Global Mini Truck Market

Market Size in USD Million

CAGR :

%

USD

121.55 Million

USD

262.45 Million

2024

2032

USD

121.55 Million

USD

262.45 Million

2024

2032

| 2025 –2032 | |

| USD 121.55 Million | |

| USD 262.45 Million | |

|

|

|

|

What is the Global Mini Truck Market Size and Growth Rate?

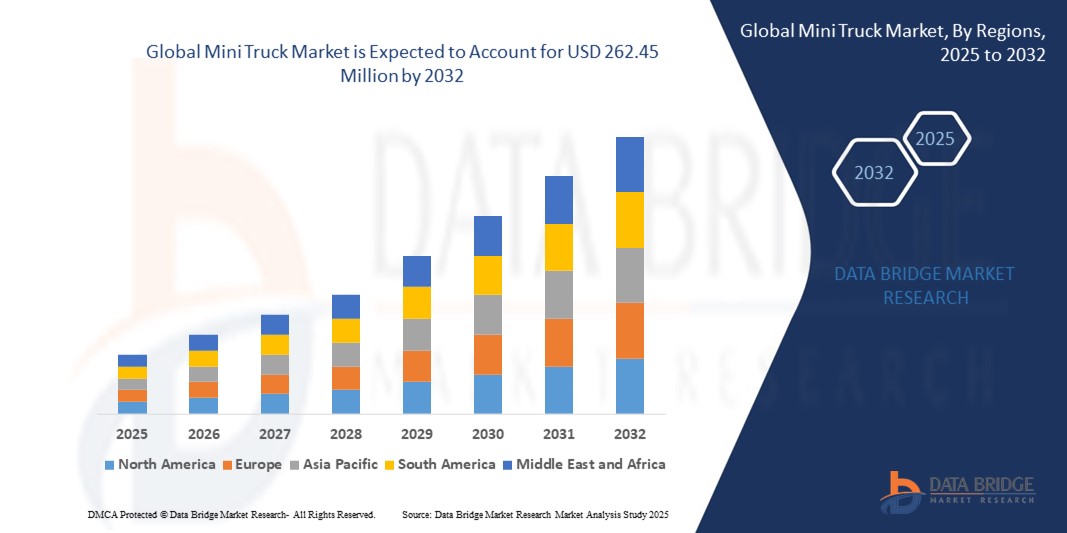

- The global mini truck market size was valued at USD 121.55 million in 2024 and is expected to reach USD 262.45 million by 2032, at a CAGR of 10.10% during the forecast period

- Increasing demand for electric mini trucks, driven by growing environmental concerns and stringent emission regulations. Manufacturers are focusing on developing electric models with improved range and performance to cater to this demand. In addition, there is a rising preference for compact and versatile mini trucks, particularly in urban areas, where space is limited and maneuverability is crucial

- Moreover, technological advancements such as advanced driver assistance systems (ADAS) and connectivity features are becoming standard offerings in modern mini trucks, enhancing safety and convenience for users. These trends collectively indicate a shifting landscape towards greener, more efficient, and technologically advanced mini trucks worldwide

What are the Major Takeaways of Mini Truck Market?

- The rapid pace of urbanization across the globe has led to increased demand for efficient transportation solutions, particularly for last-mile deliveries in congested urban areas. Mini trucks offer a compact and agile option for navigating through tight spaces and delivering goods directly to consumers or businesses. As e-commerce continues to thrive, the demand for mini trucks for last-mile delivery is expected to rise further, driving the growth of the global mini truck market

- North America dominated the mini truck market with the largest revenue share of 32.7% in 2024, driven by the rapid adoption of electric mobility solutions, favorable government incentives, and growing investments in EV infrastructure

- Asia-Pacific (APAC) market is poised to record the fastest CAGR of 8.4% from 2025 to 2032, attributed to rapid urbanization, rising disposable incomes, and aggressive EV adoption policies in China, Japan, and India

- The Standard Mini Trucks segment dominated the market with the largest revenue share of 62.4% in 2024, driven by widespread use in rural and semi-urban areas due to affordability, easy maintenance, and robust performance across diverse terrains

Report Scope and Mini Truck Market Segmentation

|

Attributes |

Mini Truck Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Mini Truck Market?

