Global Moisture Curing Adhesives Market

Market Size in USD Billion

CAGR :

%

USD

5.71 Billion

USD

10.49 Billion

2024

2032

USD

5.71 Billion

USD

10.49 Billion

2024

2032

| 2025 –2032 | |

| USD 5.71 Billion | |

| USD 10.49 Billion | |

|

|

|

|

Moisture Curing Adhesives Market Size

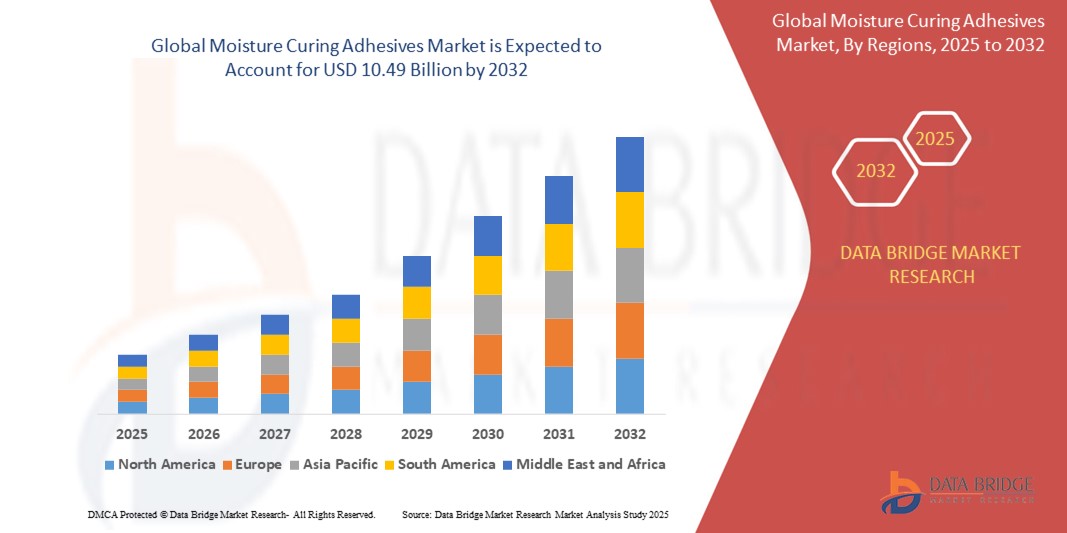

- The global moisture curing adhesives market size was valued at USD 5.71 billion in 2024 and is expected to reach USD 10.49 billion by 2032, at a CAGR of 7.90% during the forecast period

- The market growth is driven by the increasing adoption of moisture curing adhesives in various industries due to their superior bonding strength, flexibility, and ability to cure in humid conditions, enhancing their applicability in diverse environments

- Rising demand for lightweight, durable, and eco-friendly adhesive solutions in construction, automotive, and textile industries is further propelling market expansion, as these adhesives offer fast curing and strong adhesion without requiring additional heat or solvents

Moisture Curing Adhesives Market Analysis

- Moisture curing adhesives, known for their ability to cure upon exposure to moisture in the air, are critical in applications requiring strong, flexible, and durable bonds, particularly in construction, automotive, and woodworking sectors

- The growing demand for these adhesives is fueled by advancements in manufacturing processes, increasing focus on sustainable and efficient bonding solutions, and the expansion of end-use industries in emerging markets

- Asia-Pacific dominated the moisture curing adhesives market with the largest revenue share of 42.5% in 2024, driven by rapid industrialization, large-scale construction projects, and a robust manufacturing base, particularly in countries such as China, Japan, and India

- North America is expected to be the fastest-growing region during the forecast period, attributed to increasing investments in automotive innovation, infrastructure development, and the adoption of advanced adhesive technologies

- The Polyurethane segment held the largest market share of 45.1% in 2024, owing to its versatility, high bonding strength, and suitability for a wide range of applications, including construction and automotive

