Global Wearable Ambulatory Monitoring Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.36 Billion

USD

4.58 Billion

2024

2032

USD

2.36 Billion

USD

4.58 Billion

2024

2032

| 2025 –2032 | |

| USD 2.36 Billion | |

| USD 4.58 Billion | |

|

|

|

|

Wearable Ambulatory Monitoring Devices Market Size

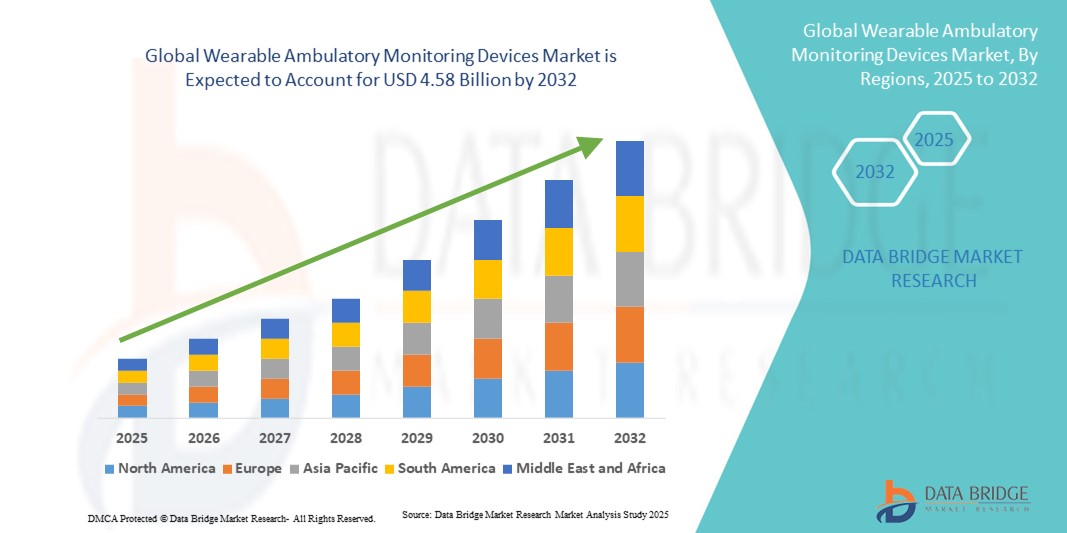

- The global wearable ambulatory monitoring devices market size was valued at USD 2.36 billion in 2024 and is expected to reach USD 4.58 billion by 2032, at a CAGR of 8.64% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic diseases, rising demand for remote patient monitoring, and advancements in wearable healthcare technology, enabling continuous and real-time health tracking

- Furthermore, growing consumer preference for portable, non-invasive, and user-friendly devices is positioning wearable ambulatory monitoring systems as an essential tool for both healthcare providers and patients. These converging factors are accelerating the uptake of Wearable Ambulatory Monitoring Devices solutions, thereby significantly boosting the industry's growth

Wearable Ambulatory Monitoring Devices Market Analysis

- Wearable ambulatory monitoring devices, designed for continuous tracking of physiological parameters such as heart rate, blood pressure, glucose levels, and respiratory activity, are increasingly vital components of modern healthcare systems in both hospital and homecare settings due to their enhanced convenience, remote monitoring capabilities, and seamless integration with digital health ecosystems

- The escalating demand for wearable ambulatory monitoring devices is primarily fueled by the growing prevalence of chronic diseases, increasing focus on preventive healthcare, and a rising preference for non-invasive, real-time monitoring solutions. These devices empower patients and healthcare providers with continuous health insights, enabling timely interventions and improved outcomes

- North America dominated the wearable ambulatory monitoring devices market with the largest revenue share of 40.8% in 2024, characterized by advanced healthcare infrastructure, high disposable incomes, and a strong presence of key industry players. The U.S. experienced substantial growth in wearable ambulatory device installations, particularly in hospitals, specialty clinics, and homecare settings, driven by innovations from both established medtech companies and startups focusing on AI-powered analytics and mobile app integration

- Asia-Pacific is expected to be the fastest growing region in the wearable ambulatory monitoring devices market during the forecast period, driven by increasing urbanization, rising disposable incomes, and expanding healthcare infrastructure. The growing adoption of digital health solutions in emerging economies such as China, India, and Japan, coupled with supportive government initiatives for remote monitoring and telemedicine, is accelerating the market’s expansion in the region

