Global Molecular Blood Typing Grouping And Infectious Disease Nat Market

Market Size in USD Billion

CAGR :

%

USD

1.07 Billion

USD

1.99 Billion

2025

2033

USD

1.07 Billion

USD

1.99 Billion

2025

2033

| 2026 –2033 | |

| USD 1.07 Billion | |

| USD 1.99 Billion | |

|

|

|

|

Molecular Blood Typing, Grouping and Infectious Disease NAT Market Size

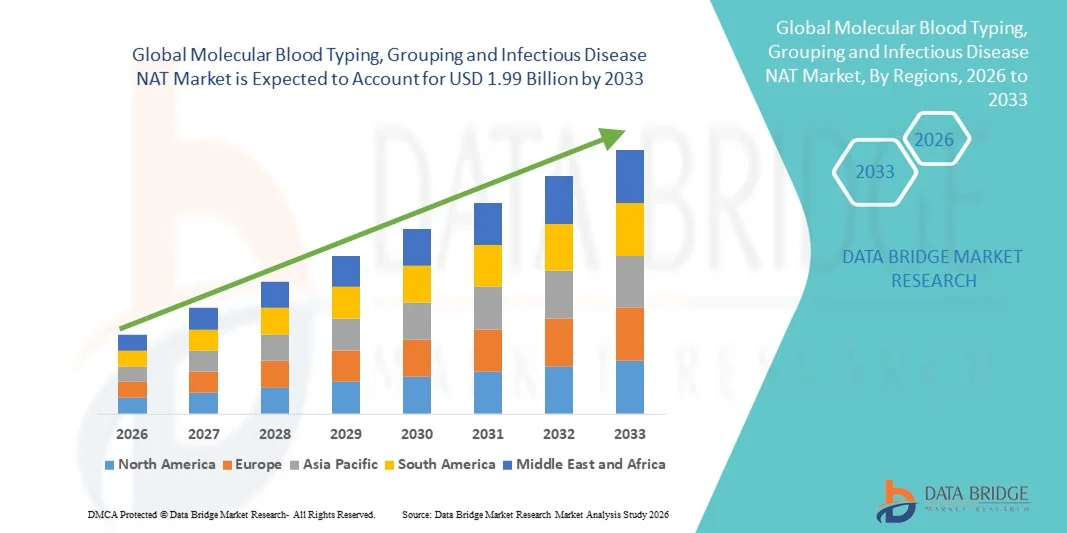

- The global molecular blood typing, grouping and infectious disease NAT market size was valued at USD 1.07 billion in 2025 and is expected to reach USD 1.99 billion by 2033, at a CAGR of 8.11% during the forecast period

- The market growth is largely driven by the increasing adoption of molecular diagnostic technologies in transfusion medicine, along with advancements in nucleic acid testing (NAT) that enable highly sensitive and accurate detection of blood group antigens and transfusion-transmissible infections

- Furthermore, rising demand for safer blood transfusions, stringent regulatory requirements for blood screening, and the growing emphasis on early and reliable detection of infectious diseases are positioning molecular blood typing and NAT solutions as essential components of modern blood banks and diagnostic laboratories. These converging factors are accelerating the uptake of advanced molecular testing systems, thereby significantly boosting the industry’s growth

Molecular Blood Typing, Grouping and Infectious Disease NAT Market Analysis

- Molecular blood typing, grouping and infectious disease NAT solutions, enabling highly sensitive genetic-level identification of blood groups and transfusion-transmissible pathogens, are increasingly vital components of modern transfusion medicine and diagnostic workflows across blood banks, hospitals, and laboratories due to their superior accuracy, early detection capability, and enhanced blood safety

- The escalating demand for molecular blood typing and NAT is primarily fueled by growing concerns over transfusion safety, rising prevalence of infectious diseases, and the shift from conventional serological methods toward advanced molecular diagnostics that minimize false results and transfusion-related risks

- North America dominated the molecular blood typing, grouping and infectious disease NAT market with the largest revenue share of 39.2% in 2025, supported by stringent blood screening regulations, advanced healthcare infrastructure, and high adoption of molecular diagnostic technologies, with the U.S. witnessing strong utilization across blood banks and hospital-based laboratories

- Asia-Pacific is expected to be the fastest growing region in the market during the forecast period due to expanding healthcare infrastructure, increasing blood transfusion volumes, rising awareness regarding blood safety, and improving access to molecular testing technologies in emerging economies

- Antigen Typing segment dominated the market with a share of 34.7% in 2025, driven by its critical role in precise blood group determination, compatibility assessment, and routine pre-transfusion testing across blood banks and hospital settings

Report Scope and Molecular Blood Typing, Grouping and Infectious Disease NAT Market Segmentation

|

Attributes |

Molecular Blood Typing, Grouping and Infectious Disease NAT Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Molecular Blood Typing, Grouping and Infectious Disease NAT Market Trends

