Global Viral Respiratory Infections Treatment Market

Market Size in USD Billion

CAGR :

%

USD

62.24 Billion

USD

119.54 Billion

2024

2032

USD

62.24 Billion

USD

119.54 Billion

2024

2032

| 2025 –2032 | |

| USD 62.24 Billion | |

| USD 119.54 Billion | |

|

|

|

|

Viral Respiratory Infections Treatment Market Size

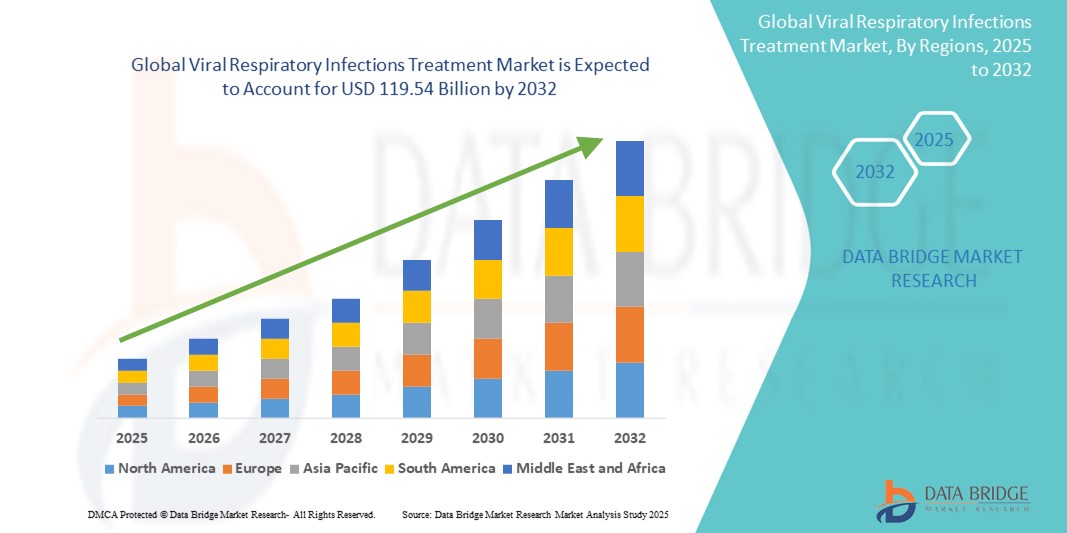

- The global viral respiratory infections treatment market size was valued at USD 62.24 billion in 2024 and is expected to reach USD 119.54 billion by 2032, at a CAGR of 8.50% during the forecast period

- The market growth is largely driven by the increasing prevalence of viral respiratory infections, such as influenza, respiratory syncytial virus (RSV), and emerging respiratory viruses, prompting a heightened need for effective antiviral drugs and supportive care solutions

- Furthermore, rising investments in R&D, coupled with the development of advanced therapeutic agents, rapid diagnostics, and improved public health infrastructure, are propelling the market forward. These combined factors are reinforcing the demand for efficient and accessible treatment options, thereby significantly driving the industry's expansion

Viral Respiratory Infections Treatment Market Analysis

- Viral respiratory infections treatment encompasses antiviral drugs, immunomodulators, and supportive therapies designed to combat infections such as influenza, respiratory syncytial virus (RSV), rhinovirus, and coronaviruses, which continue to pose significant public health challenges globally, especially among vulnerable populations including children, the elderly, and immunocompromised individuals

- The rising prevalence of viral respiratory infections, seasonal outbreaks, and the emergence of novel pathogens are key drivers accelerating demand for effective treatment options, further supported by increasing awareness, early diagnosis, and improvements in healthcare access

- North America dominated the viral respiratory infections treatment market with the largest revenue share of 38.3% in 2024, owing to robust healthcare infrastructure, high healthcare spending, widespread diagnostic capabilities, and proactive government initiatives to stockpile antiviral medications and vaccines

- Asia-Pacific is expected to be the fastest growing region in the viral respiratory infections treatment market during the forecast period due to a high burden of respiratory infections, growing healthcare investments, and increasing access to antiviral therapies

