Global Mezcal Market

Market Size in USD Million

CAGR :

%

USD

681.51 Million

USD

2,426.04 Million

2024

2032

USD

681.51 Million

USD

2,426.04 Million

2024

2032

| 2025 –2032 | |

| USD 681.51 Million | |

| USD 2,426.04 Million | |

|

|

|

|

What is the Global Mezcal Market Size and Growth Rate?

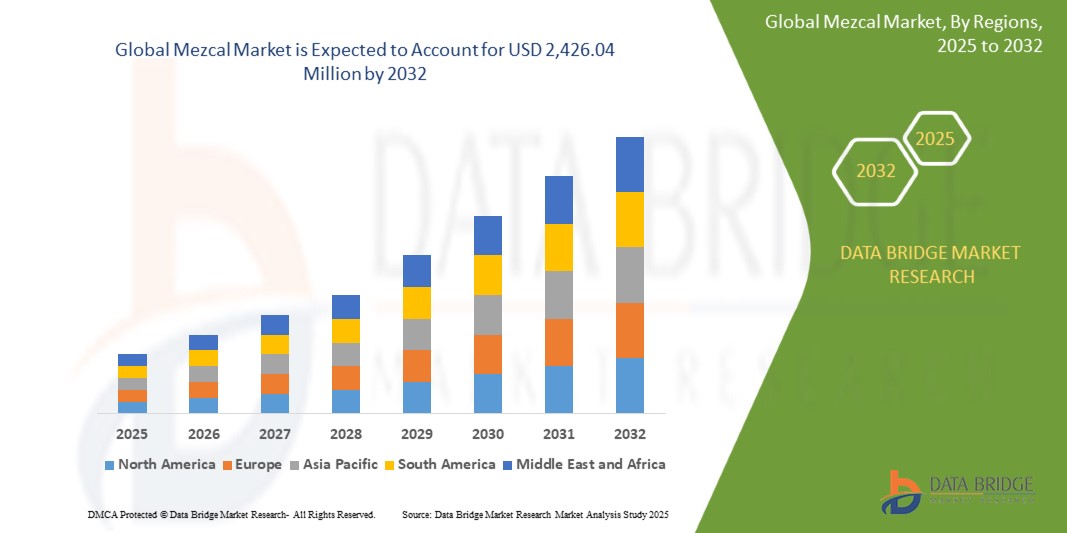

- The global mezcal market size was valued at USD 681.51 million in 2024 and is expected to reach USD 2,426.04 million by 2032, at a CAGR of 17.20% during the forecast period

- Market growth is being driven by the rising global demand for artisanal and premium spirits, particularly among younger consumers and mixology professionals who seek authentic and culturally rich beverages

- In addition, the increasing popularity of Mexican cuisine and culture, supported by international events and tourism, has contributed to boosting Mezcal’s visibility and export potential, thereby fueling the global market expansion

What are the Major Takeaways of Mezcal Market?

- Mezcal, a traditional Mexican spirit made from agave, is gaining traction globally due to its distinct smoky flavor, small-batch production methods, and growing appeal in craft cocktail culture

- The market is witnessing rapid growth, fueled by the rising premiumization of alcoholic beverages, expansion of distribution channels such as e-commerce and specialty stores, and an increasing focus on sustainability and organic certifications

- Consumers are increasingly drawn to heritage-rich, artisanal products, positioning Mezcal as a high-value alternative to mainstream spirits such as tequila and whiskey

- North America dominated the mezcal market with the largest revenue share of 62.01% in 2024, driven by rising consumer interest in premium spirits, artisanal production, and authentic Mexican cultural experiences

- Asia-Pacific mezcal market is forecasted to grow at the fastest CAGR of 8.8% from 2025 to 2032, driven by increasing western influence, a rising middle-class population, and expanding bar culture in urban centers

- Mezcal Joven dominated the mezcal market with the largest revenue share of 78.5% in 2024, driven by its affordability, lighter aging profile, and strong presence in both domestic and international markets

Report Scope and Mezcal Market Segmentation

|

Attributes |

Mezcal Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Mezcal Market?

