Global Membrane Bioreactor System Market

Market Size in USD Billion

CAGR :

%

USD

4.40 Billion

USD

9.54 Billion

2024

2032

USD

4.40 Billion

USD

9.54 Billion

2024

2032

| 2025 –2032 | |

| USD 4.40 Billion | |

| USD 9.54 Billion | |

|

|

|

|

What is the Global Membrane Bioreactor (MBR) Systems Market Size and Growth Rate?

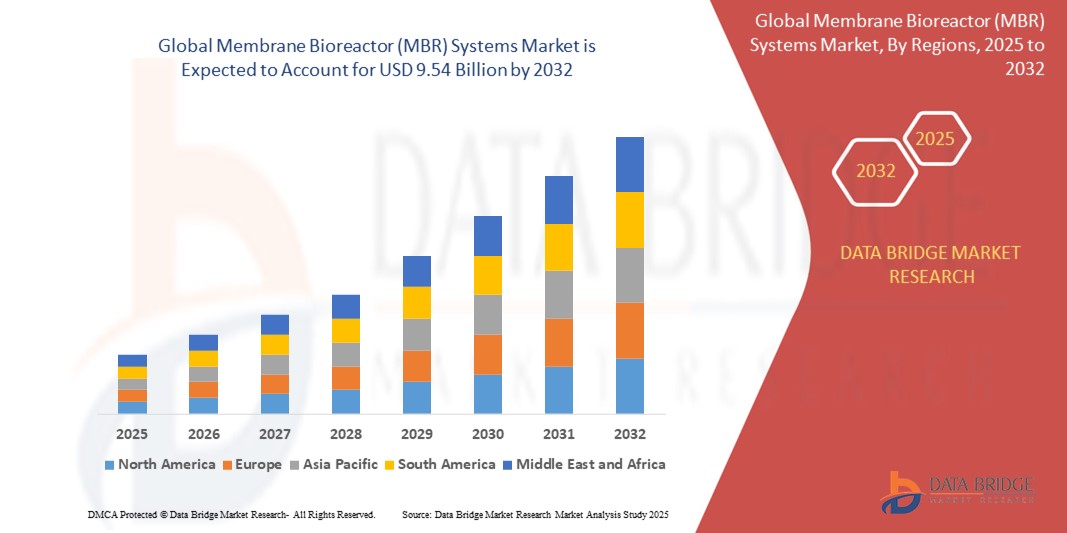

- The global membrane bioreactor (MBR) systems market size was valued at USD 4.40 billion in 2024 and is expected to reach USD 9.54 billion by 2032, at a CAGR of 10.14% during the forecast period

- The membrane bioreactor (MBR) systems market continues to surge with advancements in technology. The latest innovations drive growth, particularly in containerized membrane bioreactor system, offering efficient wastewater treatment solutions

- These systems integrate cutting-edge membrane technology with biological processes, enhancing water purification processes. As demands for sustainable solutions rise, MBR systems stand at the forefront, revolutionizing wastewater treatment with their compact and high-performance designs

What are the Major Takeaways of Membrane Bioreactor (MBR) Systems Market?

- Rapid urbanization and industrial expansion drive increased wastewater generation, necessitating efficient treatment solutions. membrane bioreactor (MBR) systems capitalize on this demand due to their compact design, exceptional treatment efficacy, and adaptability to diverse wastewater compositions

- For instance, in densely populated urban areas such as Mumbai, India, where space is limited, and wastewater volumes are high, MBR systems offer a sustainable solution for reliable membrane bioreactor (MBR) system wastewater treatment within constrained environments, unlocking market opportunities for MBR technology providers

- North America dominated the membrane bioreactor (MBR) systems market with the largest revenue share of 41.5% in 2024, driven by the region's emphasis on sustainable wastewater treatment, strict regulatory frameworks, and rising investments in advanced water management technologies

- Asia-Pacific membrane bioreactor (MBR) systems market is poised to grow at the fastest CAGR of 15.3% from 2025 to 2032, driven by rapid urbanization, rising environmental concerns, and government initiatives aimed at improving wastewater management infrastructure

- The Hollow Fiber segment dominated the membrane bioreactor (MBR) systems market with the largest market revenue share of 57.3% in 2024, driven by its compact design, high packing density, and lower operational costs

Report Scope and Membrane Bioreactor (MBR) Systems Market Segmentation

|

Attributes |

Membrane Bioreactor (MBR) Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Membrane Bioreactor (MBR) Systems Market?

