Global Molded Pulp Packaging Market

Market Size in USD Billion

CAGR :

%

USD

5.09 Billion

USD

7.67 Billion

2024

2032

USD

5.09 Billion

USD

7.67 Billion

2024

2032

| 2025 –2032 | |

| USD 5.09 Billion | |

| USD 7.67 Billion | |

|

|

|

|

What is the Global Molded Pulp Packaging Market Size and Growth Rate?

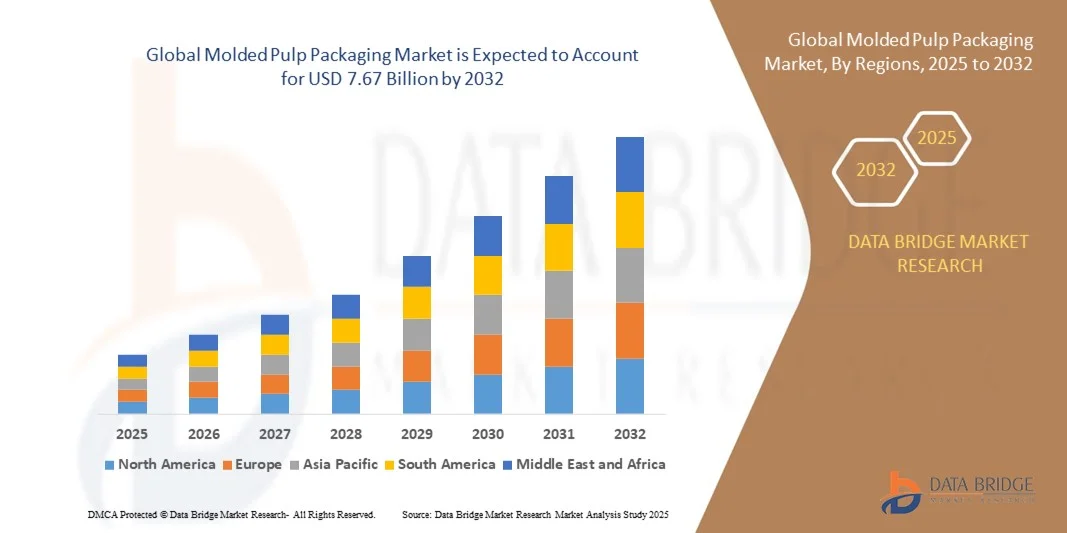

- The global molded pulp packaging market size was valued at USD 5.09 billion in 2024 and is expected to reach USD 7.67 billion by 2032, at a CAGR of 5.25% during the forecast period

- Major factors that are expected to boost the growth of the moulded pulp packaging market in the forecast period are the sustainability of the moulded pulp and the change in the consumer inclination towards the recyclable and eco-friendly materials. Also, increase in the disposable income is further anticipated to propel the growth of the moulded pulp packaging market

What are the Major Takeaways of Molded Pulp Packaging Market?

- The robust demand for reusable and sustainable packaging from end users which is estimated to further cushion the growth of the moulded pulp packaging market. On the other hand, the strict government rules and guidelines are further projected to impede the growth of the moulded pulp packaging market in the timeline period

- In addition, the advancing countries and the and the investment in research and development activities will further provide potential opportunities for the growth of the moulded pulp packaging market in the coming years. However, the variations in the costs of raw materials might further challenge the growth of the moulded pulp packaging market in the near future

- Asia-Pacific dominated the molded pulp packaging market with the largest revenue share of 34.46% in 2024, driven by rapid urbanization, growing e-commerce, and increasing demand for sustainable and biodegradable packaging solutions

- The North America molded pulp packaging market is poised to grow at the fastest CAGR of 9.47% during 2025 to 2032, driven by rising awareness of sustainability, e-commerce packaging demands, and strong regulatory support for biodegradable materials

- The thick wall segment dominated the market with the largest revenue share of 41.5% in 2024, driven by its superior strength and impact resistance, making it ideal for heavy-duty applications such as electronics and fragile goods

Report Scope and Molded Pulp Packaging Market Segmentation

|

Attributes |

Molded Pulp Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Molded Pulp Packaging Market?

