Global Microbial Identification Market

Market Size in USD Billion

CAGR :

%

USD

5.15 Billion

USD

13.42 Billion

2024

2032

USD

5.15 Billion

USD

13.42 Billion

2024

2032

| 2025 –2032 | |

| USD 5.15 Billion | |

| USD 13.42 Billion | |

|

|

|

|

Microbial Identification Market Size

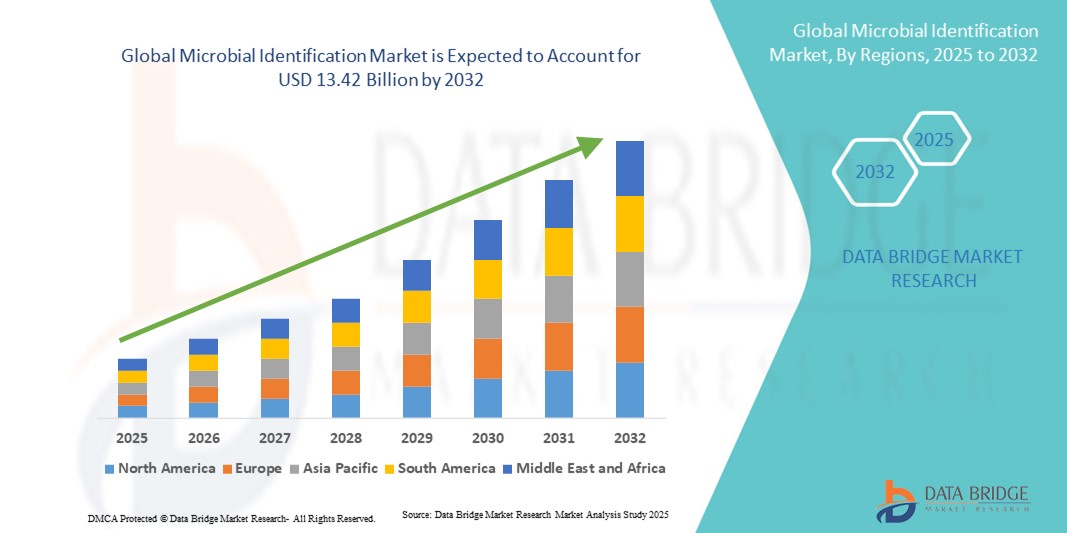

- The global microbial identification market size was valued at USD 5.15 billion in 2024 and is expected to reach USD 13.42 billion by 2032, at a CAGR of 12.70% during the forecast period

- The market growth is primarily driven by increasing demand for rapid and accurate detection of microorganisms across clinical, food, pharmaceutical, and environmental applications, coupled with technological advancements in molecular diagnostics, mass spectrometry, and next-generation sequencing platforms

- In addition, rising prevalence of infectious diseases, stringent regulatory standards for food safety, and the need for efficient pathogen monitoring in healthcare and industrial settings are propelling the adoption of microbial identification solutions, thereby fueling significant growth in the market

Microbial Identification Market Analysis

- Microbial identification systems, enabling rapid and accurate detection of microorganisms in clinical, food, pharmaceutical, and environmental samples, are increasingly critical for diagnostics, quality control, and research applications due to their enhanced precision, speed, and integration with laboratory information systems

- The rising demand for microbial identification is primarily driven by increasing prevalence of infectious diseases, stringent food safety regulations, and the growing adoption of advanced molecular and mass spectrometry-based technologies in laboratories worldwide

- North America dominated the microbial identification market with the largest revenue share of 39.3% in 2024, characterized by a well-established healthcare infrastructure, early adoption of advanced diagnostic tools, and the presence of major industry players, with the U.S. witnessing substantial growth in clinical and research applications driven by innovations in MALDI-TOF and PCR-based identification systems

- Asia-Pacific is expected to be the fastest-growing region in the microbial identification market during the forecast period due to rising investments in healthcare infrastructure, increasing focus on food safety, and growing adoption of automated diagnostic solutions

- Instruments segment dominated the microbial identification market with a market share of 47.2% in 2024, driven by their critical role in enabling high-throughput, accurate, and reliable microbial detection across clinical, food, and pharmaceutical applications

Report Scope and Microbial Identification Market Segmentation

|

Attributes |

Microbial Identification Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Microbial Identification Market Trends

