Global Medicinal Mushroom Market

Market Size in USD Billion

CAGR :

%

USD

31.99 Billion

USD

67.82 Billion

2024

2032

USD

31.99 Billion

USD

67.82 Billion

2024

2032

| 2025 –2032 | |

| USD 31.99 Billion | |

| USD 67.82 Billion | |

|

|

|

|

Medicinal Mushroom Market Size

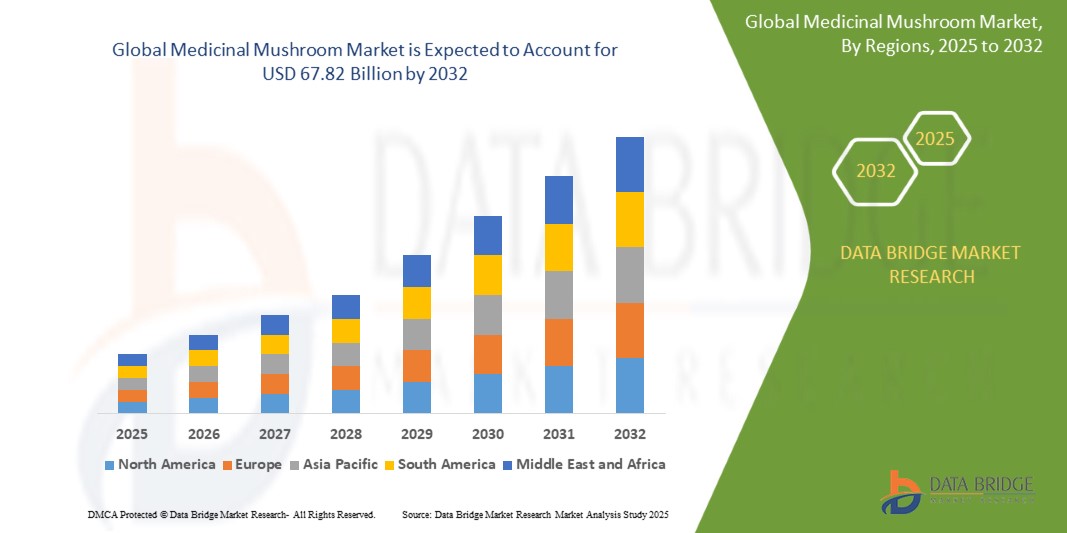

- The global medicinal mushroom market was valued at USD 31.99 billion in 2024 and is expected to reach USD 67.82 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.85%, primarily driven by expansion of the vegan population

- This growth is driven by factors such as plant-based nutrition demand, clean-label preference, and growth of vegan-friendly products

Medicinal Mushroom Market Analysis

- Medicinal mushrooms are a category of fungi recognized for their therapeutic properties, commonly used in supplements, functional foods, and wellness products to support immune health, cognitive function, and overall well-being

- Market growth is driven by rising health awareness, demand for natural remedies, and the growing vegan and wellness-focused population seeking clean-label, plant-based solutions

- The market is evolving with innovations in extraction, product development, and incorporation into mainstream items such as beverages, snacks, and supplements

- For instance, Brands such as Four Sigmatic and Om Mushroom are launching functional products combining mushrooms with adaptogens and nootropics

- The medicinal mushroom market is projected to maintain steady growth, driven by increasing consumer demand for plant-based, functional products, rising investment in clinical research, and the global trend toward personalized and preventive health

Report Scope and Medicinal Mushroom Market Segmentation

|

Attributes |

Medicinal Mushroom Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medicinal Mushroom Market Trends

“Increasing Demand for Functional Food and Nutraceutical Source”

- One prominent trend in the global medicinal mushroom market is the increasing demand for functional food and nutraceutical source

- This trend is driven by the rising consumer awareness of preventive health, the shift toward natural remedies, and the growing preference for food products that offer added health benefits beyond basic nutrition

- For instance, companies such as Host Defense and FreshCap Mushrooms are introducing mushroom-based powders, capsules, and ready-to-drink beverages that combine medicinal mushrooms such as lion’s mane and reishi with vitamins, adaptogens, and other superfoods to meet growing wellness and nutrition needs

- The surge in clean-label trends, plant-based lifestyles, and demand for sustainable health solutions is accelerating the integration of medicinal mushrooms into everyday food and beverage formats such as teas, protein bars, and smoothies