Adoption of Automated and AI-Enabled Screening Systems

- A significant and accelerating trend in the global molecular blood typing, grouping and infectious disease NAT market is the integration of automation and artificial intelligence (AI) in testing platforms, enhancing throughput, accuracy, and reliability of results

- For instance, the Beckman Coulter DxH 900 integrates AI algorithms to flag unusual blood group patterns and optimize sample handling, reducing human error and increasing lab efficiency

- AI-enabled systems can learn from historical data to predict rare blood group occurrences, provide real-time alerts for abnormal results, and optimize reagent usage, improving overall laboratory workflow

- Automated NAT and typing platforms reduce manual intervention, allowing blood banks and diagnostic labs to process higher volumes with consistent quality while minimizing operator-related errors

- This trend is driving equipment manufacturers, such as Grifols and Immucor, to develop intelligent, automated solutions capable of combining multiple molecular assays and blood typing tests in a single workflow

- The demand for AI-integrated and automated blood typing and infectious disease screening solutions is rising rapidly across hospitals, blood banks, and diagnostic laboratories, as stakeholders seek higher accuracy, efficiency, and safety

- Portable and point-of-care NAT devices are emerging, allowing smaller clinics and remote blood donation centers to perform rapid, on-site molecular testing without relying on centralized laboratories

Molecular Blood Typing, Grouping and Infectious Disease NAT Market Dynamics

Driver

Increasing Focus on Blood Safety and Early Detection of Infections

- The growing emphasis on ensuring safe transfusions and early detection of transfusion-transmissible infections is a significant driver for the adoption of molecular blood typing and NAT solutions

- For instance, in March 2025, Roche Diagnostics launched an upgraded NAT platform to enable simultaneous detection of multiple infectious agents in donated blood, enhancing safety and compliance

- Molecular diagnostics offer higher sensitivity and specificity than conventional serological testing, reducing the risk of transfusion reactions and missed infections

- Rising awareness among healthcare providers and regulatory mandates for rigorous blood screening protocols are making molecular blood typing and NAT essential in hospitals and blood banks

- The ability to detect rare blood groups and pathogens quickly, combined with integration into laboratory information systems (LIS), is propelling the uptake of these advanced platforms in both established and emerging markets

- Collaborations between molecular diagnostic companies and blood banks are increasing, enabling faster deployment of new testing technologies and protocols

- Growing adoption of high-throughput NAT platforms is supporting large-scale blood donation drives and emergency preparedness, particularly in countries with high transfusion demands

Restraint/Challenge

High Costs and Infrastructure Requirements

- The high cost of molecular blood typing and NAT instruments, along with the need for specialized infrastructure and trained personnel, poses a significant challenge to market expansion

- For instance, smaller blood banks and diagnostic labs in developing countries may hesitate to adopt advanced NAT platforms due to budget constraints and limited technical expertise

- These solutions also require regular maintenance, calibration, and quality control, increasing operational expenditure and complexity for laboratories

- In addition, regulatory compliance for molecular testing, including validation, accreditation, and adherence to biosafety standards, can be cumbersome and time-consuming for new adopters

- The perceived premium of molecular testing compared to conventional serology may slow adoption in regions with cost-sensitive healthcare systems

- Overcoming these barriers through affordable modular systems, training programs, and simplified automation will be critical to expand market penetration and ensure wider adoption

- Limited availability of skilled personnel to operate sophisticated molecular platforms can delay implementation in smaller or remote labs

- Dependence on continuous supply of high-quality reagents and consumables creates vulnerability to supply chain disruptions, impacting uninterrupted testing and market growth

Molecular Blood Typing, Grouping and Infectious Disease NAT Market Scope

The market is segmented on the basis of nature of tests and applications.

- By Nature of Tests

On the basis of nature of tests, the market is segmented into ABO, antibody screening/indirect antiglobulin, antibody panels, antigen typing, antiglobulin, RH, and crossmatching. The Antigen Typing segment dominated the market with the largest revenue share of 34.7% in 2025, driven by its critical role in accurate blood group determination and ensuring compatibility during transfusions. Blood banks and hospitals prioritize antigen typing because it reduces the risk of transfusion reactions and enhances patient safety, especially for individuals with rare blood types. The segment benefits from the growing adoption of automated and AI-enabled testing platforms that provide precise results at higher throughput. In addition, antigen typing is increasingly integrated into multiplex molecular systems, allowing simultaneous testing of multiple antigens, which improves workflow efficiency and minimizes sample handling errors. The reliability, regulatory acceptance, and clinical significance of antigen typing continue to make it the cornerstone of molecular blood typing and NAT procedures in modern laboratories.

