Global Medical Recruitment Market

Market Size in USD Million

CAGR :

%

USD

452.19 Million

USD

822.51 Million

2024

2032

USD

452.19 Million

USD

822.51 Million

2024

2032

| 2025 –2032 | |

| USD 452.19 Million | |

| USD 822.51 Million | |

|

|

|

|

Medical Recruitment Market Size

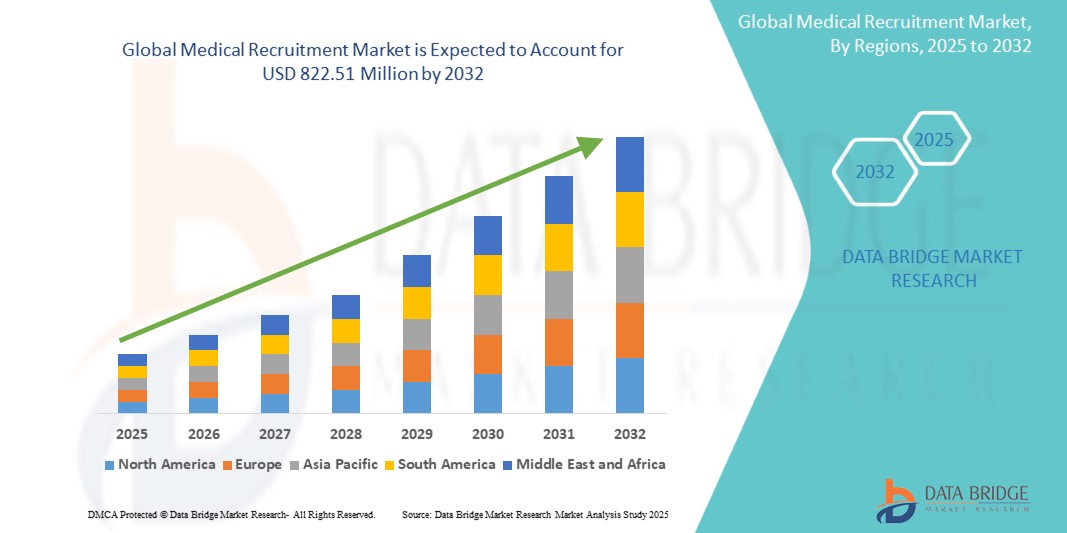

- The global Medical Recruitment market was valued at USD 452.19 Million in 2024 and is expected to reach USD 822.51 Million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.10%, primarily driven by the rising demand for healthcare professionals and the expansion of healthcare infrastructure worldwide

- This growth is driven by factors such as the increasing global shortage of skilled medical professionals, rising healthcare expenditures, and the growing need for specialized medical staffing solutions

Medical Recruitment Market Analysis

- Medical recruitment involves staffing and placement services for various healthcare professionals, including doctors, nurses, allied health workers, and administrative staff, across hospitals, clinics, and research institutions

- The market is significantly driven by the global shortage of skilled healthcare professionals, increasing healthcare demands due to aging populations, and the expansion of healthcare services in emerging economies. The rising trend of telemedicine and flexible work arrangements has further diversified recruitment strategies

- North America stands out as one of the dominant regions for medical recruitment, driven by high healthcare expenditure, a well-established healthcare system, and an ongoing demand for specialized healthcare talent

- For instance, the U.S. Bureau of Labor Statistics projects strong growth in healthcare jobs through 2032, with hospitals, home care services, and outpatient centers actively seeking talent to fill critical roles, fueling demand for medical recruitment services

- Globally, medical recruitment firms play a crucial role in bridging workforce gaps, ensuring timely placement of qualified professionals, and supporting the operational continuity of healthcare systems, especially during public health crises and seasonal surges

Report Scope and Medical Recruitment Market Segmentation

|

Attributes |

Medical Recruitment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Recruitment Market Trends

“Rising Use of AI and Digital Platforms in Healthcare Staffing”

- One prominent trend in the global medical recruitment market is the increasing use of artificial intelligence (AI) and digital platforms to streamline the hiring process and match candidates more effectively