- As consumers continue to prioritize natural and functional ingredients, the incorporation of medicinal mushrooms into nutraceuticals and functional foods is expected to remain a key driver of market growth—fueling innovation, product diversification, and broader mainstream adoption

Medicinal Mushroom Market Dynamics

Driver

“Shift Toward Preventive Health and Wellness”

- The growing focus on preventive health and wellness is a major driver of growth in the medicinal mushroom market. As consumers become more proactive about managing their long-term health, the demand for natural, functional ingredients such as medicinal mushrooms has surged

- This shift is especially notable in demographics seeking to reduce reliance on synthetic pharmaceuticals and adopt lifestyle-based health solutions. Medicinal mushrooms are widely used for their adaptogenic, anti-inflammatory, and immune-boosting properties, making them a natural fit for wellness-focused products

- With increasing concerns around chronic illness, stress, and mental fatigue, consumers are turning to natural supplements and functional foods that promote resilience, vitality, and mental clarity

- Features such as clean-label formulations, organic sourcing, and scientifically backed health claims are shaping product development, aligning with consumer preferences for safe and sustainable wellness options

- Brands in the medicinal mushroom space are investing in clinical research, education, and transparent labeling to build trust and position mushrooms as essential components of everyday health routines

For instance,

- Nature’s Way has added reishi and cordyceps to its herbal product lines, expanding its reach into natural wellness

- FreshCap Mushrooms promotes transparency with lab-tested mushroom powders used for energy, gut health, and mental clarity

- As holistic health continues to gain traction, the demand for preventive and plant-based approaches will remain a powerful force behind the expansion of the medicinal mushroom market

Opportunity

“Rise in the Research and Development Activities”

- The growing focus on research and development presents a major opportunity in the medicinal mushroom market. Scientific exploration is enabling innovation in extraction, formulation, and delivery methods

- Clinical validation of benefits such as immunity, cognition, and stress relief is increasing consumer trust and opening doors to regulated health and wellness markets

- Research-backed formulations and improved bioavailability are helping brands differentiate their offerings in a competitive landscape

For instance,

- Host Defense supports ongoing clinical trials to validate the immune-modulating effects of their mushroom mycelium

- M2 Ingredients invests in genomic research and fermentation technology to improve yield and consistency in mushroom cultivation

- As the market grows more competitive, brands investing in R&D are well-positioned to differentiate their products, meet evolving health demands, and unlock new commercial and therapeutic applications

Restraint/Challenge

“Lack of Adequate Manufacturing Skills”

- The shortage of skilled manufacturing expertise presents a notable challenge for the medicinal mushroom market. Despite increasing demand, many producers struggle to meet quality standards due to gaps in specialized processing knowledge

- The cultivation, extraction, and formulation of medicinal mushrooms require precise techniques to retain bioactive compounds and ensure consistency. A lack of trained personnel often results in suboptimal yields, contamination risks, and inconsistent product quality

- This skills gap is especially prominent in emerging markets and among small-scale growers who lack access to advanced technologies, lab infrastructure, or standardized procedures

For instance,

- In certain regions, local partners of global brands such as Hokkaido Reishi face difficulties scaling production while adhering to strict purity and GMP standards, slowing down export readiness

- Without adequate technical training and process innovation, the sector faces challenges in meeting regulatory standards, consumer expectations, and global demand, ultimately slowing the market’s growth potential

Medicinal Mushroom Market Scope

The market is segmented on the basis of type, form, and function.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Form |

|

|

By Function |

|

Medicinal Mushroom Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Medicinal Mushroom Market”

- Asia-Pacific dominates the medicinal mushroom market, driven by the region’s deep-rooted cultural acceptance of medicinal mushrooms, combined with a growing consumer preference for natural and functional health solutions

- China holds a significant share due to long-standing use of mushrooms in traditional medicine and strong demand for mushroom-based cosmetics, supplements, and functional foods

- Growth in Southeast Asia is driven by rising health awareness, urbanization, and increasing adoption of plant-based remedies

- With cultural acceptance, production capabilities, and expanding wellness trends, Asia-Pacific will remain the largest and most mature market throughout the forecast period

“North America is Projected to Register the Highest Growth Rate”

- The North America is expected to witness the highest growth rate in the medicinal mushroom market, driven by increasing consumer awareness about functional foods, wellness supplements, and plant-based health solutions

- U.S. leads regional growth, supported by an expanding base of mushroom-focused brands and increased use in sports nutrition and cognitive health

