Global Mining Machinery Market

Market Size in USD Billion

CAGR :

%

USD

25.94 Billion

USD

37.17 Billion

2024

2032

USD

25.94 Billion

USD

37.17 Billion

2024

2032

| 2025 –2032 | |

| USD 25.94 Billion | |

| USD 37.17 Billion | |

|

|

|

|

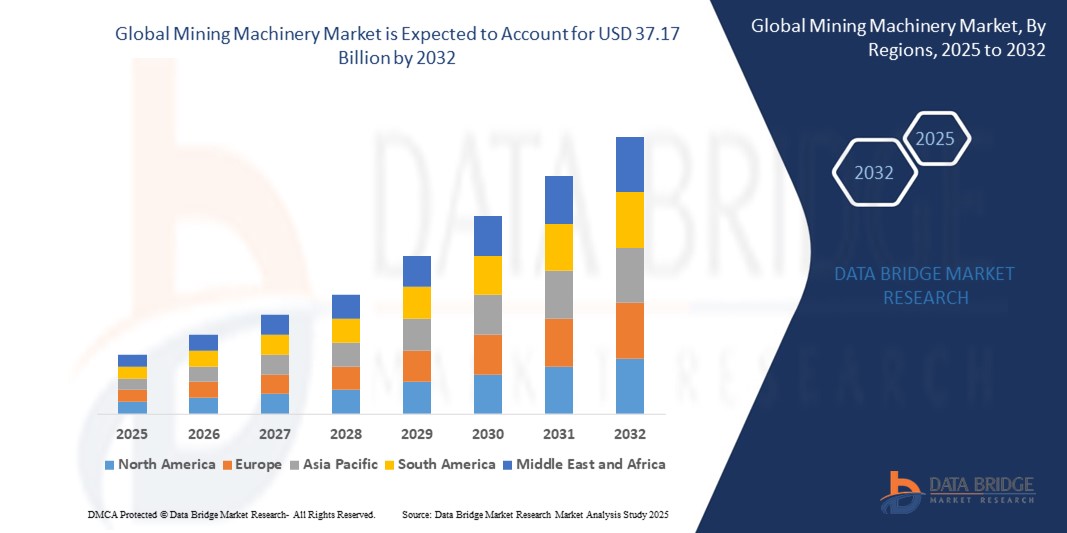

What is the Global Mining Machinery Market Size and Growth Rate?

- The global mining machinery market size was valued at USD 25.94 billion in 2024 and is expected to reach USD 37.17 billion by 2032, at a CAGR of 4.60% during the forecast period

- Mining machinery market growth is driven by advancements in autonomous and electric mining equipment. Innovations such as automated drilling systems and electric haul trucks enhance efficiency and reduce operational costs. Increased adoption of these technologies is boosting market expansion, with a growing emphasis on sustainability and reduced environmental impact further propelling growth

What are the Major Takeaways of Mining Machinery Market?

- The increasing demand for minerals and metals, driven by industries such as automotive, construction, and electronics, is propelling the mining machinery market

- For instance, in June 2023, Epiroc unveiled a new mobile hydraulic power pack designed for blast hole drills. This wagon-mounted power pack facilitates off-grid operation for electric drills, eliminating the need for existing electrical infrastructure and enhancing the efficiency and versatility of drilling operations in remote locations

- Asia Pacific dominated the mining machinery market with the largest revenue share of 48.6% in 2024, driven by significant investments in mining operations, rising demand for critical minerals, and the increasing presence of advanced mining equipment manufacturers in countries instance China, Australia, India, and Indonesia

- North America is poised to grow at the fastest CAGR of 13.2% during the forecast period from 2025 to 2032, fueled by a rising focus on automation, digitalization, and sustainable mining operations across the region

- The Surface Mining Machinery segment dominated the mining machinery market with the largest market revenue share of 47.6% in 2024, driven by the growing demand for large-scale mineral extraction, particularly in open-pit mining operations

Report Scope and Mining Machinery Market Segmentation

|

Attributes |

Mining Machinery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Mining Machinery Market?

