Global Microarray Instruments And Reagents Market

Market Size in USD Billion

CAGR :

%

USD

6.85 Billion

USD

10.83 Billion

2025

2033

USD

6.85 Billion

USD

10.83 Billion

2025

2033

| 2026 –2033 | |

| USD 6.85 Billion | |

| USD 10.83 Billion | |

|

|

|

|

Microarray Instruments and Reagents Market Size

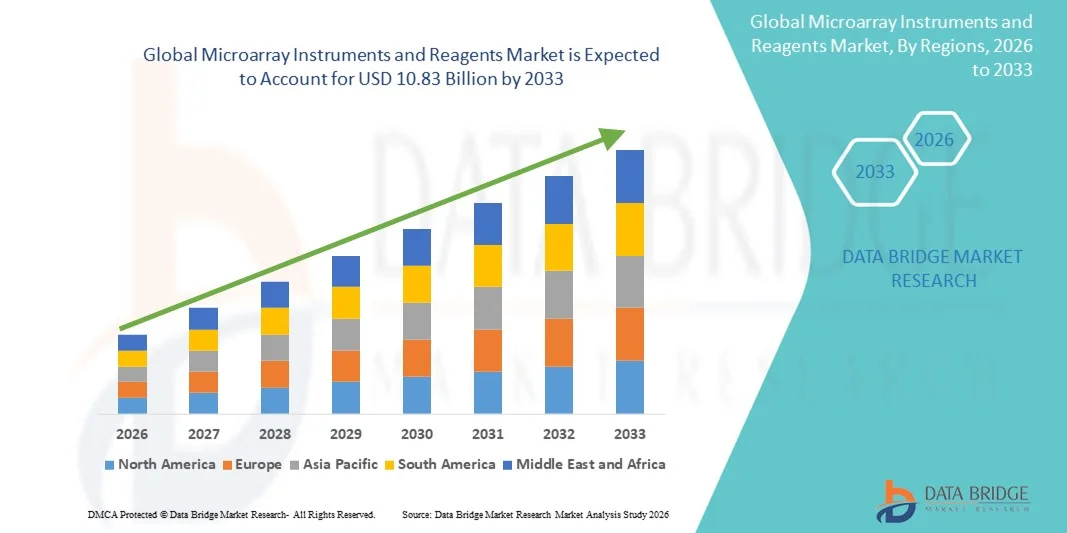

- The global microarray instruments and reagents market size was valued at USD 6.85 billion in 2025 and is expected to reach USD 10.83 billion by 2033, at a CAGR of 5.90% during the forecast period

- The market growth is largely fueled by increasing adoption of high-throughput genomic and proteomic technologies, as well as advancements in biomarker discovery and personalized medicine, which are driving demand for microarray instruments and reagents

- Furthermore, rising investments in clinical research, pharmaceutical R&D, and molecular diagnostics are accelerating the uptake of Microarray Instruments and Reagents solutions, thereby significantly boosting the industry's growth

Microarray Instruments and Reagents Market Analysis

- Microarray instruments and reagents, offering high-throughput analytical and diagnostic capabilities, are increasingly vital components of modern life sciences and biotechnology research in both academic and commercial settings due to their enhanced precision, reliability, and integration with bioinformatics and automation platforms

- The escalating demand for microarray instruments and reagents is primarily fueled by the widespread adoption of genomics, proteomics, and drug discovery research, growing need for personalized medicine, and a rising preference for high-throughput, reproducible, and cost-effective solutions

- North America dominated the microarray instruments and reagents market with the largest revenue share of approximately 39% in 2025, supported by the presence of key market players, advanced laboratory infrastructure, high research funding, and widespread adoption of microarray technologies in pharmaceutical and clinical research. The U.S. is a major contributor, driven by innovations in high-throughput microarray platforms, reagent kits, and integration with bioinformatics tools

- Asia-Pacific is expected to be the fastest-growing region in the microarray instruments and reagents market, projected to expand at a CAGR from 2026 to 2033, due to increasing investment in biotechnology research, rising number of academic and clinical research institutes, rapid urbanization, and growing adoption of advanced diagnostic and drug discovery tools

- The instruments segment dominated the largest market revenue share of 57.4% in 2025, driven by their critical role in high-throughput gene expression analysis, genotyping, and proteomic studies

Report Scope and Microarray Instruments and Reagents Market Segmentation

|

Attributes |

Microarray Instruments and Reagents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Agilent Technologies (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Microarray Instruments and Reagents Market Trends