“AI-Driven Monitoring and Predictive Maintenance in MBR Systems”

- A major evolving trend in the global membrane bioreactor (MBR) systems market is the integration of artificial intelligence (AI) and advanced monitoring technologies to optimize wastewater treatment performance, reduce operational costs, and extend membrane lifespan

- For instance, companies such as SUEZ and Veolia have introduced smart MBR systems equipped with AI-driven platforms that analyze real-time operational data to predict fouling events, suggest corrective actions, and enhance energy efficiency

- AI integration in MBR systems enables predictive maintenance by detecting early signs of membrane clogging, wear, or performance dips, thus minimizing unexpected downtime and reducing maintenance costs

- In addition, cloud-based platforms now allow remote monitoring and control of MBR operations across multiple facilities, enhancing efficiency for both municipal and industrial wastewater treatment plants

- This trend is transforming the wastewater sector by improving process reliability, enabling real-time optimization, and supporting sustainability goals. Consequently, market leaders are investing heavily in digital MBR solutions with AI-enabled diagnostics and automated performance management

- The demand for intelligent, automated, and remotely managed MBR systems is accelerating, particularly among utilities and industries aiming to enhance water reuse efficiency while reducing environmental impact

What are the Key Drivers of Membrane Bioreactor (MBR) Systems Market?

- The escalating global demand for efficient wastewater treatment, coupled with stricter environmental regulations on water discharge and water reuse, is driving significant growth in the MBR Systems market

- For instance, in March 2024, Veolia announced the deployment of its next-generation MBBR/MBR hybrid system to enhance nutrient removal and comply with evolving European wastewater standards. Such innovations are expected to bolster market growth during the forecast period

- Rising concerns over water scarcity, especially in regions such as the Middle East, Asia-Pacific, and parts of the U.S., are prompting governments and industries to adopt advanced MBR technologies for wastewater recycling and non-potable reuse applications

- In addition, the need for compact, high-efficiency treatment solutions is fueling demand for MBR systems, which offer a smaller footprint and higher effluent quality compared to conventional processes

- Growing investments in smart infrastructure, combined with public-private partnerships aimed at modernizing water treatment plants, further accelerate market expansion globally

Which Factor is challenging the Growth of the Membrane Bioreactor (MBR) Systems Market?

- Despite strong market momentum, the MBR Systems industry faces challenges related to high initial capital costs, membrane fouling issues, and energy consumption concerns

- For instance, frequent membrane replacement and energy-intensive aeration processes can increase operational expenses, limiting adoption among small-scale utilities or budget-constrained regions

- Addressing membrane fouling and optimizing energy efficiency through advanced materials and smart control systems is essential to mitigate these challenges. Companies such as BASF and DuPont are investing in next-gen membrane technologies to improve durability and performance

- In addition, technical complexities associated with MBR system integration, especially in retrofitting existing treatment plants, can hinder widespread deployment

- Overcoming these barriers will require continued R&D in cost-effective membranes, government incentives for sustainable water solutions, and increased operator training to ensure long-term system efficiency and affordability

How is the Membrane Bioreactor (MBR) Systems Market Segmented?

The market is segmented on the basis of product, configuration, and application.