“Premiumization and Craft Appeal Driving Consumer Preference”

- A key and accelerating trend in the global mezcal market is the rising consumer preference for premium, small-batch, and artisanal spirits, driven by a desire for authenticity, quality, and cultural heritage. This has positioned Mezcal as a standout choice in the broader alcoholic beverages market

- For instance, brands such as Del Maguey, Mezcal Vago, and Ilegal Mezcal have gained international recognition by promoting traditional distillation methods, regional agave varieties, and unique flavor profiles, appealing to discerning consumers and mixologists alike

- The premiumization trend is also supported by storytelling-driven marketing, transparent sourcing, and certifications such as “100% agave” and organic labeling, which help brands build trust and distinguish themselves in competitive retail environments

- This shift is transforming Mezcal from a niche spirit to a mainstream luxury product, particularly among millennials and Gen Z consumers who prioritize experience, craftsmanship, and sustainability in their purchases

- With rising global demand, especially in the U.S., Europe, and Asia, producers are expanding export operations and developing limited-edition batches to cater to upscale markets and cocktail programs in high-end hospitality venues

- This trend is expected to further solidify Mezcal’s position in the premium spirits segment, supporting sustained market growth and increasing brand valuations worldwide

What are the Key Drivers of Mezcal Market?

- Growing global interest in authentic, culturally rooted beverages is a major driver of the Mezcal market, with consumers drawn to the artisanal nature and regional identity associated with the spirit

- For instance, in March 2024, Pernod Ricard expanded its presence in the craft spirits market by acquiring a stake in Ojo de Tigre, a fast-growing Mezcal brand, highlighting the increasing investor confidence in Mezcal’s premium potential

- The increasing popularity of Mexican cuisine and mixology culture in global markets, along with the growing number of Mezcal-focused bars and educational tasting events, is fueling wider consumer engagement

- Health-conscious consumers are also contributing to growth, as many Mezcals are produced with minimal additives and traditional methods, aligning with the trend toward natural and organic products

- Expanding retail presence, especially in duty-free, specialty liquor stores, and e-commerce platforms, is making Mezcal more accessible to international audiences and enhancing market visibility

Which Factor is challenging the Growth of the Mezcal Market?

- A primary challenge facing the Mezcal market is the limited availability of agave plants, which require several years to mature and are essential for authentic Mezcal production

- For instance, agave shortages due to overharvesting and increased demand have led to supply constraints and rising production costs, potentially limiting scalability for small producers and inflating retail price

- Environmental concerns and unsustainable farming practices are compounding the issue, as deforestation and monoculture planting reduce biodiversity and strain local ecosystems

- In addition, the proliferation of new, unregulated brands has raised concerns about quality dilution and mislabeling, which could confuse consumers and harm the category’s reputation

- To address these challenges, industry leaders and local cooperatives are advocating for sustainable agave cultivation, fair trade practices, and stronger regulatory protections under the Denomination of Origin framework

- Resolving these issues is critical for maintaining product integrity and ensuring long-term, responsible growth of the Mezcal industry on a global scale

How is the Mezcal Market Segmented?

The market is segmented on the basis of product type, concentrate, price category, ABV content, year, packaging type, size, flavor type, producer type, product category, end user, and distribution channel.

- By Product Type

On the basis of product type, the mezcal market is segmented into Mezcal Joven, Mezcal Reposado, Mezcal Anejo, Mezcal Espadin, Mezcal Tepztate, Mezcal Arroqueño, Mezcal Ensamble, and Others. Mezcal Joven dominated the market with the largest revenue share of 78.5% in 2024. This unaged or minimally aged mezcal is favored for several key reasons. Its affordability makes it an accessible entry point for new consumers exploring the spirit, while its lighter aging profile allows the bold, smoky, and pure agave flavors to shine through distinctly. This unadulterated taste profile makes Joven an ideal choice for mixologists, who appreciate its versatility and ability to add a characteristic smoky depth to cocktails without the additional complexities introduced by barrel aging. Furthermore, its strong presence in both domestic (Mexican) and international markets underscores its widespread appeal and established position as a staple in the mezcal category.