Report Scope and Moisture Curing Adhesives Market Segmentation

|

Attributes |

Moisture Curing Adhesives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Moisture Curing Adhesives Market Trends

“Increasing Integration of Polyurethane, Silicone, Cyanoacrylate, Polyolefin, and Others”

- The global moisture curing adhesives market is experiencing a notable trend toward the integration of various adhesive types, including polyurethane, silicone, cyanoacrylate, polyolefin, and others, to meet diverse industry needs

- These adhesive types enable enhanced bonding strength, flexibility, and resistance to environmental factors, providing tailored solutions for applications in construction, automotive, woodworking, and textiles

- Polyurethane-based moisture curing adhesives, for instance, are gaining traction due to their versatility and ability to bond dissimilar substrates, such as metals, plastics, and composites, making them ideal for automotive and construction applications

- Companies are developing advanced formulations, such as silicone adhesives with superior thermal stability for electronics or cyanoacrylate adhesives for rapid bonding in woodworking, to address specific industry requirements

- This trend is increasing the appeal of moisture curing adhesives across a wide range of sectors, enhancing their adoption by manufacturers and end-users

- Advanced formulations can address specific performance needs, such as high water resistance, fast curing times, or compatibility with challenging substrates, improving overall efficiency and durability

Moisture Curing Adhesives Market Dynamics

Driver

“Rising Demand for Construction and Automotive Applications”

- The increasing demand for moisture curing adhesives in construction and automotive industries is a key driver for the global market

- These adhesives are widely used in construction for roofing, flooring, sealing, and bonding applications, driven by rapid urbanization and infrastructure development, particularly in the Asia-Pacific region

- In the automotive sector, moisture curing adhesives support lightweight vehicle manufacturing by bonding materials such as composites and aluminum, enhancing fuel efficiency and structural integrity

- Government initiatives promoting sustainable construction and stringent regulations on vehicle emissions are further boosting the adoption of these adhesives

- The expansion of 5G technology and IoT is enabling smarter manufacturing processes, allowing for more precise application and monitoring of adhesive performance in real-time

- Manufacturers are increasingly incorporating moisture curing adhesives as standard solutions to meet industry demands for durability, eco-friendliness, and performance

Restraint/Challenge

“High Implementation Costs and Environmental Concerns”

- The high initial costs associated with the development, production, and integration of moisture curing adhesives can be a significant barrier, particularly for small and medium-sized enterprises in emerging markets

- Formulating advanced adhesives, such as those with low-VOC or bio-based properties, often requires expensive raw materials and complex production processes

- Environmental concerns related to the use of isocyanates in polyurethane adhesives and the disposal of non-biodegradable adhesives pose a major challenge, as stricter regulations on emissions and waste management are enforced globally

- The varying regulatory frameworks across regions regarding chemical usage, emissions, and waste disposal complicate compliance for manufacturers operating internationally

- These factors can limit market growth, especially in regions with high environmental awareness or where cost sensitivity is a critical consideration

Moisture Curing Adhesives market Scope

The market is segmented on the basis of type, resin, and applications.

- By Type

On the basis of type, the global moisture curing adhesives market is segmented into polyurethane, silicone, cyanoacrylate, polyolefin, and others. The polyurethane segment dominated the largest market revenue share of 40% in 2024, driven by its versatility, high strength, and ability to bond diverse substrates such as metals, plastics, and composites. Its widespread use in construction, automotive, and electronics industries, coupled with eco-friendly low-VOC formulations, supports its dominance.

The cyanoacrylate segment is expected to witness the fastest growth rate of around 6.4% from 2025 to 2032, fueled by its rapid curing properties and increasing adoption in woodworking and construction for quick-drying applications. Advancements in cyanoacrylate formulations enhancing bond strength and environmental resistance further accelerate its growth.

- By Resin

On the basis of resin, the global moisture curing adhesives market is segmented into epoxy, polyurethane, acrylate, silicone, and others. The polyurethane resin segment dominated the largest market revenue share of 45% in 2024, owing to its superior durability, moisture resistance, and adaptability to challenging environments. Its extensive use in automotive, construction, and aerospace applications, supported by innovations in eco-friendly formulations, drives its market leadership.