- The antiviral medications segment dominated the viral respiratory infections treatment market with a market share of 47% in 2024, propelled by the development and approval of targeted therapies for influenza and RSV, as well as strategic partnerships between pharmaceutical firms and public health agencies to expand treatment access

Report Scope and Viral Respiratory Infections Treatment Market Segmentation

|

Attributes |

Viral Respiratory Infections Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Viral Respiratory Infections Treatment Market Trends

“Advancements in Antiviral Therapies and Rapid Diagnostic Technologies”

- A key and accelerating trend in the global viral respiratory infections treatment market is the advancement of novel antiviral therapies and rapid diagnostic tools aimed at improving patient outcomes and outbreak management. These innovations are transforming the way respiratory infections are detected and treated, enabling earlier intervention and more targeted therapy

- For instance, the approval of monoclonal antibody therapies such as nirsevimab for RSV prevention in infants highlights the shift toward precision medicine in viral infection treatment. In addition, Pfizer and Moderna are advancing mRNA-based vaccines and treatments that offer improved efficacy and adaptability against evolving viral strains

- The emergence of rapid point-of-care (POC) diagnostics is also streamlining patient care, enabling healthcare providers to identify specific respiratory viruses in minutes. Devices such as the BioFire FilmArray Respiratory Panel 2.1 detect over 20 pathogens with high accuracy and speed, facilitating immediate and appropriate treatment decisions

- These rapid diagnostics are crucial during seasonal surges or pandemics, where timely isolation and treatment can significantly reduce transmission and complications. Furthermore, technological progress in combination therapies—where antivirals are used with immune modulators has shown promise in managing severe cases and improving patient survival rates

- The integration of AI in healthcare analytics is further contributing to the trend, with AI-based models aiding in early outbreak prediction, treatment optimization, and real-time tracking of viral mutation patterns

- As demand for faster, more effective, and accessible treatment options rises, biopharmaceutical companies are intensifying R&D efforts to deliver next-generation solutions, fundamentally reshaping the landscape of viral respiratory infections treatment

Viral Respiratory Infections Treatment Market Dynamics

Driver

“Increasing Prevalence of Viral Outbreaks and Advancements in Antiviral Drug Development”

- The rising frequency of seasonal and pandemic-level viral respiratory infections, including influenza, RSV, and coronaviruses, is a primary driver of market growth. These infections continue to place a heavy burden on global healthcare systems, prompting increased demand for effective therapeutic options

- For instance, the global burden of influenza alone results in millions of severe cases and hundreds of thousands of deaths annually, reinforcing the need for advanced antiviral drugs and public health preparedness

- Pharmaceutical companies are actively developing and commercializing more effective antiviral medications, including novel mechanisms of action and improved resistance profiles. Gilead’s remdesivir and other investigational agents are examples of this ongoing innovation

- Government and institutional funding toward infectious disease research, including stockpiling antivirals and incentivizing vaccine production, is further propelling market expansion. In addition, rising awareness and healthcare access in emerging markets are improving early diagnosis and treatment uptake

- The increasing integration of telehealth services and digital prescription platforms also supports easier access to antiviral therapies, especially during outbreaks, where timely treatment can reduce complications and hospitalizations

Restraint/Challenge

“Viral Mutation and Antiviral Resistance Complications”

- One of the major challenges in the treatment of viral respiratory infections is the high mutation rate of viruses, leading to frequent strain variations and reduced effectiveness of existing therapies. This genetic variability complicates vaccine and drug development, often requiring reformulations and new clinical trials

- For instance, the continuous antigenic drift of influenza viruses necessitates annual vaccine updates, and the emergence of drug-resistant strains, such as oseltamivir-resistant influenza, poses a serious threat to effective disease control

- Developing broad-spectrum antivirals or combination therapies remains a complex and costly endeavor, requiring long timelines and substantial investment

- In addition, disparities in healthcare infrastructure and access, particularly in low-income regions, hinder early diagnosis and timely treatment, allowing infections to progress and spread. Inconsistent availability of antiviral drugs, high treatment costs, and regulatory delays also pose barriers to widespread adoption

- Overcoming these challenges will require sustained global collaboration, accelerated regulatory pathways for emerging therapies, and investments in genomic surveillance, resistance management, and equitable healthcare access

Viral Respiratory Infections Treatment Market Scope

The market is segmented on the basis of treatment type, type, route of administration, disease type, infection type, population, gender, end user, and distribution channel.

