Global Molecular Point Of Care Testing Using Naat Market

Market Size in USD Billion

CAGR :

%

USD

37.93 Billion

USD

86.17 Billion

2024

2032

USD

37.93 Billion

USD

86.17 Billion

2024

2032

| 2025 –2032 | |

| USD 37.93 Billion | |

| USD 86.17 Billion | |

|

|

|

|

Molecular Point of Care Testing (using NAAT) Market Size

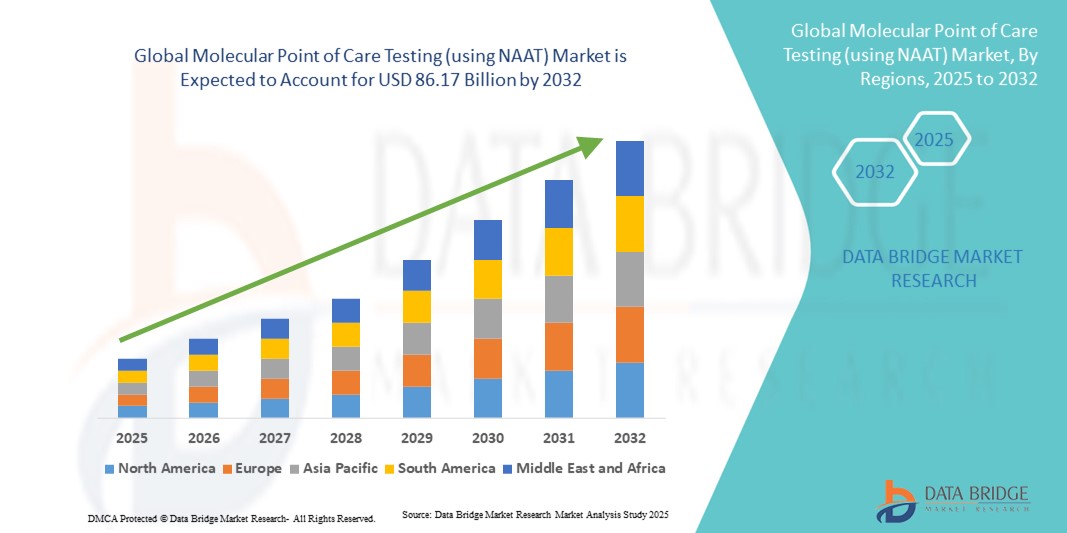

- The global molecular point of care testing (using NAAT) market size was valued at USD 37.93 billion in 2024 and is expected to reach USD 86.17 billion by 2032, at a CAGR of 1.08% during the forecast period

- This market growth is primarily driven by the increasing prevalence of infectious diseases, the demand for rapid and accurate diagnostic testing, and advancements in molecular diagnostic technologies

- In addition, the shift towards decentralized healthcare and the growing adoption of multiplex tests are contributing to the expansion of the molecular POCT market. These factors collectively position molecular point-of-care testing as a pivotal component in modern diagnostics, offering timely and precise detection of various health conditions

Molecular Point of Care Testing (using NAAT) Market Analysis

- Molecular point-of-care testing (POCT) using nucleic acid amplification testing (NAAT) provides rapid and accurate detection of infectious diseases and other medical conditions at or near the patient site, making it a crucial component of modern healthcare diagnostics in hospitals, clinics, and decentralized healthcare settings

- The growing adoption of molecular POCT is primarily driven by increasing prevalence of infectious diseases, rising demand for timely and precise diagnostics, and technological advancements in portable and user-friendly molecular testing devices

- North America dominated the molecular POCT market with the largest revenue share of 39% in 2024, supported by early adoption of advanced diagnostic technologies, high healthcare expenditure, and a strong presence of key industry players, with the U.S. witnessing substantial growth due to integration of NAAT-based tests in hospitals, clinics, and emergency care settings

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by rising healthcare infrastructure investments, increasing awareness of rapid diagnostic solutions, and growing demand for point-of-care testing in emerging economies

- Respiratory infection testing segment dominated the molecular POCT market with a market share of 43.2% in 2024, owing to the high prevalence of infectious respiratory diseases and the clinical need for rapid and accurate diagnosis to guide timely treatment and containment measures

Report Scope and Molecular Point of Care Testing (using NAAT) Market Segmentation

|

Attributes |

Molecular Point of Care Testing (using NAAT) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Molecular Point of Care Testing (using NAAT) Market Trends

