Global Metal Forming For Automotive Market

Market Size in USD Billion

CAGR :

%

USD

194.90 Billion

USD

248.82 Billion

2024

2032

USD

194.90 Billion

USD

248.82 Billion

2024

2032

| 2025 –2032 | |

| USD 194.90 Billion | |

| USD 248.82 Billion | |

|

|

|

|

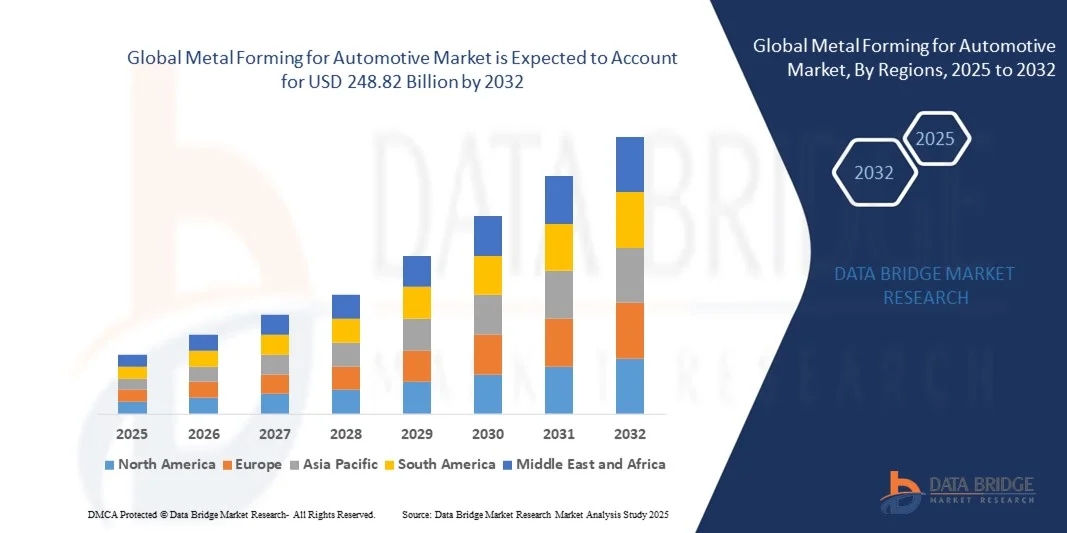

What is the Global Metal Forming for Automotive Market Size and Growth Rate?

- The global metal forming for automotive market size was valued at USD 194.90 billion in 2024 and is expected to reach USD 248.82 billion by 2032, at a CAGR of 3.10% during the forecast period

- The metal forming for automotive market growth is driven largely due to technological innovations, counting improved forming processes has seen commercial usage over the recent past. Also, the capability of manufacturers and lean manufacturing methods to decrease wastage during processes is a crucial factor driving market growth over the forecast period

- Also, the stringent emission and fuel economy regulations for lightweight materials will be one of the key drivers which are triggering the metal forming for automotive market growth

What are the Major Takeaways of Metal Forming for Automotive Market?

- Increasing global vehicle production and growing commercial vehicle demand, growing demand and production of vehicles, rise in demand for commercial vehicles along with light weighting of the vehicle with best quality and growing demand for fuel economy

- Increasing sales of electric and hybrid vehicles as well as the growing adoption of hydroforming techniques will further cater for ample new opportunities that will lead to the growth of the metal forming for the automotive market in the above-mentioned forecasted period

- Asia-Pacific dominated the metal forming for automotive market with the largest revenue share of 37.78% in 2024, driven by rapid industrialization, urbanization, and the growing adoption of lightweight and advanced automotive components

- The North America metal forming for automotive market is expected to grow at the fastest CAGR of 8.32% during the forecast period of 2025 to 2032, driven by strong automotive R&D, growing EV adoption, and increasing investments in advanced manufacturing technologies

- The stamping segment dominated the market with a revenue share of 38.5% in 2024, driven by its widespread use in manufacturing complex automotive components with high precision and repeatability

Report Scope and Metal Forming for Automotive Market Segmentation

|

Attributes |

Metal Forming for Automotive Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Metal Forming for Automotive Market?

