Global Microcontroller For Adas Market

Market Size in USD Billion

CAGR :

%

USD

2.00 Billion

USD

4.29 Billion

2024

2032

USD

2.00 Billion

USD

4.29 Billion

2024

2032

| 2025 –2032 | |

| USD 2.00 Billion | |

| USD 4.29 Billion | |

|

|

|

|

What is the Global Microcontroller for ADAS Market Size and Growth Rate?

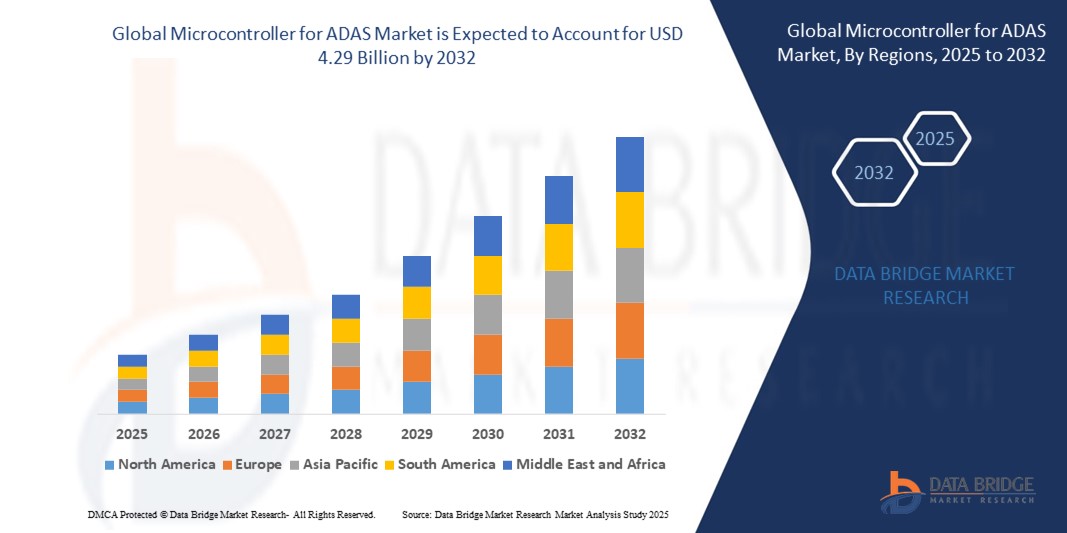

- The global microcontroller for ADAS market size was valued at USD 2.00 billion in 2024 and is expected to reach USD 4.29 billion by 2032, at a CAGR of 10.00% during the forecast period

- The global microcontroller for ADAS market is witnessing rapid growth driven by the increasing integration of ADAS features in modern vehicles to enhance safety and driving experience

- Microcontrollers serve as the backbone of these systems, enabling real-time processing of sensor data and execution of complex algorithms for functionalities such as adaptive cruise control, collision avoidance, and lane departure warning. Key factors propelling market expansion include rising demand for autonomous driving technologies, stringent safety regulations, and the automotive industry's shift towards electric and connected vehicles

What are the Major Takeaways of Microcontroller for ADAS Market?

- The shift in the automotive industry towards electric and connected vehicles is expected to act as a significant driver for the global microcontroller for ADAS market. As electric and connected vehicles become more prevalent, there is a growing need for advanced safety features and autonomous driving functionalities, which rely heavily on microcontrollers

- Overall, the automotive industry's shift towards electric and connected vehicles is driving the demand for advanced microcontrollers capable of supporting the sophisticated electronic systems and advanced driver assistance systems (ADAS) features required for the next generation of vehicles

- North America dominated the microcontroller for ADAS market with the largest revenue share of 35.8% in 2024, driven by strong adoption of advanced driver-assistance systems (ADAS) and the growing preference for premium vehicles equipped with automated parking solutions

- Asia-Pacific microcontroller for ADAS market is poised to grow at the fastest CAGR of 13.7% from 2025 to 2032, driven by surging automotive production, rising disposable incomes, and rapid urbanization in countries such as China, Japan, and India

- The 32-bit microcontrollers segment dominated the market with the largest revenue share of 72.8% in 2024, owing to their superior processing power, ability to handle complex algorithms, and compatibility with AI-based ADAS functions such as sensor fusion and predictive analysis

Report Scope and Microcontroller for ADAS Market Segmentation

|

Attributes |

Microcontroller for ADAS Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Microcontroller for ADAS Market?