Rapid Adoption of Advanced Molecular and Mass Spectrometry Technologies

- A significant trend in the global microbial identification market is the increasing adoption of advanced technologies such as PCR, MALDI-TOF mass spectrometry, and next-generation sequencing (NGS), which enable faster, more accurate, and high-throughput microorganism detection across clinical, food, and pharmaceutical applications

- For instance, Bruker’s MALDI Biotyper system allows clinical laboratories to identify pathogens in minutes rather than hours, significantly improving diagnostic workflows. Similarly, Thermo Fisher Scientific’s PCR-based platforms are increasingly utilized for precise genotypic identification in research and diagnostic labs

- Integration of these technologies with laboratory information management systems (LIMS) and automated workflows is enabling seamless sample processing, real-time reporting, and better data management

- This trend towards rapid, automated, and highly precise identification methods is transforming laboratory operations and elevating expectations for turnaround time, accuracy, and reliability in microbial diagnostics

- Companies such as bioMérieux and Shimadzu are developing integrated solutions that combine molecular, phenotypic, and proteomic methods, offering comprehensive microbial identification systems suitable for clinical, food safety, and pharmaceutical quality control applications

- The demand for faster and more reliable microbial identification technologies is growing across clinical, pharmaceutical, and food testing laboratories, driven by the need for early pathogen detection, regulatory compliance, and improved patient and product safety

Microbial Identification Market Dynamics

Driver

Rising Need for Rapid and Accurate Pathogen Detection Across Applications

- The increasing prevalence of infectious diseases, foodborne pathogens, and contamination risks in pharmaceutical manufacturing is a key driver for microbial identification solutions

- For instance, in March 2024, bioMérieux expanded its VITEK MS MALDI-TOF system capabilities to include enhanced detection of antibiotic-resistant strains, highlighting innovations that strengthen market growth

- Accurate and timely microbial identification enables hospitals, diagnostic labs, and food industries to prevent outbreaks, ensure patient safety, and maintain regulatory compliance

- Growing adoption of automated and high-throughput systems for clinical, food, and pharmaceutical applications is boosting market penetration

- Laboratories increasingly prefer solutions that reduce manual intervention, improve reliability, and integrate with digital workflows, fueling adoption in both established and emerging markets

Restraint/Challenge

High Costs and Regulatory Compliance Complexities

- The high initial investment costs for advanced instruments such as MALDI-TOF systems, NGS platforms, and automated PCR machines pose a barrier for small and mid-sized laboratories, particularly in developing regions

- For instance, some laboratories find the acquisition and maintenance of fully automated microbial identification systems cost-prohibitive compared to traditional phenotypic methods

- In addition, regulatory compliance in clinical diagnostics, food safety, and pharmaceutical testing requires rigorous validation and adherence to international standards, creating operational challenges for manufacturers and end users

- Variability in regional regulatory frameworks can delay adoption and market entry, particularly in emerging economies

- Overcoming these challenges through cost-effective solutions, modular systems, and compliance support services will be essential for sustained market growth

Microbial Identification Market Scope

The market is segmented on the basis of product and service, type, method, technology, application, and end users.

- By Product and Service

On the basis of product and service, the microbial identification market is segmented into instruments, consumables, and services. The instruments segment dominated the market with the largest revenue share of 47.2% in 2024. This dominance is due to the essential role instruments play in delivering rapid and accurate microbial detection across clinical, food, and pharmaceutical applications. Instruments such as MALDI-TOF systems, automated PCR machines, and culture analyzers are critical for high-throughput and reliable identification. Technological advancements, automation, and integration with laboratory information systems further reinforce their market position. The widespread adoption of instruments in hospitals and diagnostic labs highlights their centrality in microbial workflows. In addition, instruments are often bundled with consumables and maintenance services, strengthening their market presence.

The services segment is expected to witness the fastest growth from 2025 to 2032. This growth is driven by the increasing outsourcing of microbial testing by hospitals, food manufacturers, and pharmaceutical companies. Service providers offer specialized testing, validation, and maintenance solutions, reducing capital investment needs for laboratories. Rising contract research and testing services in emerging markets also support this trend. Services play a vital role in ensuring regulatory compliance and operational efficiency. The flexibility of accessing advanced technologies through service contracts appeals to cost-conscious labs. Furthermore, services help laboratories maintain high standards of accuracy and reliability without heavy infrastructure investment.