Adoption of Advanced Automation and AI-Driven Production

- A key trend in the global metal forming for automotive market is the increasing integration of advanced automation technologies and AI-driven manufacturing solutions. These technologies are improving production efficiency, precision, and overall product quality while reducing manual labor dependency

- For instance, automated stamping and press systems equipped with AI can optimize metal forming parameters in real-time, minimizing material waste and defects. Similarly, robotics-assisted assembly lines enable consistent high-precision outputs in complex automotive components

- AI and machine learning integration also facilitates predictive maintenance, monitoring tool wear, and anticipating machine downtime to prevent production delays. For instance, several leading OEMs employ AI-based analytics to optimize die usage and reduce operational inefficiencies

- The growing trend toward Industry 4.0 adoption in automotive manufacturing allows seamless integration between machines, data analytics, and human operators, ensuring smarter production flows and real-time monitoring

- This shift toward automated, intelligent metal forming is reshaping expectations for production scalability, cost efficiency, and quality standards. Companies such as Gestamp and Magna International are increasingly deploying AI-enabled systems to enhance precision and reduce cycle times

- The market demand for automated, AI-driven metal forming solutions is expanding rapidly, driven by OEMs’ focus on high-quality, efficient, and flexible automotive component manufacturing

What are the Key Drivers of Metal Forming for Automotive Market?

- The rising demand for lightweight, fuel-efficient vehicles, coupled with stricter emissions regulations, is driving the adoption of advanced metal forming technologies that enable precision in complex and high-strength automotive components

- For instance, in March 2024, Magna International announced the deployment of robotic press systems for aluminum body panels in EV production, supporting lightweight vehicle initiatives

- Metal forming technologies also help OEMs reduce waste, improve structural performance, and maintain tight tolerances, which is increasingly important as vehicle designs become more intricate and safety standards stricter

- The growing adoption of electric vehicles (EVs) and hybrid vehicles is fostering demand for advanced metal forming solutions, particularly for lightweight chassis, battery enclosures, and structural reinforcements

- Integration with automated production lines and AI-driven monitoring enables manufacturers to reduce downtime, optimize resource usage, and ensure consistent quality, accelerating adoption across both passenger and commercial vehicle sectors

Which Factor is Challenging the Growth of the Metal Forming for Automotive Market?

- The high initial investment costs of advanced automated metal forming machinery and AI integration pose a significant barrier, particularly for small and mid-sized manufacturers

- For instance, high-precision press systems and robotics-assisted lines require substantial capital outlay, which can delay ROI in developing regions

- Moreover, the complexity of integrating AI-driven systems with existing legacy production lines can discourage some manufacturers from rapid adoption, creating operational challenges

- Cybersecurity and data privacy risks associated with connected production systems are also rising concerns, as AI and IoT-enabled machines exchange sensitive manufacturing data. Companies such as Schaeffler AG and Kirchhoff Automotive emphasize secure protocols and encrypted analytics to mitigate such risks

- In addition, the shortage of skilled personnel capable of operating and maintaining advanced AI-driven metal forming equipment limits adoption in some markets

- Overcoming these challenges through cost-efficient automation solutions, workforce training, and robust cybersecurity measures will be essential to sustaining long-term market growth

How is the Metal Forming for Automotive Market Segmented?

The metal forming for automotive market is segmented on the basis of technique, forming type, vehicle type, and material type.

- By Technique

On the basis of technique, the metal forming for automotive market is segmented into roll forming, stretch forming, deep drawing, stamping, hydroforming, and others. The stamping segment dominated the market with a revenue share of 38.5% in 2024, driven by its widespread use in manufacturing complex automotive components with high precision and repeatability. Stamping is widely favored for producing body panels, chassis parts, and structural components due to its cost-efficiency and scalability.

