Global Microfluidic Devices Market

Market Size in USD Billion

CAGR :

%

USD

7.68 Billion

USD

26.69 Billion

2025

2033

USD

7.68 Billion

USD

26.69 Billion

2025

2033

| 2026 –2033 | |

| USD 7.68 Billion | |

| USD 26.69 Billion | |

|

|

|

|

Microfluidic Devices Market Size

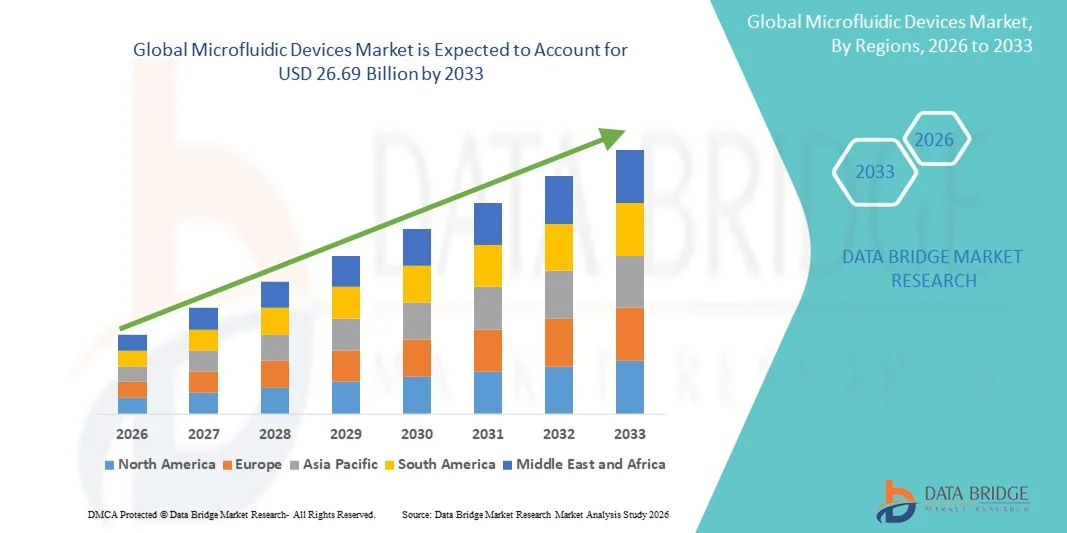

- The global microfluidic devices market size was valued at USD 7.68 billion in 2025 and is expected to reach USD 26.69 billion by 2033, at a CAGR of 16.85% during the forecast period

- The market growth is largely fueled by the increasing adoption of lab-on-a-chip technologies, advancements in point-of-care diagnostics, and rising integration of microfluidics in drug development and biomedical research

- Furthermore, growing demand for miniaturized, precise, and cost-effective analytical and diagnostic solutions in healthcare, pharmaceuticals, and biotechnology is driving the adoption of microfluidic devices. These converging factors are accelerating the utilization of microfluidic technologies, thereby significantly boosting the industry's growth

Microfluidic Devices Market Analysis

- Microfluidic devices, enabling the precise manipulation of small fluid volumes on chips or lab-on-a-chip platforms, are increasingly critical tools in healthcare, diagnostics, drug discovery, and biotechnology research due to their high accuracy, miniaturization, and automation capabilities

- The escalating demand for microfluidic devices is primarily fueled by the rising adoption of point-of-care diagnostics, the growth of personalized medicine, and the need for rapid, cost-effective, and high-throughput analytical solutions in both clinical and research settings

- North America dominated the microfluidic devices market with the largest revenue share of 39.2% in 2025, characterized by advanced healthcare infrastructure, strong research funding, and the presence of key industry players, with the U.S. leading in adoption for diagnostics, single-cell analysis, and high-throughput drug screening applications driven by innovations from both established companies and specialized startups

- Asia-Pacific is expected to be the fastest growing region in the microfluidic devices market during the forecast period due to increasing investments in healthcare infrastructure, rising biotechnology R&D activities, and expanding adoption of point-of-care and lab-on-a-chip technologies in countries such as China, Japan, and India