• By Product

On the basis of product, the membrane bioreactor (MBR) systems market is segmented into Hollow Fiber, Flat Sheet, and Multi-Tubular. The Hollow Fiber segment dominated the Membrane Bioreactor (MBR) Systems market with the largest market revenue share of 57.3% in 2024, driven by its compact design, high packing density, and lower operational costs. Hollow fiber membranes are widely preferred for municipal and industrial applications due to their efficient filtration performance and ease of maintenance. Their ability to handle high mixed liquor suspended solids (MLSS) concentrations makes them a cost-effective and space-saving solution for large-scale wastewater treatment facilities.

The Flat Sheet segment is anticipated to witness the fastest growth rate of 20.5% from 2025 to 2032, fueled by its superior mechanical strength, simple installation, and high fouling resistance. Flat sheet membranes are increasingly adopted in industrial wastewater treatment due to their robustness and suitability for treating complex effluents. The segment’s growth is further supported by rising investments in decentralized treatment plants and compact modular systems.

• By Configuration

On the basis of configuration, the membrane bioreactor (MBR) systems market is segmented into Submerged and Side Stream. The Submerged segment held the largest market revenue share of 68.9% in 2024, driven by its lower energy consumption, smaller footprint, and cost-effective operation. Submerged MBR systems are extensively used in municipal wastewater treatment due to their simplicity, reduced sludge production, and easy scalability.

The Side Stream segment is expected to witness the fastest CAGR from 2025 to 2032, owing to its higher membrane flux, enhanced cleaning capabilities, and suitability for high-strength industrial wastewater. Side stream configurations offer flexible operation and are gaining traction in industries requiring high recovery rates and stringent discharge standards.

• By Application

On the basis of application, the membrane bioreactor (MBR) systems market is segmented into Municipal Wastewater Treatment and Industrial Wastewater Treatment. The Municipal Wastewater Treatment segment accounted for the largest market revenue share of 71.4% in 2024, driven by increasing urbanization, tightening water quality regulations, and the growing need for water reuse. Municipalities worldwide are increasingly adopting MBR systems to meet strict effluent standards while optimizing land use and reducing environmental impact.

The Industrial Wastewater Treatment segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by rising industrialization, stringent discharge regulations, and the growing demand for sustainable water management solutions. Industries such as food & beverage, pharmaceuticals, textiles, and chemicals are increasingly implementing MBR systems to achieve high-quality effluent and support zero-liquid discharge (ZLD) initiatives.

Which Region Holds the Largest Share of the Membrane Bioreactor (MBR) Systems Market?

- North America dominated the membrane bioreactor (MBR) systems market with the largest revenue share of 41.5% in 2024, driven by the region's emphasis on sustainable wastewater treatment, strict regulatory frameworks, and rising investments in advanced water management technologies

- Municipalities and industries across the region are increasingly adopting MBR systems for reliable, space-efficient, and high-quality wastewater treatment, especially in water-scarce areas

- The presence of major market players, ongoing infrastructure upgrades, and the growing need for water reuse are further accelerating the deployment of MBR systems across both municipal and industrial sectors

U.S. Membrane Bioreactor (MBR) Systems Market Insight

U.S. membrane bioreactor (MBR) systems market captured the largest revenue share and regulatory mandates promoting advanced wastewater treatment solutions. The increasing adoption of MBR systems in municipal wastewater treatment plants, coupled with robust demand from industries such as food & beverage and pharmaceuticals, is driving market growth. In addition, U.S. initiatives focused on water conservation, pollution control, and smart water management are further contributing to the expanding adoption of MBR technologies across the country.

Europe Membrane Bioreactor (MBR) Systems Market Insight

Europe membrane bioreactor (MBR) systems market is projected to grow at a steady CAGR throughout the forecast period, supported by stringent environmental regulations such as the Urban Wastewater Treatment Directive and the rising demand for water recycling solutions. European nations are investing heavily in sustainable infrastructure, with MBR systems playing a crucial role in meeting strict discharge standards and promoting circular water use. Growing urbanization, coupled with technological advancements in membrane materials, is fostering adoption across municipal, industrial, and commercial sectors.

