Global Mutational Analysis Market

Market Size in USD Billion

CAGR :

%

USD

6.65 Billion

USD

16.58 Billion

2025

2033

USD

6.65 Billion

USD

16.58 Billion

2025

2033

| 2026 –2033 | |

| USD 6.65 Billion | |

| USD 16.58 Billion | |

|

|

|

|

Mutational Analysis Market Size

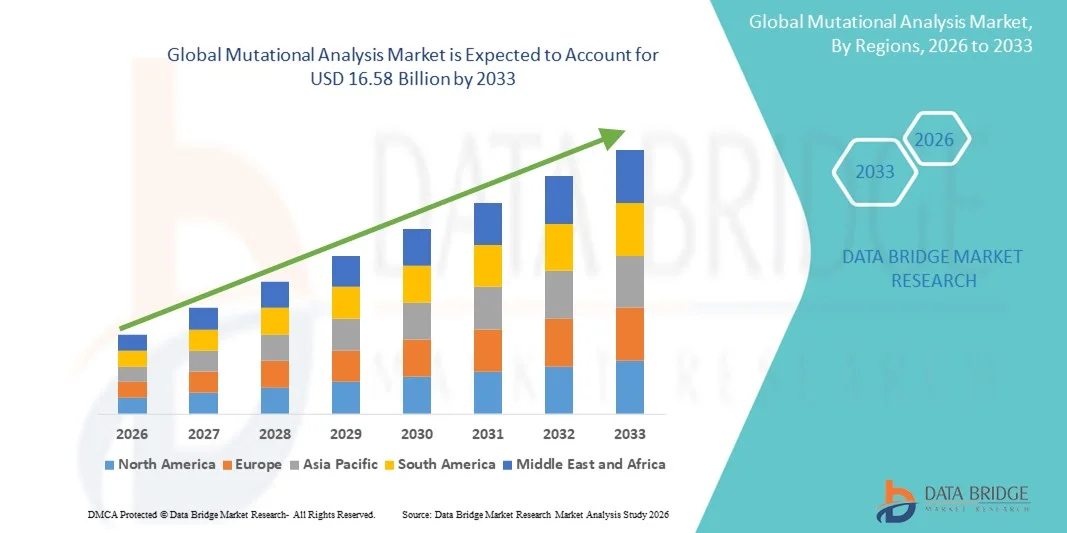

- The global mutational analysis market size was valued at USD 6.65 billion in 2025 and is expected to reach USD 16.58 billion by 2033, at a CAGR of 12.10% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced genomic technologies and continuous technological progress in molecular diagnostics, leading to greater digitalization and automation in clinical, research, and pharmaceutical settings

- Furthermore, rising demand for accurate, rapid, and cost-effective genetic testing solutions for disease diagnosis, personalized medicine, and drug development is establishing mutational analysis as a critical tool in modern healthcare and life sciences. These converging factors are accelerating the uptake of mutational analysis solutions, thereby significantly boosting the market’s overall growth

Mutational Analysis Market Analysis

- Mutational analysis, which involves the detection and characterization of genetic variations in DNA and RNA, has become a cornerstone of modern molecular diagnostics, oncology research, and personalized medicine across clinical and research settings

- The escalating demand for mutational analysis is primarily driven by the rising prevalence of cancer and inherited genetic disorders, increasing adoption of precision medicine approaches, and continuous advancements in next-generation sequencing (NGS), PCR, and bioinformatics technologies

- North America dominated the mutational analysis market with the largest revenue share of approximately 44.6% in 2025, supported by strong research funding, advanced healthcare and laboratory infrastructure, widespread use of genomic testing in oncology, and the presence of leading biotechnology and diagnostics companies, with the U.S. witnessing significant uptake due to integration of mutational profiling in clinical decision-making and drug development pipelines

