Global Mrna Drug Substance And Api Market

Market Size in USD Million

CAGR :

%

USD

940.50 Million

USD

2,017.60 Million

2025

2033

USD

940.50 Million

USD

2,017.60 Million

2025

2033

| 2026 –2033 | |

| USD 940.50 Million | |

| USD 2,017.60 Million | |

|

|

|

|

mRNA Drug Substance & API Market Size

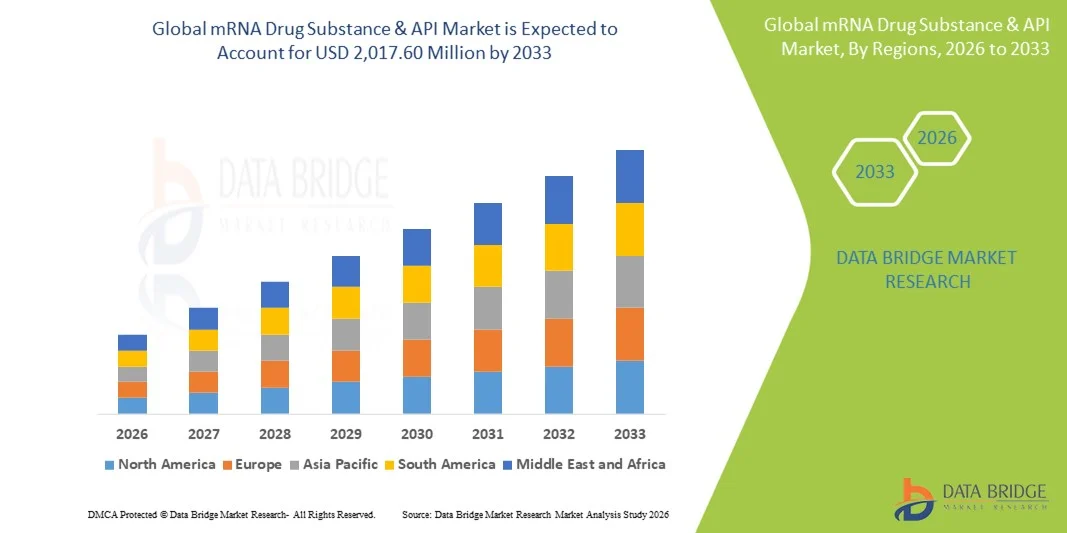

- The global mRNA drug substance & API market size was valued at USD 940.50 million in 2025 and is expected to reach USD 2,017.60 million by 2033, at a CAGR of 10.00% during the forecast period

- The market growth is largely driven by the rapid expansion of mRNA-based vaccines and therapeutics, coupled with increasing investments in advanced biologics manufacturing and in-vitro transcription technologies, which are strengthening large-scale mRNA API production capabilities

- Furthermore, rising demand for next-generation vaccines, personalized cancer therapies, and protein-replacement treatments is establishing mRNA drug substances as a critical component of modern biopharmaceutical pipelines. These converging factors are accelerating the adoption of mRNA APIs, thereby significantly boosting the overall market growth

mRNA Drug Substance & API Market Analysis

- mRNA drug substances and APIs, which comprise in-vitro transcribed messenger RNA used as the active pharmaceutical ingredient in vaccines and therapeutics, are increasingly becoming core components of modern biopharmaceutical development due to their rapid design flexibility, scalability, and ability to address a wide range of diseases

- The growing demand for mRNA drug substances and APIs is primarily driven by the expanding pipeline of mRNA-based vaccines and therapeutics, increased global focus on pandemic preparedness, and strong investments in advanced biologics manufacturing infrastructure by pharmaceutical and biotechnology companies

- North America dominated the mRNA drug substance & API market with the largest revenue share of 45.6% in 2025, supported by a strong presence of leading mRNA developers and CDMOs, robust R&D funding, and advanced manufacturing capabilities, with the U.S. witnessing significant API demand from both commercial vaccine production and late-stage clinical programs

