Global Microbial Biosensors For Diagnostics Market

Market Size in USD Million

CAGR :

%

USD

568.46 Million

USD

1,800.34 Million

2024

2032

USD

568.46 Million

USD

1,800.34 Million

2024

2032

| 2025 –2032 | |

| USD 568.46 Million | |

| USD 1,800.34 Million | |

|

|

|

|

Microbial Biosensors for Diagnostics Market Size

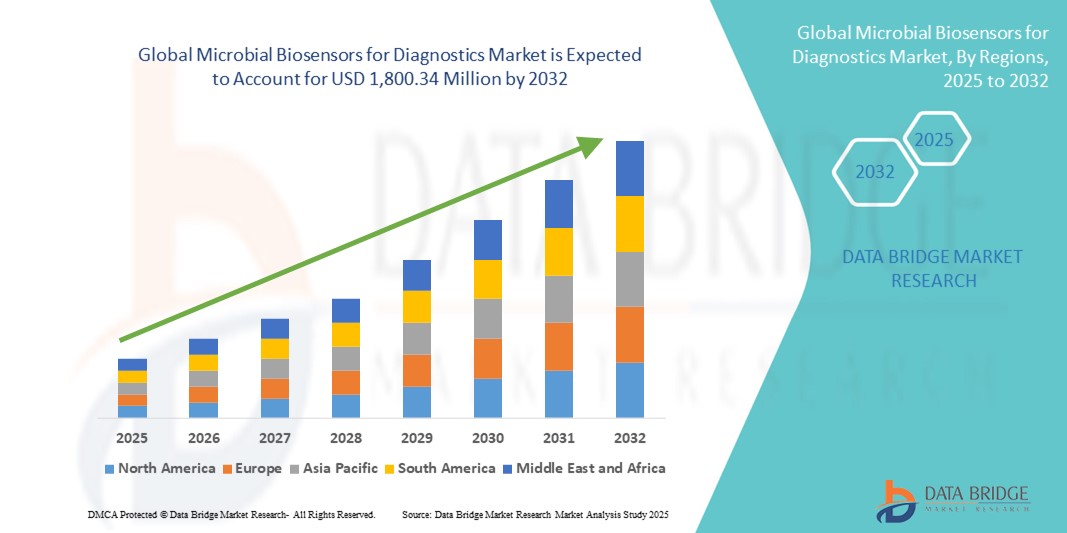

- The global microbial biosensors for diagnostics market size was valued at USD 568.46 million in 2024 and is expected to reach USD 1,800.34 million by 2032, at a CAGR of 15.50% during the forecast period

- The market growth is largely fueled by the increasing demand for rapid, sensitive, and cost-effective diagnostic tools across healthcare, food safety, and environmental sectors, supported by continuous advancements in biosensor technology and molecular detection methods

- Furthermore, growing prevalence of infectious diseases, rising emphasis on early and point-of-care diagnostics, and expanding research investments are positioning microbial biosensors as a vital component of next-generation diagnostic solutions. These converging factors are accelerating adoption, thereby significantly boosting the industry’s growth

Microbial Biosensors for Diagnostics Market Analysis

- Microbial biosensors, which utilize living microorganisms to detect target analytes, are increasingly vital tools in modern diagnostic platforms across healthcare, environmental, and food safety sectors due to their high sensitivity, rapid detection, and ability to function in complex biological samples

- The escalating demand for microbial biosensors is primarily fueled by the rising prevalence of infectious diseases, growing emphasis on point-of-care testing, and increasing need for real-time pathogen detection in clinical and environmental settings

- North America dominated the microbial biosensors for diagnostics market with the largest revenue share of 43% in 2024, driven by advanced healthcare infrastructure, strong research funding, and widespread adoption of biosensing technologies in the U.S. for rapid diagnostics and surveillance applications

- Asia-Pacific is expected to be the fastest growing region in the microbial biosensors market during the forecast period due to expanding healthcare access, increasing investment in diagnostics R&D, and growing concerns over food and water safety in emerging economies

- The electrochemical biosensor segment dominated the microbial biosensors market with a market share of 71.8% in 2024, driven by its low cost, ease of miniaturization, and compatibility with portable, point-of-care diagnostic platforms

Report Scope and Microbial Biosensors for Diagnostics Market Segmentation

|

Attributes |

Microbial Biosensors for Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Microbial Biosensors for Diagnostics Market Trends

Integration with Miniaturized, Portable, and Real-Time Diagnostic Platforms

- A significant and accelerating trend in the global microbial biosensors for diagnostics market is the integration of biosensors with portable, miniaturized diagnostic platforms capable of delivering real-time, on-site results. This trend is transforming microbial detection from traditional lab-based systems to user-friendly, field-deployable devices