Increasing Adoption of High-Throughput and Multiplex Technologies

- A significant trend in the global Microarray Instruments and Reagents market is the growing adoption of high-throughput and multiplex microarray platforms for genomics, proteomics, and transcriptomics research

- For instance, Agilent Technologies’ SurePrint G3 Human Gene Expression Microarrays are widely used in academic and clinical research for simultaneous profiling of thousands of genes, enhancing research productivity

- Researchers and laboratories are increasingly prioritizing platforms that allow simultaneous analysis of thousands of genes, proteins, or biomarkers in a single experiment, enhancing productivity and data comprehensiveness

- Technological advances in microarray fabrication, including automated spotting and high-density arrays, have increased assay precision and reduced experimental variability

- Integration with advanced imaging and detection systems is enabling faster, more accurate analysis and quantification of biomolecules

- High-throughput microarrays are being extensively utilized in personalized medicine research, drug discovery, biomarker validation, and disease profiling studies

- The trend toward multiplexing reduces reagent consumption and experimental costs, making these platforms more cost-effective for both academic and commercial laboratories

- Companies are developing ready-to-use reagent kits optimized for these high-throughput arrays, enhancing reproducibility and efficiency

- Adoption is rising in emerging markets as researchers seek comprehensive solutions for genomics and functional analysis

- The combination of automation, precision, and scalability is attracting pharmaceutical and biotechnology companies for large-scale screening

- Increasing collaborations between research institutes and commercial vendors are facilitating the adoption of advanced microarray platforms

- Overall, high-throughput and multiplex microarrays are shaping experimental workflows by providing faster, reliable, and scalable solutions for large datasets

- This trend is expected to continue as technological innovations and the need for detailed molecular profiling drive market expansion globally

Microarray Instruments and Reagents Market Dynamics

Driver

Rising Demand in Genomics Research and Personalized Medicine

- The growing emphasis on genomics, transcriptomics, and proteomics research is a key driver of the Microarray Instruments and Reagents market

- For instance, Illumina’s BeadChip microarray platforms are employed extensively for cancer biomarker discovery, supporting both research and clinical applications

- Academic and clinical researchers are increasingly using microarrays to identify gene expression patterns, disease markers, and therapeutic targets

- Pharmaceutical companies rely on microarray platforms for drug discovery, toxicity profiling, and biomarker validation, driving demand for both instruments and consumables

- Rising investment in personalized medicine initiatives, particularly in North America, Europe, and Asia-Pacific, supports market expansion

- The need for early disease detection and precision therapy encourages adoption of microarrays for large-scale gene and protein analysis

- Increasing government and private funding for genomics projects, such as cancer genomics programs and infectious disease studies, directly supports market growth

- Microarrays enable high-throughput screening, reducing time and costs for biomarker discovery and clinical research

- Integration of microarrays with next-generation sequencing (NGS) and bioinformatics platforms enhances their utility, attracting research-focused end-users

- Technological innovations in reagents and detection systems improve assay sensitivity and reproducibility, further driving adoption

- The ability to perform multiplexed analysis with minimal sample input appeals to both research and clinical laboratories

- Overall, rising genomics research, increasing focus on personalized medicine, and strong investment in life sciences are driving sustained market growth

Restraint/Challenge

High Cost of Instruments and Technical Complexity

- Despite growing demand, the high initial cost of microarray instruments and the technical complexity of performing assays remain significant challenges

- For instance, small academic laboratories in India often delay adoption due to the high investment required for advanced scanning and detection instruments

- Advanced instruments, such as high-density microarray scanners and automated spotting systems, require substantial capital investment, limiting adoption among smaller laboratories or institutions with budget constraints

- Reagents and consumables optimized for these platforms are often expensive, which can increase per-experiment costs

- The requirement for trained personnel to design, perform, and analyze microarray experiments adds operational complexity

- Complex workflows, including sample preparation, hybridization, washing, and scanning, can be error-prone, impacting data quality. Variability in sample quality or operator handling can lead to inconsistent results, particularly in sensitive clinical studies

- Integration with downstream bioinformatics analysis may require additional software investments and technical expertise. Instrument maintenance and calibration further contribute to operational costs

- Some researchers may prefer alternative technologies, such as NGS or qPCR, due to lower cost per sample and simpler workflows. Addressing these challenges requires development of cost-effective instruments, standardized kits, and simplified workflows that reduce user error and training requirements

- Overall, while high cost and technical complexity pose restraints, improvements in instrument design, automation, and ready-to-use reagents are expected to gradually alleviate these barriers and support market adoption

Microarray Instruments and Reagents Market Scope

The market is segmented on the basis of product, type, application, and end user.