Mezcal Reposado is projected to witness the fastest Compound Annual Growth Rate (CAGR) from 2025 to 2032. This anticipated rapid growth is primarily driven by a surging consumer interest in aged spirits and the overarching premiumization trend within the alcohol industry. Mezcal Reposado, which is typically aged in oak barrels for a period ranging from two months to a year, develops a smoother and more refined flavor profile compared to Joven. The aging process imparts notes of vanilla, caramel, and a subtle oak influence, appealing to consumers who appreciate a more mellow and complex drinking experience. As drinkers increasingly seek out higher-quality, sophisticated spirits and are willing to pay a premium for unique characteristics, Reposado mezcal is well-positioned to capitalize on this trend, offering a bridge between the vibrant freshness of Joven and the deep complexity of longer-aged Añejo expressions.

- By Concentrate

On the basis of concentrate, the mezcal market is segmented into 100% Tequila and Mix Tequila. 100% Tequila-based Mezcal held the largest market share of 61.4% in 2024, driven by consumer preference for purity, authenticity, and high-quality agave content.

Mix Tequila segment is expected to register steady growth due to its affordability and wider reach in budget-conscious markets and for use in cocktails. This anticipated rise is due to its affordability and broader accessibility, particularly appealing to budget-conscious consumers and serving as a versatile base for cocktails.

- By Price Category

On the basis of price category, the market is categorized into Premium, Standard, and Economy. The Premium segment led with a market share of 45.6% in 2024, supported by the global rise in demand for artisanal and high-end spirits. Consumers are increasingly valuing small-batch production and brand heritage. This dominance is largely a result of the increasing global appetite for artisanal and high-end spirits, with consumers demonstrating a growing appreciation for small-batch production and the rich heritage associated with certain brands.

The Standard segment is expected to grow at the fastest pace, especially in urban regions and among mid-income consumers exploring premiumization at affordable pricing. This acceleration is particularly expected in urban areas and among mid-income consumers who are keen to experience premiumization without the prohibitive price tag, seeking quality mezcal at a more accessible price point.

- By ABV Content

Price Category ABV (alcohol by volume) the market is segmented into 40% and above and less than 40%. 40% and above segment dominated the market with a share of 68.2% in 2024, attributed to traditional Mezcal formulations and strong consumer preference for higher-proof spirits with intense flavors.

The Less Than 40% segment is projected to gain traction due to increasing health consciousness and rising demand for lighter, sessionable alcoholic beverages.

- By Year

On the basis of year, the market is segmented into 18–24 Years, 25–44 Years, 45–64 Years, and 65+ Years. The 25–44 Years segment held the largest market share of 49.8% in 2024, driven by millennial and Gen Z consumers actively exploring craft spirits and unique cultural alcohol experiences.

This group is also expected to maintain the highest growth due to lifestyle preferences, disposable income, and active engagement in bar and nightlife culture.

- By Packaging Type

On the basis of packaging type, the market is segmented into Bottle, Cans, and Others. Bottle packaging led the market with a dominant share of 84.1% in 2024, due to its premium feel, visual appeal, and suitability for gifting and display.

Cans are forecasted to grow rapidly owing to portability, eco-friendly trends, and rising use in pre-mixed Mezcal-based cocktails.

- By Size

On the basis of size, the market is segmented into 251–500 ml, 501–750 ml, 751–1000 ml, and More Than 1000 ml. 501–750 ml size segment dominated the market with a share of 54.3% in 2024, favored by both on-premise and off-premise consumers as the standard size for spirits.

More Than 1000 ml is expected to show robust growth, especially in wholesale and hospitality channels.