“Automation and AI-Driven Operational Efficiency”

- A significant and accelerating trend in the global mining machinery market is the integration of artificial intelligence (AI), automation, and advanced sensor technologies to boost operational efficiency, safety, and cost-effectiveness. Mining companies are increasingly adopting autonomous machinery to address labor shortages and enhance productivity in harsh and remote mining environments

- For instance, Komatsu Ltd. has expanded its autonomous haulage system (AHS) operations, allowing driverless trucks to transport ore and minerals efficiently, reducing human error and operational risks. Similarly, Caterpillar Inc. has deployed autonomous mining trucks and drilling machines, enabling round-the-clock operations with improved safety standards

- AI integration allows mining machinery to analyze real-time data, predict equipment failures, and optimize routes or digging operations, thereby improving equipment lifespan and minimizing downtime. Companies are using AI to provide predictive maintenance alerts, ensuring that machinery operates with maximum uptime and safety

- The deployment of remotely operated or autonomous equipment is reshaping mining operations by reducing dependency on human intervention in hazardous environments, enhancing workforce safety, and lowering operational costs. Integration with real-time monitoring platforms enables centralized control over fleets of machines, optimizing resource management across mining sites

- The growing demand for autonomous, intelligent, and interconnected mining machinery is transforming user expectations for mining operations globally. Leading players such as Hitachi Construction Machinery and Sandvik AB are investing heavily in AI-enabled machines that deliver real-time analytics, automation, and remote operation capabilities to meet this demand

- This trend is expected to gain further momentum as mining companies prioritize operational efficiency, worker safety, and environmental sustainability, making AI and automation central pillars of future mining operations

What are the Key Drivers of Mining Machinery Market?

- The increasing demand for minerals, metals, and raw materials driven by global industrialization, renewable energy expansion, and electric vehicle production is a major driver for the mining machinery market. The need to extract resources from deeper, more remote, or complex mining sites necessitates advanced machinery with higher efficiency and reliability

- For instance, in January 2024, Epiroc Mining launched new battery-electric underground mining equipment designed to reduce emissions, improve worker safety, and lower operational costs in underground operations. Such innovations are driving growth in environmentally conscious mining practices

- The surge in automation, robotics, and AI-based solutions is fueling demand for next-generation Mining Machinery, enabling companies to optimize productivity while reducing human exposure to dangerous environments. In addition, rising investments in digital technologies such as real-time monitoring, predictive maintenance, and remote-controlled operations are enhancing equipment performance

- The global push for energy transition, including increased production of critical minerals instance lithium, cobalt, and copper, is driving large-scale investments in mining infrastructure, subsequently boosting demand for advanced Mining Machinery

- The growing emphasis on safety, operational efficiency, and sustainability is compelling mining companies to replace aging equipment with technologically advanced solutions, propelling market growth

Which Factor is challenging the Growth of the Mining Machinery Market?

- High capital costs associated with the procurement and deployment of technologically advanced mining machinery pose a significant challenge, particularly for small- and medium-sized mining operators. The upfront investment for autonomous or electric-powered equipment can deter adoption, especially in developing regions with constrained budgets

- For instance, fully autonomous haulage systems or battery-electric underground equipment require significant infrastructure upgrades and operational restructuring, making it challenging for smaller operators to justify the costs

- Furthermore, the complex integration of AI, automation, and digital platforms requires skilled personnel, which creates a talent gap in certain regions. The lack of trained operators and technicians for sophisticated Mining Machinery can delay adoption timelines

- Regulatory uncertainties, environmental restrictions, and geopolitical factors in key mining regions can hinder equipment sales and deployment. For instance, delays in obtaining permits or restrictions on certain mining activities impact machinery demand

- Overcoming these challenges will require enhanced financial solutions, partnerships for equipment leasing, workforce training initiatives, and continued innovation in cost-effective mining machinery to support sustainable and efficient mining operations globally

How is the Mining Machinery Market Segmented?

The market is segmented on the basis of category, propulsion, power output, application, mining category, type, and battery type.

• By Category

On the basis of category, the mining machinery market is segmented into Crushing, Pulverizing, Screening Machinery, Mineral Processing Backhoe Loader, Surface Mining Machinery, and Underground Mining Machinery. The Surface Mining Machinery segment dominated the mining machinery market with the largest market revenue share of 47.6% in 2024, driven by the growing demand for large-scale mineral extraction, particularly in open-pit mining operations. The high efficiency, productivity, and versatility of surface mining equipment make them a preferred choice for operators engaged in mineral, metal, and coal extraction.