AI-Driven Precision and Advanced Sensor Fusion

- A prominent and rapidly growing trend in the global microcontroller for ADAS market is the integration of artificial intelligence (AI) with multi-sensor fusion technologies, including radar, LiDAR, ultrasonic sensors, and cameras. This combination delivers superior detection accuracy, faster data processing, and predictive decision-making for critical ADAS functions

- For instance, NXP Semiconductors’ S32G MCUs integrate AI-driven algorithms to process real-time sensor inputs, enabling precise obstacle detection and adaptive responses in lane-keeping, collision avoidance, and autonomous parking. Such aswise, Infineon Technologies offers MCUs with embedded neural network accelerators to enhance object classification in high-traffic and complex environments

- AI-enabled microcontrollers in ADAS platforms can adapt to individual driving styles, adjust to diverse road and weather conditions, and forecast potential hazards before they occur. These capabilities are essential for next-generation autonomous and semi-autonomous systems

- Seamless integration with other vehicle safety systems, such as adaptive cruise control and blind spot detection, ensures coordinated responses for improved safety and performance

- Leading players such as Texas Instruments and Renesas Electronics are focusing on high-performance, energy-efficient AI MCUs capable of handling advanced algorithms while meeting stringent automotive reliability standards

- The push toward intelligent, interconnected ADAS features is reshaping the automotive landscape, with growing adoption across premium, mid-range, and even entry-level vehicle segments

What are the Key Drivers of Microcontroller for ADAS Market?

- Rising demand for advanced driver-assistance systems in both passenger and commercial vehicles, combined with increasing consumer expectations for safety and convenience, is a major driver of MCU adoption in ADAS applications

- For instance, in February 2024, STMicroelectronics launched its latest MCU platform optimized for ADAS workloads, capable of real-time multi-sensor data processing for automated lane management and collision prevention

- Urban congestion and the complexity of modern driving environments are prompting OEMs and fleet operators to deploy ADAS solutions that reduce driver fatigue, prevent accidents, and enhance driving efficiency

- The growing prevalence of connected vehicles and progress toward Level 3 and above automation are boosting demand for MCUs that can support AI processing, edge computing, and V2X communication

- Benefits such as enhanced situational awareness, improved hazard response times, and reliable performance in low-light or adverse weather conditions are increasing market penetration globally

- Electrification trends are further accelerating demand, as EV manufacturers integrate advanced ADAS features to strengthen their competitive edge and appeal to tech-savvy consumers

Which Factor is challenging the Growth of the Microcontroller for ADAS Market?

- Cybersecurity vulnerabilities in connected automotive systems are a primary concern for the Microcontroller for ADAS market. Because these MCUs interact with vehicle-wide networks, they present potential targets for cyberattacks that could impair safety-critical features

- For instance, penetration tests have shown that inadequate encryption or authentication in MCU-based ADAS systems can expose vehicles to hacking attempts, heightening consumer and OEM apprehensions

- Addressing these risks requires robust measures such as secure boot protocols, hardware-level encryption, real-time intrusion detection, and frequent firmware security patches. Companies such as Infineon Technologies are embedding hardware security modules into their automotive-grade MCUs to counter these threats

- Cost remains another constraint, especially for advanced AI-powered MCUs with high computing capacity, multiple sensor interfaces, and compliance with stringent automotive standards, making them less viable for budget vehicle segments

- In addition, driver skepticism about fully autonomous functionalities particularly in unpredictable traffic scenarios—can slow mass adoption in markets unfamiliar with advanced ADAS technologies

- To overcome these barriers, industry players must focus on affordability, reinforced cybersecurity, and consumer awareness campaigns that emphasize the safety, reliability, and convenience benefits of next-gen ADAS solutions

How is the Microcontroller for ADAS Market Segmented?