Growing Focus on Sustainable and Eco-Friendly Materials

- A significant trend in the global molded pulp packaging market is the increasing adoption of sustainable, biodegradable, and recyclable packaging solutions, driven by consumer demand and stringent environmental regulations. Companies are replacing conventional plastic-based packaging with molded pulp alternatives that reduce environmental impact while maintaining product protection

- For instance, Huhtamaki and Brødrene Hartmann have developed molded pulp packaging solutions for food and consumer goods that are fully recyclable and compostable, addressing both regulatory pressures and consumer expectations

- Molded pulp packaging innovations are also focusing on lightweight designs, improved durability, and moisture resistance, enabling wider applicability across industries such as food and beverage, electronics, and e-commerce

- The trend toward automation in production processes, including precision molding and 3D forming, allows manufacturers to scale production while minimizing waste and energy consumption

- Companies such as UFP Technologies and Eco-Products, Inc. are investing in R&D to create next-generation molded pulp packaging with enhanced functional properties and tailored designs

- This shift toward eco-conscious, high-performance, and customizable molded pulp solutions is shaping market growth and setting new standards for sustainable packaging worldwide

What are the Key Drivers of Molded Pulp Packaging Market?

- Increasing environmental awareness and government regulations targeting plastic reduction are major drivers for the growth of molded pulp packaging. Companies and consumers asuch as are shifting toward biodegradable and recyclable alternatives

- For instance, in 2023, Brødrene Hartmann A/S expanded its food packaging line with fully compostable molded pulp trays, responding to rising eco-friendly product demand

- Growing e-commerce and food delivery sectors are creating a need for protective, lightweight, and sustainable packaging that ensures product safety during transit, boosting molded pulp adoption

- The cost-effectiveness of molded pulp, coupled with its recyclability and compatibility with automated production lines, drives wider industry adoption across multiple sectors including electronics, FMCG, and agriculture

- Consumer preference for brands demonstrating environmental responsibility is influencing purchase decisions, prompting companies to invest in molded pulp solutions that enhance brand image and comply with sustainability mandates

Which Factor is Challenging the Growth of the Molded Pulp Packaging Market?

- Limitations in mechanical strength and water resistance of molded pulp packaging remain a key challenge, particularly for heavy or moisture-sensitive products

- For instance, some food and beverage manufacturers are hesitant to switch fully from plastic due to concerns over durability and shelf-life preservation

- High initial investment costs for modern molding equipment and production line automation can be a barrier for small and medium-sized packaging producers

- Fluctuations in raw material availability and quality, such as recycled paper pulp, can impact production consistency and scalability

- Addressing these challenges requires technological innovation to improve product strength, moisture resistance, and manufacturing efficiency, as well as collaborations between packaging suppliers and end-users to optimize solutions for specific applications

- Overcoming these constraints will be critical to achieving broader adoption and sustaining the growth of the molded pulp packaging market globally

How is the Molded Pulp Packaging Market Segmented?

The moulded pulp packaging market is segmented on the basis of moulded type, source, product type and end use.

- By Molded Type

On the basis of molded type, the Molded Pulp Packaging market is segmented into thick wall, transfer, thermoformed, and processed. The thick wall segment dominated the market with the largest revenue share of 41.5% in 2024, driven by its superior strength and impact resistance, making it ideal for heavy-duty applications such as electronics and fragile goods. Thick wall molded pulp solutions are preferred for their robustness, protective cushioning, and ability to replace traditional plastic and foam packaging, especially in e-commerce and industrial logistics.

The thermoformed segment is anticipated to witness the fastest growth at a CAGR of 22% from 2025 to 2032, fueled by its lightweight design, high production efficiency, and growing adoption in foodservice and retail packaging. Thermoformed molded pulp solutions offer customization in shape and size, enabling manufacturers to meet diverse packaging requirements while reducing material consumption and environmental impact.