- By Treatment Type

On the basis of treatment type, the viral respiratory infections treatment market is segmented into antiviral medications, vaccines, monoclonal antibodies, non-steroidal anti-inflammatory drugs (NSAIDs), and others. The antiviral medications segment dominated the market with the largest market revenue share of 47% in 2024, driven by the widespread use of antiviral drugs such as oseltamivir, remdesivir, and favipiravir for the treatment of influenza, COVID-19, and RSV. Their proven efficacy in reducing symptom duration and preventing complications contributes to their high adoption.

The monoclonal antibodies segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by advancements in biologic therapies and the rising demand for targeted treatments, especially for RSV and emerging respiratory pathogens. The growing number of approvals and pipeline candidates is further accelerating growth in this segment.

- By Type

On the basis of type, the viral respiratory infections treatment market is segmented into over-the-counter (OTC) and prescription-based treatments. The prescription-based segment dominated the market in 2024 due to the clinical need for physician-supervised antiviral, monoclonal, and vaccine therapies in managing moderate to severe respiratory infections. The segment benefits from higher reimbursement rates and greater regulatory backing for advanced therapeutics.

The OTC segment is projected to witness notable growth during the forecast period due to increasing consumer awareness, easy availability of symptom-relief products such as decongestants and pain relievers, and growing preference for self-medication in non-severe infections.

- By Route of Administration

On the basis of route of administration, the viral respiratory infections treatment market is segmented into oral, nasal, and injectable. The oral segment held the largest market revenue share in 2024, attributed to patient convenience, ease of administration, and strong adoption of oral antivirals such as baloxavir marboxil and favipiravir in outpatient care settings.

The injectable segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing adoption of monoclonal antibodies and injectable vaccines, particularly in high-risk and pediatric populations. Injectable routes are also favored in hospital and emergency care settings for faster therapeutic onset.

- By Disease Type

On the basis of disease type, the viral respiratory infections treatment market is segmented into COVID, influenza (flu), respiratory syncytial virus (RSV), parainfluenza, adenoviruses, rhinovirus (common cold), enterovirus, anti-inflammatory, and others. The influenza segment dominated the market with the largest revenue share in 2024 due to its high seasonal incidence, global vaccination efforts, and wide therapeutic range including both antivirals and symptom-relief medications.

The RSV segment is anticipated to witness the fastest growth rate during the forecast period owing to increasing pediatric cases, the development of targeted monoclonal antibodies, and heightened focus on neonatal and elderly respiratory health.

- By Infection Type

On the basis of infection type, the viral respiratory infections treatment market is segmented into upper respiratory infections and lower respiratory infections. The upper respiratory infections segment led the market in 2024, driven by the high global burden of conditions such as the common cold, pharyngitis, and influenza, which are commonly managed in outpatient and home care settings.

The lower respiratory infections segment is projected to grow at a faster rate from 2025 to 2032 due to rising hospitalizations related to pneumonia, bronchiolitis, and severe COVID-19, particularly in aging populations and those with chronic comorbidities.

- By Population

On the basis of population, the viral respiratory infections treatment market is segmented into pediatric, adults, and geriatric. The adult segment accounted for the largest market share in 2024, attributed to higher healthcare utilization rates and the broader use of antiviral and symptomatic treatments among working-age individuals.

The pediatric segment is expected to grow at the fastest rate during the forecast period, supported by increasing RSV and influenza prevalence in infants and young children, along with newly approved pediatric-specific treatment options.

- By Gender

On the basis of gender, the viral respiratory infections treatment market is segmented into male and female. The female segment dominated the market in 2024 with the largest revenue share, attributed to higher healthcare-seeking behavior, greater utilization of preventive services such as vaccinations, and increased responsiveness to early symptoms of respiratory infections.