- These technologies enhance recruitment efficiency by automating candidate screening, skill matching, and interview scheduling, significantly reducing time-to-hire and improving placement accuracy

- For instance, AI-driven platforms can analyze large volumes of applicant data to identify top talent for specific roles, while predictive analytics helps forecast workforce needs based on historical and real-time healthcare data

- Digital recruitment platforms also facilitate remote hiring, onboarding, and credential verification, which is especially beneficial in filling urgent roles across geographically dispersed healthcare facilities

- This trend is transforming the medical staffing landscape, enabling faster, more targeted hiring processes and addressing workforce shortages with greater precision

Medical Recruitment Market Dynamics

Driver

“Rising Healthcare Workforce Shortages and Aging Population”

- A key driver of the global medical recruitment market is the growing shortage of qualified healthcare professionals, particularly in specialized roles such as nursing, geriatrics, and critical care

- This shortage is intensified by the rapidly aging global population, which increases the demand for healthcare services and, in turn, the need for skilled professionals to deliver those services

- The pressure on healthcare systems to provide continuous and quality care has led to greater reliance on recruitment agencies and staffing firms to fill gaps quickly and efficiently

- The Governments and healthcare institutions are increasingly turning to international recruitment, flexible staffing models, and telemedicine-related roles to combat workforce imbalances and meet patient care demands

- These dynamics are fueling the growth of the medical recruitment industry, especially in regions where healthcare infrastructure is expanding and population demographics are shifting toward older age groups

For instance,

- According to the World Health Organization (WHO), the world is projected to face a shortage of 10 million healthcare workers by 2030, with the most significant gaps in low- and middle-income countries, highlighting the critical role of medical recruitment in bridging this deficit

- The U.S., the Association of American Medical Colleges (AAMC) forecasts a shortage of up to 124,000 physicians by 2034, underlining the urgent need for robust medical staffing solutions to maintain healthcare service delivery

- As a result of the growing global shortage of healthcare professionals and the increasing demand for quality medical services, there is a significant surge in the need for efficient and specialized medical recruitment solutions

Opportunity

“Enhancing Recruitment Efficiency through Artificial Intelligence and Automation”

- The integration of AI and automation in the medical recruitment process presents a significant opportunity to streamline hiring workflows, reduce administrative burdens, and improve candidate-job matching accuracy

- AI-powered platforms can analyze vast datasets to predict candidate suitability, automate initial screenings, and identify trends in workforce demand, enabling recruiters to make data-driven decisions and fill critical roles more efficiently

- In addition, automation tools can manage repetitive tasks such as interview scheduling, credential verification, and communication, allowing recruiters to focus on strategic engagement and talent retention

For instance,

- In February 2024, according to an article published by the Journal of Healthcare Management, AI-enabled recruitment tools helped healthcare organizations reduce time-to-hire by up to 40%, particularly for high-demand roles such as ICU nurses and radiology technicians. These systems used machine learning algorithms to match candidates based on skills, experience, and cultural fit

- In September 2023, the HealthTech Digital Journal reported that healthcare staffing platforms using predictive analytics improved workforce planning by identifying future shortages and suggesting proactive recruitment strategies, especially during seasonal surges or pandemics

- By adopting AI-driven solutions, medical recruitment firms can not only increase operational efficiency but also enhance the quality and timeliness of healthcare delivery through better staffing alignment

Restraint/Challenge

“Regulatory Complexities and Credentialing Delays”

- One of the major challenges facing the global medical recruitment market is the complexity of regulatory requirements and credentialing processes across different countries and regions, which can significantly delay the placement of healthcare professionals

- Licensing, visa approvals, background checks, and professional credential verification often involve lengthy procedures that can hinder timely hiring, especially for cross-border placements and temporary staffing

- This can be particularly burdensome for recruitment agencies and healthcare providers looking to quickly fill urgent or high-demand roles, such as in rural or underserved area

For instance,

- In October 2023, according to an article published by the International Journal of Health Services, delays in international medical licensing and certification verification were cited as a top challenge for recruiters, often extending the hiring timeline by several weeks or even month