The acrylate resin segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by its high bonding power, resistance to UV radiation, and suitability for outdoor applications in industries such as automotive, electronics, and construction. The increasing demand for pressure-sensitive adhesive tapes further boosts its adoption.

- By Applications

On the basis of applications, the global moisture curing adhesives market is segmented into construction, automotive, woodworking, textile, and others. The construction segment dominated the market with a revenue share of over 30% in 2024, driven by its critical role in roofing, insulation, flooring, and bonding building textiles. Rapid infrastructure development, particularly in Asia-Pacific, and the need for high-breathability adhesives fuel its dominance.

The automotive segment is expected to witness the fastest growth rate of approximately 7.5% from 2025 to 2032, propelled by rising demand for lightweight vehicles and electric vehicle production. Moisture curing adhesives are increasingly used for bonding components such as windshields, battery systems, and composites, enhancing safety and performance.

Moisture Curing Adhesives Market Regional Analysis

- Asia-Pacific dominated the moisture curing adhesives market with the largest revenue share of 42.5% in 2024, driven by rapid industrialization, large-scale construction projects, and a robust manufacturing base, particularly in countries such as China, Japan, and India

- Consumers prioritize moisture curing adhesives for their versatility, strong bonding capabilities, and resistance to environmental factors, particularly in regions with high humidity and diverse climatic conditions

- Growth is supported by advancements in adhesive technologies, such as improved polyurethane and silicone formulations, alongside rising adoption in construction, automotive, and woodworking applications

U.S. Moisture Curing Adhesives Market Insight

The U.S. is the fastest-growing market in the North America moisture curing adhesives market in 2024, fuelled by strong demand in construction and automotive industries, coupled with increasing awareness of the benefits of moisture curing adhesives for high-strength bonding. The trend toward sustainable and energy-efficient building materials and vehicle manufacturing further boosts market expansion. The integration of these adhesives in both OEM and aftermarket applications creates a robust product ecosystem.

Europe Moisture Curing Adhesives Market Insight

The Europe moisture curing adhesives market is expected to witness significant growth, supported by stringent regulations promoting sustainable construction and automotive manufacturing. Consumers seek adhesives that offer high durability and environmental resistance while meeting safety and performance standards. Growth is prominent in countries such as Germany and France, driven by demand in construction and automotive retrofit projects.

U.K. Moisture Curing Adhesives Market Insight

The U.K. market for moisture curing adhesives is expected to witness strong growth, driven by increasing demand in construction and woodworking for enhanced bonding strength and durability. Rising awareness of energy-efficient building solutions and the need for adhesives that perform in high-humidity environments encourage adoption. Evolving regulations on sustainable materials also influence consumer preferences, balancing performance with compliance.

Germany Moisture Curing Adhesives Market Insight

Germany is expected to witness robust growth in the moisture curing adhesives market, attributed to its advanced manufacturing sector and high consumer focus on quality and sustainability. German industries prefer technologically advanced adhesives, such as polyurethane and silicone-based formulations, for their ability to reduce energy consumption and enhance product longevity. Integration in premium automotive and construction applications supports sustained market growth.

Asia-Pacific Moisture Curing Adhesives Market Insight

The Asia-Pacific region dominated the global moisture curing adhesives market share of 76.6% in 2024, driven by booming construction, automotive, and textile industries in countries such as China, India, and Japan. Rising disposable incomes and increasing awareness of durable, high-performance adhesives boost demand. Government initiatives promoting sustainable construction and energy-efficient manufacturing further encourage the adoption of advanced moisture curing adhesives.

Japan Moisture Curing Adhesives Market Insight

Japan’s moisture curing adhesives market is expected to witness significant growth due to strong consumer preference for high-quality, technologically advanced adhesives that enhance performance in automotive and construction applications. The presence of major manufacturers and the integration of adhesives in OEM products accelerate market penetration. Growing interest in aftermarket applications also contributes to market expansion.