- By Type

On the basis of type, the microbial identification market is segmented into fully automatic and semi-automatic systems. The fully automatic type dominated the market in 2024. Fully automatic systems provide high accuracy, rapid processing, and minimal manual intervention, making them ideal for clinical, food, and pharmaceutical laboratories. These systems integrate sample preparation, detection, and data analysis into a single workflow, enhancing reproducibility and efficiency. They also reduce human error and support compatibility with laboratory information management systems (LIMS). Hospitals and diagnostic labs heavily invest in these systems to streamline operations. The dominance is further reinforced by their suitability for high-throughput applications and complex microbial analyses.

The semi-automatic type is expected to witness the fastest growth from 2025 to 2032. Semi-automatic systems provide partial automation, balancing cost-effectiveness with technological capability. They are particularly attractive to small- and medium-sized laboratories in emerging regions. These systems offer flexibility for manual control over some processes while automating critical steps, supporting diverse laboratory needs. Semi-automatic systems are adaptable for phenotypic, genotypic, and proteomic applications. Their affordability compared to fully automated solutions drives adoption in budget-sensitive markets. In addition, their modular design allows laboratories to upgrade as requirements evolve.

- By Method

On the basis of method, the microbial identification market is segmented into phenotypic, genotypic, and proteomic-based methods. The genotypic methods segment dominated in 2024 due to its high precision, reliability, and ability to detect pathogens at the DNA level. Genotypic methods, including PCR and sequencing, are widely used in clinical diagnostics, epidemiological studies, and pharmaceutical quality control. These methods allow rapid identification of microorganisms, including antibiotic-resistant strains. Their dominance is strengthened by the rising prevalence of infectious diseases and the need for timely pathogen detection. Laboratories increasingly prefer genotypic methods for their accuracy and reproducibility. Integration with digital workflows and LIMS further enhances their adoption.

The proteomic-based methods segment is expected to witness the fastest growth from 2025 to 2032. Proteomic methods, such as MALDI-TOF mass spectrometry, provide rapid, high-throughput identification at reduced costs. These methods require minimal sample preparation and enable precise species-level identification. Adoption is growing in clinical and industrial laboratories seeking faster turnaround times. Proteomic-based approaches are increasingly replacing traditional phenotypic methods due to their speed and reliability. Awareness of their advantages and ongoing technological improvements drive rapid growth. Emerging markets are also contributing to increased adoption rates.

- By Technology

On the basis of technology, the microbial identification market is segmented into mass spectrometry and PCR. The mass spectrometry segment dominated in 2024 due to widespread adoption of MALDI-TOF systems. Mass spectrometry enables rapid, accurate, and cost-effective microbial identification, supporting high-throughput laboratory workflows. Its integration with automated sample handling and data analysis systems enhances operational efficiency. The dominance is further strengthened by its versatility in clinical diagnostics, food safety, and pharmaceutical applications. Laboratories value its minimal sample preparation requirements and reproducible results. Mass spectrometry is increasingly preferred for species-level identification in complex samples.

The PCR segment is expected to witness the fastest growth from 2025 to 2032. PCR-based technologies are highly sensitive and specific, making them ideal for genotypic microbial identification. They are widely used for pathogen detection, antimicrobial resistance profiling, and research applications. The adoption of PCR is expanding in emerging markets due to rising healthcare infrastructure and laboratory automation. PCR platforms enable early detection and rapid decision-making in clinical diagnostics. Increasing demand in pharmaceutical quality control and food safety testing further supports growth. Continuous technological innovations in PCR systems are accelerating adoption.

- By Application

On the basis of application, the microbial identification market is segmented into diagnostic applications, food testing, pharmaceutical applications, cosmetics and personal care products testing, environmental applications, and others. The diagnostic applications segment dominated in 2024 due to the critical need for rapid pathogen identification in hospitals and diagnostic laboratories. Rising prevalence of infectious diseases and antimicrobial resistance drives demand for accurate testing. Diagnostic laboratories prioritize methods that deliver reliable, fast, and reproducible results. Integration with laboratory workflows and LIMS enhances efficiency. Hospitals rely on these applications for infection control and patient safety. The critical nature of clinical diagnostics sustains this segment’s market dominance.

The food testing segment is expected to witness the fastest growth from 2025 to 2032. Increasing regulatory requirements for food safety, rising incidence of foodborne illnesses, and growing awareness about contamination are key drivers. Advanced microbial identification technologies are adopted in food and beverage manufacturing to ensure product safety and compliance. Rapid testing enables timely intervention to prevent outbreaks. The segment benefits from global trade expansion and stricter safety regulations. Food testing laboratories are increasingly integrating automated and high-throughput identification solutions. Emerging markets show strong growth potential due to rising consumer safety awareness.

