Global Microcontroller For Electric Control Suspension Market

Market Size in USD Billion

CAGR :

%

USD

6.48 Billion

USD

13.25 Billion

2024

2032

USD

6.48 Billion

USD

13.25 Billion

2024

2032

| 2025 –2032 | |

| USD 6.48 Billion | |

| USD 13.25 Billion | |

|

|

|

|

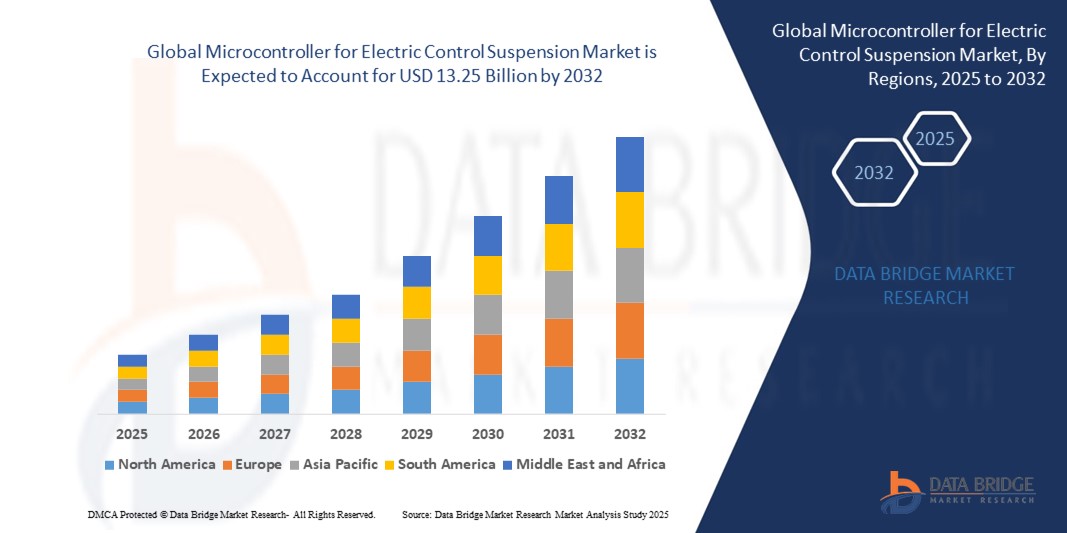

What is the Global Microcontroller for Electric Control Suspension Market Size and Growth Rate?

- The global microcontroller for electric control suspension market size was valued at USD 6.48 billion in 2024 and is expected to reach USD 13.25 billion by 2032, at a CAGR of9.35% during the forecast period

- Microcontrollers are vital components in electric control suspension (ECS) systems, regulating suspension dynamics in vehicles. They manage sensors detecting road conditions and vehicle movements, adjusting suspension settings accordingly for optimal comfort and handling. In the ECS market, microcontrollers facilitate real-time data processing, enabling rapid response to changing road conditions

- Advanced features such as predictive analytics and AI algorithms are increasingly integrated into microcontroller designs to enhance ECS performance. Their compact size, efficiency, and programmability make microcontrollers indispensable for modern ECS solutions, driving innovation and improving ride quality in automobiles

What are the Major Takeaways of Microcontroller for Electric Control Suspension Market?

- In recent years, the automotive industry has witnessed a remarkable surge in the adoption of electric vehicles (EVs). This shift is primarily driven by growing environmental concerns and the need to reduce greenhouse gas emissions. Governments worldwide are implementing stringent regulations aimed at curbing pollution, further incentivizing the transition to electric propulsion systems

- In addition, advancements in battery technology have significantly improved the range and performance of EVs, making them a more viable option for consumers. As a result, major automakers are increasingly investing in the development of electric platforms, with many announcing plans to phase out internal combustion engines entirely within the next decade

- North America dominated the microcontroller for electric control suspension market in 2024, accounting for the largest revenue share of 37.59%. This dominance is attributed to strong automotive manufacturing capabilities, high adoption of advanced suspension technologies, and significant investments in vehicle safety and performance enhancement