- Asia-Pacific is expected to be the fastest growing region in the mRNA drug substance & API market during the forecast period due to rapid expansion of biopharmaceutical manufacturing capacity, increasing government support for domestic vaccine and biologics production, and rising participation of regional CDMOs in global mRNA supply chain

- mRNA-based Vaccines segment dominated the market with a share of 52.4% in 2025, driven by sustained production of infectious disease vaccines and ongoing development of next-generation and booster vaccines

Report Scope and mRNA Drug Substance & API Market Segmentation

|

Attributes |

mRNA Drug Substance & API Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

mRNA Drug Substance & API Market Trends

Expansion of Next-Generation and Platform-Based mRNA Manufacturing

- A significant and accelerating trend in the global mRNA drug substance & API market is the shift toward next-generation mRNA platforms, including self-amplifying mRNA and optimized sequence designs, which are enhancing production efficiency, potency, and scalability across vaccine and therapeutic applications

- For instance, several leading biopharmaceutical companies are advancing self-amplifying mRNA programs that require lower API doses per treatment, thereby increasing demand for specialized, high-purity mRNA drug substances tailored to these novel platforms

- Advances in in-vitro transcription processes, capping technologies, and purification methods are enabling manufacturers to achieve higher yields, improved stability, and reduced impurities, which is critical for meeting stringent regulatory requirements

- The growing adoption of modular and platform-based manufacturing approaches is allowing rapid adaptation of mRNA APIs to new disease targets, significantly shortening development timelines for vaccines and personalized therapies

- This trend toward flexible, scalable, and platform-driven mRNA API production is reshaping industry expectations for speed-to-market and supply chain responsiveness. Consequently, companies such as Moderna and BioNTech continue to invest heavily in expanding and standardizing their mRNA drug substance manufacturing capabilities

- Continuous innovation in raw material sourcing, including nucleotides and capping reagents, is improving supply chain reliability and reducing dependency on limited suppliers, thereby strengthening long-term mRNA API manufacturing resilience

- The demand for advanced mRNA drug substances that support rapid scale-up, consistent quality, and multi-product flexibility is increasing across both commercial manufacturing and late-stage clinical development programs

mRNA Drug Substance & API Market Dynamics

Driver

Rising Demand for mRNA-Based Vaccines and Therapeutics

- The increasing global demand for mRNA-based vaccines and therapeutics, driven by infectious disease preparedness and expanding oncology pipelines, is a major driver for growth in the mRNA drug substance & API market

- For instance, in 2025, multiple pharmaceutical companies expanded their mRNA manufacturing capacity to support next-generation COVID-19, influenza, and combination vaccines, directly boosting demand for large-scale mRNA API production

- As governments and healthcare systems prioritize rapid-response vaccine platforms and innovative therapies, mRNA drug substances offer unmatched flexibility and speed compared to traditional biologic APIs

- Furthermore, the growing number of mRNA-based clinical trials across oncology, rare diseases, and protein replacement therapies is increasing sustained demand for clinical- and commercial-grade mRNA APIs

- Growing investment by governments and global health organizations in domestic mRNA manufacturing infrastructure is supporting sustained demand for locally produced mRNA drug substances and APIs

- The increasing acceptance of mRNA as a versatile platform technology across multiple disease areas is encouraging pharmaceutical companies to build long-term mRNA pipelines, driving recurring API demand beyond single-product use

- The ability to rapidly redesign and manufacture mRNA drug substances for new targets is making them a preferred API class for pharmaceutical and biotechnology companies, thereby strongly supporting market growth

Restraint/Challenge

Manufacturing Complexity and Regulatory Compliance Challenges

- The technical complexity associated with mRNA drug substance manufacturing, including stringent control of impurities, stability issues, and batch-to-batch consistency, presents a significant challenge to widespread market expansion

- For instance, regulatory authorities require extensive characterization and quality validation of mRNA APIs, increasing development timelines and compliance costs for manufacturers

- The need for specialized equipment, cold-chain infrastructure, and highly skilled personnel further elevates production costs, particularly for small and mid-sized biotechnology companies

