Global Motorcycle Apparel Market

Market Size in USD Billion

CAGR :

%

USD

13.17 Billion

USD

22.63 Billion

2024

2032

USD

13.17 Billion

USD

22.63 Billion

2024

2032

| 2025 –2032 | |

| USD 13.17 Billion | |

| USD 22.63 Billion | |

|

|

|

Motorcycle Apparel Market Size

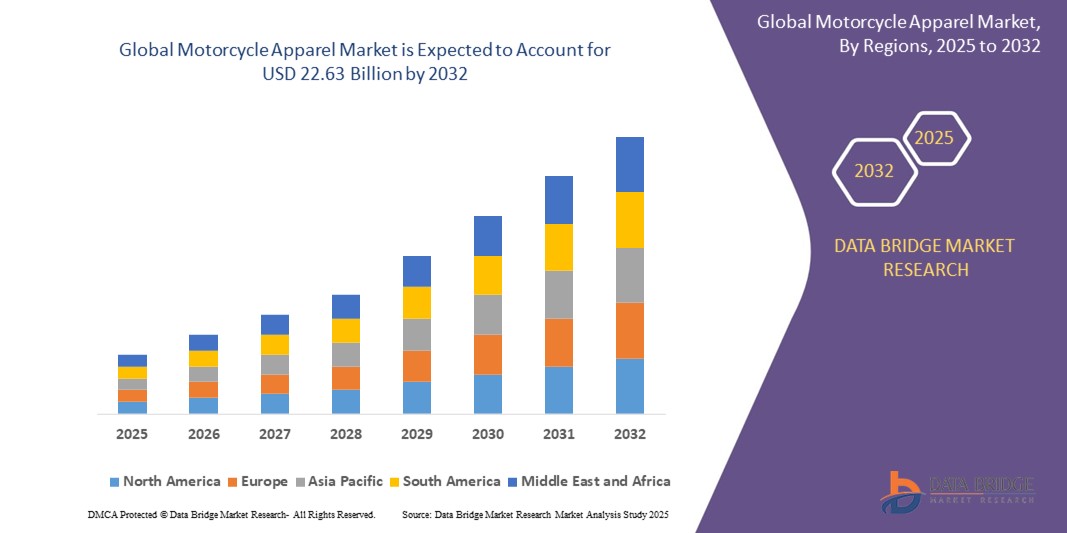

- The global motorcycle apparel market was valued at USD 13.17 billion in 2024 and is expected to reach USD 22.63 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.00%, primarily driven by the rising popularity of motorcycles as a means of personal transport and adventure travel

- This growth is driven by factors such as increasing awareness of rider safety, growth in motorbike tourism, and technological advancements in protective gear materials and smart apparel integration

Motorcycle Apparel Market Analysis

- Motorcycle apparel includes protective gear such as jackets, pants, gloves, boots, and helmets, designed to ensure rider safety and comfort during motorcycle riding. These products are essential for reducing the risk of injury and enhancing the riding experience

- The demand for motorcycle apparel is primarily driven by the growing awareness of rider safety, the rising popularity of motorcycle tourism, and advancements in material technology.

- A significant portion of the demand is also fueled by the increasing adoption of motorcycles in emerging markets, where motorcycling is a key mode of transportation

- The Asia-Pacific region stands out as one of the dominant regions for motorcycle apparel, driven by its large motorcycle-owning population and strong manufacturing base for apparel products. Countries like India, China, and Japan contribute heavily to the demand and production of motorcycle gear

- For instance, in countries such as India, the growing middle class and increased disposable income have led to higher motorcycle sales, driving up demand for protective gear and fashion-forward motorcycle apparel

- Globally, motorcycle apparel ranks as one of the most important segments within the broader motorcycle market, contributing significantly to the overall industry revenue. As safety regulations become stricter and consumers become more safety-conscious, the demand for high-quality, durable, and stylish gear continues to rise

Report Scope and Motorcycle Apparel Market Segmentation

|

Attributes |

Motorcycle Apparel Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Motorcycle Apparel Market Trends

"Integration of Smart Technology and Enhanced Safety Features"

- One prominent trend in the global motorcycle apparel market is the growing integration of smart technology and enhanced safety features into riding gear

- These advanced features improve rider safety and comfort by incorporating elements such as airbag systems, GPS tracking, and temperature regulation in jackets, helmets, and gloves

- For instance, smart helmets with built-in communication systems and heads-up displays offer real-time navigation, while airbag-equipped jackets provide additional protection in case of an accident