- Asia-Pacific microcontroller for electric control suspension market is projected to grow at the fastest CAGR of 8.12% between 2025 and 2032, fueled by rapid automotive production, expanding EV adoption, and rising consumer demand for advanced ride comfort technologies

- The 32-bit segment dominated the market with the largest revenue share of 54.8% in 2024, owing to its optimal balance between processing power, cost-efficiency, and energy consumption. These microcontrollers are widely preferred for electric control suspension systems as they offer sufficient computational capabilities for real-time adjustments while maintaining lower power requirements, making them suitable for both passenger and commercial vehicles

Report Scope and Microcontroller for Electric Control Suspension Market Segmentation

|

Attributes |

Microcontroller for Electric Control Suspension Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Microcontroller for Electric Control Suspension Market?

Integration of Smart Sensors and Predictive Suspension Control

- A key and fast-emerging trend in the global microcontroller for electric control suspension market is the integration of smart sensor technologies and predictive control algorithms to enhance ride comfort, safety, and vehicle handling performance

- For instance, Continental AG has developed an advanced suspension control system that uses real-time road surface data from accelerometers and wheel sensors to adjust damping force proactively. Similarly, ZF Friedrichshafen’s CDC (Continuous Damping Control) works with embedded microcontrollers to dynamically adapt suspension settings for varying road and load conditions

- Vehicle manufacturers are increasingly incorporating AI-based predictive systems that utilize GPS and camera data to prepare suspension systems for upcoming road irregularities, improving passenger comfort and reducing wear on suspension components

- Integration with vehicle telematics enables real-time health monitoring of suspension components, allowing preventive maintenance and reducing downtime for fleet operators

- The growing interoperability of suspension microcontrollers with ADAS (Advanced Driver Assistance Systems) is enabling coordinated braking, steering, and suspension actions, enhancing vehicle stability during emergency maneuvers

- This shift toward intelligent, connected, and adaptive suspension systems is redefining performance benchmarks in passenger cars, SUVs, and commercial vehicles. Leading players such as Continental, ZF, and KYB Corporation are investing heavily in predictive control capabilities, aiming to meet rising demand for safer and smoother rides

- Demand for such systems is increasing in premium vehicles, electric cars, and autonomous fleets, as automakers seek to differentiate through ride quality, efficiency, and driver safety features

What are the Key Drivers of Microcontroller for Electric Control Suspension Market?

- Rising consumer demand for improved ride comfort, safety, and vehicle handling is a primary driver fueling adoption of microcontroller-based electric control suspensions

- For instance, in April 2024, ZF announced a new generation of its electronically controlled suspension system, offering improved response times, energy efficiency, and integration with autonomous driving platforms, meeting the needs of next-generation vehicles

- The increasing popularity of electric and hybrid vehicles, which require adaptive suspension for battery load balancing and range optimization, is further boosting demand

- Microcontrollers in suspension systems enable customizable driving modes, providing flexibility for both comfort-oriented and performance-focused drivers

- The shift toward smart mobility solutions, including autonomous shuttles and premium EVs, is driving OEMs to integrate advanced suspension electronics as a standard feature

- Growing emphasis on predictive maintenance and fleet optimization in commercial transport is encouraging adoption in buses, trucks, and logistics vehicles

- Technological advancements such as faster processors, energy-efficient designs, and wireless connectivity are making microcontroller-based suspensions more cost-effective and easier to integrate

- Expanding automotive production in emerging economies, combined with increasing penetration of premium features in mid-range vehicles, is creating sustained growth opportunities for market players

Which Factor is challenging the Growth of the Microcontroller for Electric Control Suspension Market?

