Global Motor Testing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

3.09 Billion

USD

4.26 Billion

2024

2032

USD

3.09 Billion

USD

4.26 Billion

2024

2032

| 2025 –2032 | |

| USD 3.09 Billion | |

| USD 4.26 Billion | |

|

|

|

|

What is the Global Motor Testing Equipment Market Size and Growth Rate?

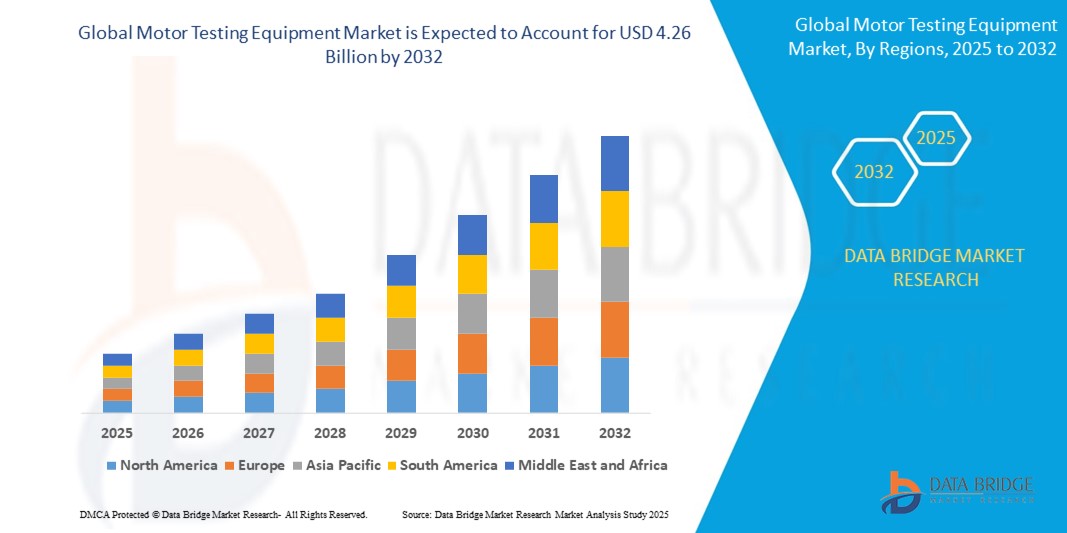

- The global motor testing equipment market size was valued at USD 3.09 billion in 2024 and is expected to reach USD 4.26 billion by 2032, at a CAGR of 4.10% during the forecast period

- This growth is driven by increasing industrial automation, rising adoption of electric vehicles, and the growing emphasis on predictive maintenance to reduce downtime

- The expansion of manufacturing sectors in emerging economies and the push for energy-efficient operations are further propelling demand for advanced motor testing solutions globally

What are the Major Takeaways of Motor Testing Equipment Market?

- Motor Testing Equipment is crucial for assessing the performance, efficiency, and operational health of electric motors in industries such as automotive, aerospace, manufacturing, and utilities.

- The market is witnessing strong traction due to a shift toward condition monitoring and predictive maintenance strategies, enabling early fault detection and reduced maintenance costs.

- Increasing demand for portable and automated testing systems, especially in electric vehicle production and industrial automation, is shaping the future growth trajectory of the Motor Testing Equipment market.

- North America dominated the motor testing equipment market with the largest revenue share of 42.11% in 2024, driven by strong industrial infrastructure, early technology adoption, and a rising focus on equipment efficiency and predictive maintenance

- Asia-Pacific (APAC) motor testing equipment market is anticipated to register the fastest CAGR of 14.05% from 2025 to 2032, driven by industrial expansion, electrification, and increasing automation in nations such as China, India, and Japan

- The Portable Motor Testing Equipment segment dominated the motor testing equipment market with the largest market revenue share of 47.5% in 2024, driven by its versatility, ease of transport, and suitability for on-site testing and diagnostics

Report Scope and Motor Testing Equipment Market Segmentation

|

Attributes |

Motor Testing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Motor Testing Equipment Market?

“AI-Powered Predictive Maintenance and Automation Integration”

- A key trend shaping the global motor testing equipment market is the increasing adoption of AI-powered predictive maintenance and integration with industrial automation platforms such as SCADA and PLC systems. This enables real-time monitoring, fault detection, and optimized asset management across diverse industries

- For instance, companies such as Schneider Electric and Fluke Corporation are developing AI-enabled motor testing tools that analyze historical and real-time data to predict equipment failure, reduce downtime, and improve operational efficiency

- These smart systems use machine learning algorithms to identify anomalies in vibration, current, and torque parameters, enabling maintenance teams to act before critical failures occur

- Integration with automation infrastructure allows seamless data sharing, improving decision-making, reducing manual intervention, and enabling centralized control over motor performance and energy consumption

- As a result, AI and automation integration is reshaping industrial motor testing by enhancing diagnostics accuracy, increasing equipment lifespan, and lowering maintenance costs—benefits that are particularly valuable in sectors such as manufacturing, energy, and automotive

What are the Key Drivers of Motor Testing Equipment Market?