- The microfluidic-based devices segment dominated the global microfluidic devices market with a market share of 44.6% in 2025, driven by their critical role in core applications such as disease diagnostics, cell analysis, and lab-on-chip system development

Report Scope and Microfluidic Devices Market Segmentation

|

Attributes |

Microfluidic Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Microfluidic Devices Market Trends

Integration with Point-of-Care and Wearable Diagnostics

- A significant and accelerating trend in the global microfluidic devices market is the increasing integration with point-of-care testing and wearable diagnostic systems, enabling real-time monitoring and rapid analysis

- For instance, the i-STAT Alinity system incorporates microfluidic cartridges for bedside blood analysis, allowing clinicians to obtain immediate results without centralized lab equipment

- Microfluidic integration with portable devices allows miniaturization of complex assays, reducing sample volumes, turnaround time, and operational costs, thereby improving accessibility in both clinical and remote settings

- The seamless incorporation of microfluidic devices with smartphones and cloud-based platforms facilitates remote monitoring, data sharing, and centralized health management for patients and healthcare providers

- This trend towards compact, rapid, and connected diagnostic solutions is fundamentally transforming healthcare delivery and research workflows. Consequently, companies such as Fluidigm and Bio-Rad are advancing microfluidic platforms with integrated detection and connectivity features

- The demand for microfluidic devices with enhanced portability, accuracy, and connectivity is growing rapidly across healthcare, pharmaceutical, and biotechnology sectors, as stakeholders increasingly prioritize efficient and precise analytical solutions

- Growing collaborations between microfluidic technology providers and pharmaceutical companies are enabling the development of specialized devices for high-throughput drug discovery and screening applications

- The emergence of hybrid microfluidic systems combining digital and continuous-flow technologies is allowing more versatile and scalable applications across diagnostics, environmental monitoring, and biotechnology research

Microfluidic Devices Market Dynamics

Driver

Rising Adoption in Diagnostics, Drug Development, and Biomedical Research

- The increasing reliance on microfluidic technologies in diagnostics, high-throughput drug screening, and biomedical research is a significant driver for market expansion

- For instance, in March 2025, Dolomite Microfluidics launched an advanced microfluidic platform enabling automated drug formulation testing, highlighting the technology's role in accelerating pharmaceutical R&D

- As healthcare systems demand faster, more accurate, and low-volume testing, microfluidic devices offer features such as multiplexed assays, reduced reagent use, and rapid turnaround, providing a compelling solution over conventional lab methods

- Furthermore, the growth of personalized medicine, genomics, and single-cell analysis is driving the adoption of microfluidics as a critical tool for precision healthcare and targeted therapeutics

- The integration of microfluidics with robotic systems and high-throughput screening platforms is enhancing efficiency, data accuracy, and reproducibility in research laboratories, further propelling market growth

- Expansion of government and private funding for microfluidics-based diagnostic and research projects is supporting R&D activities and accelerating commercialization of innovative devices

- Increasing adoption in emerging markets due to rising healthcare infrastructure investments and the demand for cost-effective diagnostic solutions is opening new growth avenues for microfluidic device manufacturers

Restraint/Challenge

Technical Complexity and High Manufacturing Costs

- The sophisticated design and fabrication requirements of microfluidic devices pose significant challenges to scalability and broader market penetration. Complex microchannel architectures and precise material selection can increase development time and production costs

- For instance, high-resolution photolithography or soft lithography used in microfluidic chip manufacturing often requires specialized equipment and skilled personnel, limiting mass adoption

- Ensuring reproducibility, device reliability, and integration with downstream detection systems is crucial but technically demanding, which can hinder commercialization and adoption by smaller laboratories

- In addition, regulatory compliance and standardization for clinical applications can be stringent, requiring extensive validation and approvals that add to the time and cost burden for manufacturers

- While innovations are gradually reducing costs, the perceived premium for high-precision microfluidic devices can still limit adoption, particularly in emerging markets or cost-sensitive research environments

- Overcoming these challenges through scalable manufacturing techniques, simplified designs, and regulatory support will be vital for sustained market growth

- Limited awareness and technical expertise among end-users regarding microfluidic systems can slow adoption, especially in smaller research institutions or developing regions

- Potential material compatibility issues and device fouling in biological or chemical assays remain technical hurdles, requiring continuous innovation in device materials and surface treatments

Microfluidic Devices Market Scope

The market is segmented on the basis of product, applications, and end users.