- By Product

On the basis of product, the Microarray Instruments and Reagents market is segmented into Instruments and Reagents. The instruments segment dominated the largest market revenue share of 57.4% in 2025, driven by their critical role in high-throughput gene expression analysis, genotyping, and proteomic studies. Microarray instruments such as scanners, hybridization systems, and automated sample processors are essential for ensuring accuracy, reproducibility, and large-scale data generation in research laboratories. Academic institutes and pharmaceutical companies heavily invest in advanced instruments to support genomics, transcriptomics, and biomarker discovery studies. The growing focus on precision medicine and personalized therapeutics has further increased the demand for sophisticated microarray platforms. Continuous technological advancements, including higher resolution imaging and improved sensitivity, are strengthening adoption. Well-established research infrastructure in North America and Europe significantly supports instrument sales. Integration with bioinformatics tools enhances workflow efficiency, further reinforcing dominance. High capital investment capacity among end users also favors instrument adoption. Increasing government and private research funding contributes to sustained demand. Moreover, instruments have a longer replacement cycle, ensuring steady revenue generation. The need for standardized and automated workflows further drives growth. Overall, the instruments segment remains the backbone of the microarray market.

The reagents segment is expected to witness the fastest CAGR of 11.2% from 2026 to 2033, fueled by recurring demand and increasing usage across diverse research applications. Reagents such as labeling kits, hybridization buffers, and detection solutions are consumed continuously, unlike instruments, making them a high-growth segment. Rising adoption of custom and application-specific microarrays in drug discovery and disease research drives reagent demand. Expansion of genomics and proteomics research in emerging economies further accelerates growth. Reagents are essential for maintaining assay sensitivity, specificity, and reproducibility. Increasing number of research studies in oncology and infectious diseases supports sustained consumption. Pharmaceutical and biotechnology companies rely heavily on optimized reagents for reliable results. Growing availability of ready-to-use reagent kits simplifies workflows, encouraging adoption. Collaborative development between instrument and reagent manufacturers improves compatibility and performance. Asia-Pacific laboratories are rapidly increasing reagent purchases due to expanding research infrastructure. Lower entry cost compared to instruments also boosts adoption. As research activity intensifies globally, reagent demand is expected to grow rapidly.

- By Type

On the basis of type, the Microarray Instruments and Reagents market is segmented into DNA Microarrays, Protein Microarrays, and Others. The DNA microarrays segment dominated the largest market revenue share of 53.6% in 2025, owing to their widespread use in gene expression profiling, SNP analysis, and copy number variation studies. DNA microarrays are extensively adopted in genomics research, cancer studies, and personalized medicine applications. Their ability to analyze thousands of genes simultaneously makes them indispensable in large-scale research projects. Academic and research institutes represent major users of DNA microarray technologies. Strong demand from pharmaceutical companies for target identification and validation further supports dominance. Continuous improvements in probe design and array density enhance performance. Availability of standardized kits increases reproducibility and reliability. North America remains a key contributor due to advanced research infrastructure. DNA microarrays are also widely used in developmental biology and toxicogenomics. Integration with automated systems improves throughput. Cost-effectiveness compared to sequencing in some applications supports adoption. Overall, DNA microarrays remain the most established segment.

The protein microarrays segment is projected to grow at the fastest CAGR of 12.4% from 2026 to 2033, driven by increasing demand for functional proteomics and biomarker discovery. Protein microarrays enable simultaneous analysis of protein interactions, expression levels, and immune responses. Rising focus on understanding disease mechanisms at the protein level fuels growth. Pharmaceutical companies increasingly use protein microarrays for drug target screening and antibody profiling. Technological advancements in surface chemistry and detection methods improve sensitivity. Growing prevalence of cancer and autoimmune diseases supports adoption. Custom protein arrays tailored to specific research needs are gaining popularity. Expanding applications in immunology and vaccine research further boost growth. Increasing R&D spending globally contributes to market expansion. Asia-Pacific is emerging as a high-growth region for protein microarrays. Improved reproducibility and assay reliability enhance adoption. Overall, protein microarrays are rapidly gaining traction.

