Global Menstrual Health Apps Market

Market Size in USD Billion

CAGR :

%

USD

1.22 Billion

USD

4.05 Billion

2024

2032

USD

1.22 Billion

USD

4.05 Billion

2024

2032

| 2025 –2032 | |

| USD 1.22 Billion | |

| USD 4.05 Billion | |

|

|

|

|

Menstrual Health Apps Market Size

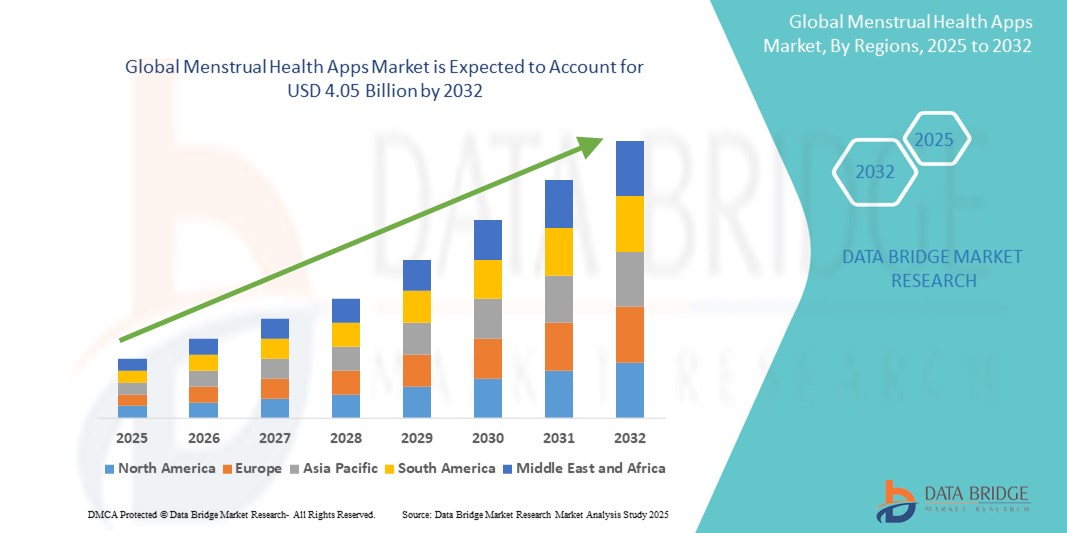

- The global menstrual health apps market size was valued at USD 1.22 billion in 2024 and is expected to reach USD 4.05 billion by 2032, at a CAGR of 16.20% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within mobile health (mHealth) platforms and femtech innovations, leading to increased digitalization in both women's health monitoring and personalized care delivery

- Furthermore, rising consumer demand for secure, user-friendly, and integrated solutions for tracking menstruation, ovulation, fertility, and hormonal health is establishing menstrual health apps as the preferred choice for millions of users globally. These converging factors are accelerating the uptake of Menstrual Health Apps solutions, thereby significantly boosting the industry's growth

Menstrual Health Apps Market Analysis

- Menstrual health apps, offering digital tools for cycle tracking, symptom logging, and reproductive health insights, are increasingly vital components of personalized healthcare for women. These apps enhance convenience, empower users with health data, and integrate seamlessly with wearable devices and digital health ecosystems

- The escalating demand for menstrual health apps is primarily fueled by the rising awareness of women’s health, growing smartphone penetration, and a global shift towards preventive and personalized healthcare. In addition, the increasing focus on fertility planning and hormonal health among young women is accelerating adoption

- North America dominated the menstrual health apps market with the largest revenue share of 41.3% in 2024, characterized by high digital health literacy, robust smartphone penetration, and the presence of leading app developers. In the U.S., the use of menstrual health apps is rapidly expanding due to increased awareness, workplace wellness programs, and integration with broader women’s telehealth services

- Asia-Pacific is expected to be the fastest growing region in the menstrual health apps market, projected to expand at a CAGR of 19.25% from 2025 to 2032, fueled by increasing urbanization, growing awareness of menstrual hygiene, and widespread access to mobile internet. Countries like India, China, and Indonesia are witnessing a surge in app downloads driven by education campaigns and partnerships with local health authorities

- The Android segment dominated the market with a revenue share of 63.4% in 2024, driven by the widespread adoption of Android smartphones globally, particularly in emerging markets where affordability and accessibility play a key role. Android-based apps benefit from a larger user base, broader device compatibility, and flexible customization options, contributing to their strong market presence

Report Scope and Menstrual Health Apps Market Segmentation

|

Attributes |

Menstrual Health Apps Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Menstrual Health Apps Market Trends

“Expanding Personalization and User Engagement in Women’s Digital Health”

- A significant and accelerating trend in the global menstrual health apps market is the deepening integration with artificial intelligence (AI) and connected digital health ecosystems. This integration is greatly enhancing user convenience by offering tailored insights based on individual health patterns, symptom tracking, and lifestyle data

- For instance, several menstrual health apps now integrate with popular digital assistants such as Amazon Alexa, Google Assistant, and Apple HealthKit. Users can receive cycle updates, reminders, and fertility insights through simple voice interactions, enhancing accessibility and usability, especially for visually impaired or busy users

