Global Metal Embossing Machine Market

Market Size in USD Billion

CAGR :

%

USD

59.37 Billion

USD

76.38 Billion

2024

2032

USD

59.37 Billion

USD

76.38 Billion

2024

2032

| 2025 –2032 | |

| USD 59.37 Billion | |

| USD 76.38 Billion | |

|

|

|

|

What is the Global Metal Embossing Machine Market Size and Growth Rate?

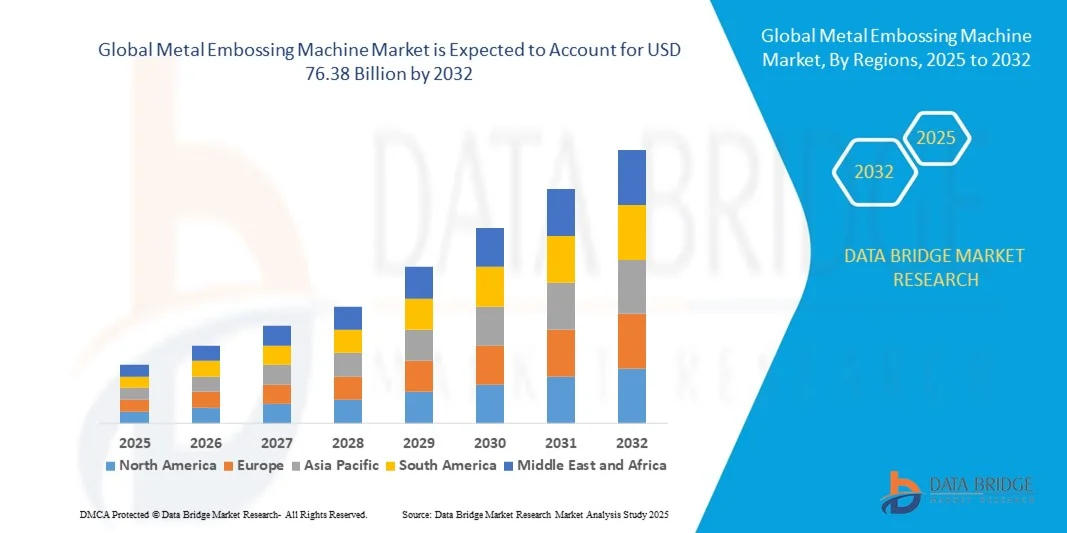

- The global metal embossing machine market size was valued at USD 59.37 billion in 2024 and is expected to reach USD 76.38 billion by 2032, at a CAGR of 3.20% during the forecast period

- Major factors that are expected to boost the growth of the metal embossing machine market in the forecast period are the development in the need for three-dimensional patterns on metal

- Furthermore, the rise in the investment towards the research and development to minimalize the growing expenses of the automated machines is further anticipated to propel the growth of the metal embossing machine market

What are the Major Takeaways of Metal Embossing Machine Market?

- The growth of the computer operating systems fuels the demand in end-use industries such as automotive, aerospace, and industrial machinery is further estimated to cushion the growth of the metal embossing machine market

- On the other hand, the instability in the costs of the raw materials is further projected to impede the growth of the metal embossing machine market in the timeline period

- Asia-Pacific dominated the metal embossing machine market with the largest revenue share of 36.64% in 2024, driven by rapid industrialization, urbanization, and the increasing adoption of advanced manufacturing technologies

- The North America metal embossing machine market is poised to grow at the fastest CAGR of 9.54% during the forecast period of 2025 to 2032. Growth is driven by increasing industrial automation, adoption of advanced manufacturing technologies, and demand for precision metal embossing in automotive and electronics sectors

- The Automatic metal embossing machine segment dominated the market with the largest revenue share of 56% in 2024, driven by the increasing demand for high precision, consistent output, and reduced human intervention in industrial applications

Report Scope and Metal Embossing Machine Market Segmentation

|

Attributes |

Metal Embossing Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Metal Embossing Machine Market?

Automation and Smart Integration for Operational Efficiency

- A prominent trend in the global metal embossing machine market is the increasing adoption of automation and smart technologies, including AI-based control systems, predictive maintenance features, and IoT-enabled monitoring. These advancements are significantly enhancing operational efficiency, precision, and productivity for manufacturers

- For instance, modern CNC metal embossing machines are integrated with predictive algorithms that adjust embossing pressure and speed in real time, ensuring consistent quality while reducing material wastage. Similarly, some machines are equipped with remote monitoring capabilities, allowing operators to track performance and maintenance needs from mobile devices

- AI-driven embossing machines can optimize workflows by learning production patterns, detecting errors early, and suggesting adjustments to improve throughput. This reduces downtime and enhances output quality, leading to better cost-efficiency

- The integration of smart systems also allows centralized control over multiple machines in a factory, streamlining operations and enabling real-time data analytics for better decision-making

- This trend toward automated, interconnected, and intelligent embossing systems is reshaping industry expectations and driving investment in advanced machinery solutions, with manufacturers increasingly prioritizing efficiency, accuracy, and remote operability

What are the Key Drivers of Metal Embossing Machine Market?