- Cultivation of shiitake, lion’s mane, and turkey tail is rising, especially in states such as Pennsylvania and Oregon, with growing interest in both natural and synthetic log farming

- Consumers are favoring organic, research-backed formulations, encouraging companies to invest in quality, transparency, and clinical studies

- With a strong wellness culture and increasing awareness of medicinal mushrooms, North America is positioned as the fastest-growing regional market through 2032

Medicinal Mushroom Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Hokkaido Reishi (Japan)

- Banken Champignons B.V. (Netherlands)

- Far West Fungi (Canada)

- Swadeshi Mushroom (India)

- Gourmet Mushrooms Ltd. (Australia)

- DXN Holdings (Malaysia)

- MahaGro India (India)

- Nikkei Marketing Limited (Japan)

- Chaga Mountain, Inc. (U.S.)

- Asia Pacific Farm Enterprises Inc. (Philippines)

- Concord Farms (U.S.)

- SSD Mushrooms (U.S.)

Latest Developments in Global Medicinal Mushroom Market

- In February 2025, CBD Life Sciences Inc. (CBDL) entered the functional mushroom market with the launch of its Mushroom Powder Capsules, featuring a blend of Lion's Mane, Cordyceps, Reishi, Maitake, and Turkey Tail. This strategic move is expected to expand the company’s presence in the wellness sector and strengthen its position in the rapidly growing medicinal mushroom market, as it taps into rising consumer interest in natural solutions for cognitive health, immunity, and overall well-being

- In November 2024, Herb Pharm strengthened its position in the medicinal mushroom market with the launch of its Mushroom Wellness line. Grown and made in the U.S., the line reflects the brand’s focus on science, sustainability, and heritage, and is set to boost its influence amid rising demand for high-quality mushroom-based supplements

- In February 2022, Doseology Sciences Inc, a British Columbia-based life sciences company, launched its Health Canada NPN-approved medicinal mushroom product line in Canada. This milestone marks a significant step in expanding the company’s footprint in the Canadian wellness market, positioning it for broader consumer reach through a planned national multichannel marketing campaign and reinforcing its role in the growing medicinal mushroom sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MEDICINAL MUSHROOM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL MEDICINAL MUSHROOM MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL MEDICINAL MUSHROOM MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.3 COMPARATIVE ANALYSIS OF FUNCTIONAL MUSHROOM SPECIES