- The use of advanced materials like carbon fiber, Kevlar, and intelligent textiles in apparel also enhances both durability and protective qualities, catering to the growing demand for high-performance gear

- This trend is transforming the motorcycle apparel market by combining innovation with safety, attracting tech-savvy consumers and boosting demand for advanced protective gear

Motorcycle Apparel Market Dynamics

Driver

"Increasing Awareness of Rider Safety and Regulatory Standards"

- The rising awareness of rider safety and the enforcement of stricter safety regulations are significantly contributing to the increased demand for high-quality motorcycle apparel

- As safety-conscious riders look for ways to minimize injury risks, the demand for protective gear such as helmets, jackets, gloves, and boots with advanced safety features continues to rise

- Governments and regulatory bodies around the world are introducing and enforcing more stringent standards for motorcycle gear, such as helmet certifications, CE (Conformité Européenne) markings, and abrasion-resistant clothing

- The growing importance of rider safety is reflected in the increased emphasis on high-performance materials like Kevlar and carbon fiber in apparel, which offer superior protection without compromising comfort or mobility

- This trend is driving the expansion of the global motorcycle apparel market, as both recreational and everyday riders seek gear that offers the best protection against potential accidents

For instance,

- In August 2023, the European Union introduced updated safety standards for protective motorcycle gear, aiming to improve rider safety across the region. These new regulations have spurred demand for higher-quality, compliant apparel

- In May 2022, the U.S. National Highway Traffic Safety Administration (NHTSA) launched a campaign to promote helmet safety, which has contributed to increased awareness and demand for certified helmets in the U.S. market

- As a result of these growing safety concerns and regulatory measures, there is a significant increase in demand for motorcycle apparel that meets the highest safety and performance standards

Opportunity

"Incorporation of Smart Technology and Wearable Devices"

- The growing incorporation of smart technology and wearable devices in motorcycle apparel presents a significant market opportunity for the industry

- Smart helmets, jackets, and gloves with features such as built-in communication systems, GPS tracking, and real-time data collection are gaining popularity among tech-savvy riders. These innovations provide enhanced functionality, safety, and convenience for riders during their trips

- Wearable devices integrated into motorcycle apparel can also monitor rider health, such as heart rate, fatigue levels, and even accident detection, improving overall rider safety

For instance,

- In June 2024, a smart motorcycle helmet with an integrated heads-up display (HUD) and navigation system was launched, allowing riders to access real-time navigation, ride stats, and emergency alerts, enhancing safety and convenience

- In March 2023, a leading motorcycle apparel company introduced jackets with embedded airbags and sensors that detect impact, inflating to protect the rider during an accident. The product received positive feedback for its innovative approach to rider safety

- The integration of these smart technologies into motorcycle gear not only enhances the rider's experience but also opens up new revenue streams for manufacturers, making it a key growth opportunity in the motorcycle apparel market

Restraint/Challenge

"High Cost of Premium Motorcycle Apparel"

- The high cost of premium motorcycle apparel poses a significant challenge for the market, particularly affecting the purchasing decisions of consumers, especially in price-sensitive regions

- High-end motorcycle gear, such as advanced helmets, jackets, and gloves with smart technology or high-performance materials like carbon fiber and Kevlar, can often cost hundreds to thousands of dollars

- This substantial financial barrier can deter new riders or those in emerging markets from investing in top-tier protective gear, leading to a reliance on lower-cost, less effective options that may compromise safety

For instance,

- In January 2025, according to a report by the Motorcycle Industry Council, the high cost of premium motorcycle helmets and protective gear has been identified as a key barrier to entry for new riders, particularly in developing regions where income levels are lower

- Consequently, such limitations can result in a disparity in safety standards, with riders in some markets opting for less protective gear, potentially increasing the risk of injury. This price sensitivity can hinder the overall growth of the market, particularly in price-conscious regions

Motorcycle Apparel Market Scope

The market is segmented on the basis of product type, material, distribution channel, and end- user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Material |

|

|

By Distribution Channel

|

|

|

By End- User |

|

Motorcycle Apparel Market Regional Analysis

“North America is the Dominant Region in the Motorcycle Apparel Market”

- North America dominates the motorcycle apparel market, driven by strong consumer demand, advanced retail infrastructure, and high adoption of premium motorcycle gear

- The U.S. holds a significant share due to increasing motorcycle ownership, a growing focus on rider safety, and a strong presence of key market players offering high-performance apparel

- The availability of well-established safety standards and a high rate of participation in motorcycle tourism further strengthen the market in the region