The Underground Mining Machinery segment is anticipated to witness the fastest growth rate of 23.5% from 2025 to 2032, fueled by increasing demand for critical minerals instance lithium, cobalt, and copper, which often require deep underground mining. Advancements in safety, automation, and battery-electric equipment are propelling adoption in underground operations.

• By Propulsion

On the basis of propulsion, the mining machinery market is segmented into Diesel and CNG/LNG/RNG. The Diesel segment accounted for the largest market revenue share in 2024, owing to the dominance of diesel-powered machinery in mining operations, known for their high torque, reliability, and ability to function in remote locations without dependency on complex fueling infrastructure.

The CNG/LNG/RNG segment is expected to witness the fastest CAGR from 2025 to 2032, driven by stringent emission regulations and the growing industry shift towards low-emission, environmentally friendly propulsion solutions.

• By Power Output

On the basis of power output, the mining machinery market is segmented into <500 HP, 500-2000 HP, and >2000 HP. The 500-2000 HP segment dominated the Mining Machinery market with the largest market revenue share of 54.3% in 2024, driven by the widespread use of mid-range power machinery across surface and underground mining operations, providing an optimal balance of efficiency, power, and cost-effectiveness.

The >2000 HP segment is projected to experience the fastest growth rate during the forecast period, supported by the demand for high-capacity machinery capable of handling large-scale mineral extraction and transport operations.

• By Application

On the basis of application, the mining machinery market is segmented into Mineral, Metal, and Coal. The Metal segment dominated the mining machinery market with the largest market revenue share in 2024, driven by increasing global demand for metals such as iron, copper, gold, and aluminum used across various industries, including construction, electronics, and renewable energy.

The Mineral segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to the rising demand for critical minerals required for electric vehicles, batteries, and energy transition technologies.

• By Mining Category

On the basis of mining category, the mining machinery market is segmented into Surface Mining and Underground Mining. The Surface Mining segment held the largest market revenue share in 2024, driven by its widespread adoption in extracting bulk commodities such as coal, iron ore, and bauxite. Surface mining operations require large, powerful machinery to maximize efficiency.

The Underground Mining segment is poised to witness the fastest CAGR during the forecast period, supported by technological advancements and increasing mineral demand from deep underground reserves.

• By Type

On the basis of type, the mining machinery market is segmented into Mining Truck and LHD (Load Haul Dump Machines). The Mining Truck segment dominated the mining machinery market with the largest market revenue share of 62.8% in 2024, driven by its critical role in hauling large volumes of extracted materials across mining sites efficiently.

The LHD segment is anticipated to witness rapid growth from 2025 to 2032, supported by their essential use in underground mining, enhanced by innovations in electric and automated LHD models.

• By Battery Type

On the basis of battery type, the mining machinery market is segmented into Lithium Iron Phosphate (LFP), Nickel Manganese Cobalt (NMC), and Others. The Lithium Iron Phosphate (LFP) segment dominated the Mining Machinery market with the largest market revenue share in 2024, owing to its superior thermal stability, safety, and long cycle life, making it ideal for electric-powered mining equipment.

The Nickel Manganese Cobalt (NMC) segment is projected to witness the fastest growth rate during the forecast period, fueled by its higher energy density, enabling longer operational hours and reduced charging frequency for battery-electric mining equipment.

Which Region Holds the Largest Share of the Mining Machinery Market?

- Asia Pacific dominated the mining machinery market with the largest revenue share of 48.6% in 2024, driven by significant investments in mining operations, rising demand for critical minerals, and the increasing presence of advanced mining equipment manufacturers in countries instance China, Australia, India, and Indonesia

- The region benefits from abundant mineral reserves, expanding infrastructure projects, and growing demand for metals such as lithium, copper, and iron ore essential for renewable energy and electric vehicle production

- Governments across Asia Pacific are heavily investing in resource extraction and technological upgrades in mining operations, fueling the adoption of advanced and autonomous mining machinery solutions for both surface and underground applications

China Mining Machinery Market Insight

The China mining machinery market captured the largest revenue share in Asia Pacific in 2024, driven by the country's vast mining sector, abundant mineral reserves, and strong focus on technological modernization. China's aggressive push towards electric vehicles and renewable energy is boosting demand for critical minerals, driving investments in mining equipment, including autonomous trucks, excavators, and loaders. Domestic manufacturers are expanding production capabilities, contributing to the market's robust growth.