- By Flavour Type

On the basis of flavour type, the market is segmented into Plain/Original and Flavored. Plain/Original Mezcal held the major share of 71.9% in 2024, backed by traditional drinkers and connoisseurs who prefer unaltered agave essence.

Flavored segment, including fruit- and spice-infused variants, are expected to grow fastest among new and experimental drinkers. This trend is driven by a broader consumer desire for novel and diverse drinking experiences beyond traditional spirits. For those new to mezcal, these flavored options can provide a more approachable entry point, easing them into the spirit's unique smoky profile with familiar fruit or spice notes. Furthermore, the growing cocktail culture actively encourages experimentation, with mixologists and home enthusiasts seeking innovative ingredients to craft unique drinks.

- By Producer Type

On the basis of producer type, the market is segmented into Microbrewery, Distillers, Brewpub, Contract Brewing Company, Regional Craft Brewery, Large Brewery, and Others. Distillers accounted for the largest market share of 48.7% in 2024, benefiting from established distribution channels and consistent quality.

Microbreweries and Regional Craft Breweries are gaining momentum, driven by the craft movement and regional branding. This growth is fueled by the burgeoning craft movement, which emphasizes unique, small-batch products, and by the appeal of regional branding that connects consumers to local production and distinct flavors.

- By Product Category

On the basis of producer category, the market is segmented into Distillers Mezcal and Handcrafted/Artisanal Mezcal. Distillers Mezcal held the dominant share, accounting for 59.6% of the market. This segment primarily comprises larger-scale operations focused on efficient, high-volume production, which allows them to effectively meet widespread demand. Their dominance is further bolstered by strong brand recognition, often backed by substantial marketing efforts and extensive distribution networks, ensuring their products are widely available and easily identifiable to a broad consumer base. The consistency in flavor and quality offered by these larger distilleries also appeals to consumers seeking a reliable and familiar experience.

Handcrafted/Artisanal Mezcal is expected to see rapid growth as consumers increasingly seek authentic, small-batch experiences and traceable sourcing. This segment encompasses mezcal produced using traditional, often ancestral methods by small-batch producers, many of whom are family-owned operations deeply rooted in specific communities. The anticipated surge in this category is driven by a growing consumer desire for authenticity, as individuals increasingly seek genuine, culturally rich products with a traceable origin. The appeal of "small-batch" production signifies exclusivity, meticulous attention to detail, and often a unique flavor profile that directly reflects the specific terroir and the artisan's skill. Furthermore, modern consumers are becoming more conscious of the ethical and environmental impact of their purchases, making the high traceability and sustainable practices often associated with handcrafted mezcal particularly appealing.

- By End User

On the basis of end user, the market is segmented into Restaurants, Hotels and Bars, Café, Catering, Airlines, Household, and Others. Hotels and Bars segment led the market with a share of 34.5% in 2024. This dominance is primarily attributed to the inherent demand for premium spirits like Mezcal in professional settings. In hotels and bars, Mezcal is a popular choice for crafting sophisticated cocktails, where its unique smoky and complex flavor profile adds depth and character to mixed drinks. Furthermore, the trend of consuming Mezcal "neat" (undiluted) or as part of a curated tasting experience also contributes significantly to its presence in these establishments. Consumers often seek out premium spirits in such environments for a social, expertly prepared, and often exclusive drinking experience that they may not be able to replicate at home.