- By Product

On the basis of product, the market is segmented into microfluidic-based devices and microfluidic components. Microfluidic-based devices dominated the market with the largest revenue share of 44.6% in 2025, driven by their extensive use in diagnostic systems, drug discovery workflows, and life science research. These devices form the core functional units enabling fluid manipulation, cell analysis, and biochemical assays at microscale precision. Their ability to integrate multiple laboratory functions into compact, portable platforms makes them increasingly essential across healthcare and biotechnology ecosystems. The segment benefits strongly from the rising adoption of point-of-care testing, which relies heavily on microfluidic-enabled cartridges and consumables. Continuous advancements in lab-on-chip technologies and growing investments in rapid diagnostic development further strengthen the dominance of this category. In addition, their compatibility with automated analytical systems and high-throughput screening solutions contributes significantly to sustained market leadership.

Microfluidic components are expected to witness the fastest growth rate during 2026–2033, driven by rapidly increasing demand for pumps, valves, sensors, chips, and connectors used in micro-scale fluid handling. The growth is fueled by expanding applications in next-generation sequencing, cell sorting, immunoassays, and precision drug delivery systems. Component-level innovation is accelerating due to the need for higher accuracy, reduced sample volume, and improved integration capabilities with digital and automated platforms. Researchers and manufacturers increasingly rely on customizable microfluidic components, enabling flexible system design across research, clinical diagnostics, and industrial automation. The rising adoption of modular microfluidic platforms is also accelerating component demand. Furthermore, expanding commercial production of polymer- and glass-based microfluidic chips is driving strong growth momentum across global markets.

- By Applications

On the basis of applications, the market is segmented into In-Vitro Diagnostics (IVD), pharmaceuticals, life science research, and manufacturing. In-vitro diagnostics dominated the market in 2025, supported by the widespread use of microfluidic platforms in rapid testing, disease screening, and decentralized diagnostics. The segment benefits from strong demand for compact, low-cost diagnostic tools, especially in areas such as infectious disease testing, cancer biomarker detection, and chronic disease monitoring. Microfluidics is increasingly being integrated into point-of-care devices, supporting faster decision-making in hospitals, clinics, and home-care settings. The COVID-19 pandemic accelerated global adoption of microfluidic diagnostic cartridges, and this momentum continues due to a sustained shift toward rapid and reliable testing. Miniaturization, automation, and accuracy advantages make microfluidic IVD tools vital for clinical laboratories. In addition, the push for personalized medicine drives significant reliance on microfluidic-enabled genomic and proteomic testing technologies.

The pharmaceuticals segment is anticipated to witness the fastest growth from 2026 to 2033, driven by increasing use of microfluidics in drug discovery, formulation, screening, and toxicity analysis. Microfluidic devices enable rapid experimentation with minimal reagent consumption, accelerating the timeline of early-stage drug development. Pharmaceutical companies are adopting organ-on-chip and tissue-on-chip platforms for more accurate modeling of human physiological responses. The ability of microfluidics to support high-throughput screening significantly enhances research productivity. Growing investment in automated drug testing and precision therapeutics continues to fuel segment expansion. Furthermore, microfluidic systems support advanced drug delivery research, enabling controlled dosing and nanoparticle formulation, contributing to the segment’s strong growth trajectory.

- By End Users

On the basis of end users, the market is segmented into POCT, pharmaceutical & life science research, drug delivery, analytical devices, clinical & veterinary diagnosis, and environment & industrial. POCT dominated the market with the largest share in 2025, driven by the high demand for rapid, accurate diagnostic tools that utilize microfluidic cartridges and integrated systems. The segment benefits substantially from the global trend toward decentralized healthcare and home-based testing. Microfluidic POCT devices deliver rapid results while using minimal sample volumes, making them ideal for emergency care, remote locations, and resource-limited environments. The growing prevalence of infectious diseases, diabetes, and cardiovascular conditions continues to boost adoption. Technological innovations such as smartphone-connected readers and cloud-linked diagnostic platforms further strengthen the segment’s market position. Increasing government and private investments in rapid diagnostic solutions are expected to maintain the dominance of POCT throughout the forecast period.