- The rising demand for energy-efficient motors, especially in sectors such as HVAC, water treatment, and automotive, is a major driver of the motor testing equipment market. Accurate testing ensures compliance with performance standards and reduces operational costs

- In March 2024, Siemens AG introduced a new series of high-precision portable motor testers to support predictive maintenance in smart factories, highlighting industry investment in advanced testing technologies

- In addition, the rapid expansion of electric vehicles (EVs) and renewable energy systems is increasing the need for regular motor diagnostics, performance testing, and fault detection

- Stringent regulatory requirements regarding motor efficiency and safety, particularly in North America and Europe, are pushing manufacturers and service providers to adopt high-quality testing equipment

- The proliferation of Industry 4.0 and smart manufacturing is also encouraging automation and digitization of testing procedures, creating sustained demand for intelligent and connected motor testing solutions

Which Factor is challenging the Growth of the Motor Testing Equipment Market?

- One of the main challenges is the high cost of advanced testing equipment, which may limit adoption among small and medium enterprises (SMEs), especially in developing countries where budget constraints are prevalent

- For instance, while large industries can invest in high-end diagnostic platforms, smaller facilities may rely on basic, less accurate tools due to financial limitations

- In addition, the lack of skilled personnel capable of operating complex testing instruments and interpreting test results can hinder effective deployment, especially in emerging markets

- The integration of motor testing systems into larger automation networks also requires significant infrastructure upgrades and compatibility checks, which can deter potential buyers

- Addressing these issues through affordable, user-friendly testing solutions, remote support features, and targeted training programs will be critical for enabling broader market penetration and long-term growth

How is the Motor Testing Equipment Market Segmented?

The market is segmented on the basis of type and application.

• By Type

On the basis of type, the motor testing equipment market is segmented into Portable Motor Testing Equipment, Benchtop Motor Testing Equipment, and Rack-Mount Motor Testing Equipment. The Portable Motor Testing Equipment segment dominated the Motor Testing Equipment market with the largest market revenue share of 47.5% in 2024, driven by its versatility, ease of transport, and suitability for on-site testing and diagnostics. Industries such as utilities, manufacturing, and automotive heavily rely on portable units for preventive maintenance and field inspections, making them a preferred choice globally.

The Benchtop Motor Testing Equipment segment is projected to witness the fastest growth rate of 6.8% from 2025 to 2032, owing to its high precision and suitability for detailed motor performance analysis in R&D and laboratory environments. These systems are extensively used by OEMs and testing labs for accurate diagnostics, load testing, and lifecycle analysis. The increasing investment in automation and motor efficiency improvements is further accelerating the adoption of benchtop units across sectors.

• By Application

On the basis of application, the motor testing equipment market is segmented into Design Verification, Maintenance, and Others. The Maintenance segment accounted for the largest market revenue share of 58.3% in 2024, driven by the growing emphasis on predictive and preventive maintenance strategies in industrial settings. Regular motor health assessments help reduce downtime, optimize energy usage, and prolong asset life, making maintenance-focused motor testing a critical component of operational workflows.

The Design Verification segment is anticipated to witness the fastest CAGR of 7.2% from 2025 to 2032, fueled by increasing R&D activities and the demand for high-performance motors in sectors such as automotive, aerospace, and consumer electronics. As companies push for innovative and energy-efficient motor designs, testing equipment that verifies performance under diverse conditions is becoming essential during the development phase.

Which Region Holds the Largest Share of the Motor Testing Equipment Market?

- North America dominated the motor testing equipment market with the largest revenue share of 42.11% in 2024, driven by strong industrial infrastructure, early technology adoption, and a rising focus on equipment efficiency and predictive maintenance

- The region’s well-established manufacturing and energy sectors continue to adopt Motor Testing Equipment to monitor motor health, reduce downtime, and comply with stringent energy regulations

- High investments in automation and the integration of smart monitoring systems further support the widespread deployment of testing equipment across sectors such as automotive, aerospace, utilities, and manufacturing

U.S. Motor Testing Equipment Market Insight

The U.S. motor testing equipment market dominated North America’s revenue in 2024, owing to its expansive industrial base and rapid adoption of Industry 4.0 practices. Manufacturers are increasingly relying on advanced motor testing equipment for performance validation, fault diagnostics, and life-cycle analysis of electric motors. Government initiatives promoting energy-efficient equipment and the presence of key OEMs and testing labs continue to support market expansion.