- For instance, researchers have developed handheld microbial biosensor devices that enable rapid detection of E. coli or Salmonella in water and food samples, which is crucial for preventing outbreaks. These systems often use paper-based or microfluidic designs integrated with smartphone apps for real-time readouts

- The adoption of electrochemical and optical biosensing technologies in portable formats allows for quick sample-to-result turnaround, reducing diagnostic time from hours or days to minutes. In addition, advances in nanomaterials and synthetic biology are improving the sensitivity and specificity of microbial biosensors, enabling detection of low pathogen loads with minimal sample preparation

- This move toward miniaturized, autonomous diagnostics aligns with global efforts to expand point-of-care testing, especially in resource-limited settings. Devices powered by microbial biosensors can be deployed in remote clinics, farms, disaster zones, and even at home for on-demand testing of pathogens in blood, saliva, or environmental samples

- As a result, companies and research institutions are investing in developing compact, low-cost biosensor systems that can be mass-produced and easily integrated with cloud-based platforms for real-time data transmission, supporting disease tracking and public health response

- The demand for rapid, easy-to-use microbial diagnostics continues to grow across healthcare, agriculture, and environmental sectors, driven by the need for early detection and containment of infectious agents. This trend is reshaping the diagnostics landscape and opening doors to scalable, distributed biosensor technologies

Microbial Biosensors for Diagnostics Market Dynamics

Driver

Growing Need for Rapid, Accurate, and Cost-Effective Diagnostics

- The global increase in infectious disease outbreaks, foodborne illnesses, and antimicrobial resistance has amplified the need for rapid and precise diagnostic solutions, positioning microbial biosensors as a key technology in this domain

- For instance, in 2024, multiple biotech startups and academic research groups announced the successful validation of portable microbial biosensors capable of detecting multi-drug-resistant bacteria within 30 minutes. Such advancements are crucial for timely diagnosis and treatment decisions, especially in emergency and low-resource settings

- Microbial biosensors offer real-time detection, low-cost operation, and can be adapted to detect a wide range of bacterial or viral pathogens, making them attractive alternatives to traditional culturing or PCR-based techniques

- Their application spans clinical diagnostics, food and water testing, and biodefense, where sensitivity, speed, and simplicity are paramount. The ability to deploy these biosensors in the field, combined with increasing public and private investment in diagnostic innovation, is expected to drive substantial market growth

- In addition, microbial biosensors integrated with smartphone-based readouts or wearable platforms support decentralized healthcare, reducing reliance on centralized labs and enabling faster medical response in rural and underserved areas

Restraint/Challenge

Stability, Regulatory Approval, and Commercial Scalability

- One of the primary challenges facing the microbial biosensors market is the biological stability of microbial components used in sensors. Maintaining consistent performance, long shelf-life, and bio-safety of engineered microorganisms under various environmental conditions remains complex

- For instance, microbial biosensors using live bacteria or genetically engineered microbes require precise storage conditions, and their sensitivity may degrade over time without specialized preservation, limiting widespread deployment in field applications

- In addition, regulatory hurdles for diagnostics involving live organisms can slow product approvals and commercial scaling. Biosensors must comply with stringent health and safety regulations, particularly for clinical use, food safety monitoring, and environmental testing

- High validation costs, complex manufacturing protocols, and lack of standardized frameworks for microbial biosensor approvals in various countries further add to commercialization barriers

- Furthermore, scalability remains a challenge, as many microbial biosensor systems are still in early-stage research or pilot production, requiring optimized fabrication techniques for cost-effective mass manufacturing

- Overcoming these limitations through innovations in synthetic biology (e.g., stable bioengineered strains), regulatory harmonization, and advanced packaging solutions will be critical to unlocking the full commercial potential of microbial biosensors across diagnostic applications

Microbial Biosensors for Diagnostics Market Scope

The market is segmented on the basis of technology, application, product type, and end user.

- By Technology

On the basis of technology, the microbial biosensors for diagnostics market is segmented into electrochemical biosensors, optical biosensors, piezoelectric biosensors, thermal biosensors, and nano-mechanical biosensors. The electrochemical biosensor segment dominated the market with the largest revenue share of 71.8% in 2024, driven by its cost-effectiveness, high sensitivity, and suitability for miniaturization and point-of-care deployment. Electrochemical biosensors are widely used for real-time pathogen detection in clinical and environmental applications due to their portability, rapid response, and compatibility with low-power electronic systems.

The optical biosensor segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by their high specificity and sensitivity, making them ideal for detecting low concentrations of pathogens in medical and food safety diagnostics. Advances in fluorescence and SPR-based detection techniques are expanding their use in multiplexed diagnostic platforms.