- The Hospital Inpatient Monitoring segment dominated the wearable ambulatory monitoring devices market with the largest market revenue share of 44.3% in 2024, as hospitals remain the primary centers for advanced cardiac diagnostics and critical care. The demand is driven by the need for continuous monitoring of patients admitted with cardiovascular diseases, arrhythmias, or those undergoing post-surgical recovery

Report Scope and Wearable Ambulatory Monitoring Devices Market Segmentation

|

Attributes |

Wearable Ambulatory Monitoring Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wearable Ambulatory Monitoring Devices Market Trends

Rising Adoption of Wearable Ambulatory Monitoring Devices in Preventive Healthcare

- A significant and accelerating trend in the global wearable ambulatory monitoring devices market is the increasing adoption of these devices for preventive healthcare and continuous patient monitoring. The growing burden of chronic diseases such as cardiovascular disorders, diabetes, and respiratory conditions is driving demand for real-time, non-invasive monitoring solutions that empower patients and healthcare providers with continuous health insights

- For instance, modern wearable ECG and cardiac event monitors are widely used to track irregular heart rhythms and detect early signs of complications. Similarly, ambulatory blood pressure monitors are being increasingly prescribed to provide a more accurate representation of patient health than traditional clinical measurements, helping physicians make timely interventions

- These devices also enable long-term monitoring outside of hospital settings, reducing the need for frequent clinical visits and lowering overall healthcare costs. Patients benefit from the ability to live normal daily lives while being monitored continuously, and physicians gain access to comprehensive datasets for more precise diagnoses and treatment planning

- The integration of advanced biosensors in wearable ambulatory monitors enhances diagnostic accuracy, enabling detection of subtle physiological changes that may otherwise go unnoticed in short-term clinical examinations. This capability is particularly valuable in managing high-risk patient groups and ensuring timely therapeutic adjustments

- The demand is further supported by the rising emphasis on remote patient monitoring (RPM) and home-based care models, especially post-pandemic, where healthcare systems worldwide have shifted towards minimizing hospital visits while ensuring continuous care. Wearable ambulatory monitors have emerged as vital tools for enabling this transformation

- Moreover, the global push towards digital healthcare and the availability of reimbursement policies in developed regions are reinforcing adoption. Device manufacturers are increasingly focusing on comfort, portability, and long battery life to ensure higher patient compliance, which is critical for reliable monitoring outcomes

- This trend towards patient-centric, continuous, and preventive monitoring solutions is fundamentally reshaping expectations in healthcare delivery. Consequently, companies are investing in innovative designs, multi-parameter monitoring devices, and improved connectivity with electronic health record (EHR) systems to enhance clinical utility and patient outcomes

- The demand for wearable ambulatory monitoring devices is rapidly growing across both developed and emerging markets as healthcare providers prioritize proactive disease management, improved patient compliance, and reduced hospitalization costs

Wearable Ambulatory Monitoring Devices Market Dynamics

Driver

Growing Need Due to Rising Chronic Diseases and Remote Patient Monitoring

- The increasing prevalence of chronic diseases such as cardiovascular disorders, diabetes, and respiratory conditions, coupled with the accelerating adoption of remote patient monitoring (RPM) and telehealth solutions, is a significant driver for the heightened demand for wearable ambulatory monitoring devices

- For instance, in 2021, the American Heart Association (AHA) highlighted the rising adoption of wearable cardiac monitoring patches (such as iRhythm’s Zio® patch and Medtronic’s LINQ insertable cardiac monitors) for patients with atrial fibrillation and other arrhythmias. These devices enable continuous, remote ECG monitoring, reducing the need for repeated hospital visits while providing physicians with real-time diagnostic data. The trend accelerated during and after the COVID-19 pandemic, as hospitals and clinics increasingly relied on telehealth and RPM solutions to manage patients with chronic cardiovascular and metabolic conditions from home

- As patients and healthcare professionals become more aware of the benefits of continuous health monitoring, these devices offer advanced features such as real-time alerts, long-term data storage, and integration with electronic health records (EHRs), providing a compelling upgrade over traditional episodic monitoring methods

- Furthermore, the growing popularity of home-based care and the desire for interconnected digital health ecosystems are making wearable monitoring devices an integral component of modern healthcare delivery, offering seamless integration with telemedicine platforms and mobile applications