- By End Users

On the basis of end users, the microbial identification market is segmented into hospitals, diagnostic laboratories, and blood banks; beverage manufacturing companies; pharmaceutical companies; and others. The hospitals, diagnostic laboratories, and blood banks segment dominated in 2024 due to high demand for microbial testing in clinical diagnostics, infection control, and laboratory research. Hospitals and diagnostic labs require sophisticated instruments for large sample volumes. Rapid and accurate identification supports patient safety and operational efficiency. Integration with digital workflows enhances performance. High prevalence of infectious diseases and need for early detection further strengthens dominance.

The pharmaceutical companies segment is expected to witness the fastest growth from 2025 to 2032. Increasing microbial testing requirements in drug development, production, and quality control drive adoption. Stringent regulatory compliance and contamination monitoring are critical for pharmaceutical manufacturing. Automated and high-throughput systems are being adopted to improve productivity and ensure accuracy. Emerging markets present opportunities due to expanding pharmaceutical industries. Companies are investing in advanced identification solutions for faster and reliable results.

Microbial Identification Market Regional Analysis

- North America dominated the microbial identification market with the largest revenue share of 39.3% in 2024, characterized by a well-established healthcare infrastructure, early adoption of advanced diagnostic tools, and the presence of major industry players

- The region’s dominance is supported by strong demand for rapid and accurate pathogen detection in hospitals, diagnostic laboratories, and pharmaceutical facilities, alongside rising awareness of antimicrobial resistance and infectious disease management

- Widespread adoption of advanced instruments such as MALDI-TOF systems, PCR platforms, and automated culture analyzers is further strengthened by high disposable incomes, technological readiness, and the presence of leading industry players

U.S. Microbial Identification Market Insight

The U.S. microbial identification market captured the largest revenue share of 42% in 2024 within North America, driven by widespread adoption of advanced diagnostic technologies and high investment in healthcare infrastructure. Hospitals, diagnostic laboratories, and research centers are increasingly prioritizing rapid and accurate pathogen detection to improve patient outcomes. The growing prevalence of infectious diseases, antimicrobial resistance, and stringent regulatory requirements for food and pharmaceutical safety further propel market growth. In addition, integration of automated systems, MALDI-TOF mass spectrometry, and PCR-based platforms with laboratory information management systems (LIMS) enhances workflow efficiency. The expansion of contract research organizations (CROs) and outsourcing of microbial testing services also supports market development.

Europe Microbial Identification Market Insight

The Europe microbial identification market is projected to grow at a significant CAGR during the forecast period, driven by rising awareness of infectious disease control, stringent regulatory frameworks for food safety, and the adoption of advanced laboratory technologies. Increasing urbanization and expansion of clinical and research laboratories are fostering the demand for high-throughput and automated microbial identification systems. European laboratories are also adopting mass spectrometry and molecular techniques to ensure rapid, reliable, and accurate detection of pathogens. Growth is observed across hospitals, diagnostic labs, and pharmaceutical companies, with adoption in both new laboratory setups and facility upgrades.

U.K. Microbial Identification Market Insight

The U.K. microbial identification market is anticipated to expand at a noteworthy CAGR during the forecast period, fueled by growing awareness of clinical diagnostics, rising incidence of infectious diseases, and demand for rapid pathogen detection. The country’s focus on healthcare innovation and robust regulatory compliance standards is supporting adoption of automated and high-throughput microbial identification systems. Diagnostic laboratories and hospitals are increasingly utilizing PCR and MALDI-TOF platforms to enhance laboratory efficiency. In addition, the U.K.’s strong research and development infrastructure facilitates the integration of advanced microbial identification solutions in clinical, pharmaceutical, and food testing applications.

Germany Microbial Identification Market Insight

The Germany microbial identification market is expected to grow at a considerable CAGR during the forecast period, driven by the demand for technologically advanced diagnostic solutions and stringent regulatory standards. German laboratories emphasize accuracy, reproducibility, and automation in microbial testing, contributing to the adoption of MALDI-TOF and PCR systems. The country’s well-developed healthcare and research infrastructure supports high investment in clinical, pharmaceutical, and food testing laboratories. Increasing focus on antimicrobial resistance monitoring and pathogen detection in hospitals and diagnostic centers further promotes market growth. Integration with laboratory information systems and digital workflows is becoming increasingly prevalent.