Advancements in Rapid, Multiplexed, and AI-Enabled Testing

- A significant and accelerating trend in the global molecular POCT market is the development of rapid, multiplexed NAAT devices and AI-enabled diagnostic platforms, which are enhancing the speed, accuracy, and usability of point-of-care testing across hospitals, clinics, and decentralized healthcare settings

- For instance, the Xpert Xpress SARS-CoV-2/Flu/RSV test integrates multiple pathogen detection in a single run, reducing turnaround time and streamlining workflow at patient sites

- AI integration in molecular POCT enables features such as automated interpretation of test results, predictive analytics for disease outbreaks, and intelligent quality control, improving diagnostic confidence and reducing human error

- These AI-driven platforms allow healthcare providers to manage multiple diagnostic parameters simultaneously, delivering faster results for critical conditions while reducing reliance on centralized laboratories

- This trend towards more rapid, accurate, and interconnected testing solutions is reshaping expectations for point-of-care diagnostics. Consequently, companies such as Abbott and Roche are developing AI-enabled NAAT devices with multiplex capabilities and user-friendly interfaces for clinical staff

- The demand for molecular POCT devices offering multiplex detection and AI-driven functionalities is growing rapidly across both hospital and outpatient settings, as healthcare providers increasingly prioritize fast and reliable diagnostics

Molecular Point of Care Testing (using NAAT) Market Dynamics

Driver

Rising Demand Due to Infectious Disease Burden and Decentralized Testing

- The increasing prevalence of infectious diseases globally, coupled with the shift toward decentralized healthcare delivery, is a significant driver for the heightened adoption of molecular POCT using NAAT

- For instance, in 2024, Cepheid launched expanded applications of its GeneXpert platform to include sexually transmitted infections and respiratory panels, reflecting efforts to meet growing diagnostic needs at point-of-care

- As healthcare providers aim for faster diagnosis and timely treatment, NAAT-based POCT offers high sensitivity, specificity, and rapid results, providing a compelling alternative to traditional centralized laboratory testing

- Furthermore, the growing emphasis on outbreak management and emergency preparedness is making molecular POCT an integral component of infectious disease control programs, enabling rapid isolation and treatment decisions

- The convenience of near-patient testing, minimal sample processing requirements, and ability to manage multiple tests simultaneously are key factors propelling the adoption of NAAT-based molecular POCT across hospitals, clinics, and field settings

Restraint/Challenge

Regulatory Hurdles and Operational Limitations

- Regulatory compliance and stringent approval processes for molecular POCT devices pose significant challenges to market expansion, as NAAT-based platforms must meet rigorous standards for accuracy, safety, and reliability before commercialization

- For instance, delays in FDA or CE approval can slow the launch of innovative POCT products, limiting access to advanced diagnostics in time-sensitive scenarios

- Operational limitations such as the requirement for trained personnel, device maintenance, and supply of consumables can restrict adoption in resource-limited settings, despite the technological advantages of NAAT devices

- In addition, the relatively high cost of advanced multiplexed or AI-enabled POCT devices compared to conventional rapid tests can be a barrier for small clinics or low-income regions, limiting widespread deployment

- While costs are gradually decreasing, the perceived premium for sophisticated molecular POCT platforms may hinder adoption in budget-sensitive healthcare settings

- Overcoming these challenges through streamlined regulatory pathways, staff training, and development of cost-effective devices will be vital for sustained market growth

Molecular Point of Care Testing (using NAAT) Market Scope

The market is segmented on the basis of product, indication, end user, mode of testing, and distribution channel.

- By Product

On the basis of product, the molecular POCT market is segmented into instruments and consumables & reagents. The instruments segment dominated the market with the largest revenue share of 55.3% in 2024, driven by the critical role of automated NAAT devices in delivering rapid and accurate results. Healthcare facilities prioritize instrument adoption due to their high throughput, reliability, and integration with laboratory information systems. Investments in modern instruments allow hospitals and laboratories to streamline workflows, improve efficiency, and reduce turnaround times for infectious disease diagnostics. The segment benefits from technological innovations, such as portable and compact instruments suitable for decentralized testing. Instruments are often paired with software platforms to facilitate automated reporting and quality control. Continuous technical support and maintenance services offered by manufacturers further support adoption.