- The convenience of non-invasive, real-time tracking of vital signs, remote access to patient data for physicians, and the ability to proactively manage chronic conditions are key factors propelling the adoption of wearable ambulatory monitoring devices across hospitals, specialty clinics, and homecare settings. The trend towards patient-centric care and the increasing availability of user-friendly wearable options further contribute to market growth

Restraint/Challenge

Concerns Regarding Data Security, Accuracy, and High Initial Costs

- Concerns surrounding the data security vulnerabilities of connected medical devices, including wearable monitoring systems, pose a significant challenge to broader market penetration. As these devices rely on network connectivity and software, they are susceptible to hacking attempts and data breaches, raising anxieties among healthcare providers and patients about the confidentiality of sensitive health information

- For instance, high-profile reports of cybersecurity vulnerabilities in connected health devices have made some healthcare institutions cautious about large-scale deployment of wearable solutions

- Addressing these cybersecurity concerns through robust encryption, HIPAA-compliant data handling, and regular software updates is crucial for building trust. Companies such as Philips and Abbott emphasize their advanced security protocols and data protection measures in their product launches to reassure potential buyers

- In addition, the relatively high initial cost of some advanced wearable monitoring systems compared to traditional diagnostic tools can be a barrier to adoption for price-sensitive healthcare providers and patients, particularly in developing regions. While basic wearable devices have become more affordable, premium features such as multi-parameter monitoring, AI-driven analytics, or long-term battery life often come with a higher price tag

- Another restraint is the issue of data accuracy and reliability. Variability in sensor performance, differences in skin types, or patient movement can impact readings, making physicians hesitant to rely solely on wearable data for clinical decision-making. Ensuring consistent accuracy and obtaining regulatory approvals remain critical challenges

- Furthermore, regulatory hurdles and the need for compliance with regional healthcare standards can slow product approvals and commercialization timelines

- While prices are gradually decreasing and accuracy is improving, the perceived complexity and cost of advanced wearable monitoring technology can still hinder widespread adoption. Overcoming these challenges through enhanced cybersecurity measures, improved sensor technology, consumer education, and the development of more affordable options will be vital for sustained market growth

Wearable Ambulatory Monitoring Devices Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the wearable ambulatory monitoring devices market is segmented into Cardiac Event Monitors, Cardiac Holter Monitor, Mobile Cardiac Telemetry Devices, Implantable Cardiac Monitor, and Others. The Cardiac Holter Monitor segment dominated the largest market revenue share of 38.6% in 2024, as these devices continue to be the most widely adopted tools for long-term cardiac rhythm monitoring. Their ability to record heart activity continuously over a 24–48-hour period provides physicians with accurate diagnostic information for arrhythmias, palpitations, and other cardiac irregularities. Holter monitors are well established in clinical practice and remain cost-effective compared to newer advanced alternatives, which strengthens their adoption in both developed and emerging markets.

The Mobile Cardiac Telemetry Devices segment is anticipated to witness the fastest growth rate of CAGR 15.2% from 2025 to 2032, propelled by the growing demand for continuous, real-time monitoring solutions beyond hospital walls. Unlike traditional Holter monitors, these devices allow wireless data transmission directly to healthcare providers, enabling early detection of potentially life-threatening conditions. Their role in facilitating remote patient management is becoming increasingly critical, particularly as healthcare systems worldwide shift toward telemedicine and home-based care. Integration with AI and IoT platforms further enhances diagnostic accuracy by allowing automated analysis and predictive alerts, which improves clinical outcomes. Rising adoption among aging populations, patients with chronic cardiovascular conditions, and in regions with expanding telehealth infrastructure is expected to fuel rapid growth.

- By Application

On the basis of application, the wearable ambulatory monitoring devices market is segmented into Hospital Inpatient Monitoring, Ambulatory Patient Monitoring, and Smart Home Healthcare. The Hospital Inpatient Monitoring segment accounted for the largest market revenue share of 44.3% in 2024, as hospitals remain the primary centers for advanced cardiac diagnostics and critical care. The demand is driven by the need for continuous monitoring of patients admitted with cardiovascular diseases, arrhythmias, or those undergoing post-surgical recovery. Hospitals benefit from their ability to integrate wearable devices with centralized monitoring systems, ensuring timely intervention and effective management of high-risk patients. Moreover, the rising number of hospital admissions for cardiac disorders and the growing reliance on advanced diagnostic equipment in inpatient settings contribute to this segment’s dominance.