The hydroforming segment is expected to witness the fastest CAGR of 22% from 2025 to 2032, fueled by the rising adoption in lightweight automotive components and structural reinforcement applications. Hydroforming enables the creation of stronger, lighter, and more geometrically complex parts, making it highly attractive for EVs and premium vehicles.

- By Forming Type

On the basis of forming type, the market is segmented into cold forming, hot forming, and warm forming. The cold forming segment held the largest revenue share of 45.1% in 2024, as it offers superior dimensional accuracy, cost efficiency, and high-volume production capability for automotive components. Cold forming is commonly used in producing steel and aluminum components for chassis, suspension, and engine parts.

The hot forming segment is projected to witness the fastest CAGR of 20.5% from 2025 to 2032, driven by increasing demand for ultra-high-strength steel components that enhance vehicle safety and reduce weight, especially in electric and hybrid vehicles. Hot forming allows manufacturers to achieve higher strength-to-weight ratios, meeting regulatory requirements for fuel efficiency and crashworthiness.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars, light commercial vehicles (LCVs), trucks, and buses. The passenger cars segment dominated the market with a revenue share of 50.3% in 2024, attributed to the high production volumes and the ongoing trend of lightweighting for fuel efficiency and emissions compliance.

The trucks segment is expected to witness the fastest CAGR of 18.8% from 2025 to 2032, driven by the growing demand for heavy-duty, durable components and structural reinforcements in logistics, commercial, and industrial sectors. The adoption of advanced metal forming techniques ensures durability, performance, and efficiency in commercial vehicles under high-stress conditions.

- By Material Type

On the basis of material type, the metal forming for automotive market is segmented into steel, aluminum, magnesium, and others. The steel segment held the largest revenue share of 52% in 2024, owing to its cost-effectiveness, versatility, and widespread use in chassis, body-in-white (BIW), and structural components.

The aluminum segment is expected to witness the fastest CAGR of 23% from 2025 to 2032, driven by the push for lightweighting in passenger cars and commercial vehicles, particularly electric vehicles. Aluminum offers a favorable strength-to-weight ratio, corrosion resistance, and enhanced energy efficiency, making it increasingly preferred in modern automotive manufacturing.

Which Region Holds the Largest Share of the Metal Forming for Automotive Market?

- Asia-Pacific dominated the metal forming for automotive market with the largest revenue share of 37.78% in 2024, driven by rapid industrialization, urbanization, and the growing adoption of lightweight and advanced automotive components

- The region benefits from strong automotive manufacturing hubs in countries such as China, Japan, and India, where technological advancements in metal forming, coupled with government incentives for electric vehicles, are fueling market growth

- Widespread industrial infrastructure, high demand for passenger cars and commercial vehicles, and cost-effective production capabilities establish Asia-Pacific as the most significant contributor to the global Metal Forming for Automotive market

China Metal Forming for Automotive Market Insight

The China metal forming for automotive market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s growing middle class, rapid urbanization, and robust domestic automotive manufacturing sector. Advanced production facilities, government support for EVs, and increasing demand for lightweight components are driving market expansion. China is also emerging as a key exporter of metal-formed automotive parts, strengthening its global position.

Japan Metal Forming for Automotive Market Insight

The Japan metal forming for automotive market is gaining traction due to the country’s high-tech culture, rapid adoption of connected vehicles, and emphasis on lightweight, safety-compliant automotive components. Japanese manufacturers are increasingly using advanced forming techniques such as hydroforming and hot stamping to meet stringent quality standards. The aging population also contributes to demand for vehicles with optimized safety features and ergonomically designed components.

Which Region is the Fastest Growing Region in the Metal Forming for Automotive Market?

The North America metal forming for automotive market is expected to grow at the fastest CAGR of 8.32% during the forecast period of 2025 to 2032, driven by strong automotive R&D, growing EV adoption, and increasing investments in advanced manufacturing technologies. OEMs are focusing on lightweight, high-strength components, particularly for electric and hybrid vehicles, which is boosting the demand for precision metal forming solutions.