U.K. Membrane Bioreactor (MBR) Systems Market Insight

U.K. membrane bioreactor (MBR) systems market is expected to grow at a notable CAGR during the forecast period, driven by increasing concerns over water scarcity, pollution control, and stricter compliance requirements post-Brexit. The rising need for decentralized wastewater treatment solutions and the country's commitment to environmental sustainability are propelling the demand for MBR systems across both residential and industrial applications.

Germany Membrane Bioreactor (MBR) Systems Market Insight

Germany membrane bioreactor (MBR) systems market is anticipated to expand at a significant CAGR, supported by the country's focus on technological innovation, water conservation, and energy-efficient treatment solutions. Germany’s advanced industrial base, combined with rising investments in sustainable infrastructure and eco-friendly technologies, is promoting the adoption of MBR systems across wastewater treatment facilities, industrial plants, and decentralized treatment units.

Which Region is the Fastest Growing Region in the Membrane Bioreactor (MBR) Systems Market?

Asia-Pacific membrane bioreactor (MBR) systems market is poised to grow at the fastest CAGR of 15.3% from 2025 to 2032, driven by rapid urbanization, rising environmental concerns, and government initiatives aimed at improving wastewater management infrastructure. Countries such as China, Japan, and India are witnessing significant investments in smart cities, industrial parks, and sustainable water treatment solutions, accelerating the adoption of MBR systems across the region. The growing middle-class population, coupled with increased industrial activity and demand for high-efficiency water treatment, is creating vast growth opportunities for MBR system manufacturers in APAC.

Japan Membrane Bioreactor (MBR) Systems Market Insight

Japan membrane bioreactor (MBR) systems market is gaining momentum, fueled by the country’s commitment to environmental protection, advanced technology integration, and stringent wastewater discharge regulations. The growing use of MBR systems in both municipal and industrial settings, along with Japan's focus on energy-efficient and compact treatment solutions, is propelling market expansion.

China Membrane Bioreactor (MBR) Systems Market Insight

China membrane bioreactor (MBR) systems market accounted for the largest market revenue share within Asia Pacific in 2024, driven by the nation's ambitious environmental policies, rapid urban development, and growing emphasis on sustainable water management. China's strong manufacturing base, coupled with extensive investments in wastewater infrastructure and smart city projects, is accelerating the widespread adoption of MBR systems across municipal, industrial, and residential sectors.

Which are the Top Companies in Membrane Bioreactor (MBR) Systems Market?

The membrane bioreactor (MBR) systems industry is primarily led by well-established companies, including:

- SUEZ (France)

- Veolia (France)

- Xylem (U.S.)

- DuPont (U.S.)

- 3M (U.S.)

- Pentair (U.K.)

- United Utilities Group PLC (U.K.)

- Kingspan Group (U.K.)

- Dow (U.S.)

- BASF SE (Germany)

- Kurita Water Industries Ltd. (Japan)

- Bio-Microbics, Inc. (U.S.)

- Calgon Carbon Corporation (U.S.)

- Trojan Technologies Inc. (Canada)

- Kemira (Finland)

- Thermax Limited (India)

- WOG GROUP (India)

- Golder Associates, Inc. (Canada)

What are the Recent Developments in Global Membrane Bioreactor (MBR) Systems Market?