The Smart Home Healthcare segment is expected to witness the fastest growth rate of CAGR 16.8% from 2025 to 2032, supported by the paradigm shift toward decentralized healthcare delivery and patient-centered care. Growing awareness of preventive healthcare, combined with rising costs of hospital stays, has led to an increased preference for at-home monitoring solutions. Wearable devices designed for smart home healthcare enable patients to track their cardiac activity in real time, while simultaneously transmitting data to healthcare providers through connected platforms. This not only reduces hospital readmissions but also enhances patient comfort and autonomy. The integration of wearable monitoring devices with telehealth services, AI-driven health platforms, and mobile applications is driving wider adoption across both developed and developing economies.

Wearable Ambulatory Monitoring Devices Market Regional Analysis

- North America dominated the wearable ambulatory monitoring devices market with the largest revenue share of 40.8% in 2024, supported by advanced healthcare infrastructure, high disposable incomes, and the presence of leading medical device manufacturers

- The region’s strong emphasis on preventive care, combined with the rising prevalence of chronic diseases such as cardiovascular disorders and diabetes, is fueling adoption. Hospitals, specialty clinics, and home healthcare providers are rapidly integrating these devices for real-time patient monitoring, ensuring timely interventions and reducing hospital readmissions

- Reimbursement support and the growing demand for remote monitoring solutions further reinforce North America’s leading position in the market

U.S. Wearable Ambulatory Monitoring Devices Market Insight

The U.S. wearable ambulatory monitoring devices market captured the largest share within North America in 2024, fueled by the country’s widespread adoption of advanced healthcare technologies and strong investment in digital health solutions. Hospitals and diagnostic centers increasingly rely on wearable ambulatory monitoring devices for cardiac monitoring, blood pressure management, and continuous glucose tracking. The U.S. also benefits from a robust ecosystem of device manufacturers, startups, and healthcare providers that are accelerating innovation in wireless monitoring and AI-powered diagnostic features. High consumer awareness, favorable insurance coverage, and the shift toward home-based care are key drivers behind the U.S. market’s expansion.

Europe Wearable Ambulatory Monitoring Devices Market Insight

The Europe wearable ambulatory monitoring devices market is projected to expand at a steady CAGR throughout the forecast period, supported by growing demand for remote monitoring, an aging population, and rising healthcare expenditures. European healthcare systems emphasize preventive diagnostics, making wearable ambulatory devices increasingly important in managing chronic conditions. Adoption is particularly strong in countries such as Germany, the U.K., and France, where advanced hospital networks and digital healthcare initiatives are accelerating uptake. The integration of wearable monitors with electronic health records (EHRs) and telemedicine platforms further drives growth across clinical and homecare settings.

U.K. Wearable Ambulatory Monitoring Devices Market Insight

The U.K. wearable ambulatory monitoring devices market is anticipated to grow at a notable CAGR during the forecast period, fueled by the government’s strong focus on digital health transformation and preventive care strategies. Hospitals and homecare providers are adopting ambulatory cardiac monitors, blood pressure devices, and portable ECG systems to reduce hospital visits and improve chronic disease management. Growing concerns regarding heart disease and lifestyle-related conditions, combined with consumer interest in mobile health technologies, are creating strong demand. The U.K.’s advanced healthcare infrastructure and established telehealth ecosystem are expected to support rapid adoption in the coming years.

Germany Wearable Ambulatory Monitoring Devices Market Insight

The Germany wearable ambulatory monitoring devices market is expected to expand at a considerable CAGR, driven by its highly developed healthcare infrastructure and emphasis on technological innovation. German hospitals and clinics are integrating wearable ambulatory monitors to improve early detection and long-term management of cardiovascular, metabolic, and respiratory conditions. The country’s focus on sustainability and digital healthcare transformation also supports adoption, with strong collaborations between research institutions and medical device manufacturers. Germany’s preference for data security and privacy in digital health further aligns with the adoption of clinically validated and compliant monitoring solutions.