China Moisture Curing Adhesives Market Insight

China holds the largest share of the Asia-Pacific moisture curing adhesives market, propelled by rapid urbanization, rising construction activities, and increasing vehicle production. The country’s growing middle class and focus on sustainable manufacturing support the adoption of advanced adhesives. Strong domestic production capabilities and competitive pricing enhance market accessibility.

Moisture Curing Adhesives Market Share

The moisture curing adhesives industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Huntsman International LLC (U.S.)

- Henkel AG & Co. KGaA (Germany)

- H.B. Fuller Company (U.S.)

- Sika AG (Switzerland)

- Royal Adhesives & Sealants (U.S.)

- Dow (U.S.)

- Illinois Tool Works Inc. (U.S.)

- Bostik (France)

- Jowat SE (Germany)

- Permabond LLC (U.K.)

- Apollo (India)

- Pidilite Industries Ltd (India)

- Master Bond Inc. (U.S.)

- Dymax Corporation (U.S.)

What are the Recent Developments in Global Moisture Curing Adhesives Market?

- In May 2024, H.B. Fuller completed the acquisition of ND Industries, a leading provider of specialty adhesives and fastener locking solutions for automotive, electronics, aerospace, and industrial applications. This strategic move expands H.B. Fuller’s high-margin product portfolio, integrating ND Industries’ Vibra-Tite® brand into its existing epoxy, cyanoacrylate, UV-curable, and anaerobic adhesive range. The acquisition strengthens H.B. Fuller’s global presence, adding five U.S. locations and 300 employees to its Engineering Adhesives business unit

- In November 2023, MasterSil 711Med successfully passed ISO 10993-5 testing, confirming its non-cytotoxicity standards for medical device manufacturing. This one-part RTV silicone requires no mixing, offering flowable application for bonding, sealing, coating, and form-in-place gasketing. Engineered for high durability, it withstands sterilization methods such as gamma radiation, EtO, and liquid sterilants. The compound provides electrical insulation, thermal resistance up to 400°F, and superior flexibility, ensuring long-term reliability in medical environments

- In June 2023, Dymax introduced HLC-M-1000, the first medical adhesive in its Hybrid Light-Curable (HLC) series. This innovative formulation combines Dymax’s light-curable technology with rapid moisture cure from anionics, enabling instant bonding in dark areas and enhanced adhesion to opaque substrates. Designed for medical device assembly, HLC-M-1000 meets biocompatibility standards and is optimized for catheters, tube sets, autoinjectors, and endoscopes. The adhesive cures under broad-spectrum light and low-intensity exposure, ensuring efficient application

- In November 2022, Henkel introduced Loctite Ablestik ICP 2120, an electrically conductive adhesive (ECA) designed to enhance electrical grounding performance in compact camera modules (CCMs). This room-temperature moisture cure formulation protects heat-sensitive substrates, ensuring high reliability and yield rates in mobile device manufacturing. Loctite Ablestik ICP 2120 offers low direct contact resistance (DCR) and high thermal conductivity (7.0 W/m-K), optimizing electrostatic discharge removal and heat dissipation. Its low modulus improves drop performance, making it ideal for miniaturized electronics

- In February 2022, Arkema finalized the acquisition of Ashland’s Performance Adhesives business, reinforcing its Adhesive Solutions segment and advancing its strategy to become a pure Specialty Materials player by 2024. This acquisition, valued at USD 1.65 billion, integrates Ashland’s pressure-sensitive, structural, and flexible packaging adhesives into Arkema’s portfolio. The deal enhances Bostik’s capabilities, expanding its presence in high-performance industrial adhesives. With six production plants and 330 employees, Ashland’s expertise complements Arkema’s global adhesive market leadership

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Moisture Curing Adhesives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Moisture Curing Adhesives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Moisture Curing Adhesives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.