- Additionally, the increasing awareness of the importance of protective gear, along with rising disposable income and a growing number of motorcycle events, is fueling market expansion across the U.S. and Canada

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the global motorcycle apparel market, driven by rapid urbanization, increased disposable income, and growing motorcycle adoption in emerging markets

- Countries such as India, China, and Japan are emerging as key markets due to their large motorcycle-owning populations and rising interest in motorcycling as a lifestyle and leisure activity

- Japan, with its well-established motorcycle culture and strong demand for high-quality apparel, remains a crucial market for premium gear and advanced safety features. The country continues to lead in innovation, with new technology integration in riding apparel

- China and India, with their expanding middle class and increasing motorcycle sales, are seeing increased investments in the motorcycle apparel sector, driven by a rising focus on safety standards and a growing demand for protective gear

Motorcycle Apparel Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Alpinestars (Italy)

- Dainese (Italy)

- Fox Racing (U.S.)

- ICON (U.S.)

- Harley-Davidson (U.S.)

- Schuberth (Germany)

- Bell Helmets (U.S.)

- RST Motorcycle Gear (U.K.)

- Revit (Netherlands)

- Spidi (Italy)

- BMW Motorrad (Germany)

- KTM (Austria)

- Scorpion EXO (U.S.)

- XPD Boots (Italy)

- Arai Helmets (Japan)

- Shark Helmets (France)

- AGV Helmets (Italy)

- Puma (Germany)

- Tucano Urbano (Italy)

- Vanson Leathers (U.S.)

Latest Developments in Global Motorcycle Apparel Market

- In March 2024, the SMART HJC 11B, a cutting-edge Bluetooth communication system exclusively developed by SENA for HJC Helmets, was introduced as the second-generation premium model for motorcyclists. This advanced system boasts an all-in-one design, seamlessly integrated into the helmet, ensuring optimal weight distribution and enhanced aerodynamic efficiency. Riders can now experience crystal-clear communication during their journeys, significantly improving both safety and convenience without compromising performance. This innovation underscores a growing trend in the global motorcycle apparel market, where the integration of smart technology in riding gear is increasingly valued

- In July 2022, Vista Outdoor Products LLC, a global leader in recreational products, strategically acquired the Fox Racing apparel brand to expand its presence in the racing gear and apparel sector. This acquisition is designed to capitalize on Fox Racing’s strong market position and innovative reputation within the motorcycle gear industry. By incorporating this renowned brand into its portfolio, Vista Outdoor aims to solidify its global standing and meet the increasing demand for high-performance racing apparel. This move highlights a key trend in the global motorcycle apparel market, where established brands and industry leaders are consolidating resources to enhance their offerings and cater to the growing consumer preference for premium, high-performance gear

- In March 2022, The Carlyle Group, a leading multinational private equity firm, acquired DAINESE, a renowned manufacturer of motorcycle apparel and protective gear. This acquisition is strategically aimed at accelerating DAINESE’s growth in the key Chinese and U.S. markets. Through this partnership, Carlyle Group intends to drive product sales and optimize the supply chain, ultimately enhancing the availability of superior protective gear to a broader customer base in these regions. This move reflects a significant trend in the global motorcycle apparel market, where strategic acquisitions are being leveraged to expand market reach and enhance operational efficiencies

- In May 2022, Royal Enfield, a renowned motorcycle manufacturer, entered into a strategic partnership with Italian riding gear brand Alpinestars to introduce a new collection of high-performance riding apparel. This collaboration combines Royal Enfield's iconic motorcycle heritage with Alpinestars' cutting-edge technology, providing riders with gear that delivers both exceptional style and superior safety features for a variety of riding conditions. This partnership is particularly relevant to the growing global motorcycle apparel market, as it underscores the increasing demand for premium, safety-focused gear

- In August 2021, Mandelli Group, a well-established Italian two-wheeler manufacturer, acquired TUCANO URBANO, a leading brand in motorcycle gear and accessories. This strategic acquisition is aimed at enhancing Mandelli's product offerings across key markets, including the U.K., Italy, Spain, and France, ensuring consumers have access to high-quality motorcycle apparel and accessories. By integrating TUCANO URBANO into its portfolio, Mandelli Group seeks to strengthen its market position and address the growing consumer demand for premium motorcycle accessories. This acquisition is a notable development within the global motorcycle apparel market, reflecting the increasing consolidation of leading brands to meet the rising demand for high-performance and stylish motorcycle gear

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.