The pharmaceutical and life science research segment is projected to grow the fastest during 2026–2033, supported by the increasing use of microfluidics for cellular analysis, DNA amplification, sequencing workflows, and high-precision biochemical studies. Researchers rely heavily on microfluidic chips and modular devices to perform controlled experiments at micro-scale volumes. The segment benefits from ongoing advancements in cell-sorting, droplet microfluidics, and organ-on-chip platforms. Microfluidics significantly enhances reproducibility and throughput in research experiments, making it an essential tool for academic and industrial laboratories. Increased funding for biotechnology and precision medicine initiatives globally is accelerating adoption. The integration of microfluidics with AI-enhanced imaging and automated laboratory systems further drives rapid segment growth.

Microfluidic Devices Market Regional Analysis

- North America dominated the microfluidic devices market with the largest revenue share of 39.2% in 2025, characterized by advanced healthcare infrastructure, strong research funding, and the presence of key industry players, with the U.S. leading in adoption for diagnostics, single-cell analysis, and high-throughput drug screening applications driven by innovations from both established companies and specialized startups

- Researchers and clinicians in the region highly value the precision, miniaturization, and rapid analytical capabilities offered by microfluidic devices, which can integrate seamlessly with automated laboratory systems and point-of-care platforms

- This widespread adoption is further supported by robust funding for R&D, the presence of leading microfluidic technology providers, and increasing implementation of personalized medicine, establishing microfluidic devices as a preferred solution for clinical, pharmaceutical, and academic applications

U.S. Microfluidic Devices Market Insight

The U.S. microfluidic devices market captured the largest revenue share of 78% in 2025 within North America, driven by the country’s strong emphasis on precision healthcare, advanced research infrastructure, and high adoption of point-of-care diagnostics. The presence of leading biotechnology and pharmaceutical companies, coupled with continuous investments in lab-on-a-chip technologies, is fueling market growth. Furthermore, the integration of microfluidic devices with automated platforms and wearable diagnostic systems is expanding applications in clinical, pharmaceutical, and academic research. Government initiatives supporting innovative diagnostics and personalized medicine are further accelerating the adoption of microfluidic technologies.

Europe Microfluidic Devices Market Insight

The Europe microfluidic devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing investments in biomedical research, stringent regulatory standards for diagnostic accuracy, and rising demand for miniaturized lab-on-a-chip solutions. Growing awareness about rapid diagnostics, particularly in oncology and infectious diseases, is boosting adoption across hospitals, laboratories, and research institutions. In addition, collaborations between European universities and biotech firms are supporting the development of next-generation microfluidic platforms. The market is witnessing growth across clinical diagnostics, pharmaceutical R&D, and environmental monitoring applications.

U.K. Microfluidic Devices Market Insight

The U.K. microfluidic devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising focus on precision medicine, single-cell analysis, and high-throughput drug screening. In addition, the increasing adoption of automated microfluidic platforms in academic and clinical research is propelling market demand. The U.K.’s strong healthcare infrastructure, along with government support for innovation in diagnostic technologies, is facilitating the commercialization of advanced microfluidic solutions. Collaborations between startups and established biotech companies are further enhancing product offerings and market penetration.

Germany Microfluidic Devices Market Insight

The Germany microfluidic devices market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing R&D investments, technological advancements in lab-on-a-chip systems, and a strong emphasis on precision diagnostics. Germany’s well-established healthcare and research infrastructure, combined with government support for innovation and digital health, promotes the adoption of microfluidic devices. The integration of microfluidics with automated analytical platforms is gaining traction, particularly in pharmaceutical research and clinical diagnostics. Eco-friendly and sustainable materials in device manufacturing are also aligning with local regulatory and consumer expectations.