- Asia-Pacific is expected to be the fastest-growing region in the mutational analysis market during the forecast period, registering a CAGR driven by expanding biotechnology sectors, increasing healthcare expenditure, rising awareness of genetic testing, and supportive government initiatives promoting genomic research in countries such as China, India, Japan, and South Korea

- The enzyme segment held the largest market revenue share of 61.4% in 2025, driven by its critical role in mutation detection workflows

Report Scope and Mutational Analysis Market Segmentation

|

Attributes |

Mutational Analysis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Thermo Fisher Scientific (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Mutational Analysis Market Trends

Advancements in Precision Genomics and High-Throughput Technologies

- A key and rapidly evolving trend in the global mutational analysis market is the increasing adoption of advanced genomic technologies such as next-generation sequencing (NGS), digital PCR, and high-throughput screening platforms, enabling precise detection of genetic mutations. These advancements significantly improve sensitivity, specificity, and turnaround time in mutational profiling

- For instance, the growing use of NGS-based mutational analysis panels allows simultaneous analysis of multiple genes, supporting applications in oncology, rare disease diagnostics, and inherited disorder screening. These platforms enable comprehensive genomic insights from limited sample volumes

- Technological progress has also led to improved bioinformatics tools and automated data interpretation software, helping laboratories manage large genomic datasets and reduce analytical errors. Enhanced workflow efficiency supports wider clinical and research adoption

- The integration of mutational analysis with personalized medicine initiatives is further shaping the market, as clinicians increasingly rely on mutation profiling to guide targeted therapies and treatment decisions

- Continuous innovation in reagents, sequencing chemistry, and sample preparation techniques is improving reproducibility and cost-effectiveness, expanding access to mutational testing across diverse healthcare settings

- Overall, the focus on accuracy, scalability, and clinical relevance is reshaping expectations for mutational analysis solutions and driving steady technological evolution across the market

Mutational Analysis Market Dynamics

Driver

Rising Burden of Genetic Disorders and Growing Demand for Precision Medicine

- The increasing prevalence of genetic disorders, cancer, and inherited diseases is a major driver fueling demand for mutational analysis solutions in both clinical and research settings. Early and accurate mutation detection is critical for diagnosis, prognosis, and therapy selection

- For instance, expanding use of mutational profiling in oncology has enabled clinicians to identify actionable mutations, supporting the growing adoption of targeted therapies and immuno-oncology treatments

- The global shift toward precision and personalized medicine is accelerating the use of mutational analysis as a routine tool in treatment planning and disease management

- Government initiatives, funding for genomic research, and national precision medicine programs are further supporting market growth by encouraging widespread genetic testing

- Pharmaceutical and biotechnology companies increasingly depend on mutational analysis during drug discovery, biomarker identification, and clinical trials, strengthening demand across the value chain

- The expansion of diagnostic laboratories and improved access to genetic testing in emerging economies are additional factors contributing to sustained market expansion

Restraint/Challenge

High Testing Costs and Complex Regulatory and Data Interpretation Challenges

- The relatively high cost of advanced mutational analysis techniques, particularly NGS-based testing and specialized reagents, remains a significant barrier to adoption, especially in cost-sensitive regions

- For instance, several oncology-focused NGS mutational analysis tests face limited or delayed reimbursement approvals in countries such as the U.S. and parts of Europe, increasing out-of-pocket costs for patients and restricting routine clinical use despite strong clinical utility

- Complex regulatory requirements for genetic testing and variability in reimbursement policies across countries can limit routine clinical implementation

- Data interpretation challenges, including the need for skilled bioinformaticians and genetic counselors, add to operational complexity and costs for laboratories and healthcare providers

- Concerns related to data privacy, ethical handling of genetic information, and secure storage of genomic data further complicate market adoption

- Small laboratories and healthcare facilities may face difficulties integrating advanced mutational analysis platforms due to infrastructure and expertise limitations

- Addressing these challenges through cost-effective technologies, standardized regulatory frameworks, improved training programs, and simplified analytical tools will be crucial for the long-term growth of the Mutational Analysis market

Mutational Analysis Market Scope

The market is segmented on the basis of type, product, technique, and end user.