- A major challenge in the microcontroller for electric control suspension market is the high cost of advanced suspension systems, particularly in budget and mid-range vehicle segments

- For example, electronically controlled suspensions require complex hardware, advanced microcontrollers, and multiple precision sensors, which significantly increase overall vehicle cost, making them less attractive for price-sensitive markets

- Maintenance and repair expenses can also be higher due to the specialized components and skilled labor required for diagnostics and servicing

- In developing economies, automakers often prioritize mechanical or semi-active suspension systems to keep vehicle prices competitive, limiting the adoption of fully electronic solutions

- In addition, integration with multiple vehicle systems demands stringent software validation and compliance with safety standards, increasing R&D costs for manufacturers

- To overcome these barriers, industry players will need to focus on cost optimization, modular designs, and scalable technologies that can be adapted across different vehicle categories without compromising performance

How is the Microcontroller for Electric Control Suspension Market Segmented?

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the microcontroller for electric control suspension market is segmented into 16-bit, 32-bit, and 64-bit. The 32-bit segment dominated the market with the largest revenue share of 54.8% in 2024, owing to its optimal balance between processing power, cost-efficiency, and energy consumption. These microcontrollers are widely preferred for electric control suspension systems as they offer sufficient computational capabilities for real-time adjustments while maintaining lower power requirements, making them suitable for both passenger and commercial vehicles. The segment also benefits from high adoption in mid- to high-end automotive models, where advanced suspension features are increasingly becoming standard.

The 64-bit segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising integration of AI-driven predictive control systems, autonomous driving technologies, and advanced telematics in premium and electric vehicles. These high-performance microcontrollers provide greater processing capacity for complex algorithms, enabling enhanced ride comfort, safety, and adaptive suspension control.

- By Application

On the basis of application, the microcontroller for electric control suspension market is segmented into passenger vehicles, commercial vehicles, and others. The passenger vehicles segment accounted for the largest revenue share of 58.6% in 2024, primarily due to the increasing incorporation of advanced suspension systems in sedans, SUVs, and luxury vehicles to improve ride comfort, handling, and safety. Growing consumer preference for premium features, even in mid-range vehicle segments, is further boosting demand.

The commercial vehicles segment is anticipated to record the fastest CAGR from 2025 to 2032, supported by the growing adoption of adaptive suspension systems in buses, trucks, and logistics fleets to enhance load handling, stability, and operational efficiency. Rising demand for durability and reduced maintenance downtime in the commercial transport sector is also driving adoption.

Which Region Holds the Largest Share of the Microcontroller for Electric Control Suspension Market?

- North America dominated the microcontroller for electric control suspension market in 2024, accounting for the largest revenue share of 37.59%. This dominance is attributed to strong automotive manufacturing capabilities, high adoption of advanced suspension technologies, and significant investments in vehicle safety and performance enhancement

- The region benefits from the widespread integration of smart sensors, telematics, and predictive control systems in passenger and commercial vehicles. Stringent safety regulations and consumer preference for premium ride quality further boost demand

- The U.S. leads the region’s market share, driven by the strong presence of leading automotive OEMs, rising adoption of electric and hybrid vehicles, and increasing demand for adaptive suspension systems in both luxury and mainstream models

U.S. Microcontroller for Electric Control Suspension Market Insight

The U.S. dominated North America’s total market share in 2024, underscoring its position as the primary hub for innovation, production, and adoption of advanced suspension technologies. Continuous investments by automakers in autonomous-ready, AI-enabled suspension systems are propelling growth. The market is supported by high consumer expectations for comfort, performance, and safety, alongside fleet operators’ focus on predictive maintenance to minimize downtime. Government support for electric mobility and infrastructure upgrades further accelerates adoption.

Europe Microcontroller for Electric Control Suspension Market Insight

Europe’s market growth is driven by the region’s focus on sustainability, emissions reduction, and advanced automotive engineering. Countries such as Germany, France, and the U.K. are leading adopters of electronically controlled suspension systems, particularly in premium and performance vehicle segments. Increasing regulatory pressure to improve fuel efficiency and ride comfort is pushing OEMs to adopt energy-efficient microcontroller-based systems. Investments in R&D and integration with ADAS platforms are shaping the region’s market trajectory.