- In addition, evolving regulatory frameworks for novel mRNA modalities can create uncertainty, requiring manufacturers to continuously adapt their processes and documentation to meet changing standards

- Limited global availability of experienced mRNA manufacturing talent can slow capacity expansion and increase operational risks for new entrants in the mRNA drug substance & API market

- Variability in global regulatory expectations for mRNA-based products can complicate multi-region commercialization strategies, requiring manufacturers to maintain parallel compliance pathways and increasing overall development costs

- Overcoming these challenges through process automation, standardized regulatory pathways, and continued investment in manufacturing innovation will be critical for ensuring long-term growth and stability in the mRNA drug substance & API market

mRNA Drug Substance & API Market Scope

The market is segmented on the basis of product type, application, therapeutic area, and end user.

- By Product Type

On the basis of product type, the global mRNA drug substance & API market is segmented into drug substance and drug product. The drug substance segment dominated the market with the largest revenue share in 2025, driven by its critical role as the core active pharmaceutical ingredient in mRNA vaccines and therapeutics. Drug substances represent the in-vitro transcribed mRNA prior to formulation, making them essential across both clinical and commercial manufacturing stages. High demand for large-scale vaccine production and expanding therapeutic pipelines has significantly increased the need for high-purity, GMP-grade mRNA drug substances. In addition, pharmaceutical companies increasingly focus on securing reliable drug substance supply to maintain control over quality and regulatory compliance. The complexity and high value associated with mRNA API production further strengthen this segment’s dominance.

The drug product segment is expected to witness the fastest growth during the forecast period, fueled by the increasing commercialization of mRNA-based vaccines and therapeutics. As more mRNA candidates advance into late-stage clinical trials and approvals, demand for finished drug products incorporating mRNA APIs is accelerating. Growth is further supported by advancements in delivery systems such as lipid nanoparticles and improved formulation stability. Expanding global vaccination programs and emerging therapeutic approvals are also contributing to rapid growth in this segment.

- By Application

On the basis of application, the market is segmented into mRNA-based vaccines and mRNA-based therapeutics. The mRNA-based vaccines segment accounted for the dominant market share of 52.4% in 2025, primarily due to large-scale production of infectious disease vaccines and ongoing booster programs. The proven success of mRNA vaccines has established them as a preferred platform for rapid response to emerging pathogens. Governments and healthcare systems continue to invest heavily in vaccine preparedness, driving sustained demand for mRNA drug substances used in vaccine manufacturing. In addition, the scalability and speed of mRNA vaccine development reinforce this segment’s leadership. Continued research into combination and next-generation vaccines further supports its dominance.

The mRNA-based therapeutics segment is anticipated to grow at the fastest CAGR during the forecast period, driven by expanding applications beyond infectious diseases. Increasing clinical success in oncology, rare diseases, and protein replacement therapies is accelerating therapeutic pipeline development. Pharmaceutical companies are increasingly leveraging mRNA platforms for personalized and precision medicine approaches. As more therapeutic candidates progress through clinical trials, demand for specialized mRNA APIs is expected to rise rapidly, supporting strong growth in this segment.

- By Therapeutic Area

On the basis of therapeutic area, the market is segmented into infectious diseases, oncological disorders, and other disorders. The infectious diseases segment dominated the market in 2025, supported by continued production of mRNA-based vaccines targeting COVID-19, influenza, and other viral infections. The ability of mRNA platforms to be rapidly adapted to new variants has made them indispensable in infectious disease management. Ongoing global immunization initiatives and pandemic preparedness programs continue to drive high-volume demand for mRNA drug substances. Strong government funding and public-private partnerships further reinforce the segment’s dominant position.

The oncological disorders segment is expected to witness the fastest growth over the forecast period, driven by rising interest in personalized cancer vaccines and mRNA-based immunotherapies. Advances in tumor-specific antigen identification and individualized treatment approaches are accelerating oncology-focused mRNA development. Increasing investment in cancer research and favorable early-stage clinical outcomes are boosting demand for mRNA APIs. This segment’s growth is further supported by the long-term potential of mRNA platforms in combination therapies.