Asia-Pacific Microbial Identification Market Insight

The Asia-Pacific microbial identification market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by rising investments in healthcare infrastructure, increasing prevalence of infectious diseases, and technological advancements in countries such as China, India, and Japan. The region’s growing focus on food safety, pharmaceutical quality control, and clinical diagnostics is boosting demand for microbial identification solutions. Government initiatives promoting digital healthcare and laboratory modernization are accelerating adoption. Emerging markets are witnessing increased use of cost-effective and high-throughput systems, expanding access to microbial testing across hospitals, diagnostic labs, and food industries.

Japan Microbial Identification Market Insight

The Japan microbial identification market is gaining momentum due to advanced healthcare infrastructure, high adoption of laboratory automation, and focus on rapid pathogen detection. Rising awareness of infectious disease management and food safety drives the use of mass spectrometry and PCR-based systems. Hospitals and diagnostic laboratories are increasingly integrating automated workflows and digital systems for faster and more accurate microbial identification. In addition, the growing demand for research and clinical testing, supported by an aging population requiring enhanced healthcare services, fuels market growth. Collaboration with technology providers ensures ongoing innovation in microbial detection solutions.

India Microbial Identification Market Insight

The India microbial identification market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, expanding healthcare infrastructure, and increasing adoption of advanced laboratory technologies. Growing demand for clinical diagnostics, food safety testing, and pharmaceutical quality control is driving the adoption of automated microbial identification solutions. Government initiatives promoting digital health and laboratory modernization, coupled with cost-effective solutions from domestic manufacturers, are propelling market growth. Hospitals, diagnostic laboratories, and pharmaceutical companies are increasingly investing in high-throughput and reliable microbial identification systems. Rising awareness of infectious diseases and contamination control further supports market expansion.

Microbial Identification Market Share

The microbial identification industry is primarily led by well-established companies, including:

- BIOMÉRIEUX (France)

- Thermo Fisher Scientific Inc. (U.S.)

- Abbott (U.S.)

- Danaher Corporation (U.S.)

- BD (U.S.)

- Bruker (U.S.)

- Cepheid (U.S.)

- Agilent Technologies, Inc. (U.S.)

- QIAGEN N.V. (Germany)

- Merck KGaA, (Germany)

- Hologic, Inc. (U.S.)

- PerkinElmer, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- F. Hoffmann-La Roche AG (Switzerland)

- Siemens Healthineers AG (Germany)

- Sysmex Corporation (Japan)

- Eiken Chemical Co., Ltd. (Japan)

- Mitsubishi Chemical Corporation (Japan)

What are the Recent Developments in Global Microbial Identification Market?

- In June 2025, Thermo Fisher Scientific introduced the Orbitrap Astral Zoom and Orbitrap Excedion Pro mass spectrometers at the ASMS 2025 conference. These next-generation instruments offer increased speed and sensitivity, setting a new performance benchmark for high-resolution, accurate mass spectrometry. These advancements are poised to revolutionize biopharma applications and omics research, enhancing microbial identification capabilities in clinical and research settings

- In May 2025, Shimadzu Corporation launched MicrobialTrack, a new global platform for microbial identification that utilizes MALDI-TOF (Matrix-Assisted Laser Desorption/Ionization Time-of-Flight) mass spectrometry. What sets it apart is its massive database of approximately 85,000 prokaryotic species, including difficult-to-culture and previously uncultured microorganisms, which significantly expands its identification capabilities beyond conventional methods

- In March 2025, bioMérieux received FDA 510(k) clearance for its VITEK® COMPACT PRO system, designed for routine identification of pathogens in clinical and industrial laboratories. This system aims to ensure the quality and safety of food, pharmaceutical, and cosmetic products. The commercial launch is planned to begin in select countries, with a global rollout starting in the second quarter of 2025

- In June 2024, Bruker announced the launch of the neofleX MALDI-TOF/TOF Imaging Profiler, a transformative system for mass spectrometry-based tissue imaging. This high-performance system enables facile OME-TIFF file output via the new SCiLS Scope software, facilitating advanced spatial biology and mass spectrometry imaging applications

- In February 2024, bioMérieux entered into a strategic research collaboration with the U.S. Food and Drug Administration (FDA) to develop tools aimed at combating food-borne pathogens. This partnership focuses on enhancing microbial detection methods to improve food safety and public health outcomes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.