- By Type

On the basis of type, the Mutational Analysis market is segmented into missense mutation, nonsense mutation, insertion, deletion, duplication, frame shift mutation, and repeat expansion. The missense mutation segment dominated the largest market revenue share of 34.6% in 2025, driven by its high prevalence in genetically linked disorders and cancers. Missense mutations are widely studied due to their direct impact on protein function without complete truncation. Their frequent identification in oncology, rare diseases, and inherited disorders supports consistent demand. Missense mutation analysis plays a critical role in precision medicine and biomarker development. Technological advancements in sequencing platforms have enhanced detection accuracy. Increasing clinical relevance in personalized therapeutics further strengthens dominance. Broad applicability across research and diagnostics contributes to sustained adoption. Favorable reimbursement scenarios for cancer-related mutation testing also support growth. Rising genetic screening programs further bolster demand. Strong academic and clinical interest ensures continued leadership of this segment in the global market.

The frame shift mutation segment is anticipated to witness the fastest growth with a CAGR of 18.9% from 2026 to 2033, owing to its severe biological impact and increasing detection in genetic disorders. Frame shift mutations often result in nonfunctional proteins, making them highly relevant for disease diagnostics. Growing focus on rare and inherited diseases fuels demand for frame shift analysis. Advances in next-generation sequencing have improved identification rates. Increased funding for genetic disorder research supports rapid adoption. Clinical utility in early disease diagnosis is expanding. Rising awareness among healthcare professionals also contributes. Pharmaceutical companies increasingly study these mutations for drug development. Improved bioinformatics tools further accelerate growth. The segment’s expanding role in precision medicine drives its fastest growth trajectory.

- By Product

On the basis of product, the Mutational Analysis market is segmented into enzyme and substrate. The enzyme segment held the largest market revenue share of 61.4% in 2025, driven by its critical role in mutation detection workflows. Enzymes are essential components in amplification, digestion, and mutation identification processes. High consumption across research laboratories and diagnostic centers fuels demand. Technological improvements have enhanced enzyme specificity and efficiency. Strong usage in PCR-based and sequencing techniques supports dominance. Enzyme kits are widely standardized and commercially available. Consistent repeat usage drives recurring revenue. Broad applicability across academic and clinical settings strengthens adoption. Growing molecular diagnostics testing volumes further support growth. The enzyme segment continues to benefit from continuous innovation and high demand stability.

The substrate segment is expected to witness the fastest CAGR of 16.7% from 2026 to 2033, driven by increasing development of advanced assay platforms. Substrates play a crucial role in improving detection sensitivity. Growing demand for high-throughput testing accelerates adoption. Expansion of personalized diagnostics increases substrate utilization. Advances in fluorescence and chemiluminescent substrates enhance accuracy. Rising investments in research tools support growth. Emerging applications in oncology testing contribute significantly. Increased automation in laboratories further fuels demand. Cost-effective substrate development supports wider adoption. Growing innovation pipelines position substrates as a rapidly expanding segment.

- By Technique

On the basis of technique, the Mutational Analysis market is segmented into DGGE, CDGE, TTGE, SSCP, PTT, and high-resolution melt. The high-resolution melt segment accounted for the largest market revenue share of 29.8% in 2025, driven by its accuracy, speed, and cost efficiency. The technique allows rapid mutation scanning without sequencing. High sensitivity in detecting subtle DNA variations supports wide adoption. Its compatibility with real-time PCR systems strengthens usage. Minimal post-PCR processing reduces turnaround time. Academic and diagnostic laboratories extensively utilize this method. Advances in instrumentation improve reliability. Growing cancer screening applications fuel uptake. Ease of implementation supports its leadership position. Strong reproducibility ensures continued dominance in the market.