Asia-Pacific Wearable Ambulatory Monitoring Devices Market Insight

The Asia-Pacific wearable ambulatory monitoring devices market region is poised to grow at the fastest CAGR during 2025–2032, fueled by rapid urbanization, rising disposable incomes, and expanding healthcare infrastructure in countries such as China, India, and Japan. The growing burden of chronic diseases in these populations, combined with increased healthcare investments, is accelerating adoption of wearable ambulatory monitors. Supportive government initiatives promoting telemedicine, digital health, and remote patient monitoring are further propelling the market. The availability of cost-effective devices manufactured locally in APAC also expands accessibility, making advanced monitoring solutions affordable for a wider population base.

Japan Wearable Ambulatory Monitoring Devices Market Insight

The Japan wearable ambulatory monitoring devices market is gaining traction, supported by the country’s high-tech healthcare environment, aging population, and rising focus on convenience in long-term care. Wearable cardiac and blood pressure monitoring devices are increasingly used for elderly care, reducing hospital dependency while enabling continuous health tracking at home. The integration of devices with broader healthcare IoT ecosystems, including telemedicine platforms and connected diagnostic systems, supports widespread adoption. Japan’s focus on improving patient comfort and accuracy in monitoring further enhances demand across hospitals, specialty clinics, and homecare providers.

China Wearable Ambulatory Monitoring Devices Market Insight

The China wearable ambulatory monitoring devices market accounted for the largest share of the Asia-Pacific market in 2024, driven by rapid healthcare digitalization, a growing middle-class population, and government support for smart healthcare initiatives. The country’s large patient pool with cardiovascular and metabolic conditions creates significant demand for continuous ambulatory monitoring. Domestic manufacturers play a critical role by offering cost-effective, innovative devices, expanding access across both urban and rural populations. China’s push toward smart cities and integration of digital health solutions into healthcare policy frameworks ensures strong growth momentum in the years ahead.

Wearable Ambulatory Monitoring Devices Market Share

The wearable ambulatory monitoring devices industry is primarily led by well-established companies, including:

- General Electric Company (U.S.)

- ACS Diagnostics (U.S.)

- Koninklijke Philips NV (Netherlands)

- iRhythm Technologies, Inc. (U.S.)

- Medicomp Inc. (U.S.)

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- G Medical Innovations Holdings Ltd. (Israel)

- Hill-Rom Services Inc. (U.S.)

- Asahi Kasei Corporation (Japan)

- BioTelemetry (U.S.)

- Preventice Solutions Inc. (U.S.)

- Telerhythmics LLC (U.S.)

- ZOLL Medical Corporation (U.S.)

Latest Developments in Global Wearable Ambulatory Monitoring Devices Market

- In November 2021, AliveCor received FDA 510(k) clearance for the KardiaMobile Card, the world’s first credit-card-sized personal ECG. This ultra-portable device allows patients to record medical-grade ECGs anytime and anywhere, expanding access to early cardiac event detection. The launch reinforced AliveCor’s position in the wearable ambulatory monitoring space by providing a discreet, pocket-sized solution for continuous heart health tracking

- In December 2022, Dexcom received FDA clearance for its Dexcom G7 Continuous Glucose Monitoring (CGM) system, designed for real-time glucose tracking. The device features a smaller, all-in-one wearable sensor with improved accuracy and faster warm-up time, enhancing user convenience. Its approval marked a significant milestone in metabolic health monitoring and strengthened Dexcom’s global leadership in the CGM market

- In October 2024, iRhythm Technologies received FDA 510(k) clearance for design updates to its Zio AT device, which is used for real-time arrhythmia monitoring. The updates were aimed at enhancing device durability, patient comfort, and diagnostic reliability. This clearance ensured that Zio remains at the forefront of ambulatory ECG monitoring solutions in both hospital and homecare environments

- In October 2024, BioIntelliSense secured FDA clearance for the BioButton Multi-Patient wearable and BioDashboard system, expanding its portfolio of medical-grade wearables. The BioButton provides continuous monitoring of vital signs, while the BioDashboard™ delivers real-time insights to clinicians. This development positioned BioIntelliSense as a strong player in hospital-at-home and remote patient monitoring programs

- In August 2024, Masimo’s W1 Medical Watch obtained FDA 510(k) clearance for connectivity to its SafetyNet telemonitoring platform, making it one of the first wrist-worn medical-grade continuous monitoring devices. The watch measures key health parameters such as SpO₂ and pulse rate, and its integration with SafetyNet allows clinicians to monitor patients remotely. This clearance further validated Masimo’s expertise in combining wearable technologies with connected healthcare ecosystems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.