India Mining Machinery Market Insight

The India mining machinery market is expected to grow at a significant CAGR during the forecast period, supported by rising demand for construction materials, coal, and industrial minerals, coupled with government initiatives to boost mining productivity. The adoption of technologically advanced machinery, including automation and electric-powered equipment, is increasing as India modernizes its mining operations to meet rising domestic and global demand.

Australia Mining Machinery Market Insight

The Australia mining machinery market is witnessing strong growth, driven by the country's dominance in mineral exports, particularly iron ore, gold, lithium, and coal. Mining companies in Australia are increasingly deploying autonomous and electric-powered machinery to improve safety, reduce operational costs, and align with environmental goals, further propelling market expansion.

Which Region is the Fastest Growing Region in the Mining Machinery Market?

North America is poised to grow at the fastest CAGR of 13.2% during the forecast period from 2025 to 2032, fueled by a rising focus on automation, digitalization, and sustainable mining operations across the region. The U.S. and Canada are leading investments in technologically advanced mining equipment, including autonomous haul trucks, battery-electric machinery, and AI-enabled monitoring systems to improve productivity, worker safety, and environmental performance.

U.S. Mining Machinery Market Insight

U.S. mining machinery market accounted for the largest revenue share in North America in 2024, driven by growing demand for metals such as copper and lithium essential for renewable energy infrastructure and electric vehicles. Mining operators are increasingly adopting AI, robotics, and autonomous systems to enhance operational efficiency and address labor shortages, making the U.S. a key growth driver for the region's mining machinery market.

Canada Mining Machinery Market Insight

The Canada mining machinery market is expanding steadily, supported by the country's vast mineral wealth, particularly in gold, copper, and rare earth elements, as well as favorable government policies promoting sustainable mining practices. The rising adoption of electric-powered equipment and autonomous mining technologies is enhancing productivity and reducing environmental impact, driving market growth in Canada.

Which are the Top Companies in Mining Machinery Market?

The mining machinery industry is primarily led by well-established companies, including:

- Caterpillar Inc. (U.S.)

- Komatsu Ltd. (Japan)

- Sandvik AB (Sweden)

- Epiroc Mining India Limited (India)

- Liebherr-International Deutschland GmbH (Germany)

- AB Volvo (Sweden)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- JCB (U.K.)

- Liugong Machinery Co., Ltd. (China)

- Kobelco Construction Machinery Co., Ltd. (Japan)

- Sumitomo Heavy Industries, Ltd. (Japan)

- XCMG Group (China)

- WIRTGEN GROUP Branch of John Deere GmbH & Co. KG (Germany)

- Mine Master Spólka z o.o. (Poland)

- FIORI GROUP S.p.A. (Italy)

- Wacker Neuson SE (Germany)

- RTM Equipment (Canada)

- ASTEC INDUSTRIES, INC. (U.S.)

- BELL Equipment (South Africa)

What are the Recent Developments in Global Mining Machinery Market?

- In July 2023, Komatsu Ltd. announced the upcoming launch of its PC210LCE-11 and 200LCE-11 models, which are 20-ton electric excavators powered by lithium-ion batteries, aimed at the Japan and European markets. This initiative reflects Komatsu's strategic push into the electric construction equipment sector and reinforces its long-term goal of achieving carbon neutrality by 2050, thereby strengthening its presence in sustainable machinery offerings

- In July 2023, Liebherr partnered with Leica Geosystems to develop and deliver an advanced range of machine control systems specifically for hydraulic excavators. These innovative systems function as driver assistance tools, designed to boost operational efficiency, enhance on-site safety, and optimize productivity in construction operations, contributing to smarter and more automated job sites

- In July 2023, Metso Corporation signed an agreement to acquire Brouwer Engineering, an Australian firm specializing in electrical and control systems for bulk material handling equipment. This acquisition allows Metso to integrate its extensive product portfolio with Brouwer Engineering’s technical expertise, providing customers with a more comprehensive suite of mining and material handling solutions

- In June 2023, Epiroc launched a new mobile hydraulic powerpack designed for blast hole drills, aiming to improve the operational efficiency of electric drilling machines. This wagon-mounted powerpack enables electric drills to function off-grid, eliminating dependence on fixed electrical infrastructure, thereby increasing mobility and flexibility in remote mining operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.