The male segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising awareness of health risks, improving access to care in emerging economies, and targeted public health initiatives aimed at closing the gender gap in healthcare engagement and treatment adherence

- By End User

On the basis of end user, the viral respiratory infections treatment market is segmented into hospitals, home care settings, clinics, research institutes and academic centers, and ambulatory surgical centers. The hospitals segment dominated the market with the largest revenue share in 2024 due to the concentration of complex and critical care treatments, including intravenous antivirals, oxygen therapy, and monoclonal antibody infusions for severe infections.

The home care settings segment is projected to experience the fastest growth rate from 2025 to 2032, supported by the increasing availability of oral medications, remote healthcare services, and self-administered treatment options that align with trends in decentralizing care.

- By Distribution Channel

On the basis of distribution channel, the viral respiratory infections treatment market is segmented into direct tender, retail sales, and others. The direct tender segment accounted for the largest market revenue share in 2024, driven by large-scale government procurement of vaccines and antivirals for public healthcare programs and emergency stockpiles.

The retail sales segment is expected to grow rapidly during the forecast period, aided by increasing e-commerce penetration, expanding pharmacy chains, and consumer preference for purchasing OTC treatments and prescription refills through digital platforms.

Viral Respiratory Infections Treatment Market Regional Analysis

- North America dominated the viral respiratory infections treatment market with the largest revenue share of 38.3% in 2024, owing to robust healthcare infrastructure, high healthcare spending, widespread diagnostic capabilities, and proactive government initiatives to stockpile antiviral medications and vaccines

- Consumers in the region benefit from widespread availability of antiviral drugs, vaccines, and diagnostic tools, supported by proactive public health policies and rapid adoption of innovative treatment solutions

- This robust market presence is further fueled by substantial healthcare spending, well-established pharmaceutical supply chains, and continuous research and development efforts, making North America a key hub for both preventive and therapeutic interventions against viral respiratory infections

U.S. Viral Respiratory Infections Treatment Market Insight

The U.S. viral respiratory infections treatment market captured the largest revenue share in North America in 2024, supported by the high burden of seasonal flu, RSV, and COVID-19 cases. The country's advanced healthcare infrastructure, strong R&D ecosystem, and widespread access to antiviral drugs and vaccines are key drivers. Rising government initiatives for pandemic preparedness and mass immunization programs, alongside increasing public awareness, continue to fuel demand. The U.S. market also benefits from rapid regulatory approvals and strong participation of major pharmaceutical companies in vaccine and therapeutic development.

Europe Viral Respiratory Infections Treatment Market Insight

The Europe viral respiratory infections treatment market is projected to expand at a substantial CAGR throughout the forecast period, driven by an aging population and the growing incidence of respiratory diseases. The region’s focus on preventive care, along with robust public healthcare systems, supports strong demand for vaccinations and antiviral therapies. Increased funding for research, coupled with early adoption of advanced treatment modalities and rapid diagnostics, is bolstering the market across both Western and Eastern Europe.

U.K. Viral Respiratory Infections Treatment Market Insight

The U.K. viral respiratory infections treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the country’s strategic focus on public health, immunization programs, and early detection. Government initiatives to expand RSV and influenza vaccine coverage, along with increased uptake of prescription-based antivirals, are fueling market growth. The presence of key clinical research centers and collaborations between the NHS and pharmaceutical companies further strengthen the U.K.’s position in this space.

Germany Viral Respiratory Infections Treatment Market Insight

The Germany viral respiratory infections treatment market is expected to expand at a considerable CAGR during the forecast period, supported by a strong pharmaceutical industry and growing investment in preventive and curative respiratory care. Germany’s focus on innovation and high public health standards has led to widespread availability of treatment options for influenza, RSV, and other viral infections. Public awareness campaigns and digital health adoption are accelerating early diagnosis and timely treatment, particularly in high-risk populations.