The single-strand conformation polymorphism (SSCP) segment is projected to grow at the fastest CAGR of 17.4% from 2026 to 2033, driven by its suitability for large-scale screening. SSCP offers cost-effective mutation detection. Increased research on genetic disorders supports demand. Improvements in gel-based detection enhance accuracy. Its simplicity supports adoption in resource-limited settings. Growing academic research funding fuels usage. Expansion in population screening programs boosts demand. Compatibility with existing lab infrastructure accelerates growth. Continued methodological refinements strengthen its market position. The technique’s affordability drives rapid expansion globally.

- By End User

On the basis of end user, the Mutational Analysis market is segmented into academic research institutes, contract research organizations, and others. The academic research institutes segment dominated the largest market revenue share of 42.1% in 2025, driven by extensive genetic research activities worldwide. Universities conduct large-scale mutation studies across diseases. Strong government funding supports sustained usage. Academic focus on genomics and proteomics fuels demand. High publication output supports continuous testing requirements. Training programs increase testing volumes. Availability of skilled researchers strengthens adoption. Long-term research projects contribute to consistent revenue. Collaboration with biopharma companies drives additional usage. The segment remains the backbone of methodological innovation in mutational analysis.

The contract research organization segment is expected to witness the fastest CAGR of 19.2% from 2026 to 2033, driven by outsourcing trends in pharmaceutical and biotechnology industries. CROs provide cost-efficient mutation analysis services. Rising clinical trial volumes boost demand. Pharmaceutical R&D outsourcing continues to expand. CROs offer advanced analytical expertise. Shorter project timelines attract sponsors. Increased precision medicine trials support growth. Global expansion of CRO facilities accelerates adoption. Technological investments strengthen service portfolios. The segment’s scalability positions it as the fastest-growing end-user category.

Mutational Analysis Market Regional Analysis

- North America dominated the mutational analysis market with the largest revenue share of approximately 44.6% in 2025, supported by strong public and private research funding, advanced healthcare and laboratory infrastructure, and the widespread adoption of genomic and molecular testing in clinical and research settings

- The region benefits from the presence of leading biotechnology, diagnostics, and pharmaceutical companies actively integrating mutational analysis into oncology, rare disease research, and precision medicine workflows.

- High adoption of precision medicine and genomic diagnostics, along with favorable reimbursement frameworks and strong collaboration between academic research institutes, hospitals, and industry players, continues to strengthen the uptake of mutational analysis technologies across both clinical and research applications

U.S. Mutational Analysis Market Insight

The U.S. mutational analysis market accounted for the majority of North America’s revenue share in 2025, driven by extensive use of mutational profiling in cancer diagnostics, companion diagnostics, and targeted drug development. The country’s well-established genomics ecosystem, presence of advanced sequencing platforms, and strong focus on translational research are accelerating demand. Additionally, the integration of mutational analysis into clinical decision-making, supported by large-scale genome projects and biopharma R&D investments, continues to propel market growth.

Europe Mutational Analysis Market Insight

The Europe mutational analysis market is projected to expand at a steady CAGR during the forecast period, driven by increasing emphasis on precision medicine, strong regulatory support for molecular diagnostics, and growing genomic research initiatives. Rising cancer incidence and the adoption of advanced diagnostic technologies across hospitals and research institutions are contributing to increased demand. Collaboration between academic institutions, diagnostic laboratories, and pharmaceutical companies further supports market expansion across the region.

U.K. Mutational Analysis Market Insight

The U.K. mutational analysis market is expected to grow at a notable CAGR, fueled by government-backed genomics programs, increased use of molecular diagnostics in oncology, and the integration of genomic data into routine clinical care. Initiatives promoting whole-genome sequencing and personalized medicine are enhancing the adoption of mutational analysis techniques across healthcare and research ecosystems.