- By Application

On the basis of application, the Microarray Instruments and Reagents market is segmented into Research Antibodies, Drug Discovery, Disease Diagnostics, and Others. The research antibodies segment accounted for the largest market revenue share of 46.1% in 2025, driven by extensive use in gene and protein validation studies. Research antibodies are essential for identifying and quantifying specific targets in microarray experiments. Academic institutions heavily rely on antibodies for basic and translational research. Pharmaceutical companies use them for pathway analysis and biomarker validation. Rising investment in life science research supports growth. High specificity and sensitivity ensure reliable outcomes. Increasing cancer research activities further drive demand. Availability of validated antibodies improves experimental accuracy. North America dominates usage due to strong research funding. Integration with microarray platforms enhances workflow efficiency. Growing focus on molecular diagnostics supports adoption. Overall, research antibodies remain the most widely used application.

The drug discovery segment is expected to register the fastest CAGR of 10.9% from 2026 to 2033, driven by the increasing use of microarrays in target identification and screening. Microarrays accelerate early-stage drug development by enabling high-throughput analysis. Pharmaceutical companies use them to study gene and protein interactions. Rising R&D investments fuel growth. Increasing demand for personalized medicine supports adoption. Microarrays help reduce development time and costs. Integration with bioinformatics enhances data analysis. Oncology drug development remains a key driver. CRO involvement further boosts usage. Asia-Pacific is emerging as a growth hub. Improved assay sensitivity strengthens adoption. Overall, drug discovery is a high-growth application area.

- By End User

On the basis of end user, the Microarray Instruments and Reagents market is segmented into Research and Academic Institutes, Pharmaceutical and Biotechnology Companies, Diagnostic Laboratories, and Others. The research and academic institutes segment dominated the market with a revenue share of 49.8% in 2025, supported by extensive genomics and proteomics research activities. Universities and public research centers rely heavily on microarray technologies. Government funding plays a major role in adoption. High volume of research projects sustains demand. Instruments and reagents are essential for experimental validation. Long-term research programs ensure consistent usage. North America and Europe lead in adoption. Collaborative projects increase demand. Availability of grants supports purchases. Focus on basic science drives usage. Integration with advanced analytics enhances research outcomes. Overall, this segment remains dominant.

The pharmaceutical and biotechnology companies segment is projected to grow at the fastest CAGR of 10.6% from 2026 to 2033, driven by increasing reliance on microarrays for drug development. Companies use microarrays for biomarker discovery and pharmacogenomics. Rising investment in R&D supports growth. Demand for high-throughput screening fuels adoption. Integration with automated platforms improves efficiency. Growing biologics pipeline drives usage. Precision medicine initiatives further boost demand. Asia-Pacific expansion supports growth. Collaboration with academic institutes accelerates adoption. Regulatory requirements favor validated platforms. Cost efficiency supports usage. Overall, this segment is the fastest growing.

Microarray Instruments and Reagents Market Regional Analysis

- North America dominated the microarray instruments and reagents market with the largest revenue share of approximately 39% in 2025,

- Supported by the strong presence of leading market players, well-established laboratory infrastructure, high research and development funding, and widespread adoption of microarray technologies across pharmaceutical, biotechnology, and clinical research applications

- The region benefits from early adoption of advanced genomics tools, increasing use of microarrays in drug discovery, toxicology studies, and precision medicine, and strong collaboration between academic institutions and industry stakeholders

U.S. Microarray Instruments and Reagents Market Insight

The U.S. microarray instruments and reagents market accounted for the largest share within North America in 2025, driven by continuous innovation in high-throughput microarray platforms, advancements in reagent kits, and the growing integration of microarray data with bioinformatics and data analytics tools. The country’s strong emphasis on genomic research, rising use of microarrays in cancer research, infectious disease studies, and pharmacogenomics, along with substantial funding from government agencies and private organizations, continues to propel market growth.

Europe Microarray Instruments and Reagents Market Insight

The Europe microarray instruments and reagents market is projected to grow at a steady CAGR during the forecast period, supported by increasing investments in life sciences research, expanding genomics and proteomics studies, and strong participation from academic and clinical research institutes. The region’s focus on translational research, personalized medicine, and biomarker discovery is driving the adoption of microarray instruments and consumables across pharmaceutical and diagnostic laboratories.

U.K. Microarray Instruments and Reagents Market Insight

The U.K. microarray instruments and reagents market is expected to witness notable growth over the forecast period, driven by strong government support for genomics research, increasing funding for academic research programs, and rising utilization of microarrays in disease diagnostics and drug development. The presence of advanced research institutions and collaborative research initiatives further supports market expansion.

Germany Microarray Instruments and Reagents Market Insight

Germany microarray instruments and reagents market is anticipated to register considerable growth in the Microarray Instruments and Reagents market, fueled by its robust research ecosystem, strong pharmaceutical and biotechnology industries, and emphasis on innovation in molecular diagnostics. The growing application of microarrays in oncology research, autoimmune disease studies, and systems biology continues to drive demand across research and clinical laboratories.