The consumables & reagents segment is expected to witness the fastest CAGR of 12.5% from 2025 to 2032, fueled by the recurring need for cartridges, test kits, and reagents used in NAAT-based POCT. Consumables are essential for daily testing operations across hospitals, clinics, and laboratories, generating continuous revenue for suppliers. Rising awareness about infectious disease testing and increased testing frequency drive demand. Multiplexed assays that require specialized reagents further accelerate growth. Technological innovations enhancing reagent stability and ease-of-use contribute to adoption. The segment also benefits from supply chain improvements that reduce delivery times and costs.

- By Indication

On the basis of indication, the market is segmented into respiratory infections testing, sexually transmitted infection (STI) testing, gastrointestinal tract infections testing, and others. The respiratory infections testing segment dominated the market with a 43.2% share in 2024, owing to high prevalence of pathogens such as SARS-CoV-2, influenza, and RSV. Rapid and accurate detection of respiratory infections is critical in hospitals, clinics, and emergency care units for timely treatment and containment. NAAT-based POCT offers high sensitivity and specificity, making it the preferred method for respiratory infections. Adoption is further driven by government programs for outbreak monitoring and control. Hospitals and laboratories integrate these tests into emergency care workflows for fast decision-making. Continuous innovations in multiplexed panels increase throughput and efficiency.

The STI testing segment is expected to witness the fastest CAGR of 13.1% from 2025 to 2032, driven by growing awareness, screening programs, and rising incidence of sexually transmitted infections. NAAT-based POCT enables rapid, confidential, and accurate detection of STIs, ideal for clinics and home-testing. Multiplexed assays detecting multiple STIs in a single test accelerate adoption. Expansion of self-testing and sexual health initiatives boosts demand. Integration with telemedicine platforms enhances result reporting and counseling. Increasing partnerships between diagnostic companies and healthcare providers further drive market growth.

- By End User

On the basis of end user, the molecular POCT market is segmented into laboratories, hospitals, clinics, ambulatory centers, homecare, assisted living facilities, and others. The hospitals segment dominated the market with the largest revenue share of 48.6% in 2024, owing to high patient volume and the need for rapid diagnostics. Hospitals invest in advanced NAAT devices to improve workflow, manage infectious outbreaks, and support emergency care. Integration with hospital information systems enhances operational efficiency. The segment benefits from continuous technological innovations and government incentives. Hospitals often require instruments that can handle multiple test types. Long-term contracts with suppliers ensure consistent supply of instruments and consumables.

The homecare segment is expected to witness the fastest CAGR of 14.2% from 2025 to 2032, fueled by rising demand for at-home testing solutions, convenience, and privacy. Homecare NAAT kits allow patients to test without visiting clinics or hospitals. Self-testing for respiratory infections and STIs drives adoption. Integration with smartphone apps enables easy result interpretation and telehealth reporting. Awareness campaigns and partnerships with telemedicine providers expand reach. Increasing acceptance of home testing by healthcare authorities supports sustained growth.

- By Mode of Testing

On the basis of mode of testing, the market is segmented into prescription-based testing and over-the-counter (OTC) testing. The prescription-based testing segment dominated the market with a 62.3% share in 2024, driven by regulatory requirements and professional oversight. Prescription-based tests provide accuracy, reliability, and clinical interpretation, especially in hospitals and clinics. Integration with healthcare workflows ensures patient safety and quality assurance. Adoption is strong for high-risk infectious diseases where expert guidance is needed. Devices are often connected to hospital networks for result tracking and reporting. Manufacturers continue to enhance usability while meeting regulatory standards.

The OTC testing segment is expected to witness the fastest CAGR of 13.5% from 2025 to 2032, fueled by growing demand for self-testing for respiratory infections, STIs, and gastrointestinal infections. Easy-to-use kits and smartphone-enabled interpretation improve accessibility. Consumers prefer OTC solutions for convenience, privacy, and reduced clinical visits. Awareness programs and telemedicine integration drive adoption. Retailers and online pharmacies increase availability. The segment benefits from simplified, pre-packaged testing kits designed for home use.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment dominated the market with a 57.4% share in 2024, driven by direct procurement for inpatient and outpatient testing. Hospitals leverage pharmacy channels for consistent supply of NAAT devices, consumables, and reagents. Bulk purchasing agreements reduce costs and ensure timely replenishment. Integration with hospital supply chain systems minimizes stockouts. Hospitals often receive technical support and training via pharmacy contracts. Partnerships with manufacturers strengthen product availability and service.