- The rising demand for precision metal components across automotive, electronics, and industrial sectors is a primary driver of metal embossing machine adoption. Manufacturers are seeking machines capable of high throughput with consistent quality

- For instance, in 2024, global automotive suppliers invested in advanced CNC embossing machines to produce lightweight, high-strength panels with intricate patterns, driving industry growth

- The growing adoption of smart manufacturing practices, Industry 4.0, and connected factory systems encourages companies to integrate AI and IoT capabilities in embossing machines, enhancing predictive maintenance and reducing operational downtime

- Furthermore, increasing emphasis on product customization, rapid prototyping, and flexible manufacturing is driving demand for versatile embossing machines capable of handling multiple metal types and designs

- The need for energy-efficient, low-maintenance, and automated machinery also contributes to market expansion, as companies prioritize sustainability and cost reduction, making advanced metal embossing machines essential in modern production facilities

Which Factor is Challenging the Growth of the Metal Embossing Machine Market?

- High capital investment required for advanced, AI-enabled metal embossing machines poses a significant challenge for small and medium-sized manufacturers. Many companies hesitate to invest due to high upfront costs and long payback periods

- In addition, the complexity of operating and maintaining automated systems requires skilled technicians, creating barriers for workforce-limited facilities or regions with skill gaps

- Cybersecurity concerns also affect adoption, as IoT-connected machines are vulnerable to network breaches that could disrupt production or compromise sensitive design data. Manufacturers must implement strong encryption, secure authentication, and regular software updates to mitigate risks

- While prices for basic embossing machines are declining, premium models with advanced AI, multi-function capabilities, and predictive maintenance remain costly, limiting adoption in cost-sensitive markets

- Overcoming these challenges requires training programs, cost-effective machine options, and enhanced cybersecurity measures, which will be vital to achieving sustained growth in the metal embossing machine market

How is the Metal Embossing Machine Market Segmented?

The market is segmented on the basis of product type and end use.

- By Product Type

On the basis of product type, the metal embossing machine market is segmented into Manual Metal Embossing Machine Manufacturers and Automatic Metal Embossing Machine Manufacturers. The Automatic Metal Embossing Machine segment dominated the market with the largest revenue share of 56% in 2024, driven by the increasing demand for high precision, consistent output, and reduced human intervention in industrial applications. Automatic machines are widely adopted across automotive, electronics, and industrial sectors due to their ability to perform complex embossing tasks at higher speeds while maintaining accuracy. These machines also integrate advanced features such as IoT monitoring, predictive maintenance, and programmable settings, which reduce downtime and operational costs.

Manual Metal Embossing Machines are expected to witness the fastest CAGR from 2025 to 2032, owing to their affordability, ease of use, and continued demand in small-scale manufacturing units and workshops where flexible, low-volume production is required. The availability of hybrid solutions further drives growth in this segment.

- By End Use

On the basis of end use, the metal embossing machine market is segmented into Low and Medium Volume and High Volume production applications. The High Volume segment accounted for the largest market revenue share of 62% in 2024, fueled by the increasing adoption of mass production techniques in automotive, electronics, and packaging industries. High volume applications benefit from automated embossing machines capable of delivering large-scale output with consistent quality, efficiency, and minimal errors, supporting industrial scalability.

The Low and Medium Volume segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing demand for customized metal products, prototyping, and flexible manufacturing for SMEs. Manufacturers are increasingly seeking compact and adaptable embossing machines that cater to small-to-medium production batches while minimizing setup time and costs. This segment’s growth is further supported by trends in personalized metal goods and niche industrial applications.

Which Region Holds the Largest Share of the Metal Embossing Machine Market?