Electrification and Sustainable Mobility in Mini Trucks

- A major and accelerating trend in the global mini truck market is the shift towards electrification and eco-friendly drivetrains, driven by stricter emission regulations and the rising demand for sustainable logistics solutions. Manufacturers are increasingly introducing electric mini trucks to meet last-mile delivery needs while reducing carbon footprints

- For instance, Tata Motors launched the Ace EV in 2022, India’s first electric mini truck designed for urban cargo applications, equipped with regenerative braking and advanced battery cooling systems. Similarly, Japan’s Suzuki and Daihatsu are collaborating to develop compact EV platforms for mini commercial vehicles

- Electric mini trucks offer lower operating costs, reduced fuel dependency, and quieter operations, making them particularly attractive for urban delivery fleets. Companies such as Ashok Leyland and BYD are investing in electric-powered light commercial vehicles (LCVs) to expand their sustainable mobility offerings

- The growing integration of connected telematics and fleet management solutions further strengthens the value proposition of electric mini trucks by enabling real-time tracking, predictive maintenance, and route optimization

- This transition towards electric and smart mini trucks is reshaping market dynamics, with government incentives and urban sustainability initiatives accelerating adoption. For instance, the Indian government’s FAME II scheme supports electrification, providing subsidies for commercial EVs including mini trucks

- The demand for compact, eco-friendly, and cost-efficient mini trucks is rising globally, particularly in emerging economies where e-commerce and last-mile delivery requirements are expanding rapidly

What are the Key Drivers of Mini Truck Market?

- The surge in e-commerce, urbanization, and last-mile delivery services is a major driver, as mini trucks are increasingly preferred for their compact size, affordability, and high maneuverability in congested city streets

- For instance, in March 2024, Mahindra & Mahindra launched the Supro Profit Truck Excel series targeting urban logistics and small businesses, highlighting improved fuel efficiency and payload capacity to meet delivery sector demands

- Rising demand for cost-effective cargo transport solutions among small businesses, farmers, and traders is boosting adoption, as mini trucks provide a balance between payload capacity and affordability compared to larger commercial vehicles

- Government initiatives supporting electric mobility, rural transportation, and small business financing schemes are further fueling market growth. Subsidized loans and tax incentives for commercial vehicle owners make mini trucks more accessible to micro-entrepreneurs

- The versatility of mini trucks, offering applications across agriculture, FMCG distribution, construction material transport, and courier services, continues to propel market expansion in both developed and emerging economies

Which Factor is Challenging the Growth of the Mini Truck Market?

- A major challenge hindering mini truck market growth is the limited infrastructure for electric charging and alternative fuels, especially in rural and semi-urban regions where mini trucks are widely used. This makes fleet operators hesitant to transition to electric mini trucks despite long-term cost savings

- For instance, while Tata Ace EV and Ashok Leyland’s Bada Dost EV have entered the market, the lack of widespread charging networks restricts mass adoption in India and Southeast Asia

- In addition, rising fuel prices and regulatory compliance costs for diesel mini trucks increase the financial burden on small business owners, particularly in price-sensitive regions

- Cybersecurity and telematics data privacy concerns are emerging as more mini trucks integrate fleet management and IoT-based connectivity, with some operators wary of data misuse

- The relatively low profit margins in small-scale logistics operations also limit investment in premium or electric models, as customers often prioritize affordability over advanced features

- Overcoming these challenges will require greater investment in EV infrastructure, affordable financing models, and awareness campaigns to highlight the long-term economic and environmental benefits of mini trucks

How is the Mini Truck Market Segmented?

The market is segmented on the basis of vehicle type, payload capacity, end-user industry, and fuel type.