The online pharmacy segment is expected to witness the fastest CAGR of 15.1% from 2025 to 2032, fueled by convenient ordering, home delivery of NAAT kits, and growing telemedicine adoption. Online platforms enable discreet purchase of both prescription and OTC tests. Digital marketing campaigns expand consumer awareness. Integration with telehealth apps allows seamless reporting of results. Consumers increasingly prefer online access for convenience and privacy. E-commerce growth and logistics improvements support rapid expansion of this distribution channel.

Molecular Point of Care Testing (using NAAT) Market Regional Analysis

- North America dominated the molecular POCT market with the largest revenue share of 39% in 2024, supported by early adoption of advanced diagnostic technologies, high healthcare expenditure, and a strong presence of key industry players, with the U.S. witnessing substantial growth due to integration of NAAT-based tests in hospitals, clinics, and emergency care settings

- Healthcare providers in the region prioritize rapid, accurate, and reliable testing, making NAAT-based POCT devices essential for hospitals, clinics, and emergency care facilities. The U.S., in particular, is witnessing substantial growth due to integration of NAAT devices in hospitals, outpatient clinics, and homecare testing, supported by innovations from both established diagnostic companies and startups

- The widespread adoption is further supported by strong healthcare infrastructure, high healthcare expenditure, and a technologically advanced population

U.S. Molecular Point of Care Testing (using NAAT) Market Insight

The U.S. molecular POCT market captured the largest revenue share of 79% in 2024 within North America, fueled by the rapid adoption of advanced diagnostic technologies and the growing need for timely infectious disease detection. Healthcare providers are increasingly prioritizing NAAT-based testing for respiratory infections, STIs, and gastrointestinal infections due to its high accuracy and fast turnaround. The rising trend of decentralized healthcare and home-based testing further propels the market. Moreover, integration of molecular POCT devices with hospital information systems and telemedicine platforms is significantly contributing to the market's expansion. The strong presence of key diagnostic companies and continuous technological innovations also support sustained growth.

Europe Molecular Point-of-Care Testing (Using NAAT) Market Insight

The Europe molecular POCT market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing demand for rapid diagnostics and rising incidence of infectious diseases. Government initiatives promoting point-of-care testing and healthcare digitization are encouraging adoption across hospitals, clinics, and laboratories. The growth is also supported by urbanization and the increasing prevalence of multi-drug-resistant infections. European healthcare providers are increasingly adopting NAAT-based testing for timely disease management and outbreak control. Both residential and commercial healthcare facilities are integrating POCT devices to enhance patient care. The market is witnessing significant growth in countries such as Germany, France, and Italy.

U.K. Molecular Point-of-Care Testing (Using NAAT) Market Insight

The U.K. molecular POCT market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for rapid diagnostics and decentralized testing solutions. Increasing awareness among healthcare providers about the benefits of NAAT-based testing, such as high sensitivity and specificity, is encouraging adoption in hospitals and clinics. Government initiatives for early detection and management of infectious diseases further support market expansion. The country’s strong healthcare infrastructure and robust e-health systems enhance device integration and result reporting. Growing adoption in both public and private healthcare sectors stimulates market growth. Telemedicine and homecare testing initiatives are expected to further propel adoption in the U.K.

Germany Molecular Point-of-Care Testing (Using NAAT) Market Insight

The Germany molecular POCT market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing prevalence of infectious diseases and demand for rapid diagnostics. Germany’s advanced healthcare infrastructure, strong emphasis on technological innovation, and high awareness among healthcare professionals promote NAAT-based POCT adoption. The integration of POCT devices with hospital information systems and laboratory networks enhances operational efficiency. There is a growing preference for decentralized testing in outpatient clinics and ambulatory centers. Adoption in both residential healthcare services and commercial diagnostic facilities is increasing. Continuous R&D and local manufacturing of POCT instruments and consumables further strengthen market growth.