- AI-powered menstrual health apps are increasingly capable of analyzing historical data to predict cycles, ovulation windows, and mood fluctuations with greater accuracy. Over time, these tools learn user behavior to provide more personalized health advice, symptom alerts, and fertility suggestions

- The seamless integration of menstrual tracking apps with wearable devices (e.g., Fitbit, Apple Watch) and broader health management platforms allows users to centralize their wellness data, from heart rate and sleep quality to hormonal fluctuations and stress levels. This creates a unified, data-rich environment that empowers users to take charge of their reproductive and general health

- This shift toward smarter, intuitive, and interconnected digital health tools is transforming the expectations of users in the women’s health segment. Companies like Flo, Clue, and Natural Cycles are developing enhanced app experiences featuring predictive analytics, mental health tracking, and telehealth connectivity for consultations

- The demand for menstrual health apps that offer seamless digital integration, privacy, and scientifically backed recommendations is growing rapidly across both developed and emerging markets, as consumers increasingly prioritize proactive health monitoring and reproductive awareness

Menstrual Health Apps Market Dynamics

Driver

“Growing Demand Due to Rising Health Awareness and Smartphone Penetration”

- The increasing awareness surrounding women’s health and wellness, combined with the global surge in smartphone usage, is a significant driver fueling the growth of the Menstrual Health Apps market

- For instance, in June 2024, Flo Health—a leading player in the space—announced the integration of AI-driven symptom tracking and predictive analytics into its platform, enhancing personalized care and reinforcing its appeal among health-conscious users. Such innovations are expected to accelerate market expansion during the forecast period

- As women increasingly seek tools to monitor menstrual cycles, fertility, and overall reproductive health, these apps offer an accessible and private means to track symptoms, manage irregularities, and prepare for doctor consultations

- Furthermore, growing popularity of telehealth services and digital wellness platforms has created synergy with menstrual health apps, allowing seamless integration of period data with virtual consultations and diagnostics

- The ability to track ovulation, receive customized health tips, manage birth control, and receive alerts related to hormonal health through a single mobile app is increasing adoption across both developed and developing markets. In addition, the rise of female-led health startups is bringing more culturally relevant, localized, and feature-rich options into the market, helping bridge the accessibility gap in underserved regions

Restraint/Challenge

“Privacy Concerns and Limited Medical Accuracy in Some Applications”

- Privacy and data security concerns pose a substantial challenge for the menstrual health apps market. As these apps collect sensitive reproductive health information, users are increasingly worried about data misuse or unauthorized sharing with third parties.

- High-profile incidents—such as the June 2022 scrutiny of U.S.-based period tracking apps following the Roe v. Wade reversal—sparked global debates over the safe handling of women’s health data, pushing for stricter privacy standards and transparency in data usage.

- Many free apps monetize through third-party data sharing or ads, which can compromise user trust. To counter this, players like Clue have started emphasizing GDPR compliance and zero data sharing policies.

- Another challenge lies in the inconsistent medical accuracy of app algorithms. Some apps rely heavily on user input without clinically validated models, leading to possible misinformation regarding fertility windows or cycle irregularities.

- This lack of clinical validation and regulation can make some solutions unreliable for users with complex medical conditions such as PCOS or irregular cycles, limiting broader trust in the apps as standalone diagnostic tools.

- Overcoming these challenges will require more stringent regulation, medical partnerships, and transparent privacy frameworks, along with user education on how to interpret the insights provided by the app effectively

Menstrual Health Apps Market Scope

The market is segmented on the basis of platform, and application.

- By Platform

On the basis of platform, the menstrual health apps market is segmented into Android and iOS. The Android segment dominated the market with a revenue share of 63.4% in 2024, driven by the widespread adoption of Android smartphones globally, particularly in emerging markets where affordability and accessibility play a key role. Android-based apps benefit from a larger user base, broader device compatibility, and flexible customization options, contributing to their strong market presence.

The iOS segment is expected to witness the fastest CAGR of 20.6% from 2025 to 2032, fueled by rising demand for premium health and wellness applications and high app engagement rates among iPhone users. iOS platforms are known for their robust privacy standards and seamless user experience, attracting health-conscious users and app developers focused on security and accuracy.

- By Application

On the basis of application, the Menstrual Health Apps market is segmented into period/cycle tracking, fertility & ovulation management, and menstrual health management. The period/cycle tracking segment held the largest market revenue share of 48.7% in 2024, owing to its broad appeal among users seeking basic menstrual awareness, symptom logging, and cycle prediction. These features are often available in free versions, making them accessible to a wide audience.

The Fertility & Ovulation Management segment is expected to witness the fastest CAGR of 21.4% from 2025 to 2032, driven by increasing interest in natural family planning, fertility awareness, and conception support. Apps in this category provide advanced features like basal body temperature tracking, hormone-level integration, and fertile window forecasting.