- By Source

On the basis of source, the Molded Pulp Packaging market is segmented into wood pulp and non-wood pulp. The wood pulp segment dominated the market with a revenue share of 68% in 2024, driven by its natural abundance, excellent molding properties, and biodegradability. Wood pulp-based molded packaging is widely adopted in foodservice, electronics, and industrial packaging due to its strength, eco-friendliness, and recyclability.

The non-wood pulp segment is expected to witness the fastest CAGR of 19.5% from 2025 to 2032, supported by innovations in alternative fibers such as bagasse, bamboo, and agricultural residues. Non-wood pulp sources are gaining traction as sustainable alternatives, helping manufacturers meet stringent environmental regulations and respond to increasing consumer demand for green packaging solutions.

- By Product Type

On the basis of product type, the Molded Pulp Packaging market is segmented into trays, cups, clamshells, plates, bowls, and others. The trays segment dominated the market with a revenue share of 35% in 2024, attributed to their extensive use in foodservice, ready-to-eat meals, and industrial packaging. Trays offer excellent protection, stackability, and ease of handling, making them a preferred choice for both consumers and manufacturers.

The cups segment is anticipated to witness the fastest CAGR of 21% from 2025 to 2032, driven by the rising demand for sustainable disposable beverage packaging in cafes, fast-food outlets, and retail. Molded pulp cups provide durability, heat insulation, and compostability, aligning with the growing trend of eco-friendly foodservice solutions globally.

- By End Use

On the basis of end use, the Molded Pulp Packaging market is segmented into foodservice disposables, food packaging, healthcare, electronics, and others. The foodservice disposables segment dominated the market with a revenue share of 42% in 2024, fueled by the increasing adoption of eco-friendly packaging in restaurants, cafes, and catering services. Molded pulp foodservice products, including trays, plates, cups, and bowls, offer biodegradable and compostable solutions that meet regulatory requirements and sustainability goals.

The food packaging segment is expected to witness the fastest CAGR of 20.5% from 2025 to 2032, driven by the growing demand for ready-to-eat meals, e-commerce food delivery, and protective packaging for fresh produce. Molded pulp packaging in this segment ensures product safety, shelf-life extension, and consumer convenience while supporting environmental sustainability initiatives.

Which Region Holds the Largest Share of the Molded Pulp Packaging Market?

- Asia-Pacific dominated the molded pulp packaging market with the largest revenue share of 34.46% in 2024, driven by rapid urbanization, growing e-commerce, and increasing demand for sustainable and biodegradable packaging solutions

- Consumers and businesses in the region are prioritizing eco-friendly alternatives, and molded pulp packagings are widely adopted in foodservice, electronics, and industrial sectors

- This widespread adoption is further supported by supportive government regulations, rising disposable incomes, and the growing emphasis on circular economy practices, establishing molded pulp packagings as a preferred choice for sustainable packaging across multiple industries

China Molded Pulp Packaging Market Insight

The China molded pulp packaging market captured the largest revenue share of 42% in 2024 within APAC, driven by the country’s expanding middle class, booming e-commerce, and heightened awareness of environmental sustainability. The adoption of molded pulp solutions is rising across foodservice disposables, electronics, and industrial packaging. Government initiatives promoting eco-friendly materials and smart city development are further bolstering growth in the country.

Japan Molded Pulp Packaging Market Insight

The Japan molded pulp packaging market is expanding steadily due to strong consumer demand for sustainable packaging and a well-developed manufacturing ecosystem. The focus on reducing plastic waste in foodservice, retail, and electronics industries is driving the adoption of molded pulp solutions. Japan’s technological expertise allows for innovative designs that improve packaging durability and reduce environmental impact, creating opportunities across both residential and commercial sectors.

Europe Molded Pulp Packaging Market Insight

The Europe molded pulp packaging market is projected to grow at a notable CAGR during the forecast period, fueled by stringent environmental regulations and growing demand for recyclable and compostable packaging. Urbanization and e-commerce expansion are driving adoption across foodservice and industrial sectors, while energy-efficient and sustainable manufacturing practices appeal to environmentally conscious consumers.