- By End User

On the basis of end user, the market is segmented into biopharmaceutical & pharmaceutical companies, contract research & manufacturing organizations (CROs/CDMOs), research institutes, and others. The biopharmaceutical & pharmaceutical companies segment held the largest market share in 2025, driven by their extensive involvement in mRNA vaccine and therapeutic development. These companies invest heavily in internal manufacturing capabilities to ensure supply security and regulatory compliance. Strong R&D pipelines, high production volumes, and commercialization activities contribute significantly to demand for mRNA drug substances. In addition, strategic investments in proprietary mRNA platforms further strengthen this segment’s dominance.

The contract research & manufacturing organizations (CROs/CDMOs) segment is projected to grow at the fastest rate during the forecast period. Increasing outsourcing of mRNA API production by small and mid-sized biotech firms is a key growth driver. CDMOs offer specialized expertise, scalable infrastructure, and regulatory support, making them attractive partners for mRNA developers. The growing number of early-stage and virtual biotech companies is expected to further accelerate demand for outsourced mRNA drug substance manufacturing services.

mRNA Drug Substance & API Market Regional Analysis

- North America dominated the mRNA drug substance & API market with the largest revenue share of 45.6% in 2025, supported by a strong presence of leading mRNA developers and CDMOs, robust R&D funding, and advanced manufacturing capabilities, with the U.S. witnessing significant API demand from both commercial vaccine production and late-stage clinical programs

- Biopharmaceutical companies in the region place high value on advanced mRNA production capabilities, regulatory compliance expertise, and reliable large-scale API supply to support both commercial manufacturing and late-stage clinical programs

- This strong regional position is further supported by substantial R&D funding, a high concentration of leading mRNA developers and CDMOs, and robust government and private-sector investments in domestic mRNA manufacturing infrastructure, establishing North America as a global hub for mRNA drug substance production

U.S. mRNA Drug Substance & API Market Insight

The U.S. mRNA drug substance & API market captured the largest revenue share within North America in 2025, fueled by the strong presence of leading mRNA vaccine and therapeutic developers and a well-established biopharmaceutical manufacturing ecosystem. Companies in the U.S. increasingly prioritize securing high-quality, GMP-grade mRNA APIs to support both commercial vaccine production and expanding therapeutic pipelines. The country’s leadership in clinical trials, rapid regulatory pathways, and significant government funding for pandemic preparedness further propel market growth. Moreover, continuous investments in large-scale mRNA manufacturing facilities and advanced process technologies are significantly contributing to market expansion.

Europe mRNA Drug Substance & API Market Insight

The Europe mRNA drug substance & API market is projected to expand at a substantial CAGR during the forecast period, primarily driven by strong regulatory support for innovative biologics and increasing focus on healthcare resilience. Rising investments in domestic vaccine manufacturing and biologics self-sufficiency are fostering demand for locally produced mRNA APIs. European pharmaceutical companies are actively expanding mRNA-based pipelines, particularly in infectious diseases and oncology. The region is witnessing growing adoption across commercial manufacturing and clinical development, supported by public-private partnerships and cross-border research collaborations.

U.K. mRNA Drug Substance & API Market Insight

The U.K. mRNA drug substance & API market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by strong government backing for advanced therapies and vaccine innovation. The country’s robust life sciences ecosystem and emphasis on translational research are accelerating mRNA API demand. Increased focus on pandemic preparedness and next-generation vaccines is further supporting market growth. In addition, collaborations between academic institutions, biotech firms, and CDMOs are expected to sustain long-term expansion of mRNA drug substance production in the U.K.

Germany mRNA Drug Substance & API Market Insight

The Germany mRNA drug substance & API market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong biopharmaceutical manufacturing capabilities and leadership in mRNA innovation. Germany’s emphasis on high-quality manufacturing standards, process optimization, and regulatory compliance supports growing demand for mRNA APIs. The presence of major mRNA technology developers and increasing investments in scalable production infrastructure are key growth drivers. Furthermore, rising focus on oncology and personalized medicine applications is contributing to sustained market expansion.