U.S. Metal Forming for Automotive Market Insight

The U.S. metal forming for automotive market captured the largest revenue share of 81% in North America in 2024, fueled by robust automotive manufacturing, investments in EV production, and the increasing adoption of high-strength, lightweight metals. The trend toward smart, energy-efficient vehicles and regulatory pressure for safety and emissions compliance further accelerates market growth. Companies are also leveraging advanced forming techniques such as roll forming, stamping, and hydroforming to enhance efficiency and performance.

Europe Metal Forming for Automotive Market Insight

The Europe metal forming for automotive market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent emission regulations, growing EV adoption, and demand for lightweight automotive components. Germany, France, and Italy are key contributors, supported by advanced automotive manufacturing infrastructure. The region is witnessing growth across passenger cars, commercial vehicles, and luxury segments, with manufacturers integrating cutting-edge metal forming techniques to optimize performance and efficiency.

U.K. Metal Forming for Automotive Market Insight

The U.K. metal forming for automotive market is anticipated to grow steadily, driven by the rise of electric vehicle production, automotive exports, and adoption of advanced forming technologies. Increasing government incentives for EV production and the emphasis on sustainability are encouraging OEMs to implement lightweight and high-strength metal components.

Germany Metal Forming for Automotive Market Insight

The Germany metal forming for automotive market is expected to expand at a considerable CAGR due to the presence of leading automotive manufacturers, strong industrial infrastructure, and growing demand for lightweight, high-strength automotive components. Adoption of advanced techniques such as hydroforming, hot stamping, and deep drawing is increasing, particularly in EV and premium vehicle production, ensuring high precision and structural integrity.

Which are the Top Companies in Metal Forming for Automotive Market?

The metal forming for automotive industry is primarily led by well-established companies, including:

- HYUNDAI MOBIS (South Korea)

- Schaeffler AG (Germany)

- Gestamp (Spain)

- Magna International Inc. (Canada)

- Kirchhoff Automotive (Germany)

- CIE Automotive (Spain)

- BENTELER (Austria)

- Tower International (U.S.)

- TOYOTA BOSHOKU CORPORATION (Japan)

- AISIN SEIKI Co., Ltd. (Japan)

- MILLS PRODUCTS (U.S.)

- Superform Aluminum (U.S.)

- Hirotec Corporation (Japan)

- Volkswagen (Germany)

- Daimler AG (Germany)

- Ford Motor Company (U.S.)

- Hyundai Motor Company (South Korea)

- Japan Automotive Manufacturers Association, Inc. (Japan)

- TOYOTA MOTOR CORPORATION (Japan)

- GKN Automotive Limited (U.K.)

- Alcoa Corporation (U.S.)

What are the Recent Developments in Global Metal Forming for Automotive Market?

- In March 2025, Hyundai Steel committed USD 5.8 billion to develop an electric-arc-furnace complex in Louisiana, targeting an annual production of 2.7 million tons of automotive plate by 2029, strengthening its position in the North American automotive steel market

- In March 2025, Techint Engineering & Construction secured a USD 255 million contract to expand Vinton Steel’s Texas mill to a capacity of 400,000 tons per year using Tenova’s energy-efficient process, enabling enhanced production efficiency and sustainability in steel manufacturing

- In February 2025, Standex International acquired McStarlite Co. for USD 56.5 million, incorporating cold deep-draw expertise into its engineered products portfolio, thereby broadening its capabilities in precision metal forming

- In February 2025, Architect Equity purchased Gibbs Die Casting Corporation, augmenting its precision aluminum capabilities to support multi-energy powertrain components, further diversifying its offerings in automotive metal forming solutions

- In September 2024, Fanon Corporation, a multi-market holding company, R&D center, and manufacturer of advanced laser material processing systems, highlighted the advantages of its Bulk-To-Shape (BTS) additive manufacturing/3D metal printing technology for the metal forming and fabricating industries, demonstrating innovation in next-generation metal forming techniques

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.