Global Multi Mode Optical Transceiver Market

Market Size in USD Billion

CAGR :

%

USD

11.64 Billion

USD

25.15 Billion

2024

2032

USD

11.64 Billion

USD

25.15 Billion

2024

2032

| 2025 –2032 | |

| USD 11.64 Billion | |

| USD 25.15 Billion | |

|

|

|

|

Multi-Mode Optical Transceiver Market Size

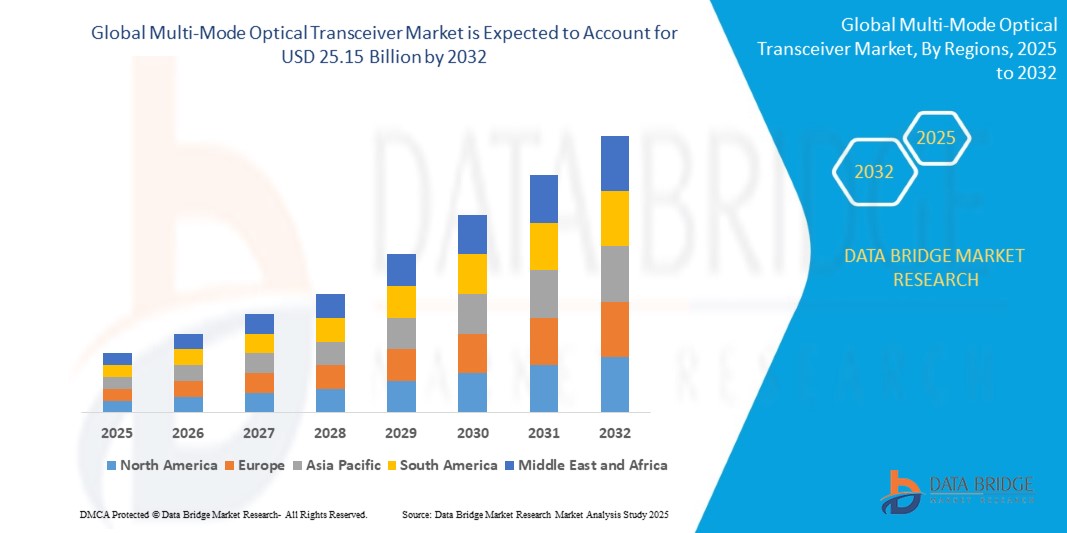

- The global multi-mode optical transceiver market size was valued at USD 11.64 billion in 2024 and is expected to reach USD 25.15 billion by 2032, at a CAGR of 10.10% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-speed data transmission, expanding data center infrastructures, and growing adoption of cloud-based services and enterprise networking solutions

- The rising shift toward virtualization, edge computing, and real-time data processing is further accelerating the need for efficient, low-latency optical communication technologies

Multi-Mode Optical Transceiver Market Analysis

- The market is experiencing steady growth as enterprises and service providers seek cost-effective, short-reach solutions for high-bandwidth connectivity

- Multi-mode optical transceivers are widely adopted in local area networks (LANs), data centers, and enterprise networks due to their lower cost and ease of installation compared to single-mode solutions

- Asia-Pacific dominated the multi-mode optical transceiver market with the largest revenue share of 38.5% in 2024, driven by rapid digitalization, expansion of cloud data centers, and growing demand for high-speed internet infrastructure across developing economies

- The Europe region is expected to witness the highest growth rate in the global multi-mode optical transceiver market, driven by rising adoption of sustainable data transmission technologies, widespread 5G deployment, and growing emphasis on cloud connectivity and digital transformation across multiple sectors

- The QSFP, QSFP+, QSFP14, and QSFP28 segment held the largest market revenue share in 2024, driven by its growing use in high-performance computing and data center environments. These form factors offer high-density, high-speed connectivity ideal for scaling bandwidth in top-of-rack and aggregation layers. Enterprises and hyperscale cloud operators increasingly prefer QSFP modules due to their versatility in supporting 40G and 100G networks

Report Scope and Multi-Mode Optical Transceiver Market Segmentation

|

Attributes |

Multi-Mode Optical Transceiver Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Multi-Mode Optical Transceiver Market Trends

“Surging Demand For High-Speed Transceivers In Data Centers”

- Rapid expansion of cloud platforms, video streaming, and enterprise digitization is fuelling the need for high-speed, short-reach optical communication within data centers

- Multi-mode transceivers are increasingly preferred for connections between servers and switches due to their cost-efficiency and power-saving features

- Demand is rising for 40G, 100G, and 400G multi-mode modules to support scalability and bandwidth-intensive workloads

- Short-range, high-bandwidth use cases such as Top-of-Rack (ToR) and End-of-Row (EoR) architectures are benefitting from compact, high-speed modules

- For instance, Microsoft Azure continues to upgrade its data center architecture using 100G SR4 multi-mode transceivers to optimize performance and cost

Multi-Mode Optical Transceiver Market Dynamics

Driver

“Rising Demand for Scalable and Cost-Efficient Network Infrastructure”

- Increasing internet traffic and data center workloads are creating demand for scalable and affordable network solutions