Germany Mutational Analysis Market Insight

Germany’s mutational analysis market is anticipated to register considerable growth during the forecast period, supported by strong biomedical research infrastructure, robust funding for life sciences, and high adoption of advanced diagnostic technologies. The country’s focus on innovation, alongside increasing applications of mutational analysis in oncology and rare disease research, is driving market expansion across clinical laboratories and research institutes.

Asia-Pacific Mutational Analysis Market Insight

The Asia-Pacific mutational analysis market is expected to be the fastest-growing region during the forecast period, registering a strong CAGR driven by expanding biotechnology sectors, rising healthcare expenditure, and increasing awareness of genetic testing. Supportive government initiatives promoting genomics research, coupled with improving access to advanced diagnostic technologies, are accelerating market growth across the region.

Japan Mutational Analysis Market Insight

Japan’s mutational analysis market is gaining momentum due to strong investments in biomedical research, growing adoption of precision oncology, and an increasing focus on early disease detection. The country’s advanced healthcare infrastructure and aging population are contributing to higher demand for genetic and molecular diagnostics, supporting steady market growth.

China Mutational Analysis Market Insight

The China mutational analysis market held a significant revenue share within Asia-Pacific in 2025, driven by rapid expansion of genomic research, increasing government funding, and the growing use of molecular diagnostics in cancer and hereditary disease testing. The presence of a large patient population, improving laboratory infrastructure, and a strong push toward innovation in biotechnology are key factors propelling market growth in China.

Mutational Analysis Market Share

The Mutational Analysis industry is primarily led by well-established companies, including:

• Thermo Fisher Scientific (U.S.)

• Agilent Technologies (U.S.)

• Bio-Rad Laboratories (U.S.)

• Illumina (U.S.)

• Roche Diagnostics (Switzerland)

• Danaher Corporation (U.S.)

• PerkinElmer (U.S.)

• Merck KGaA (Germany)

• Takara Bio (Japan)

• GenScript Biotech (U.S./China)

• New England Biolabs (U.S.)

• Promega Corporation (U.S.)

• Oxford Nanopore Technologies (U.K.)

• Pacific Biosciences (U.S.)

• BGI Genomics (China)

• Eurofins Scientific (Luxembourg)

• LGC Biosearch Technologies (U.K.)

• Integrated DNA Technologies (IDT) (U.S.)

• Abcam (U.K.)

Latest Developments in Global Mutational Analysis Market

- In March 2023, Illumina announced the launch of Connected Insights, a cloud-based software to enable tertiary analysis of sequencing data for clinical next-generation sequencing (NGS), initially supporting somatic oncology applications and with plans to add rare-disease and whole-genome sequencing workflows

- In November 2023, Illumina launched a next-generation liquid biopsy assay — TruSight Oncology 500 ctDNA v2 — enabling noninvasive comprehensive genomic profiling (CGP) from circulating tumor DNA (ctDNA) when tissue is unavailable, with improved sensitivity, lower DNA input requirements, and faster turnaround time

- In January 2024, QIAGEN Digital Insights (QDI) introduced an enhanced version of its analysis platform — QIAGEN CLC Genomics Workbench Premium with LightSpeed — with a new “LightSpeed” module for ultra-fast NGS secondary analysis of somatic cancer panels: converting raw sequencing data to variants in minutes, drastically cutting cost and processing time per test

- In September 2024, Integrated DNA Technologies (IDT) expanded its CGP offering by launching a new Archer HRD Module — enabling homologous recombination deficiency (HRD) assessment in addition to existing tumor mutational burden (TMB) and microsatellite instability (MSI) analysis — allowing labs to perform more comprehensive mutational and biomarker profiling from low-input samples

- In August 2025, Twist Bioscience unveiled a new Twist Oncology DNA CGP Panel — a platform-agnostic, customizable comprehensive genomic profiling panel covering 562 genes across major tumor types; capable of detecting base substitutions, indels, copy-number variations, rearrangements, and assessing tumor mutational burden (TMB) and microsatellite instability (MSI)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.