Asia-Pacific Viral Respiratory Infections Treatment Market Insight

The Asia-Pacific viral respiratory infections treatment market is poised to grow at the fastest CAGR of 21.3% during the forecast period of 2025 to 2032, driven by a rising population, frequent outbreaks, and increasing healthcare spending. Countries such as China, India, and Japan are witnessing higher investments in vaccine development, mass immunization programs, and improved access to antiviral medications. Government-led digital health initiatives and public-private partnerships are expanding treatment availability, especially in rural and underserved areas.

Japan Viral Respiratory Infections Treatment Market Insight

The Japan viral respiratory infections treatment market is gaining momentum due to its aging population, strong emphasis on healthcare innovation, and high seasonal infection rates. Government vaccination drives, particularly for influenza and COVID-19, are widespread, and the country is at the forefront of introducing new treatment technologies. The integration of AI in healthcare and rapid diagnostic adoption are further driving growth, especially in hospital and elderly care settings.

India Viral Respiratory Infections Treatment Market Insight

The India viral respiratory infections treatment market accounted for the largest revenue share in Asia Pacific in 2024, fueled by high infection rates, a large pediatric population, and expanding healthcare access. Government initiatives such as Ayushman Bharat and intensified immunization programs are key contributors to market growth. The increasing production of affordable generic antivirals and vaccines by domestic pharmaceutical companies is improving accessibility, while rising health awareness is encouraging early treatment adoption across urban and semi-urban regions.

Viral Respiratory Infections Treatment Market Share

The viral respiratory infections treatment industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Sanofi (France)

- AstraZeneca (U.K.)

- Merck & Co., Inc. (U.S.)

- Moderna, Inc. (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- AbbVie Inc. (U.S.)

- Bayer AG (Germany)

- Boehringer Ingelheim International GmbH (Germany)

- Novartis AG (Switzerland)

- BioCryst Pharmaceuticals, Inc. (U.S.)

- CSL Limited (Australia)

- Shionogi & Co., Ltd. (Japan)

- Vaxart, Inc. (U.S.)

- Daiichi Sankyo Company, Limited (Japan)

- Sinovac Biotech Ltd. (China)

- Serum Institute of India Pvt. Ltd. (India)

- Takeda Pharmaceutical Company Limited (Japan)

What are the Recent Developments in Global Viral Respiratory Infections Treatment Market?

- In April 2023, GSK plc announced positive Phase III trial results for its RSV vaccine candidate, Arexvy, targeted at older adults. The vaccine demonstrated strong efficacy in preventing RSV-related lower respiratory tract disease, marking a major advancement in protecting vulnerable populations. GSK’s development reflects the growing focus on preventive strategies for respiratory infections and the increasing role of vaccines in reducing healthcare burden globally.

- In March 2023, Pfizer Inc. launched Abrysvo, its bivalent RSV vaccine for adults aged 60 and above, following FDA approval. The dual-strain formulation is designed to provide broader protection against circulating RSV strains. The introduction of Abrysvo underscores Pfizer’s commitment to innovation in respiratory care and supports global efforts to combat seasonal and age-related viral infections

- In March 2023, Moderna Inc. announced promising interim results from its Phase III trial for mRNA-1010, a quadrivalent influenza vaccine based on mRNA technology. The candidate showed immunogenicity comparable to or better than existing licensed flu vaccines. This development signifies a potential shift toward mRNA-based platforms for seasonal viral infection prevention, leveraging the success of COVID-19 vaccine technology

- In February 2023, Roche Holding AG, through its diagnostics division, launched a next-generation multiplex PCR test capable of simultaneously detecting COVID-19, influenza A/B, and RSV. The new test enhances diagnostic efficiency and accuracy, particularly during respiratory infection surges, and supports clinicians in making faster, informed treatment decisions. The launch reflects the increasing emphasis on rapid diagnostics in viral disease management

- In January 2023, AstraZeneca and Sanofi received expanded regulatory approval in the EU for Beyfortus (nirsevimab), a long-acting monoclonal antibody for the prevention of RSV in infants. The approval allows a broader application beyond high-risk infants, marking a shift toward universal RSV prophylaxis. This collaborative innovation highlights the growing role of monoclonal antibodies in respiratory infection prevention and pediatric healthcare

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.