The ABO segment is expected to witness the fastest growth rate of 20% CAGR from 2026 to 2033, fueled by expanding blood transfusion programs in emerging economies and increasing awareness of blood safety. ABO testing forms the foundation of blood group compatibility screening and is being rapidly integrated into automated NAT systems to enhance accuracy and reduce turnaround time. The growth is also driven by the rising number of hospital-based transfusion services and diagnostic laboratories implementing high-throughput ABO molecular assays. Moreover, technological advances allowing simultaneous detection of ABO along with other antigens or infectious agents are increasing adoption rates. Expanding government and NGO initiatives to improve transfusion safety in regions such as Asia-Pacific and Latin America further contribute to the rapid uptake of ABO molecular testing platforms.

- By Applications

On the basis of applications, the market is segmented into hospitals, diagnostic labs, research labs, and blood banks. The Blood Banks segment dominated the market with the largest share of 41% in 2025, as they are at the forefront of mandatory screening for infectious diseases and blood compatibility testing. Blood banks require high-throughput, reliable molecular testing platforms to screen donated blood efficiently and safely, ensuring compliance with strict regulatory mandates. Antigen typing, NAT for infectious diseases, and crossmatching are essential components of their routine workflow, making blood banks the largest end-users of molecular blood typing and NAT systems. The dominance is further supported by investments in modern laboratory infrastructure, automation, and digital monitoring systems to enhance operational efficiency. Blood banks also benefit from centralized testing systems that allow rapid distribution of safe blood units to multiple hospitals and healthcare centers.

The Hospitals segment is expected to witness the fastest CAGR of 21% from 2026 to 2033, driven by the increasing implementation of molecular testing within transfusion medicine and emergency care departments. Hospitals are adopting on-site molecular blood typing and NAT platforms to reduce dependence on external blood centers, shorten turnaround times, and improve patient outcomes. The growth is further supported by rising patient volumes, growing awareness of transfusion-related risks, and regulatory encouragement for advanced pre-transfusion testing. Hospitals are increasingly integrating these platforms into laboratory information systems (LIS) and electronic health records (EHR) for seamless workflow management. The expanding availability of modular, user-friendly NAT systems also allows smaller hospitals to adopt molecular testing with minimal technical expertise.

Molecular Blood Typing, Grouping and Infectious Disease NAT Market Regional Analysis

- North America dominated the molecular blood typing, grouping and infectious disease NAT market with the largest revenue share of 39.2% in 2025, supported by stringent blood screening regulations, advanced healthcare infrastructure, and high adoption of molecular diagnostic technologies, with the U.S. witnessing strong utilization across blood banks and hospital-based laboratories

- Hospitals, blood banks, and diagnostic laboratories in the region prioritize safety, accuracy, and efficiency in transfusion medicine, leading to widespread use of NAT and molecular blood typing platforms for routine and emergency testing

- This dominance is further supported by strong healthcare investments, a technologically adept workforce, and early adoption of automated and AI-enabled molecular testing systems, making North America a key market for both commercial and hospital-based end-users

U.S. Molecular Blood Typing, Grouping and Infectious Disease NAT Market Insight

The U.S. molecular blood typing, grouping and infectious disease NAT market captured the largest revenue share of 82% in 2025 within North America, fueled by the widespread adoption of advanced blood screening technologies and stringent regulatory requirements. Hospitals and blood banks prioritize accurate, rapid, and safe testing, leading to strong uptake of NAT and molecular blood typing platforms. The growing focus on transfusion safety, early detection of infectious diseases, and integration of automated and AI-enabled testing systems further propels market growth. In addition, the presence of key market players, well-established healthcare infrastructure, and high healthcare expenditure support the expansion of molecular diagnostic services across the country.

Europe Molecular Blood Typing, Grouping and Infectious Disease NAT Market Insight

The Europe molecular blood typing, grouping and infectious disease NAT market is projected to expand at a substantial CAGR throughout the forecast period, driven by strict regulatory mandates for blood screening and the rising need for safe transfusion practices. Increased awareness regarding transfusion-transmissible infections and the adoption of advanced molecular diagnostic platforms are fostering market growth. European hospitals and blood banks are increasingly investing in automated NAT and blood typing systems to improve workflow efficiency and ensure compliance. The growth is further supported by increasing healthcare infrastructure development and the integration of molecular testing into routine diagnostic services.

U.K. Molecular Blood Typing, Grouping and Infectious Disease NAT Market Insight

The U.K. molecular blood typing, grouping and infectious disease NAT market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the heightened focus on patient safety, early detection of infections, and adoption of modern diagnostic technologies. Blood banks and hospital laboratories are expanding the use of NAT and molecular blood typing platforms to enhance transfusion safety and operational efficiency. In addition, the U.K.’s strong healthcare infrastructure, government support for advanced diagnostics, and growing awareness of blood safety are expected to continue stimulating market growth.