Asia-Pacific Microarray Instruments and Reagents Market Insight

The Asia-Pacific microarray instruments and reagents market is expected to be the fastest-growing region during the forecast period from 2026 to 2033, driven by increasing investments in biotechnology research, rapid expansion of academic and clinical research institutes, and growing adoption of advanced diagnostic and drug discovery technologies. Rising government initiatives supporting genomics research, improving healthcare infrastructure, and increasing collaboration between global and regional research organizations are further accelerating market growth across the region.

Japan Microarray Instruments and Reagents Market Insight

The Japan microarray instruments and reagents market is gaining traction due to the country’s strong focus on advanced biomedical research, precision medicine, and aging population–related disease studies. The growing application of microarrays in cancer genomics, neurological research, and pharmacogenomics, along with technological advancements in analytical platforms, continues to support market growth.

China Microarray Instruments and Reagents Market Insight

China microarray instruments and reagents market accounted for a significant revenue share in the Asia-Pacific Microarray Instruments and Reagents market in 2025, supported by rapid growth in biotechnology research, expanding academic and clinical research infrastructure, and increasing government funding for genomics and molecular biology studies. The rising adoption of microarray technologies in disease diagnostics, agricultural genomics, and drug discovery, along with the presence of domestic manufacturers, is driving sustained market expansion in China.

Microarray Instruments and Reagents Market Share

The Microarray Instruments and Reagents industry is primarily led by well-established companies, including:

• Agilent Technologies (U.S.)

• Thermo Fisher Scientific (U.S.)

• Illumina, Inc. (U.S.)

• Bio-Rad Laboratories (U.S.)

• PerkinElmer (U.S.)

• Roche Diagnostics (Switzerland)

• GE Healthcare (U.S.)

• Takara Bio Inc. (Japan)

• Arraystar Inc. (U.S.)

• Oxford Gene Technology (UK)

• Standard BioTools (formerly Fluidigm) (U.S.)

• Luminex Corporation (U.S.)

• GSD NovaType (Belgium)

• CapitalBio Technology (China)

• Macrogen Inc. (South Korea)

Latest Developments in Global Microarray Instruments and Reagents Market

- In August 2023, Thermo Fisher Scientific introduced the Applied Biosystems CytoScan HD Accel microarray platform, designed to offer comprehensive genomic analysis with improved coverage of more than 5,000 critical genome regions. The platform is aimed at enhancing prenatal, postnatal, and oncology research workflows by delivering faster turnaround times and increased assay productivity for laboratories, particularly addressing the need for high-resolution genomic profiling. This launch underscores Thermo Fisher’s commitment to expanding advanced microarray instrumentation in clinical and research settings

- In August 2024, Illumina unveiled a next-generation Infinium Gene Expression Microarray platform, offering higher probe density and improved reproducibility to support complex gene-expression profiling studies. The new platform is intended to help researchers uncover deeper insights into gene regulatory networks with enhanced data quality, reflecting Illumina’s strategy to strengthen microarray capabilities alongside its sequencing technologies

- In June 2024, Qiagen announced a multi-year contract with a leading biopharmaceutical company to supply large-scale microarray-based gene expression profiling services and panels. This partnership highlights growing industry demand for outsourced, large-cohort microarray analyses in drug discovery and translational research programs, indicating the maturity of service-based offerings in the microarray market

- In December 2024, LinkZill launched its TruArray high-throughput oligonucleotide microarray chip, featuring high synthesis accuracy and customization flexibility for research, diagnostics, and synthetic biology applications. The TruArray chip supports rapid array synthesis and broad application scope, helping expand microarray utility across both academic and industrial laboratories

- In February 2025, Thermo Fisher Scientific launched its new high-throughput microarray-based diagnostic platform branded as PhenoChip, which is designed to enable scalable microarray testing for both oncology and infectious disease panels in clinical laboratories. The PhenoChip platform marks an expansion of Thermo Fisher’s portfolio into integrated, scalable microarray solutions that support a broader range of clinical applications beyond traditional research environments

- In March 2025, Roche announced a strategic collaboration with Illumina to co-develop integrated microarray-enabled diagnostic platforms, aimed at accelerating oncology and infectious disease testing through combined microarray and sequencing workflows. This partnership reflects a broader industry shift toward hybrid genomic platforms that leverage strengths of both technologies to support faster and more accurate translational research and clinical diagnostics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.