U.K. Microcontroller for Electric Control Suspension Market Insight

The U.K. market is growing steadily, supported by urban redevelopment projects, expansion of public transport fleets, and the rise of electric mobility. Automakers are focusing on integrating low-emission, adaptive suspension systems in compliance with environmental targets. Consumer demand for technologically advanced vehicles equipped with comfort-oriented and safety-focused suspension features is increasing. Government incentives for greener vehicles further stimulate adoption.

Germany Microcontroller for Electric Control Suspension Market Insight

Germany remains a stronghold in the European market, driven by its global leadership in automotive engineering, precision manufacturing, and innovation. OEMs are introducing advanced microcontroller-based suspension systems to meet stringent performance and environmental standards. The country’s premium car segment is a major adopter of predictive suspension control and AI-driven comfort systems. Growing focus on electric and hybrid vehicles is further driving demand.

Which Region is the Fastest Growing Region in the Microcontroller for Electric Control Suspension Market?

Asia-Pacific microcontroller for electric control suspension market is projected to grow at the fastest CAGR of 8.12% between 2025 and 2032, fueled by rapid automotive production, expanding EV adoption, and rising consumer demand for advanced ride comfort technologies. Countries such as China, Japan, and India are leading the trend, with strong support from government initiatives promoting electric mobility and vehicle safety. Affordable yet advanced suspension solutions from domestic manufacturers are boosting market penetration.

Japan Microcontroller for Electric Control Suspension Market Insight

Japan’s growth is supported by high urban density, stringent safety standards, and strong R&D capabilities in automotive electronics. Automakers are integrating AI-enabled predictive suspension systems to enhance comfort in both passenger and commercial vehicles. Demand for hybrid and low-emission vehicles, combined with advanced fleet management solutions, sustains market expansion.

China Microcontroller for Electric Control Suspension Market Insight

China holds the largest share within Asia-Pacific, backed by massive vehicle production volumes, strong domestic manufacturing, and large-scale adoption of adaptive suspension technologies. Government-backed infrastructure and smart city projects are further accelerating demand. Local manufacturers are producing cost-effective, high-quality systems, enabling adoption across a wide range of vehicle categories from economy to premium segments.

Which are the Top Companies in Microcontroller for Electric Control Suspension Market?

The microcontroller for electric control suspension industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Infineon Technologies AG (Germany)

- Texas Instruments Incorporated (U.S.)

- STMicroelectronics (Switzerland)

- Renesas Electronics Corporation (Japan)

- Semiconductor Components Industries, LLC (U.S.)

- Microchip Technology Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Analog Devices, Inc. (U.S.)

What are the Recent Developments in Global Microcontroller for Electric Control Suspension Market?

- In January 2025, Tenneco completed the sale of Öhlins Racing to Brembo for USD 405 million, combining advanced performance braking with adaptive damping solutions tailored for premium vehicle models. This strategic move strengthens Brembo’s position in the high-performance automotive systems market

- In January 2025, Sona Comstar invested USD 4 million in ClearMotion to accelerate the commercial deployment of proactive suspension technology. This investment is expected to fast-track innovation and bring next-generation ride comfort solutions to the market

- In October 2024, Ams OSRAM introduced high-resolution position sensors essential for the integration of steer-by-wire and active suspension systems. This advancement enhances precision, safety, and control in modern automotive applications

- In December 2023, Infineon Technologies AG launched a new series of 32-bit microcontrollers optimized for electric vehicle suspension systems, featuring enhanced processing power and built-in cybersecurity functions. This product line aims to improve operational safety and performance in next-generation automotive platforms

- In October 2023, Bosch GmbH unveiled its next-generation microcontroller platform specifically designed for electric control suspension systems, incorporating advanced sensor fusion and predictive control algorithms. This development is set to enhance ride comfort and vehicle handling in a wide range of applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.