5.4 PORTER’S FIVE FORCES

5.5 FACTORS INFLUENCING PURCHASING DECISION

5.6 INDUTRY TRENDS AND FUTURE PERSPECTIVE

6 REGULATIONS AND LABELLING CLAIMS

7 GLOBAL MEDICINAL MUSHROOM MARKET, BY SPECIES

7.1 OVERVIEW

7.2 REISHI

7.2.1 REISHI, BY TYPE

7.2.1.1. GANODERMA LINGZHI / LUCIDUM

7.2.1.2. GANODERMA TSUGAE

7.2.1.3. GANODERMA OREGANESE

7.3 LION’S MANE

7.3.1 LION’S MANE, BY TYPE

7.3.1.1. HERICUM ERINACEUS

7.3.1.2. H. AMERICANUM

7.3.1.3. H. CORALLOIDES

7.4 TURKEY TAIL

7.5 CHAGA

7.6 SHIITAKE

7.6.1 SHIITAKE, BY TYPE

7.6.1.1. DONKO

7.6.1.2. TENPAKU DONKO

7.6.1.3. CHABANA DONKO

7.6.1.4. YORI

7.6.1.5. KOSHIN

7.7 MAITAKE

7.8 CORDYCEPS

7.9 TREMELLA

7.1 OTHERS

8 GLOBAL MEDICINAL MUSHROOM MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 WILD

8.3 CULTIVATED

9 GLOBAL MEDICINAL MUSHROOM MARKET, BY CATGEORY

9.1 OVERVIEW

9.2 REGULAR

9.3 FULL SPECTRUM

10 GLOBAL MEDICINAL MUSHROOM MARKET, BY NATURE

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 GLOBAL MEDICINAL MUSHROOM MARKET, BY CULTIVATION METHOD

11.1 OVERVIEW

11.2 LOG/WOOD CULTIVATED

11.2.1 LOG/WOOD CULTIVATED, BY LOG/WOOD TYPE

11.2.1.1. RED OAK

11.2.1.2. IRONWOOD

11.2.1.3. MUSCLEWOOD

11.2.1.4. SUGAR MAPLE

11.3 BED CULTIVATED

12 GLOBAL MEDICINAL MUSHROOM MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD & BEVERAGES

12.2.1 FOOD & BEVERAGES, BY TYPE

12.2.1.1. BAKERY

12.2.1.1.1. BAKERY, BY TYPE

12.2.1.1.1.1 BREAD & ROLLS

12.2.1.1.1.2 CAKES, PASTRIES & TRUFFLE

12.2.1.1.1.3 BISCUIT

12.2.1.1.1.4 TART & PIES

12.2.1.1.1.5 BROWNIES

12.2.1.1.1.6 COOKIES & CRACKERS

12.2.1.1.1.7 TORTILLA

12.2.1.2. SAUCES, SOUPS, & DRESSINGS

12.2.1.3. MEDICINAL FOOD & BEVERAGES

12.2.1.4. PLANT-BASED MEAT

12.2.1.4.1. PLANT-BASED MEAT PRODUCTS, BY TYPE

12.2.1.4.1.1 PORK ALTERNATIVE

12.2.1.4.1.2 CHICKEN ALTERNATIVE

12.2.1.4.1.3 SEAFOOD SEAFOOD ALTERNATIVE

12.2.1.4.1.4 BEEF ALTERNATIVE

12.2.1.4.1.5 OTHERS

12.2.1.5. BEVERAGES

12.2.1.5.1. BEVERAGES, BY TYPE

12.2.1.5.1.1 MUSHRROM TEA

12.2.1.5.1.2 MUSHROOM COFFEE

12.2.1.5.1.3 OTHERS

12.2.2 FOOD & BEVERAGES, BY MUSHROOM SPECIES

12.2.2.1. REISHI

12.2.2.2. LION’S MANE

12.2.2.3. TURKEY TAIL

12.2.2.4. CHAGA

12.2.2.5. SHIITAKE

12.2.2.6. MAITAKE

12.2.2.7. CORDYCEPS

12.2.2.8. TREMELLA

12.2.2.9. OTHERS

12.2.3 FOOD & BEVERAGES, BY MUSHROOM CATEGORY

12.2.3.1. REGULAR

12.2.3.2. FULL SPECTRUM

12.3 DIETARY SUPPLEMENTS

12.3.1 DITARY SUPPLEMENTS, BY TYPE

12.3.1.1. WEIGHT MANAGEMNET

12.3.1.2. HEART HEALTH

12.3.1.3. IMMUNE HEALTH

12.3.1.4. BONE & JOINT HEALTH

12.3.1.5. SKIN HEALTH

12.3.1.6. BRAIN HEALTH

12.3.1.7. OVERALL WELLBEING

12.3.1.8. OTHERS

12.3.2 DITERY SUPPLEMENTS, BY FORM

12.3.2.1. TABLETS

12.3.2.2. CAPSULES

12.3.2.3. GUMMY

12.3.2.4. SUPPLEMENT POWDER

12.3.2.5. OTHERS

12.3.3 DIETARY SUPPLEMENTS, BY MUSHROOM SPECIES

12.3.3.1. REISHI

12.3.3.2. LION’S MANE

12.3.3.3. TURKEY TAIL

12.3.3.4. CHAGA

12.3.3.5. SHIITAKE

12.3.3.6. MAITAKE

12.3.3.7. CORDYCEPS

12.3.3.8. TREMELLA

12.3.3.9. OTHERS

12.3.4 DIETARY SUPPLEMENT, BY MUSHROOM CATEGORY

12.3.4.1. REGULAR

12.3.4.2. FULL SPECTRUM

12.4 NUTRACEUTICAL

12.4.1 NUTRACEUTICAL, BY MUSHROOM SPECIES

12.4.1.1. REISHI

12.4.1.2. LION’S MANE

12.4.1.3. TURKEY TAIL

12.4.1.4. CHAGA

12.4.1.5. SHIITAKE

12.4.1.6. MAITAKE

12.4.1.7. CORDYCEPS

12.4.1.8. TREMELLA

12.4.1.9. OTHERS

12.4.2 NUTRACEUTICAL, BY MUSHROOM CATEGORY

12.4.2.1. REGULAR

12.4.2.2. FULL SPECTRUM

12.5 PHARMACEUTICAL

12.5.1 PHARMACEUTICAL, BY MUSHROOM SPECIES

12.5.1.1. REISHI

12.5.1.2. LION’S MANE

12.5.1.3. TURKEY TAIL

12.5.1.4. CHAGA

12.5.1.5. SHIITAKE