- By Vehicle Type

On the basis of vehicle type, the mini truck market is segmented into Standard Mini Trucks and Electric Mini Trucks. The Standard Mini Trucks segment dominated the market with the largest revenue share of 62.4% in 2024, driven by widespread use in rural and semi-urban areas due to affordability, easy maintenance, and robust performance across diverse terrains. Standard mini trucks continue to remain the first choice for small businesses and transport operators in emerging economies.

The Electric Mini Trucks segment is anticipated to register the fastest CAGR from 2025 to 2032, supported by government incentives, stricter emission norms, and advancements in battery technology. Rapid adoption in urban logistics and last-mile delivery fleets is accelerating their growth.

- By Payload Capacity

On the basis of payload capacity, the mini truck market is segmented into Under 500 kg and 500 kg to 1,000 kg. The 500 kg to 1,000 kg segment dominated the market with a revenue share of 55.7% in 2024, driven by increasing demand for medium-load capacity vehicles in construction, logistics, and agricultural supply chains. These vehicles offer a balance of higher payload efficiency with cost-effectiveness.

The Under 500 kg segment is projected to witness the fastest CAGR during 2025–2032, fueled by demand in last-mile deliveries, e-commerce distribution, and small-scale logistics where lightweight operations are required.

- By End-User Industry

On the basis of end-user industry, the mini truck market is segmented into Logistics and Transportation and Construction and Infrastructure. The Logistics and Transportation segment dominated the market with the largest revenue share of 59.3% in 2024, attributed to the rising demand for efficient small commercial vehicles in e-commerce, FMCG distribution, and retail supply chains.

The Construction and Infrastructure segment is expected to record the fastest CAGR through 2032, backed by infrastructure development projects, urbanization, and the demand for robust vehicles capable of carrying building materials across shorter distances.

- By Drive Type

On the basis of drive type, the mini truck market is segmented into All-Wheel Drive (AWD) and Front-Wheel Drive (FWD). The Front-Wheel Drive (FWD) segment held the largest revenue share of 63.1% in 2024, as these vehicles are more cost-efficient, fuel-saving, and easier to maintain for urban and semi-urban road networks.

The All-Wheel Drive (AWD) segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by increasing adoption in construction, mining, and off-road applications that require better traction and durability.

- By Fuel Type

On the basis of fuel type, the mini truck market is segmented into Petrol and Diesel. The Diesel segment dominated the market with a revenue share of 66.8% in 2024, primarily due to its fuel efficiency, higher torque, and preference in long-haul and heavy-load transport across emerging economies.

The Petrol segment is projected to witness the fastest CAGR from 2025 to 2032, supported by lower initial costs, stricter emission regulations on diesel engines, and growing urban adoption for short-distance commercial applications.

Which Region Holds the Largest Share of the Mini Truck Market?

- North America dominated the mini truck market with the largest revenue share of 32.7% in 2024, driven by the rapid adoption of electric mobility solutions, favorable government incentives, and growing investments in EV infrastructure

- Consumers in the region are increasingly inclined towards sustainable transportation, enhanced vehicle performance, and seamless integration of EVs with advanced digital technologies

- This growth is further supported by strong purchasing power, a robust EV manufacturing ecosystem, and the rising demand for zero-emission fleets, positioning Mini Trucks as a mainstream mobility option

U.S. Mini Truck Market Insight

U.S. captured the largest revenue share in 2024 within North America, fueled by early adoption of EVs and the growing popularity of electric pickup models among both personal and commercial users. Consumers value high-performance EVs with extended range, fast-charging capabilities, and smart connectivity features. Moreover, leading automakers such as Tesla, Ford, and Rivian are spearheading innovation and expanding production capacity, significantly driving market growth in the country.

