage their own health core pillars of preventive care

- For instance, devices such as blood glucose monitors, inhalers, and portable diagnostic tools increasingly utilize polyoxymethylene components due to their reliability and resistance to frequent sterilization and handling. As the demand for remote healthcare and personal monitoring devices grows, especially in aging populations and in regions with limited access to clinical facilities, polyoxymethylene’s role in the medical device manufacturing process is becoming even more prominent

- Furthermore, manufacturers are responding to this trend by investing in the development of lightweight, compact, and ergonomic devices tailored to everyday use. As innovation continues to evolve within the preventive healthcare space, the need for dependable materials such as medical-grade polyoxymethylene is expected to grow accordingly, reinforcing its position as a key enabler of the next generation of preventive healthcare technologies

Medical Polyoxymethylene Market Dynamics

Driver

Rising Demand for High-Performance Plastics in Medical Devices

- The growing demand for advanced medical devices that require durable, lightweight, and biocompatible materials is a key driver for the medical polyoxymethylene (POM) market. As healthcare technology continues to evolve, there is increasing reliance on high-performance plastics such as polyoxymethylene for applications in diagnostic equipment, surgical tools, and drug delivery systems

- For instance, the increasing prevalence of chronic diseases and the rise in minimally invasive surgeries have driven the need for precision components, such as gears, valves, and actuators made from medical-grade polyoxymethylene. Its excellent dimensional stability, low friction, and chemical resistance make it an ideal substitute for metal parts in many medical applications

- Furthermore, polyoxymethylene 's compliance with stringent regulatory standards such as FDA and ISO, combined with its ability to withstand repeated sterilization, positions it as a preferred material for reusable medical devices

- The material also supports design flexibility, which enables manufacturers to produce intricate and miniaturized components used in modern medical technologies

- The growing adoption of wearable medical devices and home healthcare equipment is further boosting demand, as these applications benefit from P polyoxymethylene’s lightweight nature and mechanical strength. As healthcare systems emphasize efficiency, safety, and patient comfort, the role of polyoxymethylene in the development of next-generation medical devices is expected to expand significantly

Restraint/Challenge

Environmental Concerns and Competition from Alternative Materials

- Despite its favorable properties, medical-grade polyoxymethylene faces challenges related to environmental sustainability and increasing competition from newer, eco-friendly materials. polyoxymethylene is a non-biodegradable thermoplastic, and concerns about plastic waste, especially in the medical sector, have raised questions about its long-term viability

- For instance, with the global push toward sustainability, many healthcare manufacturers are exploring bio-based or recyclable alternatives to traditional engineering plastics

- This trend may limit the growth potential of polyoxymethylene unless eco-conscious production methods and recycling solutions are developed and adopted at scale

- In addition, advancements in alternative materials such as high-performance polyamides, polyether ether ketone (PEEK), and biopolymers are intensifying competition. These materials offer similar or enhanced performance characteristics with a smaller environmental footprint, drawing attention from both manufacturers and regulators

- Another challenge lies in the volatility of raw material prices and supply chain disruptions, which can impact production costs and availability. To remain competitive, stakeholders in the polyoxymethylene market will need to invest in sustainable manufacturing, explore recycling technologies, and continuously innovate to meet evolving regulatory and consumer demands in the medical industry

Medical Polyoxymethylene Market Scope

The market is segmented on the basis of product type, processing method, application, and end-use industry.

- By Product Type

On the basis of product type, the medical polyoxymethylene market is segmented into homopolymer and copolymer. The homopolymer segment dominated the market with the largest revenue share of 52.4% in 2024, attributed to its superior mechanical strength, stiffness, and dimensional stability, which are critical for high-precision medical components. Homopolymers are widely used in surgical instruments and orthopedic devices where durability and reliability are paramount.

The copolymer segment is expected to witness robust growth due to its enhanced chemical resistance and impact strength, making it suitable for specialized applications requiring greater toughness and resistance to sterilization methods.