Asia-Pacific Microfluidic Devices Market Insight

The Asia-Pacific microfluidic devices market is poised to grow at the fastest CAGR of 26% during the forecast period of 2026 to 2033, driven by rising investments in biotechnology, rapid urbanization, and increasing healthcare infrastructure in countries such as China, Japan, and India. The growing adoption of point-of-care diagnostics, wearable testing systems, and lab-on-a-chip platforms is driving market expansion. Furthermore, government initiatives to promote innovation in healthcare and biotechnology are accelerating microfluidic device adoption. The region is also emerging as a manufacturing hub for microfluidic components, making devices more accessible and cost-effective for research and clinical applications.

Japan Microfluidic Devices Market Insight

The Japan microfluidic devices market is gaining momentum due to the country’s focus on advanced healthcare technologies, aging population, and rising demand for precision diagnostics. Adoption is fueled by increasing implementation of point-of-care testing, lab-on-a-chip devices, and integration with wearable monitoring systems. Japanese research institutions and hospitals are investing heavily in microfluidic technologies for clinical and biomedical applications. The emphasis on miniaturized, automated, and connected diagnostic solutions is driving innovation, particularly in drug development, personalized medicine, and healthcare monitoring.

India Microfluidic Devices Market Insight

The India microfluidic devices market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s expanding biotechnology sector, increasing healthcare infrastructure, and rising adoption of innovative diagnostic technologies. India is witnessing rapid growth in point-of-care testing, pharmaceutical research, and clinical laboratories utilizing microfluidic platforms. Government initiatives supporting smart healthcare, affordable diagnostics, and research innovation are propelling market growth. The availability of cost-effective microfluidic solutions and collaborations between domestic manufacturers and international technology providers are further enhancing adoption across clinical, pharmaceutical, and academic research applications.

Microfluidic Devices Market Share

The Microfluidic Devices industry is primarily led by well-established companies, including:

- Standard BioTools Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- PerkinElmer (U.S.)

- Illumina, Inc. (U.S.)

- Abbott (U.S.)

- Danaher (U.S.)

- Fluigent SA (France)

- Micronit Microtechnologies B.V. (Netherlands)

- Sphere Fluidics Limited (U.K.)

- Elveflow (France)

- uFluidix Inc. (Canada)

- Microfluidic ChipShop GmbH (Germany)

- Cellix Ltd. (Ireland)

- ALine Inc. (U.S.)

- Parker Hannifin Corporation (U.S.)

- SMC Corporation (Japan)

- Camozzi Automation Spa Società Unipersonale (Italy)

- Blacktrace Holdings Ltd. (U.K.)

What are the Recent Developments in Global Microfluidic Devices Market?

- In September 2025, researchers at Terasaki Institute for Biomedical Innovation (in collaboration with University of Texas San Antonio) unveiled a new microfluidic‑based biosensing platform that enables real-time, label‑free tracking of monoclonal antibody secretion from cells potentially transforming biomanufacturing by accelerating screening and lowering production costs

- In November 2024, Parallel Fluidics closed a US$ 7 million seed funding round to accelerate development of its on‑demand microfluidic design and manufacturing platform, including commercialization of its new microvalve product “MV‑2,” aimed at enabling point‑of-care and clinical applications outside of traditional labs

- In February 2024, a study published under Microfluidics and Organ‑on‑a‑Chip for Disease Modeling and Drug Screening highlighted significant advances in combining microfluidic devices with organ‑on‑a‑chip (OoC) systems for disease modeling and drug screening underlining growing adoption of microfluidic platforms in preclinical research and personalized medicine

- In August 2023, Cytovale launched the IntelliSep® Test an FDA‑cleared, rapid microfluidic assay for sepsis detection that evaluates white‑blood‑cell deformability, delivering sepsis‑risk stratification results in 8–10 minutes. It has since been adopted in hospital emergency departments to improve early detection and patient triage

- In May 2023, CellFE, Inc. announced the commercial launch of its “Infinity Mtx™” cellular engineering platform a microfluidic-based system that uses rapid cell compression and re‑expansion to introduce payloads into cells efficiently, promising higher yields and faster cell therapy manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.