- In March 2024, the Global Healthcare Workforce Alliance reported that inconsistent regulatory frameworks across regions, particularly in Europe and Asia, created obstacles for deploying skilled professionals where they are most needed, thereby limiting the market’s responsiveness to global health crises

- Consequently, these regulatory hurdles can reduce recruitment efficiency, increase operational costs, and limit access to talent, ultimately restraining the growth and scalability of the global medical recruitment market

Medical Recruitment Market Scope

The market is segmented on basis of job type, recruitment type, and end user

|

Segmentation |

Sub-Segmentation |

|

By Job Type |

|

|

By Recruitment Type |

|

|

By End User |

|

Medical Recruitment Market Regional Analysis

“North America is the Dominant Region in the Medical Recruitment Market”

- North America leads the global medical recruitment market, supported by a highly developed healthcare system, rising demand for skilled healthcare professionals, and a growing reliance on recruitment agencies to address staffing shortages

- The U.S. holds the largest share due to a strong presence of healthcare institutions, an aging population, and increasing incidences of chronic diseases requiring specialized medical care

- The region’s proactive adoption of digital recruitment platforms, AI-driven staffing solutions, and favorable reimbursement frameworks enhance the efficiency and effectiveness of recruitment processes

- The expansion of locum tenens staffing and travel nursing, particularly during seasonal healthcare surges or public health emergencies, continues to drive market demand in North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the fastest growth in the medical recruitment market, fueled by rapid urbanization, expanding healthcare infrastructure, and rising government investments in healthcare services

- Countries such as India, China, and the Philippines are emerging as both key sources of skilled healthcare professionals and growing destinations for healthcare recruitment due to increasing demand for quality care

- Japan and South Korea, with their advanced healthcare systems and aging populations, are also experiencing a rise in demand for specialized professionals, creating opportunities for both local and international staffing solutions

- The region's increasing focus on medical tourism, public-private healthcare partnerships, and digitization of recruitment processes is further accelerating market growth and attracting global recruitment firms

Medical Recruitment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- AdeccoGroup (Switzerland)

- Randstad N.V. (Netherlands)

- Kelly Services Inc. (U.S.)

- ManpowerGroup (U.S.)

- Recruit Holdings Co., Ltd. (Japan)

- Hays plc (U.K.)

- Maxim Healthcare Services (U.S.)

- CHG Management, Inc. (U.S.)

- Medacs Healthcare (U.K.)

- Barton Associates (U.S.)

- Allegis Group (U.S.)

- SPENCER STUART (U.S.)

- Morgan McKinley (Ireland)

- Robert Walters Plc. (U.K.)

- Egon Zehnder (Switzerland)

- Korn Ferry (U.S.)

- Jackson Healthcare (U.S.)

- NHS Professionals (U.K.)

- TeamHealth (U.S.)

- AMN Healthcare (U.S.)

Latest Developments in Global Medical Recruitment Market

- In February 2025, Hedge funds are increasingly hiring doctors, scientists, and healthcare analysts to gain an edge in pharmaceutical investments. This trend aims to leverage specialized medical expertise to navigate the complexities of the pharmaceutical industry effectively

- In January 2025, The NHS in the UK successfully recruited 1,503 new General Practitioners (GPs) over six months, addressing severe shortages in general practice. This initiative aims to eliminate the morning scramble for appointments and improve patient services

- In December 2024, The Queensland government in Australia abolished incentives of up to USD 70,000 for attracting healthcare workers to remote areas. The decision was based on the program not meeting workforce growth targets and concerns over budget overruns

- In November 2024, an independent report from The McKell Institute highlighted the need for minimum staffing levels for doctors in South Australia's public hospitals to combat fatigue and burnout. Nearly 40% of doctors surveyed did not expect to remain in the public system within the next three years due to these issues

- In October 2024, A federal lawsuit filed in Virginia accused several universities, animal hospitals, and the American Association of Veterinary Clinicians of conspiring to suppress wages and limit employment mobility of veterinary interns and residents. The suit centers around a matching placement system that allegedly bars applicants from negotiating employment terms prior to match results

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.