U.K. Molded Pulp Packaging Market Insight

The U.K. molded pulp packaging market is expected to expand at a considerable CAGR, driven by regulatory policies favoring biodegradable packaging and the growing trend of eco-friendly consumer products. Retailers and foodservice operators are increasingly incorporating molded pulp solutions to meet sustainability targets and respond to consumer preferences.

Germany Molded Pulp Packaging Market Insight

The Germany molded pulp packaging market is witnessing steady growth due to strong environmental policies, industrial sustainability initiatives, and consumer demand for eco-friendly alternatives. Adoption is increasing in foodservice, electronics, and industrial packaging applications, while innovations in molded pulp manufacturing improve product strength and functionality.

Which Region is the Fastest Growing Region in the Molded Pulp Packaging Market?

The North America molded pulp packaging market is poised to grow at the fastest CAGR of 9.47% during 2025 to 2032, driven by rising awareness of sustainability, e-commerce packaging demands, and strong regulatory support for biodegradable materials. The growth is supported by the increasing adoption of molded pulp solutions in foodservice, electronics, and industrial sectors, as well as rising consumer demand for environmentally responsible products.

U.S. Molded Pulp Packaging Market Insight

The U.S. molded pulp packaging market accounted for the largest revenue share in North America in 2024, driven by adoption of eco-friendly foodservice disposables, industrial packaging, and electronics packaging. Rising consumer awareness of environmental sustainability, coupled with corporate sustainability initiatives, is accelerating the use of molded pulp packaging solutions across various industries.

Canada Molded Pulp Packaging Market Insight

The Canada molded pulp packaging market is expanding due to increasing e-commerce activity and government policies promoting sustainable packaging. Adoption is rising in foodservice and industrial applications, while innovative molded pulp solutions are being implemented to enhance product protection, durability, and environmental compliance.

Which are the Top Companies in Molded Pulp Packaging Market?

The molded pulp packaging industry is primarily led by well-established companies, including:

- Brødrene Hartmann A/S (Denmark)

- Huhtamaki Oyj (Finland)

- UFP Technologies, Inc. (U.S.)

- Thermoform Engineered Quality LLC (U.S.)

- Eco-Products, Inc. (U.S.)

- Pro-Pac Packaging Limited (Australia)

- AmerCareRoyal (U.S.)

- Fabri-Kal (U.S.)

- Henry Molded Products Inc. (U.S.)

- EnviroPAK (U.S.)

- Pacific Pulp Molding, Inc. (U.S.)

- Cascades Inc. (Canada)

- Sabert Corporation (U.S.)

- ProtoPak Engineering Corporation (U.S.)

- CELLULOSES DE LA LOIRE (France)

- Atlantic Pulp (Canada)

- Sealed Air (U.S.)

- TRIDAS (U.S.)

- KEIDING INC. (U.S.)

- Unified Packaging Solutions Pvt. Ltd. (India)

- FiberCel (U.S.)

- Sustainable Packaging Industries (U.S.)

- Berkley (U.S.)

What are the Recent Developments in Global Molded Pulp Packaging Market?

- In June 2025, Smurfit Kappa and WestRock completed a USD 34 billion merger, forming the combined entity Smurfit WestRock, marking a major consolidation in the molded pulp packaging industry and strengthening their global market presence

- In May 2025, Metsä Group and Amcor partnered to jointly develop molded fiber food packaging, aiming to provide sustainable and innovative packaging solutions, further advancing eco-friendly practices in the packaging sector

- In June 2023, ANTAIRA TECHNOLOGIES, LLC announced its transition to fully molded pulp packaging for its network devices across North America, aligning with industry trends towards sustainable packaging and reinforcing its commitment to environmental responsibility

- In March 2023, Eco-Products, Inc.'s Vanguard clamshell became the first molded fiber product with no added PFAS to receive approval from the Compost Manufacturing Alliance, representing a significant step in safe, compostable packaging solutions

- In February 2023, Huhtamaki Oyj announced the acquisition of a joint venture foodservice distribution business in Australia, enabling the company to provide packaging solutions to a broad network of regional and metropolitan wholesalers, restaurants, and foodservice providers, thereby expanding its regional footprint

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Molded Pulp Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Molded Pulp Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Molded Pulp Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.