- Multi-mode transceivers offer lower deployment costs due to the use of inexpensive VCSELs and standard multi-mode fiber

- Their energy-efficient design supports dense switch environments and lowers operational expenditure

- Enterprises benefit from easy modular upgrades without overhauling the existing network infrastructure

- For instance, Facebook deploys multi-mode transceivers to maintain high-speed communication across its data center clusters while optimizing cost and power use

Restraint/Challenge

“Limited Transmission Distance and Modal Dispersion Constraints”

- Multi-mode transceivers are restricted to short-distance communication, generally under 500 meters, limiting their application in wide-area networks

- Modal dispersion in multi-mode fibers can cause signal degradation over longer distances, reducing performance reliability

- Long-haul applications such as metro networks or inter-building links require single-mode alternatives

- The shift toward unified network infrastructure demands flexible solutions, which multi-mode transceivers often cannot meet

- For instance, telecom operators in Europe have opted for single-mode transceivers in regional fiber rollouts to avoid modal dispersion and ensure consistent signal quality

Multi-Mode Optical Transceiver Market Scope

The market is segmented on the basis of form factor, data rate, distance, wavelength, connector, and application.

• By Form Factor

On the basis of form factor, the multi-mode optical transceiver market is segmented into SFF and SFP, SFP+ and SFP28, QSFP, QSFP+, QSFP14, and QSFP28, CFP, CFP2, and CFP4, XFP, and CXP. The QSFP, QSFP+, QSFP14, and QSFP28 segment held the largest market revenue share in 2024, driven by its growing use in high-performance computing and data center environments. These form factors offer high-density, high-speed connectivity ideal for scaling bandwidth in top-of-rack and aggregation layers. Enterprises and hyperscale cloud operators increasingly prefer QSFP modules due to their versatility in supporting 40G and 100G networks.

The CFP, CFP2, and CFP4 segment is expected to witness the fastest CAGR from 2025 to 2032, supported by its adoption in next-generation core network applications. These modules are suitable for high-capacity links and long-haul data transmission in telecom networks, benefiting from their compact design and support for multiple 100G channels.

• By Data Rate

On the basis of data rate, the market is segmented into less than 10 GBPS, 10 GBPS to 40 GBPS, 41 GBPS to 100 GBPS, and more than 100 GBPS. The 10 GBPS to 40 GBPS segment dominated the market in 2024 due to its broad deployment in legacy and upgraded enterprise systems, balancing performance and cost-efficiency.

The 41 GBPS to 100 GBPS segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increased demand for higher bandwidth across cloud service providers and financial institutions requiring ultra-low latency.

• By Distance

On the basis of distance, the market is segmented into less than 1 KM, 1 to 10 KM, 11 to 100 KM, and more than 100 KM. The less than 1 KM segment accounted for the largest revenue share in 2024, owing to the extensive use of multi-mode transceivers in short-range connections within data centers and LANs.

The 1 to 10 KM segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing deployment in campus networks and metro access rings where slightly longer reach is required without transitioning to single-mode solutions.

• By Wavelength

On the basis of wavelength, the market is segmented into 850 NM band, 1310 NM band, 1550 NM band, and others. The 850 NM band segment led the market in 2024, primarily due to its dominance in multi-mode transceivers used for short-range, high-speed communication. Its compatibility with cost-effective VCSEL technology further enhances its adoption.

The 1310 NM band segment is expected to witness the fastest CAGR from 2025 to 2032, backed by its ability to reduce modal dispersion and support longer transmission distances within multi-mode infrastructure.

• By Connector

On the basis of connector, the market is segmented into LC connector, SC connector, MPO connector, and RJ-45. The LC connector segment held the largest market share in 2024 due to its compact size and wide use in high-density data center and telecom installations.

The MPO connector segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its capability to support parallel optics and high-speed transmission in modern optical networking environments.

• By Application

On the basis of application, the multi-mode optical transceiver market is segmented into telecommunication, data center, and enterprise. The data center segment captured the largest market share in 2024, attributed to increasing bandwidth demand, rapid adoption of virtualization, and rising deployment of cloud infrastructure.

The telecommunication segment is expected to witness the fastest CAGR from 2025 to 2032, supported by network operators upgrading infrastructure to accommodate 5G, fiber-to-the-home (FTTH), and next-gen transport networks.

Multi-Mode Optical Transceiver Market Regional Analysis

- Asia-Pacific dominated the multi-mode optical transceiver market with the largest revenue share of 38.5% in 2024, driven by rapid digitalization, expansion of cloud data centers, and growing demand for high-speed internet infrastructure across developing economies

- The presence of major electronic manufacturers, increasing adoption of 5G, and government-backed smart city projects are contributing significantly to the market’s growth

- Countries such as China, Japan, and South Korea are at the forefront of deploying advanced optical communication technologies, supported by high bandwidth requirements in telecom and enterprise networks

China Multi-Mode Optical Transceiver Market Insight

The China market captured the largest share in Asia-Pacific in 2024, driven by its status as a global manufacturing hub and strong investments in broadband infrastructure and 5G deployment. The rapid increase in cloud computing services, along with the rise of data-intensive applications, is propelling the need for high-speed, short-range transceivers. Leading domestic players and growing export activity continue to solidify China’s dominance in the region.