Asia-Pacific mRNA Drug Substance & API Market Insight

The Asia-Pacific mRNA drug substance & API market is poised to grow at the fastest CAGR during the forecast period, driven by rapid expansion of biopharmaceutical manufacturing capacity and increasing government support for domestic vaccine production. Countries across the region are investing heavily in mRNA technology to reduce reliance on imports and strengthen healthcare preparedness. Growing participation of regional CDMOs in global supply chains is further boosting demand for mRNA APIs. In addition, rising clinical trial activity and expanding biotech ecosystems are accelerating market growth across Asia-Pacific.

Japan mRNA Drug Substance & API Market Insight

The Japan mRNA drug substance & API market is gaining momentum due to the country’s strong focus on advanced medical technologies and innovation-driven healthcare systems. Japan places significant emphasis on high-quality, precision manufacturing, supporting demand for premium-grade mRNA APIs. Increasing adoption of mRNA platforms in infectious disease prevention and oncology research is fueling market growth. Moreover, collaborations between pharmaceutical companies and academic research institutions are expected to further stimulate demand for mRNA drug substances.

India mRNA Drug Substance & API Market Insight

The India mRNA drug substance & API market accounted for a significant share within Asia-Pacific in 2025, attributed to rapid expansion of domestic biopharmaceutical manufacturing and strong government initiatives supporting vaccine self-reliance. India is emerging as a key hub for large-scale, cost-effective mRNA API production, supported by a growing network of biotech companies and CDMOs. Rising investments in R&D, increasing clinical trial activity, and expanding public health programs are driving demand for mRNA drug substances. The country’s focus on strengthening local manufacturing capabilities is expected to further propel market growth over the forecast period.

mRNA Drug Substance & API Market Share

The mRNA Drug Substance & API industry is primarily led by well-established companies, including:

- BioNTech SE (Germany)

- Moderna, Inc. (U.S.)

- Arcturus Therapeutics Holdings Inc. (U.S.)

- ARCALIS, Inc. (Japan)

- BioCina (Australia)

- Biomay AG (Austria)

- Lonza Group Ltd (Switzerland)

- WuXi Vaccines (China)

- Samsung Biologics (South Korea)

- AGC Biologics (Japan)

- Thermo Fisher Scientific Inc. (U.S.)

- Catalent, Inc. (U.S.)

- CordenPharma International (Germany)

- PolyPeptide Group AG (Switzerland)

- Genevant Sciences, Inc. (U.S.)

- Rentschler Biopharma SE (Germany)

- Merck KGaA (Germany)

- Cytiva (U.S.)

- GSK plc (U.K.)

- CureVac N.V. (Germany)

What are the Recent Developments in Global mRNA Drug Substance & API Market?

- In September 2025, Moderna officially opened its Moderna Innovation and Technology Centre in Oxfordshire, UK a new state-of-the-art mRNA vaccine manufacturing facility that will produce domestic mRNA vaccines and support research into cancer and rare diseases, marking a significant expansion of localized mRNA drug substance and API production in Europe

- In May 2025, Moderna’s UK mRNA manufacturing facility received a Manufacturer’s/Importer’s Authorisation (MIA) from the UK’s MHRA, enabling fully regulated commercial production of mRNA vaccines and supporting broader mRNA API supply for the local and regional markets

- In August 2025, BioNTech, Pfizer, CureVac, and GSK settled a long-running patent dispute over mRNA vaccine technology, including agreements on licensing and royalty arrangements, clearing legal obstacles that could impact future collaborative manufacturing and API usage strategies

- In December 2023, BioNTech announced plans to start mRNA vaccine production at a new facility in Rwanda by 2025, representing one of the first African regional mRNA manufacturing sites and expanding global mRNA substance and manufacturing footprint beyond traditional markets

- In May 2021, BioNTech revealed plans to build a major mRNA vaccine manufacturing site in Singapore a key Asia-Pacific mRNA API production hub expected to strengthen regional access and supply capacity for large-scale mRNA drug substance manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.