Asia-Pacific Molecular Point-of-Care Testing (Using NAAT) Market Insight

The Asia-Pacific molecular POCT market is poised to grow at the fastest CAGR of 23.5% during the forecast period of 2025 to 2032, driven by rising incidence of infectious diseases, increasing healthcare investments, and expanding testing infrastructure in countries such as China, Japan, and India. The region's growing focus on decentralized and home-based testing solutions is driving adoption. Government programs promoting digital healthcare and infectious disease monitoring support market expansion. The presence of local manufacturers ensures affordable NAAT devices and consumables. Increasing urbanization, technological adoption, and rising awareness about early diagnosis further propel growth. Demand across hospitals, clinics, and homecare settings is increasing steadily.

Japan Molecular Point-of-Care Testing (Using NAAT) Market Insight

The Japan molecular POCT market is gaining momentum due to high healthcare standards, advanced diagnostic technology adoption, and rising awareness about rapid testing. The country emphasizes accurate and timely detection of infectious diseases, driving adoption in hospitals, clinics, and homecare settings. Integration of NAAT devices with hospital networks and telemedicine platforms enhances efficiency. Aging population demographics further increase demand for user-friendly, accessible testing solutions. Continuous innovations in multiplexed and portable NAAT devices support the market. Growing preference for preventive healthcare and digital diagnostics accelerates adoption in both residential and commercial healthcare sectors.

India Molecular Point-of-Care Testing (Using NAAT) Market Insight

The India molecular POCT market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s high prevalence of infectious diseases, expanding middle class, and increasing healthcare awareness. Rapid urbanization and government initiatives toward smart healthcare and digital diagnostics are key growth drivers. Hospitals, clinics, and homecare services are increasingly adopting NAAT-based POCT devices for faster diagnosis and treatment. Affordable devices from local manufacturers enhance accessibility across urban and semi-urban regions. Rising demand for multiplexed testing solutions further accelerates adoption. Strong public health programs and partnerships with diagnostic companies continue to drive market growth.

Molecular Point of Care Testing (using NAAT) Market Share

The Molecular Point of Care Testing (using NAAT) industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Hologic, Inc. (U.S.)

- BD (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S.)

- QIAGEN (Netherlands)

- BIOMÉRIEUX (France)

- Danaher (U.S.)

- Illumina, Inc. (U.S.)

- Sysmex Corporation (Japan)

- Siemens Healthineers AG (Germany)

- Seegene Inc. (South Korea)

- Guardant Health, Inc. (U.S.)

- Labcorp (U.S.)

- Exact Sciences Corporation (U.S.)

- 10x Genomics, Inc. (U.S.)

- DNA Genotek Inc. (Canada)

- PathoNostics (Netherlands)

- Molbio Diagnostics Limited. (India)

What are the Recent Developments in Global Molecular Point of Care Testing (using NAAT) Market?

- In July 2025, BD (Becton, Dickinson and Company) received FDA 510(k) clearance for its BD Veritor™ System for SARS-CoV-2, a digital test designed to detect COVID-19 antigens in symptomatic individuals in about 15 minutes at points of care such as doctors' offices, urgent care centers, and retail clinics

- In October 2024, The World Health Organization (WHO) approved the first diagnostic test for mpox (formerly known as monkeypox) for emergency use. This approval aims to enhance global access to rapid and accurate diagnostics for mpox, particularly in resource-limited settings. The test utilizes nucleic acid amplification technology, enabling point-of-care testing with high sensitivity and specificity

- In April 2024, Roche Diagnostics launched the cobas® 5800 system, a next-generation molecular testing automation platform designed to improve productivity and reduce errors in laboratories. The system offers standardized assays and scalable solutions, making it suitable for various testing volumes and mixes. By enhancing automation in molecular diagnostics, the cobas® 5800 system aims to streamline workflows and ensure consistent results across testing environments

- In March 2023, QuidelOrtho Corporation announced that it has been granted a De Novo request from the U.S. Food and Drug Administration (FDA), allowing the company to market its new Sofia® 2 SARS Antigen+ FIA. The Sofia 2 SARS Antigen+ FIA is the first rapid antigen test that detects COVID-19 to be awarded FDA market clearance

- In March 2023, The LumiraDx SARS-CoV-2 Ag Test is authorized for use at the point of care in patient care settings operating under a CLIA Certificate of Waiver, Certificate of Compliance, or Certificate of Accreditation. This test is intended for use by medical professionals or operators who are proficient in performing tests in point-of-care settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.