- In January 2023, Xylem, a leading global water technology company, completed the acquisition of Evoqua Water Technologies LLC. This strategic move created the world’s largest pure-play water technology company. The acquisition enhances Xylem’s ability to address global water challenges such as scarcity and quality by integrating Evoqua’s advanced treatment technologies. This move positions Xylem as a stronger force in the water treatment sector, broadening its global capabilities

- In January 2023, Kovalus Separation Solutions (KSS) entered into a partnership with Aqana to provide anaerobic wastewater treatment technologies to industrial customers in North America. The collaboration combines the expertise of both companies in technologies such as Moving Bed Biofilm Reactors (MBBR), Membrane Bioreactors (MBR), and Reverse Osmosis (RO) to tackle complex industrial wastewater treatment requirements. This partnership expands KSS's footprint and strengthens its solutions portfolio for industrial water treatment

- In June 2022, KSS acquired the LIONEX technology from Chemionex Inc., which served as the foundation for launching the company’s Li-PRO process—a proprietary global solution for Direct Lithium Extraction (DLE). The Li-PRO process integrates lithium-selective extraction media with KSS’s PURON membrane pretreatment and high-recovery RO technologies to produce purified lithium chloride solutions. This acquisition positions KSS as a leader in sustainable lithium extraction, vital for the energy and battery sectors

- In May 2022, MANN+HUMMEL Water & Fluid Solutions introduced its new BIO-CEL M+ filtration module at IFAT to address evolving global market needs. The product is available in 100- and 200-square-meter versions to cater to diverse project requirements. This product launch strengthens MANN+HUMMEL's position in the competitive water filtration market by offering scalable and efficient solutions

- In January 2020, DuPont finalized the acquisition of Memcor from Evoqua Water Technologies, following its announcement in 2019. The acquisition expanded DuPont’s water treatment portfolio by adding ultrafiltration and Membrane Bioreactor (MBR) technologies. This integration allowed DuPont to deliver more comprehensive and innovative wastewater solutions for both municipal and industrial sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MEMBRANE BIOREACTOR (MBR) SYSTEMS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL MEMBRANE BIOREACTOR (MBR) SYSTEMS MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL MEMBRANE BIOREACTOR (MBR) SYSTEMS MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL PRODUCTION COVERAGE

5.2 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.3 LIST OF KEY BUYERS, BY REGION