- Asia-Pacific dominated the metal embossing machine market with the largest revenue share of 36.64% in 2024, driven by rapid industrialization, urbanization, and the increasing adoption of advanced manufacturing technologies

- Consumers and manufacturers in the region highly value efficiency, precision, and automation in metal embossing machines for automotive, electronics, and packaging industries

- The widespread adoption is further supported by government initiatives promoting smart factories, affordable labor costs, and the presence of leading domestic manufacturers, establishing metal embossing machines as a preferred solution for large-scale industrial applications

China Metal Embossing Machine Market Insight

The China metal embossing machine market accounted for the largest market revenue share in Asia-Pacific in 2024, fueled by the expanding middle class, rapid industrial expansion, and the push towards smart factories. Chinese manufacturers are increasingly adopting automated embossing solutions for high-volume production in automotive, electronics, and consumer goods sectors. Affordable pricing and localized manufacturing capabilities further drive adoption. The growing focus on precision, efficiency, and integration with Industry 4.0 technologies positions China as a key market hub in the Asia-Pacific region.

Japan Metal Embossing Machine Market Insight

The Japan metal embossing machine market is experiencing steady growth due to its high-tech industrial base, increasing automation, and strong demand for precision manufacturing. Adoption is driven by the electronics and automotive sectors, where high-quality embossing solutions are critical. Integration of advanced IoT and smart manufacturing technologies enhances operational efficiency and reduces downtime. Japan's emphasis on innovation, quality, and sustainability is further supporting the uptake of automated metal embossing machines in both commercial and industrial applications.

Which Region is the Fastest Growing Region in the Metal Embossing Machine Market?

The North America metal embossing machine market is poised to grow at the fastest CAGR of 9.54% during the forecast period of 2025 to 2032. Growth is driven by increasing industrial automation, adoption of advanced manufacturing technologies, and demand for precision metal embossing in automotive and electronics sectors. High technological maturity, robust industrial infrastructure, and strong investment in smart factories are further supporting market expansion. In addition, increasing adoption of Industry 4.0 standards and integration with automated production lines is accelerating the deployment of Metal Embossing Machines across manufacturing facilities in the region.

U.S. Metal Embossing Machine Market Insight

The U.S. metal embossing machine market captured a leading position within North America, driven by industrial automation trends, high adoption of smart manufacturing, and demand for high-quality embossing in automotive and electronics production. Manufacturers are leveraging advanced automation, predictive maintenance, and IoT-enabled monitoring to optimize performance and reduce operational costs. The focus on energy-efficient, precise, and scalable solutions is fueling growth. The integration of Metal Embossing Machines with broader smart manufacturing systems ensures centralized control and improved productivity, further reinforcing the U.S. as a critical growth market in North America.

Which are the Top Companies in Metal Embossing Machine Market?

The metal embossing machine industry is primarily led by well-established companies, including:

- Acro Metal Stamping Co (U.S.)

- Manor Tool & Manufacturing (U.S.)

- D&H Industries, Inc. (U.S.)

- Kenmode, Inc. (U.S.)

- Klesk Metal Stamping Co. (U.S.)

- Clow Stamping Company (U.S.)

- Goshen Stamping Company (U.S.)

- Tempco Manufacturing Company, Inc. (U.S.)

- INTERPLEX HOLDINGS PTE. LTD. (Singapore)

- Caparo (U.K.)

- Nissan Motor Company, Ltd. (Japan)

- AAPICO Hitech Public Company Limited (Thailand)

- Gestamp Automoción, S.A. (Spain)

- Ford Motor Company (U.S.)

- Jawo Sheng Precise Machinery Works Co., Ltd. (Taiwan)

- Alliance Machine & Engraving, LLC (U.S.)

- Anhui LIFU Machinery Technology (China)

- The Bradbury Co., Inc. (U.S.)

What are the Recent Developments in Global Metal Embossing Machine Market?

- In November 2023, Generational Growth Capital, an equity firm based in Milwaukee, U.S., acquired Federal Tool & Engineering, BP Metals, and Rockford Specialties, located in Wisconsin, Minnesota, and Illinois, U.S., respectively, all of which are metal stamping and structural steel manufacturers, strengthening its manufacturing capacity and logistics capabilities, enabling better support for customers through uninterrupted delivery

- In October 2023, Ryerson acquired Norlen Inc., a metal stamping fabricator based in Wisconsin, U.S., primarily serving the agricultural and defense markets, enhancing Ryerson’s portfolio and production capabilities in specialized metal stamping solutions

- In June 2023, General Motors announced an investment of over USD 500 million into its Arlington, Texas, U.S. assembly plant to produce the next-generation SUVs, including the purchase of new metal stamping, body shop, and assembly equipment, aiming to boost production efficiency and meet future demand

- In May 2021, Stanley Spring and Stamping acquired Precision Forming and Stamping, a U.S.-based manufacturer of metal stamping machines and flat springs for automotive, electrical, HVAC, and medical industries, offering four-slide and multi-slide stamping services, to enhance its overall stamping capabilities and expand its industrial offerings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Metal Embossing Machine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Metal Embossing Machine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Metal Embossing Machine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.