- By Application

On the basis of application, the microbial biosensors for diagnostics market is segmented into medical diagnostics, food safety testing, environmental monitoring, biodefense and security, and research & laboratory use. The medical diagnostics segment held the largest market share of approximately 66.5% in 2024, driven by increasing prevalence of infectious diseases, the need for early disease detection, and the growing adoption of rapid diagnostic solutions in hospitals and clinics. Microbial biosensors enable timely and accurate detection of pathogens, aiding in better clinical outcomes and infection control.

The environmental monitoring segment is anticipated to witness the fastest CAGR from 2025 to 2032, supported by rising concerns over water and soil contamination and the need for real-time microbial surveillance. Governments and environmental agencies are increasingly investing in biosensor technologies for rapid detection of microbial pollutants and biohazards.

- By Product Type

On the basis of product type, the microbial biosensors for diagnostics market is segmented into laboratory-based biosensors, point-of-care (POC) biosensors, and wearable/implantable biosensors. The laboratory-based biosensors segment led the market in 2024 due to their extensive use in research institutes, centralized diagnostic laboratories, and food safety testing facilities. These biosensors are preferred for their accuracy, stability, and suitability for high-throughput analysis.

The point-of-care (POC) biosensors segment is expected to register the fastest CAGR from 2025 to 2032, driven by the increasing demand for portable, user-friendly diagnostic tools in remote or resource-limited settings. These biosensors facilitate rapid, on-site testing for infectious diseases, minimizing the need for complex lab infrastructure and reducing time to diagnosis.

- By End User

On the basis of end user, the microbial biosensors for diagnostics market is segmented into hospitals and clinics, diagnostic laboratories, food & beverage industry, environmental monitoring agencies, and academic and research institutes. The hospitals and clinics segment held the largest market share in 2024, driven by the growing adoption of microbial biosensors for diagnosing hospital-acquired infections (HAIs), sepsis, and other infectious diseases. The increasing need for rapid, bedside diagnostics and antimicrobial resistance tracking is further fueling demand in clinical settings.

The food & beverage industry segment is projected to witness the fastest growth from 2025 to 2032, owing to stringent food safety regulations and increasing consumer awareness regarding foodborne illnesses. Microbial biosensors provide real-time detection of pathogens such as E. coli and Salmonella in food products, supporting improved quality control and public safety.

Microbial Biosensors for Diagnostics Market Regional Analysis

- North America dominated the microbial biosensors for diagnostics market with the largest revenue share of 43% in 2024, driven by advanced healthcare infrastructure, strong research funding, and widespread adoption of biosensing technologies in the U.S. for rapid diagnostics and surveillance applications

- Healthcare providers and research institutions in the region highly value the rapid detection capabilities, portability, and integration of microbial biosensors with digital diagnostic platforms, which support faster decision-making in clinical and field settings

- This widespread adoption is further supported by robust R&D funding, a high level of public health awareness, and regulatory initiatives promoting early disease detection, establishing microbial biosensors as a preferred tool for clinical diagnostics, environmental monitoring, and food safety assurance across the U.S. and Canada

U.S. Microbial Biosensors for Diagnostics Market Insight

The U.S. microbial biosensors for diagnostics market captured the largest revenue share of 80.3% in 2024 within North America, fueled by a robust healthcare infrastructure, high incidence of infectious diseases, and advanced technological adoption in diagnostics. The emphasis on rapid, point-of-care testing and government initiatives for early disease detection further strengthen market growth. In addition, strong R&D investment from both public and private sectors is accelerating the development of innovative biosensor technologies for clinical, environmental, and food safety applications.

Europe Microbial Biosensors for Diagnostics Market Insight

The Europe microbial biosensors for diagnostics market is projected to grow at a strong CAGR throughout the forecast period, primarily driven by increasing demand for real-time, accurate diagnostic tools in medical and environmental fields. Regulatory support for early disease screening, rising environmental awareness, and the need for safe food supply chains are fostering biosensor adoption. Technological innovation and a growing network of academic-industry partnerships are advancing market penetration across various EU nations.

U.K. Microbial Biosensors for Diagnostics Market Insight

The U.K. microbial biosensors for diagnostics market is anticipated to grow at a robust CAGR, supported by national healthcare initiatives targeting early detection and antibiotic resistance management. Increased investments in biotechnology and rapid diagnostics, coupled with an emphasis on decentralizing healthcare testing through portable devices, are bolstering demand. The U.K.’s vibrant biotech ecosystem and regulatory alignment with EU standards continue to drive innovation and adoption.