The market is segmented on the basis of type, application, and vehicle type.

- By Type

On the basis of type, the microcontroller for ADAS market is segmented into 32-bit microcontrollers, 16-bit microcontrollers, and 8-bit microcontrollers. The 32-bit microcontrollers segment dominated the market with the largest revenue share of 72.8% in 2024, owing to their superior processing power, ability to handle complex algorithms, and compatibility with AI-based ADAS functions such as sensor fusion and predictive analysis. Their higher memory capacity and faster data throughput make them the preferred choice for advanced driver-assist applications in both premium and mid-range vehicles.

The 16-bit microcontrollers segment is expected to witness the fastest growth rate from 2025 to 2032, supported by their balance between performance and cost-effectiveness, making them ideal for mid-level ADAS applications where full 32-bit processing is not required.

- By Application

On the basis of application, the market is segmented into adaptive cruise control (ACC), collision avoidance systems, lane departure warning/assist (LDW/LKA), automatic emergency braking (AEB), traffic sign recognition (TSR), and others. The adaptive cruise control (ACC) segment held the largest market revenue share of 34.6% in 2024, driven by its increasing adoption as a standard safety feature in passenger and premium vehicles. ACC systems rely heavily on high-performance MCUs for real-time sensor data processing and automated speed adjustment, enhancing both safety and driving comfort.

The collision avoidance systems segment is projected to record the fastest CAGR from 2025 to 2032, propelled by stricter safety regulations and rising consumer demand for features that proactively prevent accidents.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars, commercial vehicles, and electric vehicles. The passenger cars segment dominated the market with a revenue share of 61.2% in 2024, supported by the growing integration of ADAS features in mid-range and premium car models to improve driver safety and convenience. Increasing consumer preference for technology-rich vehicles and OEM efforts to differentiate their offerings further boost this segment’s share.

The electric vehicles (EVs) segment is expected to witness the highest growth rate from 2025 to 2032, fueled by the strong push toward electrification and the trend of embedding advanced ADAS features as standard offerings in EV platforms.

Which Region Holds the Largest Share of the Microcontroller for ADAS Market?

- North America dominated the microcontroller for ADAS market with the largest revenue share of 41.12% in 2024, driven by early adoption of advanced driver-assistance systems (ADAS), particularly adaptive cruise control, collision avoidance, and lane departure warning features

- Strong consumer preference for technologically advanced and safety-oriented vehicles, combined with high penetration of premium and luxury segments, has reinforced the region’s leadership position

- A well-established automotive manufacturing ecosystem, presence of leading semiconductor suppliers, and supportive regulatory mandates for safety technologies continue to propel demand

U.S. Microcontroller for ADAS Market Insight

The U.S. dominated the North American market share in 2024, supported by strong demand for ADAS-integrated SUVs, electric vehicles, and high-end passenger cars. Advancements in AI-enabled microcontrollers and faster integration of sensor fusion technologies are driving innovation. OEM focus on differentiating vehicles through next-gen driver assistance features is also fueling growth.

Europe Microcontroller for ADAS Market Insight

Europe is projected to register steady market expansion during the forecast period, backed by strict safety regulations such as Euro NCAP’s five-star requirements and growing adoption of ADAS in both premium and mass-market vehicles. High urban density in cities such as Paris, Rome, and Madrid is pushing demand for collision avoidance and lane-keeping technologies. Automakers in the region are also emphasizing fuel efficiency and accident reduction through smart driving systems.

U.K. Microcontroller for ADAS Market Insight

The U.K. market is expected to expand robustly, driven by increasing integration of adaptive cruise control and automatic emergency braking in compact and mid-sized vehicles. Urban congestion, a tech-savvy consumer base, and a competitive premium vehicle segment are boosting demand. Manufacturers are adding ADAS features to standard trims to meet growing safety expectations.

Germany Microcontroller for ADAS Market Insight

Germany is set to maintain a strong growth trajectory, supported by its reputation for automotive engineering excellence and leadership in autonomous driving research. Premium OEMs such as BMW, Mercedes-Benz, and Audi are heavily investing in microcontroller-driven ADAS platforms. High consumer trust in precision engineering and a focus on top-tier safety standards align with the adoption of advanced features.