12.5.1.6. MAITAKE

12.5.1.7. CORDYCEPS

12.5.1.8. TREMELLA

12.5.1.9. OTHERS

12.5.2 PHARMACEUTICAL, BY MUSHROOM CATEGORY

12.5.2.1. REGULAR

12.5.2.2. FULL SPECTRUM

12.6 PERSONAL CARE

12.6.1 PERSONAL CARE, BY MUSHROOM SPECIES

12.6.1.1. REISHI

12.6.1.2. LION’S MANE

12.6.1.3. TURKEY TAIL

12.6.1.4. CHAGA

12.6.1.5. SHIITAKE

12.6.1.6. MAITAKE

12.6.1.7. CORDYCEPS

12.6.1.8. TREMELLA

12.6.1.9. OTHERS

12.6.2 PERSONAL CARE, BY MUSHROOM CATEGORY

12.6.2.1. REGULAR

12.6.2.2. FULL SPECTRUM

12.7 SPORTS NUTRITION

12.7.1 SPORTS NUTRITION, BY MUSHROOM SPECIES

12.7.1.1. REISHI

12.7.1.2. LION’S MANE

12.7.1.3. TURKEY TAIL

12.7.1.4. CHAGA

12.7.1.5. SHIITAKE

12.7.1.6. MAITAKE

12.7.1.7. CORDYCEPS

12.7.1.8. TREMELLA

12.7.1.9. OTHERS

12.7.2 SPORTS NUTRITION, BY MUSHROOM CATEGORY

12.7.2.1. REGULAR

12.7.2.2. FULL SPECTRUM

12.8 OTHERS

13 GLOBAL MEDICINAL MUSHROOM MARKET, BY REGION

GLOBAL MEDICINAL MUSHROOM MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

13.2 EUROPE

13.2.1 GERMANY

13.2.2 U.K.

13.2.3 ITALY

13.2.4 FRANCE

13.2.5 SPAIN

13.2.6 RUSSIA

13.2.7 SWITZERLAND

13.2.8 TURKEY

13.2.9 BELGIUM

13.2.10 NETHERLANDS

13.2.11 REST OF EUROPE

13.3 ASIA-PACIFIC

13.3.1 JAPAN

13.3.2 CHINA

13.3.3 SOUTH KOREA

13.3.4 INDIA

13.3.5 SINGAPORE

13.3.6 THAILAND

13.3.7 INDONESIA

13.3.8 MALAYSIA

13.3.9 PHILIPPINES

13.3.10 AUSTRALIA

13.3.11 REST OF ASIA-PACIFIC

13.4 SOUTH AMERICA

13.4.1 BRAZIL

13.4.2 ARGENTINA

13.4.3 REST OF SOUTH AMERICA

13.5 MIDDLE EAST AND AFRICA

13.5.1 SOUTH AFRICA

13.5.2 EGYPT

13.5.3 SAUDI ARABIA

13.5.4 UNITED ARAB EMIRATES

13.5.5 ISRAEL

13.5.6 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL MEDICINAL MUSHROOM MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS AND ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.7 EXPANSIONS

14.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

16 GLOBAL MEDICINAL MUSHROOM MARKET - COMPANY PROFILES

16.1 MYCOTRITION GMBH

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT UPDATES

16.2 NORDIC MUSHROOMS

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT UPDATES

16.3 ALOHA MEDICINALS

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT UPDATES

16.4 NAMMEX

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT UPDATES

16.5 HOKKAIDO REISHI

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT UPDATES

16.6 BANKEN CHAMPIGNONS B.V.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT UPDATES

16.7 FAR WEST FUNGI

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT UPDATES

16.8 DXN HOLDINGS

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT UPDATES

16.9 SSD BIO SCIENCES

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT UPDATES

16.1 CONCORD FARMS

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT UPDATES

16.11 ERNÄHRUNGS

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT UPDATES

16.12 HIRANO MUSHROOM LLC

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT UPDATES

16.13 THE GIORGI COMPANIES, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT UPDATES

16.14 MUSHROOM KING FARM.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 FUNGI PERFECTI

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT UPDATES

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17 RELATED REPORTS

18 QUESTIONNAIRE

19 CONCLUSION

20 ABOUT DATA BRIDGE MARKET RESEARCH

Global Medicinal Mushroom Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Medicinal Mushroom Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Medicinal Mushroom Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.