5.3.1 NORTH AMERICA

5.3.2 EUROPE

5.3.3 ASIA PACIFIC

5.3.4 SOUTH AMERICA

5.3.5 MIDDLE EAST & AFRICA

5.4 PORTER’S FIVE FORCES

5.5 PESTEL ANALYSIS

5.6 REGULATION COVERAGE

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 CLIMATE CHANGE SCENARIO

7.1 ENVIRONMENTAL CONCERNS

7.2 INDUSTRY RESPONSE

7.3 GOVERNMENT’S ROLE

7.4 ANALYST RECOMMENDATIONS

8 GLOBAL MEMBRANE BIOREACTOR (MBR) SYSTEMS MARKET, BY PRODUCT, (2022-2031) (USD MILLION)

8.1 OVERVIEW

8.2 HOLLOW FIBER

8.3 FLAT SHEET

8.4 MULTI-TUBULAR

9 GLOBAL MEMBRANE BIOREACTOR (MBR) SYSTEMS MARKET, BY CONFIGURATION, (2022-2031) (USD MILLION)

9.1 OVERVIEW

9.2 SUBMERGED

9.3 SIDE STREAM

10 GLOBAL MEMBRANE BIOREACTOR (MBR) SYSTEMS MARKET, BY APPLICATION, (2022-2031) (USD MILLION)

10.1 OVERVIEW

10.2 MUNICIPAL WASTEWATER TREATMENT

10.3 INDUSTRIAL WASTEWATER TREATMENT

11 GLOBAL MEMBRANE BIOREACTOR (MBR) SYSTEMS MARKET, BY GEOGRAPHY

11.1 GLOBAL MEMBRANE BIOREACTOR (MBR) SYSTEMS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

11.2 NORTH AMERICA

11.2.1 U.S.

11.2.2 CANADA

11.2.3 MEXICO

11.3 EUROPE

11.3.1 GERMANY

11.3.2 U.K.

11.3.3 ITALY

11.3.4 FRANCE

11.3.5 SPAIN

11.3.6 SWITZERLAND

11.3.7 BELGIUM

11.3.8 THE NETHERLANDS

11.3.9 RUSSIA

11.3.10 TURKEY

11.3.11 REST OF EUROPE

11.4 ASIA-PACIFIC

11.4.1 JAPAN

11.4.2 CHINA

11.4.3 SOUTH KOREA

11.4.4 INDIA

11.4.5 AUSTRALIA & NEW ZEALAND

11.4.6 HONG KONG

11.4.7 TAIWAN

11.4.8 SINGAPORE

11.4.9 THAILAND

11.4.10 INDONESIA

11.4.11 MALAYSIA

11.4.12 PHILIPPINES

11.4.13 REST OF ASIA-PACIFIC

11.5 SOUTH AMERICA

11.5.1 BRAZIL

11.5.2 ARGENTINA

11.5.3 VENEZUELA

11.5.4 REST OF SOUTH AMERICA

11.6 MIDDLE EAST & AFRICA

11.6.1 SAUDI ARABIA

11.6.2 QATAR

11.6.3 UAE

11.6.4 KUWAIT

11.6.5 ISRAEL

11.6.6 SOUTH AFRICA

11.6.7 EGYPT

11.6.8 REST OF SOUTH AMERICA

12 GLOBAL MEMBRANE BIOREACTOR (MBR) SYSTEMS MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12.5 MERGERS & ACQUISITIONS

12.6 NEW PRODUCT DEVELOPMENT & APPROVALS

12.7 EXPANSIONS

12.8 REGULATORY CHANGES

12.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

13 SWOT ANALYSIS AND DATABRIDGE MARKET RESEARCH ANALYSIS

14 GLOBAL MEMBRANE BIOREACTOR (MBR) SYSTEMS MARKET – COMPANY PROFILE

14.1 SUEZ

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 SWOT ANALYSIS

14.1.5 RECENT UPDATES

14.2 VEOLIA

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 SWOT ANALYSIS

14.2.5 RECENT UPDATES

14.3 XYLEM

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 SWOT ANALYSIS

14.3.5 RECENT UPDATES

14.4 DUPONT

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 SWOT ANALYSIS

14.4.5 RECENT UPDATES

14.5 3M

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 SWOT ANALYSIS

14.5.5 RECENT UPDATES

14.6 PENTAIR

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 SWOT ANALYSIS

14.6.5 RECENT UPDATES

14.7 UNITED UTILITIES GROUP PLC

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 SWOT ANALYSIS

14.7.5 RECENT UPDATES

14.8 KINGSPAN GROUP PLC

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 SWOT ANALYSIS

14.8.5 RECENT UPDATES

14.9 DOW

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 SWOT ANALYSIS

14.9.5 RECENT UPDATES

14.1 BASF SE

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 SWOT ANALYSIS

14.10.5 RECENT UPDATES

14.11 KURITA WATER INDUSTRIES LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 SWOT ANALYSIS

14.11.5 RECENT UPDATES

14.12 BIO-MICROBICS, INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 SWOT ANALYSIS

14.12.5 RECENT UPDATES

14.13 CALGON CARBON CORPORATION

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 SWOT ANALYSIS

14.13.5 RECENT UPDATES

14.14 TROJAN TECHNOLOGIES INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 SWOT ANALYSIS

14.14.5 RECENT UPDATES

14.15 KEMIRA OYJ

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 SWOT ANALYSIS

14.15.5 RECENT UPDATES

14.16 THERMAX LIMITED

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 SWOT ANALYSIS

14.16.5 RECENT UPDATES

14.17 WOG TECHNOLOGIES

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 SWOT ANALYSIS

14.17.5 RECENT UPDATES

15 CONCLUSION

16 QUESTIONNAIRE

17 RELATED REPORTS

18 ABOUT DATA BRIDGE MARKET RESEARCH

Global Membrane Bioreactor System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Membrane Bioreactor System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Membrane Bioreactor System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.