Which Region is the Fastest Growing in the Microcontroller for ADAS Market?

Asia-Pacific is projected to grow at the fastest CAGR of 10.9% from 2025 to 2032, fueled by booming automotive production, rapid electrification, and rising disposable incomes in China, Japan, and India. Government-led safety regulations, smart city initiatives, and the expansion of connected vehicle infrastructure are accelerating adoption across both premium and mass-market segments. Competitive manufacturing costs and high-volume semiconductor production are also enabling faster deployment of ADAS technologies.

Japan Microcontroller for ADAS Market Insight

Japan’s growth is supported by its robust automotive innovation ecosystem and preference for vehicles with advanced safety features. Integration of microcontroller-powered lane guidance, traffic sign recognition, and collision prevention systems is increasing. An aging driver population is further boosting demand for ADAS-equipped vehicles that enhance comfort and reduce driver strain.

China Microcontroller for ADAS Market Insight

China held the largest revenue share in the Asia-Pacific market in 2024, driven by strong consumer demand for connected, high-tech vehicles and aggressive government promotion of intelligent transportation systems. Domestic automakers are integrating microcontroller-based ADAS features into a wider range of vehicle models, making them accessible to mass-market buyers while keeping pace with international safety standards.

Which are the Top Companies in Microcontroller for ADAS Market?

The microcontroller for ADAS industry is primarily led by well-established companies, including:

- Renesas Electronics Corporation (Japan)

- NXP Semiconductors (Netherlands)

- Infineon Technologies AG (Germany)

- STMicroelectronics (Switzerland)

- Texas Instruments Incorporated (U.S.)

- Microchip Technology Inc. (U.S.)

- Cypress Semiconductor Corporation (U.S.)

- Analog Devices, Inc. (U.S.)

- Semiconductor Components Industries, LLC (U.S.)

- Maxim Integrated Products, Inc. (U.S.)

What are the Recent Developments in Global Microcontroller for ADAS Market?

- In November 2023, STMicroelectronics introduced a new microcontroller (MCU) combining the company’s wireless design expertise with its high-performing and efficient STM32 architecture. The STM32WL3, the latest in ST’s integrated wireless chip range, features an advanced, power-efficient multi-protocol radio for long-range communication using license-free ISM frequency bands worldwide. This launch reinforces STMicroelectronics’ position as a leader in wireless-enabled microcontrollers for industrial and automotive applications

- In February 2023, STMicroelectronics expanded its STM32 family of advanced microcontrollers (MCUs) with new STM32U5 devices, enhancing performance while reducing power consumption for extended runtimes and improved energy efficiency. These MCUs broaden storage options to 128Kbyte Flash for cost-sensitive projects while offering high-density versions for sophisticated, feature-rich interfaces. This expansion strengthens ST’s ability to serve both budget-conscious and advanced automotive application markets

- In September 2022, STMicroelectronics unveiled its Stellar P6 Automotive MCU for EV platform system integration, supporting high-data-rate in-car communication protocols and enabling over-the-air updates. The MCU ensures fully synchronized operations and continuous performance upgrades for software-defined vehicles. This innovation supports the evolution of next-generation connected and autonomous automotive platforms

- In September 2022, Microchip Technology announced a 32-bit MCU built on the Arm Cortex-M0+ Core, offering functional safety, cyber-security protection, and AUTOSAR compatibility. Known as the PIC32CM JH MCU, it features enhanced touch technology with driver shielding for noise and water-tolerant performance. This development enhances Microchip’s competitive edge in delivering safety- and security-focused automotive microcontrollers

- In April 2022, Nanjing SemiDrive Technology Ltd. (China) introduced the E3 series of ARM-based automotive microcontrollers designed for drive-by-wire chassis, brake control, battery management systems (BMS), ADAS/autonomous motion control, LCD instrumentation, HUDs, and streaming media vision systems. This series further cements SemiDrive’s commitment to advancing intelligent and connected vehicle technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.