Germany Molecular Blood Typing, Grouping and Infectious Disease NAT Market Insight

The Germany molecular blood typing, grouping and infectious disease NAT market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of transfusion safety and demand for technologically advanced molecular diagnostic solutions. Germany’s well-established healthcare infrastructure, emphasis on innovation, and focus on high-quality patient care promote the adoption of NAT and molecular blood typing systems. Hospitals and blood banks are integrating automated and AI-enabled platforms to improve workflow efficiency, reduce errors, and ensure compliance with stringent regulatory standards.

Asia-Pacific Molecular Blood Typing, Grouping and Infectious Disease NAT Market Insight

The Asia-Pacific molecular blood typing, grouping and infectious disease NAT market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by expanding healthcare infrastructure, increasing blood transfusion volumes, and rising awareness regarding transfusion safety in countries such as China, Japan, and India. Government initiatives to improve blood safety and adoption of modern diagnostic technologies are driving market growth. The growing number of hospitals, diagnostic labs, and blood banks in the region is further supporting the adoption of molecular testing platforms.

Japan Molecular Blood Typing, Grouping and Infectious Disease NAT Market Insight

The Japan molecular blood typing, grouping and infectious disease NAT market is gaining momentum due to the country’s high-tech healthcare environment, strong regulatory focus on transfusion safety, and the increasing number of hospitals and blood banks adopting advanced NAT and molecular blood typing platforms. The demand for rapid, accurate, and automated testing solutions is rising, particularly for emergency transfusions and rare blood type detection. In addition, integration of molecular diagnostics with hospital information systems is enhancing laboratory workflow and patient safety.

India Molecular Blood Typing, Grouping and Infectious Disease NAT Market Insight

The India molecular blood typing, grouping and infectious disease NAT market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid healthcare infrastructure expansion, growing blood donation programs, and increased awareness of transfusion safety. Hospitals and blood banks are investing in automated and AI-enabled NAT and molecular typing systems to enhance testing accuracy and efficiency. Government initiatives promoting safe blood transfusion practices and the availability of cost-effective molecular platforms are key factors propelling market growth in India.

Molecular Blood Typing, Grouping and Infectious Disease NAT Market Share

The Molecular Blood Typing, Grouping and Infectious Disease NAT industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Abbott (U.S.)

- Bio Rad Laboratories, Inc. (U.S.)

- DiaSorin S.p.A. (Italy)

- Hologic, Inc. (U.S.)

- Quotient Limited (Switzerland)

- BAG Diagnostics GmbH (Germany)

- Fujirebio Holdings, Inc. (Japan)

- Mylab Discovery Solutions Pvt. Ltd. (India)

- Siemens Healthineers AG (Germany)

- Beckman Coulter, Inc. (U.S.)

- Ortho Clinical Diagnostics (U.S.)

- Immucor, Inc. (U.S.)

- BioView Ltd. (Israel)

- Tecan Group Ltd. (Switzerland)

- Quidel Corporation (U.S.)

- BGI Genomics (China)

- Biocept, Inc. (U.S.)

- Nanostring Technologies, Inc. (U.S.)

- Promega Corporation (U.S.)

What are the Recent Developments in Global Molecular Blood Typing, Grouping and Infectious Disease NAT Market?

- In December 2025, Surat Raktdan Kendra and Research Centre (SRKRC) in India upgraded its NAT testing system to a fully automated platform, significantly boosting blood safety by detecting infections (HIV, HBV, HCV) that conventional ELISA tests missed and preventing contaminated blood from reaching patients

- In November 2025, AIIMS Nagpur inaugurated Central India’s first government‑run Individual Donor Nucleic Acid Testing (ID‑NAT) laboratory, enhancing molecular screening of HIV, Hepatitis B, and Hepatitis C at the molecular level and strengthening regional blood safety infrastructure

- In July 2025, the Orissa High Court directed the state government to detail the rollout of NAT‑PCR testing across all government blood collection centres to enhance blood safety by implementing advanced molecular tests, highlighting legal and public pressure to expand NAT implementation beyond limited centres

- In July 2025, the U.S. FDA approved the cobas® HIV‑1/HIV‑2 qualitative nucleic acid test for use on Roche’s automated platforms (5800/6800/8800 systems), representing an important regulatory milestone for molecular diagnostics by enabling high‑performance NAT to detect and differentiate HIV‑1 and HIV‑2 RNA in serum/plasma

- In May 2025, India announced plans to mandate nucleic acid testing (NAT) for all imported blood products to reduce infection risk from transfusions, reflecting regulatory efforts to expand NAT use for safer blood screening

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.