The Household segment is forecasted to grow significantly due to the rise of home bartending and online alcohol delivery platforms. This anticipated surge is driven by two key factors: the rise of home bartending and the increasing prevalence of online alcohol delivery platforms. The trend of home bartending, which gained significant traction during periods of lockdown and continues to flourish due to evolving lifestyle preferences and a desire for cost-effective entertainment, encourages consumers to invest in spirits and mixology tools for personal use. Many individuals are now exploring cocktail creation at home, and Mezcal, with its versatility, fits well into this growing hobby. Simultaneously, the proliferation of online alcohol delivery platforms has revolutionized access to a wide array of spirits, including Mezcal. These platforms offer unparalleled convenience, allowing consumers to browse and purchase their preferred beverages from the comfort of their homes and have them delivered directly to their doorstep.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Offline Trade and Online Trade. Offline Trade held the dominant share of 76.2% in 2024, including liquor stores, supermarkets, and specialty outlets where consumers can physically examine products. This segment encompasses traditional retail avenues such as dedicated liquor stores, large supermarkets, and specialized outlets, all of which allow consumers the invaluable opportunity to physically examine products before purchase. This hands-on interaction is a crucial factor contributing to its dominant position, as it enables consumers to assess bottles, read labels, and, where permissible, engage in tastings to discern aroma and flavor profiles, which is particularly important for a nuanced spirit like Mezcal.

Online Trade is expected to expand rapidly due to changing shopping habits, e-commerce growth, and D2C (direct-to-consumer) strategies by Mezcal brands. The fundamental shift in consumer shopping habits towards digital platforms across various product categories is a primary catalyst, as consumers increasingly value the convenience, broader selection, and often competitive pricing offered by e-commerce. This broader e-commerce growth, supported by advancements in online platforms, secure payment systems, and efficient logistics, provides a robust foundation for the growth of online Mezcal sales. Crucially, the adoption of D2C (direct-to-consumer) strategies by Mezcal brands is a major accelerator for this segment.

Which Region Holds the Largest Share of the Mezcal Maret?

- North America dominated the mezcal market with the largest revenue share of 62.01% in 2024, driven by rising consumer interest in premium spirits, artisanal production, and authentic Mexican cultural experiences

- The region's demand is strongly influenced by the millennial and Gen Z population who value handcrafted, sustainable, and unique spirits. The increasing presence of Mezcal in cocktail culture and upscale bars further fuels consumption

- North America’s strong distribution network, including specialized liquor stores, premium bars, and e-commerce channels, enhances accessibility and consumer engagement with Mezcal products

U.S. Mezcal Market Insight

The U.S. Mezcal market dominated the North American revenue share in 2024, underpinned by a growing craft spirits trend and shifting consumer preferences toward agave-based liquors. The influx of cocktail culture and premium positioning of Mezcal as a handcrafted spirit have accelerated its adoption. Innovative branding, celebrity endorsements, and availability in premium retail stores are further strengthening Mezcal’s presence in the U.S. spirits landscape.

Europe Mezcal Market Insight

The Europe Mezcal market is expected to grow at a robust CAGR during the forecast period, supported by expanding consumer interest in exotic and artisanal beverages. Consumers across Europe, especially in urban areas, are increasingly drawn to premium, heritage-rich spirits, favoring Mezcal for its distinct smoky flavor and traditional production process. Growth is further driven by expanding on-trade consumption, rising influence of global cuisines, and increasing imports across Germany, Spain, and the U.K.

U.K. Mezcal Market Insight

The U.K. Mezcal market is projected to grow significantly due to the rise of agave spirits among younger consumers and cocktail enthusiasts. The country’s premium spirits segment continues to expand, with Mezcal gaining shelf space in both retail and hospitality. Events such as Mezcal tastings and inclusion in mixology programs are promoting awareness and adoption in both mainstream and upscale markets.

Germany Mezcal Market Insight

Germany is emerging as a key growth market in Europe, with demand driven by rising consumer interest in craft spirits and sustainable production practices. Germans are increasingly seeking out niche and authentic alcohol experiences, and Mezcal’s traditional production and organic qualities appeal to environmentally conscious buyers. Bars and specialty liquor stores in major cities are contributing to its visibility and consumption growth.

Which Region is the Fastest Growing Region in the Mezcal Market?

Asia-Pacific Mezcal market is forecasted to grow at the fastest CAGR of 8.8% from 2025 to 2032, driven by increasing western influence, a rising middle-class population, and expanding bar culture in urban centers. Countries such as Japan, China, and South Korea are experiencing growing interest in premium international spirits, with younger consumers seeking unique and culturally rich options such as Mezcal. Government support for cultural imports, growing e-commerce penetration, and tourism-driven exposure to Mezcal are boosting market entry and expansion efforts.