- By Processing Method

On the basis of processing method, the market is segmented into injection molding, extrusion, and machining. The injection molding segment held the largest revenue share of 55.26% in 2024, driven by its efficiency in producing complex and precise medical components with high repeatability. Injection molding also supports mass production, making it a preferred choice in manufacturing disposable and reusable medical parts.

Machining is anticipated to witness the fastest growth rate during the forecast period due to its application in producing customized and intricate medical devices requiring tight tolerances.

- By Application

On the basis of application, the market is segmented into surgical instruments, diagnostic equipment, orthopedic devices, dental appliances, and others. The surgical instruments segment accounted for the largest market revenue share of 65.35% in 2024, fueled by the need for high-precision, sterilizable materials that maintain performance under repeated use. Increasing adoption of minimally invasive surgeries and advanced medical tools is further driving demand.

Orthopedic devices are expected to register the fastest CAGR owing to rising cases of musculoskeletal disorders and innovations in implantable devices and supports made from medical POM.

- By End-Use Industry

On the basis of end-use industry, the medical polyoxymethylene market is segmented into hospitals, diagnostic centers, dental clinics, and research institutes. Hospitals accounted for the largest revenue share of 46.36% in 2024, supported by increasing patient inflow and demand for advanced medical equipment.

Diagnostic centers are expected to witness the fastest growth during the forecast period due to growing adoption of sophisticated diagnostic tools that rely on durable and high-performance polymer components.

Medical Polyoxymethylene Market Regional Analysis

- North America held the largest revenue share of 38.5% in the global medical polyoxymethylene market in 2024, driven by a well-established healthcare infrastructure, high healthcare spending, and a strong presence of major medical device manufacturers

- The region’s demand for high-performance engineering plastics in applications such as drug delivery devices, diagnostic equipment, and surgical tools supports consistent market growth

- Favorable regulatory standards, technological advancements in medical device manufacturing, and an aging population requiring ongoing medical care also contribute to the rising demand for medical-grade polyoxymethylene across North America

U.S. Medical Polyoxymethylene Market Insight

The U.S. accounted for the largest revenue share of 82% in North America in 2024, owing to its leadership in advanced healthcare technologies and a strong focus on precision and minimally invasive medical devices. The country’s high investment in R&D and rapid adoption of innovative materials for critical applications such as inhalers, insulin pens, and diagnostic equipment further drive the market. In addition, collaborations between medical device manufacturers and material suppliers are fostering the growth of polyoxymethylene usage across a wide range of medical solutions.

Europe Medical Polyoxymethylene Market Insight

The Europe medical polyoxymethylene market is expected to grow at a steady CAGR over the forecast period, supported by the region’s strict regulatory framework for medical devices and strong demand for safe, biocompatible materials. Growing trends in home-based healthcare, increased adoption of reusable medical instruments, and the expansion of outpatient care facilities are boosting the market. Sustainability initiatives and preferences for precision-engineered plastics also contribute to the steady rise in polyoxymethylene demand across the region.

Germany Medical Polyoxymethylene Market Insight

Germany is projected to experience a notable CAGR through 2031 due to its advanced manufacturing capabilities and focus on high-quality medical equipment. The country's emphasis on precision engineering and material performance aligns with polyoxymethylene’s characteristics, making it a preferred choice in orthopedic tools, diagnostic components, and surgical instruments. Furthermore, the demand for efficient, cost-effective, and sterilizable materials in the German healthcare system is driving the adoption of medical-grade polyoxymethylene.

Asia-Pacific Medical Polyoxymethylene Market Insight

The Asia-Pacific medical polyoxymethylene market is anticipated to grow at the fastest CAGR of 8.3% from 2024 to 2031, driven by rapid healthcare expansion, rising medical device production, and growing investments in medical infrastructure in countries such as China, India, and Japan. An increasing focus on improving healthcare access, along with the rise of local medical device manufacturers, is fueling the adoption of cost-effective and high-performance materials such as polyoxymethylene. Government support for healthcare modernization and local production capabilities further enhances regional market potential.