Germany Microbial Biosensors for Diagnostics Market Insight

The Germany microbial biosensors for diagnostics market is expected to expand steadily, driven by advancements in precision diagnostics and strong government backing for research in biosensor technologies. The country’s commitment to sustainability and environmental safety is also encouraging the use of biosensors in water and soil monitoring. Germany’s leadership in life sciences R&D, along with rising demand in food safety testing, further strengthens market momentum.

Asia-Pacific Microbial Biosensors for Diagnostics Market Insight

The Asia-Pacific microbial biosensors for diagnostics market is poised to grow at the fastest CAGR of 23.7% from 2025 to 2032, propelled by rising healthcare needs, growing biotechnology sectors, and expanding government funding in countries such as China, India, and Japan. The push toward affordable, decentralized diagnostics and increasing awareness of food and water safety are key drivers. Emerging research hubs and greater acceptance of point-of-care testing solutions are expected to broaden market reach across urban and rural settings.

Japan Microbial Biosensors for Diagnostics Market Insight

The Japan microbial biosensors for diagnostics market is gaining traction due to the country's focus on advanced healthcare technologies and proactive public health policies. Japan’s aging population and emphasis on early disease detection are fostering the use of portable biosensors in hospitals and clinics. Moreover, strong government support for digital healthcare innovation and increasing integration with IoT-enabled platforms are enhancing diagnostic efficiency.

India Microbial Biosensors for Diagnostics Market Insight

The India microbial biosensors for diagnostics market accounted for the largest market revenue share in Asia Pacific in 2024, driven by a rising burden of infectious diseases, expanding diagnostic infrastructure, and growing awareness of food and water hygiene. India’s strong base of biosensor manufacturers and supportive initiatives under the “Make in India” campaign are boosting local production. Increasing public-private collaboration and rural healthcare programs are further accelerating biosensor adoption across diverse applications.

Microbial Biosensors for Diagnostics Market Share

The microbial biosensors for diagnostics industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- BIOMÉRIEUX (France)

- Siemens Healthineers AG (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- QIAGEN N.V. (Netherlands)

- Danaher Corporation (U.S.)

- Agilent Technologies, Inc. (U.S.)

- BD (U.S.)

- Sysmex Corporation (Japan)

- PerkinElmer (U.S.)

- Merck KGaA (Germany)

- GE HealthCare (U.S.)

- Illumina, Inc. (U.S.)

- Luminex Corporation (U.S.)

- Oxford Nanopore Technologies plc (U.K.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Tecan Group Ltd. (Switzerland)

- Bruker Corporation (U.S.)

- Analytik Jena GmbH+Co. KG (Germany)

What are the Recent Developments in Global Microbial Biosensors for Diagnostics Market?

- In March 2024, Researchers at the University of California, Berkeley, unveiled a next-generation microbial biosensor platform capable of detecting antibiotic-resistant bacteria in real time. This innovation leverages synthetic biology to engineer microbes that produce a fluorescent signal upon interaction with resistant pathogens, offering a rapid and highly specific diagnostic tool. The development signifies a major leap in combating global antimicrobial resistance through real-time, point-of-care diagnostics

- In February 2024, Swiss-based biosensor company BioSYNTH AG announced the successful pilot testing of its portable microbial biosensor device for early detection of urinary tract infections (UTIs) in outpatient settings. Designed for use in remote or resource-limited regions, the handheld sensor combines high sensitivity with rapid turnaround time, highlighting the firm’s efforts to decentralize diagnostics and improve access to essential healthcare services

- In December 2023, Indian Institute of Technology (IIT) Madras researchers introduced a low-cost microbial biosensor for rapid screening of tuberculosis (TB) using breath samples. The sensor, utilizing genetically modified microbial strains, offers non-invasive detection with results in under 30 minutes. This innovation holds the potential to revolutionize TB screening in high-burden countries such as India, making diagnostics more accessible and scalable

- In October 2023, U.K.-based startup BioAware Ltd. launched a smart microbial biosensor integrated with cloud-based analytics to monitor hospital-acquired infections (HAIs) in real time. The system uses engineered microbes to detect pathogens on surfaces and air in healthcare settings, automatically alerting personnel through a mobile platform. This marks a significant advancement in infection control and hospital safety protocols

- In August 2023, the National Institutes of Health (NIH) in the U.S. awarded a USD 5 million grant to a consortium led by Johns Hopkins University to develop microbial biosensor-based platforms for early cancer detection. The initiative focuses on engineering microbes that respond to tumor-associated metabolites in biological fluids, enabling non-invasive diagnostics with potential applications in early-stage oncology screening and monitoring

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.