Japan Multi-Mode Optical Transceiver Market Insight

Japan is expected to witness the fastest CAGR from 2025 to 2032, supported by a robust telecommunications infrastructure and a high concentration of data centers in urban areas. The demand for multi-mode transceivers is particularly strong in enterprise and financial services sectors, where ultra-low latency and short-distance communication are essential. Japan's focus on upgrading legacy systems and investing in smart grid networks is further driving demand for optical networking solutions.

North America Multi-Mode Optical Transceiver Market Insight

North America holds a substantial market share due to its early adoption of fiber-optic technologies and extensive investment in hyperscale data centers. The rise of video streaming, cloud gaming, and edge computing is accelerating the demand for high-performance optical transceivers. The market is supported by strong partnerships between data center operators and technology providers focusing on next-generation optical solutions.

U.S. Multi-Mode Optical Transceiver Market Insight

The U.S. remains the leading contributor in North America, driven by increasing demand for high-speed data transmission in telecom and enterprise segments. The country's leadership in deploying AI, IoT, and machine learning platforms is creating massive data volumes that necessitate advanced network infrastructure. The push towards green data centers is also encouraging the adoption of energy-efficient transceiver modules.

Europe Multi-Mode Optical Transceiver Market Insight

Europe’s market is expected to witness the fastest CAGR from 2025 to 2032, due to ongoing digital transformation across industries and a growing emphasis on sustainable and energy-efficient technologies. The European Union’s focus on 5G rollout and digital infrastructure investments is fostering demand for optical transceivers in telecom, healthcare, and education. The region is also seeing rising adoption in local cloud computing ecosystems and data security platforms.

U.K. Multi-Mode Optical Transceiver Market Insight

The U.K. market is expected to witness the fastest CAGR from 2025 to 2032, supported by strong data center investments and government initiatives to enhance digital connectivity nationwide. Increased adoption of cloud services by small and medium enterprises (SMEs) and the proliferation of smart technologies in public infrastructure are boosting demand for short-distance, high-speed optical links. The post-pandemic push for digital resilience continues to fuel the market.

Germany Multi-Mode Optical Transceiver Market Insight

Germany is expected to witness the fastest CAGR from 2025 to 2032, with increased deployment of fiber-optic networks in industrial automation and enterprise applications. The market is supported by the country’s emphasis on Industry 4.0 and digital innovation. German data centers are also increasingly integrating high-performance, low-power transceivers to meet growing energy efficiency standards while supporting massive data workloads.

Multi-Mode Optical Transceiver Market Share

The Multi-Mode Optical Transceiver industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- SICK AG (Germany)

- ams OSRAM AG (Austria)

- TE Connectivity (Switzerland)

- MTS Systems (U.S.)

- Vishay Technologies Inc. (U.S.)

- Infineon Technologies AG (Germany)

- STMicroelectronics (Switzerland)

- Bourns (U.S.)

- Allegro Microsystem (U.S.)

- Synaptics (U.S.)

- Apple Inc. (U.S.)

- Egis Technology (Taiwan)

- Crucialtec (South Korea)

- Novatek Microelectronics (Taiwan)

- Qualcomm Technologies, Inc. (U.S.)

- Q Technology (China)

- CMOS Sensor Inc. (U.S.)

- ELAN Microelectonics (Taiwan)

- OXI Technology (China)

- Sonavation Inc. (U.S)

- Touch Biometrix (U.K.)

- Vkansee (U.S.)

Latest Developments in Global Multi-Mode Optical Transceiver Market

- In 2023, Broadcom and Semtech Corporation displayed a cutting-edge 200 G/lane optical transceiver at ECOC 2023. This collaboration highlighted Semtech's Fiberdge 200 G PAM4 PMDs alongside Broadcom's advanced DSP PHY and single-mode optics. Their innovation addresses the growing demand for high-speed data transmission, particularly in cloud infrastructure and data centers, enhancing connectivity and performance

- In 2023, II-VI Incorporated presented next-generation transceivers and laser technology at ECOC 2023, specifically catering to 800 G and 1.6T datacom transmission needs. These advancements are crucial for supporting the burgeoning cloud ecosystem, fueled by artificial intelligence and machine learning applications. Designed for integration into high-capacity Ethernet switches, these transceivers enable seamless data flow with their 100 G electrical lanes, ensuring efficient and reliable connectivity

- In 2021, Allegro MicroSystems, Inc. made waves with the launch of the A31315 sensor, enriching its 3DMAG family of rotary and linear magnetic-position sensors. Renowned for its precision and adaptability across various design placements, this sensor offers superior accuracy and on-chip diagnostics. Its deployment underscores the significance of precise sensing solutions, benefiting industries ranging from automotive to industrial automation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Multi Mode Optical Transceiver Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Multi Mode Optical Transceiver Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Multi Mode Optical Transceiver Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.