China Medical Polyoxymethylene Market Insight

China accounted for the largest revenue share in the Asia-Pacific region in 2024 due to its booming medical device manufacturing sector and strong government support for healthcare innovation. The country's emphasis on affordable and scalable healthcare solutions aligns with the use of polyoxymethylene in disposable and reusable devices. Growing exports of medical devices and increasing domestic demand for advanced equipment are accelerating polyoxymethylene adoption.

Japan Medical Polyoxymethylene Market Insight

Japan is seeing strong growth in the medical polyoxymethylene market, driven by its highly developed healthcare system and focus on technological precision. The aging population and demand for reliable, miniaturized medical devices are increasing the use of high-performance plastics. Japanese manufacturers prioritize biocompatibility, durability, and precision all areas where polyoxymethylene excels making it a material of choice for both local use and exports.

Medical Polyoxymethylene Market Share

Medical polyoxymethylene market leaders operating in the Market Are:

- Kolon ENP (South Korea)

- BASF SE (Germany)

- Celanese Corporation (U.S.)

- Polyplastics Co., Ltd. (Japan)

- ASAHI KASEI CORPORATION (Japan)

- SABIC (Saudi Arabia)

- Delrin USA, LLC (U.S.)

- Ensinger (Germany)

- GLOBAL POLYACETAL CO., LTD. (China)

- Daicel Corporation (Polyplastics Co. Ltd) (Japan)

- DuPont de Nemours Inc. (U.S.)

- Chemieuro (South Korea)

- Mitsubishi Chemical Corporation (Japan)

- Westlake Plastics (U.S.)

- Yuntianhua Group Co. Ltd (China)

Recent Developments in the Global Medical Polyoxymethylene Market

- In July 2024, Celanese Corporation, a global leader in engineered materials, announced the expansion of its medical-grade polyoxymethylene production capacity at its manufacturing site in Germany. This strategic move aims to meet the growing demand for high-performance plastics in the medical sector, particularly in drug delivery systems and surgical tools. The expansion reflects Celanese’s commitment to supporting the healthcare industry with reliable, regulatory-compliant materials that enable innovation in patient care and device manufacturing

- In May 2024, BASF SE introduced a new range of medical-grade polyoxymethylene under its Ultraform PRO line, designed specifically for use in medical and pharmaceutical applications. The new grades offer improved biocompatibility, dimensional stability, and resistance to repeated sterilization, meeting ISO 10993 and USP Class VI standards. This development enhances BASF’s portfolio and reinforces its role as a leading provider of advanced materials for next-generation medical devices

- In April 2024, Polyplastics Co., Ltd. launched a collaborative R&D initiative with a European medical device manufacturer to develop precision diagnostic components using high-purity POM. The project focuses on creating miniaturized, chemically resistant parts for advanced diagnostic equipment. This collaboration highlights the increasing role of specialty POM materials in the development of high-accuracy medical technologies and showcases Polyplastics' commitment to global innovation

- In March 2024, Mitsubishi Engineering-Plastics Corporation announced enhancements to its DURACON® medical-grade POM to improve long-term performance in implantable and reusable devices. The upgraded material features enhanced fatigue resistance and stability under repeated sterilization cycles. This advancement supports the growing market demand for durable and safe materials in minimally invasive surgery and high-precision medical tools

- In February 2024, Ensinger GmbH, a leading manufacturer of high-performance thermoplastics, introduced a new medical-grade POM rod and sheet product line aimed at custom machining for surgical instruments and orthopedic devices. These semi-finished products offer ease of fabrication and compliance with global medical standards, providing OEMs with versatile material solutions for rapid prototyping and small-batch production of medical components

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Medical Polyoxymethylene Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Medical Polyoxymethylene Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Medical Polyoxymethylene Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.