Europe Motor Testing Equipment Market Insight

The Europe motor testing equipment market is projected to grow steadily during the forecast period, propelled by strict industrial efficiency standards and growing investments in R&D. The region's emphasis on sustainable energy and electrification in transportation is boosting demand for high-performance motor testing across electric vehicles, wind energy, and industrial machinery. Integration with digital platforms for real-time diagnostics and condition monitoring is further enhancing equipment utilization across key markets.

U.K. Motor Testing Equipment Market Insight

The U.K. market is poised for strong growth, supported by its active automotive and renewable energy sectors. The country’s focus on net-zero emissions and electrification has increased investments in electric motor development and validation, spurring demand for motor testing equipment. In addition, government incentives for clean tech and innovation in testing automation are expected to boost adoption rates.

Germany Motor Testing Equipment Market Insight

Germany, known for its engineering excellence and leadership in automotive and manufacturing sectors, is expected to see consistent growth in the motor testing equipment market. High demand for efficient motor systems, R&D in e-mobility, and regulatory compliance regarding energy consumption are key drivers. The market is also supported by strong export activity, with Germany being a hub for producing and testing industrial motors.

Which Region is the Fastest Growing in the Motor Testing Equipment Market?

Asia-Pacific (APAC) motor testing equipment market is anticipated to register the fastest CAGR of 14.05% from 2025 to 2032, driven by industrial expansion, electrification, and increasing automation in nations such as China, India, and Japan. APAC’s rapidly growing manufacturing sector, supported by government incentives for infrastructure development and smart manufacturing, is fueling demand. The region’s competitive production costs and the presence of leading motor and equipment manufacturers make it a strategic hub for both demand and supply of Motor Testing Equipment.

Japan Motor Testing Equipment Market Insight

Japan’s motor testing equipment market is expanding steadily due to its technological sophistication and leadership in electronics and automotive R&D. The focus on electric mobility, precision engineering, and industrial automation is increasing demand for advanced testing systems. The country’s commitment to innovation, along with aging industrial equipment in need of monitoring, supports steady market growth.

China Motor Testing Equipment Market Insight

China held the largest revenue share in the Asia-Pacific region in 2024, fueled by rapid industrialization, the growth of smart manufacturing, and a surge in electric vehicle production. China’s focus on becoming a global leader in EVs, robotics, and industrial automation is resulting in high deployment of Motor Testing Equipment in both production and maintenance applications. Local companies are also investing in affordable and technologically advanced testing solutions, increasing market accessibility across industries.

Which are the Top Companies in Motor Testing Equipment Market?

The motor testing equipment industry is primarily led by well-established companies, including:

- AVL List GmbH (Austria)

- Horiba Ltd. (Japan)

- Bosch Automotive Service Solutions (Germany)

- Siemens AG (Germany)

- Honeywell International Inc. (U.S.)

- SGS SA (Switzerland)

- Actia Group (France)

- Delphi Technologies (U.K.)

- Softing AG (Germany)

- KPIT Technologies Ltd. (India)

- MAHA Maschinenbau Haldenwang GmbH & Co. KG (Germany)

- ABB Ltd. (Switzerland)

- Denso Corporation (Japan)

- Continental AG (Germany)

- Snap-on Incorporated (U.S.)

What are the Recent Developments in Global Motor Testing Equipment Market?

- In April 2025, Bosch Automotive Service Solutions introduced a next-generation ADAS calibration and diagnostic platform, featuring AI-powered fault detection and cloud connectivity to streamline workshop operations and minimize service delays. This innovation is set to significantly enhance diagnostic precision and reduce vehicle service downtime across workshops

- In March 2025, AVL List GmbH launched a high-performance test bench system for electric vehicle powertrains, incorporating real-time simulation, regenerative load management, and multi-voltage support to address the evolving requirements of next-generation EVs. This system is expected to accelerate EV development cycles while improving energy efficiency and testing versatility

- In February 2025, Horiba Ltd. introduced a modular emission testing platform designed to meet upcoming Euro 7 regulations, with capabilities for enhanced particulate detection and real driving emissions (RDE) analysis. This solution strengthens regulatory compliance and supports environmental sustainability in vehicle development

- In January 2025, AB Dynamics integrated automated functionalities into its Track Applications Suite, enabling driving robots to conduct complex ADAS tests for heavy vehicles under difficult and sensitive conditions. The suite also includes the Post Processor software, which delivers real-time performance feedback for rapid test program optimization. This upgrade greatly enhances the accuracy, efficiency, and responsiveness of ADAS testing processes

- In September 2023, Horiba Mira inaugurated a state-of-the-art driving simulator center at its Nuneaton headquarters, with an investment exceeding approx. 5.0 million USD. The facility houses the U.K.’s first VI-Grade DiM250 Dynamic Simulator, aimed at advancing vehicle attribute engineering and reducing dependence on physical prototypes. This center marks a significant step toward more sustainable and cost-effective vehicle development in the automotive sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Motor Testing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Motor Testing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Motor Testing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.