Japan Mezcal Market Insight

Japan’s Mezcal market is expanding due to the country's strong affinity for high-quality and artisanal spirits. Urban millennials and hospitality professionals are showing a growing interest in Mezcal-based cocktails, while importers and local distributors focus on promoting Mexican culture and agave spirits. Limited editions and handcrafted bottlings are especially popular in Japan’s premium spirits segment.

China Mezcal Market Insight

China accounted for the largest market share within Asia-Pacific in 2024, supported by increasing disposable incomes and growing demand for imported, premium alcoholic beverages. The rise of luxury consumption and urban nightlife culture is positioning Mezcal as an aspirational product among affluent millennials. Strategic marketing, local partnerships, and rising visibility through online liquor platforms are key contributors to market expansion in China.

Which are the Top Companies in Mezcal Market?

The mezcal industry is primarily led by well-established companies, including:

- Davide Campari-Milano N.V. (Italy)

- BACARDI (Bermuda)

- Craft Distillers (U.S.)

- MADRE MEZCAL (U.S.)

- Familia Camarena (Mexico)

- Brown-Forman (U.S.)

- Diageo (U.K.)

- Pernod Ricard (France)

- WILLIAM GRANT & SONS LTD (Scotland)

- Rey Campero (Mexico)

- Tequila & Mezcal Private Brands S.A. de C.V. (Mexico)

- Destilería Tlacolula (Mexico)

- El Silencio Holdings, INC. (U.S.)

- Sauza Tequila Import Company (U.S.)

- Dos Hombres LLC (U.S.)

- Del Maguey (U.S.)

- Wahaka Mezcal (Mexico)

- BOZAL MEZCAL Sombra (Mexico)

- Pensador Mezcal (Mexico)

- Ilegal Mezcal (U.S.)

What are the Recent Developments in Global Mezcal Market?

- In August 2023, Nosotros Tequila and Mezcal announced a strategic partnership with Republic National Distributing Company (RNDC). This collaboration aims to enhance the distribution of agave spirits across various markets. By expanding RNDC's agave product portfolio, the partnership seeks to meet the growing consumer demand for premium agave spirits, fostering brand growth and increasing overall market presence

- In June 2022, Madre Mezcal, a certified artisanal mezcal brand hailing from Mexico, introduced its ready-to-drink canned cocktail, ‘Desert Water.’ This refreshing beverage combines Madre Espadin mezcal with sparkling water, real fruit, and a selection of herbs and plants. The launch of this cocktail reflects a growing trend in the spirits industry, appealing to consumers looking for convenient yet high-quality cocktail options that maintain authentic mezcal flavor

- In March 2022, Compañia Tequilera de Arandas S.A. de C.V.'s Lobos 1707, an ultra-premium tequila and mezcal brand, proudly announced its expansion into the Canadian market. The launch was celebrated with an official event in Toronto, marking a significant milestone for the brand. This strategic move enhances Lobos 1707’s international presence and taps into the increasing demand for high-quality agave spirits among Canadian consumers

- In January 2022, Diageo PLC, a global leader in alcoholic beverages, acquired the premium artisanal mezcal brand Mezcal Unión by purchasing Casa UM. This acquisition positions Diageo to broaden its mezcal offerings significantly. As one of the top mezcal producers, Mezcal Unión's unique product range will complement Diageo’s extensive portfolio, enhancing its market competitiveness in the growing mezcal segment

- In August 2021, Diageo PLC announced its intention to acquire the artisan mezcal brand Mezcal Unión by purchasing Casa UM. This strategic acquisition is aimed at strengthening Diageo’s foothold in the growing mezcal market. By incorporating Mezcal Unión into its portfolio, Diageo seeks to leverage its marketing capabilities and distribution network to enhance brand visibility and accessibility in the competitive spirits landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Mezcal Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Mezcal Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Mezcal Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.