Europe Mini Truck Market Insight

Europe Mini Truck market is projected to grow at a substantial CAGR throughout the forecast period, supported by stringent emission regulations and strong government support for EV adoption. Rising urbanization, combined with increased investments in EV charging networks, is encouraging adoption across both personal and fleet applications. European consumers are also highly receptive to the sustainability and energy efficiency offered by electric pickups, driving demand in residential, commercial, and industrial sectors.

U.K. Mini Truck Market Insight

U.K. market is expected to grow at a noteworthy CAGR, propelled by the country’s push towards achieving net-zero emissions and rapid development of EV infrastructure. Rising concerns about environmental sustainability and fuel cost savings are motivating consumers and businesses to switch to electric pickups. In addition, strong government policies, tax incentives, and the expansion of last-mile delivery services are expected to further accelerate market growth in the U.K.

Germany Mini Truck Market Insight

Germany market is anticipated to expand at a considerable CAGR, driven by the country’s engineering excellence and focus on green mobility solutions. The strong presence of leading automakers and suppliers, coupled with innovation in EV technology, is fueling adoption. Germany’s advanced charging infrastructure and sustainability-focused policies are also encouraging integration of Mini Trucks into both private and commercial fleets, supporting long-term growth.

Which Region is the Fastest Growing Region in the Mini Truck Market?

Asia-Pacific (APAC) market is poised to record the fastest CAGR of 8.4% from 2025 to 2032, attributed to rapid urbanization, rising disposable incomes, and aggressive EV adoption policies in China, Japan, and India. The region is becoming a global hub for EV manufacturing, with strong government backing, cost-effective production, and expanding charging infrastructure. This is making mini trucks more affordable and accessible, driving mass adoption across diverse consumer groups.

Japan Mini Truck Market Insight

Japan market is experiencing strong growth, supported by the country’s tech-savvy culture, rapid urbanization, and strong environmental goals. Japanese consumers are prioritizing advanced, convenient, and secure electric mobility solutions. The integration of electric pickups with smart city initiatives and IoT-based vehicle systems is fueling adoption, while the country’s aging population is further boosting demand for user-friendly, low-maintenance EVs.

China Mini Truck Market Insight

China market held the largest revenue share within APAC in 2024, driven by the nation’s expanding EV ecosystem, rising middle-class population, and aggressive government mandates for green mobility. With strong domestic manufacturing capabilities and cost-efficient EV production, China is a global leader in the adoption of electric pickups. The expansion of smart city projects and availability of affordable EV options are further accelerating widespread adoption across both consumer and commercial applications.

Which are the Top Companies in Mini Truck Market?

The mini truck industry is primarily led by well-established companies, including:

- Suzuki (Japan)

- Honda Motor Co., Ltd. (Japan)

- Fiat S.p.A (Italy)

- Ford Motor Company (U.S.)

- General Motors Company (U.S.)

- Toyota Motor Corporation (Japan)

- Tata Motors Limited (India)

- Ashok Leyland (India)

What are the Recent Developments in Global Mini Truck Market?

- In May 2024, Ashok Leyland revealed plans to introduce 5–6 new LCV models during the year, with a strategic focus on the 2-to-3.5-tonne segment. The company aims to raise its LCV market share from 20% to 25%, highlighting its aggressive expansion strategy. This move strengthens Ashok Leyland’s competitive position in the Indian LCV market

- In February 2024, Mitsubishi Fuso introduced its new light-duty Canter truck in Japan, equipped with a 10-inch full LCD panel, steering wheel switches, and a central display for enhanced usability. The redesigned interior features a streamlined layout, improving driver comfort and ease of entry and exit. This launch reinforces Mitsubishi Fuso’s commitment to innovation and user-friendly vehicle design

- In November 2021, Ford showcased the all-electric F-100 Eluminator concept, a zero-emission demonstration truck powered by its new Ford Performance Parts Eluminator electric crate motor. The concept highlighted Ford’s focus on electric performance innovation and its efforts to tap into the rising demand for EVs. This initiative underlines Ford’s long-term vision to expand its electric mobility portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.