Menstrual Health Apps Market Regional Analysis

- North America dominated the menstrual health apps market, accounting for 41.3% of global revenue share in 2024, driven by increasing health consciousness among women and strong penetration of mobile technologies

- The demand is bolstered by widespread adoption of digital health platforms, and high interest in fertility and reproductive health tracking apps

- High smartphone usage rates, presence of key players, and supportive healthcare infrastructure are further propelling regional growth

U.S. Menstrual Health Apps Market Insight

The U.S. menstrual health apps market held a commanding 76.8% share of the North American Menstrual Health Apps market in 2024. This dominance is attributed to rising consumer awareness around menstrual disorders, PCOS, fertility planning, and preference for AI-powered health tracking. Apps like Flo, Glow, and Clue lead the market with millions of downloads and continuous feature innovations, contributing to strong user retention and revenue generation.

Europe Menstrual Health Apps Market Insight

The Europe menstrual health apps market is projected to grow at a CAGR of 16.7% from 2025 to 2032, supported by increasing acceptance of femtech and privacy-centric menstrual tracking tools. In 2024, Europe contributed 23.5% of the global Menstrual Health Apps market, driven by tech-forward countries such as Germany, U.K., France, and Nordic nations. Integration with EU-backed health initiatives and increased focus on reproductive education are also driving growth.

U.K. Menstrual Health Apps Market Insight

The U.K. menstrual health apps market is expected to grow at a CAGR of 15.3% during the forecast period due to rising demand for ovulation prediction apps, fertility monitoring, and pregnancy planners. In 2024, the U.K. accounted for approximately 6.1% of Europe’s menstrual app market, with rising interest among women aged 18–35 in digital reproductive health tools. Strong mobile adoption and integration of digital health services within NHS offerings support continued growth.

Germany Menstrual Health Apps Market Insight

The Germany menstrual health apps market is expected to witness a CAGR of 14.9% from 2025 to 2032, supported by an increase in femtech startups and regulatory clarity under GDPR. The country captured 5.6% of Europe’s share in 2024, driven by women’s growing preference for secure and evidence-based health tracking solutions. Apps focusing on menstrual irregularities and hormonal management are in high demand among urban populations.

Asia-Pacific Menstrual Health Apps Market Insight

The Asia-Pacific menstrual health apps market region is expected to record the fastest CAGR of 19.25% from 2025 to 2032, with rising smartphone penetration, expanding internet access, and increased public health initiatives. In 2024, the region held a market share of 19.2%, led by China, India, Japan, and South Korea. Localized language support, affordable app subscriptions, and educational campaigns are expanding reach into both urban and rural female populations.

Japan Menstrual Health Apps Market Insight

The Japan menstrual health apps market is growing at a CAGR of 13.5%, supported by high levels of technological adoption, an aging population seeking menopause tracking, and corporate wellness integration. Japan accounted for 4.2% of Asia-Pacific’s revenue in 2024. The preference for AI-driven health dashboards and strong interoperability with wearables continues to drive user engagement.

China Menstrual Health Apps Market Insight

The China menstrual health apps market represented the largest share within Asia-Pacific at 47% in 2024, due to a growing middle class and rapid digitalization of women’s health services. Strong backing from domestic femtech companies, partnerships with online pharmacies, and usage in telehealth ecosystems are boosting growth. The market is expected to grow at a CAGR of 26.1%, the highest in the region, during the forecast period.

Menstrual Health Apps Market Share

The menstrual health apps industry is primarily led by well-established companies, including:

- Flo Health Inc (U.K.)

- BioWink GmbH (Germany)

- Glow, Inc. (U.S.)

- Ovia Health (U.S.)

- Kindara, Inc. (U.S.)

- SimpleInnovation (U.S.)

- Natural Cycles Nordic AB (Sweden)

- Plackal Tech (India)

- Cycle Technologies (U.S.)

- GP International LLC (U.S.)

- Procter & Gamble (U.S.)

- Perigee (Sweden)

- Bellabeat (Slovenia)

- Eve by Glow (U.S.)

Latest Developments in Global Menstrual Health Apps Market

- In September 2023, Apple Inc. launched advanced cycle tracking features in its Apple Watch Series 8 and later models, using wrist temperature and heart rate data to improve ovulation estimates and detect irregular menstrual patterns. This AI-driven approach to menstrual health management prioritizes privacy and accuracy, helping users identify potential health issues such as PCOS and endometriosis

- In June 2024, Flo Health, one of the most downloaded menstrual health apps globally, partnered with Databricks to improve its AI capabilities, enhancing predictive accuracy in fertility windows and period cycles. This collaboration is designed to give users smarter, more personalized insights into their menstrual health

- In June 2024, Cambridge University researchers urged public health bodies like the NHS to launch transparent, privacy-focused menstrual tracking apps after finding that many popular apps collect sensitive personal data—including sexual activity and contraceptive use—that could be used for profiling or surveillance

- In May 2024, Asan (UK) released a free menstrual tracking app developed by an all-women team, designed to track periods and ovulation while also measuring environmental impact related to period products. The app aims to empower menstruators with free, comprehensive tools without exploiting user data

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.